Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Habib Bank Limited: Valuation Triggers Overly Priced In!

Cargado por

jibranqqDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Habib Bank Limited: Valuation Triggers Overly Priced In!

Cargado por

jibranqqCopyright:

Formatos disponibles

BMACapitalManagementLtd.801Unitower,I.I.

ChundrigarRoad,Karachi,74000,PakistanForfurtherqueries,pleasecontact:

bmaresearch@bmacapital.comorcallUAN:111262111

This memorandum is produced by BMA Capital Management Limited and is only for the use of their clients. While the information contained

herein is from sources believed reliable, we do not represent that it is accurate or complete and should not be relied upon as such. Opinions

expressedmayberevisedatanytime.Thismemorandumisforinformationonlyandisnotanoffertobuyorsell,orsolicitationofanyoffertobuy

orsellthesecuritiesmentioned.

1

WehaveinitiatedouractivecoverageonHabibBankLimited(HBL)withDec14TPof

PKR145/share.SincetheonsetofFY14alongwithhigherinflationaryexpectationand

reversalinmonetarypolicystancebroughtinvestorsattentiontowardslaidbackHBL

share thus the scrip has provided a notable return of 51% in FY14TD, thus overly

pricinginthevaluationdrivers

HBL remained a leading bank in Pakistan banking space with ubiquitous branch

network of 1,497 domestic branches and 43 branches in international jurisdiction.

This robust branch network enabled banks deposits to grow at a significant level of

30.4%in2012whencomparedwiththeindustrygrowthof13.4%in2012.Lookingat

its prevailing branch network, we believe, the bank will retain its ascendency in

banking deposits however it will not replicate mammoth growth witnessed in

outgoingyears

As of Sep 2013, the bank enjoys CASA of 76% from 68% registered in Dec 2012.

Notable improvement in CASA is primarily due to reduction in the share of fixed

deposits to 24% in Sep13 from 30% in Dec13 along with rising share of savings and

currentaccount.However,peggingofMDRofsavingsaccounttoreporatewilllikely

tokeepcostoffundinghighthusoffsetingtheimpactofdecreaseinfixeddeposits

Lookingatprevailingstructuralissues,webelievethatHBLwilltiltadditionaldeposits

towards government securities however in the long run, the bank is anticipating to

seeahandsomegrowthinadvancesespeciallyfromtextilesector

Valuationtriggersoverlypricedin!

We have initiated our active coverage on Habib Bank Limited (HBL) with Dec14 TP of

PKR145/share. Since the onset of FY14 along with higher inflationary expectation and

reversal in monetary policy stance brought investors attention towards laidback HBL

sharethusthescriphasprovidedanotablereturnof51%inFY14TD.Webelievethatthe

recentrunupinthestockpriceisfairlyreflectingallpossiblevaluetriggersthatmayallure

investorattentiongoingforward.Consequently,atourtargetprice,thescripistradingat

apremiumof20%hencewerecommendaSellcallonthescrip.Atyesterdaysclose,the

scripistradingat2014EPERandPBVof10.0xand1.8xrespectively.

Leveragingubiquitousbranchnetwork

HBLremainedaleadingbankinPakistanBankingspacewithubiquitousbranchnetworkof

1,540branchesindomesticandinternationaljurisdiction.Robustbranchnetworkenabled

banks deposit to grow at a significant level of 30.4% in 2012 when compared with the

industrygrowthof13.4%.Resultantly,banksmarketshareinindustrydepositreachedto

a record high of 17.1% in 2012. Due to aggressive drive for deposit accretion by other

banks,HBLisnotlikelytosustainthecurrentgrowthrateandweanticipateittogrowby

8.8% in 2013E, curtailing its market share to 16.7% in 2013E. Despite decline in market

share, we believe, the bank will retain its ascendency in banking deposits and branch

network because the management plans to increase branch network by around 2030

branches annually and so we have accounted 5yr (20132018) CAGR of 14% in deposits.

HabibBankLimited

Valuationtriggersoverlypricedin!

Wednesday January15,2013

SELL

TargetPriceDec14:PKR145

CurrentPrice:PKR180

Bloomberg HBL.PA

Reuters HBL.KA

MCAP(USDmn) 2,294

12MADT(USDmn.) 0.4

SharesOutstanding 1,334

Valuations

2012A 2013F 2014F

EPS 16.2 15.8 19.6

DPS 7.5 9.0 10.0

HBLvs.KSE100RelativeChart

2014FDividendYield(%) 6%

CapitalGain(%) 20%

TotalGain(%) 14%

80

100

120

140

160

180

J

a

n

1

3

F

e

b

1

3

M

a

r

1

3

A

p

r

1

3

M

a

y

1

3

J

u

n

1

3

J

u

l

1

3

A

u

g

1

3

S

e

p

1

3

O

c

t

1

3

N

o

v

1

3

D

e

c

1

3

J

a

n

1

4

KSE100Index HBL

HBL Profile: HBL, together with its subsidiaries,

engages in commercial banking, modaraba

management, and asset management related

services in Pakistan. It also has operations in Asia

Pacific,Europe,NorthAmerica,andtheMiddleEast.

As of December 31, 2012, the company operated

1,497 branches, including 33 Islamic banking

branches in Pakistan, as well as 43 branches outside

Pakistan. HBL was founded in 1947 and is

headquarteredinKarachi,Pakistan.

IqbalIsmailDinani

Iqbal.dinani@bmacapital.com

+92111262111Ext:2059

BMACapitalManagementLtd.801Unitower,I.I.ChundrigarRoad,Karachi,74000,PakistanForfurtherqueries,pleasecontact:

bmaresearch@bmacapital.comorcallUAN:111262111

This memorandum is produced by BMA Capital Management Limited and is only for the use of their clients. While the information contained

herein is from sources believed reliable, we do not represent that it is accurate or complete and should not be relied upon as such. Opinions

expressedmayberevisedatanytime.Thismemorandumisforinformationonlyandisnotanoffertobuyorsell,orsolicitationofanyoffertobuy

orsellthesecuritiesmentioned.

2

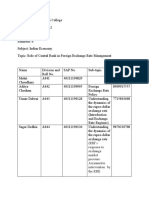

PeercomparisonofbranchnetworkandmarketshareinDeposits

Source:BMAResearch

Depositcomposition;skewedtowardssavings

The bank is enjoying one of the highest CASA ratio of 76% registered in Sep 2013 as

compared to 68% in 2012. This robust increase in CASA is primarily attributed to rapid

declineintheshareoffixeddepositsto24%inSep2013from31%in2012.Moreover,the

bank has also witnessed a sizable growth in savings accounts as its share significantly

increasedto47%inSep2013from43%in2013.However,thenotionofsavingsaccount

as a low cost deposit is off the table, since SBP has pegged minimum deposit rate on

savings account to repo rate thus in every monetary tightening phase, cost of savings

account is likely to increase proportionally. Refer below charts explaining rising

contributionofcostofsavingsaccountinoverallfundingcost.Hadthisnotbeenpegged,

thebanksearningsduring4Q2013Ewouldhavebeenhigherby6%.

200

400

600

800

1,000

1,200

1,400

1,600

1,800

MCB UBL HBL ABL NBP BAFL

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

BranchesLHS MarketShareRHS

Risingshareofsavingaccount

akjsdf;laj

andsoincreasingcostofsavings

depositsinoverallfundingcost

Source:CompanyReports,BMAResearch

0%

20%

40%

60%

80%

100%

120%

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

E

2

0

1

4

E

Savings OtherDeposits

Repurchaseagreements STborrowings

LTborrowings

0%

20%

40%

60%

80%

100%

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

E

2

0

1

4

E

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

Fixed Savings Current CASARHS

CASAcomparisonofpeerbanks

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

HBL NBP MCB UBL ABL BAFL

CAtoDeposits SavingstoDeposits

CASA

2

Source:BMAResearch

BMACapitalManagementLtd.801Unitower,I.I.ChundrigarRoad,Karachi,74000,PakistanForfurtherqueries,pleasecontact:

bmaresearch@bmacapital.comorcallUAN:111262111

This memorandum is produced by BMA Capital Management Limited and is only for the use of their clients. While the information contained

herein is from sources believed reliable, we do not represent that it is accurate or complete and should not be relied upon as such. Opinions

expressedmayberevisedatanytime.Thismemorandumisforinformationonlyandisnotanoffertobuyorsell,orsolicitationofanyoffertobuy

orsellthesecuritiesmentioned.

3

InvestmentPhilosophy;IDRtoovershadowADR

Post2008economicturmoilleddeteriorationinbanksassetqualityindicatorsparticularly

infection ratio as it peaked to 11.1% in 2011, however prudent stance on lending side

curtailedinfectionratioto10.1%in2012.Inordertofurtherstrengthenassetquality,the

banksexposureingovt.securitiesincreasedto63%in2012from41%in2011.According

toourdiscussionwiththemanagement,bankwillremainvigilantinissuingnewloansto

high credit worthy corporate and individuals and relatively heavy on government

securities side. Thus we believe that asset quality indicators will be welcoming going

forward and it may allure investors by propping up a story of possible reversals in

provisionsbookedearlier.

Furthermore,thebanksexposureinequityinvestmentremainmutedtothelowestlevel

of 0.4% of total deposits when compared with other top tier banks thus we believe that

thebankhasalreadymissedearningopportunityofpostelectionbullruninthemarket.

ComparisonofEquityinvestmentandgovt.securitiesoftoptierbanks

Source:BMAResearch

Branchlessbanking;betterlatethannever!

In ordertocapture rising demand of branchless banking,the bank has recently launched

HBL Express and HBL AtWork in order to tap growing market however the bank is quite

late when compared with other top tier banks. However, the management is confident

thatthebankwillefficientlyincreaseitsmarketsharebyleveragingitsnationwidebranch

network.Webelieve,theseinitiativeswilljackupbanksfeeandcommissionincometo3

yr CAGR of 16% with improving contribution to noncore income of 53% in 2015E from

40% in Sep 2013. Moreover, the banks cash management division (collection side) has

recently crossed transaction volume of PKR1.0trn,highest in the industry thereby adding

value to banks product portfolio. Furthermore, the management also believes that the

bankislikelytowinsomeprivatizationmandatesthusunderpinningnonfundedincome.

Valuation

We have used DDM and RIVM method for equity valuation of the bank and average of

thesematricesderiveourfairvalueforthescrip.Basedonthesemethodologies,Dec14TP

isatPKR145/share,whichistradingatapremiumof20%toitstargetprice.Moreover,the

scripalsooffersadividendyieldof6.0%.

0%

10%

20%

30%

40%

50%

60%

70%

80%

HBL NBP MCB UBL ABL BAFL

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

Govt.Securities%ofDeposits Equity%ofDepositsRHS

También podría gustarte

- Bangladesh Quarterly Economic Update: June 2014De EverandBangladesh Quarterly Economic Update: June 2014Aún no hay calificaciones

- HDFC Bank - Visit Update - Oct 14Documento9 páginasHDFC Bank - Visit Update - Oct 14Pradeep RaghunathanAún no hay calificaciones

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingDe EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingAún no hay calificaciones

- Yes Bank: Rating: BUYDocumento2 páginasYes Bank: Rating: BUYmdannyAún no hay calificaciones

- Banks: Possible Impact of Sharper Than Eyed DR Hikes: Morning BriefingDocumento2 páginasBanks: Possible Impact of Sharper Than Eyed DR Hikes: Morning BriefingScorpian MouniehAún no hay calificaciones

- IndusInd Bank-2QFY14 Result Update - 15 October 2013 Longtermgrp++ NBDocumento4 páginasIndusInd Bank-2QFY14 Result Update - 15 October 2013 Longtermgrp++ NBdarshanmaldeAún no hay calificaciones

- Sharekhan Top Picks: November 30, 2012Documento7 páginasSharekhan Top Picks: November 30, 2012didwaniasAún no hay calificaciones

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDocumento3 páginasICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkAún no hay calificaciones

- An Assignment On "The Impact of Merger Between CBOP and HDFC BANK"Documento12 páginasAn Assignment On "The Impact of Merger Between CBOP and HDFC BANK"Hardeep Singh BhatiaAún no hay calificaciones

- FIN410.5 Team 2 Fall 2022 1Documento6 páginasFIN410.5 Team 2 Fall 2022 1Mohammad Fahim HossainAún no hay calificaciones

- HDFC Bank: CMP: INR537 TP: INR600 NeutralDocumento12 páginasHDFC Bank: CMP: INR537 TP: INR600 NeutralDarshan RavalAún no hay calificaciones

- Sharekhan Top Picks: January 01, 2013Documento7 páginasSharekhan Top Picks: January 01, 2013Rajiv MahajanAún no hay calificaciones

- Fag 3qcy2012ruDocumento6 páginasFag 3qcy2012ruAngel BrokingAún no hay calificaciones

- Axis Bank Q4FY12 Result 30-April-12Documento8 páginasAxis Bank Q4FY12 Result 30-April-12Rajesh VoraAún no hay calificaciones

- Morgan Capital Equity Research Nigeria Breweries PLCDocumento5 páginasMorgan Capital Equity Research Nigeria Breweries PLCImoUstino ImoAún no hay calificaciones

- BHEL-4QFY13 Result Update - 24 May 2013Documento5 páginasBHEL-4QFY13 Result Update - 24 May 2013Ravi ShekharAún no hay calificaciones

- Sharekhan Top Picks: February 02, 2013Documento7 páginasSharekhan Top Picks: February 02, 2013nit111Aún no hay calificaciones

- Headline Published OnDocumento5 páginasHeadline Published OnAmol GadeAún no hay calificaciones

- Management Round Table 12 13Documento13 páginasManagement Round Table 12 13Rahul SaikiaAún no hay calificaciones

- Fedral Bank LTDDocumento256 páginasFedral Bank LTDAnonymous NnVgCXDwAún no hay calificaciones

- Can Fin Homes LTD (NSE Code: CANFINHOME) - Alpha/Alpha + Stock Recommendation For May'13Documento21 páginasCan Fin Homes LTD (NSE Code: CANFINHOME) - Alpha/Alpha + Stock Recommendation For May'13shahavAún no hay calificaciones

- Agricultural Bank of ChinaDocumento7 páginasAgricultural Bank of ChinaJack YuanAún no hay calificaciones

- Initiating Coverage HDFC Bank - 170212Documento14 páginasInitiating Coverage HDFC Bank - 170212Sumit JatiaAún no hay calificaciones

- PNB1-Jan 2008Documento2 páginasPNB1-Jan 2008Neeraj BagadeAún no hay calificaciones

- Market Outlook 19th December 2011Documento5 páginasMarket Outlook 19th December 2011Angel BrokingAún no hay calificaciones

- Analyst Report Issued by IIFL (Company Update)Documento16 páginasAnalyst Report Issued by IIFL (Company Update)Shyam SunderAún no hay calificaciones

- Annual Report 2012-2013 Federal BankDocumento192 páginasAnnual Report 2012-2013 Federal BankMoaaz AhmedAún no hay calificaciones

- DCB Bank Buy Emkay ResearchDocumento23 páginasDCB Bank Buy Emkay ResearchGreyFoolAún no hay calificaciones

- Stock of The Funds Advisory Today - Buy Stock of Union Bank's With Target Price Rs.152/shareDocumento28 páginasStock of The Funds Advisory Today - Buy Stock of Union Bank's With Target Price Rs.152/shareNarnolia Securities LimitedAún no hay calificaciones

- HDFC Buy CallDocumento21 páginasHDFC Buy CallSurya BalamuruganAún no hay calificaciones

- Axis Bank LTD CVDocumento4 páginasAxis Bank LTD CVPrayagraj PradhanAún no hay calificaciones

- Ratio Analysis of HDFC FINALDocumento10 páginasRatio Analysis of HDFC FINALJAYKISHAN JOSHI100% (2)

- Federal BankDocumento20 páginasFederal BankbbaalluuAún no hay calificaciones

- BankingDocumento328 páginasBankingRaviSinghAún no hay calificaciones

- CASA Accretion: Key Points Supply DemandDocumento11 páginasCASA Accretion: Key Points Supply DemandDarshan RavalAún no hay calificaciones

- Indianivesh Securities Private Limited: Balanced Aggressive ConservativeDocumento9 páginasIndianivesh Securities Private Limited: Balanced Aggressive ConservativeShashi KapoorAún no hay calificaciones

- Q3 2020 Earnings Call Company Participants: OperatorDocumento22 páginasQ3 2020 Earnings Call Company Participants: OperatorGirish Raj SankunnyAún no hay calificaciones

- Bank and NBFC - MehalDocumento38 páginasBank and NBFC - Mehalsushrut pawaskarAún no hay calificaciones

- Bajaj Finance Limited Q2 FY15 Presentation: 14 October 2014Documento33 páginasBajaj Finance Limited Q2 FY15 Presentation: 14 October 2014adi99123Aún no hay calificaciones

- RBL 20181127 Mosl CF PDFDocumento8 páginasRBL 20181127 Mosl CF PDFmilandeepAún no hay calificaciones

- HDFC Bank: Opportunity Meets Execution!Documento28 páginasHDFC Bank: Opportunity Meets Execution!Priyanshu GuptaAún no hay calificaciones

- Financial Management Anjum HakimDocumento4 páginasFinancial Management Anjum HakimimbisatAún no hay calificaciones

- Bajaj Capital Centre For Investment Research: Buy HDFC BankDocumento9 páginasBajaj Capital Centre For Investment Research: Buy HDFC BankShikhar KumarAún no hay calificaciones

- HDFC 2qfy2013ruDocumento9 páginasHDFC 2qfy2013ruAngel BrokingAún no hay calificaciones

- 2014 09 Clsa Conference PresentationDocumento67 páginas2014 09 Clsa Conference PresentationTara Ann CoelhoAún no hay calificaciones

- Indian Bank Investment Note - QIPDocumento5 páginasIndian Bank Investment Note - QIPAyushi somaniAún no hay calificaciones

- Market Outlook 12th March 2012Documento4 páginasMarket Outlook 12th March 2012Angel BrokingAún no hay calificaciones

- SWOT Analysis of Bank AlfalahDocumento14 páginasSWOT Analysis of Bank Alfalahamina8720% (1)

- SWOT Analysis of Bank Alfalah: StrengthsDocumento14 páginasSWOT Analysis of Bank Alfalah: Strengthsusman_3Aún no hay calificaciones

- Top 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The SameDocumento4 páginasTop 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The Sameapi-234474152Aún no hay calificaciones

- IndiaBanks GoldilocksWithAMinorBump20230310 PDFDocumento26 páginasIndiaBanks GoldilocksWithAMinorBump20230310 PDFchaingangriteshAún no hay calificaciones

- Nib Bank LimitedDocumento7 páginasNib Bank LimitedrafeyzzAún no hay calificaciones

- Banking Sector (Afifc)Documento12 páginasBanking Sector (Afifc)Punam PandeyAún no hay calificaciones

- Rbi Bulletin October 2013Documento140 páginasRbi Bulletin October 2013vijaythealmightyAún no hay calificaciones

- QS - Indian Bank - Initiating CoverageDocumento11 páginasQS - Indian Bank - Initiating CoverageratithaneAún no hay calificaciones

- HDFC Bank Rs 485: All Around Strong Performance HoldDocumento8 páginasHDFC Bank Rs 485: All Around Strong Performance HoldP VinayakamAún no hay calificaciones

- Nivesh Stock PicksDocumento13 páginasNivesh Stock PicksAnonymous W7lVR9qs25Aún no hay calificaciones

- Ndian Banking Sector OutlookDocumento3 páginasNdian Banking Sector OutlookvinaypandeychandAún no hay calificaciones

- India Equity Analytics Today: Hold Rating On Prestige Estates StockDocumento25 páginasIndia Equity Analytics Today: Hold Rating On Prestige Estates StockNarnolia Securities LimitedAún no hay calificaciones

- Allied Bank Limited CoverageDocumento22 páginasAllied Bank Limited Coverage$ayan@Aún no hay calificaciones

- IMF Conditionality: Nadir Cheema Facebook Count220 Twitter Share 15Documento1 páginaIMF Conditionality: Nadir Cheema Facebook Count220 Twitter Share 15jibranqqAún no hay calificaciones

- Title: Anarchism: From Theory To Practice Author: Topics: Source: Retrieved On October 26, 2009 FromDocumento68 páginasTitle: Anarchism: From Theory To Practice Author: Topics: Source: Retrieved On October 26, 2009 FromjibranqqAún no hay calificaciones

- Nordic ModelDocumento13 páginasNordic ModeljibranqqAún no hay calificaciones

- Toward DemocracyDocumento15 páginasToward DemocracyjibranqqAún no hay calificaciones

- Hilosopher Faceoff: Rousseau vs. Mill: "On Liberty"Documento8 páginasHilosopher Faceoff: Rousseau vs. Mill: "On Liberty"jibranqqAún no hay calificaciones

- Book Reviews: S. Akbar ZaidiDocumento17 páginasBook Reviews: S. Akbar ZaidijibranqqAún no hay calificaciones

- David Hume, Sceptic PDFDocumento139 páginasDavid Hume, Sceptic PDFjibranqqAún no hay calificaciones

- Utopian InvestmentsDocumento29 páginasUtopian InvestmentsjibranqqAún no hay calificaciones

- Presentation VariationDocumento5 páginasPresentation VariationjibranqqAún no hay calificaciones

- vB10 Fiji PDFDocumento652 páginasvB10 Fiji PDFjibranqqAún no hay calificaciones

- Teaching and Learning Brochure PDFDocumento32 páginasTeaching and Learning Brochure PDFjibranqq100% (1)

- Official Rules-1 PDFDocumento21 páginasOfficial Rules-1 PDFjibranqqAún no hay calificaciones

- Pakistan Strategy 30-6-2015Documento2 páginasPakistan Strategy 30-6-2015jibranqqAún no hay calificaciones

- Ogdc Pol Result PreviewDocumento3 páginasOgdc Pol Result PreviewjibranqqAún no hay calificaciones

- Getting The Big Idea Handout PDFDocumento4 páginasGetting The Big Idea Handout PDFjibranqqAún no hay calificaciones

- Religion&Society PDFDocumento17 páginasReligion&Society PDFjibranqqAún no hay calificaciones

- Case 07: R. MarleneDocumento7 páginasCase 07: R. MarleneAnonymous bV4OSIAún no hay calificaciones

- Balance Scorecard FrameworkDocumento178 páginasBalance Scorecard FrameworkNouman HassanAún no hay calificaciones

- Fintech - Did Someone Cancel The Revolution?Documento16 páginasFintech - Did Someone Cancel The Revolution?Dominic PaolinoAún no hay calificaciones

- ICSID Provisional Measures To Enjoin Parallel Domestic Litigation (R.gil)Documento70 páginasICSID Provisional Measures To Enjoin Parallel Domestic Litigation (R.gil)Rodrigo Gil100% (2)

- PT ESS1217 - Mapping Report Break LinkDocumento392 páginasPT ESS1217 - Mapping Report Break Linkricho naiborhuAún no hay calificaciones

- Sale and Leaseback Problem Solving MCDocumento4 páginasSale and Leaseback Problem Solving MCTeresa RevilalaAún no hay calificaciones

- Investments Time and Capital MarketsDocumento41 páginasInvestments Time and Capital MarketsAgam Moga AnandaAún no hay calificaciones

- Pre-Contract - Invitation For PrequalificationDocumento54 páginasPre-Contract - Invitation For PrequalificationDilanthaDeSilvaAún no hay calificaciones

- Dofp-I 2011Documento33 páginasDofp-I 2011Manoj ManhasAún no hay calificaciones

- Day Spa Business PlanDocumento33 páginasDay Spa Business PlanPreeti Dhaka33% (3)

- LR Questions PDFDocumento10 páginasLR Questions PDFkumassa kenyaAún no hay calificaciones

- Analyzing and Improving Management PerformanceDocumento25 páginasAnalyzing and Improving Management PerformanceSerena Van Der Woodsen100% (1)

- Tybcom - A - Group No. - 5Documento10 páginasTybcom - A - Group No. - 5Mnimi SalesAún no hay calificaciones

- My Subscriptions Courses ACC410-Advanced Accounting Chapter 2 HomeworkDocumento29 páginasMy Subscriptions Courses ACC410-Advanced Accounting Chapter 2 Homeworksuruth242Aún no hay calificaciones

- Market Outlook: Dealer's DiaryDocumento16 páginasMarket Outlook: Dealer's DiaryAngel BrokingAún no hay calificaciones

- Sources of FinanceDocumento10 páginasSources of FinanceOmer UddinAún no hay calificaciones

- Bilant LB Engleza Model 2003Documento5 páginasBilant LB Engleza Model 2003Monica FrangetiAún no hay calificaciones

- Trust and Consequences: A Survey of Berkshire Hathaway Operating ManagersDocumento5 páginasTrust and Consequences: A Survey of Berkshire Hathaway Operating ManagersHaridas HaldarAún no hay calificaciones

- GCC Education Industry Report July 2014Documento97 páginasGCC Education Industry Report July 2014shabina921Aún no hay calificaciones

- Green FundingDocumento21 páginasGreen Fundingamreensiddiqui1501Aún no hay calificaciones

- Daily Lesson Log/Plan: Monday Tuesday Wednesday ThursdayDocumento5 páginasDaily Lesson Log/Plan: Monday Tuesday Wednesday ThursdayJovelyn Ignacio VinluanAún no hay calificaciones

- S.No Company Name Regional OfficeDocumento647 páginasS.No Company Name Regional OfficeSunny SinghAún no hay calificaciones

- CH 09Documento25 páginasCH 09hafizAún no hay calificaciones

- Sbi Mutual Fund: SBI Magnum Children's Benefit Fund - Savings PlanDocumento9 páginasSbi Mutual Fund: SBI Magnum Children's Benefit Fund - Savings PlanvvpvarunAún no hay calificaciones

- Balance SheetDocumento4 páginasBalance SheetPFEAún no hay calificaciones

- Cost Accounting and ManagementDocumento25 páginasCost Accounting and ManagementRavi shankarAún no hay calificaciones

- The Case of Bernard MadoffDocumento10 páginasThe Case of Bernard Madoffmanzanojade1985Aún no hay calificaciones

- Givegivegivegivecorpcorpcorpcorp Productsproductsproductsproductsproductsproductsproductsproducts& ServicesservicesservicesservicesservicesservicesservicesservicesDocumento17 páginasGivegivegivegivecorpcorpcorpcorp Productsproductsproductsproductsproductsproductsproductsproducts& ServicesservicesservicesservicesservicesservicesservicesservicesAde SulaemanAún no hay calificaciones

- Presented By: Sujeeth Joishy K SumalathaDocumento15 páginasPresented By: Sujeeth Joishy K SumalathaKiran NayakAún no hay calificaciones

- The Meadow DanceDocumento22 páginasThe Meadow DancemarutishAún no hay calificaciones

- Introduction to Negotiable Instruments: As per Indian LawsDe EverandIntroduction to Negotiable Instruments: As per Indian LawsCalificación: 5 de 5 estrellas5/5 (1)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingDe EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingCalificación: 4.5 de 5 estrellas4.5/5 (97)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorDe EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorCalificación: 4.5 de 5 estrellas4.5/5 (132)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersDe EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersAún no hay calificaciones

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooDe EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooCalificación: 5 de 5 estrellas5/5 (2)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsDe EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsAún no hay calificaciones

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersDe EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersAún no hay calificaciones

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementDe EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementCalificación: 4.5 de 5 estrellas4.5/5 (20)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpDe EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpCalificación: 4 de 5 estrellas4/5 (214)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorDe EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorCalificación: 4.5 de 5 estrellas4.5/5 (63)

- Indian Polity with Indian Constitution & Parliamentary AffairsDe EverandIndian Polity with Indian Constitution & Parliamentary AffairsAún no hay calificaciones

- Public Finance: Legal Aspects: Collective monographDe EverandPublic Finance: Legal Aspects: Collective monographAún no hay calificaciones

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsDe EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsCalificación: 5 de 5 estrellas5/5 (24)

- Contract Law in America: A Social and Economic Case StudyDe EverandContract Law in America: A Social and Economic Case StudyAún no hay calificaciones

- The Streetwise Guide to Going Broke without Losing your ShirtDe EverandThe Streetwise Guide to Going Broke without Losing your ShirtAún no hay calificaciones

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessDe EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessCalificación: 5 de 5 estrellas5/5 (1)

- Corporate Law: A Handbook for Managers: Volume oneDe EverandCorporate Law: A Handbook for Managers: Volume oneAún no hay calificaciones

- International Business Law: Cases and MaterialsDe EverandInternational Business Law: Cases and MaterialsCalificación: 5 de 5 estrellas5/5 (1)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistDe EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistCalificación: 4 de 5 estrellas4/5 (34)

- Nolo's Quick LLC: All You Need to Know About Limited Liability CompaniesDe EverandNolo's Quick LLC: All You Need to Know About Limited Liability CompaniesCalificación: 4.5 de 5 estrellas4.5/5 (7)

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesDe EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesCalificación: 4 de 5 estrellas4/5 (1)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseDe EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseAún no hay calificaciones