Documentos de Académico

Documentos de Profesional

Documentos de Cultura

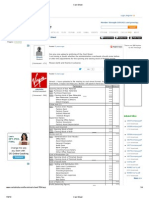

Balance Sheet (Amount in RS.) : Current Assets

Cargado por

Naval VaswaniTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Balance Sheet (Amount in RS.) : Current Assets

Cargado por

Naval VaswaniCopyright:

Formatos disponibles

Current Assets Year 0 Year 1 Year 2 Year 3

A Cash

B Accounts Receivables

C Inventories

D Pre Paid Expenditures

E Total Current Assets 0 0 0 0

Fixed Assets Year 0 Year 1 Year 2 Year 3

F Land

G

Building/

Infrastructure

H Machinery & Equipment

I Furniture & Fixtures

J Office Vehicles

K Office Equipment

L Total Fixed Assets 0 0 0 0

Total Assets 0 0 0 0

Current Liabilities Year 0 Year 1 Year 2 Year 3

M Accounts Payable

N Short Term Debt

O Other Liabilities

P Total Current Liabilities 0 0 0 0

Long Term Liabilities Year 0 Year 1 Year 2 Year 3

Q Long Term Loan

R

Total Long Term

Liabilities

0 0 0 0

Equity Year 0 Year 1 Year 2 Year 3

(A+B+C+D)

Assets having a life of more than one year and

acquired for permanent use in the business.

(F+G+H+I+J +K)

Cost of office equipment (printers, computers, fax,

telephone etc) minus accumulated depreciation.

(E+L)

Liabilities which are payable with in a period of one

year.

The amount payable to the creditors of the business

for example the suppliers of raw material.

Outstanding amount of the amount representing short

term debt acquired for working capital.

Other trade liabilities, if any.

Liabilities which are payable after a period of one year

or more.

Outstanding balance of the amount acquired from the

bank as a long term loan, lease facilities, etc.

Liabilities

(M+N+O)

(Q)

The investment of the owners / partners /

shareholders.

Assets of the business having a life of less than a

year.

Cash available with the business, at office or in the

bank account.

Cost of furniture and fixture (electricity fittings etc)

minus accumulated depreciation.

Cost of office vehicles (if any) minus accumulated

depreciation.

Assets

Balance Sheet (Amount in Rs.)

Amount to be received on account of credit sales.

Stock of raw material, work in process, finished

goods, store and spares.

Expenses paid in advance, egg, advance building

rent, insurance premium, lease payment etc.

Cost of the land used for office or factory (no

depreciation).

Cost of the building and infrastructure used for office

or factory minus accumulated depreciation.

Cost of machinery and equipment minus

accumulated depreciation.

S Capital

T Retained earnings

U Total Equity 0 0 0 0

Total Liabilities and

Equity

0 0 0 0

0 0 0 0

(S+T)

Total of Assets and Liabilities should be equal.

Contribution of owners towards the business

commonly referred as owners' equity.

Amount retained from the annual revenue.

(P+R+U)

Year 4 Year 5

0 0

Year 4 Year 5

0 0

0 0

Year 4 Year 5

0 0

Year 4 Year 5

0 0

Year 4 Year 5

Liabilities

Assets

Balance Sheet (Amount in Rs.)

0 0

0 0

0 0

También podría gustarte

- Balance Sheet TemplateDocumento4 páginasBalance Sheet TemplateSardar A A KhanAún no hay calificaciones

- PDF ContractDocumento5 páginasPDF ContractSea GardenAún no hay calificaciones

- The Financial Accounting Cycle PDFDocumento219 páginasThe Financial Accounting Cycle PDFQuadjo Opoku Sarkodie100% (1)

- WAG BID Proposal 2009Documento12 páginasWAG BID Proposal 2009Tri H HarinantoAún no hay calificaciones

- 101 Mill Road Venue Business PlanDocumento7 páginas101 Mill Road Venue Business PlanAbhi TagoresAún no hay calificaciones

- Business Intelligence ROI Calculator - PreviewDocumento76 páginasBusiness Intelligence ROI Calculator - PreviewNaval Vaswani100% (1)

- Detailed Budget FormatDocumento7 páginasDetailed Budget Formatgowdamandavi100% (1)

- Purchase To Pay Cycle DocumentationDocumento2 páginasPurchase To Pay Cycle DocumentationNyeko FrancisAún no hay calificaciones

- The Shift EbookDocumento17 páginasThe Shift EbookoZENAún no hay calificaciones

- The Balance Sheet and Income Statement ExplainedDocumento2 páginasThe Balance Sheet and Income Statement ExplainedKamaljit Singh100% (1)

- Journal EntriesDocumento55 páginasJournal Entriesmunna00016100% (1)

- Agreement: Carmen'S Kitchen'S Services Provided Are Detailed As FollowsDocumento2 páginasAgreement: Carmen'S Kitchen'S Services Provided Are Detailed As FollowsJhei VictorianoAún no hay calificaciones

- Description of Financial Report in HotelDocumento7 páginasDescription of Financial Report in HotelDesy PirdayantiAún no hay calificaciones

- Guidelines f0r Financial Reporting and Auditing of ProjectsDocumento24 páginasGuidelines f0r Financial Reporting and Auditing of ProjectsYadushreshtha Singh SirmathuraAún no hay calificaciones

- Toast Profit Loss Statement Template 2022Documento24 páginasToast Profit Loss Statement Template 2022Krishna SharmaAún no hay calificaciones

- Costing and Budgeting by YousufDocumento23 páginasCosting and Budgeting by YousufYousuf HasanAún no hay calificaciones

- IC Internal Audit Checklist 8624Documento3 páginasIC Internal Audit Checklist 8624Tarun KumarAún no hay calificaciones

- Bakery Business Plan Executive SummaryDocumento11 páginasBakery Business Plan Executive SummaryTendai KaleaAún no hay calificaciones

- Memo TemplatesDocumento15 páginasMemo TemplatesMahaz SadiqAún no hay calificaciones

- Expense Report: From: To: Purpose: Statement #: Name: Employee ID: Department: ManagerDocumento4 páginasExpense Report: From: To: Purpose: Statement #: Name: Employee ID: Department: Managerprajapatiprashant40Aún no hay calificaciones

- Fort Bonifacio Development Corp. v. CIRDocumento3 páginasFort Bonifacio Development Corp. v. CIREduard Doron FloresAún no hay calificaciones

- Descriptive Chart of Accounts Model TemplateDocumento17 páginasDescriptive Chart of Accounts Model Templateयशोधन कुलकर्णीAún no hay calificaciones

- F.accounting, C.accounting and Auditing McqsDocumento72 páginasF.accounting, C.accounting and Auditing McqssadamAún no hay calificaciones

- Managerial Accounting Excel Project 2Documento8 páginasManagerial Accounting Excel Project 2John GuerreroAún no hay calificaciones

- Food and BeverageDocumento62 páginasFood and BeverageTom TommyAún no hay calificaciones

- UC Davis Verb ListDocumento10 páginasUC Davis Verb ListMrDubsterAún no hay calificaciones

- Papa Geo's Restaurant: Budget Proposal For (2018-2022)Documento25 páginasPapa Geo's Restaurant: Budget Proposal For (2018-2022)Paramjit Singh100% (2)

- Generation IY Final SmallDocumento25 páginasGeneration IY Final SmallNaval VaswaniAún no hay calificaciones

- PortfolioDocumento49 páginasPortfolioapi-373140726Aún no hay calificaciones

- FINANCE MANAGEMENT FIN420chp 1Documento10 páginasFINANCE MANAGEMENT FIN420chp 1Yanty IbrahimAún no hay calificaciones

- Vendor Registration Form PDFDocumento2 páginasVendor Registration Form PDFHINAAún no hay calificaciones

- Culinary Math FormulasDocumento1 páginaCulinary Math FormulasAn Ling100% (1)

- Managing Cost ControlDocumento44 páginasManaging Cost Controlنايف العتيبي100% (1)

- FinalDocumento27 páginasFinalNiomi GolraiAún no hay calificaciones

- AA Exam Tech Day 1Documento46 páginasAA Exam Tech Day 1shahabAún no hay calificaciones

- Silicon Philippines V CirDocumento2 páginasSilicon Philippines V CirKia BiAún no hay calificaciones

- Event Management India PDFDocumento2 páginasEvent Management India PDFShawnAún no hay calificaciones

- Event Budgeting TemplateDocumento2 páginasEvent Budgeting TemplatetiffanynblAún no hay calificaciones

- Ch. 6 Food Production Control I PortionsDocumento27 páginasCh. 6 Food Production Control I PortionsAnn Jaleen CatuAún no hay calificaciones

- ACT112.QS2 With AnswersDocumento6 páginasACT112.QS2 With AnswersGinie Lyn Rosal88% (8)

- Fundamentals of Marketing Management: by Prabhat Ranjan Choudhury, Sr. Lecturer, B.J.B (A) College, BhubaneswarDocumento53 páginasFundamentals of Marketing Management: by Prabhat Ranjan Choudhury, Sr. Lecturer, B.J.B (A) College, Bhubaneswarprabhatrc4235Aún no hay calificaciones

- AssignmentDocumento30 páginasAssignmentPrincy JohnAún no hay calificaciones

- Problem Set #3 MCQsDocumento5 páginasProblem Set #3 MCQsAj Guanzon100% (1)

- Understanding a Model Balance SheetDocumento2 páginasUnderstanding a Model Balance SheetHina JeeAún no hay calificaciones

- Bakery Business PlanDocumento27 páginasBakery Business PlanNafeh SaemdahrAún no hay calificaciones

- ECON 102 Excise Tax and Marginal AnalysisDocumento16 páginasECON 102 Excise Tax and Marginal AnalysisNikole Ornstein0% (1)

- IFMIS Re-Engineering Component DetailsDocumento2 páginasIFMIS Re-Engineering Component DetailsMinistry of Finance50% (2)

- Outline of Business PlanDocumento3 páginasOutline of Business PlanCoCo MaLuAún no hay calificaciones

- Cost Sheet FormatDocumento2 páginasCost Sheet FormatAMIN BUHARI ABDUL KHADERAún no hay calificaciones

- Restaurant Financial ProjectionsDocumento37 páginasRestaurant Financial ProjectionsPaul NdegAún no hay calificaciones

- Costing of 100 Plates of LunchDocumento22 páginasCosting of 100 Plates of LunchTarun SharmaAún no hay calificaciones

- Case Analysis (Cisco)Documento9 páginasCase Analysis (Cisco)Faisal SunnyAún no hay calificaciones

- Process Costing in SequentialDocumento8 páginasProcess Costing in SequentialSarfaraz HeranjaAún no hay calificaciones

- Theme Meal Final-1Documento25 páginasTheme Meal Final-1api-346187971Aún no hay calificaciones

- Administrative ExpensesDocumento2 páginasAdministrative ExpensessweetpotatoAún no hay calificaciones

- FINANCE MANAGEMENT FIN420 CHP 2Documento12 páginasFINANCE MANAGEMENT FIN420 CHP 2Yanty IbrahimAún no hay calificaciones

- Financial Ratios (Vertical and Horizontal Analysis)Documento16 páginasFinancial Ratios (Vertical and Horizontal Analysis)bkkcheesepieAún no hay calificaciones

- Understanding Financial Statements and Financial RatiosDocumento5 páginasUnderstanding Financial Statements and Financial RatiosJana Rose PaladaAún no hay calificaciones

- Scaffolding MethodDocumento1 páginaScaffolding MethodMaryAún no hay calificaciones

- Operations Management 1Documento16 páginasOperations Management 1Godfrey MkandalaAún no hay calificaciones

- BUMKT509: Company Name: Cocomai Student Name: Student IdDocumento15 páginasBUMKT509: Company Name: Cocomai Student Name: Student IdMisha AliAún no hay calificaciones

- Manage Operation PlanDocumento24 páginasManage Operation Plandamanrana100% (2)

- Selling Yourself - A Guide To Writing Effective ResumesDocumento3 páginasSelling Yourself - A Guide To Writing Effective ResumesJonah butlerAún no hay calificaciones

- Chapter 12 Project Procurement ManagementDocumento40 páginasChapter 12 Project Procurement ManagementnkjerseyAún no hay calificaciones

- Sample Meeting Agenda and MinutesDocumento2 páginasSample Meeting Agenda and MinutesMonir KhanAún no hay calificaciones

- SPC Budget Breakdown and Allocation: Program Committee Item Price Unit Supplier No. of Pax/QuantityDocumento9 páginasSPC Budget Breakdown and Allocation: Program Committee Item Price Unit Supplier No. of Pax/Quantitymarianne glaze motoAún no hay calificaciones

- Financial Health Analysis of Cookie & Coffee Creations IncDocumento11 páginasFinancial Health Analysis of Cookie & Coffee Creations Incgsilguero13Aún no hay calificaciones

- ACC100 Chapter 10Documento61 páginasACC100 Chapter 10ConnieAún no hay calificaciones

- Morning Coffee RFPDocumento11 páginasMorning Coffee RFPScott YorkeAún no hay calificaciones

- Operations Plan: Stephen Lawrence and Frank MoyesDocumento17 páginasOperations Plan: Stephen Lawrence and Frank Moyesvkavtuashvili100% (2)

- Newsletter Highlights Shenanigans in Club Bar Over the DecadesDocumento8 páginasNewsletter Highlights Shenanigans in Club Bar Over the DecadesNaval VaswaniAún no hay calificaciones

- List of Heritage BuildingsDocumento11 páginasList of Heritage BuildingsNaval Vaswani50% (2)

- Labour & Human Resources Department Annual Development Programme 2016-17Documento2 páginasLabour & Human Resources Department Annual Development Programme 2016-17Naval VaswaniAún no hay calificaciones

- NiceClassification PDFDocumento196 páginasNiceClassification PDFNaval VaswaniAún no hay calificaciones

- RoiDocumento2 páginasRoiNaval VaswaniAún no hay calificaciones

- Strategicmanagement Selectedquestionsandanswers 130917042931 Phpapp02Documento30 páginasStrategicmanagement Selectedquestionsandanswers 130917042931 Phpapp02Raghav RamabadranAún no hay calificaciones

- SamsungDocumento10 páginasSamsungGrosaru FlorinAún no hay calificaciones

- 1st Quarter 2016Documento20 páginas1st Quarter 2016Naval VaswaniAún no hay calificaciones

- Procedure For Registration PDFDocumento5 páginasProcedure For Registration PDFNaval VaswaniAún no hay calificaciones

- SamsungDocumento10 páginasSamsungGrosaru FlorinAún no hay calificaciones

- Biz Insight 2Documento44 páginasBiz Insight 2Naval VaswaniAún no hay calificaciones

- NIFT Digital Certificates GuideDocumento6 páginasNIFT Digital Certificates GuideNaval VaswaniAún no hay calificaciones

- The Innovator's Secret WeaponDocumento9 páginasThe Innovator's Secret WeaponNaval VaswaniAún no hay calificaciones

- Celeberating Service ExcellenceDocumento5 páginasCeleberating Service ExcellenceNaval VaswaniAún no hay calificaciones

- Adv MKT MGT ISLDocumento1 páginaAdv MKT MGT ISLNaval VaswaniAún no hay calificaciones

- Understanding CulturesDocumento25 páginasUnderstanding CulturesNaval VaswaniAún no hay calificaciones

- Table ReservationDocumento1 páginaTable ReservationNaval VaswaniAún no hay calificaciones

- Guide For Winding Up A Business in PakistanDocumento10 páginasGuide For Winding Up A Business in PakistanAhsen Hameed KianiAún no hay calificaciones

- Why We Don't Really Know What "Statistical Significance" Means: A Major Educational FailureDocumento24 páginasWhy We Don't Really Know What "Statistical Significance" Means: A Major Educational FailureNaval VaswaniAún no hay calificaciones

- Building The Business Case For Omnichannel CX TipsheetDocumento3 páginasBuilding The Business Case For Omnichannel CX TipsheetNaval VaswaniAún no hay calificaciones

- Syllabus PDFDocumento150 páginasSyllabus PDFAsma SethiAún no hay calificaciones

- Marketing Research Guide for Transportation ProjectsDocumento61 páginasMarketing Research Guide for Transportation ProjectsNaval VaswaniAún no hay calificaciones

- l19 HandoutDocumento5 páginasl19 HandoutNaval VaswaniAún no hay calificaciones

- Brand Equity Measurement SystemDocumento6 páginasBrand Equity Measurement SystemNaval VaswaniAún no hay calificaciones

- CA IPCC Accounts Mock Test Series 1 - Sept 2015Documento8 páginasCA IPCC Accounts Mock Test Series 1 - Sept 2015Ramesh Gupta100% (1)

- MY Bank LTDDocumento83 páginasMY Bank LTDAiza RizviAún no hay calificaciones

- Maruti Suzuki India: Volume Decline in Offing, Expensive ValuationsDocumento13 páginasMaruti Suzuki India: Volume Decline in Offing, Expensive ValuationsPulkit TalujaAún no hay calificaciones

- VAT Exemption Guide for Foreign MissionsDocumento10 páginasVAT Exemption Guide for Foreign MissionsXhris ChingAún no hay calificaciones

- Financial Management 2a Workbook 2017 (Pdfdrive)Documento175 páginasFinancial Management 2a Workbook 2017 (Pdfdrive)nkese.asandaAún no hay calificaciones

- EbitdaDocumento4 páginasEbitdaVenugopal Balakrishnan NairAún no hay calificaciones

- Limited Risk Models - Sept 4 2013Documento40 páginasLimited Risk Models - Sept 4 2013sriramrangaAún no hay calificaciones

- Queensland Government GazetteDocumento53 páginasQueensland Government GazettemarklaforestAún no hay calificaciones

- Tutorial (Merchandising With Answers)Documento16 páginasTutorial (Merchandising With Answers)Luize Nathaniele Santos0% (1)

- Netflix Case-1Documento6 páginasNetflix Case-1Eliza Sankar-GortonAún no hay calificaciones

- Concepcion LGU Heavily Indebted Under Raul Banias - VillanuevaDocumento2 páginasConcepcion LGU Heavily Indebted Under Raul Banias - VillanuevaManuel MejoradaAún no hay calificaciones

- Cost SheetDocumento4 páginasCost SheetAuthentic StagAún no hay calificaciones

- Financial Accounting MCQ 4Documento25 páginasFinancial Accounting MCQ 4Akash GangulyAún no hay calificaciones

- Merger Vodafone & Hutch - AnitaDocumento23 páginasMerger Vodafone & Hutch - Anitaravi100% (1)

- The Auditor's Going Concern Opinion As A Communication RiskDocumento27 páginasThe Auditor's Going Concern Opinion As A Communication RiskNana MooAún no hay calificaciones

- Consolidation (Study Hub)Documento4 páginasConsolidation (Study Hub)HammadAún no hay calificaciones

- Enhanced cash flow analysis of replacement printing pressesDocumento37 páginasEnhanced cash flow analysis of replacement printing pressesRiangelli Exconde100% (1)

- Consolidations—Changes in Ownership InterestsDocumento2 páginasConsolidations—Changes in Ownership InterestsAurell MonicaAún no hay calificaciones

- 4 stages of a bull market & how to profit from each stageDocumento5 páginas4 stages of a bull market & how to profit from each stageDineshAún no hay calificaciones

- Class - Xii - Macroeconomics - Worksheet No-01 - Value Added by A Firm - 2018-19Documento3 páginasClass - Xii - Macroeconomics - Worksheet No-01 - Value Added by A Firm - 2018-19Amit50% (2)

- Battle of The Exes: Understanding The Effect of The Ex Ante and Ex Post Approaches On Damage CalculationsDocumento3 páginasBattle of The Exes: Understanding The Effect of The Ex Ante and Ex Post Approaches On Damage CalculationsVeris Consulting, Inc.Aún no hay calificaciones

- Financial Derivatives ExplainedDocumento24 páginasFinancial Derivatives ExplainedDennis JeonAún no hay calificaciones