Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Akmen

Cargado por

bpm_ui_1Descripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Akmen

Cargado por

bpm_ui_1Copyright:

Formatos disponibles

Sunk Costs are not Relevant Costs

A manager at White Co. wants to replace an old machine with a new,

more efficient machine.

New machine:

List price 90,000 $

Annual variable expenses 80,000

Expected life in years 5

Old machine:

Original cost 72,000 $

Remaining book value 60,000

Disposal value now 15,000

Annual variable expenses 100,000

Remaining life in years 5

1

Sunk Costs are not Relevant Costs

Whites sales are $200,000 per year.

Fixed expenses, other than depreciation, are $70,000 per year.

Should the manager purchase the new machine?

The manager recommends that the company not purchase the new machine since

disposal of the old machine would result in a loss:

Remaining book value 60,000 $

Disposal value (15,000)

Loss from disposal 45,000 $

2

For Five Years

Keep Old

Machine

Purchase

New

Machine Difference

Sales 1,000,000 $ 1,000,000 $ - $

Variable expenses (500,000) (400,000) 100,000

Other fixed expenses (350,000) (350,000) -

Depreciation - new (90,000) (90,000)

Depreciation - old (60,000) (60,000) -

Disposal of old machine 15,000 15,000

Total net income 90,000 $ 115,000 $ 25,000 $

Correct Analysis

Look at the comparative cost and revenue for the next five years.

Would you recommend purchasing the new machine even

though we will show a $45,000 loss on the old machine?

3

Relevant Cost Analysis

Savings in variable expenses

provided by the new machine

($20,000 5 yrs.) 100,000 $

Cost of the new machine (90,000)

Disposal value of old machine 15,000

Net effect 25,000 $

4

1. Adding/Dropping Segments

Segment Income Statement

Digital Watches

Sales 500,000 $

Less: variable expenses

Variable mfg. costs 120,000 $

Variable shipping costs 5,000

Commissions 75,000 200,000

Contribution margin 300,000 $

Less: fixed expenses

General factory overhead 60,000 $

Salary of line manager 90,000

Depreciation of equipment 50,000

Advertising - direct 100,000

Rent - factory space 70,000

General admin. expenses 30,000 400,000

Net loss (100,000) $

5

A Contribution Margin Approach

Contribution Margin

Solution

Contribution margin lost if digital

watches are dropped (300,000) $

Less fixed costs that can be avoided

Salary of the line manager 90,000 $

Advertising - direct 100,000

Rent - factory space 70,000 260,000

Net disadvantage (40,000) $

Remember, depreciation on equipment with no resale

value is not relevant to the decision since it is a sunk

cost and is not avoidable.

6

Comparative Income Approach

Solution

Keep

Digital

Watches

Drop

Digital

Watches Difference

Sales 500,000 $ - $ (500,000) $

Less variable expenses: -

Mfg. expenses 120,000 - 120,000

Freight out 5,000 - 5,000

Commissions 75,000 - 75,000

Total variable expenses 200,000 - 200,000

Contribution margin 300,000 - (300,000)

Less fixed expenses:

General factory overhead 60,000 60,000 -

Salary of line manager 90,000 - 90,000

Depreciation 50,000 50,000 -

Advertising - direct 100,000 - 100,000

Rent - factory space 70,000 - 70,000

General admin. expenses 30,000 30,000 -

Total fixed expenses 400,000 140,000 260,000

Net loss (100,000) $ (140,000) $ (40,000) $

7

The Make or Buy Decision

Essex manufactures part 4A that is currently used in

one of its products.

The unit cost to make this part is:

Direct materials $ 9

Direct labor 5

Variable overhead 1

Depreciation of special equip. 3

Supervisor's salary 2

General factory overhead 10

Total cost per unit 30 $

8

The Make or Buy Decision

The special equipment used to manufacture part 4A has no

resale value.

General factory overhead is allocated on the basis of direct

labor hours.

The $30 total unit cost is based on 20,000 parts produced

each year.

An outside supplier has offered to provide the 20,000

parts at a cost of $25 per part.

Should we accept the suppliers offer?

9

The Make or Buy Decision

Should we make or buy part 4A?

Cost

Per Unit Cost of 20,000 Units

Make Buy

Outside purchase price $ 25 $ 500,000

Direct materials 9 $ 180,000

Direct labor 5 100,000

Variable overhead 1 20,000

Depreciation of equip. 3 -

Supervisor's salary 2 40,000

General factory overhead 10 -

Total cost 30 $ 340,000 $ 500,000 $

10

Special Orders

Jet, Inc. receives a one-time order that is not considered

part of its normal ongoing business.

Jet, Inc. makes a single product with a unit variable cost of $8.

Normal selling price is $20 per unit.

A foreign distributor offers to purchase 3,000 units for $10 per

unit.

Annual capacity is 10,000 units, and annual fixed costs total

$48,000, but Jet, Inc. is currently producing and selling only

5,000 units.

Should Jet accept the offer?

11

Special Orders

Jet, Inc.

Contribution Income Statement

Revenue (5,000 $20) 100,000 $

Variable costs:

Direct materials 20,000 $

Direct labor 5,000

Manufacturing overhead 10,000

Marketing costs 5,000

Total variable costs 40,000

Contribution margin 60,000

Fixed costs:

Manufacturing overhead 28,000 $

Marketing costs 20,000

Total fixed costs 48,000

Net income 12,000 $

12

Special Orders

If Jet accepts the offer, net income will increase by

$6,000.

Increase in revenue (3,000 $10) 30,000 $

Increase in costs (3,000 $8 variable cost) 24,000

Increase in net income 6,000 $

We can reach the same results more quickly like this:

Special order contribution margin = $10 $8 = $2

Change in income = $2 3,000 units = $6,000.

13

Utilization of a Constrained Resource

Ensign Company produces two products and selected data

is shown below:

Product

1 2

Selling price per unit $ 60 $ 50

Less variable expenses per unit 36 35

Contribution margin per unit 24 $ 15 $

Current demand per week (units) 2,000 2,200

Contribution margin ratio 40% 30%

Processing time required

on machine A1 per unit 1.00 min. 0.50 min.

14

Utilization of a Constrained Resource

Machine A1 is the constrained resource. There is

excess capacity on all other machines. Machine

A1 is being used at 100% of its capacity, and has a

capacity of 2,400 minutes per week.

Should Ensign focus its efforts on Product ocus its effo

1 or 2?

15

Utilization of a Constrained Resource

Machine A1 is the constrained resource. There is excess capacity on

all other machines. Machine A1 is being used at 100% of its capacity,

and has a capacity of 2,400 minutes per week.

Should Ensign focus its efforts on Product 1 or 2?

Product 2 should be emphasized. Provides more valuable use of

the constrained resource machine A1, yielding a contribution

margin of $30 per minute as opposed to $24 for Product 1.

Product

1 2

Contribution margin per unit $ 24 $ 15

Time required to produce one unit 1.00 min. 0.50 min.

Contribution margin per minute 24 $ min. 30 $ min.

If there are no other considerations, the best plan would be to produce to meet

current demand for Product 2 and then use remaining capacity to make Product 1.

16

Utilization of a Constrained Resource

Alloting Our Constrained Recource (Machine A1)

Weekly demand for Product 2 2,200 units

Time required per unit 0.50 min.

Total time required to make

Product 2 1,100 min.

Total time available 2,400 min.

Time used to make Product 2 1,100 min.

Time available for Product 1 1,300 min.

Time required per unit 1.00 min.

Production of Product 1 1,300 units

17

Utilization of a Constrained Resource

According to the plan, we will produce 2,200 units of According to the plan, we will produce 2,200 units of g g g g g g g g g pppppppppppp p

Product 2 and 1,300 of Product 1. Our contribution and 1,300 of Product 1. Our and 1,300 of Product 1. Our

margin looks like this.

Product 1 Product 2

Production and sales (units) 1,300 2,200

Contribution margin per unit 24 $ 15 $

Total contribution margin 31,200 $ 33,000 $

The total contribution margin for Ensign is $64,200.

18

Sell or Process Further

Data about Sawmills joint products includes:

Per Log

Lumber Sawdust

Sales value at the split-off point 140 $ 40 $

Sales value after further processing 270 50

Allocated joint product costs 176 24

Cost of further processing 50 20

Sawmill, Inc. cuts logs from which unfinished lumber and sawdust are the

immediate joint products.

Unfinished lumber is sold as is or processed further into finished lumber.

Sawdust can also be sold as is to gardening wholesalers or processed

further into presto-logs.

19

Sell or Process Further

Analysis of Sell or Process Further

Per Log

Lumber Sawdust

Sales value after further processing 270 $ 50 $

Sales value at the split-off point 140 40

Incremental revenue 130 10

Cost of further processing 50 20

Profit (loss) from further processing 80 $ (10) $

Should we process the lumber

further and sell the sawdust as is?

20

David, Matt, and Marc:

Total expenses = $900

Cost allocated = $300 per person

Rent and Utilities $570

Cable TV 50

High speed Internet access 40

Groceries 240

Total $900

Refining Cost Systems

21

Refining Cost Systems

More Refined Allocation

David Matt Marc Total

Rent and Utilities $190 $190 $190 $570

Cable TV 25 25 50

Internet access 40 40

Groceries 80 160 240

Total costs allocated $215 $310 $375 $900

Original cost allocation 300 300 300 900

Difference $(85) $ 10 $75 $0

22

Traditional versus Activity-Based

Costing Systems

Chemtech produces large quantities of commodity chemicals.

It also manufactures small quantities of specialty chemicals.

In the past, Chemtechs manufacturing department has used

direct labor hours as its single allocation base at a 200% rate.

Among its many products, the department produces Aldehyde (a

commodity chemical used by producing plastics) and...

Phenylephrine Hydrochloride (PH), which is a specialty chemical.

A single customer uses PH in manufacturing blood-pressure

medications.

23

Chemtech Traditional Cost System

Aldehyde PH

Sale price per pound $10 $70

Less: manufacturing

cost per pound

Direct materials 5 20

Direct labor 1 10

Manufacturing overhead 2 20

Gross profit per pound $ 2 $20

Traditional versus Activity-Based

Costing Systems

24

Traditional versus Activity-Based

Costing Systems

Assume that the company produced 7,000 pounds of Aldehyde and 5 pounds

of PH.

What is the total labor cost per product?

7,000 pounds $1 = $7,000 (Aldehyde)

5 pounds $10 = $50 (PH)

What is the total manufacturing overhead allocated to each product?

$7,000 200% = $14,000 to Aldehyde

$50 200% = $100 to PH

Chemtech assigns 140 times as much

overhead to Aldehyde as to PH.

25

Activity-Based Costing System

Identify activities.

Mixing

Processing

Testing

Estimate the total indirect

costs of each activity.

Labor $150,000

Depreciation 200,000

Other 250,000

Total $600,000

Step 1 Step 2

Identify the primary cost driver for

each activitys indirect costs.

(1) (2) (3)

Activity Estimated Costs Cost Driver

Mixing $600,000 # of batches

Processing $300,000 # of hours (MH)

Testing $600,000 # samples

Step 3

26

Estimate the total quantity of each allocation base.

(1) (4)

Activity Estimated Quantity of Cost Driver

Mixing 4,000 batches

Processing 5,000 machine hours (MH)

Testing 3,000 samples

Step 4

Compute the allocation rate for each activity.

(1) (5)

Activity Cost Allocation Rate

Mixing $600,000 4,000 = $150/batch

Processing $300,000 5,000 = $60/MH

Testing $600,000 3,000 = $200/sample

Step 5

27

Activity-Based Costing System

Obtain the actual quantity of each allocation

base used by each product.

During the year, Chemtech produced

60 batches of Aldehyde and 1 batch of PH.

The remaining batches consist

of Chemtechs other chemicals.

Step 6

28

Activity-Based Costing System

Allocate the costs to each product.

Mixing Cost Allocation:

Aldehyde: 60 batches $150 per batch = $9,000

PH: 1 batch $150 per batch = $150

Step 7

29

Activity-Based Costing System

The ABC system allocates 29 times as

much overhead to Aldehyde as to PH.

Activity Cost Driver Units Cost Allocated to:

Used By:

Aldehyde PH Aldehyde PH

Mixing 60 batches 1 batch $ 9,000 $150

Processing 30MH 2 MH 1,830* 120

Testing 14 samples 1 sample 2,800 200

Total $13,630 $470

*30MH $60 per MH = $1,830

30

Cost/pound Traditional ABC

(Overhead) System System

Aldehyde $ 2.00 $ 1.95

PH $20.00 $94.00

Activity-Based Costing System

What is the overhead cost per pound?

Aldehyde: $13,630 7,000 = $1.95

PH: $470 5 = $94

31

Activity-Based Costing System

Aldehyde PH

Sale price per pound $10.00 $ 70.00

Less: manufacturing

cost per pound

Direct materials 5.00 20.00

Direct labor 1.00 10.00

Manufacturing overhead 1.95 94.00

Gross profit per pound $ 2.05 $(54.00)

Chemtech Gross Profit per Pound

32

Pricing and Product Mix Decisions

Aldehyde PH

Sale price per pound $10.00 $70.00

Less: manufacturing

cost per pound 8.00 50.00

Gross profit per pound $ 2.00 $20.00

Original Cost System

33

Pricing and Product Mix Decisions

Aldehyde PH

Sale price per pound $10.00 $70.00

Less: manufacturing

cost per pound 7.95 124.00

Gross profit per pound $2.05 $(54.00)

Activity-Based Cost System

34

Pricing and Product Mix Decisions

Chemtech has three alternatives:

1 Cut the cost of PH.

2Increase the sale price of PH.

3Drop the PH product.

Cost Reduction Decisions

Value engineering means systematically evaluating

activities in an effort to reduce costs while

satisfying customer needs.

35

Target Pricing

Target sale price (based on market research)

Desired profit = Target cost

Traditional Cost-Based Pricing

Full product cost (from entire value chain)

+ Desired profit = Sale price

Target Pricing versus Traditional Cost-Based

Pricing

Assume that the market price of aldehyde is likely to fall to $9.50 per

pound.

The desired target profit is 20% of the sale price.

What is the target cost?

$9.50 $1.90 = $7.60

36

Target Pricing versus Traditional Cost-Based

Pricing

Current Costs

Manufacturing $7.95 per pound

Nonmanufacturing costs = $0.50 per pound

$7.60 $8.45 = $(0.85)

Current costs must be reduced by $0.85 per pound.

37

Accounting-Based Performance

Measure Example

Relax Inns owns three small hotels

one each in Boston, Denver, and Miami.

At the present, Relax Inns does not

allocate the total long-term debt of

the company to the three separate hotels.

38

Accounting-Based Performance Measure Example

Boston Hotel

Current assets $ 350,000

Long-term assets 550,000

Total assets $ 900,000

Current liabilities $ 50,000

Revenues $1,100,000

Variable costs 297,000

Fixed costs 637,000

Operating income $ 166,000

Denver Hotel

Current assets $ 400,000

Long-term assets 600,000

Total assets $1,000,000

Current liabilities $ 150,000

Revenues $1,200,000

Variable costs 310,000

Fixed costs 650,000

Operating income $ 240,000

39

Accounting-Based Performance Measure

Example

Miami Hotel

Current assets $ 600,000

Long-term assets 5,000,000

Total assets $5,600,000

Current liabilities $ 300,000

Revenues $3,200,000

Variable costs 882,000

Fixed costs 1,166,000

Operating income $1,152,000

40

Accounting-Based Performance Measure

Example

Total current assets $1,350,000

Total long-term assets 6,150,000

Total assets $7,500,000

Total current liabilities $ 500,000

Long-term debt 4,800,000

Stockholders equity 2,200,000

Total liabilities and equity $7,500,000

41

Approaches to

Measuring Performance

Three approaches include a measure of investment:

Return on investment (ROI)

Residual income (RI)

Economic value added (EVA

)

A fourth approach, return on sales (ROS),

does not measure investment.

42

What is the return on investment for each hotel?

Return on Investment

Boston Hotel: $166,000 Operating income

$900,000 Total assets = 18%

Denver Hotel: $240,000 Operating income

$1,000,000 Total assets = 24%

Miami Hotel: $1,152,000 Operating income

$5,600,000 Total assets= 21%

43

The DuPont method of profitability analysis

recognizes that there are two basic

ingredients in profit making:

DuPont Method

1. Using assets to generate more revenues

2. Increasing income per dollar of revenues

Investment turnover = Revenues Investment

Return on sales = Income Revenues

ROI = Return on sales Investment turnover

44

DuPont Method

How can Relax Inns attain a 30% target

ROI for the Denver hotel?

Present situation: Revenues Total assets

= $1,200,000 $1,000,000 = 1.20

Operating income Revenues

= $240,000 $1,200,000 = 0.20

1.20 0.20 = 24%

45

DuPont Method

Alternative A: Decrease assets, keeping

revenues and operating income per

dollar of revenue constant.

Revenues Total assets

= $1,200,000 $800,000 = 1.50

1.50 0.20 = 30%

Alternative B: Increase revenues,

Keeping assets and operating income

per dollar of revenues constant.

Revenues Total assets

= $1,500,000 $1,000,000 = 1.50

1.50 0.20 = 30%

Operating income Revenues

= $300,000 $1,500,000 = 0.20

46

DuPont Method

Alternative C: Decrease costs to increase

operating income per dollar of revenues,

keeping revenues and assets constant.

Revenues Total assets

= $1,200,000 $1,000,000 = 1.20

1.20 0.25 = 30%

Operating income Revenues

= $300,000 $1,200,000 = 0.25

47

Residual Income

Residual income (RI)

= Income

(Required rate of return Investment)

Assume that Relax Inns required

rate of return is 12%.

What is the residual income from each hotel?

48

Residual Income

Boston Hotel:

Total assets $900,000 12% = $108,000

Operating income $166,000 $108,000

= Residual income $58,000

Denver Hotel = $120,000

Miami Hotel = $480,000

49

Economic Value Added

Economic value added (EVA

)

= After-tax operating income

[Weighted-average cost of capital

(Total assets current liabilities)]

Total assets minus current liabilities can also be computed as:

Long-term assets + Current assets

Current liabilities, or

Long-term assets + Working capital

50

Economic Value Added Example

Assume that Relax Inns has two sources of

long-term funds:

1. Long-term debt with a market value and

book value of $4,800,000 issued at an

interest rate of 10%

2. Equity capital that also has a market value of

$4,800,000 and a book value of $2,200,000

Tax rate is 30%.

51

Economic Value Added Example

What is the after-tax cost of capital?

0.10 (1 Tax rate) = 0.07, or 7%

Assume that Relax Inns cost of

equity capital is 14%.

What is the weighted-average cost of capital?

52

Economic Value Added Example

WACC = [(7% Market value of debt)

+ (14% Market value of equity)]

(Market value of debt + Market value of equity)

WACC = [(0.07 4,800,000)

+ (0.14 4,800,000)] $9,600,000

WACC = $336,000 + $672,000 $9,600,000

WACC = 0.105, or 10.5%

53

Economic Value Added Example

What is the after-tax operating income for each hotel?

Boston Hotel:

Operating income $166,000 0.7 = $116,200

Denver Hotel:

Operating income $240,000 0.7 = $168,000

Miami Hotel:

Operating income $1,152,000 0.7 = $806,400

54

Economic Value Added Example

What is the investment?

Boston Hotel: Total assets $900,000

Current liabilities $50,000 = $850,000

Denver Hotel: Total assets $1,000,000

Current liabilities $150,000 = $850,000

Miami Hotel: Total assets $5,600,000

Current liabilities $300,000 = $5,300,000

55

Economic Value Added Example

What is the weighted-average cost of capital

times the investment for each hotel?

Boston Hotel: $850,000 10.5% = $89,250

Denver Hotel: $850,000 10.5% = $89,250

Miami Hotel: $5,300,000 10.5% = $556,500

56

Economic Value Added Example

What is the economic value added?

Boston Hotel: $116,200 $89,250 = $26,950

Denver Hotel: $168,000 $89,250 = $78,750

Miami Hotel: $806,400 $556,500 = $249,900

The EVA

charges managers for the cost

of their investments in long-term assets

and working capital.

57

Return on Sales

The income-to-revenues (sales) ratio, or return

on sales (ROS) ratio, is a frequently used

financial performance measure.

What is the ROS for each hotel?

Boston Hotel: $166,000 $1,100,000 = 15%

Denver Hotel: $240,000 $1,200,000 = 20%

Miami Hotel: $1,152,000 $3,200,000 = 36%

58

Comparing Performance

Hotel ROI RI EVA

ROS

Boston 18% $ 58,000 $ 26,950 15%

Denver 24% $120,000 $ 78,750 20%

Miami 21% $480,000 $249,900 36%

Hotel ROI RI EVA

ROS

Boston 3 3 3 3

Denver 1 2 2 2

Miami 2 1 1 1

Methods Ranking

59

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Marriot CaseDocumento15 páginasMarriot CaseArsh00100% (7)

- Hankinson - Location Branding - A Study of The Branding Practices of 12 English CitiesDocumento16 páginasHankinson - Location Branding - A Study of The Branding Practices of 12 English CitiesNatalia Ney100% (1)

- Demand and SupplyDocumento61 páginasDemand and SupplyGirish PremchandranAún no hay calificaciones

- Chemical BondingDocumento7 páginasChemical BondingSanaa SamkoAún no hay calificaciones

- Approach To A Case of ScoliosisDocumento54 páginasApproach To A Case of ScoliosisJocuri KosoAún no hay calificaciones

- OptiX OSN 8800 6800 3800 Configuration Guide (V100R007)Documento924 páginasOptiX OSN 8800 6800 3800 Configuration Guide (V100R007)vladAún no hay calificaciones

- AI in HealthDocumento105 páginasAI in HealthxenoachAún no hay calificaciones

- SRL CompressorsDocumento20 páginasSRL Compressorssthe03Aún no hay calificaciones

- 19-Microendoscopic Lumbar DiscectomyDocumento8 páginas19-Microendoscopic Lumbar DiscectomyNewton IssacAún no hay calificaciones

- New Kanban System DesignDocumento4 páginasNew Kanban System DesignJebin GeorgeAún no hay calificaciones

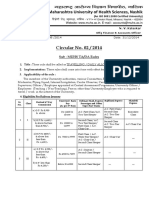

- Circular No 02 2014 TA DA 010115 PDFDocumento10 páginasCircular No 02 2014 TA DA 010115 PDFsachin sonawane100% (1)

- Slides 99 Netslicing Georg Mayer 3gpp Network Slicing 04Documento13 páginasSlides 99 Netslicing Georg Mayer 3gpp Network Slicing 04malli gaduAún no hay calificaciones

- Educ 3 Prelim Act.1 AlidonDocumento2 páginasEduc 3 Prelim Act.1 AlidonJonash AlidonAún no hay calificaciones

- Vickram Bahl & Anr. v. Siddhartha Bahl & Anr.: CS (OS) No. 78 of 2016 Casе AnalysisDocumento17 páginasVickram Bahl & Anr. v. Siddhartha Bahl & Anr.: CS (OS) No. 78 of 2016 Casе AnalysisShabriAún no hay calificaciones

- Cryptography Practical 1Documento41 páginasCryptography Practical 1Harsha GangwaniAún no hay calificaciones

- 5g-core-guide-building-a-new-world Переход от лте к 5г английскийDocumento13 páginas5g-core-guide-building-a-new-world Переход от лте к 5г английскийmashaAún no hay calificaciones

- Activity-Based Management (ABM) Is A Systemwide, Integrated Approach That FocusesDocumento4 páginasActivity-Based Management (ABM) Is A Systemwide, Integrated Approach That FocusestogarikalAún no hay calificaciones

- End of Semester Student SurveyDocumento2 páginasEnd of Semester Student SurveyJoaquinAún no hay calificaciones

- Responsive Docs - CREW Versus Department of Justice (DOJ) : Regarding Investigation Records of Magliocchetti: 11/12/13 - Part 3Documento172 páginasResponsive Docs - CREW Versus Department of Justice (DOJ) : Regarding Investigation Records of Magliocchetti: 11/12/13 - Part 3CREWAún no hay calificaciones

- Kolehiyo NG Lungsod NG Lipa: College of Teacher EducationDocumento3 páginasKolehiyo NG Lungsod NG Lipa: College of Teacher EducationPrincess LopezAún no hay calificaciones

- 5f Time of Legends Joan of Arc RulebookDocumento36 páginas5f Time of Legends Joan of Arc Rulebookpierre borget100% (1)

- Assignment 2 Malaysian StudiesDocumento4 páginasAssignment 2 Malaysian StudiesPenny PunAún no hay calificaciones

- MagmatismDocumento12 páginasMagmatismVea Patricia Angelo100% (1)

- Picc Lite ManualDocumento366 páginasPicc Lite Manualtanny_03Aún no hay calificaciones

- Repair and Field Service BrochureDocumento4 páginasRepair and Field Service Brochurecorsini999Aún no hay calificaciones

- Land Building and MachineryDocumento26 páginasLand Building and MachineryNathalie Getino100% (1)

- CRM Final22222222222Documento26 páginasCRM Final22222222222Manraj SinghAún no hay calificaciones

- 1 Piling LaranganDocumento3 páginas1 Piling LaranganHannie Jane Salazar HerreraAún no hay calificaciones

- Green and White Zero Waste Living Education Video PresentationDocumento12 páginasGreen and White Zero Waste Living Education Video PresentationNicole SarileAún no hay calificaciones

- 978-1119504306 Financial Accounting - 4thDocumento4 páginas978-1119504306 Financial Accounting - 4thtaupaypayAún no hay calificaciones