Documentos de Académico

Documentos de Profesional

Documentos de Cultura

22 Cost Estimating For Turnarounds

Cargado por

nilanga123Descripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

22 Cost Estimating For Turnarounds

Cargado por

nilanga123Copyright:

Formatos disponibles

Cost estimating for turnarounds

T

urnarounds are major events

for refneries and other petro-

chemical facilities. They

typically cost signifcant sums of

operational expense (opex) and capi-

tal expense (capex) money to

execute. They cause lost opportunity

cost through lost production while

the facility is shut down. If poorly

managed, turnarounds offer signif-

cant risk of accidents. If poorly

executed, they can also be the cause

of signifcant production disruption

after startup, due to leaks and other

production trips. Hence, there is a

potential to save signifcant sums of

money, by ensuring turnarounds are

run correctly.

However, despite the large poten-

tial for saving money, there has,

until recently, been very little focus

in the turnaround world on making

sure turnarounds are run cost eff-

ciently or on fnding ways to

improve cost estimating and execu-

tion skills. In the past seven to eight

years, this attitude has begun to

change and turnaround teams are

beginning to look at how they can

improve. One potentially rich source

of ideas on how to improve is for

the turnaround teams to examine

how their capital project brethren

estimate and execute projects. In the

capital project world, the potential

for leaving money on the table

due to poor project estimating and

execution has meant that decades of

time and effort have been spent, and

continue to be spent, on developing

techniques to ensure that estimation

and execution is carried out

effciently.

This article focuses on cost estima-

tion. It does not presume to provide

all the answers on how to improve

Cost estimates for refnery turnarounds can lack accuracy, but lessons learned

from capital project estimating could improve matters

Gordon LawrenCe

Asset Performance Networks

turnaround cost estimates. Rather, it

attempts to lay the groundwork for

a discussion on how to improve cost

estimating in process facility turna-

rounds. It highlights the point that

cost estimating in the turnaround

world is currently not very accurate.

It then goes on to look at ideas on

how to improve cost estimate accu-

racy, by looking at ideas that might

be adapted from the capital project

world. In particular, it looks at the

stage gate approval system, the

development of scope and estimate

bases for different levels of estimate

accuracy, and at the development of

allowances for known unknowns

and contingency for unknown

unknowns. Finally, it makes some

suggestions for the next steps in

developing better turnaround cost

estimates.

what is a process industry

turnaround?

A turnaround (in the context of the

process industries) is defned by the

American Petroleum Institute as a

planned, periodic shutdown (total or

partial) of a... process unit or plant

to perform maintenance, overhaul

and repair operations and to inspect,

test and replace process materials

and equipment.

1

Refneries and

other petrochemical facilities that

run on a continuous rather than a

batch production cycle must, every

few years, shut down operations to

provide access to the production

units in order that essential mainte-

nance, modifcation and inspection

work can be carried out that could

not be done while the units are in

operation.

Turnarounds are events that are

planned well in advance and

typically take place on a four-to-six

year cycle. The length of a typical

turnaround execution phase (ie, the

period when the facility is shut

down and hydrocarbon free) is

usually around three-to-fve weeks.

The scope of a turnaround typi-

cally includes:

Inspection of equipment to

company regulations or governmen-

tal rules

Inspection of pipework for corro-

sion and erosion damage, both

internal (process weak points) and

external (corrosion under insulation,

or CUI)

Cleaning, repair and maintenance

of equipment, pipework and instru-

mentation (pulling and cleaning heat

exchanger tube bundles, repairing

leaks in pipework or checking of

pressure relief valves)

Minor upgrades and modifcations

to the facilities (items controlled

under the management of change

[MoC] procedures)

Tie-ins for capital projects.

Historically poor estimation and

execution effciency

Historically, there was a tendency

among operating companies to view

turnarounds as an inevitable and

necessary evil, and to accept that

they would cost what they cost

and take as long as they take.

However, in recent years, there has

been a growing recognition that this

attitude leaves money on the table

in the form of the opportunity cost

of lost production while the facility

is shut down for longer than neces-

sary; and unnecessarily excessive

expenditure of money during the

turnaround, through running the

turnaround ineffciently.

www.eptq.com PTQ Q1 2012 33

Reprinted from

Petroleum Technology Quarterly

Q1 2012

www.eptq.com

www.eptq.com PTQ Q1 2012 35

results in a 50% accuracy estimate,

the following conceptual design

stage results in a 30% estimate, and

the fnal basic design stage results in

a 10% estimate. Hence, the focus of

the stage is in developing a scope

basis to meet the estimate basis

requirements for the level of accu-

racy intended

The project cannot proceed to the

next stage without frst going

through a stage gate review to check

whether it has achieved the required

scope and estimate basis

Full funding of the project is

usually only received at the end of

the third, basic design phase.

The focus, therefore, in the capital

project world is on calculating How

much money do we need in order to

carry out this scope?.

Turnarounds

In the turnaround world, there has

been a movement in recent years

towards a form of stage gated

approach, in an attempt to improve

front-end defnition. However, the

system is not yet as clearly defned

as in the capital project world.

There are some key differences in

the way the approach is applied.

The length of each stage is (more or

less) fxed, based on the amount of

time remaining until the turnaround

In order to improve turnaround

effciency, there is a need to examine

the estimation of costs for turna-

rounds, the estimation of schedule

time, and the effciency of planning

and execution of the turnaround.

This article focuses on the frst of

those three areas, the estimation of

costs.

accuracy of turnaround cost

estimates

A cost estimate needs to be accurate

in order to provide management

with the information needed to

decide how to proceed, to allow

cash fow planning and to aid in

frm control of expenditure.

In a survey of conference partici-

pants at the Turnaround Industry

Networking Conference (TINC)

Europe, held in March 2011 in

Amsterdam, The Netherlands,

2

83%

of respondents said that their turna-

round control budget was intended

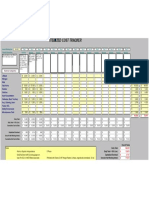

to be a 10% estimate (see Figure 1).

3

The remaining 17% said that their

estimate was supposed to include

suffcient contingency/reserve that

it was a not to exceed number.

None said that their budget was

intended to be a 30% estimate.

We then took a sample of 93 recent

turnarounds and in each case

compared the total actual cost for

the turnaround (including both capi-

tal and maintenance work) with the

control budget. Figure 2 plots the

over- or under-run of the actual

costs, expressed as a percentage of

the control budget. It shows the

mean (the horizontal bar) and 80%

confdence range (the vertical bar) of

the results in our sample set and

compares it to the results we would

have expected if the cost estimates

truly were 10%, or if they were

30%.

Based on the results shown in

Figure 2, we can say that turnaround

cost budgets tend, on average, to

under-estimate the actual cost by

around 16% (the distance of the

mean bar from the 100% point)

and the budgets themselves show a

variability of closer to 30% accu-

racy than their purported 10%

accuracy (the vertical line shows the

80% confdence range around the

mean).

Clearly, there is an opportunity to

improve cost estimating accuracy in

turnarounds.

Comparing capital projects with

turnarounds

Cost estimating of capital projects in

the process industries has gone

through a number of improvements

over the years. It may well be that

some of the lessons and devices

used in capital projects can provide

a basis from which to develop a

system for better turnaround

estimates.

Stage gates

Capital projects

In the capital project world, it is now

generally accepted that front-end

defnition is the key to a successful

project. In order to achieve good

front-end defnition, capital project

teams have largely moved toward a

stage gated approach, whereby the

design proceeds through three

distinct stages of ever-improving

scope defnition.

4

Key points are:

The length of each stage is a func-

tion of the work required to be

completed in that stage

The culmination of each stage is a

cost estimate, with the estimates

getting more accurate with each

succeeding stage. Generally speak-

ing, the feasibility stage of a project

120

160

170

150

140

130

110

100

90

80

70

Theoretical range

10% estimate

Theoretical range

30% estimate

Turnaround

actual costs

P90

P10

Mean

N=93

A

c

t

u

a

l

t

u

r

n

a

r

o

u

n

d

c

o

s

t

s

a

s

a

p

r

o

p

o

r

t

i

o

n

o

f

t

h

e

b

u

d

g

e

t

,

%

60

Figure 2 Accuracy of turnaround control estimates: expectation and reality

Figure 1 Expectation of accuracy in turnaround control estimates: vox populi

starts. Generally, by about 1412

months before the turnaround, the

frst review of status will be held. A

second review may be held around

nine-to-six months before and the

last review about three-to-two

months before.

The stages are not focused on

scope defnition for cost estimates

of a given accuracy. Instead of the

issuance of an estimate marking the

end of a stage, the ends of these

stages are delineated by their prox-

imity to the start date of the

turnaround. There are guidelines

on what level of scope defnition

should be expected at each of these

turnaround stage gates, but these

guidelines are not as universally

adopted as their counterparts are

on capital projects.

By the nature of a turnaround,

refusing to let a turnaround team

proceed to the next stage because it

is insuffciently prepared at the time

of the stage gate review is not

usually a feasible option. The budget

tends to be fxed back at the 30%

or even 50% estimate stage.

Consequently, with turnarounds, the

focus tends to be on How much

scope can we carry out for this

amount of money? rather than the

capital project paradigm of How

much money do we need in order to

carry out this scope?.

Scope basis and estimate basis

In this section, we make a distinc-

tion between the scope basis (the

level of defnition of the design

deliverables and documents) and

the estimate basis (the methodology

used to calculate costs, based on

those deliverables).

Capital projects

In the world of process industry

capital projects, the scope basis

and the estimate basis are both

relatively well defned for various

levels of estimate accuracy, from

50% down to 10% or better. One

well-known example of where this

is documented is AACE International

Recommended Practice No. 18R-97.

5

Lawrence also lists typical require-

ments.

4

(Table 1 and Table 2 are

adapted from Lawrence, 2008.) In

addition, it is accepted practice to

document the cost estimate in a

www.eptq.com PTQ Q1 2012 37

written basis of estimate

document.

early estimate: 50% rough order of

magnitude

In capital projects, the frst cost

estimates are usually highly deter-

ministic, using high-level factoring

methods rather than the stochastic

approach of calculating from the

bottom up. The cost of a facility is

typically factored off such details as,

for example, the production capacity

of the new facility, with adjustments

made for infation and location. Such

estimates generally have little in

terms of scope basis, often merely

an outline of the facility capacity

Table 1

50% ROM

estimate

General project data

Engineering deliverables

Project scope

description

Facility capacity

Facility location

Ground surveys

Project

execution plan

Contract strategy

Project schedule

Cost estimating plan

Plot plans

Process flow diagrams

Utility flow diagrams

Project execution plan

P&IDs

Heat and material

balances

Process

equipment list

Utility

equipment list

Electrical single line

diagram

Process engineers

equipment datasheets

Mechanical engineers

equipment datasheets

Equipment general

arrangement

Block flow diagrams

30% ROM

estimate

10%

control

estimate

General

General

None

None

None

Outline

None

None

None

None None

None

None

None

None

None

None

None

None

Assumed

Assumed

Level I

milestones

Defined

Defined

Defined

Defined

Defined Defined

Defined

Level III

detailed

resource

loaded

schedule

Defined

Defined

Defined

Defined

Specific

Complete

Complete

Complete

Complete

Complete

Complete

Complete

Complete

Complete

Complete

Complete

Complete

Complete

Complete

Complete

Specific

Preliminary

Preliminary

Preliminary

Preliminary

Preliminary

Preliminary

Preliminary

Preliminary

Preliminary

Preliminary

Preliminary

Preliminary

Level II

preliminary

the previous turnaround scope, and

the estimate basis uses that historical

total cost.

Conceptual estimate: 30%

On turnarounds, teams appear to

aim to have the overall scope frozen

and challenged by this point.

However, this has not always been

achieved. In terms of deliverable

documents for the scope basis, the

mechanical workpacks are usually

developed. The estimate basis is a

mix of deterministic and stochastic,

as the mechanical work packs are

costed (in-house) in some detail, but

the other work (electrical, instru-

mentation scaffolding, insulation,

and so on) is usually factored off the

mechanical costs, using historical

factors.

authorisation/control estimate: 10%

Some turnaround teams do now

have all discipline scopes developed

and externally costed. However, in

our experience, the number of teams

that take their estimates to this level

of detail are relatively few, despite

the fact that most teams claim their

control estimates are 10% or better.

work breakdown structure

Capital projects

All companies have their own varia-

tions on how they prefer to break

down costs within the estimate.

Indeed, the work breakdown struc-

ture (WBS) may differ slightly, from

project to project, depending on the

scope. Nevertheless, at a high level,

there is a measure of agreement

across the industry on how to break

down capital project costs. The

breakdown tends to be as shown in

Table 3.

Turnarounds

At present, there is no clear, common

agreement across the process indus-

tries on a high-level WBS for

turnaround costs. Most turnaround

teams split costs into direct costs

costs that can be specifcally assigned

to a cost object, such as an item of

existing plant and indirect costs

costs that cannot easily be directly

attributed to a cost object. However,

the defnition of what should be

considered direct or indirect cost

varies from site to site (presumably

38 PTQ Q1 2012 www.eptq.com

required. The estimate basis relies

on historical data of the total cost of

the entire facilities rather than

detailed cost data.

Conceptual estimate: 30%

In capital projects, a considerable

amount of work would be completed

on the scope basis, coming close to

freezing the overall scope and devel-

oping many of the design drawings

by the time this estimate was

prepared.

The estimate basis would have

moved from a high-level, determin-

istic estimate to a mix of the

stochastic and deterministic, and the

team moves towards Lang factors or

other, similar methods to calculate

the project cost (factoring off one

element of the project scope, most

typically the equipment cost).

authorisation/control estimate: 10%

By this stage, the scope basis on a

capital project is generally very

detailed, with completed P&IDs,

order specifcations for major equip-

ment and so forth. The estimate

basis is now stochastic, built bottom

up from the material take-offs and

using market cost data rather than

historical database information.

Turnarounds

There appears to be no document

equivalent to AACE International

Recommended Practice No. 18R-97

for process industry turnarounds. In

the absence of such a document, we

have informally surveyed a number

of turnarounds to look at the vari-

ous scope and estimate bases used

by the turnaround teams to develop

estimates of nominal accuracies of

50%, 30% and 10%.

The frst problem we have encoun-

tered is that there is some variation

in the methods used. Second, the

concept of writing down a detailed

basis of estimate document is

something that still has to take root

in the turnaround world; hence,

understanding how each estimate

was developed is diffcult. (We were

occasionally given documents

described by the team as the basis

of estimate, but these were gener-

ally extremely simple, high-level

notes on the estimate spreadsheet

itself rather than a formal and

detailed document.) Nevertheless,

we have attempted to provide a

general overview of the methods

being used by turnaround teams for

the various estimates.

early estimate: 50% rough order of

magnitude

The early estimate is frequently

merely the cost of the last turna-

round, adjusted for infation, with

perhaps an educated guess as to

how the scope may have grown or

shrunk since the last turnaround.

The scope basis is therefore merely

Table 2

8asic

design

Lngineering

Pactored, based on

previous, similar

facilities (based on

production capacity,

facility surface area

similar metric)

Lquipment

8ulk

material

Construction

labour

50% ROM

estimate

30% estimate

10% control

estimate

8udget estimate,

or factored off

equipment

8udget quotes for

ma|or items,

database costs

for remainder

Complete

Pirm quote

8udget quotes

based on detailed

material take-offs

8udget quotes

based on detailed

material take-offs

Pirm quotes for

ma|or items,

budget quotes

for remainder

Pactored off

equipment

Pactored off

equipment

Detailed estimate

because of different internal account-

ing practices).

The costs of owner supervision are

generally agreed to be indirect, since

at any hour of the day a team could

be supervising work on a range of

existing plant areas. Contracted

labour on tasks that can be assigned

to specifc existing plant items is

generally categorised as direct cost.

Furthermore, tracking this cost by

plant unit/area and by equipment

class/type and by equipment

number is relatively common.

However, costs such as rented

equipment (cranes, heat exchanger

bundle pullers, and so on) are less

consistently assigned to either direct

or indirect categories, presumably

because such items can only some-

times be attributed to a specifc plant

item (for instance, if a crane is only

needed to work on a specifc item).

Theoretically, it should be possible

to assign bulk material (pipe, valves,

for instance) to specifc plant items

and hence categorise the material as

direct. However, this is not always

done. One would logically expect

consumable materials such as weld-

ing rods to be indirect costs because

of the diffculty of assigning them to

specifc plant items. However, the

situation can be clouded by the fact

40 PTQ Q1 2012 www.eptq.com

Table 3

Home Office

Field

Capital

Expense

Allowances for

unknown unknowns

Allowances for

known unknowns

Direct

Design

Engineering

Equipment

Contingency

Commissioning

Operations staff

Bulk materials

Construction labour

Construction

management/supervision

Temporary facilities,

craneage, scaffold, etc

Design

allowances

on each

line item

Escalation

allowances

on each

line item

Project

management/supervision

Indirect

that consumables and bulk materials

occasionally are not separated.

allowances for uncertainty

Any cost estimate, by nature of it

being an estimate, requires funds for

the uncertain elements of the scope.

These uncertain elements can be

divided into known unknowns

and unknown unknowns. The

known unknowns are allowances

for items or quantities that the esti-

mator knows, from historical

evidence, will be needed in a specifc

line item of the estimate. The

unknown unknowns are the items

or quantities that were under-esti-

mated or completely overlooked in

the estimate. The estimator does not

know exactly in which line item the

funds will be needed, but history

tells the estimator that some funds

will be needed to bring the estimate

to the P50 point. These unknown

unknowns are contingency funds.

The need for contingency is a hotly

debated subject, but has been

discussed elsewhere

6

and we do not

propose to explore this topic here.

Capital projects

Known unknowns

The known unknowns in capital

projects take the form of design

allowances allocated to each line

item for the known unknown of

that line item (for instance, wastage

in the piping material take-off,

design development in equipment).

The amount of design allowance

to include is usually determined

through expert judgment based on

historical data.

Unknown unknowns

Contingency is for the unknown

unknowns in the estimate (for

instance, it is discovered during

construction that the need for an

electrical transformer was over-

looked in the design).

As discussed by Burroughs &

Juntima,

7

the amount of contingency

to include is typically calculated in

one of four ways:

As a predetermined percentage

(of the base estimate)

Through expert judgment (gut

feeling/experience) based on histori-

cal data

Through a Monte Carlo-type

review of the cost effect of expected

risks

Through use of a regression

model, based on historical data.

Turnarounds

In the case of funds for uncertainty,

there is a little more general agree-

ment than perhaps in other areas of

estimating for turnarounds, in as

much as it is generally accepted that

funds are needed for unknown

items.

Known unknowns

In turnarounds, the known

unknowns are (a) emerging work

(work to repair items that have

broken/failed between the comple-

tion of the estimate and the start of

the turnaround); and (b) discovery

work (repair work that is discov-

ered during the turnaround once

equipment or pipework is opened

up for detailed inspection).

In common with the design allow-

ances on capital projects, estimates

of likely emerging work and discov-

ery work should (in theory) be

calculable and assigned to specifc

estimate line items. (For instance, we

can expect other X valves to fail

between now and the shutdown, or

based on past experience we should

expect that the trays in column Z

will be discovered to be damaged

when we open it up.)

However, what we have observed

is that very often such items are not

reported in the estimate to this level

of detail. Instead, they tend to be

listed as single line items on their

own. In addition, anecdotally, we

observe that very often the discov-

ery work in particular appears to be

underestimated an optimism

about what is likely to be found

seeming to prevail.

The amount of emerging work

allowance and discovery work

allowance appears to be calculated

on the basis of experience from

previous turnarounds or from inti-

mate knowledge of the state of the

facility. But when it is based on

experience of previous turnarounds,

this experience is rarely backed up

by hard numbers, showing what

was spent in previous turnarounds

as a percentage of the base scope

cost.

Unknown unknowns

In turnarounds, just as in capital

projects, a contingency for the items

that were overlooked or completely

unforeseen at the time of the esti-

mate issue is required. (For instance,

money was included in the discov-

ery work allowance to spend three

days repairing trays in column X,

because the column was old and

was operating at low throughput.

However, it took two days longer

than expected to repair the trays in

column X. That extra two days cost

comes out of contingency.)

Whereas in capital projects contin-

gency is calculated on the basis of

one of four methods, each of which

has at least some logical foundation

to it, in turnarounds we observe that

contingency often appears to be

calculated simply as the difference

between the current base estimate

plus discovery and emerging work

allowances and the original, rough

estimate quoted to management

(assuming the rough estimate to be

a higher number!).

Quantifcation of turnaround

allowances

We then looked further into how

much allowance for uncertainty was

included by turnaround estimators

and how much was actually used.

How much is included?

The frst problem that we encoun-

tered in this study was that while

most turnaround teams recognise

the three main areas of unconfrmed

scope that need funding as being (1)

emerging work, (2) discovery work

and (3) contingency for the unfore-

seen, few teams clearly differentiate

between them in their estimates.

Indeed, in a survey that we carried

out, out of 216 turnarounds, only 34

(or 16%) could give a clear differen-

tiation in their cost estimate between

these three areas and the main

estimate.

Nevertheless, from the data gath-

ered we are able to show (see Figure

3) that teams typically include a total

of just under 13% of the base esti-

mate (where base estimate = the

total cost estimate before the three

uncertainty allowances are included)

as a total of all three allowance

amounts.

That funding breaks down in turn

into an average of 16% for emerging

work, 38% for discovery and 46%

for contingency (see Figure 4).

How much is spent?

We then attempted to look at how

much in each category is typically

consumed. From this information, we

hoped to begin developing guidelines

on calculating how much should be

included in an estimate. However,

we found that although some teams

have begun to track the consumption

of the three elements in their actual

costs this practice is still immature

within the turnaround community.

Without historical data on actual

expenditure in these three catego-

ries, it is impossible to close the

loop and begin developing guide-

lines on how much should be

included in each category in an

estimate.

Conclusions

The problem

Currently, turnaround cost estimates

are inaccurate in that, on average,

turnaround costs overrun their esti-

mates. They are also highly

unpredictable in the level of their

inaccuracy (that is, the overrun

does not remain within the claimed

10% accuracy of most estimates).

16

22

20

18

14

12

10

8

6

T

o

t

a

l

a

l

l

o

w

a

n

c

e

s

a

s

p

r

o

p

o

r

t

i

o

n

o

f

t

h

e

b

a

s

e

e

s

t

i

m

a

t

e

,

%

Emerging work + discovery work

+ contingency

4

+1SD

1SD

Mean

N=38

Figure 3 Uncertainty allowance included in estimate

Contingency

38%

Emerging

work

16%

Discovery

work

38%

N=34

Figure 4 Breakdown of uncertainty

allowance into emerging, discovery and

contingency

www.eptq.com PTQ Q1 2012 41

Furthermore, there is no clear

agreement on the defnition of

what information a cost estimate

should be based upon in order to

allow it to be defned as a 10%

estimate.

There are no guidelines on how to

calculate uncertainty allowances for

emerging work, discovery work and

contingency. Nor are many teams

gathering the actual cost expendi-

ture data that would allow such

guidelines to be developed in the

future.

Learning from capital projects

The capital project world historically

had similar problems with cost esti-

mating. Over the years, it has

improved through:

Tying estimates to stage gates

Clearly defning the scope basis

and estimate basis required for a

certain level of estimate accuracy

Using similar work breakdown

structures, allowing comparison

benchmarking of data

Gathering data on allowances for

uncertainty and developing logical

methodologies for estimating those

allowances.

The turnaround world has already

begun to learn from capital projects

by copying the stage gate approach.

There seems to be little reason to

suppose that turnaround teams

cannot continue to learn from capital

projects in order to develop turna-

round-specifc standards for scope

basis, estimate basis and calculation

of allowances.

recommendations for immediate

action

If the estimation of turnarounds is

to become more accurate and

predictable, we recommend that, as

a frst step, a series of actions should

be adopted within the turnaround

community.

defne the scope and estimate basis

There should be wide agreement on

what the scope and estimate basis

is for calling an estimate 50%, 30%

or 10% accurate. The capital projects

community has such agreement in

documents referred to earlier.

Suggested outline versions for turn-

arounds are given in Tables 4

and 5, respectively. Table 4

42 PTQ Q1 2012 www.eptq.com

50% ROM

estimate

General turnaround scope data

Engineering deliverables

30% ROM

estimate

10%

control

estimate

Equipment count

Turnaround premises

Risk Based Inspection

(RBI) data

Maintenance turnaround

backlog

Listing little

definition

Baseline

no markup

None

None

None

None None

None

Original

baseline

None

Listing high

level, based

on asset

management

strategy

95%

complete

99%

complete

60-70%

complete

99%

complete

Hazard and Operability

study (HAZOP)

Listing high

level

60-70%

complete

100%

complete

Plant engineering design

changes (expense)

Listing not

all inclusive

60-80%

complete

100%

complete

Leak Detection And

Repair (LDAR)

Listing

preliminary

Listing

preliminary

Partial

markup

Partial

turnaround

markups

Partial for

new capital

Complete

listing

Previous turnaround

scope

Plot plans

logistics markups

Plant engineering

design packages

Major capital project

engineering design

Flare minimisation plan

Heat transfer data

Utility plan

Oils plan

P&ID markups

Process engineering

design basis for plant

engineering capital

Turnaround boundaries

Listing 90% Listing 90% Listing 90%

Process Hazard Analysis

(PHA)

Listing high

level

60-70%

complete

100%

complete

Management Of Change

(MOC) design changes

40-60%

complete

100%

complete

Complete

Complete

Complete

Complete

Complete

Complete

Complete

Complete

Preliminary

100%

complete

100%

complete

80-90%

complete

100%

complete

Preliminary

80-90%

complete

100%

complete

Capital projects

80-90%

complete

100%

complete

Listing

Listing

Listing

various

stages

Partial

Partial

Partial

None Complete Partial

None Complete Partial

Preliminary

Partial

None

Startup procedures

maintenance

(new equipment)

Complete Partial

Baseline

none for new

capital

Original Equipment

Manufacturer (OEM)

specifications & drawings

Complete

Preliminary

Plant projects

Standardise the wBS

Move towards a common standard

layout for cost estimates. The capital

projects community has such a

standard (see Table 3). A suggested

outline version for turnarounds is

shown in Table 6.

Track the uncertainty allowances

If the turnaround community is

ever to develop even rudimentary

rules of thumb for estimating

emerging work, discovery work

and contingency for the unforeseen,

it must begin to track expenditure

in these areas. This will require two

responses from the community: a

willingness to differentiate clearly

the three categories in cost esti-

mates; and a willingness to

accurately track actual expenditure

from these three categories during

a turnaround.

Tie the estimates to the stage gates

In the world of capital projects, the

stage gate culminates in a cost esti-

mate. Currently, the typical review

stages for preparation and planning

of a turnaround are not tied to a cost

estimate. Tying the estimate and

stage gate together could improve

review of planning and preparation

progress.

recommendations for longer-term

next steps

This article covers only the frst steps

in improving the accuracy and

predictability of turnaround cost

estimates. Further steps need to be

taken. Once there is common agree-

ment on the minimum standard of

scope basis and estimate basis for

turnaround estimates, and once

turnaround teams begin gathering

actual uncertainty allowance data,

the community will then be in a

position to begin developing logical

methodologies for calculating more

accurately the required level of

allowance for uncertainty in emerg-

ing work, discovery work and

contingency for each turnaround.

acknowledgements

The author would like to acknowledge the

encouragement offered during the preparation

of this article by Bobby Vichich, Vice President,

Turnarounds, at Asset Performance Networks,

as well as the invaluable advice (particularly,

but not only, relating to Table 4) of John Casper,

Senior Consultant and Subject Matter Expert

for Turnarounds and Capital Projects, at Asset

Performance Networks.

references

1 http://www.api.org/aboutoilgas/sectors/

refning/refnery-turnaround.cfm.

2 http://ap-networks.com/latest-news/tinc-

europe-2011-summary.html.

3 We are very aware of the fact that in recent

years the preference within project cost

estimating circles is not to talk of a typical

10% or 30% estimate, but rather to talk

of classes of estimates. This is because of

the need to recognise that for the same level

of scope defnition, two projects could have

different levels of estimate accuracy because

of the inherent risks in their characteristics. For

example, a new technology project probably

carries more risk than a similar-sized project

expanding an existing plant. However, the

turnaround world has not yet reached that

level of sophistication. Hence, for the survey,

we used terms that are readily recognised, such

as 10% estimate.

Table 6

4 Lawrence G R, Stage gated approval processes

a practical way to develop and flter capital

investment ideas, Pharmaceutical Engineering,

vol 20, No 2, March/April 2008.

5 AACE International Recommended Practice

No. 18R-97; cost estimate classifcation system,

as applied in engineering, procurement, and

construction for the process industries.

6 Lawrence G R, The use and misuse of

contingency or why cutting contingency

makes projects more expensive, not less.

Pharmaceutical Engineering, vol 27, No 5, Sept/

Oct 2007.

7 Burroughs S E, Juntima G, Exploring Techniques

for Contingency Setting, AACE International

Transactions, Washington DC, 2004.

Gordon Lawrence is a Senior Consultant with

Asset Performance Networks, Amsterdam.

He holds a bachelors degree in chemical

engineering from Heriot-Watt University,

Edinburgh, a masters in biochemical

engineering from Birmingham University, and

an MBA from Strathclyde University Business

School, Glasgow.

Email: glawrence@ap-networks.com

www.eptq.com PTQ Q1 2012 43

Mechanical

work

Other

disciplines

Cost of the last

TA, adjusted for

inflation

Quantities for

mechanical work

from workpacks,

but then priced

in-house

Other disciplines

factored from

mechanical,

based on history

Quantities for all

disciplines

calculated and

priced by

contractors,

based on

workpacks

50% ROM

estimate

30% ROM

estimate

10% control

estimate

Home Office

Field

(during

shutdown

period)

Allowances for

unknown unknowns

Allowances for

known unknowns

Direct

(broken down by

unit/area, equipment

type and equipment

number

Field (before the

shutdown period)

Emerging

work

allowances

on each line

item

Discovery

work

allowances

on each line

item

Indirect

Contingency

Consumables

Equipment

Bulk materials

Turnaround planning

and preparation

Turnaround field

labour

Pre-turnaround field

work

Equipment rental

cranes, scaffold, etc

Logistics, temporary

facilities, etc.

Turnaround

management/

supervision

Direct

Indirect

Maintenance

Capital projects

Table 5

También podría gustarte

- Value Of Work Done A Complete Guide - 2020 EditionDe EverandValue Of Work Done A Complete Guide - 2020 EditionAún no hay calificaciones

- GAO Bid Protest GuideDocumento70 páginasGAO Bid Protest GuideStavros Panagoulopoulos100% (1)

- Pembuatan Proposal ProyekDocumento41 páginasPembuatan Proposal ProyekpudjijatiAún no hay calificaciones

- Ramel Ornales Construction SuperintendentDocumento6 páginasRamel Ornales Construction SuperintendentIndustrial WeldersAún no hay calificaciones

- Cost Time ResourcesDocumento1 páginaCost Time ResourcesLee ChonAún no hay calificaciones

- Wo Cost TrackerDocumento1 páginaWo Cost TrackerAbdul Hameed OmarAún no hay calificaciones

- Description SLP Number Date Location Project Client Prepared by REF Attachments Machine: ConfigurationDocumento1 páginaDescription SLP Number Date Location Project Client Prepared by REF Attachments Machine: ConfigurationozchrisAún no hay calificaciones

- Flying Leads-The HowDocumento4 páginasFlying Leads-The HowOffshore World100% (1)

- P6 Training AberdeenDocumento3 páginasP6 Training AberdeenNnamdiAún no hay calificaciones

- Schedule Price - Fire Proofing BSB's Scope - R.1Documento6 páginasSchedule Price - Fire Proofing BSB's Scope - R.1Mj Edin100% (1)

- 5-9. Scope of WorkDocumento6 páginas5-9. Scope of WorkKimberly Miller67% (3)

- ESIA - Oil & Gas For Yamal Peninsula in Northern RussiaDocumento866 páginasESIA - Oil & Gas For Yamal Peninsula in Northern RussiaEzzadin BabanAún no hay calificaciones

- Pakistan 2005 Earthquake: Prepared by Asian Development Bank and World Bank Islamabad, Pakistan November 12, 2005Documento26 páginasPakistan 2005 Earthquake: Prepared by Asian Development Bank and World Bank Islamabad, Pakistan November 12, 2005Aslam KyonAún no hay calificaciones

- Project Standards and Specifications Subcontracting Procedure Rev01webDocumento4 páginasProject Standards and Specifications Subcontracting Procedure Rev01webimran shaukatAún no hay calificaciones

- Latin MaximDocumento3 páginasLatin MaximVince OchondraAún no hay calificaciones

- Amec / Tekfen / Azfen Consortium: BP Exploration (Shah Deniz) LimitedDocumento8 páginasAmec / Tekfen / Azfen Consortium: BP Exploration (Shah Deniz) Limitedmekhman mekhtyAún no hay calificaciones

- Construction Phase Progress: Progrees Status Report As of 28Th January 2018Documento2 páginasConstruction Phase Progress: Progrees Status Report As of 28Th January 2018Athambawa RameesAún no hay calificaciones

- 13 Project ControlDocumento43 páginas13 Project Controlpranav guptaAún no hay calificaciones

- Decision Support System For Selecting The Proper Project Delivery Method Using Analytical Hierarchy Process (AHP)Documento9 páginasDecision Support System For Selecting The Proper Project Delivery Method Using Analytical Hierarchy Process (AHP)writeahmedAún no hay calificaciones

- Project Closeout Checklist: Category DescriptionDocumento4 páginasProject Closeout Checklist: Category DescriptionElisha WankogereAún no hay calificaciones

- SC Project Closeout Report v6Documento27 páginasSC Project Closeout Report v6SateeshIngoleAún no hay calificaciones

- Company ProfileDocumento2 páginasCompany ProfileGrace EuniceAún no hay calificaciones

- Financial Crisis - Group 6Documento8 páginasFinancial Crisis - Group 6Anonymous ZCvBMCO9Aún no hay calificaciones

- RasGas Sustainability Report 2011 PDFDocumento78 páginasRasGas Sustainability Report 2011 PDFjameskagomeAún no hay calificaciones

- How To Write Admission LettersDocumento2 páginasHow To Write Admission Lettersbiffin100% (1)

- Closeout Checklist PDFDocumento1 páginaCloseout Checklist PDFNikhil KpAún no hay calificaciones

- Cover Sheet For Individual Assignments: September'2009Documento19 páginasCover Sheet For Individual Assignments: September'2009Povenesan Krishnan100% (1)

- 90 Days Look Ahead Plan 27-02-2014Documento187 páginas90 Days Look Ahead Plan 27-02-2014Vijayshanker GuptaAún no hay calificaciones

- Typical Project ConstraintsDocumento2 páginasTypical Project ConstraintsKIT2584Aún no hay calificaciones

- Gas Pipeline RIght of Way CondemnationDocumento56 páginasGas Pipeline RIght of Way CondemnationJames "Chip" NorthrupAún no hay calificaciones

- Paint Specification Package CDocumento32 páginasPaint Specification Package CMohammedAún no hay calificaciones

- BOA Bid Evaluation CriteriaDocumento10 páginasBOA Bid Evaluation CriteriaOmogbai InijezeAún no hay calificaciones

- PQ Doc For Ammonia - Urea II Project Final (2 Indonesia's Petrokimia Gresik,.Documento29 páginasPQ Doc For Ammonia - Urea II Project Final (2 Indonesia's Petrokimia Gresik,.George Van BommelAún no hay calificaciones

- Analysis of Eia For Obajana Gas Pipeline Project in NigeriaDocumento13 páginasAnalysis of Eia For Obajana Gas Pipeline Project in NigeriaAnyanwu EugeneAún no hay calificaciones

- Risk Assessment Guidelines For Mega Development Rev4Documento6 páginasRisk Assessment Guidelines For Mega Development Rev4MAGDY KAMELAún no hay calificaciones

- Crc-p-600 Welding Machine Spec. Brochure 2Documento4 páginasCrc-p-600 Welding Machine Spec. Brochure 2gdgfd100% (1)

- 10 - Notification of WorksDocumento1 página10 - Notification of WorksfreannAún no hay calificaciones

- Manual de Vaporizadores AmbientalesDocumento9 páginasManual de Vaporizadores AmbientalesJose Luis Tadeo SabinoAún no hay calificaciones

- Cost Premise - 2011Documento17 páginasCost Premise - 2011Olusegun OyebanjiAún no hay calificaciones

- Energy and Power Overview - LNGDocumento28 páginasEnergy and Power Overview - LNGRhys JamesAún no hay calificaciones

- Developing The Project PlanDocumento8 páginasDeveloping The Project PlanStephanie BucogAún no hay calificaciones

- Pipeline 2017 (Web)Documento65 páginasPipeline 2017 (Web)Irfan OmercausevicAún no hay calificaciones

- Weekly Project Status ReportDocumento2 páginasWeekly Project Status ReportRobi Maulana100% (1)

- Logistic Booklet Material Delivery Muara Bakau Rev4Documento7 páginasLogistic Booklet Material Delivery Muara Bakau Rev4Irwin RahartyoAún no hay calificaciones

- Enbridge Gas LetterDocumento2 páginasEnbridge Gas LettermchardieAún no hay calificaciones

- Business Administration Notes 27th April 11Documento57 páginasBusiness Administration Notes 27th April 11Danny WongAún no hay calificaciones

- Nigerian Pipeline Completed Through Swamp, Rock and ForestDocumento2 páginasNigerian Pipeline Completed Through Swamp, Rock and Forestargentino_ar01Aún no hay calificaciones

- J P Kenny BrochureDocumento16 páginasJ P Kenny BrochurechinemeikeAún no hay calificaciones

- Example Safe Work Method StatementDocumento2 páginasExample Safe Work Method StatementHamza NoumanAún no hay calificaciones

- Rail ConstructionDocumento74 páginasRail ConstructionChaithanya KumarAún no hay calificaciones

- Estimating Project Times and Costs: Mcgraw-Hill/Irwin ReservedDocumento23 páginasEstimating Project Times and Costs: Mcgraw-Hill/Irwin ReservedAbdullah TalibAún no hay calificaciones

- Jorge Tariga: Project Management Contractor Near-Miss at Worksite ReportDocumento15 páginasJorge Tariga: Project Management Contractor Near-Miss at Worksite ReportEever Paul De LeonAún no hay calificaciones

- MSDGC Contractor QC Plan TemplateDocumento32 páginasMSDGC Contractor QC Plan TemplateBenjamin BrownAún no hay calificaciones

- Fuel Dispensing Pump TestingDocumento4 páginasFuel Dispensing Pump TestingAnonymous FW5PVUp50% (2)

- Project Life CycleDocumento25 páginasProject Life CycleIshfahani NurcholishAún no hay calificaciones

- Decommissioning of Offshore Oil and Gas StructuresDocumento27 páginasDecommissioning of Offshore Oil and Gas Structurescarrolng82Aún no hay calificaciones

- Petronas Canada Hsse PolicyDocumento11 páginasPetronas Canada Hsse Policymohamed100% (1)

- Offshore Travel RequirementsDocumento7 páginasOffshore Travel RequirementsK S RaoAún no hay calificaciones

- Analysis of Cost Estimating Through Concurrent Engineering Environment Through Life Cycle AnalysisDocumento10 páginasAnalysis of Cost Estimating Through Concurrent Engineering Environment Through Life Cycle AnalysisEmdad YusufAún no hay calificaciones

- Dot 1995Documento13 páginasDot 1995Braulio BastosAún no hay calificaciones

- Indra: 19-JUN-2017 As BuiltDocumento6 páginasIndra: 19-JUN-2017 As Builtnilanga123Aún no hay calificaciones

- Constructability ReviewDocumento1 páginaConstructability Reviewnilanga123Aún no hay calificaciones

- Memory Verses LearntDocumento8 páginasMemory Verses Learntnilanga123Aún no hay calificaciones

- BSC Course PosterDocumento1 páginaBSC Course Posternilanga123Aún no hay calificaciones

- To Full Fill Your Housing Dream Pleas Call Nations Trust Banks Representative Appointed To Bahrain Tharanga Perera On 33831318 or 38416222Documento1 páginaTo Full Fill Your Housing Dream Pleas Call Nations Trust Banks Representative Appointed To Bahrain Tharanga Perera On 33831318 or 38416222nilanga123Aún no hay calificaciones

- 104 PhaseDiags QS2AnsDocumento6 páginas104 PhaseDiags QS2Ansnilanga123Aún no hay calificaciones

- Job Safety Analysis Made Simple: ISBN 0-660-18606-3 DSS Catalogue Number CC273-2/01-4EDocumento42 páginasJob Safety Analysis Made Simple: ISBN 0-660-18606-3 DSS Catalogue Number CC273-2/01-4Enilanga123Aún no hay calificaciones

- Skills Shortages Tcm77-160052Documento10 páginasSkills Shortages Tcm77-160052nilanga123Aún no hay calificaciones

- Safe Rigging Principles Requirements Retraining Presentation Attch2Documento2 páginasSafe Rigging Principles Requirements Retraining Presentation Attch2nilanga123Aún no hay calificaciones

- En Maflowrap Application GuidelinesDocumento2 páginasEn Maflowrap Application Guidelinesnilanga123Aún no hay calificaciones

- Data Sheets For GRP Pipe PN10Documento7 páginasData Sheets For GRP Pipe PN10nilanga123Aún no hay calificaciones

- Literacy Lesson PlanDocumento5 páginasLiteracy Lesson Planapi-437974951Aún no hay calificaciones

- A Project Report ON: Admerit IIT & ME, Patna LC Code:-01780Documento74 páginasA Project Report ON: Admerit IIT & ME, Patna LC Code:-01780Santosh FranAún no hay calificaciones

- Mabini Colleges, Inc: College of Education Daet, Camarines NorteDocumento8 páginasMabini Colleges, Inc: College of Education Daet, Camarines NorteFrancia BalaneAún no hay calificaciones

- The MES Performance Advantage Best of The Best Plants Use MESDocumento20 páginasThe MES Performance Advantage Best of The Best Plants Use MESNiraj KumarAún no hay calificaciones

- Elena Alina Popa: Key StrengthsDocumento3 páginasElena Alina Popa: Key StrengthsElena Alina PopaAún no hay calificaciones

- Resarch Paper - Google SearchDocumento2 páginasResarch Paper - Google SearchhudAún no hay calificaciones

- Week 9-1 - H0 and H1 (Updated)Documento11 páginasWeek 9-1 - H0 and H1 (Updated)Phan Hung SonAún no hay calificaciones

- GRADES 1 To 12 Daily Lesson Log Grade 3 Science Quarter 1: I. Objectives Monday Tuesday Wednesday Thursday FridayDocumento10 páginasGRADES 1 To 12 Daily Lesson Log Grade 3 Science Quarter 1: I. Objectives Monday Tuesday Wednesday Thursday Fridayblood lustAún no hay calificaciones

- Blessings in DisguiseDocumento238 páginasBlessings in DisguiseAJ HassanAún no hay calificaciones

- An Overview On Co-Operative Societies in BangladeshDocumento11 páginasAn Overview On Co-Operative Societies in BangladeshAlexander DeckerAún no hay calificaciones

- Thesis Report FormatDocumento21 páginasThesis Report Formatsebsibe birhanuAún no hay calificaciones

- Teoria Do MSR ADocumento4 páginasTeoria Do MSR AAlexandre Valeriano da SilvaAún no hay calificaciones

- MAT565 - Tutorial - Inverse LaplaceDocumento2 páginasMAT565 - Tutorial - Inverse LaplacefaqhrulAún no hay calificaciones

- Tugas Fak. Kedokteran Untad Therapy WorksheetDocumento4 páginasTugas Fak. Kedokteran Untad Therapy WorksheetTha IthaAún no hay calificaciones

- Schopenhauer S LebenDocumento345 páginasSchopenhauer S LebenVeRa100% (1)

- Family Day by Day - The Guide To A Successful Family LifeDocumento212 páginasFamily Day by Day - The Guide To A Successful Family Lifeprajya100% (3)

- 2017 WikiVisual Illustration Style GuideDocumento29 páginas2017 WikiVisual Illustration Style GuidePeter Slattery100% (3)

- ForensicDocumento23 páginasForensicKamya ChandokAún no hay calificaciones

- Werewere FelaDocumento17 páginasWerewere FelaStacy HardyAún no hay calificaciones

- Kindly Encircle The Letter of Your ChoiceDocumento5 páginasKindly Encircle The Letter of Your ChoiceJheongmie ObaAún no hay calificaciones

- Quiz Unit 2 B3Documento9 páginasQuiz Unit 2 B3Nicolás Felipe Moreno PáezAún no hay calificaciones

- CDP MCQs - Child Development & Pedagogy (CDP) MCQ Questions With AnswerDocumento4 páginasCDP MCQs - Child Development & Pedagogy (CDP) MCQ Questions With AnswerPallav JainAún no hay calificaciones

- Vibration MeasurementDocumento20 páginasVibration MeasurementDae A VeritasAún no hay calificaciones

- No. 119 - March 2005Documento68 páginasNo. 119 - March 2005European Southern ObservatoryAún no hay calificaciones

- DLP 7 - Unique Selling PropositionDocumento2 páginasDLP 7 - Unique Selling PropositionDecember Ember100% (1)

- Strut & Tie ModelDocumento67 páginasStrut & Tie Modelahmed adel100% (9)

- ESE 18 Cut Offs English PDFDocumento1 páginaESE 18 Cut Offs English PDFkishan singhAún no hay calificaciones

- German Short Stories For BeginnersDocumento82 páginasGerman Short Stories For BeginnersHùynh Ngọc DiễmAún no hay calificaciones

- Self Measures For Self-Esteem STATE SELF-ESTEEMDocumento4 páginasSelf Measures For Self-Esteem STATE SELF-ESTEEMAlina100% (1)

- v53nS5 Bio Anthro SupplementDocumento272 páginasv53nS5 Bio Anthro SupplementJean-FrançoisVéranAún no hay calificaciones