Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Egian Position Paper Audit Reform

Cargado por

Shafiqur RahmanDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Egian Position Paper Audit Reform

Cargado por

Shafiqur RahmanCopyright:

Formatos disponibles

Page | 1 EGIAN, Avenue dOrbaix 43, 1180 Brussels, Belgium info@egian.

eu

March 2012

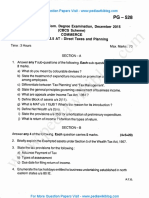

Position Paper

EGIAN supports rebalancing of proposals for much needed

reform of the European audit market

Contents

Background

1 Introduction

2 Legislative intervention essential

3 The problems with the current audit market

4 Key features of a more vibrant market

Quality driven

Independent

Transparent

More diverse due to additional players

Progressive

Proportionate and growth-orientated

A Single market

Sustainable

5 Rebalancing of reforms to facilitate additional firms entering

market

Additional players critically underpin the reform programme

Promoting additional players mandatorily or by encouragement

Focussing on large PIEs

The reforms form an interconnected package

Comments on specific proposals

6 Support for regular and fair tendering

7 Mandatory rotation of firms current period too short

Page | 2 EGIAN, Avenue dOrbaix 43, 1180 Brussels, Belgium info@egian.eu

March 2012

8 Provision of non-audit services support for appropriate

limitations

9 Pure audit firm model misleading label

10 Co-audit essential to bringing additional players into the market

Joint audit key measure to reduce concentration

Shared audit a stepping stone to reducing concentration

11 Conclusion working together to come up with workable reforms

Appendix

EGIANs initial views on selected other proposals in the draft

regulation

a Support for use of International Standards on Auditing (ISAs)

b Concern over internal quality control review

c Contingency planning inadequate response to risk of exit of a

dominant firm

d Support for prohibition of Big 4 only contractual clauses

e Support for modification of ownership rules

f Support for creating a single European market for audit

g Support for corporate governance statement

h Audit committees all members should be independent

i Caution on role of ESME

j Clarification needed on sanctioning powers

Page | 3 EGIAN, Avenue dOrbaix 43, 1180 Brussels, Belgium info@egian.eu

March 2012

EGIAN supports rebalancing of proposals for much needed

reform of the European audit market

Background

1. Introduction

The European Group of International Accounting Networks and Associations

(EGIAN), which represents nearly all of the major international networks and

associations of audit firms apart from the Big 4, welcomes the publication by the

European Commission of the draft regulation on specific requirements regarding

statutory audit of public interest entities and of the draft directive amending

Directive 2006/43/EC on statutory audits of annual accounts and consolidated

accounts.

The publication of the draft regulation and directive enables the proposed

measures to be discussed through a transparent and democratic process.

There is an unprecedented opportunity to create a Single Market in the

European Union (EU) in audit which addresses the needs of the principal users

of audit reports and is focused on promoting audit quality, independence and

transparency. EGIAN has concerns, however, that, as the proposed legislation

currently stands, it will not achieve these goals. This paper proposes a practical

way forward to create an open vibrant audit market for Public Interest Entities

(PIEs) involving additional firms and which has serving the public interest at its

heart.

2. Legislative intervention essential

EGIAN believes that legislative intervention is essential to bring about the

necessary change in the PIE audit market across the EU. Voluntary initiatives

have not secured any significant changes and legislative intervention is therefore

now unavoidable. Without it the current unsatisfactory situation will continue to

deteriorate further until it goes beyond the point of being reversible. The situation

would be severely aggravated were one of the four dominant players to leave

the market, a concern regularly voiced by regulators and regulatory capture

would in all likelihood be guaranteed at this point.

3. The problems with the current audit market

Page | 4 EGIAN, Avenue dOrbaix 43, 1180 Brussels, Belgium info@egian.eu

March 2012

Leading investors, the European Commission and a number of reports in some

Member States have identified serious problems with the operation of the

current audit market for PIEs and especially large PIEs. A stagnant audit market

is preventing audit achieving its full potential. The problems include:

excessively high degrees of concentration amongst the dominant firms in the

PIE audit market in nearly all Member States;

the presence of only four firms with a meaningful market share and, in some

sectors, even fewer;

high barriers to building meaningful market share or entry for new players;

low rates of switching and tendering;

a low level of innovation; and

worries about independence and institutional familiarity and bias.

Taken together, these concerns highlight that the current model is not meeting

the needs of shareholders, other stakeholders or the wider public interest.

In support of the above concerns, the European Commissions Impact

Assessment for the draft regulation and directive, highlights that:

the market share of the Big 4 audit firms for listed companies exceeds 85%

in the vast majority of Member States;

all EUROSTOXX50 were audited by the Big 4 in 2010;

in the UK the Big 4 audit 99% of the FTSE100 and around 95% of the

FTSE350

in Germany two firms in the Big 4 have 90% of the mandates in the DAX30;

and

in Spain all of the IBEX35 are audited by the Big 4 with the lead firm

responsible for 46% of those audits as well as all of those related to the

major banks.

In marked contrast to the above figures, in France, where there is joint audit, the

Big 4s share of the audit market amongst FTSE350 equivalent companies is a

much more reasonable 58%.

4. Key features of a more open vibrant market

To address the problems outlined above, the EU must create a much more open

vibrant market for the audit of listed companies and other PIEs with additional

players willing to challenge the status quo. Such a reformed market should be

based on the following key attributes:

- Quality driven

Page | 5 EGIAN, Avenue dOrbaix 43, 1180 Brussels, Belgium info@egian.eu

March 2012

A healthy market for the audit of listed companies and other PIEs must have

quality at its heart and promote a culture of continual enhancement in quality

with an emphasis on professional values being placed ahead of business

interests. Members of the Forum of Firms, for instance, which includes a number

of members of EGIAN, have committed themselves to adhere to and promote

the consistent application of high-quality audit practices worldwide and national

regulators thoroughly monitor adherence to the necessary standards. In

addition, a strong focus on innovation at firm and profession-wide levels should

form an integral part of a quality driven approach.

- Independent

There are concerns about the independence of auditors, or the perception of

their independence, in circumstances where the fees for non-audit services,

especially on a large PIE audit, are a high fraction of, and sometimes exceed,

those earned from the audit. These concerns stem from the firm reporting to the

company management in respect of non-audit services as opposed to

shareholders, and the audit committee on their behalf, in the case of the audit.

Whilst the IFAC Code of Ethics provides safeguards with regards to auditors

providing non-audit services, we need to address any reasonable concerns that

remain if auditing is to be widely regarded as achieving the necessary high

standards of independence expected of a profession.

- Transparent

There needs to be much greater transparency in a reformed market with

regards, for example, to the reporting of key issues on the audit; details relating

to when the auditor was first appointed; audit tenders; links between the auditor

and audited entity and the provision of information relating to the audit firm.

- More diverse due to additional players

Merely creating a more competitive environment among the current dominant

players will neither lead to the change in culture or practices that is necessary to

bring about enhanced quality and independence that is called for in the audit

market for listed companies nor will it guard against the exit from the market of

one of the current dominant players. Contingency planning to manage the risk of

such an eventuality is not enough. The introduction of additional players is

essential.

Page | 6 EGIAN, Avenue dOrbaix 43, 1180 Brussels, Belgium info@egian.eu

March 2012

- Progressive

The changes introduced must be progressive such that within a reasonably short

timeframe, say 3 to 5 years, the additional players will be able to compete on an

equal footing and collectively gain a significant share of the market.

- Proportionate and growth-orientated

Against a background of more robust regulation of auditors, especially with

regards to large PIEs, care is needed to avoid the imposition of inappropriate

burdens on smaller listed companies as well as on unlisted small and medium-

sized undertakings as they have a vital role to play in securing economic growth

and new jobs across the European Union. Concentration issues are far less of a

problem in these segments of the audit market. And account must be taken of

their particular needs which arise from their having less access to in-house

resources as they have a vital role to play in securing economic growth and new

jobs across the European Union.

- A Single Market

To meet stakeholders needs, the market needs to advance from being a series

of separate national markets to a single European market where firms and

individuals can work across frontiers more effectively. The proposed introduction

of the voluntary European Quality Certificate is therefore welcome as are the

proposals for a European Passport, subject to appropriate safeguards being in

place. .

- Sustainable

The combined effect of the reforms should be to create a market that is more

sustainable and stable than is currently the case.

5. Rebalancing of reforms to facilitate additional firms entering market

Additional players critically underpin the reform programme

Reforms proposed should be tested against the criteria set out in Section 4

above. The current proposals need to be rebalanced, especially with regards to

more clearly facilitating the entry of additional players into the market as this

underpins many of the other reforms. In this section, we identify the package of

key reforms we believe are necessary and in the Appendix we discuss other

important measures.

Page | 7 EGIAN, Avenue dOrbaix 43, 1180 Brussels, Belgium info@egian.eu

March 2012

Promoting additional players mandatorily or by encouragement?

If they are to achieve their objective, the reforms adopted need to offer

reasonable assurance that additional players will have a more significant role in

the PIE audit market in the future. This can be most straightforwardly be

achieved by mandatory measures, or alternatively by encouragement to boards,

to make appointments from among non-dominant players. If the latter approach

is adopted, there will need to be significant encouragement to boards in a

number of areas to promote the necessary change in approach.

Focusing on large PIEs

We believe a number of the proposed measures are best directed primarily

towards large listed companies, where the concerns relating to independence

and concentration in the audit market are greatest, rather than their applying to

all PIEs.

The reforms form an interconnected package

Lastly, the reforms must be considered as a package of interconnected

measures aimed at producing significant change to the structure of the audit

market. Care needs to be taken not to look at individual measures in isolation as

this may lead to their impact not being properly assessed.

Comments on specific proposals

6 Support for regular and fair tendering

We support regular and fair tendering for audits and would suggest that audits

should be subject to tender at periods between 7-9 years recognising that 7

years is the maximum period before rotation of partners under the Eighth

Directive and IFACs Code of Ethics. The tendering process should be fair and

open to a range of firms with the necessary skills in addition to the dominant

players which may go beyond just requiring one non-dominant player to be

included on the tender list. There should also be transparency on when the

auditor was first appointed; when the last competitive audit tender was held; how

the tendering process was conducted, where applicable; and the reasons the

successful firm was chosen. Full information should also be provided of links

between the audited entity and the auditor in order to reduce the current high

levels of familiarity and institutional bias favouring the dominant firms.

Page | 8 EGIAN, Avenue dOrbaix 43, 1180 Brussels, Belgium info@egian.eu

March 2012

7 Mandatory rotation of firms- current period too short

We are not persuaded of the overall benefits of the mandatory rotation of firms

at periods not normally exceeding 6 years. This seems unduly short when

considering the overall cost which will be incurred, and the inevitable learning

curve. We believe a strict rotation of partners combined with fair and regular

tendering would be an appropriate response to concerns about unduly long

periods of tenure. That being said, should the mandatory rotation of firms be

considered necessary , we would suggest a longer period should apply before

rotation, say 14-16 years with rotation not being needed in circumstances where

there was joint audit or, possibly, for smaller PIEs. The period suggested is

based on approximately two terms of 7 years, the period for the rotation of

partners, as discussed above..

8 Provision of non-audit services - support for appropriate limitations

As discussed above, we understand the concerns relating to the provision of

non-audit services by auditors especially to large PIEs. We are concerned,

however, that the 10% cap on fees for audit related services appears unrealistic,

as it for example includes the reviews of interim statements, and is not

necessary as none of the services included in the allowed list to which the cap

applies poses a threat to the auditors independence. The cost of such a review

could exceed 10% of the audit fee, especially for smaller cap companies. In

addition, the auditor is generally best placed to provide them. We also consider

that the list of proposed prohibited services should be reviewed with a view to

reducing it for smaller PIEs given that these entities are not a significant source

of concern to investors with regards to independence issues.

9 Pure audit firm model misleading label

The proposal that firms in large networks which earn more than one third of

their audit income from large PIEs should only provide audit services to their

clients has been misleadingly labelled a pure audit firm model by those

opposed to it. We prefer to call it a balanced audit firm model. It is fully within

the dominant firms control to remain within the proposed limits and so be able

to remain multi-disciplinary if they believe this to be a preferable form of

organisation for the firm. It is very important to bear in mind that this is the only

measure that attempts to address the unacceptably high levels of concentration

in the market.

10 Co-audit- essential to bringing additional players into the market

Page | 9 EGIAN, Avenue dOrbaix 43, 1180 Brussels, Belgium info@egian.eu

March 2012

We need to move away from the concept of a group of companies having just

one auditor and towards that of two, or occasionally more, firms working

together. This will crucially help to preserve the auditors combined knowledge of

the group when one of the auditors changes, a concern frequently cited by the

largest clients of the dominant firms. Co-audit may take the form of joint audit or

shared audit and these are now explained.

J oint audit - key measure to reduce concentration

The joint audit of large public interest entities, where one of the auditors is not a

dominant player, will lead to a reduction in concentration and provide protection

to large listed companies against the risk of a dominant player leaving the

market unexpectedly. The joint auditors are jointly responsible for the opinion on

the PIEs group financial statements as a whole and thus it brings the merits of

the four eyes principle with additional scrutiny of complex issues arising on the

audit. In the current proposed text, there is only very modest encouragement to

adopt joint audit with the proposed basic period before compulsory rotation

being extended from 6 years in the case of sole audits to 9 years for joint audits.

Mandatory joint audit would form a useful part of a package of measures

designed to lead to more diversity in the PIE market and could be achieved in a

practical way.

If joint audit, including use of a non-dominant firm, is just to be encouraged, our

less preferred alternative, the incentives to adopt it should be markedly

increased, eg abolition of the need for mandatory rotation; longer periods before

tendering is required; less restrictions on the provision of non-audit services as

each joint auditor will need to assess the non-audit services provided by the

other with regards to their impact on independence; and the possibility of not

counting joint audit fees for the calculation of the pure audit firm thresholds.

Shared audit - a stepping stone to reducing concentration

Another way to reduce concentration over time would be by increasing the

number of shared audits under which a different auditor than that of the group

consolidated accounts audits a number of subsidiaries. If it is to be a meaningful

sharing of the total audit work in a group, it is important that the second auditor

be involved in the audit of some important group subsidiaries. Whilst not

immediately reducing the level of concentration amongst the dominant players, if

measured by number of listed audit assignments, it would serve to allow more

PIEs to use and trust more auditing firms. Such a relationship may make it

easier for the subsidiary auditor to build its share of the group audit and over

time to become a credible candidate in subsequent audit tenders for the listed

Page | 10 EGIAN, Avenue dOrbaix 43, 1180 Brussels, Belgium

info@egian.eu

March 2012

PIE. This would be in line with our support for progressive reform which builds

on itself over time.

11 Conclusion- working together to come up with workable reforms

The current review of the audit market in the European Union provides a unique

opportunity to tackle problems with its functioning that have built up over many

years and which, if not addressed, will continue to get progressively worse.

Whether one analyses the current situation from an audit regulatory or a

competition perspective, the issues giving rise to concern and the proposed

remedies, such as the need for additional players in the large listed audit

marketplace, are the same.

The current audit market is not currently meeting the needs of shareholders or

the wider public interest, or those of the Single Market. We cannot allow this

situation to continue. At EGIAN, we firmly believe in the concept of different firms

working together and we believe that to move the audit reform agenda forward it

is vital that members of EGIAN, the Big 4 and professional auditing bodies work

together and with board representatives, governmental representatives,

investors, parliamentarians and regulators to develop a programme of workable

reforms that will bring benefits to investors, the capital markets generally and

wider society.

Page | 11 EGIAN, Avenue dOrbaix 43, 1180 Brussels, Belgium

info@egian.eu

March 2012

Appendix

EGIANs initial views on selected other proposals in the draft

regulation

a. Support for use of International Standards on Auditing

We support the proposal that auditing should be undertaken in accordance with

International Standards on Auditing and, in full respect of the Union sovereignty,

would welcome it being clear that this reference is to the IAASBs clarified

International Standards on Auditing which are widely recognised and have been

developed after extensive due process under a respected governance structure

enjoying European Commission support.

b. Concern over internal quality control review

We have serious concerns about the proposal in Article 22.2(m) which calls for

the auditor to report on the internal control system. There is a risk that such a

proposal will lead to significant additional costs for the audited entity without

commensurate benefits for shareholders and others and be a move in the

direction of the Sarbanes-Oxley-driven approach in the US, or indeed beyond it,

which would be most unfortunate.

c. Contingency planning - inadequate response to risk of exit of a

dominant firm

Whilst we support contingency planning for the largest firms we do not believe it

is a sufficient response on its own to address the risk of one of the dominant

players leaving the market unexpectedly. Moreover, the contingency planning

should take account of the need for concentration in the market not to be

increased following such an exit. Creating the conditions for additional players to

win a significant market share collectively is the best way to address the issue of

a dominant player exiting the market.

d. Support for prohibition of Big 4 only contractual clauses

We strongly support the prohibition of Big 4 only contractual clauses in loan and

other agreements, a proposal for which there is widespread support. Non

contractual restrictions must also be disclosed by the company.

Page | 12 EGIAN, Avenue dOrbaix 43, 1180 Brussels, Belgium

info@egian.eu

March 2012

e. Support for modification of ownership rules

We support the relaxation of the current ownership rules so that audit firms

which wish to do so may avail themselves of the change in order ot be able to

raise increased amounts of external funding. We do not, however, think it will

have a substantial impact in practice as most firms seem to prefer the current

partnership model. We would also counsel that statutory limitation of auditors

liabilities would need to be considered alongside the relaxation in order to make

the latter of realistic interest.

f. Support for creating a single European market for audit

It is essential that a single audit market for Europe be created and we therefore

support the proposed introduction on a voluntary basis of the European quality

certificate and of the move to home country supervision coupled with a

European passport to make it more easy for audit firms and auditors in the

European Union to work across Member State frontiers. We do, however,

consider that where the adaptation procedure is adopted that care is needed to

ensure the auditors involved have the necessary understanding of relevant laws

and regulations in their host country and possess the necessary language

capabilities.

g. Support for Corporate Governance Statement

We support the proposals that audit firms with significant revenues from large

PIEs should publish corporate governance statements.

h. Audit Committees - all members should be independent

The Audit Committee has an important role in supporting audit effectiveness. In

this context we support the audit committee being composed of non-executive

members of the governing body of the audited entity but we believe that all

members and not just a majority should be independent. We agree that at least

one member of the Audit Committee should have relevant accounting and/or

auditing expertise. We are not sure, however, that it also needs to be specified

that another member should have auditing expertise.

i. Caution on role of ESMA

We support the proposal that co-operation between competent authorities

should be organised within the framework of ESMA but caution is needed to

Page | 13 EGIAN, Avenue dOrbaix 43, 1180 Brussels, Belgium

info@egian.eu

March 2012

ensure ESMAs role does not become too pervasive. We would not support

ESMA being cast in the role of standard setter.

j. Clarification needed on sanctioning powers

Whilst welcoming the statement in Article 61 that sanctions shall be proportionate

as well as effective and dissuasive and the list of factors to be taken into account

when determining appropriate sanctions, as set out in Article 63, we do have

concerns that some of the potential sanctions set out in Article 62 are potentially

very severe and do not distinguish between different Articles which may have been

breached.

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- ADocumento2 páginasAShafiqur RahmanAún no hay calificaciones

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- 436 1. English Lecture 01 (C Unit) 1Documento38 páginas436 1. English Lecture 01 (C Unit) 1Shafiqur RahmanAún no hay calificaciones

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- List of VariablesDocumento5 páginasList of VariablesShafiqur RahmanAún no hay calificaciones

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- OECD-Guidelines Multinational CorporationsDocumento2 páginasOECD-Guidelines Multinational CorporationsShafiqur RahmanAún no hay calificaciones

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Caux Round Table Principles For Responsible BusinessDocumento8 páginasCaux Round Table Principles For Responsible BusinessMd Sifat KhanAún no hay calificaciones

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Topics 7Documento2 páginasTopics 7Shafiqur RahmanAún no hay calificaciones

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- FarEastKnittingDyeingIndustriesLimited Prospectus 20140413 1402Documento75 páginasFarEastKnittingDyeingIndustriesLimited Prospectus 20140413 1402Shafiqur RahmanAún no hay calificaciones

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- UCB Trainee Officer Written Test DetailsDocumento1 páginaUCB Trainee Officer Written Test DetailsShafiqur RahmanAún no hay calificaciones

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- In Depth Study On Different International StandardsDocumento84 páginasIn Depth Study On Different International StandardsShafiqur RahmanAún no hay calificaciones

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- Example of CSRDocumento1 páginaExample of CSRShafiqur RahmanAún no hay calificaciones

- United Nations Global Compactfor Higher Education InstitutionsDocumento37 páginasUnited Nations Global Compactfor Higher Education InstitutionsShafiqur RahmanAún no hay calificaciones

- Cover LetterDocumento4 páginasCover LetterShafiqur RahmanAún no hay calificaciones

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Invitation For Tenders (IFT) : Bangladesh Water Development BoardDocumento3 páginasInvitation For Tenders (IFT) : Bangladesh Water Development BoardShafiqur RahmanAún no hay calificaciones

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- Marketing Strategy Factors Behind DHL's Global SuccessDocumento18 páginasMarketing Strategy Factors Behind DHL's Global SuccessShafiqur RahmanAún no hay calificaciones

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Article CisarDocumento8 páginasArticle CisarShafiqur RahmanAún no hay calificaciones

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Oecd eDocumento23 páginasOecd eShafiqur RahmanAún no hay calificaciones

- Identify The ChallengesDocumento4 páginasIdentify The ChallengesShafiqur RahmanAún no hay calificaciones

- Introduction Nature and Scope of Business LawDocumento37 páginasIntroduction Nature and Scope of Business LawShafiqur RahmanAún no hay calificaciones

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- University of Dhaka FontDocumento1 páginaUniversity of Dhaka FontShafiqur RahmanAún no hay calificaciones

- History and Types of DiplomacyDocumento13 páginasHistory and Types of DiplomacyShafiqur RahmanAún no hay calificaciones

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- SPSSDocumento14 páginasSPSSShafiqur RahmanAún no hay calificaciones

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- National Bank (Intership Report)Documento39 páginasNational Bank (Intership Report)Shafiqur RahmanAún no hay calificaciones

- Sumon CVDocumento3 páginasSumon CVShafiqur RahmanAún no hay calificaciones

- FX Market of CanadaDocumento29 páginasFX Market of CanadaShafiqur RahmanAún no hay calificaciones

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Baby Food-12Documento6 páginasBaby Food-12Shafiqur RahmanAún no hay calificaciones

- CH 06Documento5 páginasCH 06Shafiqur RahmanAún no hay calificaciones

- Ò P Ó Bdwbu: FWZ© WB '©WKKV 2013-2014Documento3 páginasÒ P Ó Bdwbu: FWZ© WB '©WKKV 2013-2014Shafiqur RahmanAún no hay calificaciones

- Eurocurrency MarketsDocumento4 páginasEurocurrency Marketssmh9662Aún no hay calificaciones

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- CPA CV Seeking Accounting PositionDocumento2 páginasCPA CV Seeking Accounting Positionsamy njorogeAún no hay calificaciones

- Liabilities of AuditorDocumento39 páginasLiabilities of AuditorMenuka SiwaAún no hay calificaciones

- Coso Deck IntosaiDocumento53 páginasCoso Deck IntosaiAntonio PérezAún no hay calificaciones

- 3rd Sem MCom Direct Taxes Dec 2015Documento4 páginas3rd Sem MCom Direct Taxes Dec 2015ravi nAún no hay calificaciones

- 2020 Inspection Bdo Usa, LLP: (Headquartered in Chicago, Illinois)Documento28 páginas2020 Inspection Bdo Usa, LLP: (Headquartered in Chicago, Illinois)Jason BramwellAún no hay calificaciones

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Jewels G. Sayo - CVDocumento4 páginasJewels G. Sayo - CVJewels NaraggaAún no hay calificaciones

- The Effect of Budget Control On Financial Performance Among State - Owned EnterprisesDocumento13 páginasThe Effect of Budget Control On Financial Performance Among State - Owned EnterprisesIOER International Multidisciplinary Research Journal ( IIMRJ)Aún no hay calificaciones

- Class 11 Account Solution For Session (2023-2024) Chapter-6 Trial Balance and Rectification of BalanceDocumento79 páginasClass 11 Account Solution For Session (2023-2024) Chapter-6 Trial Balance and Rectification of Balancesyed mohdAún no hay calificaciones

- FAR101A-Financial Accounting and Reporting ADocumento153 páginasFAR101A-Financial Accounting and Reporting AMark Juliah NaveraAún no hay calificaciones

- Messier 11e Chap13 PPT TBDocumento31 páginasMessier 11e Chap13 PPT TBSamuel TwentyoneAún no hay calificaciones

- Introduction To Fraud Examination: (Pengujian/Pemeriksaan)Documento23 páginasIntroduction To Fraud Examination: (Pengujian/Pemeriksaan)Ivone ChandraAún no hay calificaciones

- IMF Country Report On MoldovaDocumento108 páginasIMF Country Report On MoldovaJurnalAún no hay calificaciones

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Guidelines on Tertiary Education Subsidy DisbursementsDocumento26 páginasGuidelines on Tertiary Education Subsidy Disbursementsnanie1986100% (2)

- La Trobe Offer Letter Angad Singh Arneja 17602542 08.04.2013Documento2 páginasLa Trobe Offer Letter Angad Singh Arneja 17602542 08.04.2013Travis Conner67% (3)

- Cost accounting concepts explainedDocumento37 páginasCost accounting concepts explainedEhsan Umer Farooqi100% (1)

- Audit of Hotels DepartmentDocumento29 páginasAudit of Hotels DepartmentMedha SinghAún no hay calificaciones

- Corporate Governance Christine Mallin Chapter 8 Directors and Board Structure CompressDocumento5 páginasCorporate Governance Christine Mallin Chapter 8 Directors and Board Structure CompressMathildeAún no hay calificaciones

- Chapter 11 Audit of Insurance CompaniesDocumento62 páginasChapter 11 Audit of Insurance CompaniesDiyanaBankovaAún no hay calificaciones

- Break Even AnalysisDocumento20 páginasBreak Even AnalysisirissocabaAún no hay calificaciones

- CGMA Magazine Inaugural IssueDocumento52 páginasCGMA Magazine Inaugural IssueSebastian PaulAún no hay calificaciones

- Chapter 21 - Foreign Currency TranslationsDocumento10 páginasChapter 21 - Foreign Currency TranslationsHansley AldovinoAún no hay calificaciones

- Reaction Paper Public Fiscal AdministrationDocumento25 páginasReaction Paper Public Fiscal AdministrationLeigh LynAún no hay calificaciones

- Internal Audit Asset ManagementDocumento8 páginasInternal Audit Asset ManagementamadouAún no hay calificaciones

- Refrig Plant Ice Silo REFRI KAN 06 06 2015Documento321 páginasRefrig Plant Ice Silo REFRI KAN 06 06 2015onkarratheeAún no hay calificaciones

- V ResumeDocumento3 páginasV ResumeAshwani AggarwalAún no hay calificaciones

- Strategy Review, Evaluation and Control ChapterDocumento37 páginasStrategy Review, Evaluation and Control Chapterhanson365Aún no hay calificaciones

- Chapter 3 - Risk Assessment & Internal ControlDocumento1 páginaChapter 3 - Risk Assessment & Internal Controlthuzh007Aún no hay calificaciones

- IFE Matrix guide for evaluating internal factorsDocumento4 páginasIFE Matrix guide for evaluating internal factorsSudip DhakalAún no hay calificaciones

- Auditing Fraud Enron Scandal Affected UsersDocumento2 páginasAuditing Fraud Enron Scandal Affected UsersJustin SolanoAún no hay calificaciones

- Audit Revenue Cycle AssertionsDocumento57 páginasAudit Revenue Cycle AssertionsRia CruzAún no hay calificaciones

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingDe EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingCalificación: 4.5 de 5 estrellas4.5/5 (97)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorDe EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorCalificación: 4.5 de 5 estrellas4.5/5 (63)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementDe EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementCalificación: 4.5 de 5 estrellas4.5/5 (20)

- Introduction to Negotiable Instruments: As per Indian LawsDe EverandIntroduction to Negotiable Instruments: As per Indian LawsCalificación: 5 de 5 estrellas5/5 (1)