Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Anthony & Hawkins Ch. 10 Solution

Cargado por

Feby RahmawatiTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Anthony & Hawkins Ch. 10 Solution

Cargado por

Feby RahmawatiCopyright:

Formatos disponibles

CHAPTER 10

OTHER ITEMS THAT AFFECT

NET INCOME AND OWNERS EQUITY

Changes from Eleventh Edition

Updated from Eleventh Edition.

Approach

This chapter contains several topics that instructors may wish to emphasize in varying degrees. In

particular, the rather detailed rules on extraordinary items, discontinued operations, change in accounting

principles, and correction of errors may be more than students can readily assimilate; they can always

refer back to the rules if this becomes necessary.

Similarly, some instructors prefer not to get into foreign currency matters at all in an introductory course;

some cover transactions but not translation; and others cover both, perhaps because of the increased

emphasis on covering international issues in the overall core curriculum.

With respect to personnel costs, the important point is the difference between transactions that are costs to

the company and those that result from the company serving as a collection agency for the government. In

my own view, any details of pension accounting can be withheld for an intermediate course, but I want

students to have an overview of the issues and complications of pension accounting.

I spend the most time on deferred taxes, both because virtually every set of financial statements students

are likely to see will contain this item and because it always seems to be a difficult topic for students to

master. The ease of teaching this subject diminished even further when MACRS allowances replaced the

usual tax deprecation illustrations using sum-of-the-years-digits depreciation. FAS109, in my view,

further complicates matters.

Cases

Norman Corporation (B) raises some new, and reviews some old, issues in expense recognition.

Silver Appliance Company enables students to explore deferred tax accounting in the context of the

installment method of reporting installment sales revenues.

Kansas City Zephyrs Baseball Club, Inc., requires students to apply accrual accounting to cash flows in

order to properly match costs and revenues.

Freedom Technology Company deals with the translation of financial statements. If desired, both the

currently required method and alternative approaches can be compared.

Proxim, Inc. raises issues related to proforma earnings disclosures. This case is new with the Twelfth

Edition.

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

Problems

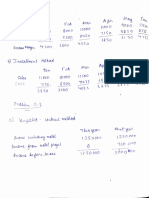

Problem 10-1

Wages Payable

Cash

FICA Taxes Payable

Withholding Taxes Payable

And, to finish, payment to government:

FICA Taxes Payable

Unemployment Taxes Payable

Withholding Taxes Payable

Cash

1,025.00

776.35

74.65

174.00

149.30

40.05

174.00

363.35

Problem 10-2

dr. Pension Cost...............................................................................................................................................................................

85,000

cr. Cash........................................................................................................................................................................................

40,100

Pension Liability.....................................................................................................................................................................

44,900

Problem 10-3

Financial Statements (Accrual Basis)

1999

2000

2001

2002

Revenues.........................................................................................................................................................................................

$456,000

$696,000

$840,000

$780,000

Expenses.........................................................................................................................................................................................

270,000

672,000

798,000

618,000

Profit before taxes...........................................................................................................................................................................

186,000

24,000

42,000

162,000

Tax provision (30%)........................................................................................................................................................................

55,800

7,200

12,600

48,600

Tax Return (Cash Basis)

1999

2000

2001

2002

Receipts...........................................................................................................................................................................................

$336,000

$636,000

$894,000

$690,000

Disbursements.................................................................................................................................................................................

288,000

528,000

750,000

606,000

Taxable income...............................................................................................................................................................................

48,000

108,000

144,000

84,000

Tax payment (30%).........................................................................................................................................................................

14,400

32,400

43,200

25,200

1999

2000

2001

2002

Tax provision..................................................................................................................................................................................

$55,800

$ 7,200

$ 12,600

$48,600

Tax payment....................................................................................................................................................................................

14,400

32,400

43,200

25,200

Difference.......................................................................................................................................................................................

41,400

(25,200)

(30,600)

23,400

Cumulative difference.....................................................................................................................................................................

$41,400

$16,200

$(14,400)

$ 9,000

Cash basis accounting for tax payment purposes was preferable for the 1999 - 02 period. It resulted in

lower cumulative tax payments.

The difference between the annual tax provision and tax payments would be handled through deferred tax

accounting.

2007 McGraw-Hill/Irwin

Chapter 10

Problem 10-4

Net book value of machinery for financial reporting purposes

Year

1997

1998

1999

2000

2001

2002

Cost

$2,750,000

2,750,000

2,750,000

2,750,000

2,750,000

2,750,000

Depreciation

Expense

$275,000

550,000

550,000

550,000

550,000

275,000

Cumulative

Depreciation

Allowance

$ 275,000

825,000

1,375,000

1,925,000

2,475,000

2,750,000

Net Book Value

$2,475,000

1,925,000

1,375,000

825,000

275,000

-0-

Depreciation

Deduction

$550,000

880,000

528,000

316,250

316,250

159,500

Cumulative

Depreciation

Deduction

$ 550,000

1,430,000

1,958,000

2,274,250

2,590,500

2,750,000

Net Tax Basis

$2,200,000

1,320,000

792,000

475,750

159,500

-0-

Net tax basis of machinery for tax purpose.

Year

1997

1998

1999

2000

2001

2002

Tax Basis

$2,750,000

2,750,000

2,750,000

2,750,000

2,750,000

2,750,000

Deferred Tax Liability Calculation

Year

1997

1998

1999

2000

2001

2002

Net Book Value

$2,475,000

1,925,000

1,375,000

825,000

275,000

-0-

Net Tax Basis

$2,200,000

1,320,000

792,000

475,750

159,500

-0-

Difference

$275,000

605,000

583,000

349,250

115,500

-0-

Deferred Tax

Liability

$110,000

242,000

233,200

139,700

46,200

-0-

Taxable Income

$ 950,000

620,000

972,000

1,183,750

1,183,750

1,340,500

Tax Payment

$380,000

248,000

388,800

473,500

473,500

536,200

Income Tax Payments

Year

1997

1998

1999

2000

2001

2002

Profit Before

Depreciation

$1,500,000

1,500,000

1,500,000

1,500,000

1,500,000

1,500,000

Depreciation

$550,000

880,000

528,000

316,250

316,250

159,500

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

Income Tax Provisions

Year

1997

1998

1999

2000

2001

2002

1997

1998

1999

2000

2001

2002

Profit before

Depreciation

$1,500,000

1,500,000

1,500,000

1,500,000

1,500,000

1,500,000

Depreciation

$275,000

550,000

550,000

550,000

550,000

275,000

Pretax Income

$1,225,000

950,000

950,000

950,000

950,000

1,225,000

Tax Provision Presentation

Current

Deferred

Tax Expense

Tax Expense

$380,000

$110,000

248,000

132,000

388,800

(8,800)

473,500

(93,500)

473,500

(93,500)

536,200

(46,200)

Tax Provision

$490,000

380,000

380,000

380,000

380,000

490,000

Total Tax

Provision

$490,000

380,000

380,000

380,000

380,000

490,000

In 1999 the deferred tax liability account reverses.

A T-account tracking of the 1997 - 2002 tax payments, tax provision and deferred tax liability balances

can be constructed from the above schedules. Tax payments reduce cash. The deferred tax portion of the

total tax provision is initially a credit to the deferred tax liability account (1997 - 98) and thereafter a debit

entry.

Problem 10-5

1. APB Opinion No. 30 requires that in order to qualify as an extraordinary item, an event must satisfy

two criteria:

1. The event must be unusual; it should be highly abnormal and unrelated to, or only incidentally

related to, the ordinary activities of the entity.

2. The event must occur infrequently; it should be of a type that would not reasonably be expected

to recur in the foreseeable future.

Item 5 (loss of $300,000 due to explosion caused by disgruntled ex-husband of an employee) meets

the two extraordinary-item criteria.

Item 1 is explicitly excluded by APB No. 30 as an extraordinary item.

Item 2 is not an extraordinary item. Hurricanes are not an infrequent event in Louisiana.

Item 3 may be considered an extraordinary item if floods in northern New Mexico occur

infrequently.

Item 4 is not an extraordinary item. Selling segments of a business is a frequent business activity.

2007 McGraw-Hill/Irwin

Chapter 10

2.

Income before

extraordinary item........................................................................................................

$XXX,XXX

Extraordinary item, net

of applicable income

taxes ($90,000).............................................................................................................

210,000

Net income

$XXX,XXX

Problem 10-6

a. and b.

c.

1.

dr. Inventory...........................................................................................................................................

57,600

cr. Note Payable...................................................................................................................................

57,600

2.

dr. Note Receivable................................................................................................................................

2,700

cr. Sales................................................................................................................................................

2,700

3.

dr. Accounts Receivable.........................................................................................................................

720,000

cr. Sales................................................................................................................................................

720,000

4.

dr. Inventory...........................................................................................................................................

119,600

cr. Account Payable.............................................................................................................................

119,600

1.

Note Payable (year end).........................................................................................................................

$ 60,000

Note Payable (transaction date)..............................................................................................................

57,600

Exchange loss....................................................................................................................................

$ 2,400

2.

Note receivable (year end).....................................................................................................................

$ 3,000

Note receivable (transaction date)..........................................................................................................

2,700

Exchange gain....................................................................................................................................

$ 300

3.

Account receivable (year end)................................................................................................................

$692,308

Account receivable (transaction date)....................................................................................................

720,000

Exchange loss....................................................................................................................................

$ 27,692

4.

No exchange gain or loss. Exchange rate unchanged.

Cases

Case 10-1: Norman Corporation (B)

Note: This case has been updated from the Tenth Edition.

Approach

This case provides a basis for discussing several tough problems in expense recognition. Except for the

summary given in Exhibit A of this note, each of the topics is self-contained. They may provide more

material than the instructor wishes to cover in one session; any of them can be omitted without hurting the

overall results.

*

This teaching note was prepared by Robert N. Anthony. Copyright Robert N. Anthony.

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

Answers to Questions

1. Although many firms charge the cost of such brochures as an expense when incurred, there is no

requirement that this be done. The $25,000 of brochures on hand are economic resources that will

benefit a future period. Unless the conservatism concept is given heavy weight, Normans treatment is

appropriate.

2. The almost universal and required practice is to charge advertising expenditures as expense in the

year incurred. There is one important exception to this requirement. Direct response advertising costs

can be capitalized if a reasonable estimate of the response rate can be made based on past advertising

programs. The argument made for capitalization seems sound. Because a prospective lender might

well question this departure from custom, however, Allen Burrows can argue that it is prudent to

charge the $75,000 as an expense.

3. However strong the rationale for capitalization, research/development costs must be expensed in

accordance with FASB Statement No. 2. Thus, expense must be increased by $19,000, which is the

difference between the amount charged and the expenditure for 2006. (This issue resurfaced in the

context of computer software development costs; see FASB-86. It permits capitalization if certain

conditions are met.)

This is a change in accounting principles and the cumulative effect of the change must be shown on

the income statement. Referring back to Exhibit 1 of the (A) case, the balance in the Development

Costs account at the beginning of 2006 must have been $105,648 ($124,648 - $55,000 + $36,000),

and this amount must be charged against income. (It is to be hoped that the lender will accept these

unusual charges for what they are in appraising the resulting net income.)

4. Despite the literature on the subject, human resource accounting is not a generally accepted

accounting principle. Those few companies that have reported such training costs as assets have done

so in supplementary notes or supplementary financial statements, not in the official statements. The

$35,000 should therefore be charged as an expense.

5. This is typical of situations in which there is no right answer. The net amount of accounts receivable

should be an amount that has a high probability of being received. In this case, if the firm pays off at

less than 77 cents on the dollar, the bad debt allowance ($5,250) is not large enough, even if there are

no other bad debts. The prudent solution is to increase the allowance. There is no point in debating the

amount of the increase at length because there are no facts to go on (which is typical in these

situations). The important point is that some increase is needed. A case can be made for increasing the

allowance by $14,000 or so, and this arbitrary amount is used here.

6. Imputing an expense for self-insurance is not permitted under generally accepted accounting

principles. Income should be increased by $1,250, which is the difference between the $5,000 charged

and the $3,750 that should have been charged. This is also a change in accounting principles, so the

opening balance of $19,650 ($20,900 - $5,000 + $3,750) in the reserve account should be credited to

income.

7. This problem illustrates the treatment of discontinued operations, even though the amount involved is

a little small to be material. APB Opinion No. 30 applies to discontinuance of a component of an

entity whose activities represent a separate major line of business or class of customer, . . . provided

that its assets, results of operations, and activities can be clearly distinguished, physically and

operationally and for financial reporting purposes, from the other assets, results of operations, and

activities of the entity. (par. 13)

2007 McGraw-Hill/Irwin

Chapter 10

The transaction must be reported in the year in which the decision to sell is made, in this case, 2006.

It is reported in two parts:

a. Operating income of the parking lot for 2006 is set out separately. In this case, it would be

$19,000, less applicable income taxes, assumed here to be $7,600 (40%), an increase in net

income of $11,400.

b. AP-30, par. 15, requires recognizing a loss on discontinued operations at the measurement date

(here, December 31, 2006); but a gain should not be reported until it is realized. This is consistent

with the conservatism concept. Thus, Normans treatment of this item was correct, even though

its rationale was not the relevant one.

8. The fact that the president sold the stock for $25,000 is irrelevant. This was a transaction between two

outside parties, and had no effect on the Norman Corporation itself. The $3,000 gain on the sale of the

treasury stock does not affect income. A corporation cannot make a gain by issuing its own stock. The

$3,000 should have been credited directly to Capital Surplus (which is the term used by Norman, but

which more properly is called Additional Paid-in Capital).

9. The charge to Retained Earnings should have been made when the $50,000 dividend was declared,

not when it was paid. Thus, the 2006 dividend should have been charged to Retained Earnings in

2006 rather than in 2007, so the amount reported as dividends for 2006 was correct. The result of

Normans practice is to omit a current liability, Dividends Payable. The balance sheet should

therefore be adjusted by increasing current liabilities by $50,000 and decreasing Retained Earnings by

$50,000. (There is, of course, no impact on income from dividend transactions.)

The effect of these transactions is summarized in Exhibit A.

Question 2

Norman could clean up its net nonoperating income and expense account (which should be called

nonoperating revenue and expense, but usually isnt in practice). These items actually are either operating

items (e.g., interest expense, which should be shown as a separate line), or extraordinary items,

accounting changes, correction of errors, or discontinued operations (all below the line items).

EXHIBIT A

NORMAN CORPORATION (B)

Item

1

2

3

3

4

5

6

6

7

7

8

9

(a)

(b)

(a)

(b)

(a)

(b)

Effect on Income of

Required Changes

None

None (?)

$ -19,000

-105,648

-35,000

-14 000 (?)

+1,250

+19,650

None

None

-3,000

None

Net effect.............................................................................................................................................

$-155,748

Of which, change in accounting principles..........................................................................................

$ - 85,998

Discontinued operations.......................................................................................................................

None

Other....................................................................................................................................................

-69,750

$-155,748

7

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

Case 10-2: Silver Appliance Company*

Note: This case is the same version that was in the Eleventh Edition.

Approach

This case enables students to get some hands-on experience in dealing with the complex matter of

deferred taxes, and also in applying the installment method that was described in Chapter 5. It also

requires them to think through how these complexities can be explained to a nonaccountant, and to

recognize that a change in accounting method for tax purposes may involve transitional problems relating

to potential double taxation of income.

Many students will have difficulties figuring out the calculations required for Question 1. These

difficulties can be mitigated by including on the assignment sheet a worksheet format like that used in

Exhibit A of this note. Alternatively, we can hand out in class a copy of Exhibit A, or have them copy it

from a transparency. In any event, in class I go through an example for one year using T accounts, as

follows:

Book

Tax

Sales....................................................................................................................................................................................

$1,000

$900

Cost of sales @ 70%...........................................................................................................................................................

700

630

Gross margin.......................................................................................................................................................................

300

270

Other expenses....................................................................................................................................................................

200

200

Pretax income......................................................................................................................................................................

100

70

Income tax expense @ 34%................................................................................................................................................

34

23.8

Actual taxes as percent of pretax Book income...............................................................................................................

34%

23.8%

Cash (or Taxes

Payable)

23.8

Income Tax

Expense

34

Deferred

Taxes

10.2

This illustrates both the basic concept of deferred taxes, and also the rationale taxes as a percent of

pretax income would be understated (23.8% instead of the true 34%) if the book income tax expense

amount were the amount of actual taxes rather than the actual tax rate applied to book pretax income.

This example uses the deferral method--rather than the liability method--to compute deferred taxes.

Students find this deferral method easier to understand.

Comments on Questions

Question 1

The required calculations are displayed in Exhibit A. Line 8 shows how much less Silvers taxes would

have been in 1989-93 and that taxes would have been higher in 1993 using the installment method. Line 9

shows each years year-end balance of Deferred Taxes; again, note that the reversal in 1993 causes the

balance to decrease.

This teaching note was prepared by James S. Reece. Copyright James S. Reece.

2007 McGraw-Hill/Irwin

Chapter 10

Exhibit A

SILVER APPLIANCE COMPANY

(In Thousands)

Accounting: Text and Cases 12e Instructors Manual

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

Anthony/Hawkins/Merchant

1989

1990

1991

1992

1993

Year-end installment receivables.................................................................................................................................................

$190.1

$351.9

$526.2

$559.4

$489.1

Gross margin %...........................................................................................................................................................................

34.6%

35.1%

34.2%

33.4%

32.2%

Deferred gross margin (= 1 * 2)..................................................................................................................................................

65.77

123.52

179.96

186.84

157.49

Pretax profit, delivery basis.........................................................................................................................................................

332.6

415.3

478.2

492.5

461.3

Income taxes, delivery basis (34% of 4)......................................................................................................................................

113.08

141.20

162.59

167.45

156.84

Pretax profit, installment basis (= 4 - 3 +

previous years 3) 47.31..............................................................................................................................................................

266.83

357.55

421.76

485.62

490.65

Income taxes, installment basis (34% of 6).................................................................................................................................

90.72

121.57

143.40

165.11

166.82

1

2

Tax deferred (5 - 7)......................................................................................................................................................................

22.36

19.63

19.19

2.34

(9.98)

Cumulative tax deferred..............................................................................................................................................................

22.36

41.99

61.18

63.52

53.54

Liability method calculations is Line 3 ($65.77) times 34 percent.

Liability method calculations is $41.99 minus $22.36 (see line 9).

Question 2

The balance in the deferred tax account is best described as the cumulative amount of taxes that the

company has postponed by using the installment method rather than the delivery method for tax purposes.

Some people refer to this as an interest-free loan from the government. This is true in the sense that

these funds would have been paid in taxes if the tax laws did not permit use of the installment method. In

another sense, it is not true: if the company used the installment method for both book and tax

purposes, the company would have the same cash-flow benefit, but would not show any deferred tax

accounting (ignoring other possible book-tax accounting differences); that is, it would have the same

loan, even though the loan would not be reflected in the balance sheet.

I also feel it should be explained to Mr. Silver that deferred taxes are a liability, but not in the same sense

that taxes payable are. Personally, I find the APBs analogy in Opinion No. 11 very compelling: like

accounts payable, deferred taxes do come due and get paid, even though the balance in the account may

grow because each years credits (new payables or deferrals) exceed that years debits (accounts paid or

deferral reversals). Indeed 1993s simultaneous drop in installment sales and gross margin percentage

relative to 1992 clearly illustrates the phenomenon of turnover within the Deferred Taxes account. Like

Mr. Silvers architect friend, Silvers taxes could remain essentially constant even though delivery-basis

sales and profit have declined (see lines 4 and 6 of Exhibit A).

The instructor may wish to indicate in advance that he or she does not expect students to check the tax

code regarding the double taxation issue. The point of the question is to make students realize that there

can be transitional problems surrounding a change in accounting method for tax purposes. Students

should at least be able to answer, There will be double taxation on installment sales recognized in 1993

under the delivery method, but not collected until 1994 when the installment method is adopted, unless

the tax laws recognize this problem and provide relief for it. In fact, the tax law (Sec. 453) says that

Silver would have to report in 1994 all installment collections made in 1994, but could adjust 1994 taxes

downward for those 1994 collections that were taxed under the delivery method in 1993. In effect, then,

Silver would get a refund of that portion of 1993 taxes that related to installment sales that were reported

in both 1993 and 1994, and would be taxed on these collections only in 1994.

Although the question is not explicitly asked, the discussion should end with resolution of the issue as to

whether Silver should change to the installment method. If students have previously raised a similar

question on a switch from FIFO to LIFO, having seen here that 1993 taxes would have been higher on the

installment basis than the delivery basis, they are tempted to answer, It depends on the expected future

relationship between income on the installment basis and the delivery basis. However, in this instance

10

2007 McGraw-Hill/Irwin

Chapter 10

that answer is not correct. Unless tax rates are expected to be increased, the installment method will

always provide some advantage: there is no way (given no double taxation in the year of change) that a

change from the delivery basis to the installment basis could result at any time in a negative (debit)

balance in Deferred Taxes. Thus, the change should be made.

Case 10-4: Freedom Technology Company*

Note: This case is unchanged from the Eleventh Edition.

Approach

Because FASB 8 proscribed the earlier freedom of choice of a translation method, and then FASB 52

changed FASB 8s method, I prefer teaching this case with a legislative history flavor, rather than just

dealing with the mechanics of the net investment or current rate method. While the students still learn the

basics behind the net investment method, they gain a better understanding of the translation concept in

general and also are exposed to the lengthy controversy surrounding some otherwise apparently

innocuous accounting rules. Of course, some instructors will choose to assign only Question 1.

This topic is not included in many core financial accounting courses. However, with the increase in

multinational operations of businesses, and the resultant concern about international content in the

business core curriculum, the topic seems more germane to the core course than it did in previous years.

Comments on Questions

I begin class with a student presenting the statements called for in questions 1 and 2 (see Ex. A and B).

Using the text example (Illustration 10-7) as a basis, students have little trouble with the net investment

method, except for the equity items. Some will forget to translate capital stock at the rate in effect when it

was issued. While most will have gotten the translation adjustment as a plug figure, many will have

trouble directly calculating it. As indicated at the bottom of Exhibit A, the importance of the calculation is

not the mechanics so much as the insight one gains into what the adjustment represents.

The remeasurement of monetary/nonmonetary method is more difficult, both because it is not illustrated

in the text and because of the nonmonetary asset adjustments being different from those in the net

investment method. These difficulties should not be permitted to obscure the different investment

exposure concepts behind the two methods. The net investment method views the owners equity as being

exposed to exchange rate fluctuations; i.e., fluctuations in assets translated amounts are offset to the

extent possible by liability fluctuations, leaving exposed only the portion of assets financed by equity. By

contrast, the monetary/nonmonetary method treats nonmonetary assets as a hedge against unfavorable

exchange rate fluctuations. (Compare especially the translated amounts for fixed assets under the two

methods.)

One word of caution is in order. To keep this problem as simple as possible, the foreign entity was formed

at the start of the current year (i.e., October 1, 20xl). It is for this reason (plus the assumption of no

dividends) that in Exhibits A and B the year-end retained earnings are the same as the years net income.

In succeeding years, the concept for getting the translation gain or loss as a plug figure remains the

same, but the mechanics become slightly more complex. (In fact, in practice this item is derived as a plug

figure, rather than calculated directly.)

This case example clearly illustrates the reason the translation method controversy at least among

statement preparers seems to have died down since the issuance of FASB 52. In circumstances such as

those faced by Freedom A (i.e., foreign currency value dropping relative to the dollar), the

*

This teaching note was prepared by Robert N. Anthony. Copyright Robert N. Anthony.

11

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

monetary/nonmonetary method reports a smaller translation loss; hence, in pre-FASB 8 days, this method

would have been the better of the two from managements standpoint. The preparers real objection to

FASB 8, in my view, was not the method so much as it was treating the translation gain or loss as an

element of net income. Despite a companys best efforts to keep operating earnings consistently on the

rise, the translation gain or loss caused fluctuations, resulting in great consternation among top managers.

This phenomenon can lead the class, if the instructor wishes, into a discussion of the efficient markets

hypothesis as it relates to accounting methods. According to EMH, the translation method used should

have no impact on stock price, since cash flow is independent of method used. Of course, if management,

given a method they must use (e.g., monetary/nonmonetary), changes its decisions solely to influence the

result reported by the accounting method, then stock price could be affected because cash flows could be

different. A study done by Professor Shank, et al. (see Financial Executive, Feb. 1980 for a summary)

revealed that companies were in fact engaging in transactions that were induced more by FASB 8 than by

purely economic considerations, especially currency hedging transactions. The study also indicated that

FASB 8 did not change the markets perception of the riskiness of firms affected by FASB 8, and the

managements FASB 8 induced action was therefore unwarranted. To quote the study, Managers are so

committed to the importance of the accounting numbers that they will undertake actions in the foreign

currency area which they know will increase expected costs and risk levels just to preserve desired

relationships in the accounting numbers.

12

2007 McGraw-Hill/Irwin

Chapter 10

Exhibit A

Net Investment Translation Method

(won in millions, dollars in thousands)

Freedom-Korea

Balance Sheet as of September 30, 20x2

Assets

Won

Exchange Rate

Dollars

Cash...................................................................................................................................................................................

W591

$0.00124

$ 732.8

Receivables........................................................................................................................................................................

1,182

0.00124

1,465.7

Inventories..........................................................................................................................................................................

552

0.00124

684.5

Fixed assets .......................................................................................................................................................................

575

0.00124

713.0

W2,900

$3,596.0

Liabilities and Owners Equity

Current liabilities................................................................................................................................................................

W624

0.00124

$ 773.8

Capital stock.......................................................................................................................................................................

1,000

0.00140

1,400.0

Retained earnings...............................................................................................................................................................

1,276

(see below)

1684.3

Accum. translation adjustments..........................................................................................................................................

---*

(262.1)

W2,900

$3,596.0

Income Statement for the year ended September 30, 20x2

Revenues............................................................................................................................................................................

W7,090

$0.00132

$9,358.8

Cost of sales ......................................................................................................................................................................

4,415

0.00132

5,827.8

Other expenses...................................................................................................................................................................

1,399

0.00132

1,846.7

Net Income.........................................................................................................................................................................

W1,276

$1,684.3

* Calculation of translation loss:

Oct. 1, 20xl net assets = W1,000

Translated at Sept 30, 20x2 rate = 1,000 * $0.00124..............................................................................................

$ 1,240.0

Translated at Oct. 1, 20xl rate = 1,000 * 0.00140...................................................................................................

1,400.0

Loss on beginning-of-year net assets......................................................................................................................

$ (160x.0)

Increment in net assets during FT 20x2 = W 1,276

Translated at Sept 30,20x2 rate = 1,276 * $0.00124...............................................................................................

$1,582.2

Translated at average FY 20x2 rate = 1,276 * 0.00132...........................................................................................

1,684.3

Loss on increment in net assets...............................................................................................................................

$ (102.1)

Total loss in dollar value of net assets........................................................................................................................

$ (262.1)

(The loss figure can be determined without the above calculation, since the loss is the amount needed to

make the balance sheet balance; but the calculation shows the rationale behind the loss, i.e., the loss

occurred because the parent held South Korean won net assets while the value of the won fell relative to

the dollar.)

13

Accounting: Text and Cases 12e Instructors Manual

Anthony/Hawkins/Merchant

Exhibit B

Monetary/Nonmonetary Translation Method

(won in millions, dollars in thousands)

Freedom-Korea

Balance Sheet as of September 30, 20x2

Assets

Won

Exchange Rate

Dollars

Cash................................................................................................................................................................................................

W591

$0.00124

$ 732.8

Receivables.....................................................................................................................................................................................

1,182

0.00124

1,465.7

Inventories......................................................................................................................................................................................

552

0.00126

695.5

Fixed assets.....................................................................................................................................................................................

575

0.00140

805.0

W2,900

$3,699.0

Liabilities and Owners Equity

Current liabilities.............................................................................................................................................................................

W624

0.00124

$ 773.8

Capital stock....................................................................................................................................................................................

1,000

0.00140

1,400.0

Retained earnings............................................................................................................................................................................

1,276

(plug)

1,525.2

W2,900

$3,699.0

Income Statement for the year ended September 30, 20x2

Revenue..........................................................................................................................................................................................

W7,090

$0.00132

$9,358.8

Cost of sales....................................................................................................................................................................................

4,415

0.00132*

5,827.8*

Other expenses (excl. deprec.)........................................................................................................................................................

1,374

0.00132

1,813.7

Depreciation....................................................................................................................................................................................

25

0.00140

35.0

Operating income............................................................................................................................................................................

1,276

1,682.3

Translation gain (loss).....................................................................................................................................................................

---(plug)

(157.1)

Net Income .....................................................................................................................................................................................

W1,276

$1,525.2

*This is an approximation. A precise calculation incorporates beginning and ending inventories, as well as

purchases, thus:

Beginning inventory........................................................................................................................................................................

W0

0.00140

$

0.0

Plus purchases.................................................................................................................................................................................

4,967

0.00132

6,556.4

Less ending inventory.....................................................................................................................................................................

(552)

0.00126

(695.5)

Cost of sales....................................................................................................................................................................................

W4,415

$5,860.9

14

También podría gustarte

- Chapter 5 ProblemsDocumento7 páginasChapter 5 Problemsanu balakrishnanAún no hay calificaciones

- Chap 026Documento17 páginasChap 026Neetu Rajaraman100% (2)

- Basel III - An Easy To Understand SummaryDocumento18 páginasBasel III - An Easy To Understand SummaryDhiwakar Sb100% (2)

- Anthony Im 26Documento18 páginasAnthony Im 26Aswin PratamaAún no hay calificaciones

- Case 5 Joan Holtz Answer KeyDocumento5 páginasCase 5 Joan Holtz Answer KeyAashima GroverAún no hay calificaciones

- Ross Appendix19ADocumento7 páginasRoss Appendix19ARichard RobinsonAún no hay calificaciones

- Can One Size Fits AllDocumento8 páginasCan One Size Fits AllAngelica B. PatagAún no hay calificaciones

- Chapter 27 Management AccountingDocumento19 páginasChapter 27 Management AccountingLiz Espinosa100% (1)

- Sources of Capital: Debt: Changes From Eleventh EditionDocumento19 páginasSources of Capital: Debt: Changes From Eleventh EditionDhiwakar Sb100% (1)

- Pinetree MotelMP 26 Case - N - Group 4Documento5 páginasPinetree MotelMP 26 Case - N - Group 4harleeniitrAún no hay calificaciones

- Landau CompanyDocumento4 páginasLandau Companyrond_2728Aún no hay calificaciones

- Financial Statement Analysis: Changes From Eleventh EditionDocumento11 páginasFinancial Statement Analysis: Changes From Eleventh EditionDhiwakar SbAún no hay calificaciones

- Financial Statement Analysis: Changes From Eleventh EditionDocumento11 páginasFinancial Statement Analysis: Changes From Eleventh EditionDhiwakar SbAún no hay calificaciones

- Control: The Management Control Environment: Changes From The Eleventh EditionDocumento22 páginasControl: The Management Control Environment: Changes From The Eleventh EditionRobin Shephard Hogue100% (1)

- Revenue and Monetary Assets: Changes From Eleventh EditionDocumento21 páginasRevenue and Monetary Assets: Changes From Eleventh EditionMenahil KAún no hay calificaciones

- (Case 6-7) 5-1 Stern CorporationDocumento1 página(Case 6-7) 5-1 Stern CorporationJuanda0% (1)

- Accounting Texts and Cases Ch. 12 SolutionDocumento9 páginasAccounting Texts and Cases Ch. 12 SolutionFeby Rahmawati100% (2)

- Delaney Motors CaseDocumento15 páginasDelaney Motors CaseVan DyAún no hay calificaciones

- Delaney Motors Case SolutionDocumento13 páginasDelaney Motors Case SolutionParambrahma Panda100% (2)

- Long-Lived Nonmonetary Assets and Their Amortization: Changes From Eleventh EditionDocumento11 páginasLong-Lived Nonmonetary Assets and Their Amortization: Changes From Eleventh Editioner4sallAún no hay calificaciones

- Accounting Text and Cases 12 Ed - Chapter 1Documento16 páginasAccounting Text and Cases 12 Ed - Chapter 1sanjay28382100% (2)

- Lipman Bottle Company Case Analysis Group1Documento13 páginasLipman Bottle Company Case Analysis Group1Shubham Nigam100% (1)

- AkuntansiDocumento3 páginasAkuntansier4sallAún no hay calificaciones

- anthonyIM 06Documento18 páginasanthonyIM 06Jigar ShahAún no hay calificaciones

- anthonyIM 06Documento18 páginasanthonyIM 06Jigar ShahAún no hay calificaciones

- Basic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDocumento19 páginasBasic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDhiwakar SbAún no hay calificaciones

- anthonyIM 09Documento17 páginasanthonyIM 09Ki Umbara100% (1)

- Save Mart and Copies Express CaseDocumento7 páginasSave Mart and Copies Express CaseanushaAún no hay calificaciones

- Revenue and Monetary Assets: Changes From Eleventh EditionDocumento22 páginasRevenue and Monetary Assets: Changes From Eleventh EditionDhiwakar SbAún no hay calificaciones

- Profitability of Products and Relative ProfitabilityDocumento5 páginasProfitability of Products and Relative Profitabilityshaun3187Aún no hay calificaciones

- Bonus ch15 PDFDocumento45 páginasBonus ch15 PDFFlorence Louise DollenoAún no hay calificaciones

- Chapter 12 SolutionsDocumento29 páginasChapter 12 SolutionsAnik Kumar MallickAún no hay calificaciones

- Lone Pine Cafe CaseDocumento13 páginasLone Pine Cafe CaseGj Rillo100% (1)

- Additional Aspects of Product Costing Systems: Changes From Eleventh EditionDocumento21 páginasAdditional Aspects of Product Costing Systems: Changes From Eleventh EditionceojiAún no hay calificaciones

- anthonyIM 24Documento18 páginasanthonyIM 24Victor LimAún no hay calificaciones

- Problem 13-1 - Chapter 13 - SolutionDocumento6 páginasProblem 13-1 - Chapter 13 - Solutionppdisme100% (1)

- Chapter 7 (Case) : Joan HoltzDocumento2 páginasChapter 7 (Case) : Joan Holtzjenice joy100% (1)

- Case 5 Grennel FarmsDocumento2 páginasCase 5 Grennel FarmsGj RilloAún no hay calificaciones

- CH 21Documento7 páginasCH 21Rand Al-akamAún no hay calificaciones

- Sinclair Company Group Case StudyDocumento20 páginasSinclair Company Group Case StudyNida Amri50% (4)

- Case 6 1 Browning Manufacturing Company 2 PDF FreeDocumento7 páginasCase 6 1 Browning Manufacturing Company 2 PDF FreeLia AmeliaAún no hay calificaciones

- Bonus Ch15Documento45 páginasBonus Ch15agctdna5017Aún no hay calificaciones

- Castillo OPERRES Syllabus ELGA Term 1, AY2018-19 091118 PDFDocumento13 páginasCastillo OPERRES Syllabus ELGA Term 1, AY2018-19 091118 PDFdeaAún no hay calificaciones

- Clarkson Lumbar CompanyDocumento41 páginasClarkson Lumbar CompanyTheOxyCleanGuyAún no hay calificaciones

- Chapter 8 PDFDocumento36 páginasChapter 8 PDFRoan CalimdorAún no hay calificaciones

- SolutionCH9 CH11Documento9 páginasSolutionCH9 CH11qwerty1234qwer100% (1)

- Chap 028Documento12 páginasChap 028Rand Al-akam100% (1)

- Solution Manual For Book CP 4Documento107 páginasSolution Manual For Book CP 4SkfAún no hay calificaciones

- Chapter7 Problems MySolutionsDocumento12 páginasChapter7 Problems MySolutionssindhuja21100% (1)

- Cadillac Cody CaseDocumento13 páginasCadillac Cody CaseKiran CheriyanAún no hay calificaciones

- Chapter 12: Corporate Valuation and Financial Planning: Page 1Documento33 páginasChapter 12: Corporate Valuation and Financial Planning: Page 1nouraAún no hay calificaciones

- anthonyIM 24Documento18 páginasanthonyIM 24ceojiAún no hay calificaciones

- 7001 Assignment #3Documento9 páginas7001 Assignment #3南玖Aún no hay calificaciones

- Chapter 14 SolutionsDocumento35 páginasChapter 14 SolutionsAnik Kumar MallickAún no hay calificaciones

- Case 5-3Documento2 páginasCase 5-3ragil1988Aún no hay calificaciones

- Cases Chap010Documento20 páginasCases Chap010faraz_soleymaniAún no hay calificaciones

- Financial Managerial Accounting 3rd Edition Horngren Solutions ManualDocumento10 páginasFinancial Managerial Accounting 3rd Edition Horngren Solutions Manualexsect.drizzlezu94% (17)

- Financial Managerial Accounting 3Rd Edition Horngren Solutions Manual Full Chapter PDFDocumento31 páginasFinancial Managerial Accounting 3Rd Edition Horngren Solutions Manual Full Chapter PDFMeganPrestonceim100% (12)

- 10 Exercises BE Solutions-1Documento40 páginas10 Exercises BE Solutions-1loveliangel0% (2)

- Accounting in Business: Quick StudiesDocumento13 páginasAccounting in Business: Quick StudiesAlex TseAún no hay calificaciones

- Intermediate Accounting Vol 2 4th Edition Lo Solutions ManualDocumento6 páginasIntermediate Accounting Vol 2 4th Edition Lo Solutions Manualconvive.unsadden.hgp2100% (17)

- F1 Financial Operations Questions and Answers From Past Ask A Tutor' Events - Archived by Syllabus AreaDocumento13 páginasF1 Financial Operations Questions and Answers From Past Ask A Tutor' Events - Archived by Syllabus Areakabirakhan2007Aún no hay calificaciones

- Solution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition by Byrd and Chen ISBN 0133115097 9780133115093Documento36 páginasSolution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition by Byrd and Chen ISBN 0133115097 9780133115093juliebeasleywjcygdaisn100% (23)

- Fundamentals of Taxation 2015 8th Edition Cruz Solutions Manual 1Documento31 páginasFundamentals of Taxation 2015 8th Edition Cruz Solutions Manual 1george100% (39)

- Common Finance Interview QuestionsDocumento3 páginasCommon Finance Interview QuestionsLeon Mushi100% (1)

- RTGS Holidays 2015Documento1 páginaRTGS Holidays 2015Dhiwakar SbAún no hay calificaciones

- 2490395Documento24 páginas2490395Dhiwakar SbAún no hay calificaciones

- Regn T-VIDocumento1 páginaRegn T-VIDhiwakar SbAún no hay calificaciones

- Valuing IntangiblesDocumento28 páginasValuing IntangiblesMayank LodhaAún no hay calificaciones

- HCL-ROW - Pre-Sales and SolutionsDocumento2 páginasHCL-ROW - Pre-Sales and SolutionsDhiwakar SbAún no hay calificaciones

- Basell III Issues ImplicationsDocumento0 páginasBasell III Issues ImplicationsRupesh DhindeAún no hay calificaciones

- Stochastic CalculusDocumento18 páginasStochastic CalculusemailymAún no hay calificaciones

- IIML Casebook 2014-15Documento213 páginasIIML Casebook 2014-15Dhiwakar Sb100% (1)

- Reliance MediaWorks - Exit Offer Letter - FinalDocumento12 páginasReliance MediaWorks - Exit Offer Letter - FinalDhiwakar SbAún no hay calificaciones

- Reliance Broadcast Network Limited: This Document Is Important and Requires Your Immediate AttentionDocumento12 páginasReliance Broadcast Network Limited: This Document Is Important and Requires Your Immediate AttentionDhiwakar SbAún no hay calificaciones

- IT MOSt 070415Documento18 páginasIT MOSt 070415Dhiwakar SbAún no hay calificaciones

- A Case Study On Supply Chain Management With Special Reference To Mumbai DabbawalaDocumento7 páginasA Case Study On Supply Chain Management With Special Reference To Mumbai DabbawalaAbhinav RamariaAún no hay calificaciones

- Wedding InvitationDocumento3 páginasWedding InvitationDhiwakar SbAún no hay calificaciones

- TMP 1784767780Documento13 páginasTMP 1784767780Didi MuftiAún no hay calificaciones

- Session 12 CAPMDocumento19 páginasSession 12 CAPMDhiwakar SbAún no hay calificaciones

- Dec'14 Preview: Cross Currency Pangs Add To The Seasonal WeaknessDocumento9 páginasDec'14 Preview: Cross Currency Pangs Add To The Seasonal WeaknessDhiwakar SbAún no hay calificaciones

- Accounting Records and Systems: Changes From Eleventh EditionDocumento22 páginasAccounting Records and Systems: Changes From Eleventh EditionDhiwakar SbAún no hay calificaciones

- Revenue and Monetary Assets: Changes From Eleventh EditionDocumento22 páginasRevenue and Monetary Assets: Changes From Eleventh EditionDhiwakar SbAún no hay calificaciones

- anthonyIM 01Documento15 páginasanthonyIM 01Julz JuliaAún no hay calificaciones

- Dhiwakar Ticket (To Lucknow)Documento3 páginasDhiwakar Ticket (To Lucknow)Dhiwakar SbAún no hay calificaciones

- Wat-Pi Primer 2014Documento26 páginasWat-Pi Primer 2014Dhiwakar SbAún no hay calificaciones