Documentos de Académico

Documentos de Profesional

Documentos de Cultura

What Changes Would Be Needed For The ECB To Cut Its Rates Further?

Cargado por

harpocrates744Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

What Changes Would Be Needed For The ECB To Cut Its Rates Further?

Cargado por

harpocrates744Copyright:

Formatos disponibles

What changes would be needed for the ECB to cut its rates further?

According to our reaction function, three factors - or a combination of them - could lead to a cut in monetary

policy rates in the euro zone: a rise in the unemployment rate of around 0.3 percentage point; an appreciation

of the euro of roughly 10 cents; no rebound in headline inflation in April, contrary to what is expected. While

the probability associated with these developments is not insignificant, which justifies the downward bias in

the ECB's monetary policy stance, we continue to believe the most likely scenario for key interest rates is

status quo.

Despite the decision this month to leave interest rates

unchanged, the ECB has maintained its forward guidance,

leaving the door ajar for another round of conventional

easing. But while markets on the whole were surprised by the

status quo this month (Chart 1), we seek to determine what

developments would be needed to convince the ECB to cut

its rates again.

We make the assumption that there will be no external shock

to the European economy (currency crisis in emerging

countries, geopolitical crisis in Ukraine, extreme weather

events, etc.). A rate cut could then be triggered by short-term

changes in the economic variables that have the greatest

impact on the ECBs monetary policy actions. In our opinion,

they include inflation, the unemployment rate (its deviation

from the natural unemployment rate, the threshold from which

wages - and therefore underlying inflation - accelerate), the

euro's exchange rate and, to a lesser extent, changes in the

M3 money supply.

We have actually shown in the past that these variables are

part of the ECBs historical reaction function, which

resembles a Taylor Rule adjusted for certain financial

conditions

1

.

These variables do not all have the same importance, and

the impact of some of them is lagged, e.g. the exchange rate

and the money supply:

( ) ( ) ( )

( ) ( )

sept _ dummy * . M * . EUR * .

Infl * . gap _ NAIRU * . . ECB

.

t

.

t

.

t

.

t

. .

t

11 33 0 3 08 0 43 1

23 0 87 0 1 4

7 4

9

0 8

6

2 12

1

0 5 9 34 2 26

+

+ + =

Starting from our estimate of the ECB's repo rate by using

this reaction function, while taking into account the data

available for the March Council meeting, we simulate the

short-term changes that would drive the repo rate significantly

below the current level of 0.25% (Chart 2).

1

Flash 2006-289: Do you speak ECB?

99,64

99,66

99,68

99,70

99,72

99,74

99,76

99,78

99,64

99,66

99,68

99,7

99,72

99,74

99,76

99,78

02 January 2014 01 February 2014 03 March 2014

Chart 1

Euribor 3M September 2014

Sources : Reuters

ECB Council

Meeting 6 March

12 March 2014 - No. 36

Sylvain Broyer, Cdric Thellier

N36

I

2

Ceteris paribus, and based on our working assumptions, we

find that the ECB might cut its repo rate if:

The unemployment rate rises by around 0.3

percentage point (without the structural

unemployment rate changing significantly);

The euro appreciates suddenly but lastingly by

roughly 10 cents against the dollar;

Inflation does not rebound by 30 bp in April, contrary

to what is expected (due to a base effect, Chart 3);

0,0

0,5

1,0

1,5

2,0

2,5

3,0

3,5

4,0

4,5

5,0

0,0

0,5

1,0

1,5

2,0

2,5

3,0

3,5

4,0

4,5

5,0

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14

Chart 2

ECB Repo rate & augmented Taylor rule

ECB key rate

Fitted reaction function

Sources: ECB, NATIXIS

Fore.

-1

0

1

2

3

4

-1

0

1

2

3

4

02 03 04 05 06 07 08 09 10 11 12 13 14 15

Chart 3. Euro zone: HICP inflation rates

(YoY as %)

Headline HICP

Core HICP

Sources: Eurostat, Natixis

Fore.

N36

I

3

También podría gustarte

- Modeling ECB Rates with Business Cycle StatesDocumento14 páginasModeling ECB Rates with Business Cycle StatesmfcarAún no hay calificaciones

- Daily Currency Briefing: The Beginning of The End?Documento4 páginasDaily Currency Briefing: The Beginning of The End?timurrsAún no hay calificaciones

- Flash Note: Euro Area: ECB Monetary PolicyDocumento3 páginasFlash Note: Euro Area: ECB Monetary Policyapi-309425623Aún no hay calificaciones

- U T R U ECB M P: Sing Aylor Ules To Nderstand Onetary OlicyDocumento38 páginasU T R U ECB M P: Sing Aylor Ules To Nderstand Onetary Olicyblood88Aún no hay calificaciones

- LSR Macro Picture: Danger ZoneDocumento11 páginasLSR Macro Picture: Danger Zonenelson ongAún no hay calificaciones

- DCB 230611Documento4 páginasDCB 230611timurrsAún no hay calificaciones

- Working Paper Series: Towards A Robust Monetary Policy Rule For The Euro AreaDocumento43 páginasWorking Paper Series: Towards A Robust Monetary Policy Rule For The Euro AreaNedelcu LikaAún no hay calificaciones

- Daily FX Strategy: ECB Preview: EUR To Take Fright From QE-lite?Documento2 páginasDaily FX Strategy: ECB Preview: EUR To Take Fright From QE-lite?GlobalStrategyAún no hay calificaciones

- Daily Currency Briefing: How Would The ECB Treat A Greek Default Rating?Documento4 páginasDaily Currency Briefing: How Would The ECB Treat A Greek Default Rating?timurrsAún no hay calificaciones

- Session 5 Paper Cassola Durre HolthausenDocumento64 páginasSession 5 Paper Cassola Durre HolthausenAyu LestariAún no hay calificaciones

- EUR Interest Rate Outlook - Jul11Documento4 páginasEUR Interest Rate Outlook - Jul11timurrsAún no hay calificaciones

- Weekly Market Brief: ECB Moves Centre StageDocumento2 páginasWeekly Market Brief: ECB Moves Centre Stagepathanfor786Aún no hay calificaciones

- Ecb Electronification of PaDocumento198 páginasEcb Electronification of PaFlaviub23Aún no hay calificaciones

- ThesisDocumento77 páginasThesisAngates1Aún no hay calificaciones

- FOMC Minutes Indicate Slowing of QE3: Morning ReportDocumento3 páginasFOMC Minutes Indicate Slowing of QE3: Morning Reportnaudaslietas_lvAún no hay calificaciones

- No Interest Rate Cut From The ECB: Morning ReportDocumento3 páginasNo Interest Rate Cut From The ECB: Morning Reportnaudaslietas_lvAún no hay calificaciones

- Ner182 02Documento29 páginasNer182 02Amogh SahuAún no hay calificaciones

- Mre121213 PDFDocumento3 páginasMre121213 PDFnaudaslietas_lvAún no hay calificaciones

- Deflation Danger 130705Documento8 páginasDeflation Danger 130705eliforuAún no hay calificaciones

- SR 397Documento16 páginasSR 397farshadmkAún no hay calificaciones

- 30 June COTW Commentary 2Documento5 páginas30 June COTW Commentary 2jitenparekhAún no hay calificaciones

- Expects No Rate Cut From ECB: Morning ReportDocumento3 páginasExpects No Rate Cut From ECB: Morning Reportnaudaslietas_lvAún no hay calificaciones

- Currency Wars: The Fed Strikes Back in Response to ECB EasingDocumento5 páginasCurrency Wars: The Fed Strikes Back in Response to ECB EasingkunalwarwickAún no hay calificaciones

- TOF - Lecture 2 BIDocumento8 páginasTOF - Lecture 2 BIHoang TranAún no hay calificaciones

- Working Paper Series: European Central BankDocumento45 páginasWorking Paper Series: European Central BankjhgAún no hay calificaciones

- New Setbacks, Further Policy Action Needed: Figure 1. Global GDP GrowthDocumento8 páginasNew Setbacks, Further Policy Action Needed: Figure 1. Global GDP GrowthumeshnihalaniAún no hay calificaciones

- Ier Nov 11Documento2 páginasIer Nov 11derek_2010Aún no hay calificaciones

- ECB Will Cut Its Interest Rate This Afternoon: Morning ReportDocumento3 páginasECB Will Cut Its Interest Rate This Afternoon: Morning Reportnaudaslietas_lvAún no hay calificaciones

- As Macro Revision Trade SterlingDocumento2 páginasAs Macro Revision Trade SterlingAnonymous fIL7OsuyAún no hay calificaciones

- Econ UKEconomicsInsights 01aug11Documento6 páginasEcon UKEconomicsInsights 01aug11Nicola DukeAún no hay calificaciones

- Weak Euro-Zone Pmis Hit Markets: Morning ReportDocumento3 páginasWeak Euro-Zone Pmis Hit Markets: Morning Reportnaudaslietas_lvAún no hay calificaciones

- Fed Lifts Growth Forecasts For 2012: Morning ReportDocumento3 páginasFed Lifts Growth Forecasts For 2012: Morning Reportnaudaslietas_lvAún no hay calificaciones

- Sa-2019-Inflation, A Phillips Curve For The Euro Area, Nber ReviewDocumento28 páginasSa-2019-Inflation, A Phillips Curve For The Euro Area, Nber ReviewAyu SrimulyaniAún no hay calificaciones

- Evaluate The Factors Considered by The Bank of England When Setting The Interest RateDocumento3 páginasEvaluate The Factors Considered by The Bank of England When Setting The Interest RateShazAún no hay calificaciones

- China Cuts Interest Rates: Morning ReportDocumento3 páginasChina Cuts Interest Rates: Morning Reportnaudaslietas_lvAún no hay calificaciones

- Pantheon Eurozone Economic Monitor, May 12Documento5 páginasPantheon Eurozone Economic Monitor, May 12Pantheon MacroeconomicsAún no hay calificaciones

- Work 703Documento42 páginasWork 703TBP_Think_TankAún no hay calificaciones

- Barkleys Bank Interest RateDocumento2 páginasBarkleys Bank Interest Ratemarina321Aún no hay calificaciones

- Recent UK Economy PerformanceDocumento7 páginasRecent UK Economy PerformanceRishabh JindalAún no hay calificaciones

- FOMC Minutes Surprised Markets: Morning ReportDocumento3 páginasFOMC Minutes Surprised Markets: Morning Reportnaudaslietas_lvAún no hay calificaciones

- Markets Await QE3 Signals: Morning ReportDocumento3 páginasMarkets Await QE3 Signals: Morning Reportnaudaslietas_lvAún no hay calificaciones

- MRE120803Documento3 páginasMRE120803naudaslietas_lvAún no hay calificaciones

- Can Mario Monti Save Italy?: Morning ReportDocumento3 páginasCan Mario Monti Save Italy?: Morning Reportnaudaslietas_lvAún no hay calificaciones

- Dailymarkets UpdateDocumento29 páginasDailymarkets Updateapi-25889552Aún no hay calificaciones

- Ecb wp2219 en PDFDocumento98 páginasEcb wp2219 en PDFgrobbebolAún no hay calificaciones

- S&P Turned Market Sentiment: Morning ReportDocumento3 páginasS&P Turned Market Sentiment: Morning Reportnaudaslietas_lvAún no hay calificaciones

- Euro Zone Recession Coming To An End?: Morning ReportDocumento4 páginasEuro Zone Recession Coming To An End?: Morning Reportnaudaslietas_lvAún no hay calificaciones

- Macroeconomics: Theory and Applications: SpringDocumento15 páginasMacroeconomics: Theory and Applications: Springmed2011GAún no hay calificaciones

- No New Measures From The ECB: Morning ReportDocumento3 páginasNo New Measures From The ECB: Morning Reportnaudaslietas_lvAún no hay calificaciones

- Several Important Events This Week: Morning ReportDocumento3 páginasSeveral Important Events This Week: Morning Reportnaudaslietas_lvAún no hay calificaciones

- MRE120620Documento3 páginasMRE120620naudaslietas_lvAún no hay calificaciones

- 2q 2011 European UpdateDocumento47 páginas2q 2011 European Updatealexander7713Aún no hay calificaciones

- CriticismsDocumento2 páginasCriticismstanwir13Aún no hay calificaciones

- Ecb Press CoDocumento4 páginasEcb Press Conimish2Aún no hay calificaciones

- "We Will Be Ready To Act": Morning ReportDocumento3 páginas"We Will Be Ready To Act": Morning Reportnaudaslietas_lvAún no hay calificaciones

- ECB Rate Cut, New Measures Brewing: Morning ReportDocumento3 páginasECB Rate Cut, New Measures Brewing: Morning Reportnaudaslietas_lvAún no hay calificaciones

- Spain Puts Pressure On Germany: Morning ReportDocumento3 páginasSpain Puts Pressure On Germany: Morning Reportnaudaslietas_lvAún no hay calificaciones

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsDe EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsAún no hay calificaciones

- From Convergence to Crisis: Labor Markets and the Instability of the EuroDe EverandFrom Convergence to Crisis: Labor Markets and the Instability of the EuroAún no hay calificaciones

- Bridge - The Theory of Total Tricks 02Documento6 páginasBridge - The Theory of Total Tricks 02harpocrates744Aún no hay calificaciones

- Bridge - The Theory of Total Tricks 01Documento3 páginasBridge - The Theory of Total Tricks 01harpocrates744Aún no hay calificaciones

- William Ramesey - Astrologia Munda (Revised English Edition by Birch Field)Documento309 páginasWilliam Ramesey - Astrologia Munda (Revised English Edition by Birch Field)musaourania100% (20)

- Abu Mashar Princeof Astrologers ColorDocumento8 páginasAbu Mashar Princeof Astrologers ColorSaptarishisAstrologyAún no hay calificaciones

- Recursive Diamond Bidding SystemDocumento36 páginasRecursive Diamond Bidding Systemharpocrates744Aún no hay calificaciones

- Thorpe, B - Northern Mythology 3 (1851)Documento379 páginasThorpe, B - Northern Mythology 3 (1851)harpocrates744Aún no hay calificaciones

- Ambra 2004 PDFDocumento90 páginasAmbra 2004 PDFdodge666Aún no hay calificaciones

- Monetary Policy enDocumento161 páginasMonetary Policy endanplaiAún no hay calificaciones

- Thorpe, B - Northern Mythology 2 (1851)Documento321 páginasThorpe, B - Northern Mythology 2 (1851)harpocrates744Aún no hay calificaciones

- Thorpe, B - Northern Mythology 1 (1851)Documento341 páginasThorpe, B - Northern Mythology 1 (1851)harpocrates744Aún no hay calificaciones

- Div 2753 - 08 AFG's Response To CESR's Consultation On OTC Derivatives StandardisationDocumento8 páginasDiv 2753 - 08 AFG's Response To CESR's Consultation On OTC Derivatives Standardisationharpocrates744Aún no hay calificaciones

- Sacrobosco, J de - The SphereDocumento19 páginasSacrobosco, J de - The Sphereharpocrates744Aún no hay calificaciones

- La Kabylie Et Les Coutumes Kabyles 1/3, Par Hanoteau Et Letourneux, 1893Documento607 páginasLa Kabylie Et Les Coutumes Kabyles 1/3, Par Hanoteau Et Letourneux, 1893Tamkaṛḍit - la Bibliothèque amazighe (berbère) internationale100% (3)

- Ten Principle of EconomicsDocumento30 páginasTen Principle of EconomicsWahab khan100% (6)

- Electricity Company of Ghana LimitedDocumento55 páginasElectricity Company of Ghana LimitedFuaad DodooAún no hay calificaciones

- Understanding Economic Environments Facing BusinessDocumento28 páginasUnderstanding Economic Environments Facing BusinessSamarth Dargan100% (1)

- Midterm Macro 2Documento22 páginasMidterm Macro 2chang vicAún no hay calificaciones

- Case Studies Risk ManagementDocumento5 páginasCase Studies Risk ManagementГруппа МЭ3-8Aún no hay calificaciones

- Renewed Hope 2023 Brochure All Pages 1Documento80 páginasRenewed Hope 2023 Brochure All Pages 1Johnson ShodipoAún no hay calificaciones

- Real Estate Investment and FinanceDocumento7 páginasReal Estate Investment and Financepatrick wafulaAún no hay calificaciones

- A Project On M.P of RbiDocumento37 páginasA Project On M.P of RbiUmesh Soni100% (1)

- HR3 TitleI&II MemoDocumento16 páginasHR3 TitleI&II MemoPeter SullivanAún no hay calificaciones

- National Income Notes IcaiDocumento50 páginasNational Income Notes Icaig_81195199Aún no hay calificaciones

- Economic Environment Course Outline 2021-22 - PGP - 25Documento4 páginasEconomic Environment Course Outline 2021-22 - PGP - 25Swati PorwalAún no hay calificaciones

- African Economic Outlook Aeo 2023Documento238 páginasAfrican Economic Outlook Aeo 2023Lmv 2022Aún no hay calificaciones

- The Wall Street Journal 1 August 2022Documento35 páginasThe Wall Street Journal 1 August 2022Karim IjiouiAún no hay calificaciones

- MACRO Assignment 2Documento5 páginasMACRO Assignment 2marta lis tuaAún no hay calificaciones

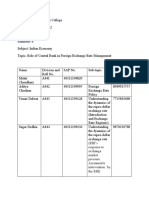

- International Financial Management 9th Edition Jeff Madura Test BankDocumento15 páginasInternational Financial Management 9th Edition Jeff Madura Test Bankclitusarielbeehax100% (29)

- Measuring and Managing Cost EscalationDocumento7 páginasMeasuring and Managing Cost EscalationLeo CalejaAún no hay calificaciones

- Economics 2 PDFDocumento32 páginasEconomics 2 PDFutkarshAún no hay calificaciones

- Chapter One For Ijeoma IG CLASS-1Documento77 páginasChapter One For Ijeoma IG CLASS-1Onyebuchi ChiawaAún no hay calificaciones

- CAPE Economics 2017 U2 P2 PDFDocumento13 páginasCAPE Economics 2017 U2 P2 PDFIsmadth2918388Aún no hay calificaciones

- Test Bank For International Financial Management 13th EditionDocumento36 páginasTest Bank For International Financial Management 13th Editionancientypyemia1pxotk100% (47)

- AQA MCQ Macroeconomics Book 2Documento36 páginasAQA MCQ Macroeconomics Book 2kumarraghav581Aún no hay calificaciones

- Final Assignment: Course: International Finance (INE 3001 E)Documento15 páginasFinal Assignment: Course: International Finance (INE 3001 E)Yến Bạc HàAún no hay calificaciones

- Profit Management ConceptsDocumento21 páginasProfit Management ConceptsParkhi AgarwalAún no hay calificaciones

- GS Inflation Implementation 10-20Documento20 páginasGS Inflation Implementation 10-20bobmezzAún no hay calificaciones

- Company Analysis On Pacific Jeans LTDDocumento84 páginasCompany Analysis On Pacific Jeans LTDKeya BiswasAún no hay calificaciones

- A Project Work Report Proposal: A Study Analysis On The Interested of Nepal Bank LimitedDocumento7 páginasA Project Work Report Proposal: A Study Analysis On The Interested of Nepal Bank LimitedKanaj NamAún no hay calificaciones

- Monetary Authority of Singapore: ANNUAL REPORT 2012/2013Documento132 páginasMonetary Authority of Singapore: ANNUAL REPORT 2012/2013ZerohedgeAún no hay calificaciones

- Debt Serving EssayDocumento11 páginasDebt Serving Essaymuna moonoAún no hay calificaciones

- Tybcom - A - Group No. - 5Documento10 páginasTybcom - A - Group No. - 5Mnimi SalesAún no hay calificaciones