Documentos de Académico

Documentos de Profesional

Documentos de Cultura

4 - Tech Hardware Sector

Cargado por

girishrajsTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

4 - Tech Hardware Sector

Cargado por

girishrajsCopyright:

Formatos disponibles

Please refer to page 124 for important disclosures and analyst certification, or on our website

www.macquarie.com/research/disclosures.

GLOBAL

Inside

Divergent Device; Convergent Demand 2

The line becomes more blurred; focus on

total device growth opportunities 8

User appetite or self-cannibalization? 14

Commercial replacement cycle could peak20

Low-priced NBs and more 2-1 NBs a

chance to outshine 22

More consolidated landscape, in particular

in consumer PC segments 27

Our Investment strategy and stock picks 32

Company notes 36

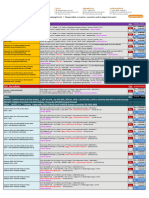

Valuation Table Summary

Mkt Cap Last Target TSR

Ticker Company Rating (US$m) Close Price (%)

AAPL US Apple O 576,392 96.3 104.0 10%

2357 TT Asustek O 7,121 291.5 349.0 26%

2317 TT Hon Hai O 43,301 89.0 114.0 31%

4938 TT Pegatron O 4,104 53.6 66.0 29%

3231 TT Wistron O 2,399 29.8 37.0 28%

2324 TT Compal N 2,934 20.2 21.7 14%

INTC US Intel N 152,738 30.9 30.0 0%

2356 TT Inventec N 2,501 21.2 21.8 10%

2382 TT Quanta N 9,274 73.0 80.0 15%

2353 TT Acer U 1,844 20.1 17.0 -15%

Source: Macquarie Research, October 2014; prices as of

17 October

Please see rating, TP and EPS changes in

Fig 82.

Analyst(s)

Macquarie Capital Securities Limited, Taiwan

Branch

Ellen Tseng

+886 2 2734 7524 ellen.tseng@macquarie.com

Kaylin Tsai

+886 2 2734 7523 kaylin.tsai@macquarie.com

Macquarie Capital (USA) Inc.

Deepon Nag

+1 212 231 8014 deepon.nag@macquarie.com

Ben Schachter

+1 212 231 0644 ben.schachter@macquarie.com

20 October 2014

Tech Hardware Sector

Divergent Device; Convergent

Demand

We are negative on the PC hardware sector in 2015 but we see a few

opportunities in selective segments. We favour brand OEMs with innovation

capabilities that can differentiate their product offerings or seize cross-over form

factor design opportunities ahead of its peers. We thus favour Apples supply

chain over traditional PC brands. After multiple brands have withdrawn from the

PC market, we expect further PC industry consolidation. We are thus more

negative on NB ODMs given less brand customers left. ODMs could face more

margin pressure. We are more cautious on commercial market growth but we

expect low-priced NBs and more 2-1 NBs to outshine other segments in 2015.

The line becomes more blurred: User Appetite or self-

cannibalization?

We forecast that total convergence devices will grow at a CAGR of 11.3% in

2013-2017. While cannibalization in each category seems to be inevitable; we

identify a few winners. We view the popularity of Office on iPads as a testament

to the desire for cloud-based work applications on lighter devices. Apple aims to

launch a large size iPad (>12) to address growing demand for the commercial

segment, despite the risk of cannibalizing its Macbook Air sales, but we believe

traditional PC brands are more vulnerable to Apples future success. With

Googles increasing investment in ChromeOS, Chromebooks could accelerate

the transition from client to cloud, and shift towards low-end cloud-based devices.

A converged Chrome/Android OS with support for Office would allow for greater

penetration of Chromebooks into the commercial market in the future.

Commercial PC replacement cycle could peak

While most mature markets have upgraded their commercial PCs due to the

Windows XP phase-out, emerging markets such as China and Latin America

have fallen behind the curve. This ideally suggests potential replacement

demand from emerging markets. However, we have not yet indentified signs of

an uptick from these emerging markets, and this could imply the commercial

upgrade cycle could be peaking slightly earlier than expected.

Low-priced NBs and more 2-1 NBs a chance to outshine

Despite consumer PC demand remaining soft in 2014, we believe there is a fair

chance that low-priced consumer NB/2-1 NBs could have a better opportunity to

outshine other segments in 2015. This is thanks to Microsoft Windows Bing

Program (lower OS fee, extension support to 11 above models) and more

compelling 2-1 and much thinner NB models launched based on the Intel Core M

processor. In addition, more PC brands have withdrawn from consumer PC

segments, indicating more share gain opportunities for tier-one players and

possibly a more rational pricing environment. We believe that Windows 10 as

unlikely to trigger a robust consumer replacement cycle, but see potential pent-

up demand in next 2 quarters.

Our investment strategy and stock picks

We favour Apple and its supply chain over traditional PC suppliers, given the

formers capability to drive consumer appetite. Apple and Hon Hai are our

favorite picks. We upgrade Asustek from N to OP; and favour its market share

gain capability. We downgrade Compal from OP to N given its higher

commercial NBs exposure. We retain N on Intel.

Macquarie Research Tech Hardware Sector

20 October 2014 2

Divergent Device; Convergent Demand

We are negative on the PC hardware sector in 2015; however, we see few opportunities in

selective segments. We favour brand OEMs with innovation capabilities that can differentiate

their product offerings or seize cross-over form factor design opportunities ahead of its peers.

We thus favour Apples supply chain over traditional PC brands. After multiple brands have

withdrawn from the PC market, we expect further PC industry consolidation. We are thus

more negative on NB ODMs given less brand customers left. ODMs could face more margin

pressure. We are more cautious on commercial market growth in 2015, but we expect low-

priced NBs and more 2-1 NBs/thinner NBs to outshine other segments in 2015.

The line is becoming more blurred; focus on total addressable

device market growth

While we identity decreasing value-added hardware in the long term, which is negative to the

tech hardware sector, we believe that selective tech hardware companies can leverage

growing form factor evolution from NBs, Chromebooks, Tablets, 2-1 NBs, smartphones etc

and provide consumers advanced options to own multiple different devices for mobility. We

see companies that are ahead of peers in innovating new device offerings, thus triggering

consumer replacement cycle, are better positioned.

We forecast that total convergence devices will grow at a CAGR of 11.3% in 2013-2017, or

total convergence devices to still grow 10.8% YoY in 2015, despite slowing growth versus

17% YoY in 2014. While cannibalization in each category seems to be inevitable, we expect

winners will benefit from form factor variations to gain respective market share, and seize the

opportunity to diversify and cross over with multiple devices.

Fig 1 Total Device Market Unit Forecast Fig 2 Total Device: Form Factor YoY Growth

Source: IDC, Macquarie Research, October 2014 Source: IDC, Macquarie Research, October 2014

User Appetite or self-cannibalization

We are seeing more comprehensive cannibalization between devices as the line is becoming

more blurred. This will continue to put pressure on some of the traditional PC brand

companies (such as Acer) who lack innovation and form factor design capabilities that

address better mobility devices.

Moreover, we view the popularity of Office on iPads as a testament to the desire for cloud-

based work applications on lighter devices. Apple aims to launch a large size iPad (>12) to

address growing demand for the commercial segment in 1Q15, despite the risk of

cannibalizing its Macbook Air sales, but we believe traditional PC brands are more vulnerable

to Apples future success. .

26%

17.3%

10.8%

9.3%

8.2%

0%

5%

10%

15%

20%

25%

30%

0

500

1000

1500

2000

2500

2013 2014E 2015E 2016E 2017E

YoY

unit: M

Desktop NB

2-1 NB/tablets Pure Tablet

High end smartphones Mid-range smartphones

Low-end smartphones Total device growth( YoY)

-20%

-10%

0%

10%

20%

30%

40%

50%

60%

70%

2013 2014E 2015E 2016E 2017E

Desktop NB

2-1 NB/Tablets Tablet

SubTotal(PC+Tablet) High end smartphones

Mid-range smartphones Low-end smartphones

total smartphone Total device growth( YoY)

Winners should

address growing

form factor

evolution in

convergence

devices

Apples capability to

drive consumer

appetites towards

divergent form

factors for mobility

Macquarie Research Tech Hardware Sector

20 October 2014 3

The larger iPads BOM cost will probably be lower than the new Macbook Airs and so should

retail pricing, if history is a guide: Apples Macbook Air 11/13 models are priced at US$899-

1199 and iPad Air 2 (9.7) at US$499-699. We think the new, larger iPad could be priced at

US$699-$999, and a new Macbook Air at US$999-1199. Such pricing may well lead to

cannibalisation of demand from the Apple Macbook Air (as well as other PC brands NB sales)

if users prefer to have more economic choices.

With Googles increasing investment in ChromeOS, Chromebooks could accelerate the

transition from client to cloud, shift towards low-end (or lower ASP) cloud-based devices. A

converged Chrome/Android OS with support for Office would allow for greater penetration of

Chromebooks into the commercial market in the future.

Fig 3 Dimension comparison for iPad Air 2/Macbook Air/new 12 Macbook Air

Name iPad Air 2 MacBook Air (11) MacBook Air (13) New >12" Macbook Air

New >12 iPad

(iPad Pro)

Launch Date October 2014 October 2013 October 2013 1Q15 NA

Price $499 / 599 / 699 (Wifi) US$899/US$1,199 US$1,199/US$1,299 US$999-1,199 US$699-999

Dimensions Height: 6.1mm

Width: 240mm

Depth: 169.5mm

Height: 17mm

Width: 300mm

Depth: 192mm

Height: 17mm

Width: 325mm

Depth: 227mm

Height: 9mm? Height: <7.5mm?

Display Diagonal 9.7" 11.6" 13.3" 12.9"? 12"?

Source: Company data, Macquarie Research, October 2014; new models are based on Macquarie Research

Commercial PC replacement cycle could peak

While most mature markets have upgraded their commercial PCs due to the Windows XP

phase-out, emerging markets such as China and Latin America have fallen behind the curve.

This ideally suggests potential replacement demand from emerging markets. However, we

have not yet indentified signs of an uptick from these emerging markets, and this could imply

the commercial upgrade cycle could be peaking slightly earlier than expected.

Fig 4 Desktop: Operating System Market Share Trend

Source: Net Application, Macquarie Research, October 2014

Commercial demand

could be peaking

early than expected

if the emerging

market does not

catch up

Macquarie Research Tech Hardware Sector

20 October 2014 4

Low-priced NBs and more 2-1 NBs a chance to outshine

Despite consumer PC demand remaining soft in 2014, we believe there is a fair chance that

low-priced consumer NB/2-1 NBs could have a better opportunity to outshine other segments

in 2015. This is thanks to Microsoft Windows Bing Program (lower OS fee, extension support

to 11 above models) as well as more compelling 2-1 NB/thinner NB models launched based

on the Intel Core M processor. As Intel Core M processors have lower power consumption

(4.5W vs 11W for Haswell generation), this could help OEMs reduce thermal solution costs

(such as fans/thermal module), and design much slimmer devices (less than 9mm) which

would likely attract more consumers to replace legacy NBs.

Near term, while we view Windows 10 as unlikely to trigger a robust consumer replacement

cycle, it could have a ST impact if consumers choose to wait for the new Windows 10 in the

next 2 quarters.

Moreover, we also expect a more consolidated landscape given Samsung, Sony, Toshiba

have withdrawn from either the regional PC markets or consumer PC market, which could

favour top-tier PC brands to gain further market share, in particular in the consumer PC

market. Post HPs recent split into two entities, we believe the new HP Inc (personal

computing and printers) will also need to focus on generating steadier shareholder returns,

which could prevent aggressive pricing cuts with a focus on profitability, in our view. This is

more positive for PC brands but more negative for ODMs given fewer brands customers left.

Fig 5 2-1 NB Projection Forecast Fig 6 Global PC brand Market share

Source: IDC, Macquarie Research, October 2014 Source: IDC, Macquarie Research, October 2014

Our Investment strategy and stock picks

While we believe the overall hardware sector landscape remains challenging, we foresee

selective opportunities and identify a few winners. We are selective in our stock picks. Our

favourite picks are based on the following investment strategies:

We favour Apple-related plays over traditional PC brands supply chains: We prefer

to stay with Apples major iPhone/iPad suppliers given Apples capability to grow divergent

cross-over devices such as iPhones, iPads, iPad minis, iPad Pro, Macbook Airs,

Macbook Pros, which are backed by its solid ecosystem. We also believe Apple will further

strengthen its market position, thus gaining more share. Apple (AAPL US, OP, covered by

Ben Schachter) and Apples major outsourcing supplier, Hon Hai (2317 TT, OP), for

Macbook Pros, iPhones, iPad Air/iPad mini/iPad Pro, remain our favourite stock picks.

0

5

10

15

20

25

30

2013 2014E 2015E 2016E 2017E

unit:M

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

2012Q3 2012Q4 2013Q1 2013Q2 2013Q3 2013Q4 2014Q1 2014Q2

Lenovo HP

ASUS Acer

Dell Apple

Samsung+Sony+ Toshiba Fujitsu

Others

We also expect top-

tier brands to

benefit from more

consolidation

Macquarie Research Tech Hardware Sector

20 October 2014 5

We favour selective Asia PC brands over NB ODMs in general given a more

consolidated landscape after multiple PC brands have withdrawn from the PC

market: We favour Asia PC brands that can gain global market share consistently, as well

diversify into divergent form factors (tablets, smartphones) successfully. We are generally

concerned that ODMs could face more pricing pressure given only a few PC brands have

left in the market which will increase their negotiation power over ODMs. We upgrade

Asustek (2357 TT, OP) from Neutral to Outperform as we prefer its higher leverage of its

design capability to differentiate its product offerings, thus helping gain more market share.

Moreover, we believe Asusteks smartphone business could become profitable, given

rising scale of economies, and further diversify into the smartphone business on a longer-

term basis.

We are cautious given a commercial market slowdown, but are more positive on 2-1

form-factor, consumer NB opportunities: We think commercial demand could reach a

peak, and PC demand is unlikely to grow substantially but will have selective form-factor

opportunities. We maintain a Neutral rating on Intel (INTC, N, covered by Deepon Nag). As

we note that corporate PC shipments are set to decelerate in the coming quarters as the

Windows XP corporate replacement cycle tapers down. While we expect reacceleration

from consumer PC markets due to strong growth in emerging segments (2-in-1s,

Chromebooks), low price points and the release of Microsofts new operating system

(Windows 10), we are concerned on excess inventories in the channel and weakening

mix and are cautious on INTC stock. We also downgrade Compal (2324 TT, N) from

Outperform to Neutral as we believe the commercial NB upgrade cycle could reach

saturation and Compal has higher commercial NB demand exposure. Thus Compal will

have a high comparison base in 2014. It also faces an order reshuffle impact from Acer,

thus NB volumes will likely decline in 2015.

Fig 7 Recommendation/valuation summary

Mkt Cap Last Target TSR EPS (local $/) PER (X) P/BV (X) ROE (%) Div yield (%)

Ticker Company Rating (US$m) Close Price (%) 13A 14E 15E 13A 14E 15E 13A 14E 15E 13A 14E 15E 13A 14E 15E

EMS/ODM

2317 TT Hon Hai O 43,301 89.0 114.0 31% 7.30 8.00 9.26 12.2 11.1 9.6 1.7 1.6 1.4 15.1 14.9 15.8 2.1 3.1 3.6

2382 TT Quanta N 9,274 73.0 80.0 15% 4.84 5.20 6.03 15.1 14.0 12.1 2.3 2.4 2.3 15.1 16.8 19.3 5.2 5.0 5.8

2356 TT Inventec N 2,501 21.2 21.8 10% 1.97 1.91 2.07 10.8 11.1 10.3 1.4 1.5 1.4 13.5 13.0 14.1 7.5 7.2 7.8

4938 TT Pegatron O 4,104 53.6 66.0 29% 4.17 4.86 5.83 12.9 11.0 9.2 1.1 1.2 1.1 9.4 10.7 12.3 5.2 6.1 7.3

2324 TT Compal N 2,934 20.2 21.7 14% 0.57 1.26 2.12 35.5 16.0 9.5 0.9 1.0 1.0 2.4 5.9 10.1 4.9 7.0 7.0

3231 TT Wistron O 2,399 29.8 37.0 28% 2.42 2.01 3.24 12.3 14.9 9.2 1.1 1.1 1.0 8.9 7.4 11.8 6.2 3.4 5.4

Average 16.7 13.2 10.3 1.6 1.6 1.5 11.7 12.5 14.9 4.9 5.0 5.9

Brand

992 HK Lenovo NR 14,632 10.72 NR NA 0.06 0.08 0.09 25.1 18.0 15.9 5.6 4.9 4.0 24.6 27.9 26.4 0.2 0.2 0.3

2353 TT Acer U 1,844 20.1 17.0 -15% (7.54) 0.41 0.41 nmf 48.6 49.4 1.0 0.9 0.9 -31.3 2.0 1.9 0.0 0.0 0.0

2357 TT Asustek O 7,121 291.5 349.0 26% 28.56 28.06 30.30 10.2 10.4 9.6 1.6 1.5 1.4 16.4 15.1 15.4 6.6 6.5 7.1

AAPL US Apple O 576,392 96.3 104.0 10% 5.68 6.31 6.86 16.9 15.2 14.0 5.0 4.7 4.0 30.6 31.2 30.8 1.7 1.9 2.0

HPQ US HP NR 63,453 34.00 NR NA 3.99 3.61 3.74 8.5 9.4 9.1 2.9 2.4 2.2 -31.1 21.2 24.0 1.8 2.1 2.0

Average 15.2 20.3 19.6 3.2 2.9 2.5 1.9 19.5 19.7 2.0 2.2 2.3

PC Semi

INTC US Intel N 152,738 30.9 30.0 0% 1.9 2.3 2.4 16.3 13.9 12.8 2.7 2.7 2.4 17.6 19.3 19.8 2.9 2.9 2.9

NVDA US NVIDIA U 9,456 17.5 16.0 -7% 0.9 0.7 1.0 19.4 23.6 16.8 2.2 2.3 2.3 12.5 9.5 13.5 0.4 1.8 1.9

AMD US AMD N 2,021 2.6 4.0 52% -0.1 -0.1 0.1 nmf nmf 31.1 3.7 3.9 2.6 -15.3 -18.3 10.1 0.0 0.0 0.0

Average 17.9 18.8 20.2 2.9 3.0 2.4 4.9 3.5 14.5 1.1 1.6 1.6

Source: Bloomberg, Macquarie Research, October 2014, pricing as of October 17, 2014; note estimates for not rated stocks are based on Bloomberg

consensus

Macquarie Research Tech Hardware Sector

20 October 2014 6

Fig 8 Asia Hardware: dividend yield (2014E) is attractive though

Source: Macquarie Research, October 2014, market data as of Oct 17th, 2014

Fig 9 Asia Hardware stock QFII holding history

Source: TEJ, Macquarie Research, October 2014

* PC ODM= Compal, Quanta, Wistron, Inventec; PC brands=Asustek, Acer; EMS=Hon Hai, Pegatron

Fig 10 ODMs vs. Intel: Stock performance Fig 11 PC Brands vs. Intel: Stock performance

Source: TEJ, Macquarie Research, October 2014 Source: TEJ, Macquarie Research, October 2014

Average=4.8%

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

Hon Hai Quanta Inventec Pegatron Compal Wistron Acer Asustek

(%)

30

35

40

45

50

55

(%)

PC ODM PC brands EMS

-40%

-30%

-20%

-10%

0%

10%

20%

30%

40%

50%

60%

70%

Compal Quanta Wistron

Inventec Hon Hai Pegatron

Intel

-30%

-20%

-10%

0%

10%

20%

30%

40%

50%

60%

70%

Acer Asustek Intel

Macquarie Research Tech Hardware Sector

20 October 2014 7

Fig 12 EMS vs. Apple: Stock performance

Source: TEJ, Macquarie Research, October 2014

-30%

-20%

-10%

0%

10%

20%

30%

40%

50%

60%

Hon Hai Pegatron Apple

Macquarie Research Tech Hardware Sector

20 October 2014 8

The line becomes more blurred; focus on

total device growth opportunities

Total Device market to grow at a CAGR of 11.3% in 2013-2017

We identify decreasing value-added hardware in the long term is more negative to the tech

hardware sector. However, we believe that selective tech hardware companies could still

benefit from form-factor evolution such as NBs, Tablets, 2-1 NBs, large-size smartphones etc

as these devices design capabilities are further enhanced or improved along with technology

advancements. These efforts will thus provide consumers an option to own multiple different

devices for mobility; the innovation of device offerings could also help trigger the consumer

replacement cycle and increase total device market opportunities.

We forecast that total convergence devices will grow 10.8% in 2015, slowing from 17% YoY

in 2014, yet still positive unit growth. We still project total devices will grow at an 11.3%

CAGR during 2013-2017E. While cannibalization in each category seems to be inevitable,

winners will benefit from form factor variations to gain respective market share, and seize the

opportunity to diversify and cross over with multiple devices.

Fig 13 Total Device Unit Forecast

Volume( unit) 2013 2014E 2015E 2016E 2017E

Desktop 136 138 135 133 131

NB 178 171 169 167 166

2-1 NB/tablets 6.2 10.3 16 22.1 27

Pure Tablet 219 236 264 294 325

SubTotal (PC+Tablet) 539 555 584 616 650

High end smartphones 274 303 322 332 337

Mid-range smartphones 305 373 410 444 469

Low-end smartphones 422 578 687 796 911

SubTotal (smartphone) 1002 1253 1419 1572 1717

Growth rate (YoY) 2013 2014E 2015E 2016E 2017E

Desktop -8% 1.5% -2.0% -2.0% -1.0%

NB -11% -4.0% -1.5% -0.7% -0.6%

2-1 NB/Tablets 33.7 66.1% 55.3% 38.1% 22.2%

Tablet 52.20% 7.9% 12.0% 11.5% 10.5%

SubTotal (PC+Tablet) 8.0% 3.0% 5.1% 5.6% 5.4%

High end smartphones 21.8% 10.6% 6.3% 3.1% 1.5%

Mid-range smartphones 27.6% 22.3% 9.9% 8.3% 5.6%

Low-end smartphones 62.3% 37.0% 18.9% 15.9% 14.4%

Sub-total(smartphone) 38.0% 25.0% 13.2% 10.8% 9.2%

Total device growth (YoY) 26.0% 17.3% 10.8% 9.3% 8.2%

Source: IDC, Macquarie Research, October 2014

Fig 14 Total Device Unit/Growth Trend

Source: IDC, Macquarie Research, October 2014

26%

17.3%

10.8%

9.3%

8.2%

0%

5%

10%

15%

20%

25%

30%

0

500

1000

1500

2000

2500

2013 2014E 2015E 2016E 2017E

YoY

unit: M

Desktop NB 2-1 NB/tablets

Pure Tablet High end smartphones Mid-range smartphones

Low-end smartphones Total device growth( YoY)

Total device market

is growing, thanks

to form-factor

diversity as

consumers have

more options for

mobility

Macquarie Research Tech Hardware Sector

20 October 2014 9

Global PC bolstered by commercial replacement cycle in 2014,

growth rate to be more flattish going forwards

The 2014 Global PC industry have been bolstered by PC replacement demand in the

commercial segment. The desktop segment has been stronger due to commercial

replacement demand. During its recent 3Q earnings conference call, Intel mentioned they see

continued strength in enterprise demand, and its shifting from Desktop earlier this year and

moving to the NB segment in 2H14.

We estimate that the desktop segment will likely grow 1.5% YoY in 2014. For the NB

segment, while it has been negatively affected by tablets before, the NB segment unit decline

had became milder in 2014, declining by only 4% YoY in 2014 versus an 11% YoY decline in

2013, based on our estimate. Intel also said they expect a standard holiday seasons for

consumers in the PC segment.

Looking forwards, we project that total PCs (including 2-1 NBs/tablets) will decline only 0.3%

in 2014, versus a 9% decline in 2013, thanks to commercial NBs recovering as well as less

cannibalization. We expect the growth rate will be flattish in 2015-2017 (or grow

0.1%/0.7%/0.8%, respectively). Excluding 2-1 NBs, which could also be categorized as

tablets in IDC definition, we believe the PC sector could decline 1.6% YoY in 2014, and 1.7%

in 2015, or 1.3% in 2016.

Fig 15 Global PC unit Growth Forecast

Source: IDC, Macquarie Research, October 2014

Commercial segments have triggered corporate replacements because Microsoft stopped

support for Windows XP in April 2014.

Moreover, major brands support to launch Microsoft Windows Bing-enabled program, priced

at US$249 in 2Q14, has also helped stimulate some consumer demand for 2015 in our view.

PCs brands also have made some progress addressing tablet competition with more slim,

touch, and low-cost models available. Growth of Chromebooks, particularly in the education

segment in mature markets, is also contributing to PC units, despite much lower ASPs. In

addition to the stimulus from the end of support for Windows XP, severe competition from

tablets has declined as the tablet penetration rate stabilizes and volume shifts to smaller sizes

that are less competitive with PCs.

PC shipments in mature regions have been much stronger than emerging markets so far this

year, thanks not only to the commercial segment but also consumer segments showing an

upswing in these mature markets. Performance in emerging markets still continued to drag on

global PC shipments, resulting from poor economic and political challenges.

-10%

-2% -2%

-1%

-1%

-9%

-0.3%

0.1%

0.7% 0.8%

-12%

-10%

-8%

-6%

-4%

-2%

0%

2%

-

50

100

150

200

250

300

350

2013 2014E 2015E 2016E 2017E

unit: M

Desktop NB 2-1 NB/tablets

YoY( Exclude 2-1)-RHS YoY( include 2-1)-RHS

Microsoft Windows

Bing-enable

program also

helping to stimulate

demand but lower

NB ASPs

2014 PC demand

has been supported

by the commercial

replacement cycle

and strengthened

from mature

markets, thus

offsetting a decline

in emerging markets

Macquarie Research Tech Hardware Sector

20 October 2014 10

Fig 16 Global PC shipments by form factor Fig 17 Global PC shipments by segment

Source: IDC, Macquarie Research, October 2014 Source: IDC , Macquarie Research, October 2014

Fig 18 PC Instalment Base is peaking Fig 19 Replacement demand as % of PC

Source: IDC, Macquarie Research, October 2014

Source: IDC, Macquarie Research, October 2014

Due to a stronger commercial replacement cycle, Desktop PC demand has been doing better

than NB PCs. In fact, NBs as % of PCs have been falling due to tablet cannibalization (Fig

16). As a result, total consumer PC demand has also fallen as a % of total PC, and

commercial PCs have dominated consumer PCs since 2Q13.

The PC instalment base is also peaking given limited additions for new PC users, while

tablets and smartphones attract from some light PC users. PC replacement demand has

been a main source of PC growth since 2010 (Fig 19).

Fig 20 illustrates PC unit growth has been improving, despite total PC unit growth not turning

to positive unit growth. However, commercial PC has turned to positive unit growth, while

consumer decline also became much milder versus 2013. Both commercial DTs and

consumer DTs outperformed consumer DTs and consumer NBs (Fig 22-23).

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

100,000

3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Unit

Total DT PC Total NB PC

52%

53%

54%

55%

56%

57%

58%

59%

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

100,000

3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Unit

Total DT PC Total NB PC NB as % of PC

45%

46%

47%

48%

49%

50%

51%

52%

53%

54%

55%

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

100,000

3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Unit

Commercial PC Consumer PC Consumer as % of PC

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

2

2

0

1

3

2

0

1

4

2

0

1

5

2

0

1

6

2

0

1

7

2

0

1

8

PC install base(unit:m)

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

-

50

100

150

200

250

300

350

400

replacement demand % as global PC

PC replacement

demand had been a

source of growth

since 2010

Macquarie Research Tech Hardware Sector

20 October 2014 11

Fig 20 Global PC growth YoY Trend (by form factor) Fig 21 Global PC growth - YoY growth (by segment)

Source: IDC tracker, Macquarie Research, October 2014 Source: IDC tracker, Macquarie Research, October 2014

Fig 22 Global Commercial PC growth - YoY trend Fig 23 Global Consumer PC growth - YoY trend

Source: IDC Tracker Macquarie Research, October 2014 Source: IDC tracker, Macquarie Research, October 2014

But Near-term Demand has been tapering off since August onwards

Microsoft and Intel plan to release a new platform in 1H15, which will likely affect PC demand

in 4Q14 as vendors are turning more cautious on inventory management. We think that there

is potential pent-up demand from consumers as they are waiting for new platforms, such as

Windows 10 (set to launch in 2Q15) and Intels 14nm Y series Broadwell processor

(launching in December, but mass produced in 1Q15). We expect consumer demand to

remain lukewarm this upcoming Christmas season.

In addition, Apples iPhone 6/6 Plus and upcoming new generation of iPad, launched in

October, will likely attract consumers, thus affecting consumer NB demand. In fact, NB ODMs

indicated a dropping off since mid-August, and we believe consumer demand in 4Q14 will

remain lacklustre.

According to figure 24-26, we forecast a worst case scenario in 4Q or declines in low-single

digits (-3% QoQ) for the top five NB ODMs. This is below historic seasonality (average 2010-

2013: +3% QoQ, or average 2002-2013: + 11% QoQ). We note that 4Q strength has been

much lower the past three years due to NB cannibalization, but 4Q14 could present a much

lower base due to a higher base in 3Q14 (+11% QoQ).

-16.0%

-14.0%

-12.0%

-10.0%

-8.0%

-6.0%

-4.0%

-2.0%

0.0%

2.0%

4.0%

3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Total PC Totoal DT PC Total NB PC

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Total PC Total Commercial PC Total Consumer PC

-15%

-10%

-5%

0%

5%

10%

3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Total commercial PC Commerical DT Commercial NB

-20.0%

-18.0%

-16.0%

-14.0%

-12.0%

-10.0%

-8.0%

-6.0%

-4.0%

-2.0%

0.0%

3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Total consumer PC Consumer DT Consumer NB

While NB ODMs

posted a stronger

than expected 3Q14,

a correction is likely

in 4Q14

Macquarie Research Tech Hardware Sector

20 October 2014 12

Fig 24 Top-Five ODMs NB shipments Fig 25 Top Five ODMs NB Shipments (YoY)

Source: Company Data, Macquarie Research, October 2014 Source: Company Data, Macquarie Research, October 2014

Fig 26 Top Five NB ODMs: Seasonality Trend (QoQ)

Source: Company Data, Macquarie Research, October 2014

We expect rising inventory risk near term

We also note that NB ODMs and PC OEM inventories appeared roughly normal to high in 2Q,

which adds risk of an inventory correction if consumer end demand remains soft in the

upcoming holiday seasons in 4Q14.

-25%

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

1Q14 2Q14 3Q14 4Q14E

Unit: K

Quanta Compal Wistron Pegatron

Inventec YoY(RHS) QoQ(RHS)

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

30%

40%

Quanta Compal Wistron Pegatron Inventec Total

1Q14 2Q14 3Q14 4Q14E

-10%

8%

15%

11%

-12%

6%

2%

3%

-15%

-10%

-5%

0%

5%

10%

15%

20%

-25%

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

1Q 2Q 3Q 4Q

2008 2009 2010 2011

2012 2013 2014 Average(2002-2007)-RHS

average(2002-2013)- RHS Average(2010-2013)- RHS

Macquarie Research Tech Hardware Sector

20 October 2014 13

Fig 27 NB ODM inventories Fig 28 PC OEM inventories

Source: FactSet, Company Data, Macquarie Capital (USA), October 2014. Source: FactSet, Company Data, Macquarie Capital (USA), October 2014.

38

36

35

26

41

39

43

34

35

38

44

33

44

39

41

27

37

41

0

5

10

15

20

25

30

35

40

45

50

1Q10 3Q10 1Q11 3Q11 1Q12 3Q12 1Q13 3Q13 1Q14

NT$ bn

Average 5Yr Average

0

10

20

30

40

50

60

70

0

10

20

30

40

50

60

70

80

90

1

Q

9

8

4

Q

9

8

3

Q

9

9

2

Q

0

0

1

Q

0

1

4

Q

0

1

3

Q

0

2

2

Q

0

3

1

Q

0

4

4

Q

0

4

3

Q

0

5

2

Q

0

6

1

Q

0

7

4

Q

0

7

3

Q

0

8

2

Q

0

9

1

Q

1

0

4

Q

1

0

3

Q

1

1

2

Q

1

2

1

Q

1

3

4

Q

1

3

%

NT$ bn

Average (LHS) 5Yr Avg (RHS)

Macquarie Research Tech Hardware Sector

20 October 2014 14

User appetite or self-cannibalization?

Which one? You choose: Apple iPad Pro or Apples first 2-1

(NB/Tablet) MacBook Air

We are seeing more comprehensive cannibalization between devices as the line is becoming

more blurred. This will continue to put pressure on some of the traditional PC brand

companies (such as Acer) who lack innovation and form-factor design capabilities.

Since Apple launched the first generation iPad, consumer NBs have negatively been affected

by iPads rising penetration as consumers have become attracted to iPads mobility as well as

easy-to-use interface and solid app eco-systems. Nonetheless, iPads mainly cannibalized

consumer NBs and have not posed a big impact on the commercial segment. Apple aims to

launch >12 iPad (iPad Pro) in 1H15. We see the likelihood that Apple can further foray into

the commercial segment, thus further cannibalizing the commercial NB market segment if

Apple executes its strategy well.

Microsoft also announced that it will make its MSOffice (Excel, Word, PowerPoint) available

for the application in iPads. >12 inch iPad is likely emerging as an option for enterprise, and

Apple is also actively partnering with IBM. While this could potentially adversely affect Apples

Macbook Air sales if the pricing gap between iPad Pro (>12, likely 12) and Macbook Air

(>12) attracts more preference for iPad Pro, we think Apples foray into the large iPad

market could still have a more negative threat to traditional NB brands in general- in particular

for commercial NB demand in the future. Apple notes that in the enterprise market, 98 of the

Fortune 500 companies have adopted iPads, and 91% of the activations in enterprise tablets

are from iPads, according to Good Technology. Apple indicated many of those enterprises

are writing apps that are key proprietary apps for running that business, and this is great for

that company because they are more productive as result of that.

The 2-1 NBs offering could also affect traditional pure tablet demand in our view, especially if

those devices start to offer more attractive pricing. While Apple also aims to launch the

Macbook Air >12 model (likely 12.9 based on the Intel Core M processor) in 1Q15 we

believe that it is still unlikely Apple will adopt a 2-1 form-factor design given potential

cannibalization on its iPad, but any evolution Apple makes could continue going forwards,

thus changing the competitive competition. Microsoft also introduced its new Surface Pro 3

models with 12-inch screens and its 2-1 form-factor models. MSFT Surface Pro 3 has further

reduced the thickness by 14% compared to Surface Pro 2 the weight itself is also lighter

than the Apple MacBook Air. Although we dont think Microsoft can sell Surface Pro in big

volumes given its premium pricing over other similar MSFT-based OS 2-1 and much weaker

apps eco-system versus Apple, we think the proliferation of 2-1 devices and more mature

features backed by other hardware specs advancement will definitely be something to watch

in 2015 (Fig 31).

Apple Macbook Air (>12 with a Retina display) based on an Intel Core M processor will be

able to come with a thinner dimension profile likely 9 mm (vs the current Macbook Airs 17

mm)- thus more compelling NBs in 2015. While a new, larger iPad could also cannibalize

demand for the Macbook Air especially if the new tablet is priced lower and comes with an

optional keyboard function.

The larger iPads BOM cost will probably be lower than the new Macbook Airs and so should

retail pricing, if history is a guide: Apples Macbook Air 11/13 models are priced at US$899-

1199 and iPad Air 2 (9.7) at US$499-699. We think the new, larger iPad could be priced at

US$699-$999, and a new Macbook Air at US$999-1199. Such pricing may well lead to

cannibalisation of demand from the Apple Macbook Air if users prefer to have more economic

choices.

Apple has not yet

decided on a 2-1

form-factor design;

Apple will refresh

MacBook in 1Q15

will shrink the

thickness

Pricing gap will

definitely play a

crucial role in

affecting sale

strength of Apple

Macbook Air or

Apple iPad Pro

Apple aims to

launch large-size

iPads to target the

commercial

segment in 1H15.

Apples launch of

iPad Pro could

also cannibalize its

Macbook Air sales,

but could have more

impact to traditional

PC brands

Macquarie Research Tech Hardware Sector

20 October 2014 15

Fig 29 Smart Device: Market cannibalization

Source: Display Research, Macquarie Research, October 2014

Fig 30 Dimension comparison iPad Air 2/Macbook Air/new 12 Macbook Air

Model Name iPad Air 2 MacBook Air (11-inch) MacBook Air (13-inch)

New > 12" Macbook

Air

New >12 iPad

(iPad Pro)

Launch Oct-14 Oct-13 Oct-13 1Q15 1Q15

Price $499 / 599 / 699 (Wifi) US$899/US$1,199 US$1,199/US$1,299 US$999-1,199? US$699-999 ?

Dimensions Height: 6.1mm Height: 17mm Height: 17mm Height: 9mm? Height: .5mm?

Width: 240mm Width: 300mm Width: 325mm

Depth: 169.5mm Depth: 192mm Depth: 227mm

Display diagonal 9.7" 11.6" 13.3" 12.9"? 12?

Source: Company data, Macquarie Research, October 2014; New Models are based on Macquarie Research Estimates

Fig 31 Spec comparison for 2-1 and/or slim form factor NBs

Name

Microsoft

Surface Pro 3

Apple

MacBook Air(old)

Asus

Transformer Book T300FA

Model Picture

Form factor 2 in 1 NB only 2 in 1

Price $799 $899 up $599

Dimensions Height: 0.36"( 9.1mm) Height: 0.11-0.68" ( 2.8mm-17mm) Height: 0.79"(20.3mm)

Width: 11.5" Width: 11.8" Width: 12.1"

Depth: 7.93" Depth: 7.56" Depth: 8.15"

Weight: 1.76lbs 2.38lbs 3.52lbs

Embedded OS Microsoft Windows 8.1 Pro Mac OS X Mavericks Microsoft Windows 8.1/ 8.1 Pro

Display Diagonal 12" 11.6" 12.5"

Display Resolution 2160 x 1440 1366 x 768 1366 x 768

CPU Intel Core i7 1.7GHz dual-core Intel Core i5 with 3MB

shared L3 cache

Intel Core M

ROM capacity 64/128/256/512 GB 64GB/128GB 32GB/64GB eMMC(tablet)

500GB/1TB HDD (dock)

RAM capacity 4/8 GB 4GB and configurable to 8GB 4GB

Battery Life Up to 9 hours Up to 5 hours TBD

Source: Company data, Macquarie Research, October 2014

Macquarie Research Tech Hardware Sector

20 October 2014 16

We also expect to see more competitive overlap among display sizes for tablets, notebooks,

and smartphones, as Apple has announced its new iPhone 6 Plus with an increased screen

size of 5.5-inch. We believe the large screen of the iPhone 6 Plus will also cannibalize sales

of the Apple iPad mini with a 7 screen, which is not much bigger than the 5.5 iPhone 6 Plus.

According to Canalys, that 5 and above display is featured on almost half (47%) of the

smartphones with an unlocked retail price of US$500 or more in 1Q14, and on the remaining

53% of high-end smartphones, 87% were iPhones. Apple has launched iPhone 6/6 plus and

we believe the large-size smartphone trend will be accelerating.

We expect shipments of the 7- to 7.9-inch tablets will be cannibalized somewhat by 5.5-inch-

and-larger smartphones. We thus forecast that the unit share of the 7- to 7.9-inch tablets will

decline from 55% in 2014 to 35% in 2018. We believe shipments of tablets with 11-inch-and-

larger screens will rise from 2% in 2014 to 14% in 2018, as tablets directly compete with

smaller notebooks with screen sizes up to 13-inches.

While we also believe that the total tablet market size is still increasing, growth momentum

continues to decrease given prolonged upgrades and market saturation. We expect the

overall tablet market will only grow 7.9% YoY in 2014 and 12% YoY in 2015 (Fig 34).

Fig 32 Global tablet shipment growth trend Fig 33 Global smartphone shipment growth trend

Source: IDC, Macquarie Research, October 2014 Source: IDC, Macquarie Research, October 2014

Fig 34 Tablet forecast by operating system Fig 35 Tablet: Operating System Share

Source: IDC, Macquarie Research, October 2014 Source: IDC, Macquarie Research, October 2014

-50%

0%

50%

100%

150%

200%

-

10

20

30

40

50

60

70

80

90

1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

(m units)

Tablet shipment (LHS) QoQ growth (RHS)

YoY growth (RHS)

-10%

0%

10%

20%

30%

40%

50%

60%

-

50

100

150

200

250

300

350

1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

(m units)

Smartphone shipment (LHS) QoQ growth (RHS)

YoY growth (RHS)

0%

20%

40%

60%

80%

100%

120%

140%

160%

0.0

50.0

100.0

150.0

200.0

250.0

300.0

350.0

2012 2013 2014E 2015E 2016E 2017E

Unit: M

iOS Win 8 Android Total tablet YoY

0%

10%

20%

30%

40%

50%

60%

70%

80%

2011 2012E 2013 2014E 2015E 2016E

iPad Win 8 Android

7-7.9 tablet to be

cannibalized by 5.5

larger smartphone

CAGR 2013-2017= 10.4%

Macquarie Research Tech Hardware Sector

20 October 2014 17

Fig 36 Tablet: Commercial/Consumer Mix Fig 37 Tablet: Size Breakdown

Source: IDC, Macquarie Research, October 2014 Source: IDC, Macquarie Research, October 14

Fig 38 Mini NB is fading rapidly Fig 39 2-in-1 NB/Tablet is rising

Source: IDC, Macquarie Research, October 2014 Source: IDC, Macquarie Research, October 2014

Google rising investment on Chrome OS

Our US tech team- Ben Schachter and Deepon Nag issued Macquarie Technology report

GOOG/INTC Bet on CA Chrome to win in May 2014 , and they believe that Chrome OS is

an underappreciated strategic priority for both Google and Intel, and also conclude the following :

Expanding the Chrome/Android platform is core to GOOG. We believe GOOGs ability

to deploy computing resources to build out a global platform more efficiently than others is

its core competitive advantage. With Sundar Pichai leading Android/Chrome/Apps, we see

the potential for Chrome/Android to be integrated into a single ecosystem/platform,

benefitting GOOG/INTC/others. In an open job post, GOOGs discusses Chrome as a

disruptive effort to move computing to the next level and away from the regimes that have

defined computing for the past 30 years.

Intel embracing Chrome opportunity, which we see as more strategic. Although most

initial Chromebooks designs were based on ARM architectures, we note that Intel has

increased its share of Chromebooks to over 50%.While the lower BOMs of Chromebooks

imply lower ASPs , we see this as a strategic opportunity for Intel to penetrate the Android

smartphone and tablet (and other devices) markets. We note that Google recently also

extended Android to wearables, a market Intel has also made investments in (such as its

recent purchase of Basis).

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2012 2013 2014E 2015E 2016E 2017E 2018E

Consumer Commercial

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2012 2013 2014E 2015E 2016E 2017E 2018E

Smaller than 8in. 8in. and larger

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

10,000

Unit:M

Mini NB Mini %

0

5

10

15

20

25

30

2013 2014E 2015E 2016E 2017E

unit:M

Googles Chrome

OS will have more

impact to PC form

factor, and impact to

PC makers as the

transition from

client device to low-

end cloud devices

accelerates as

opposed to

traditional NBs

Macquarie Research Tech Hardware Sector

20 October 2014 18

Following the Capex for over 10 years, ever since our 2004 GOOG initiation, weve

focused on GOOGs capex to understand its priorities. Its massive infrastructure is

now set to alter the traditional computing paradigm . We expect more aggressive support

for cloud computing, across a wider variety of devices on the Chrome/Android platform

beyond smartphones/ tablets/Chromebooks.

The Chrome ecosystem limited for now, but Android could open it up to new

markets. Chrome OS still has a thin application environment including a lack of support

for many productivity apps, but we note Android has a vast array of applications (including

MS office). While we believe that many Android apps wont port cleanly into the

Chromebook form factor, we believe the form factor lends itself better to productivity apps

than on a tablet or smartphone, and expect the expanding app ecosystem to act as a

catalyst for Chrome devices to increase penetration into the traditional Win-tel based PC

system installed base. We note that Android is now the largest platform ecosystem in both

the tablet and smartphone markets.

Monetization. More internet use = more $ for GOOG. While the model will evolve,

platform owners should be able to extract a toll from developers & users. Currently, most

platform models have the platform owner taking a 30% toll for apps.

Commercial PC market embracing PC-lite devices, adding risk to

traditional PC market

IDC estimates that the commercial PC market was ~45-50% of the overall PC market in

2013, and has seen growth over the past few quarters due to an increase in corporate

replacements ahead of the expiration of support for Windows XP. While iOS and Android

based tablets have not seen significant penetration into the commercial space, we note since

MSFT released Office for iPads on March 27, Office applications have been the most

downloaded apps on iTunes. We view the popularity of Office on iPads as a testament to the

desire for cloud based work applications on PC lite devices, and believe that a converged

Chrome/Android OS with support for Office would allow for greater penetration of

Chromebooks into the commercial market. We think the commercial PC Business will

decelerate in 2H14 as corporate replacements slow post the Windows XP expiration and the

introduction of Office on Chromebooks and iPads could further post more of a threat to

traditional PC companies.

IDC estimates that Chromebooks shipped roughly 2.5 million units in 2013 (~1% of total PC

market), and will grow 68% YoY in 2014. We believe Chromebooks are gaining share on

conventional notebooks and tablets due to their low price points and increased functionality

due to expanding cloud offerings. In fact, there are more PC brands embracing the

Chromebook opportunity in order to help grow their market share and ensure they do not

miss out on new disruptive innovation in this segment. However, we expect this will continue

to weigh down their average selling prices and make their product mix more unfavourable.

NPD marketing research firm reported that Chromebooks held 21% of the US notebook

market in 2013, up from a negligible amount in 2012. In addition, these devices rose from

0.2% of commercial market unit shipments in January to November 2012 to 9.6% for the

same period in 2013.

Commercial PC

market embrace

iPad would post

more threat to

traditional PC

makers

Macquarie Research Tech Hardware Sector

20 October 2014 19

Fig 40 Chromebook shipments to rise Fig 41 PC/tablet US commercial unit sales

Source: IDC, Macquarie Research (USA), May 2014

Source: IDC, Macquarie Capital (USA), May 2014. Data based on IDC

survey

Fig 42 Google Search Trend Fig 43 Android OS market share

Source: Google.com, Macquarie Research, October 2014. Source: : IDC, Gartner, Macquarie Capital (USA), May 2014.

Fig 44 Recent Chromebook models spec

Name

Samsung

Chromebook 2

(11.6")

Samsung

Chromebook 2

(13.3")

Asustek

Chromebook

C200

Asustek

Chromebook

C300

Acer

Chromebook

13

Acer

Chromebook

11

Toshiba

Chromebook 2

Launch Date May, 2014 May, 2014 May, 2014 May, 2014 September,

2014

September,

2014

September,

2014

Price $299.99 $399.99 $249.99 $249.99 $299.99 $199.99 $249.99

Dimensions 289.6 x 204.7 x

16.8 mm

323.1 x 223.5 x

16.5 mm

304.8 x 198.1 x

20.3 mm

330.2 x 231.1 x

22.9 mm

327.7 x 228.6 x

18.0 mm

299.7 x 203.2 x

18.0 mm

320 x 214 x

19.3 mm

Weight 1.10 kg 1.39 kg 1.13 kg 1.40 kg 1.50 kg 1.20 kg 1.35 kg

Embedded OS Google Chrome

OS

Google Chrome

OS

Google Chrome

OS

Google Chrome

OS

Google

Chrome OS

Google

Chrome OS

Google

Chrome OS

CPU Samsung Exynos 5

Octa 5420

Samsung Exynos

5 Octa 5800

Intel Celeron

N2830/N2930

Intel Celeron

N2830/N2930

Nvidia Tegra

K1

Intel Celeron

N2830

Intel Celeron

N2830

CPU Clock 1.9GHz+1.3GHz 2.0GHz+1.3GHz 2.16GHz 2.16GHz 2.1GHz 2.16GHz 2.16GHz

Storage 16GB eMMC 16GB eMMC 16GB/32GB eMMC 16GB/32GB eMMC 32 GB SSD 16 GB SSD 16 GB SSD

RAM Capacity 4GB 4GB 2/4GB Up to 4GB 4GB 2GB 2GB

Display Diagonal 11.6" 13.3" 11.6" 13.3" 13.3" 11.6" 13.3"

Display Resolution 1367 x 768 1920 x 1080 1367 x 768 1367 x 768 1920 x 1080 1367 x 768 1367 x 768

WLAN Built-in dual band

Wi-Fi 802.11

a/b/g/n

Built-in dual band

Wi-Fi 802.11

a/b/g/n

Built-in dual band

Wi-Fi 802.11

a/b/g/n

Built-in dual band

Wi-Fi 802.11

a/b/g/n

Built-in dual

band Wi-Fi

802.11 ac

Built-in dual

band Wi-Fi

802.11 a/b/g/n

Built-in dual

band Wi-Fi

802.11 a/b/g/n

Bluetooth Bluetooth 4.0

Compatible

Bluetooth 4.0

Compatible

Bluetooth 4.0

Compatible

Bluetooth 4.0

Compatible

Bluetooth 4.0

Compatible

Bluetooth 4.0

Compatible

Bluetooth 4.0

Compatible

Battery Life Up to 8 Hours Up to 8.5 Hours Up to 11 Hours Up to 10 Hours Up to 11 Hours Up to 8 Hours Up to 10.5

Hours

Source: Company data, Macquarie Research, October 2014

42.9%

32.3%

17.1%

0.2%

4.2%

0.8%

2.6%

34.1%

27.8%

15.8%

9.6%

8.7%

2.2% 1.8%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

40.0%

45.0%

50.0%

Windows

Notebook

All Desktop iPads Chromebooks Android

Tablets

Windows

Tablets

Apple

Notebook

Jan-Nov 2012 Jan-Nov 2013

69%

79%

46%

62%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

2012 2013

Android smartphone market share Android tablet market share

Macquarie Research Tech Hardware Sector

20 October 2014 20

Commercial replacement cycle could peak

Windows XP migration cycle could also slow down in 2015

After Microsoft ended support for XP in April 2014, there has been some forced adoption of

Windows 7, couple with the need for corporate refreshes driving PC volumes since 2H13.

According to Net Application, as of the end of September 2014, there were still 23.87% of

PCs using Windows XP, although this ratio has fallen substantially from the peak since March

2013 (Fig 45).

We originally thought that this could still suggest room for an upgrade to Windows 7 in the

upcoming 2-3 quarters, however, we note that most mature markets have been upgrading

their commercial PCs, but emerging markets such as China and Latin America have not

experienced an uptick in commercial unit growth as shown on Fig 47-48.

While this ideally suggests potential commercial upgrade cycles from emerging markets, we

have not yet indentified any signs of uptick from these emerging markets any time soon, and

this could imply the commercial upgrade cycle could be peaking slightly earlier than expected.

In fact, during the peak Windows XP adoption, it used to dominate over 80% market share,

and Windows Vista has been a relatively unsucessful version of Windows OS. Windows 7 so

far has only caputred roughly 52.71% market share as of the end of September, still far below

Windows XPs peak level.

Fig 45 Windows Operating system version migration

Source: Net Application, Macquarie Research, October 2014

Fig 46 Windows XP EOL benefit fading

Source: IDC, Company Data, Macquarie Capital (USA), October 2014

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

1

Q

0

1

3

Q

0

1

1

Q

0

2

3

Q

0

2

1

Q

0

3

3

Q

0

3

1

Q

0

4

3

Q

0

4

1

Q

0

5

3

Q

0

5

1

Q

0

6

3

Q

0

6

1

Q

0

7

3

Q

0

7

1

Q

0

8

3

Q

0

8

1

Q

0

9

3

Q

0

9

1

Q

1

0

3

Q

1

0

1

Q

1

1

3

Q

1

1

1

Q

1

2

3

Q

1

2

1

Q

1

3

3

Q

1

3

1

Q

1

4

3

Q

1

4

E

1

Q

1

5

E

Windows 95 end of life caused surge in demand,

followed by deceleration in PC growth

Windows XP end of life

Concern on whether

commercial

replacement cycle

could reach

saturation if

emerging market

uptick does not take

off soon

Macquarie Research Tech Hardware Sector

20 October 2014 21

Fig 47 US Commercial PC growth YoY trend Fig 48 China Commercial PC growth YoY trend

Source: IDC Tracker, Macquarie Research, October 2014 Source: IDC tracker, Macquarie Research, October 2014

Fig 49 EMEA Commercial PC growth YoY Trend

Fig 50 Latin America Commercial PC growth YoY

trend

Source: IDC Tracker , Macquarie Research, October 2014 Source: IDC tracker, Macquarie Research, October 2014

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Total Commercial PC Commerical DT Commercial NB

-40.0%

-35.0%

-30.0%

-25.0%

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Total Commercial PC Commerical DT Commercial NB

-25.0%

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Total Commercial PC Commerical DT Commercial NB

-50.0%

-40.0%

-30.0%

-20.0%

-10.0%

0.0%

10.0%

20.0%

30.0%

40.0%

3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Total Commercial PC Commerical DT Commercial NB

Macquarie Research Tech Hardware Sector

20 October 2014 22

Low-priced NBs and more 2-1 NBs a

chance to outshine

Despite consumer PC demands (both DT/NB) remaining soft, we believe there is a fair

chance that selective form-factor consumer NBs (2-1 NBs, low-priced NBs) could have a

better opportunity to outshine in 2015, thanks to more low-priced NB offerings supported by

Microsoft Windows Bing Program as well as more compelling 2-1 NB/thinner NB models

launching based on Intel Core M processors. Moreover, we also expect a more consolidated

landscape which favours top-tier PC brands, in particular in the consumer PC segment. Near

term, while we believe that Windows 10 is unlikely to trigger a robust consumer replacement

cycle, it could have a ST impact if consumers choose to wait for the new Windows 10 in the

next two quarters.

Moreover, we also expect a more consolidated landscape given Samsung, Sony, Toshiba

have withdrawn from either the regional PC markets or consumer PC market, which could

favour top-tier PC brands to gain further market share, in particular in the consumer PC

market. Post HPs recent split into two entities, we believe the new HP Inc (personal

computing and printers) will also need to focus on generating steadier shareholder returns,

which could prevent aggressive pricing cuts with a focus on profitability, in our view. This is

more positive for PC brands but more negative for ODMs given fewer brands as customers.

Consumer PC demand remains soft but has a low comparison

base in 2015 onwards

Although consumer PC demand still posts negative unit growth, the YoY decline has became

less severe off of a lower comparison base. The market expectation for consumer PCs

remains pretty bearish, and as a result, we expect a consumer PC recovery will provide key

catalysts to the sector.

Fig 51 US consumer PC growth YoY Trend Fig 52 PRC Consumer PC growth YoY trend

Source: IDC tracker, Macquarie Research, October 2014 Source: IDC tracker, Macquarie Research, October 2014

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Total Consumer PC Consumer DT Consumer NB

-25.0%

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Total consumer PC Consumer DT Consumer NB

Consumer demand

remains soft, but

market expectation

is low; a few

potential drivers

Macquarie Research Tech Hardware Sector

20 October 2014 23

Fig 53 EMEA consumer PC Growth YoY Trend

Fig 54 Latin America consumer PC growth YoY

Trend

Source: IDC tracker, Macquarie Research, October 2014 Source: IDC tracker, Macquarie Research, October 2014

Intel Core M (Broadwell) processor transition opportunity for more

2-1 offerings with a more compelling design

Intel will the launch Core M (14 nm) based series processors specifically applied for

notebook/2-1 models in 4Q14. Intel claims that the Core M processor (Broadwell) is about

50% smaller and 30% thinner than Intels Haswell (core i3, i5, and i7) chips, with a 60% lower

idle power level for a longer battery life. Availability will start in 4Q14, but will have more

offerings in 1Q15.

As the Intel Core M processor has lower power consumption (4.5W vs 11W for Haswell

generation), this could help OEMs reduce thermal solution costs (such as fans/thermal

module), and design much slimmer devices (less than 9mm) as an example. PC OEMs,

including HP, Lenovo, Asustek, Acer, and Dell, all unveiled the Intel Core M processor based

products and aim to be available in 4Q14 from October. These models include AsusTek

Transformer T300 Chi, Transform Book T300FA, Zenbook UX305, Dell Latitude 13 7000

series, or Lenovo Thinkpad Helix 2, or HP Envy x2.

Apple also aims to launch in 1Q15 the new Macbook Air (12 inch models) based on the Intel

core M processor (while the form factor could still be pure NB), but will reduce the thickness

of its Macbook air.

While PC OEMs are cautious not to overbuild inventory due to the rising risk of carrying

legacy products in early 4Q and have guided to QoQ declines in 4Q, we believe the transition

could still offer some fresh growth beyond 4Q14 and towards 2015.

Fig 55 Major Core M based NB model spec comparison

Name

Asus Transformer

Book T300FA

Asus Transformer

T300 Chi

Asus Zenbook

UX305

Dell Latitude 13 7000

series HPEnvy x2

Lenovo Thinkpad

Helix 2

Dimensions 308.5 x 207 x 20.3 mm 14.7 mm thick 324 x 226 x 12.3mm 320 x 230 x 20mm TBD 9.7mm thick

Weight 1.6 kg 0.68 kg 1.2 kg 3.67 pounds TBD 0.82 kg

Price USD599 TBD TBD TBD USD1,050 USD 999

OS Windows 8.1/Windows

8.1 Pro

Windows

8.1/Windows 8.1 Pro

Windows

8.1/Windows 8.1 Pro

Windows 8.1/Windows

8.1 Pro

Windows 8.1 Windows 8.1

CPU Intel Core M Intel Core M Intel Core M Intel Core M Intel Core M Intel Core M

HDD/SSD capacity 32GB/64GB

eMMC(tablet)

500GB/1TB HDD (dock)

TBD 128GB/256GB SSD Up to 512 GB SSD

Up to 512 GB

SSD

128 GB to 180GB

SSD

RAM Capacity 4G 4G DDR3L 1600 4G/8G DDR3L 1600 Up to 8G DDR3L 1600 4G 4G/8G

Display diagonal 12.5" 12.5" 13.3" 13.3" 13.3" 11.6"

Display resolution

1366x768 2560x1480

3200x1800 or

1920x1200

1920x1080 1920x1080 1920x1080

WLAN Yes Yes Yes Yes Yes Yes

Bluetooth Yes Yes Yes Yes Yes Yes

Battery life TBD TBD 45Whr 30Whr TBD Up to 10 hrs

Release date Fall 2014 4Q14 TBD Oct-14 Oct-14 Oct-14

Source: Company data, Macquarie Research, October 2014

-35.0%

-30.0%

-25.0%

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

15.0%

3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Total Consumer PC Consumer DT Consumer NB

-35.0%

-30.0%

-25.0%

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14

Total consumer PC Consumer DT Consumer NB

The much slimmer

design could help

form-factor

innovation, and help

to drive NB demand

such as 2-1

products

Macquarie Research Tech Hardware Sector

20 October 2014 24

MSFT plans to develop various price ranges of models equipped

with MSFT OS system

To fend off tablet market cannibalization for NB segments, Microsoft has lowered the

Windows licenses fee to near $0 for any OEM building a device less than 9 inches. In

addition, Microsoft also added a low-cost Windows OS offering with Bing integration for

OEMs (note that Windows 8.1 with Bing is identical to the regular version of Windows 8.1, but

it has Microsoft's Bing search engine as a default). Microsoft provided brand OEM vendors

its Windows 8.1 with Bing solution, offering a lower licenses fee to enable them to sell NBs for

US$249 or lower on June 1, 2014. In fact, according to our understanding, Windows 8.1 with

a Bing OS option is available to OEMs at a price thats probably close to zero or US$15 at

low-cost devices.

Originally, Microsoft launched the Windows 8.1 OS with Bing solution for below US$249 for

notebooks in 2Q14, however Microsoft has decided to push the offering further in 2015. The

company aims to design some modifications on specifications and applied markets, which

could suppress Chromebooks. Microsoft will offer the program to target a different price range

for different sizes of NBs. They have clear guidance such as thickness needs to go much

slimmer than 25mm or battery life for 5 hrs, and memory starts for 1-4G DDR3 and 16-32GB

SDD or 500GB HDD.

However, to prevent the product line from hurting the brands profitability, the solution will

apply to 14 below models for mature markets, but PC vendors can release 15 models using

the Windows 8.1/ Bing program in other emerging markets. For example, Asustek will also

announce several new inexpensive 14 to 15 K and X series NBs in 4Q, priced at US$249,

using Intel Bay Trail M series processor.

The new offering, combined with lower hardware specs, aims to motivate OEMs to offer a

more attractive product line-up of value-based notebooks and tablets to the market. However,

the much lower NB price will still drive down revenue for PC makers, although it will also help

take attention away from Andorid devices, or Chormebook threat. According to supply chains,

the proportion of entry-level NBs could increase up to 60-70% in 2H15 versus only 50-60% in

1H14.

While these new notebooks have basic processors and specifications just like Chromebooks,

they offer the ability to run actual desktop applications and can work without being connected

to the Internet. They also offer more storage space than basic Chromebooks that ship with a

paltry 16GB of storage, a capacity that's considered standard on many base-model

smartphones and tablets. Please refer to Fig 56 for details on spec comparison.

These low-end Windows notebooks also come in larger screen sizes than most

Chromebooks, which have displays starting at 11 inches up to about 14 inches. For example,

HP Stream 14, a 14 laptop priced at US$299, is designed to take on Chromebook. HP also

has a 15.6-inch non-touch laptop. Dell's $249.99 US Inspiron 15 has a 15-inch display, runs

on an Intel Celeron processor and has 500GB of storage. Google's Chrome OS has no such

touch requirement, and can be managed quite easily with a mouse or a track pad.

While these low-price points could help to decrease the impact from Chromebooks, Microsoft

still lacks tightly integrated cloud services, and these low-cost Windows machines still carry

the burden of being seen as just another Windows client regardless of the price. For

industries like education that have embraced the Chromebook, a cheaper Windows PC is

unlikely to win them back to Microsoft. According to an industry survey, Google-

operated Chromebook devices accounted for almost 30 percent of all education shipments in

Q214. The devices also outnumbered shipments of notebooks running the Windows and

MacOS operating systems combined.

MSFT aims to offer

low-cost Windows

OS with Bing

integration to fend

off threat from

Chrome and

Android devices

The new MSFT Bing

program, however,

will lower ASPs and

hurt profitability for

mainstream models;

makers need to

drive more scale

Microsoft will

extend the offering

to cover multiple

segments, but will

limit to only 14

models in mature

markets

Macquarie Research Tech Hardware Sector

20 October 2014 25

Fig 56 Comparison of Chromebook and Windows low-end NBs

Type Windows NB Widows NB Chromebook Chromebook

Brand HP ASUS HP Acer

Model Stream 14 Eeebook X205-TA HP Chromebook 14 Acer C720

Price $299 $199 $299 $199

Processor AMD A4- 6400T Atom Bay Trail-T T3735 Intel Celeron 2955U Intel Celeron

OS Windows 8.1 Windows 8.1 Chrome OS Chrome OS

Battery 3 cell 38Wh 51 WHr, 4-cell 3 cell

Display 14" 1366x768 11.6" 1366x768 14" 1366x768 14" 1366x768

RAM 2GB 2GB 2GB 2GB

HDD 32GB eMMC 32 / 64GB eMMC 16GB SSD 16GB SSD

ODD NA NA NA NA

Graphics Intel Intel

Webcam Front facing VGA HD Cam VGA Cam

Ports 1 HDMI 1 HDMI 1 HDMI 1 HDMI

SD card reader SD card reader Multiformat media reader SD card reader

2 USB 2.0 1 USB 2.0 1 USB 2.0 1 USB 2.0

1 USB 3.0 1 USB 3.0 2 USB 3.0 1 USB 3.0

802.11 b/g/n 802.11 b/g 802.11 b/g/n 802.11 b/g/n

Bluetooth Bluetooth 4.0 Bluetooth Bluetooth

Dimension(inch) 0.7" height 11.3x7.6x0.69mm 13.6 x 9.4 x 0.81 11.3 x 8 x 0.75

Weight 1.75kg 2.16lbs(980g) 4.1lbs (1.9kg) 2.8lbs (1.3kg)

Notes 100GB free cloud space for 2

yrs from Microsoft

115GB free cloud space for 2

yrs from Microsoft

100GB free cloud space for 2

yrs from Google

30-day free trial for Google

Play Music Access

15GB for life/500GB ASUS

WebStorage free for 2 years

Source: Company Data, Macquarie Research, October 2014

Windows 10 official release in 2Q15 unlikely to trigger a robust

consumer replacement cycle

Windows 10 was announced on September 30, 2014, and Microsoft claims it represents a

significant leap over Windows 8.

Microsoft claims that Windows 10 runs across all form-factor devices including desktops,

laptops, tablets, phablets and smartphones.

Start menu is back: The start menu will be returning on Windows 10

Better Touch/Keyboard and mouse integration: Microsoft is calling the new approach

Continuum and it is an umbrella term for a better merger between two different input

methods. Continuum will be able to automatically switch between modes by detecting how

users interact with their devices.

Virtual desktops: Multiple virtual desktops will enhance the multitasking ability.

Fig 57 Windows 10 major features

Feature Description

One OS One OS for all devices, including DT, NB, AIO, tablet, smartphone, Xbox, etc.

Traditional start menu Return of traditional Start menu is back side by side with the Metro UI.

Multitasking "Task View" feature for multitasking and creating multiple desktops.

Switch laptop/tablet mode "Continuum" feature for easy switching between laptop and tablet mode.

Command Prompt Command Prompt now able to copy and paste with keyboard shortcuts.

Source: Company data, Macquarie Research, October 2014

Overall, while we view Windows 10 as unlikely to trigger a robust consumer replacement

cycle, it could have a ST impact if consumers choose to wait for the new Windows 10 in the

next 2 quarters. We expect consumer PC shipments to accelerate mostly due to reduced

price points and, to a lesser extent, to the launch of Windows 10. We note that 3 of the last 4

MSFT operating system updates have resulted in a YoY acceleration of PC shipments in the

quarter following the release.

We also note that Microsofts latest OS refresh in 2012 (Windows 8) didnt cause much of a

refresh cycle, and that Windows 8 users account for only 13% of current Windows users.

We note that most customers stayed with their current OS rather than upgrading to Windows

8 as shown by the 4% market share held by Windows 8 OS one year after launch. As a

result, we believe it is likely there may be pent up demand for a new OS after release.

We believe Windows

10 will unlikely

trigger a robust

consumer

replacement cycle,

but could lead to

some ST pent-up

demand post the

Windows 10 release

Macquarie Research Tech Hardware Sector

20 October 2014 26

Fig 58 PC shipments YoY (%) have accelerated in the quarter following a new

Windows OS release 3 of the last 4 instances

Source: IDC, Company Data, Macquarie Capital (USA), October 2014

Fig 59 Desktop OS market share (%) 3Q14

Source: IDC, Company Data, Macquarie Capital (USA), October 2014

Fig 60 Desktop OS market share quarter prior to

Windows 8 launch (2Q12)

Fig 61 Desktop OS market share one year post

Windows 8 launch (2Q13)

Source: IDC, Company Data, Macquarie Capital (USA), October 2014 Source: IDC, Company Data, Macquarie Capital (USA), October 2014

Windows XP

45%

Windows 7

40%

Windows Vista

7%

Mac OS X

10.7

3%

Mac OS

X 10.6

3%

Linux

1%

Mac OS

X 10.5

1%

Other

0%

Windows XP

38%

Windows 7

45%

Windows Vista

4%

Windows 8

4%

Mac OS X

10.8

3%

Mac OS

X 10.6

2%

Mac OS

X 10.7

2%

Other

2%

Macquarie Research Tech Hardware Sector

20 October 2014 27

More consolidated landscape, in particular

in consumer PC segments