Documentos de Académico

Documentos de Profesional

Documentos de Cultura

51 - Tax Free Incomes

Cargado por

Dhirendra SinghTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

51 - Tax Free Incomes

Cargado por

Dhirendra SinghCopyright:

Formatos disponibles

Tax Free Incomes

The following are 17 important items of income, which are fully exempt from income tax and which a resident

individual Indian assessee can use with profit for the purpose of tax planning.

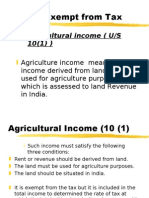

1. Agricultural income

Under the provisions of Section 101! of the Income Tax "ct, agricultural income is fully exempt from income tax.

#owever, for individuals or #U$s when agricultural income is in excess of %s &,000, it is aggregated with the total

income for the purposes of computing tax on the total income in a manner which results into 'no' tax on agricultural

income (ut an increased income tax on the other income.

"gricultural income which fulfils the a(ove conditions is completely exempt from tax. The manner of calculating tax on

total income and agricultural income, is explained in the following illustration)

Illustration

$or $* +00,-0. assessment year +00.-10!, a male individual

has a total income from trading in textiles amounting to %s

1,&+,000/ (esides, he has earned %s 00,000 as income from

agriculture.

The income tax paya(le (y him will (e computed as under)

1n the first %s 1&0,000 of the taxa(le non-agricultural

income) Nil

1n the next %s 00,000 of agricultural income falling

under 102 sla(!) Nil

1n the next %s +,000 of taxa(le non-agricultural

income 3 10 per cent) Rs 200

Income tax on aggregated income of %s 1&+,000 4

%s 00,000 5 %s 1.+,000) Rs 200

2. Receipts from Hindu Undivided Family (HUF)

"ny sum received (y an individual as a mem(er of a #indu Undivided $amily, where the said sum has (een paid out

of the income of the family, or, in the case of an imparti(le estate, where such sum has (een paid out of the income

of the estate (elonging to the family, is completely exempt from income tax in the hands of an individual mem(er of

the family under Section 10+!.

. !"are from a partners"ip firm

Under the provisions of Section 10+"!, in the case of a person (eing a partner of a firm which is separately assessed

as such, his share in the total income of the firm is completely exempt from income tax since "* 1..6-.0.

$or this purpose, the share of a partner in the total income of a firm separately assessed as such would (e an

amount which (ears to the total income of the firm the same share as the amount of the share in the profits of the firm

in accordance with the partnership deed (ears to such profits.

Downloaded from www.CAstudentdesk.co.nr Page 1

#. Allo$ance for foreign service

"ny allowances or per7uisites paid or allowed as such outside India (y the 8overnment to a citi9en of India,

rendering service outside India, are completely exempt from tax under Section 107!. This provision can (e ta:en

advantage of (y the citi9ens of India who are in government service so that they can accumulate tax-free per7uisites

and allowances received outside India.

%. &ratuities

Under the provisions of Section 1010! of the IT "ct, any death-cum-retirement gratuity of a government servant is

completely exempt from income tax. #owever, in respect of private sector employees gratuity received on retirement

or on (ecoming incapacitated or on termination or any gratuity received (y his widow, children or dependants on his

death is exempt su(;ect to certain conditions.

The maximum amount of exemption is %s. 6,&0,000/. 1f course, this is further su(;ect to certain other limits li:e the

one half-month<s salary for each year of completed service, calculated on the (asis of average salary for the 10

months immediately preceding the year in which the gratuity is paid or +0 months< salary as calculated. Thus, the

least of these items is exempt from income tax under Section 1010!.

'. (ommutation of pension

The entire amount of any payment in commutation of pension (y a government servant or any payment in

commutation of pension from =I> pension fund is exempt from income tax under Section 1010"! of IT "ct.

#owever, in respect of private sector employees, only the following amount of commuted pension is exempt, namely)

a! ?here the employee received any gratuity, the commuted value of one-third of the pension which he is normally

entitled to receive/ and (! In any other case, the commuted value of half of such pension.

It may (e noted here that the monthly pension receiva(le (y a pensioner is lia(le to full income tax li:e any other item

of salary or income and no standard deduction is now availa(le in respect of pension received (y a tax payer.

). *eave salary of central government employees

Under Section 1010""! the maximum amount receiva(le (y the employees of central government as cash

e7uivalent to the leave salary in respect of earned leave at their credit upto 10 months< leave at the time of their

retirement, whether on superannuation or otherwise, would (e %s. 6,00,000.

+. ,oluntary retirement or separation payment

Under the provisions of Section 1010>!, any amount received (y an employee of a pu(lic sector company or of any

other company or of a local authority or a statutory authority or a cooperative society or university or IIT or II@ at the

time of his voluntary retirement A%! or voluntary separation in accordance with any scheme or schemes of A% as per

%ule +B", is completely exempt from tax. The maximum amount of money received at such A% which is so exempt is

%s. &00,000.

-. *ife insurance receipts

Under Section 1010C!, any sum received under a =ife Insurance Dolicy =ID!, including the sum allocated (y way of

(onus on such policy, other than uEs ,0CC" or under a Feyman Insurance Dolicy, or under an insurance policy

issued on or after 1.0.+006 in respect of which the premium paya(le for any of the years during the term of the policy

exceeds +0 per cent of the actual capital sum assured, is fully exempt from tax.

#owever, all moneys received on death of the insured are fully exempt from tax Thus, generally moneys received

from life insurance policies whether from the =ife Insurance >orporation or any other private insurance company

would (e exempt from income tax.

Downloaded from www.CAstudentdesk.co.nr Page 2

10. .ayment received from provident funds

Under the provisions of Sections 1011!, 1+! and 16! any payment from a government or recognised provident fund

D$! or approved superannuation fund, or DD$ is exempt from income tax.

11. (ertain types of interest payment

There are certain types of interest payments which are fully exempt from income tax uEs 10 1&!. These are descri(ed

(elow)

(i) Income (y way of interest, premium on redemption or other payment on such securities, (onds, annuity

certificates, savings certificates, other certificates issued (y the >entral 8overnment and deposits as the >entral

8overnment may, (y notification in the 1fficial 8a9ette, specify in this (ehalf.

(iia) In the case of an individual or a #indu Undivided $amily, interest on such capital investment (onds as the

>entral 8overnment may, (y notification in the 1fficial 8a9ette, specify in this (ehalf i.e. 7 >apital Investment

Bonds!/

(ii/) In the case of an individual or a #indu Undivided $amily, interest on such %elief Bonds as the >entral

8overnment may, (y notification in the 1fficial 8a9ette, specify in this (ehalf i.e., . per cent or ,.& per cent or , per

cent or 7 per cent %elief Bonds!/ iid! Interest on G%I (onds/

(iiia) Interest on securities held (y the issue department of the >entral Ban: of >eylon constituted under the >eylon

@onetary =aw "ct, 1.0./

(iii/) Interest paya(le to any (an: incorporated in a country outside India and authorised to perform central (an:ing

functions in that country on any deposits made (y it, with the approval of the %eserve Ban: of India [8et Huote] or with

any scheduled (an:/

(iv) >ertain interest paya(le (y 8overnment or a local authority on moneys (orrowed (y it, including hedging charges

on currency fluctuation from the "* +000-+001!, etc./

(v) Interest on 8old Ceposit Bonds/

(vi) Interest on certain deposits are) Bhopal 8as victims/

(vii) Interest on (onds of local authorities as notified,

(viii) Interest on I.& per cent Savings Bonds JKxemptL issued (y the %BI, and

(i0) Stipulated new tax free (onds to (e notified from time to time.

12. !c"olars"ip and a$ards1 etc

"ny :ind of scholarship granted to meet the cost of education is exempt from tax under Section 101I!. Similarly,

certain awards and rewards, etc. are completely exempt from tax under Section 1017"!, for example, =a:hotia

Duras:ar of %s 100,000 awarded to the (est %a;asthani author, every year under Gotification Go. 1..E+,E.&-IT "-I!

dated ++-0-1..I.

"ny daily allowance received (y a @em(er of Darliament or (y an @=" or any mem(er of any >ommittee of

Darliament or State legislature is also exempt from tax under Section 1017!.

1. &allantry a$ards1 etc. 22 !ection 10(1+)

The $inance "ct, 1... has, with effect from "* +000-+001, provided for complete exemption for the pension and

family pension of 8allantry "ward ?inners li:e Daramvir >ha:ra, @ahavir >ha:ra, and Air >ha:ra and also other

8allantry "ward winners notified (y the >entral 8overnment.

1#. 3ividends on s"ares and units 22 !ection 10(#) 4 (%)

?ith effect from the "ssessment *ear +000-0&, the dividend income and income of units of mutual funds received (y

the assessee completely exempt from income tax.

1%. *ong2term capital gains of transfer of securities 22 !ection 10(+)

?ith effect from $* +000-0&, any income arising to a taxpayer on account of sale of long-term capital asset (eing

securities is completely outside the purview of tax lia(ility especially when the transaction has (een su(;ected to

Securities Transaction Tax STT!.

Downloaded from www.CAstudentdesk.co.nr Page 3

Thus, if the shares of any company listed in the stoc: exchange are sold after holding it for a minimum period of one

year then there will (e no lia(ility to payment of capital gains. This provision would even apply for the old shares

which are held (y an assessee and are sold after the $inance Go.+! "ct, +000 came into force.

1'. Amount received /y $ay of gift1 etc 22 !ection 10(-)

"s per the $inance Go. +! "ct, +000, gift, etc. received after 1-.-+000 (y an individual or an #U$ whether in cash or

(y way of credit, etc. is (eing su(;ected to tax if the same is not received from a stipulated relative. Section 106.!

provides that the amount received to the extent of %s &0,000 will, however, (e exempt from the purview of tax

payment.

Similarly, amount received on the occasion of marriage from non-relatives, etc. would also (e exempted. It may (e

noted that the gift from relatives, as specified in the section can (e received without any upper limit.

1). 5a0 e0emption regarding reverse mortgage sc"eme 22 sections 2(#)) and #)(0)

"ny transfer of a capital asset in a transaction of reverse mortgage for senior citi9ens under a scheme made and

notified (y the >entral 8overnment would not (e regarded as a transfer and therefore would not attract capital gains

tax. The loan amount would also (e exempt from tax. These amendments (y the $inance Bill, +00, apply from $*

+007-0, onwards.

Downloaded from www.CAstudentdesk.co.nr Page 4

También podría gustarte

- Incomes Which Do Not Form OF Total Income (Section 10) : Dr. P.Sree Sudha, Associate Professor, DsnluDocumento48 páginasIncomes Which Do Not Form OF Total Income (Section 10) : Dr. P.Sree Sudha, Associate Professor, Dsnluleela naga janaki rajitha attiliAún no hay calificaciones

- Income Exempt from Tax under Section 10Documento3 páginasIncome Exempt from Tax under Section 10Monisha ParekhAún no hay calificaciones

- Notes On Exempted IncomeDocumento4 páginasNotes On Exempted Incomevaibs8900Aún no hay calificaciones

- Direct Tax SLE-1 Roll No KSPMCAA012 Dev Shah Mcom Part 1 Sem 3 2022-2023 Exemption Under Sec 10Documento20 páginasDirect Tax SLE-1 Roll No KSPMCAA012 Dev Shah Mcom Part 1 Sem 3 2022-2023 Exemption Under Sec 10Dev ShahAún no hay calificaciones

- Tax Facts For IndividualsDocumento9 páginasTax Facts For Individualsred20055Aún no hay calificaciones

- Tax Deductions under Sections 80C to 80UDocumento41 páginasTax Deductions under Sections 80C to 80UanupchicheAún no hay calificaciones

- MF0003 - Taxation ManagementDocumento7 páginasMF0003 - Taxation ManagementushasnAún no hay calificaciones

- Income Tax in IndiaDocumento19 páginasIncome Tax in IndiaConcepts TreeAún no hay calificaciones

- Tax Exemptions Under Indian Income Tax LawDocumento3 páginasTax Exemptions Under Indian Income Tax LawSneha PotekarAún no hay calificaciones

- Section 80C To 80U 1Documento41 páginasSection 80C To 80U 1karanmasharAún no hay calificaciones

- Income From SalaryDocumento29 páginasIncome From SalaryIsmail SayyadAún no hay calificaciones

- Section Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionDocumento32 páginasSection Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionanilpeddamalliAún no hay calificaciones

- Taxiation AssignmentDocumento9 páginasTaxiation AssignmentNoman AreebAún no hay calificaciones

- Incom TaxDocumento54 páginasIncom TaxRamesh AlathurAún no hay calificaciones

- Section 10 of The Income Tax ActDocumento10 páginasSection 10 of The Income Tax ActVANSHIKA SINGHAún no hay calificaciones

- Tax Deductions ExplainedDocumento16 páginasTax Deductions ExplainedArpit VermaAún no hay calificaciones

- TaxDocumento11 páginasTaxDilkash WaraichAún no hay calificaciones

- Exemptions Deductions Assessment: Principles of Taxation Income Tax Act 1961Documento24 páginasExemptions Deductions Assessment: Principles of Taxation Income Tax Act 1961Presidency UniversityAún no hay calificaciones

- Chapter Four TaxDocumento54 páginasChapter Four TaxEmebet Tesema100% (4)

- Income ExemptDocumento25 páginasIncome Exemptapi-3832224Aún no hay calificaciones

- 7th Term - Legal Frameworks of ConstructionDocumento79 páginas7th Term - Legal Frameworks of ConstructionShreedharAún no hay calificaciones

- IT-03 Incomes Exempt From TaxDocumento18 páginasIT-03 Incomes Exempt From TaxAkshat GoyalAún no hay calificaciones

- Deductions From Income From Other SourcesDocumento7 páginasDeductions From Income From Other SourcesPADMANABHAN POTTIAún no hay calificaciones

- Chapter - 1: Page - 1Documento7 páginasChapter - 1: Page - 1Arunangsu ChandaAún no hay calificaciones

- Income From SalaryDocumento30 páginasIncome From SalaryNicholas OwensAún no hay calificaciones

- Module-1: Basic Concepts and DefinitionsDocumento35 páginasModule-1: Basic Concepts and Definitions2VX20BA091Aún no hay calificaciones

- Section 10 ExemptDocumento2 páginasSection 10 ExemptUttam Kumar GhoshAún no hay calificaciones

- Chapter ViaDocumento4 páginasChapter ViaCA Gourav JashnaniAún no hay calificaciones

- INCOME TAX - 6 Other SourcesDocumento5 páginasINCOME TAX - 6 Other SourcesAbhaya kumarAún no hay calificaciones

- Income Tax ActDocumento4 páginasIncome Tax ActishitashivhareAún no hay calificaciones

- Non Taxable Income, Income From Salary and Income From HPDocumento35 páginasNon Taxable Income, Income From Salary and Income From HPAnonymous ckTjn7RCq8Aún no hay calificaciones

- Employee Provident Fund and Public Provident Fund comparedDocumento6 páginasEmployee Provident Fund and Public Provident Fund comparedtimtoyAún no hay calificaciones

- Non Taxable IncomeDocumento35 páginasNon Taxable IncomeGayatri RaneAún no hay calificaciones

- Tax Exemptions Under Section 10Documento22 páginasTax Exemptions Under Section 10AnshuAún no hay calificaciones

- ASSESSMENT YEAR 2014 Tax Rates and DetailsDocumento6 páginasASSESSMENT YEAR 2014 Tax Rates and Detailsamit2201Aún no hay calificaciones

- ItlpDocumento12 páginasItlpNotJames BondAún no hay calificaciones

- Income Tax Rates (For Individuals, Hufs, Association of Persons, Body of Individuals) Assessment Year 2011-2012 Relevant To Financial Year 2010-2011Documento6 páginasIncome Tax Rates (For Individuals, Hufs, Association of Persons, Body of Individuals) Assessment Year 2011-2012 Relevant To Financial Year 2010-2011jhancyAún no hay calificaciones

- Total IncomeDocumento3 páginasTotal IncomeFaisal AhmedAún no hay calificaciones

- Income-Tax-Fy2016-17 Income-Tax Benefits From Life Insurance and Rates For Assessment Year 2017-2018 (Financial Year 2016-2017)Documento3 páginasIncome-Tax-Fy2016-17 Income-Tax Benefits From Life Insurance and Rates For Assessment Year 2017-2018 (Financial Year 2016-2017)Puran Singh LabanaAún no hay calificaciones

- Introduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentDocumento19 páginasIntroduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentRtr Sandeep ShekharAún no hay calificaciones

- The Income Tax ActDocumento8 páginasThe Income Tax ActChakshuBehlAún no hay calificaciones

- Income Exempt From TaxDocumento20 páginasIncome Exempt From TaxSaad AliAún no hay calificaciones

- Tax Slab and Deductions for FY 2009-10Documento44 páginasTax Slab and Deductions for FY 2009-10pradeep mathurAún no hay calificaciones

- Rates of Income Tax and Amendments for Super Senior Citizens, Senior Citizens and Other IndividualsDocumento24 páginasRates of Income Tax and Amendments for Super Senior Citizens, Senior Citizens and Other IndividualsavneetAún no hay calificaciones

- It'S Matter of Law and WelfareDocumento36 páginasIt'S Matter of Law and WelfareAwinash ChowdaryAún no hay calificaciones

- Income ExemptDocumento21 páginasIncome Exemptapi-3832224100% (1)

- Hari Income Tax Department - Do CXDocumento12 páginasHari Income Tax Department - Do CXNelluri Surendhar ChowdaryAún no hay calificaciones

- Heads of IncomeDocumento6 páginasHeads of Incomevijay kumarAún no hay calificaciones

- General Deductions (Under Section 80) : Basic Rules Governing Deductions Under Sections 80C To 80UDocumento67 páginasGeneral Deductions (Under Section 80) : Basic Rules Governing Deductions Under Sections 80C To 80UVENKATESAN DAún no hay calificaciones

- Income TaxDocumento21 páginasIncome Taxpayal sachdevAún no hay calificaciones

- Residential Status of An IndividualDocumento11 páginasResidential Status of An IndividualRevathy PrasannanAún no hay calificaciones

- 1 .Income Tax On Salaries - (01.06.2015)Documento57 páginas1 .Income Tax On Salaries - (01.06.2015)yvAún no hay calificaciones

- Salary Includes: U/s 17Documento14 páginasSalary Includes: U/s 17Ansh NayyarAún no hay calificaciones

- Public CHAPTER 4Documento15 páginasPublic CHAPTER 4embiale ayaluAún no hay calificaciones

- Tax Planning For SalaryDocumento31 páginasTax Planning For SalaryAjit SwainAún no hay calificaciones

- Gross Income Inc Exc DedDocumento9 páginasGross Income Inc Exc DedMelbert BallaraAún no hay calificaciones

- Income Tax Unit-1 PDFDocumento12 páginasIncome Tax Unit-1 PDFAnirban ThakurAún no hay calificaciones

- DeductionsDocumento11 páginasDeductionsguest1Aún no hay calificaciones

- 1040 Exam Prep: Module I: The Form 1040 FormulaDe Everand1040 Exam Prep: Module I: The Form 1040 FormulaCalificación: 1 de 5 estrellas1/5 (3)

- 1040 Exam Prep Module IV: Items Excluded from Gross IncomeDe Everand1040 Exam Prep Module IV: Items Excluded from Gross IncomeAún no hay calificaciones

- To Become An Accounting TechnicianDocumento4 páginasTo Become An Accounting TechnicianultimatewinnnnerAún no hay calificaciones

- ButerflyDocumento1 páginaButerflyDhirendra SinghAún no hay calificaciones

- GST First White PaperDocumento5 páginasGST First White PaperDhirendra SinghAún no hay calificaciones

- Great LessonsDocumento2 páginasGreat LessonsDhirendra SinghAún no hay calificaciones

- Income Tax Judgements 2009Documento10 páginasIncome Tax Judgements 2009Dhirendra SinghAún no hay calificaciones

- 40 - Section 9 of The Indian Income Tax ActDocumento18 páginas40 - Section 9 of The Indian Income Tax ActDhirendra SinghAún no hay calificaciones

- Accounting TermsDocumento30 páginasAccounting TermsDhirendra SinghAún no hay calificaciones

- Income Deemed To Accrue or Arise in IndiaDocumento2 páginasIncome Deemed To Accrue or Arise in IndiaDhirendra SinghAún no hay calificaciones

- Individaul Residential Status ProblemsDocumento1 páginaIndividaul Residential Status ProblemsDhirendra SinghAún no hay calificaciones

- TAXATION PREWEEK QUIZDocumento19 páginasTAXATION PREWEEK QUIZVanessa Anne Acuña DavisAún no hay calificaciones

- Capital Gains CalculatorDocumento2 páginasCapital Gains CalculatorA.YOGAGURUAún no hay calificaciones

- BIR Revenue Regulations 4-2014Documento2 páginasBIR Revenue Regulations 4-2014Tonyo CruzAún no hay calificaciones

- Mathematics For Business 10th Edition Salzman Test Bank DownloadDocumento42 páginasMathematics For Business 10th Edition Salzman Test Bank DownloadRebecca Tillman100% (22)

- Palkka Mepv2022k12a1t36702c0 09.12.2022Documento3 páginasPalkka Mepv2022k12a1t36702c0 09.12.2022CesarAún no hay calificaciones

- Daleel 23 273 - SupplierDocumento6 páginasDaleel 23 273 - SupplierSales SES OmanAún no hay calificaciones

- Manpower quotation cost component U.PDocumento5 páginasManpower quotation cost component U.PAmar Rajput100% (2)

- Ka 2122 1844721Documento9 páginasKa 2122 1844721Swetha WariAún no hay calificaciones

- Canadian Tax Principles 2017-2018. Study Guide QuestionsDocumento266 páginasCanadian Tax Principles 2017-2018. Study Guide QuestionsTimilehin Akintayo100% (9)

- Delivery Challan: GST NO.: 29ADOPS6311H1Z5Documento5 páginasDelivery Challan: GST NO.: 29ADOPS6311H1Z5Ajay KumarAún no hay calificaciones

- Form 10A - Filed FormDocumento4 páginasForm 10A - Filed FormSandeep AgrawalAún no hay calificaciones

- LIC KOMAL JEEVAN Plan 159: Child Education & Start-Up Money PlanDocumento15 páginasLIC KOMAL JEEVAN Plan 159: Child Education & Start-Up Money PlanKshitiz RastogiAún no hay calificaciones

- How To Start A Private FoundationDocumento7 páginasHow To Start A Private FoundationEmmanuel Mudoni67% (3)

- WHT TDS UCilDocumento11 páginasWHT TDS UCilRajesh KumarAún no hay calificaciones

- Activity: Basic Earnings Per ShareDocumento2 páginasActivity: Basic Earnings Per Sharebi23450% (1)

- FKMPS9021Q Q3 2016-17Documento2 páginasFKMPS9021Q Q3 2016-17Hannan SatopayAún no hay calificaciones

- United States v. The Motorlease Corporation, 334 F.2d 617, 2d Cir. (1964)Documento4 páginasUnited States v. The Motorlease Corporation, 334 F.2d 617, 2d Cir. (1964)Scribd Government DocsAún no hay calificaciones

- CPA Review Taxation ExamDocumento16 páginasCPA Review Taxation ExamAmeroden AbdullahAún no hay calificaciones

- Impact of E-Commerce On Taxation: Kirti and Namrata AgrawalDocumento8 páginasImpact of E-Commerce On Taxation: Kirti and Namrata AgrawalseranAún no hay calificaciones

- Tax Invoice GeneratorDocumento1 páginaTax Invoice GeneratorUdhav RohiraAún no hay calificaciones

- Invoice 394723 15067151Documento1 páginaInvoice 394723 15067151johndoesrightAún no hay calificaciones

- Proforma Invoice: Tera Software LimitedDocumento1 páginaProforma Invoice: Tera Software LimitedSigitek Software ServicesAún no hay calificaciones

- Accounting For Income Taxes SlidesDocumento51 páginasAccounting For Income Taxes SlidesparmitchoudhuryAún no hay calificaciones

- BFJPIA Cup 4 Business Law and TaxationDocumento8 páginasBFJPIA Cup 4 Business Law and TaxationJerecko Ace ManlangatanAún no hay calificaciones

- Sepco Online BilllDocumento1 páginaSepco Online Billlshaikh_piscesAún no hay calificaciones

- Causes of Tax Evasion and Avoidance-Facts From NCR of India: June 2020Documento13 páginasCauses of Tax Evasion and Avoidance-Facts From NCR of India: June 2020Che DivineAún no hay calificaciones

- ICICI ReceiptDocumento1 páginaICICI ReceiptShivam GuptaAún no hay calificaciones

- Tax Rev SyllabusDocumento14 páginasTax Rev SyllabusIanLightPajaroAún no hay calificaciones

- CH2-Notes EnglishDocumento8 páginasCH2-Notes Englishhayleyparsons1984Aún no hay calificaciones

- Missoula Gas Tax Request LetterDocumento2 páginasMissoula Gas Tax Request LetterOlivia IversonAún no hay calificaciones