Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Genius Case Study

Cargado por

chengad0 calificaciones0% encontró este documento útil (0 votos)

80 vistas10 páginasThis document summarizes the context and challenge for GE in expanding access to quality maternal and infant healthcare in rural India. Specifically, it outlines that GE aims to grow its footprint in tier 3-5 towns by developing low-cost medical equipment suited for small, private clinics in these areas. However, while the demand exists, GE's products have not seen widespread adoption in these rural clinics due to challenges with equipment use, training, maintenance and service delivery in remote locations. The case challenges GE to address these issues to successfully market its solutions and meet the major need for improved rural maternal and infant care.

Descripción original:

cs

Derechos de autor

© © All Rights Reserved

Formatos disponibles

PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoThis document summarizes the context and challenge for GE in expanding access to quality maternal and infant healthcare in rural India. Specifically, it outlines that GE aims to grow its footprint in tier 3-5 towns by developing low-cost medical equipment suited for small, private clinics in these areas. However, while the demand exists, GE's products have not seen widespread adoption in these rural clinics due to challenges with equipment use, training, maintenance and service delivery in remote locations. The case challenges GE to address these issues to successfully market its solutions and meet the major need for improved rural maternal and infant care.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

80 vistas10 páginasGenius Case Study

Cargado por

chengadThis document summarizes the context and challenge for GE in expanding access to quality maternal and infant healthcare in rural India. Specifically, it outlines that GE aims to grow its footprint in tier 3-5 towns by developing low-cost medical equipment suited for small, private clinics in these areas. However, while the demand exists, GE's products have not seen widespread adoption in these rural clinics due to challenges with equipment use, training, maintenance and service delivery in remote locations. The case challenges GE to address these issues to successfully market its solutions and meet the major need for improved rural maternal and infant care.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

Está en la página 1de 10

Welcome to the GE India Case Study Challenge!

From inspiration to imagination at work, GE has been at the forefront of innovation.

With newer opportunities and ever-increasing challenges, GE works on things that matter!

Heres your opportunity to try and solve one of Indias toughest healthcare challenges and

showcase your genius!

PREFACE

Ravi and his wife Sapna reside in a village in one of the districts of Karnataka, India. The couple is

expecting their first child and wants to ensure a safe maternity. They are also wary about any

complications that might arise during the delivery. The clinic nearby caters to the basic healthcare

needs of the town. But complicated cases are referred to the hospital in Mangalore which is 160 kms

away. This has been a concern for the local population. The cost of treatment in the city hospitals is

another challenge as patients and their families have to arrange for finances and be prepared for the

hospitalization costs.

Dr. Waghe from the Government Hospital at Mangalore shares similar concerns. Expecting mothers

who arrive at our hospital at late stage of their pregnancy are sometimes diagnosed with

complications which are difficult to address. There are certain cases where infants are referred to us

by doctors of near-by villages due to lack of adequate healthcare facilities and infrastructure in their

villages. But at times they arrive too late for us to help them out in anyway.

A skewed distribution of medical facilities between urban and rural India has resulted in limited

access to quality and specialized medical care services to the rural population. Research has pointed

out that only three out of ten people ultimately get treated in tier 3 and other small towns. This

reflects a huge potential for infrastructural investment in these markets and a gap for healthcare

delivery that needs to be plugged.

For GE Healthcare, the backbone of the In Country for Country model (products for local customers

and local environments) rests on tier 3, 4 and 5 towns - these are markets with huge potential for

hospitals/healthcare services and where GE would like to grow its footprint, with a special focus on

the Maternal and Infant Care segment.

THE HEALTHCARE INDUSTRY IN INDIA

A report on Indian healthcare forecasts the USD 52.7 billion sector to grow at 13 per cent per annum.

It is expected that the healthcare will double to USD 106.3 billion in the next five to seven years. The

healthcare industry is poised for growth with these drivers:

Changing landscape (faster up gradation in technology, new product innovation, burgeoning

middle class, political agenda, government expenditure as a per cent of GDP),

Improvement in healthcare delivery and financing (large private sector players, rise in

insurance, large players targeting small towns), and

Changing patient profile (increased incidence of lifestyle diseases, rise in disposable income,

growing patient awareness, access and preferences, increased life expectancy)

Industry bodies have been lobbying for the healthcare sector to be given infrastructure status and

associated tax benefits that will trigger investments in hospitals. If this demand is accepted, it would

give an additional fillip to the healthcare industry in India

However, there are some alarming statistics to be shared here. With 20 per cent of the world's

disease burden, we have only 6 per cent of the world's hospital beds. Hospital beds per 1000

population in India is less than 50 per cent of that in other emerging markets like Brazil and China

and less than 35 per cent of the world average. Even the infrastructure that exists is highly

fragmented and disproportionately distributed. It is dominated by public healthcare facilities which

have 62 per cent of the beds while private players account for the remaining 38 per cent. The

healthcare insurance industry has witnessed growth in the recent years. However, not to the level

expected, considering 64 per cent of the healthcare expenditure in India is out-of the patients

pocket.

Despite these barriers and challenges, improved quality of care which is both accessible and

affordable is a felt need across tiers of healthcare facilities.

MATERNAL AND INFANT CARE MARKET IN INDIA

With approximately 30 million births India creates a mini Australia every year. 74 per cent of these

births occur in non-metro locations out of which only 49 per cent are in equipped healthcare centres.

The magnitude of the problem can be gauged by the fact that Maternal Mortality Rate and Infant

Mortality Rate in India is 230 and 55 respectively, as compared to 11 and 5 for developed countries.

A majority of deliveries occur in small nursing homes and primary health centres. These centres are

equipped to handle a normal delivery. However, in case of complications or post-birth care scenarios,

most of the cases are referred to secondary health centres in bigger towns, district hospitals, or city

nursing homes. The time lost in moving from a primary to secondary health centre is a major reason

for fatalities that occur in infants/mothers.

GEs PRESENT BUSINESS MODEL & FUTURE PLAN

As a pioneer in the healthcare industry, GE Healthcare manufactures large medical equipment e.g.

CT, MRI, X-Ray etc. which are used in hospitals located in metros, tier 1 & 2 cities. These are high-price

sophisticated healthcare equipment with high margin and low volume. The customers who purchase

the equipment are trained and skilled in using them. Also, the equipment is serviced either by GE

engineers or by the bio-medical engineers recruited by these hospitals.

However, given the opportunities in the non-metro markets, GE Healthcare has increasingly ventured

into manufacturing smaller equipment that meets the needs of these markets, for example, the

Lullaby warmer, LED Phototherapy, and ECG.

GE Healthcare has

gradually been adopting

an in country for

country approach to

product development

researching, developing

and manufacturing

technology that is

appropriate for local

customers and local

environments, to bring

down costs and make

diagnostics more

affordable and

accessible. For example,

the growing infant

mortality rate posed a

major problem for India with more than 5 per cent infants dying in the country. GE used to import the

Lullaby Baby Warmer, at a substantial cost of $20,000 which acted as a price barrier. But, now that it

has been especially designed for the Indian market and is being manufactured locally in India, the

cost has come down drastically.

GE envisions that the next wave of growth for the company will come from these markets, looking at

newer and better technologies for screening, earlier diagnosis, treatment assessment and

monitoring, which is both cost effective and accessible. This requires that the equipment be reliable

and robust. The equipment must be low cost as the price affects the margins of the product

considerably. Hence these products need to be sold in high volumes to cater to the affordability

factor of customers and thereby ensure profitability for GE.

Additionally, the customers in the tier 3/4/5 markets are neither trained nor skilled enough to use the

equipment. Furthermore, in case of any service issues with the equipment, both GE personnel and

external engineers are not readily available to service these markets.

The ability to use GE equipment is critical for winning in this market and depends on the following

parameters:

- Ease of use

- Minimal training on equipment (intuitive to use)

- Parts & Service Delivery

- Maintenance (regular maintenance and replacement of parts)

- Logistics to serve the population in tier 3/4/5 towns

GOVERNMENT INITIATIVE

A number of steps are being taken by the Government to ensure that quality care at affordable cost

reaches the masses in the smaller towns of India. One such initiative is the Janani Suraksha Yojna

aimed at reducing maternal and infant mortality rates and increasing institutional deliveries in below

poverty line (BPL) families. The government offers cash-assistance to expecting mothers so that their

deliveries happen in institutions (private/government centres/nursing homes).

Before this scheme 45 per cent births occurred in homes with poor health and hygiene conditions.

With the successful launch of the Scheme, this figure has reduced to 35 per cent resulting in

approximately. 2.6 million additional births through institutional delivery. This has led to an increase

in demand for care where more consumers are reaching out to private setups apart from the govt.

established facilities.

However, the current market is unable to meet the requirements of this surge in demand due to

inadequate infrastructure and lack of trained/skilled manpower.

TARGET GROUP

For the purpose of this case, the focus is on the private small-town mom & pop clinics in tier 3/4/5

towns.

GEs CHALLENGE

Given the current demand of this market and the alignment of GEs low cost product solution to tier 3

and below markets, these products should ideally be a running success in these mom & pop clinics.

GE expects the demand for the products to be in tens of thousands, however till date it has only

served a few thousands, due to constraints in reaching the market.

The challenge for GE is to reach out to these untapped markets and drive usage of their equipment in

mom & pop clinics. With its designed for India products that are affordable and reliable, GE is on the

look-out for solutions that can drive high volumes of these products in these markets. The challenge

exists in shortage of trained manpower that can service or fix the equipment in remote locations.

The ability to implement a business model with the right channel partners for such extensive services

all over the country and proper governance is another challenge. The options for GE are to either go

to this market on its own or come up with a strategy by partnering and sharing channels with other

healthcare/service providers.

In the current scenario, 90 per cent of

GE sales happen through its direct

sales force. The GE sales force structure

for the Maternal & Infant Care segment

is represented alongside.

Product Sales Specialists are domain

experts and handle sales for the

Maternal & Infant Care Segment.

Specialists handle sales for all products

under the Life Care Solutions segment

(Maternal & Infant Care is part of this

segment).

Generalists handle sales for the entire product portfolio of GE Healthcare (including all segments).

The remaining 10 per cent of GE sales is through a dealer or distributor network (approximately 40

dealers or distributors located in big cities). The GE empanelled dealers in turn create sub-dealers to

enable sales. These multiple layers end up adding cost to the structure (typically a double mark-up),

which in turn increases the cost for the customer. In order to be empanelled as a GE dealer

/distributor, a vendor must meet rigorous business/financial criteria. This poses a big challenge for

GE towards creating a large dealer network across Tier 3/4/5 towns.

YOUR CHALLENGE

Design an overarching strategy for GE to succeed in delivering healthcare equipment and support

services in tier 3, 4 and 5 towns. While doing so provide particular emphasis on the aspects detailed

below:

a. Provide solutions for GE to reach the customer in the specified markets along with a map of

the appropriate channel structure. The proposed solution should not have too many layers of

distribution channels to ensure that the cost of the product remains low.

b. Draw a plan of action for GE to fulfil the training and awareness needs of the customer.

Explore avenues that will help the customer self-maintain the product (troubleshoot, part

replacement, clean, upkeep etc.) thereby providing a sustained model of delivery of

healthcare support solutions.

c. GE has a strong compliance policy when it comes to selection of partners or dealers. Draw

best practices from existing B2B/B2C MNCs to develop a strategy for selection of channel

partners in this market without it being a deterrent to the business.

Teams are advised to highlight some of the best practices followed by B2B/B2C MNCs in this market

segment and propose a benchmark for GE.

For the purpose of the case, you could consider the following as a definition of the tiers:

Tier 3 4-8 lac population

Tier 4 1-4 lac population

Tier 5 Less than 1 lac population

Also, a visit to a private clinic or a primary health centre in a sub 1 lac population town is

recommended for understanding the challenges on the ground.

APPENDIX

GE HEALTHCARE IN INDIA

GE recognized India's healthcare challenges of cost, access and quality and was amongst the few

MNCs to set up manufacturing plants in India to produce high end healthcare imaging products, in a

cost-effective manner. GE also set up a Research & Development Centre for designing healthcare

solutions In India, for India and employs over 1500 scientists and engineers specifically to develop

healthcare solutions. GE Healthcare has received multiple awards from the Government of

Karnataka as well as Government of India towards achieving growth and excellence in exporting

medical technologies from India. GE has already developed many products in India, for India, some of

which are exported to other markets for e.g. MAC 400 (a portable ECG device), Lullaby baby warmers,

Phototherapy solutions, Vivid P3 (cardiac imaging ultrasound system) and a number of ultrasound

systems.

GE CURRENT SCENARIO

GE Present GE Future (requirements)

Tier 1, 2 Tier 3, 4, 5

Large equipment

e.g. CT/MR etc.

Smaller equipment that meets needs of these

markets

e.g. LED PT, Lullaby Warmers, ECG etc.

Delicate, High end equipment Robust, reliable, rugged

High price + Sophisticated

Low volume products predominantly

Low price + Price sensitive

Need higher volumes for the same level of

revenue

Trained & skilled manpower and customers Need to train customers to build skillset and

expertise (both technical & clinical)

Service delivered through GE personnel and

staff recruited and trained by GE & customers

Neither GE nor trained staff present currently for

service or maintenance needs; need to address

the gap

HEALTHCARE SCENARIO IN SMALL TOWNS

Untapped Opportunities

A district and sub-district level analysis shows a large gap and lack of good secondary care

facilities in towns across the country

On an average people travel up to 200 kms to avail quality secondary care/ tertiary care

services

The need of the day is to strengthen secondary/higher secondary level healthcare at the

district HQ level where 70 per cent of population resides

A largely unregulated industry and skewed bed additions biased towards the metros have

resulted in 80 per cent healthcare facilities servicing less than 30 per cent of the countrys

population

Private hospitals are mostly single doctor owned nursing homes offering very basic

healthcare services at questionable quality

Challenges

High capital costs: Depending on the region and real estate costs, an average hospital requires a

capital infusion of Rs 40 lakhs to 1 crore per bed. Land and building account for almost 40 per cent of

the total project cost and affects the viability depending on the resulting per bed cost.

Medical equipment: About 40 per cent of the costs in a tertiary setup are taken up by medical

equipment (cutting edge technology at the time of purchase). This becomes obsolete within 5-7 years

of the setup. This is even more challenging as majority of equipment is imported and very few local

reputed manufacturers exist. This will lead to higher treatment costs and low utilization rates

resulting in undesired operating margins.

Please note that the contents of the case have been created jointly by GE India and the Industry

Institute Partnership Cell, NMIMS Mumbai.

GUIDELINES FOR WORKING ON THE SOLUTION

Registered teams are expected to work on the Case Study shared by GE and present the

analysis/recommendation in the form of a power point presentation, not exceeding 11 slides

(including one cover slide)

Each team is allowed to submit only 1 entry at the end of the challenge. In case of multiple

entries from the same team, we will consider only the first (earliest) entry for evaluation

Participating teams are required to send in their entry in the form of a pdf file (ppt converted

to pdf) over email to genius@ge.com

The name of the pdf file and the email subject line must be

Genius2012_InstituteNameCode_TeamName

All entries must be submitted by Sunday, October 21, 2012 11:59 pm

Any team submissions made beyond the stipulated timelines or in any other format will not

be considered for evaluation

Our mailbox may receive high traffic close to the deadline. Hence, we request the teams to

send across their entries well in advance

All teams which have successfully submitted their entries within the stipulated time will

receive an acknowledgement of receipt within 2 working days

EVALUATION PROCESS

Each entry will be carefully evaluated by a panel of senior leaders from GE

The analysis should be presented in a way that it solves all objectives in the best possible way

We encourage teams to visit a nearby village or Tier 3/4/5 town to understand the case in

depth

The panel will shortlist the Top 5 teams for the Grand Finale based on the following criteria:

Strategic Focus

Depth of analysis

Originality, Innovation and Imagination

Ease of Implementation of the solution

Understanding of the challenge in a holistic way

Quality of presentation

The Top 5 teams will be announced on Friday, October 26, 2012

GRAND FINALE

All members from the Top 5 teams will be invited to attend the Grand Finale in person at

Mumbai. Details on the pre-work and other requirements for the Grand Finale will be shared

with the shortlisted teams accordingly

The Grand Finale will be hosted at Mumbai on Thursday, November 8, 2012

The Jury for the Grand Finale will consist of senior leaders from GE and senior faculty

members from reputed B-Schools

All costs pertaining to travel of the shortlisted teams to Mumbai, boarding/lodging, as well as

return to the campus will be borne by GE

The decision of the Judges pertaining to Genius will be final and binding

PRIZES

The Winning Team shall receive a cash prize of INR 1,50,000. The runners-up team shall

receive a cash prize of INR 75,000. All members of the Top 5 teams will be felicitated by

personalized certificates of achievement.

The Winning Team members will be given an opportunity to get mentored by senior leaders

from GE.

The Winning Team members shall be eligible for a Pre-Placement Interview (PPI) for the

Entry-level GE Leadership Programs, basis eligibility criteria and Jury discretion.

All the Bestand may the Better Team Win!!

También podría gustarte

- Market Potential Analysis of Healthcare Information Service in KolkataDocumento58 páginasMarket Potential Analysis of Healthcare Information Service in KolkataDebmalya DeAún no hay calificaciones

- Iim Grp-1 Capstone ProjectDocumento24 páginasIim Grp-1 Capstone ProjectAbhi SAún no hay calificaciones

- Case Analysis: Group No. 1, Section B, PGP-2, IIM IndoreDocumento7 páginasCase Analysis: Group No. 1, Section B, PGP-2, IIM IndorePappu JoshiAún no hay calificaciones

- Healthcare Industry Trends and Porter's Five Forces AnalysisDocumento31 páginasHealthcare Industry Trends and Porter's Five Forces AnalysisRaheem AhmedAún no hay calificaciones

- Emerging Markets Case Studies CollectionDocumento15 páginasEmerging Markets Case Studies CollectionPasan Wijesiri100% (1)

- India HealthcareDocumento16 páginasIndia HealthcareNeeraj SethiAún no hay calificaciones

- Study of Healthcare Facilities and Access To Healthcare in Badshahibagh and Near VillagesDocumento17 páginasStudy of Healthcare Facilities and Access To Healthcare in Badshahibagh and Near VillagesMd Kashif RazaAún no hay calificaciones

- Explanations OF CASEDocumento3 páginasExplanations OF CASEblikerishabhAún no hay calificaciones

- Healthcare Service SectorDocumento73 páginasHealthcare Service SectorMansi MullickAún no hay calificaciones

- FINAL SSM HospitalDocumento31 páginasFINAL SSM HospitalshoebAún no hay calificaciones

- Healthcare: India Sector NotesDocumento29 páginasHealthcare: India Sector NotesGaurav Singh RanaAún no hay calificaciones

- STYLE OF STUDY: Case Based Approach Methodology: Primary Research (Sample Size 50) & Cases (2 Indian & 2 Global) Table of ContentsDocumento13 páginasSTYLE OF STUDY: Case Based Approach Methodology: Primary Research (Sample Size 50) & Cases (2 Indian & 2 Global) Table of ContentsTanvi SandavAún no hay calificaciones

- Industry OrientationDocumento14 páginasIndustry OrientationSiddhartha KapoorAún no hay calificaciones

- Mba HR (Employee Motivation)Documento68 páginasMba HR (Employee Motivation)Om PrakashAún no hay calificaciones

- Introduction To HospitalDocumento10 páginasIntroduction To HospitalAakansha DhadaseAún no hay calificaciones

- Bombay Hospital - Final ReportDocumento41 páginasBombay Hospital - Final ReportHarsh Bhardwaj0% (2)

- Systems: Improving Performance (WHO, 2000), Are Good Health, Responsiveness To TheDocumento30 páginasSystems: Improving Performance (WHO, 2000), Are Good Health, Responsiveness To ThePrashanth KarkeraAún no hay calificaciones

- Healthcare Industry Scope and Opportunities in IndiaDocumento86 páginasHealthcare Industry Scope and Opportunities in IndiaMurali2k1369% (16)

- Group4 NewService Healthcare 1Documento18 páginasGroup4 NewService Healthcare 1Siddhartha LodhaAún no hay calificaciones

- How To Prepare Project Report For New HospitalDocumento66 páginasHow To Prepare Project Report For New HospitalDrAnilkesar Gohil75% (12)

- 9/8/2019 Hospital and Healthcare IndustryDocumento18 páginas9/8/2019 Hospital and Healthcare IndustryLalit KolheAún no hay calificaciones

- Indian Healthcare Sector Report at ConsultingDocumento33 páginasIndian Healthcare Sector Report at Consultingjyotichauhankv1Aún no hay calificaciones

- Case Study SMDocumento7 páginasCase Study SMPavithra TamilAún no hay calificaciones

- FDI in Health CareDocumento28 páginasFDI in Health CareVivek PimplapureAún no hay calificaciones

- Paper 2 - Health Insurance in India - Future ChallengesDocumento16 páginasPaper 2 - Health Insurance in India - Future ChallengesAamir AnisAún no hay calificaciones

- Excellence in Diagnostic CareDocumento20 páginasExcellence in Diagnostic CareDominic LiangAún no hay calificaciones

- C C C CCCCCCCDocumento9 páginasC C C CCCCCCCNikhil ChandAún no hay calificaciones

- Healthcare Industry in India PESTEL AnalysisDocumento3 páginasHealthcare Industry in India PESTEL AnalysisAASHNA SOOD 1827228Aún no hay calificaciones

- Healthcare Financing in IndiaDocumento3 páginasHealthcare Financing in IndiaswiftblogsAún no hay calificaciones

- The Modicare Project CL PDPDocumento5 páginasThe Modicare Project CL PDPDanish S MehtaAún no hay calificaciones

- Whats Next For Indian Agri TechDocumento28 páginasWhats Next For Indian Agri TechMuskan KushwahaAún no hay calificaciones

- Group09 Healthcare Final Cut-1Documento32 páginasGroup09 Healthcare Final Cut-1Arrow NagAún no hay calificaciones

- Medicin: Oaching FOR HangeDocumento17 páginasMedicin: Oaching FOR HangeAnup SoansAún no hay calificaciones

- HOSPITAL INDUSTRY: A USD 40 BILLION OPPORTUNITYDocumento30 páginasHOSPITAL INDUSTRY: A USD 40 BILLION OPPORTUNITYArun.RajAún no hay calificaciones

- Internship Project Report On Mobile-Health Applications For The Efficient Delivery of Health Care Facility To People: - A Survey On Woodland RPGDocumento42 páginasInternship Project Report On Mobile-Health Applications For The Efficient Delivery of Health Care Facility To People: - A Survey On Woodland RPGBishal RoyAún no hay calificaciones

- Project Hospital Fin All Business SummaryDocumento32 páginasProject Hospital Fin All Business Summarykanchoo100% (1)

- Beyond Telemedicine Venturra-4Documento17 páginasBeyond Telemedicine Venturra-4LeecomAún no hay calificaciones

- Mac I Pgp2011686 FortisDocumento7 páginasMac I Pgp2011686 FortisSuruchi KashyapAún no hay calificaciones

- Draft 2Documento61 páginasDraft 2jeyologyAún no hay calificaciones

- Project Report On SimpleekareDocumento62 páginasProject Report On SimpleekareBishwaranjan MishraAún no hay calificaciones

- Primer To Valuation - IJK FINANCE - Group No.7Documento9 páginasPrimer To Valuation - IJK FINANCE - Group No.7antonypottoAún no hay calificaciones

- Indian Institute of Management Indore: Annual Report Analysis Fortis Healthcare (India) LTDDocumento22 páginasIndian Institute of Management Indore: Annual Report Analysis Fortis Healthcare (India) LTDSuruchi KashyapAún no hay calificaciones

- HealthCare Service MarketingDocumento46 páginasHealthCare Service MarketingTarang Baheti100% (1)

- Sector Update Indian Health Care Industry March 2015Documento6 páginasSector Update Indian Health Care Industry March 2015Pankaj MittalAún no hay calificaciones

- Thesis On Health InsuranceDocumento8 páginasThesis On Health Insurancekimberlyjonesnaperville100% (2)

- E-Governance Improves Healthcare AccessDocumento20 páginasE-Governance Improves Healthcare Accessnoel_24Aún no hay calificaciones

- PHDSDocumento3 páginasPHDSKathrina Doroneo (rina)Aún no hay calificaciones

- Emergency Care in The Modern Health Care IndustryDocumento7 páginasEmergency Care in The Modern Health Care IndustryAssignmentLab.comAún no hay calificaciones

- Indian Healthcare Business ModelsDocumento27 páginasIndian Healthcare Business ModelsMahesh MahtoliaAún no hay calificaciones

- Health CareDocumento4 páginasHealth Careviswa chowdaryAún no hay calificaciones

- Man Environment Interaction of Naz BasinDocumento28 páginasMan Environment Interaction of Naz BasinTp TpAún no hay calificaciones

- 1st Chapter Review of My ProjectDocumento44 páginas1st Chapter Review of My ProjectMuhammad. HAún no hay calificaciones

- Scope of IT in Indian Healthcare: Click To Edit Master Subtitle StyleDocumento13 páginasScope of IT in Indian Healthcare: Click To Edit Master Subtitle StyleNikhil YadavAún no hay calificaciones

- Part - C Chapter-1-Introduction: A. Overview of The Service Sector and Its Contribution in The EconomyDocumento13 páginasPart - C Chapter-1-Introduction: A. Overview of The Service Sector and Its Contribution in The EconomysheetalrahuldewanAún no hay calificaciones

- Textbook of Urgent Care Management: Chapter 36, Virtual CareDe EverandTextbook of Urgent Care Management: Chapter 36, Virtual CareAún no hay calificaciones

- Healthcare Insights: Better Care, Better BusinessDe EverandHealthcare Insights: Better Care, Better BusinessAún no hay calificaciones

- Leadership Skills for the New Health Economy a 5Q© ApproachDe EverandLeadership Skills for the New Health Economy a 5Q© ApproachAún no hay calificaciones

- Outsourcing Technology In the Healthcare Industry: In Depth Research to Protect the Security, Technology, and Profitability of Your BusinessDe EverandOutsourcing Technology In the Healthcare Industry: In Depth Research to Protect the Security, Technology, and Profitability of Your BusinessAún no hay calificaciones

- The Big Unlock: Harnessing Data and Growing Digital Health Businesses in a Value-Based Care EraDe EverandThe Big Unlock: Harnessing Data and Growing Digital Health Businesses in a Value-Based Care EraAún no hay calificaciones

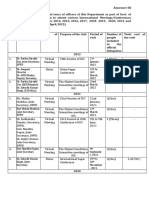

- Annexure IDocumento3 páginasAnnexure IchengadAún no hay calificaciones

- Annex Ure IVDocumento2 páginasAnnex Ure IVchengadAún no hay calificaciones

- MTF Rice 27.08.18 PDFDocumento13 páginasMTF Rice 27.08.18 PDFchengadAún no hay calificaciones

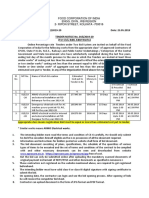

- FCI Tender RepairDocumento3 páginasFCI Tender RepairchengadAún no hay calificaciones

- Food Corporation of India Regional Office JammuDocumento13 páginasFood Corporation of India Regional Office JammuchengadAún no hay calificaciones

- Food Corporation of India Regional Office: JammuDocumento3 páginasFood Corporation of India Regional Office: JammuchengadAún no hay calificaciones

- NIT Rice 27.08.18Documento1 páginaNIT Rice 27.08.18chengadAún no hay calificaciones

- Annexure IIIDocumento13 páginasAnnexure IIIchengadAún no hay calificaciones

- Notice Inviting Financial Bids For Sale of Wheat To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionDocumento1 páginaNotice Inviting Financial Bids For Sale of Wheat To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionchengadAún no hay calificaciones

- Notice Inviting Bids For Sale of Raw Rice Ga To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionDocumento1 páginaNotice Inviting Bids For Sale of Raw Rice Ga To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionchengadAún no hay calificaciones

- NIT dt.23.05.19 PDFDocumento3 páginasNIT dt.23.05.19 PDFchengadAún no hay calificaciones

- Tender NoticeDocumento2 páginasTender NoticechengadAún no hay calificaciones

- NIT 01E 2019-20 (Electrical Work)Documento4 páginasNIT 01E 2019-20 (Electrical Work)chengadAún no hay calificaciones

- FCI tender for AR&MO worksDocumento3 páginasFCI tender for AR&MO workschengadAún no hay calificaciones

- Wheat Depotwise QuantityDocumento1 páginaWheat Depotwise QuantitychengadAún no hay calificaciones

- Wheat MTF - 9Documento13 páginasWheat MTF - 9chengadAún no hay calificaciones

- Food Corporation of India Regional Office: Kesavadasapuram Pattom Palace P.O: Thiruvananthapuram 695 004Documento2 páginasFood Corporation of India Regional Office: Kesavadasapuram Pattom Palace P.O: Thiruvananthapuram 695 004chengadAún no hay calificaciones

- MTF Wheat 03 - 10 - 2019Documento17 páginasMTF Wheat 03 - 10 - 2019chengadAún no hay calificaciones

- Rice Depotwise QuantityDocumento1 páginaRice Depotwise QuantitychengadAún no hay calificaciones

- Food Corporation of India: Ph. No. 0135-2970038, 0135-2665993 e Mail: Gmukfci@gov - inDocumento1 páginaFood Corporation of India: Ph. No. 0135-2970038, 0135-2665993 e Mail: Gmukfci@gov - inchengadAún no hay calificaciones

- MTF Wheat Dt.14.01.16Documento11 páginasMTF Wheat Dt.14.01.16chengadAún no hay calificaciones

- Rice Guidelines 8Documento5 páginasRice Guidelines 8chengadAún no hay calificaciones

- 61 - Ee11 - 2019 MTFDocumento12 páginas61 - Ee11 - 2019 MTFchengadAún no hay calificaciones

- fci Date of NIT Last Date For Depositing EMD Starting Date and Time For Online Bidding End Date and Time For Online BiddingDocumento1 páginafci Date of NIT Last Date For Depositing EMD Starting Date and Time For Online Bidding End Date and Time For Online BiddingchengadAún no hay calificaciones

- MTF Rice - 9Documento12 páginasMTF Rice - 9chengadAún no hay calificaciones

- Tender NIT No - 03 2017-18 Website-BSWCDocumento4 páginasTender NIT No - 03 2017-18 Website-BSWCchengadAún no hay calificaciones

- MTF Wheat 16.08.2019Documento17 páginasMTF Wheat 16.08.2019chengadAún no hay calificaciones

- 61 - Ee11 - 2019 NITDocumento1 página61 - Ee11 - 2019 NITchengadAún no hay calificaciones

- 2.MTF Rice - 6Documento18 páginas2.MTF Rice - 6chengadAún no hay calificaciones

- MTF of Wheat - 5Documento18 páginasMTF of Wheat - 5chengadAún no hay calificaciones

- WHATs New in CPCRDocumento4 páginasWHATs New in CPCRJessicaHernandezAún no hay calificaciones

- PolycythemiaDocumento82 páginasPolycythemiaTiffany Mae Arud100% (3)

- Warehouse EssayDocumento8 páginasWarehouse Essayafibojmbjifexj100% (2)

- GS 101 Advance English SkillsDocumento49 páginasGS 101 Advance English SkillsJomarie Sahhara Grande Turtoga0% (1)

- Pathophysiology of Acute GastroenteritisDocumento5 páginasPathophysiology of Acute Gastroenteritisheron_bayanin_15Aún no hay calificaciones

- 2023 Summit Program Draft 5 Apr18Documento43 páginas2023 Summit Program Draft 5 Apr18Raheem KassamAún no hay calificaciones

- Non-Profit Organization Funds Gregory Grabovoi TeachingsDocumento95 páginasNon-Profit Organization Funds Gregory Grabovoi Teachingsssss87va93% (27)

- Group 2 Research G8Documento24 páginasGroup 2 Research G8aurasaliseAún no hay calificaciones

- MCQs blood & cell physiology blogDocumento8 páginasMCQs blood & cell physiology bloglubna malikAún no hay calificaciones

- NCPDocumento4 páginasNCPAnn AquinoAún no hay calificaciones

- Colposcopic Findings Prepubertal Assessed For Sexual Abuse: Genital GirlsDocumento5 páginasColposcopic Findings Prepubertal Assessed For Sexual Abuse: Genital GirlsSusi PuspitaAún no hay calificaciones

- CU DFScience Notes Bacteria General Dairy Micro 06 10 PDFDocumento10 páginasCU DFScience Notes Bacteria General Dairy Micro 06 10 PDFjoel osortoAún no hay calificaciones

- Phet Natural SelectionDocumento6 páginasPhet Natural Selectionapi-315485944Aún no hay calificaciones

- Kim (2015) - Lemon Detox Diet Reduced Body FatDocumento12 páginasKim (2015) - Lemon Detox Diet Reduced Body FatRodrigo MelloAún no hay calificaciones

- Medicine in Allen: Sensitive TouchDocumento38 páginasMedicine in Allen: Sensitive TouchAyeshik ChakrabortyAún no hay calificaciones

- MeningitisDocumento21 páginasMeningitisSonya GodwinAún no hay calificaciones

- First International congress on clinical Hypnosis & Related Sciences programDocumento91 páginasFirst International congress on clinical Hypnosis & Related Sciences programGolnaz BaghdadiAún no hay calificaciones

- Cinnarizine A Contemporary ReviewDocumento9 páginasCinnarizine A Contemporary ReviewprimaAún no hay calificaciones

- 2018 Overview Digestive System HandoutDocumento11 páginas2018 Overview Digestive System HandoutdraganAún no hay calificaciones

- MCQ in MedicineDocumento18 páginasMCQ in MedicineEslamAlmassri75% (4)

- Case Report NystagmusDocumento6 páginasCase Report Nystagmusghitza80Aún no hay calificaciones

- Congenital SyphilisDocumento28 páginasCongenital SyphilisMeena Koushal100% (4)

- Important Uses of Neem ExtractDocumento3 páginasImportant Uses of Neem ExtractAbdurrahman MustaphaAún no hay calificaciones

- GugulipidDocumento7 páginasGugulipidManish WadhwaniAún no hay calificaciones

- Hypertensive Emergencies in The Emergency DepartmentDocumento13 páginasHypertensive Emergencies in The Emergency DepartmentLuis Lopez RevelesAún no hay calificaciones

- Chapter 2 Herbs That Clear HeatDocumento159 páginasChapter 2 Herbs That Clear HeatCarleta Stan100% (1)

- HRCA GK Quiz Syllabus Class 7-8Documento19 páginasHRCA GK Quiz Syllabus Class 7-8Sualiha MalikAún no hay calificaciones

- Brucellosis: A Review of the Disease and Its TransmissionDocumento94 páginasBrucellosis: A Review of the Disease and Its TransmissionAbdelrahman Mokhtar100% (1)

- Radiology Report-R5016547Documento4 páginasRadiology Report-R5016547Rajeev SAún no hay calificaciones

- Medicinal Properties of GarlicDocumento7 páginasMedicinal Properties of GarlicFawzia Haznah Nurul Imani0% (1)