Documentos de Académico

Documentos de Profesional

Documentos de Cultura

RMC 73-2007

Cargado por

Dorothy Puguon0 calificaciones0% encontró este documento útil (0 votos)

22 vistas2 páginastax

Título original

rmc 73-2007

Derechos de autor

© © All Rights Reserved

Formatos disponibles

PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentotax

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

22 vistas2 páginasRMC 73-2007

Cargado por

Dorothy Puguontax

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

Está en la página 1de 2

Page 1 of 2

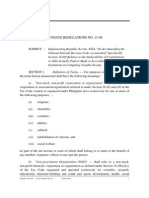

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

Quezon City

November12, 2007

REVENUE MEMORANDUM CIRCULAR NO. 73-2007

SUBJECT : Re-issuing the Guidelines on the Proper Treatment of Block Sale of Shares of

Stock Disposed of in the Stock Exchange

TO : The Philippine Stock Exchange, Internal Revenue Officers and Employees

and All Others Concerned

I. Background

The National Internal Revenue Code has traditionally made a distinction between

shares of stock that are listed and traded in the Stock Exchange from those that are not.

Briefly, under Section 127 of the Tax Code of 1997, sale, barter, exchange or other

disposition of shares of stock other than the sale by a dealer in securities, are taxed at the rate

of 1/2 of 1% of the gross selling price or gross value in money provided the shares are listed

and traded through the local stock exchange; while on the other hand, for shares that are not

disposed of through the local stock exchange, a final tax at either 5% or 10% is imposed on

the net capital gains under Section 24(C); Section 25(A)(3); Section 25(B); Section 27(D)(2);

Section 28(A)(7)(c) and Section 28(B)(5)(c), all of the Tax Code of 1997, as amended.

The fundamental principle underlying this preferential treatment was and still is the

national goal of promoting and hastening the development of the domestic capital market by

means of enticing and stimulating the general public to actively take part in the trading in the

local stock exchange.

II. Statement of Policy

In order to keep- up with modern developments and more importantly give emphasis

on the economic as well as substantial aspect rather than on the formal portion of the

transaction, sale of shares of stock where the sale is prearranged or the buyer/s is

predetermined is taxable under either Section 24(C); Section 25(A)(3); Section 25(B);

Section 27(D)(2); Section 28(A)(7)(c) and Section 28(B)(5)(c) notwithstanding the fact that

the transaction passed through the Exchange or the said facility was used.

Page 2 of 2

Accordingly, any transaction, which in effect excludes the public by any means from

taking part in the trading, shall be taxed under the aforementioned relevant provisions as

enumerated in the preceding paragraph.

This Circular expressly covers but is not limited to cases of block sale. A block sale

as defined in the Implementing Rules and Regulations of the Securities Regulation Code is a

matched trade that does not go through the automated order matching system of an Exchange

trading system but instead has been prearranged by and among the Broker Dealer's clients

and is then entered as a done deal directly into the trading system.

All internal revenue issuances which are inconsistent herewith, are hereby repealed,

modified, and/or amended accordingly.

All internal revenue officers and others concerned are enjoined to give this Circular

as wide as publicity as possible.

This Circular shall take effect immediately.

(Original Signed)

LILIAN B. HEFTI

Commissioner of Internal Revenue

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Quiz 1 & 2 - MidtermDocumento11 páginasQuiz 1 & 2 - MidtermJoshua Cabinas100% (4)

- RMC No. 44-2005Documento8 páginasRMC No. 44-2005Dorothy PuguonAún no hay calificaciones

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- PD 87Documento18 páginasPD 87Dorothy PuguonAún no hay calificaciones

- RR 13-98Documento17 páginasRR 13-98Dorothy PuguonAún no hay calificaciones

- Syllabus-IPC First Semester 2015-2016Documento14 páginasSyllabus-IPC First Semester 2015-2016Dorothy PuguonAún no hay calificaciones

- PD 1354Documento5 páginasPD 1354Dorothy PuguonAún no hay calificaciones

- Producers Bank of The Phil Vs NLRC - 118069 - November 16, 1998Documento4 páginasProducers Bank of The Phil Vs NLRC - 118069 - November 16, 1998Dorothy PuguonAún no hay calificaciones

- RA No.7549Documento2 páginasRA No.7549Dorothy PuguonAún no hay calificaciones

- Rmo 17-2002Documento4 páginasRmo 17-2002Anonymous Q0KzFR2iAún no hay calificaciones

- Ra 10378Documento6 páginasRa 10378Dorothy PuguonAún no hay calificaciones

- Ra 9504 Minimum Wage and Optional Standard DeductionDocumento6 páginasRa 9504 Minimum Wage and Optional Standard Deductionapi-247793055Aún no hay calificaciones

- List of Revenue Regulations 2012Documento42 páginasList of Revenue Regulations 2012Dorothy PuguonAún no hay calificaciones

- RMC 77-2003Documento4 páginasRMC 77-2003Dorothy PuguonAún no hay calificaciones

- Pal V Palea 19 Scra 483Documento2 páginasPal V Palea 19 Scra 483Dorothy PuguonAún no hay calificaciones

- 76-2003 Exemption Nonstock Non ProfitDocumento3 páginas76-2003 Exemption Nonstock Non Profitapi-247793055Aún no hay calificaciones

- List of Revenue Memorandum Orders 2012Documento88 páginasList of Revenue Memorandum Orders 2012Dorothy PuguonAún no hay calificaciones

- RMC 76 2003Documento1 páginaRMC 76 2003Dorothy PuguonAún no hay calificaciones

- RespondentsDocumento17 páginasRespondentsDorothy PuguonAún no hay calificaciones

- Nestle V NLRCDocumento3 páginasNestle V NLRCDorothy PuguonAún no hay calificaciones

- Cebu Seamen's Assoc V 1992Documento3 páginasCebu Seamen's Assoc V 1992Dorothy PuguonAún no hay calificaciones

- Nea V CoaDocumento10 páginasNea V CoaDorothy PuguonAún no hay calificaciones

- RR 2-98Documento57 páginasRR 2-98Dorothy PuguonAún no hay calificaciones

- FEATI V BautistaDocumento16 páginasFEATI V BautistaDorothy PuguonAún no hay calificaciones

- RespondentsDocumento9 páginasRespondentsDorothy PuguonAún no hay calificaciones

- 109406Documento14 páginas109406Dorothy PuguonAún no hay calificaciones

- Province of North Cotabato Vs RepublicDocumento55 páginasProvince of North Cotabato Vs Republicfidel_ramos_1100% (1)

- MarcusDocumento10 páginasMarcusAngeles Sabandal SalinasAún no hay calificaciones

- Nac V CoaDocumento8 páginasNac V CoaDorothy PuguonAún no hay calificaciones

- Civil Liberties Vs Executive SecretaryDocumento9 páginasCivil Liberties Vs Executive SecretarySannie RemotinAún no hay calificaciones

- Cruz V CoaDocumento4 páginasCruz V CoaDorothy PuguonAún no hay calificaciones

- 3 Ordinary and Preference SharesDocumento4 páginas3 Ordinary and Preference SharesVP RaoAún no hay calificaciones

- Project Report On Financial Analysis of Reliance Industry Limited PDF FreeDocumento85 páginasProject Report On Financial Analysis of Reliance Industry Limited PDF FreeKanika singhAún no hay calificaciones

- Chapter 11 (Tan - Lee)Documento59 páginasChapter 11 (Tan - Lee)Anindya AldoraAún no hay calificaciones

- Financial AccountingDocumento748 páginasFinancial AccountingShubham Upadhyay100% (2)

- Principles of Managerial Finance Brief 7th Edition Gitman Test BankDocumento63 páginasPrinciples of Managerial Finance Brief 7th Edition Gitman Test Bankkennethmorgansjyfwondxp100% (25)

- Amended IRR of The SRCDocumento255 páginasAmended IRR of The SRCEdgar Jino Bartolata0% (1)

- Ca Inter 4-12-2019 PDFDocumento172 páginasCa Inter 4-12-2019 PDFstillness speaksAún no hay calificaciones

- Bombay DyeingDocumento222 páginasBombay DyeingReTHINK INDIAAún no hay calificaciones

- DEY's B.ST Ch8Sources of Business Finance PPTs As PeDocumento120 páginasDEY's B.ST Ch8Sources of Business Finance PPTs As PeIk RarAún no hay calificaciones

- Fundamentals of Corporate Finance Australian 2Nd Edition Berk Test Bank Full Chapter PDFDocumento42 páginasFundamentals of Corporate Finance Australian 2Nd Edition Berk Test Bank Full Chapter PDFRussellFischerqxcj100% (12)

- Point of IndifferenceDocumento3 páginasPoint of IndifferenceSandhyaAún no hay calificaciones

- Westmont PLCDocumento5 páginasWestmont PLCmutuamutisya306Aún no hay calificaciones

- Mowjow Business Brief 12052011a EnglishDocumento54 páginasMowjow Business Brief 12052011a EnglishhaimmayanAún no hay calificaciones

- 5.1 Capital Companies in PolandDocumento6 páginas5.1 Capital Companies in PolandBianca SăvulescuAún no hay calificaciones

- 86 City of Davao vs. AP Holdings, IncDocumento2 páginas86 City of Davao vs. AP Holdings, IncChoco Maphison100% (1)

- Cost & Asset Accounting: Prof - Dr.G.M.MamoorDocumento51 páginasCost & Asset Accounting: Prof - Dr.G.M.MamoorPIRZADA TALHA ISMAIL100% (1)

- Corporate Law ProjectDocumento11 páginasCorporate Law ProjectVanshita GuptaAún no hay calificaciones

- 655 Week 10 Notes PDFDocumento80 páginas655 Week 10 Notes PDFsanaha786Aún no hay calificaciones

- AC7&8 Module 4 Investments in Equity SecuritiesDocumento28 páginasAC7&8 Module 4 Investments in Equity SecuritiesCatherine JaramillaAún no hay calificaciones

- Form Two Business StudiesDocumento198 páginasForm Two Business StudiesusavihwevhumalcolmAún no hay calificaciones

- The Definite Guide To Dividend InvestingDocumento44 páginasThe Definite Guide To Dividend InvestingBD VERMAAún no hay calificaciones

- UST Taxation Law - Hernando Case DigestsDocumento47 páginasUST Taxation Law - Hernando Case DigestsLuis NovalAún no hay calificaciones

- Annual Report 2015 - 2016: Disruptive Landscape, Prudent Risk Management, Ensuring GrowthDocumento78 páginasAnnual Report 2015 - 2016: Disruptive Landscape, Prudent Risk Management, Ensuring GrowtheepAún no hay calificaciones

- Tomco HLL Merger: Submitted by Akhilesh DalalDocumento35 páginasTomco HLL Merger: Submitted by Akhilesh DalalAkhilesh DalalAún no hay calificaciones

- IntaccDocumento13 páginasIntaccMelita CarriedoAún no hay calificaciones

- Ratio Analysis-1Documento4 páginasRatio Analysis-1Ramakrishna J RAún no hay calificaciones

- PresentationDocumento9 páginasPresentationRamani RanjanAún no hay calificaciones

- Shares and Dividends Class X Maths CISCEDocumento23 páginasShares and Dividends Class X Maths CISCENatasha SinghAún no hay calificaciones

- 07.2 - Shareholders EquityDocumento5 páginas07.2 - Shareholders EquityDonna Abogado100% (1)