Documentos de Académico

Documentos de Profesional

Documentos de Cultura

All Debt Products.

Cargado por

R. Singh0 calificaciones0% encontró este documento útil (0 votos)

178 vistas3 páginasgood one

Derechos de autor

© © All Rights Reserved

Formatos disponibles

PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentogood one

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

178 vistas3 páginasAll Debt Products.

Cargado por

R. Singhgood one

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

Está en la página 1de 3

All debt products..

http://www.subramoney.com/2014/02/all-debt-products/[2/5/2014 1:34:04 AM]

Subramoney

We Make Smart People Richer

What is an IPO?

All debt products..

Let us see what happens when a HNI

wants to build a debt portfolio of his

balance sheet!

Why only a HNI? Simply because a not

very rich person may be happy with 4-

5 PPF accounts (into which he can

invest about Rs. 2-3 lakhs a year),

some bank fixed deposits, etc.

However for a HNI, he has to look at

the following assets:

Savings bank account, bank fixed

deposits, PPF, Tax free bonds, taxable

bonds, and a variety of debt funds

from the insurance basket.

The mutual fund basket products are: liquid fund, ultra short term bond fund,

short term bond fund, income fund, gilt fund, and FMP.

Assuming that the former set of products are well known, let us look at the debt

offering from the Mutual fund industry. What distinguishes them is the

DURATION of the fund schemes. Here we are ranking them from least duration to

highest duration:

1. Liquid fund:

A fund that everybody should have. This should be like your savings bank

account. Whenever you have money which you think is excess it should lie in this

account, in the GROWTH mode. Unlike your savings bank account, this account

gives you CAPITAL GAINS and hence you will pay lesser tax say 10% instead of

30% that you pay on the savings bank interest. Also the returns could be greater

than a savings account but it could be lesser than the return you could get

from a bank fixed deposit.

2. Ultra short term bond fund:

This has a greater duration than a liquid fund, but lesser than the other funds

mentioned here. If you have a time duration greater than a few days say a few

months 100 days this fund could be a better option compared to a liquid

fund. However the returns on this fund maybe very close to a liquid fund, and

may not really matter. However if you know that you require the money after 130

days it might make sense to be in an Ultra short term bond fund.

3. Short term bond fund:

When you have money for slightly longer duration of say 12-18 -30 months you

could look at this fund. Obviously this fund could give a higher return than the

earlier 2 funds, but now the funds start getting a little riskier. When Interest

rates go UP bond funds lose VALUE. How much value they lose depends on the

duration of the fund. The first 2 funds have a very low duration, hence the

impact is minimal. However the short term bond fund could lose some value.

There is absolutely no need to panic you have a 30 months view, so there is a

good chance that the notional loss could be made up.

4. Intermediate bond fund (upto 6-7 years duration)

Funds with higher maturity! this is likely to give you a good return, but carry a

higher risk when interest rate changes.

5. Long bond fund (more than 8 years duration)

These funds invest in corporate bonds with longer duration. As India does not

RETIRE RICH

INVEST RS 40 A

DAY

List Price: Rs.399

Our Price: Rs.359

Tags

3 Years 10 Years Amp

asset allocation assets banks

Clue crores emi

Financial planner

financial planning fund

managers God hdfc

India inflation

insurance interest

rates invest Investing

Investments investor

Pages

Book written by me

Author

Categories

Attitude towards Money (137)

Attitude, Philosophy, Life and

God (107)

Banks and Banking (89)

Blessings and Messages (12)

Books and book review (39)

Budgeting (30)

Business Finance Learnings

(39)

Charity (32)

Children and Money (62)

Commodity (33)

Content of this Blog (29)

corporate governance (38)

Credit and borrowing (46)

Debt Markets simplified (74)

Doctors and Investing (27)

Economics (101)

Economy (96)

Education, Career, Sales (54)

Equity (269)

Ethics (61)

Financial education (354)

Financial Frauds (59)

Financial jokes (17)

Financial planner (77)

General Insurance (16)

Goal Setting (26)

Investing (260)

Investing Fables (20)

Investment Myths (69)

Life insurance (167)

Lifestyle and Philosophy (21)

Media (45)

Motivation (3)

Mutual funds (195)

National Pension Scheme (17)

Personal Finance (268)

Defence Personnel &

Finance (6)

Financial Advisor (73)

Smart Spending (17)

Philosophy and Parenting (6)

Politics (20)

Real Estate (78)

Regulator, Regulations (32)

Search...

All debt products..

http://www.subramoney.com/2014/02/all-debt-products/[2/5/2014 1:34:04 AM]

Share this:

have many instruments in this genresome portion of these funds go into GILT

Hdfc Income fund has about 50% in gilts! These funds are very safe from a

default point of view, BUT VERY RISKY from any adverse movement in the

interest rate in the country.

6. Gilt and Long tenure bonds

If you have a real long term view then you can look at gilt funds with say 15

years duration. This is the riskiest set of bond funds! However if interest rates go

down these funds will go up the maximum. For just a slight fall in interest rates

you could see a fantastic jump!

So a HNI has to build a portfolio with a little of all of this and hope to

dynamically be in the best combination at any point in time. Or he could be in a

Dynamic Bond fund..

Related Articles:

What is an IPO?

Doctors selling their practice? part 1

life insurance mis-selling

Pehredar mis-selling episode.

Post Footer automatically generated by Add Post Footer Plugin for wordpress.

This entry was posted on Tuesday, February 4th, 2014 at 4:53 am and is filed under

Uncategorized. You can follow any responses to this entry through the RSS 2.0 feed. You can

leave a response, or trackback from your own site.

7 Responses to All debt products..

B on February 4th, 2014 at 9:13 am

Agreed. but sir,,.if you compare historical long term returns liquid funds

have matched or only slightly underperformed(if not outpaced) returns by most

of the other riskier debt mf options.rate sensitive options average out over a

long timeso why not stay in liquid funds??? unless ofcourse you want to time

interest rate cycles for say few quarters

Anurag on February 4th, 2014 at 11:14 am

Floating Rate funds are also good options for medium term.

lakhs Life

insurance life

insurance companies life

insurance company

money mumbai

mutual fund

Mutual

funds Nbsp net

worth parents people

Personal Finance ppf

Real Estate Retirement

Risk salary sebi sensex

SIP term insurance

warren buffet

Retirement (94)

Rip off (21)

Risk (59)

Sales and Marketing (16)

Simplyfying Finance and

Investing (1)

Social attitudes (49)

Taxation (7)

Uncategorized (593)

XBRL (31)

Twitter LinkedIn Google Facebook

All debt products..

http://www.subramoney.com/2014/02/all-debt-products/[2/5/2014 1:34:04 AM]

Copyright Subramoney - Powered by WordPress

ProSense theme created by Dosh Dosh and The Wrong Advices.

ramprakash on February 4th, 2014 at 12:00 pm

Hi Subra

The CAPITAL GAINS you mention under liquid funds is in fact applicable for all

type of debt funds, but is only applicable if the holding period is atleast 1 year

and above. Else it will be considered as income under other heads and taxable at

individual tax slab rate.

Nitin on February 4th, 2014 at 12:01 pm

Sir

What about using Yes/Axis bank savings account (7% returns) as an alternative

to Liquid Funds?

Thanks

Nitin

mylearningcafe.blogspot.com

mymoneyrules.blogspot.com

Mohana Ganesh on February 4th, 2014 at 1:39 pm

Very informative. But this applies only to HINI. Correct me, if I am wrong.

Milind on February 4th, 2014 at 4:34 pm

Hi Subra ! Good Input for HNIS

subra on February 4th, 2014 at 6:07 pm

of course Mohana it applies to you also. You are a HNI.

Leave a Reply

Name (required)

Mail (will not be published) (required)

Website

Notify me of followup comments via e-mail

WP-SpamFree by Pole Position Marketing

Notify me of new posts by email.

Submit Comment

También podría gustarte

- The Exciting World of Indian Mutual FundsDe EverandThe Exciting World of Indian Mutual FundsCalificación: 5 de 5 estrellas5/5 (1)

- Capital Letter December 2012Documento6 páginasCapital Letter December 2012marketingAún no hay calificaciones

- Investing for Interest 18: The Magic of Money Market Funds: Financial Freedom, #223De EverandInvesting for Interest 18: The Magic of Money Market Funds: Financial Freedom, #223Aún no hay calificaciones

- Mutual FundDocumento4 páginasMutual FundRishel LisaoAún no hay calificaciones

- Introduction to Index Funds and ETF's - Passive Investing for BeginnersDe EverandIntroduction to Index Funds and ETF's - Passive Investing for BeginnersCalificación: 4.5 de 5 estrellas4.5/5 (7)

- Capital Letter May 2011Documento6 páginasCapital Letter May 2011marketingAún no hay calificaciones

- Direct Investment in Stocks Vs Investment in Mutual FundsDocumento5 páginasDirect Investment in Stocks Vs Investment in Mutual Fundssimha27Aún no hay calificaciones

- Definition of 'Debt Funds': What Is A Mutual Fund?Documento5 páginasDefinition of 'Debt Funds': What Is A Mutual Fund?Girish SahareAún no hay calificaciones

- Monthly IssueDocumento55 páginasMonthly IssueJeso P. JamesAún no hay calificaciones

- Capital Letter July 2011Documento5 páginasCapital Letter July 2011marketingAún no hay calificaciones

- Mutual Fund: IntroductionDocumento5 páginasMutual Fund: IntroductionHarish MalaviyaAún no hay calificaciones

- The Top 5 Best Performing Mutual Funds of India-: A) Liquid Money: (20% of Total)Documento5 páginasThe Top 5 Best Performing Mutual Funds of India-: A) Liquid Money: (20% of Total)Pravin ShindeAún no hay calificaciones

- The Story of Mr. Mutual FundDocumento50 páginasThe Story of Mr. Mutual Fundshah_rohit5272Aún no hay calificaciones

- Nvesting Verview: o o o o o oDocumento26 páginasNvesting Verview: o o o o o oranjanmodiAún no hay calificaciones

- 8 Interesting Ways To Make Your Savings Grow: BanksDocumento4 páginas8 Interesting Ways To Make Your Savings Grow: BanksJems HamalAún no hay calificaciones

- Good Guide:: What Is A Mutual Fund?Documento11 páginasGood Guide:: What Is A Mutual Fund?cjvinayanAún no hay calificaciones

- Aequitas InvestmentsDocumento5 páginasAequitas InvestmentsSantosh RoutAún no hay calificaciones

- Retirement Planning Month at Investment-Mantra - In: Best Pension Plans 1 Crore Life InsuranceDocumento6 páginasRetirement Planning Month at Investment-Mantra - In: Best Pension Plans 1 Crore Life InsuranceMansoor AhmedAún no hay calificaciones

- Mutual Funds: Jason FernandesDocumento12 páginasMutual Funds: Jason Fernandesjason_fernandes_2Aún no hay calificaciones

- Financial Investment OptionsDocumento8 páginasFinancial Investment OptionsIndu GuptaAún no hay calificaciones

- Letter From Cio Rajeev Thakkar Unitholders Meet 2023Documento13 páginasLetter From Cio Rajeev Thakkar Unitholders Meet 2023azuredevops1155Aún no hay calificaciones

- Different Types of Debt FundsDocumento3 páginasDifferent Types of Debt Fundsranjan sharmaAún no hay calificaciones

- AssignmentDocumento18 páginasAssignmentDrishti SrivatavaAún no hay calificaciones

- Performance Evaluation of Mutual Funds: Mutual Fund Is Better Investment PlanDocumento9 páginasPerformance Evaluation of Mutual Funds: Mutual Fund Is Better Investment PlanPritesh BhanushaliAún no hay calificaciones

- How Do I Buy The Units of A FundDocumento10 páginasHow Do I Buy The Units of A FundskmahapatroAún no hay calificaciones

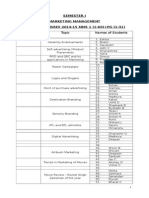

- Investment Management: Assignment-1Documento9 páginasInvestment Management: Assignment-1Nikita ParidaAún no hay calificaciones

- Best Time To Buy Stocks Is When You Don't Feel Like Buying'Documento7 páginasBest Time To Buy Stocks Is When You Don't Feel Like Buying'dhruvasomayajiAún no hay calificaciones

- Fidelity's: Top TipsDocumento24 páginasFidelity's: Top Tipsmandar LawandeAún no hay calificaciones

- Capital Letter September 2011Documento6 páginasCapital Letter September 2011marketingAún no hay calificaciones

- Fin O Pedia Issue 33 Sep2 Sep8Documento4 páginasFin O Pedia Issue 33 Sep2 Sep8CMDfromNagpurAún no hay calificaciones

- Understanding Mutual Funds in Five MinutesDocumento2 páginasUnderstanding Mutual Funds in Five MinutesNitesh AgarwalAún no hay calificaciones

- How To Build A Mutual Fund Portfolio: The Debt-Equity RatioDocumento10 páginasHow To Build A Mutual Fund Portfolio: The Debt-Equity Ratioparry5000Aún no hay calificaciones

- Axis BankDocumento4 páginasAxis BankAdarsh PatilAún no hay calificaciones

- Capital Letter December 2011Documento5 páginasCapital Letter December 2011marketingAún no hay calificaciones

- Debt Funds Simplified PDFDocumento28 páginasDebt Funds Simplified PDFsirusemippuAún no hay calificaciones

- 1.10 Advantages of Mutual Funds:: 1. DiversificationDocumento6 páginas1.10 Advantages of Mutual Funds:: 1. DiversificationSmartboy AmitAún no hay calificaciones

- Investment 101 - Mutual Fund BasicDocumento22 páginasInvestment 101 - Mutual Fund BasicR-Linn PerezAún no hay calificaciones

- Mera Funds Newsletter October 2022Documento11 páginasMera Funds Newsletter October 2022Prasanna ShenoyAún no hay calificaciones

- Questions and Answers Capital IQDocumento28 páginasQuestions and Answers Capital IQrishifiib08100% (1)

- Are Your Investments Losing Money? Here's HelpDocumento3 páginasAre Your Investments Losing Money? Here's HelpsarkctAún no hay calificaciones

- Mutual Funds E Book v2.5Documento50 páginasMutual Funds E Book v2.5Aarna FinAún no hay calificaciones

- Beginners Guide To Mutual Funds 2019 UnovestDocumento41 páginasBeginners Guide To Mutual Funds 2019 UnovestBDE HolisticAún no hay calificaciones

- Are Ulips or Insurance Linked Plan Worth An Investment?Documento2 páginasAre Ulips or Insurance Linked Plan Worth An Investment?Mithun JishnuAún no hay calificaciones

- Wealth ManagementDocumento144 páginasWealth ManagementVedant BhansaliAún no hay calificaciones

- Project Report On Mutual FundDocumento60 páginasProject Report On Mutual FundBaldeep KaurAún no hay calificaciones

- Money Market Mutual FundsDocumento4 páginasMoney Market Mutual FundsShreesh ChandraAún no hay calificaciones

- A Brief of How Mutual Funds WorkDocumento12 páginasA Brief of How Mutual Funds WorkAitham Anil KumarAún no hay calificaciones

- Think Fundsindia August UpdatedDocumento6 páginasThink Fundsindia August UpdatedAkshay PandeyAún no hay calificaciones

- Mutual FundDocumento85 páginasMutual FundAishwarya AwateAún no hay calificaciones

- Investment PlanDocumento8 páginasInvestment PlanSIMPAO, Ma. Kristine Mae C.Aún no hay calificaciones

- Low Risk InvestmentsDocumento6 páginasLow Risk Investmentsmyschool90Aún no hay calificaciones

- Financial Literacy Project - 1Documento16 páginasFinancial Literacy Project - 1Gracy GuptaAún no hay calificaciones

- Mint Money 1 For WEBDocumento17 páginasMint Money 1 For WEBRoshan KumarAún no hay calificaciones

- ChapterDocumento90 páginasChapterRavi SharmaAún no hay calificaciones

- What Is Mutual Fund?Documento42 páginasWhat Is Mutual Fund?Preity RajaniAún no hay calificaciones

- Babasaheb Bhimrao Ambedkar University: Karan Shukla 194120 B.B.A. 5 Managing Personal FinanceDocumento8 páginasBabasaheb Bhimrao Ambedkar University: Karan Shukla 194120 B.B.A. 5 Managing Personal FinanceShivani ShuklaAún no hay calificaciones

- Project 2 PDFDocumento20 páginasProject 2 PDFPrasad JoshiAún no hay calificaciones

- Arthigamya E-Brochure PDFDocumento12 páginasArthigamya E-Brochure PDFAbhinav AnandAún no hay calificaciones

- ELT122Documento72 páginasELT122JsmnvllaAún no hay calificaciones

- Sbi PDFDocumento10 páginasSbi PDFdisewazoAún no hay calificaciones

- Balaji Viswanathan's Answer To How Is It Possible That Only 3% of Indians Pay Income Tax - QuoraDocumento5 páginasBalaji Viswanathan's Answer To How Is It Possible That Only 3% of Indians Pay Income Tax - QuoraR. SinghAún no hay calificaciones

- Financials & Key RatiosDocumento1 páginaFinancials & Key RatiosR. SinghAún no hay calificaciones

- HTTP WWW - Prudenttrader.com PT-TripleSDocumento6 páginasHTTP WWW - Prudenttrader.com PT-TripleSR. SinghAún no hay calificaciones

- Safal Niveshak Mastermind BrochureDocumento3 páginasSafal Niveshak Mastermind BrochureR. SinghAún no hay calificaciones

- Duos (Amiduos)Documento13 páginasDuos (Amiduos)R. SinghAún no hay calificaciones

- Investor CurriculumDocumento22 páginasInvestor CurriculumR. SinghAún no hay calificaciones

- Rounding Off DecimalsDocumento3 páginasRounding Off DecimalsR. SinghAún no hay calificaciones

- Analysis of Indian Cement Industry & Financial Performance of ACC LTDDocumento1 páginaAnalysis of Indian Cement Industry & Financial Performance of ACC LTDR. SinghAún no hay calificaciones

- Funny Full Forms.........Documento7 páginasFunny Full Forms.........R. SinghAún no hay calificaciones

- SL - No Particulars Sessions 1 Session of 3 HoursDocumento1 páginaSL - No Particulars Sessions 1 Session of 3 HoursR. SinghAún no hay calificaciones

- Date of Presentation Topic Names of StudentsDocumento2 páginasDate of Presentation Topic Names of StudentsR. SinghAún no hay calificaciones

- Born To Serve .Documento3 páginasBorn To Serve .R. SinghAún no hay calificaciones

- PFC Equity Reportfor Upload-10th July 2012Documento31 páginasPFC Equity Reportfor Upload-10th July 2012R. SinghAún no hay calificaciones

- Bust A MumbaiDocumento28 páginasBust A MumbaiR. SinghAún no hay calificaciones

- This I BeleiveDocumento3 páginasThis I Beleiveapi-708902979Aún no hay calificaciones

- HLX 150Documento44 páginasHLX 150menendez2050100% (1)

- Essentials of Materials Science and Engineering Si Edition 3rd Edition Askeland Solutions ManualDocumento11 páginasEssentials of Materials Science and Engineering Si Edition 3rd Edition Askeland Solutions Manualjeffreyhayesagoisypdfm100% (13)

- Allama Iqbal Open University, Islamabad: (Secondary Teacher Education Department) WarningDocumento2 páginasAllama Iqbal Open University, Islamabad: (Secondary Teacher Education Department) WarningAiNa KhanAún no hay calificaciones

- E9d30c8 4837smartDocumento1 páginaE9d30c8 4837smartSantoshAún no hay calificaciones

- Answers & Solutions: For For For For For JEE (MAIN) - 2019 (Online) Phase-2Documento22 páginasAnswers & Solutions: For For For For For JEE (MAIN) - 2019 (Online) Phase-2Manila NandaAún no hay calificaciones

- How To Read Research PaperDocumento7 páginasHow To Read Research Papertuigauund100% (1)

- Mico - Hydraulic Power Brake Systems For ForkliftsDocumento4 páginasMico - Hydraulic Power Brake Systems For ForkliftsJenner Volnney Quispe Chata100% (1)

- Entrep Module 4 Q1 Week 4 1Documento14 páginasEntrep Module 4 Q1 Week 4 1VirplerryAún no hay calificaciones

- Projects & Operations: IN: NE Power Systm ImprvmDocumento5 páginasProjects & Operations: IN: NE Power Systm ImprvmGaurang PatelAún no hay calificaciones

- Talking SwedishDocumento32 páginasTalking Swedishdiana jimenezAún no hay calificaciones

- Installing Hyperledger Fabric and Composer: Ser/latest/installing/development-To Ols - HTMLDocumento13 páginasInstalling Hyperledger Fabric and Composer: Ser/latest/installing/development-To Ols - HTMLVidhi jainAún no hay calificaciones

- Enga10 Speaking Test3Documento2 páginasEnga10 Speaking Test3luana serraAún no hay calificaciones

- Detergent For Auto DishWashing Machine EDocumento5 páginasDetergent For Auto DishWashing Machine EkaltoumAún no hay calificaciones

- Comparative Genomics 2 - PART 1Documento31 páginasComparative Genomics 2 - PART 1NnleinomAún no hay calificaciones

- Project Proposal Environmental Protection Program-DeNRDocumento57 páginasProject Proposal Environmental Protection Program-DeNRLGU PadadaAún no hay calificaciones

- CodeDocumento47 páginasCodeNadia KhurshidAún no hay calificaciones

- Cornering Fatigue Test and Radial Fatigue Test On A Rim With Steps For A Mono-Tyre E-Vehicle Using Finite Element AnalysisDocumento8 páginasCornering Fatigue Test and Radial Fatigue Test On A Rim With Steps For A Mono-Tyre E-Vehicle Using Finite Element AnalysisGowtham KumarAún no hay calificaciones

- Infinity Tower, Dubai, UAEDocumento10 páginasInfinity Tower, Dubai, UAEryan rakhmat setiadiAún no hay calificaciones

- 1.4 Creating Graphic OrganizerDocumento1 página1.4 Creating Graphic OrganizerTrixie Roselle Y. MesiasAún no hay calificaciones

- Method Statement Free Download: How To Do Installation of Suspended False CeilingsDocumento3 páginasMethod Statement Free Download: How To Do Installation of Suspended False Ceilingsmozartjr22100% (1)

- Sample Invoice PDFDocumento3 páginasSample Invoice PDFMarcus OlivieraaAún no hay calificaciones

- Interview With Hohepa Mapiria Joseph - Joe - Murphy Royal Regent 7 July 2003Documento61 páginasInterview With Hohepa Mapiria Joseph - Joe - Murphy Royal Regent 7 July 2003kiwiit100% (8)

- Antibullying Presentation 1Documento23 páginasAntibullying Presentation 1Martin Ceazar HermocillaAún no hay calificaciones

- English ExercisesDocumento2 páginasEnglish ExercisesLiceth HuertasAún no hay calificaciones

- Demand, Elasticity of Demand and Demand ForecastingDocumento16 páginasDemand, Elasticity of Demand and Demand Forecastingankit thapliyal100% (1)

- The Lion and The Boar Story EnglishDocumento2 páginasThe Lion and The Boar Story EnglishKemal AmarullahAún no hay calificaciones

- Wavoo Wajeeha Women's College - Annual Report - 2013-14Documento29 páginasWavoo Wajeeha Women's College - Annual Report - 2013-14kayalonthewebAún no hay calificaciones

- Nocturne 2024Documento162 páginasNocturne 2024Peter JonesAún no hay calificaciones

- Business Advantage Pers Study Book Intermediate PDFDocumento98 páginasBusiness Advantage Pers Study Book Intermediate PDFCool Nigga100% (1)