Documentos de Académico

Documentos de Profesional

Documentos de Cultura

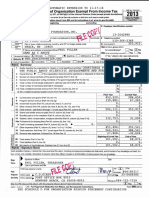

2013 Audit Report

Cargado por

Space Frontier FoundationDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

2013 Audit Report

Cargado por

Space Frontier FoundationCopyright:

Formatos disponibles

Space Frontier Foundation, Inc.

Financial Statements

December 31, 2013

(With Independent Auditors Report thereon)

Space Frontier Foundation, Inc.

Table of Contents

Independent Auditors Report

Financial Statements

Statement of Financial Position

Statement of Activities

Statements of Changes in Net Assets

Statement of Cash Flows

Notes to Financial Statements

C.D. GIEDT, CPA

Member

BUSINESS DEVELOPMENT & TAX CONSULTANTS

American Institute and California

Society of Certified Public Accountants

www.cdgiedtcpa.com

FAX: 760.747.0588

1030 East Pennsylvania Avenue

Escondido, California 92025.4017

TELEPHONE: 760.747.0539

Independent Auditors Report

Board of Directors

Space Frontier Foundation, Inc.

Nyack, New York

We have audited the accompanying statement of financial position of the Space Frontier Foundation, Inc. (a non-profit

corporation) as of December 31, 2013 and the related statements of activities, changes in net assets and cash flows for the year

then ended.

Management's Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting

principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal

control relevant to the preparation and fair presentation of financial statements that are free from material misstatement whether due to

fraud or error.

Auditor's Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with generally accepted auditing standards in the United States of America and the standards

applicable to financial audits. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether

the financial statements are free of material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The

procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the financial

statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to

preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the

circumstances, but not for the purpose of expressing an opinion on the effectiveness of internal control. Accordingly, we express no

such opinion. And audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant

accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We conducted our audit in accordance with generally accepted auditing standards in the United States of America. Those standards require

that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement.

An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also

includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial

statement presentation. We believe that our audit provides a reasonable basis for our opinion. We believe that the audit evidence we have

obtained is sufficient and appropriate to provide a basis for our audit opinions.

Opinions

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Space

Frontier Foundation, Inc. as of December 31, 2013 and the results of its operations and activities for the year then ended, in

conformity with generally accepted accounting principles in the United States of America.

Other Reporting

Information for the year ended December 31, 2012 is presented for comparative purposes only and was extracted from the

financial statements presented by fund for the year, in which an unqualified opinion dated November 19, 2013 was expressed.

CDGiedt,CPA

Escondido, California

December 9, 2014

Space Frontier Foundation, Inc.

Statement of Financial Position

December 31, 2013

Unrestricted

Temporarily

Restricted

Permanently

Restricted

2013

Total

2012

Total

Assets

Current assets

Cash and

equivalents

62,246

Other current assets

6,630

Total current assets

68,876

Total assets

68,876

$62,246 $101,502

6,630

68,876

101,502

$68,876

101,502

Liabilities

Current liabilities

Accounts payable

Accrued liabilities

Total current

liabilities

Total liabilities

68,876

68,876

101,502

Total net assets

Total liabilities &

net assets

68,876

$68,876 $101,502

See accompanying notes to financial statements.

Space Frontier Foundation, Inc.

Statement of Activities

For the year ended December 31, 2013

Unrestricted

Temporarily

Restricted

2013

Total

2012

Total

Income

Direct Support

Communications

General Operations

$6,563

Space Ventures

Teachers in Space

58,111

$103

103

1,230

8,573

8,573

28,878

1,400

685

685

2,980

2,980

61

12,341

50,690

$96,243

235,960

235,960

355,986

67,265

67,265

139,882

303,225

303,225

495,868

38,349

315,566

353,915

592,111

FlamingMir

Direct Support - Other

Total Direct Support

$38,349

$38,349

38,349

Donations/Grants

Program Service Revenue

NewSpace Conferences/BPC

Total Program Service Revenue

Total Income

Expense by Programs

42,257

42,607

Communications

1,424

1,424

7,262

Overview Institute

2,753

2,753

100,196

100,196

206,329

86,966

86,966

135,111

318

148,321

148,321

161,000

2,085

Program support

46,257

Teachers in Space

NewSpace conferences/BPC

Vision Project

Business Plan Competition

FlamingMir

300

300

IASE

324

324

299

7,232

2,000

564,243

$ 27,868

Return to the Moon

46,257

340,284

386,541

$(7,908)

$(24,718)

$(32,626)

The Watch

Total Expense

Increase (decrease) in net assets

See accompanying notes to financial statements.

Space Frontier Foundation, Inc.

Statement of Changes in Net Assets

For the year ended December 31, 2013

Unrestricted

Temporarily

Restricted

Permanently

Restricted

Net assets, beginning of year

Unrestricted net assets

$ 86,223

Temporarily restricted

Release restriction

(17,971)

17,971

(7,908)

(24,718)

60,344

($24,718)

2012

Total

$ 86,223

$ 53,634

(17,971)

(17,971)

Permanently restricted

2013

Total

33,250

33,250

20,000

-

Increase(decrease)

in net assets

Net assets, end of year

(32,626)

27,868

33,250

$ 68,876

$ 101,502

See accompanying notes to financial statements.

Space Frontier Foundation, Inc.

Statement of Cash Flows

For the year ended December 31, 2013

Increase(decrease)net assets

Adjustments to reconcile

increase (decrease) in net assets

to net cash provided by

operating activities

Changes in:

Other assets

2013

Total

2012

Total

$(32,626)

27,868

none

(6,630)

(39,256)

27,868

(39,256)

27,868

Beginning of year

101,502

73,634

End of year

$62,246

$101,502

Net cash provided(used) by operating

activities

Transfers/adjustments, net

Net increase (decrease)

in cash and cash equivalents

Cash & cash equivalents:

See accompanying notes to financial statements.

Space Frontier Foundation, Inc.

Notes to Financial Statements

December 31, 2013

Note A- Organization and nature of activities

The Space Frontier Foundation, Inc. (the Foundation) was incorporated on October 6, 1988 (reinstated

February 13, 1996) and began operations in 1988. The corporation is a Georgia non-profit public benefit

corporation and is not organized for the private gain of any person. It is organized under the Non-profit Public

Benefit Corporation Law for charitable purposes. The charitable purpose of the corporation is to engage in the

process of educating the public about scientific developments and promote active pursuit of scientific research

toward expansion of the human presence in a space faring civilization.

Some of its programs are as follows:

Advocates- this program involves key participants that commit $180 annually plus they actively engage in one

or more specific programs as discussed below.

New Space Conferences- annual 3-day conferences that focus on the current, near term and future potential and

challenges of the emerging commercial space industry.

Space Business Plan Competition(BPC) - Helping entrepreneurs create NewSpace start-ups and firms that

develop technologies in support of the NewSpace industry by competing for cash prizes.

Teachers in Space - Stimulating student interest in science, technology, engineering and mathematics

(STEM) by engaging their teachers through actual suborbital spaceflight for some teachers, and

extraordinary space-related experiences and unique teaching materials for others.

Space Ventures / TEDxMidTownNY A multidisciplinary presentation / discussion series, featuring

speakers who are actively engaged in the advancement of field research, exploration, and opening the space

frontier.

High Frontier the Foundation has permanently restricted and reserved funds to provide for the future

publishing of the book about future space colonization, "High Frontier" by Gerard K. ONeill. This amounts to

$20,000, and is included in permanently restricted assets.

Notes to Financial Statements (continued)

December 31, 2013

Note B - Summary of significant accounting policies

Basis of Presentation

In accordance with Statement of Financial Accounting Standards No. 116 (SFAS No. 116) Accounting for

Contributions Received and Contributions Made, contributions, including unconditional promises to give, are

recognized as revenue in the period received.

In accordance with Statement of Financial Accounting Standards No. 117 (SFAS No. 117), Financial

Statements of Not-for-Profit Organizations, net assets and revenues, expenses, gains and losses are classified

based on the existence or absence of donor imposed restrictions. Accordingly, net assets of the Foundation and

changes therein are classified and report as follows:

Unrestricted net assets- net assets that are not subject to donor imposed stipulations.

Temporarily restricted net assets - net assets that are subject to donor-imposed stipulations that require

passage of time or the occurrence of a specific event. When the purpose restrictions are accomplished,

the temporarily restricted net assets are reclassified to unrestricted net assets.

Permanently restricted net assets- net assets that are subject to donor-imposed restrictions that they be

maintained permanently while permitting the Foundation to use or expend part or all of the income

derived from the donated assets. The Foundation shows its income and expense in two columns

because it believes this more effectively matches restricted income and allowed expenses.

Accordingly, the Foundation records gifts of cash and other assets as temporarily restricted contributions if

they are received with donor stipulations that limit their use of the donated assets. When a donor restriction

expires, or when a stipulated time restriction ends or the purpose of the restriction is accomplished,

temporarily restricted net assets are reclassified to unrestricted net assets and reported in the statement of

activities as net assets released from donor restrictions. Contributions with permanent (long-term) donor

imposed restrictions that received are recorded as permanently restricted in the statement of activities.

The financial statements of the Foundation have been prepared on the accrual basis of accounting.

The Foundations support comes primarily from individual donors contributions and grant(s) income. Annual

campaign contributions are generally available for unrestricted use in the related campaign year unless

specifically restricted by the donor.

Pledges receivable are recorded as received and recorded at their net realizable value as of the end of the fiscal

year. Allowance for uncollectible pledges is provided based on managements evaluation of potential

uncollectible pledges at year-end. As of year-end there are no receivables and no allowance has been provided.

Endowment contributions and investments are permanently restricted by the donor. Investment earnings are

recorded separately and available for distribution in accordance with donor restrictions.

Contributions of non-cash assets are recorded at their fair values in the period received. There are no material

contributions of donated services. Volunteer time and services (material for some projects) has not been

quantified and collected or valued.

The Foundation considers all liquid investments such as certificates of deposit with maturity of 12 months or less

to be cash equivalents.

Investments are composed of mutual funds investing primarily in equity and debt securities and are carried at fair

value.

Notes to Financial Statements (continued)

December 31, 2013

Note C Cash & cash equivalents

Cash & cash equivalents are summarized at year ends as follows:

Checking

Wells Fargo Bank

Total

K:\CDGESC2014\SPACEFRONTIER2013AUDITREPORT.docx

2013

2012

$ 62,246 $ 101,502

$ 62,246 $ 101,502

También podría gustarte

- Space Settlement Act of 1988Documento5 páginasSpace Settlement Act of 1988Space Frontier FoundationAún no hay calificaciones

- 2012 Audit ReportDocumento10 páginas2012 Audit ReportSpace Frontier FoundationAún no hay calificaciones

- NewSpace 2012 ProgramDocumento47 páginasNewSpace 2012 ProgramSpace Frontier FoundationAún no hay calificaciones

- NSE2002 ProgramDocumento10 páginasNSE2002 ProgramSpace Frontier FoundationAún no hay calificaciones

- NewSpace 2014 ProgramDocumento47 páginasNewSpace 2014 ProgramSpace Frontier FoundationAún no hay calificaciones

- Space Frontier Foundation - SFC 11 Report and PhotosDocumento4 páginasSpace Frontier Foundation - SFC 11 Report and PhotosSpace Frontier FoundationAún no hay calificaciones

- NewSpace 2013 ProgramDocumento49 páginasNewSpace 2013 ProgramSpace Frontier FoundationAún no hay calificaciones

- 2011 Audit ReportDocumento10 páginas2011 Audit ReportSpace Frontier FoundationAún no hay calificaciones

- SFF IRS Form990 2013Documento27 páginasSFF IRS Form990 2013Space Frontier FoundationAún no hay calificaciones

- NewSpace 2013 ProgramDocumento49 páginasNewSpace 2013 ProgramSpace Frontier FoundationAún no hay calificaciones

- 2001 Arthur C. Clarke Gala: Space Frontier Foundation - 2001 Clarke Gala Report and PhotosDocumento5 páginas2001 Arthur C. Clarke Gala: Space Frontier Foundation - 2001 Clarke Gala Report and PhotosSpace Frontier FoundationAún no hay calificaciones

- CATSSymposium1997 ReportDocumento36 páginasCATSSymposium1997 ReportSpace Frontier FoundationAún no hay calificaciones

- Space Frontier Foundation - Space Frontier Conference XII: SynopsisDocumento14 páginasSpace Frontier Foundation - Space Frontier Conference XII: SynopsisSpace Frontier FoundationAún no hay calificaciones

- Space Frontier Foundation - Space Frontier Conference 6: U.S. Air Force Phillips Laboratory ProspaceDocumento10 páginasSpace Frontier Foundation - Space Frontier Conference 6: U.S. Air Force Phillips Laboratory ProspaceSpace Frontier FoundationAún no hay calificaciones

- Space Frontier Conference 7 - Space: The Revolution Is Now!Documento6 páginasSpace Frontier Conference 7 - Space: The Revolution Is Now!Space Frontier FoundationAún no hay calificaciones

- Space Frontier Foundation - Space Frontier Conference 8Documento7 páginasSpace Frontier Foundation - Space Frontier Conference 8Space Frontier FoundationAún no hay calificaciones

- Space Frontier Conference 9: Odyssey's HorizonDocumento5 páginasSpace Frontier Conference 9: Odyssey's HorizonSpace Frontier FoundationAún no hay calificaciones

- SFC2004 Program13Documento8 páginasSFC2004 Program13Space Frontier FoundationAún no hay calificaciones

- Space Frontier Conference 10: in Search of 2001Documento9 páginasSpace Frontier Conference 10: in Search of 2001Space Frontier FoundationAún no hay calificaciones

- Space Frontier Conference 14: Another Successful Event From The Space Frontier Foundation!Documento11 páginasSpace Frontier Conference 14: Another Successful Event From The Space Frontier Foundation!Space Frontier FoundationAún no hay calificaciones

- RTM2001 ProgramIIIDocumento1 páginaRTM2001 ProgramIIISpace Frontier FoundationAún no hay calificaciones

- Space Enterprise SymposiumDocumento4 páginasSpace Enterprise SymposiumSpace Frontier FoundationAún no hay calificaciones

- Return of Organization Exempt From Income Tax: 13-3542980 NameDocumento20 páginasReturn of Organization Exempt From Income Tax: 13-3542980 NameSpace Frontier FoundationAún no hay calificaciones

- Silicon Valley Space Enterprise SymposiumDocumento2 páginasSilicon Valley Space Enterprise SymposiumSpace Frontier FoundationAún no hay calificaciones

- AeroSpace Economy in North CarolinaDocumento30 páginasAeroSpace Economy in North CarolinaSpace Frontier FoundationAún no hay calificaciones

- 2013 Annual ReviewDocumento19 páginas2013 Annual ReviewSpace Frontier FoundationAún no hay calificaciones

- The Space Frontier Foundation's Fourth Annual Return To The Moon Conference "Crossroads To The Cosmos"Documento7 páginasThe Space Frontier Foundation's Fourth Annual Return To The Moon Conference "Crossroads To The Cosmos"Space Frontier FoundationAún no hay calificaciones

- 2011 Annual ReviewDocumento17 páginas2011 Annual ReviewSpace Frontier FoundationAún no hay calificaciones

- 2012 Annual ReviewDocumento17 páginas2012 Annual ReviewSpace Frontier FoundationAún no hay calificaciones

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- BusLaw Chapter 1Documento4 páginasBusLaw Chapter 1ElleAún no hay calificaciones

- Controlled Chaos in Joseph Heller's Catch-22Documento5 páginasControlled Chaos in Joseph Heller's Catch-22OliverAún no hay calificaciones

- Aircraft Accident/Incident Summary Report: WASHINGTON, D.C. 20594Documento14 páginasAircraft Accident/Incident Summary Report: WASHINGTON, D.C. 20594Harry NuryantoAún no hay calificaciones

- EXL ServiceDocumento2 páginasEXL ServiceMohit MishraAún no hay calificaciones

- RA MEWP 0003 Dec 2011Documento3 páginasRA MEWP 0003 Dec 2011Anup George Thomas100% (1)

- Forces of Fantasy (1ed)Documento127 páginasForces of Fantasy (1ed)Strogg100% (7)

- Problematika Pengembangan Kurikulum Di Lembaga Pendidikan Islam: Tinjauan EpistimologiDocumento11 páginasProblematika Pengembangan Kurikulum Di Lembaga Pendidikan Islam: Tinjauan EpistimologiAhdanzulAún no hay calificaciones

- World-Systems Analysis An Introduction B PDFDocumento64 páginasWorld-Systems Analysis An Introduction B PDFJan AudreyAún no hay calificaciones

- Tax 2 AssignmentDocumento6 páginasTax 2 AssignmentKim EcarmaAún no hay calificaciones

- Chapter 3-Hedging Strategies Using Futures-29.01.2014Documento26 páginasChapter 3-Hedging Strategies Using Futures-29.01.2014abaig2011Aún no hay calificaciones

- 8098 pt1Documento385 páginas8098 pt1Hotib PerwiraAún no hay calificaciones

- LDN Mun BrgysDocumento8 páginasLDN Mun BrgysNaimah LindaoAún no hay calificaciones

- PLAI 10 Point AgendaDocumento24 páginasPLAI 10 Point Agendaapacedera689100% (2)

- English The Salem Witchcraft Trials ReportDocumento4 páginasEnglish The Salem Witchcraft Trials ReportThomas TranAún no hay calificaciones

- Rationale For Instruction: Social Studies Lesson Plan TemplateDocumento3 páginasRationale For Instruction: Social Studies Lesson Plan Templateapi-255764870Aún no hay calificaciones

- The Meaning of Life Without Parole - Rough Draft 1Documento4 páginasThe Meaning of Life Without Parole - Rough Draft 1api-504422093Aún no hay calificaciones

- Network Marketing - Money and Reward BrochureDocumento24 páginasNetwork Marketing - Money and Reward BrochureMunkhbold ShagdarAún no hay calificaciones

- Solution Manual For Fundamentals of Modern Manufacturing 6Th Edition by Groover Isbn 1119128692 9781119128694 Full Chapter PDFDocumento24 páginasSolution Manual For Fundamentals of Modern Manufacturing 6Th Edition by Groover Isbn 1119128692 9781119128694 Full Chapter PDFsusan.lemke155100% (11)

- Flowserve Corp Case StudyDocumento3 páginasFlowserve Corp Case Studytexwan_Aún no hay calificaciones

- Environmental PolicyLegislationRules & RegulationsDocumento14 páginasEnvironmental PolicyLegislationRules & RegulationsNikin KannolliAún no hay calificaciones

- Types of Electronic CommerceDocumento2 páginasTypes of Electronic CommerceVivek RajAún no hay calificaciones

- An Analysis of Gram Nyayalaya Act, 2008 FDRDocumento15 páginasAn Analysis of Gram Nyayalaya Act, 2008 FDRPrakash Kumar0% (1)

- Hue University Faculty Labor ContractDocumento3 páginasHue University Faculty Labor ContractĐặng Như ThànhAún no hay calificaciones

- Microsoft End-Point ManagerDocumento25 páginasMicrosoft End-Point ManagermaazAún no hay calificaciones

- Gurdjieff & Fritz Peters, Part IDocumento7 páginasGurdjieff & Fritz Peters, Part IThe Gurdjieff JournalAún no hay calificaciones

- CallClerk User GuideDocumento94 páginasCallClerk User GuiderrjlAún no hay calificaciones

- Spouses Ismael and Teresita Macasaet Vs Spouses Vicente and Rosario MacasaetDocumento20 páginasSpouses Ismael and Teresita Macasaet Vs Spouses Vicente and Rosario MacasaetGladys Laureta GarciaAún no hay calificaciones

- Pilot Registration Process OverviewDocumento48 páginasPilot Registration Process OverviewMohit DasAún no hay calificaciones

- URP - Questionnaire SampleDocumento8 páginasURP - Questionnaire SampleFardinAún no hay calificaciones

- How To Get The Poor Off Our ConscienceDocumento4 páginasHow To Get The Poor Off Our Conscience钟丽虹Aún no hay calificaciones