Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Customs Tariff Notification No.22/2014 Dated 11th July, 2014

Cargado por

stephin k j0 calificaciones0% encontró este documento útil (0 votos)

20 vistas2 páginasCustoms Tariff Notification No.22/2014 "Seeks to amend notification No. 84/97-Customs, dated the 11th November, 1997 so as to allow transfer/sale/re-export goods imported prior to 1.3.2008 for use in projects financed by the UN or an international organization." Dated 11th July, 2014

Derechos de autor

© © All Rights Reserved

Formatos disponibles

PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCustoms Tariff Notification No.22/2014 "Seeks to amend notification No. 84/97-Customs, dated the 11th November, 1997 so as to allow transfer/sale/re-export goods imported prior to 1.3.2008 for use in projects financed by the UN or an international organization." Dated 11th July, 2014

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

20 vistas2 páginasCustoms Tariff Notification No.22/2014 Dated 11th July, 2014

Cargado por

stephin k jCustoms Tariff Notification No.22/2014 "Seeks to amend notification No. 84/97-Customs, dated the 11th November, 1997 so as to allow transfer/sale/re-export goods imported prior to 1.3.2008 for use in projects financed by the UN or an international organization." Dated 11th July, 2014

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

Está en la página 1de 2

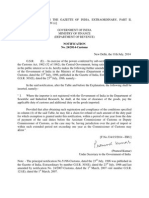

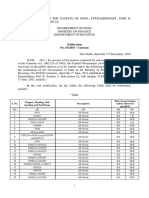

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II,

SECTION 3, SUB-SECTION (i)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

Notification

No. 22/2014-Customs

New Delhi, the 11th July, 2014

G.S.R. (E). - In exercise of the powers conferred by sub-section (1) of section 25 of the

Customs Act, 1962 (52 of 1962) read with sub-section (4) of section 68 of the Finance (No.2)

Act, 1996 (33 of 1996), the Central Government, being satisfied that it is necessary in the public

interest so to do, hereby makes the following further amendments in the notification of the

Government of India in the Ministry of Finance (Department of Revenue) No. 84/97-Customs,

dated the 11

th

November, 1997 which was published in the Gazette of India, Extraordinary, vide

G.S.R. 645 (E) dated the 11

th

November, 1997, namely: -

In the said notification, after the proviso, the following shall be inserted, namely:-

2. Where the goods are imported prior to the 1

st

March, 2008, the importer may-

(a) transfer the goods to a new project subject to the condition that the importer produces

before the Assistant Commissioner of Customs or Deputy Commissioner of Customs, as

the case may be, having jurisdiction over the port of import, a certificate from the officer

concerned of the Central Government, State Government or Union territory

Administration, as the case may be, that the goods are no longer required for the project

and a declaration from the United Nations, the World Bank, the Asian Development

Bank or any other international organization listed in the Annexure to the said

notification that the said goods are required for the said new project which has duly been

approved by the Government of India; or

(b) re-export the goods when the goods are no longer required for the existing project subject

to the condition that the identity of the goods is established and no export incentive is

claimed against such re-export; or

(c) pay the duty of customs which would have been payable but for the exemption contained

herein on the depreciated value of the goods subject to the condition that the importer

produces before the Assistant Commissioner of Customs or Deputy Commissioner of

Customs, as the case may be, having jurisdiction over the port of import, a certificate

from the officer concerned of the Central Government, State Government or Union

territory Administration, as the case may be, that the goods are no longer required for the

project. The depreciated value of the goods shall be equal to the original value of the

goods at the time of import reduced by the percentage points calculated by straight line

method as specified below for each quarter of a year or part thereof from the date of

clearance of the goods, namely:-

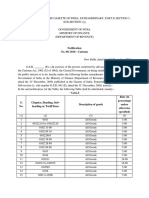

(i) for each quarter in the first year at the rate of 4 per cent;

(ii) for each quarter in the second year at the rate of 3 per cent;

(iii) for each quarter in the third year at the rate of 2.5 per cent; and

(iv) for each quarter in the fourth year and subsequent years at the rate of 2 per

cent,

subject to the maximum of 70%..

[F. No.334/15/2014-TRU]

(Pramod Kumar)

Under Secretary to the Government of India

Note.- The principal notification No. 84/97-Customs, dated the 11

th

November, 1997 was

published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number

G.S.R. 645(E) dated the 11

th

November, 1997 and last amended by notification No. 24/2008-

Customs, dated the 1

st

March, 2008, published in the Gazette of India, Extraordinary, Part II,

Section 3, Sub-section (i) vide number G.S.R. 123(E) dated the 1

st

March, 2008.

También podría gustarte

- 17th July - Gazette 2184.21 - EDocumento122 páginas17th July - Gazette 2184.21 - EShami MudunkotuwaAún no hay calificaciones

- Market Penetration of Maggie NoodelsDocumento10 páginasMarket Penetration of Maggie Noodelsapi-3765623100% (1)

- Jenis Transaksi (Type Transaction) : Lima Puluh Juta Lima Ribu Rupiah Pembayaran DP MobilDocumento2 páginasJenis Transaksi (Type Transaction) : Lima Puluh Juta Lima Ribu Rupiah Pembayaran DP MobilWilly TeguhAún no hay calificaciones

- SAP PM Tables and Related FieldsDocumento8 páginasSAP PM Tables and Related FieldsSunil PeddiAún no hay calificaciones

- VAT Transfer PostingDocumento1 páginaVAT Transfer PostingabbasxAún no hay calificaciones

- FEMA23RDocumento9 páginasFEMA23RDrawing & Dishbursing OfficerAún no hay calificaciones

- Notification No. 52/2011-Service Tax: ProvidedDocumento12 páginasNotification No. 52/2011-Service Tax: Providedsatish kumarAún no hay calificaciones

- 'RULE96Documento3 páginas'RULE96naren.invincible244Aún no hay calificaciones

- Short Title, Extent and Commencement.Documento13 páginasShort Title, Extent and Commencement.SagarAún no hay calificaciones

- cs24 2013Documento3 páginascs24 2013stephin k jAún no hay calificaciones

- 30th June - 2182-10 - EDocumento26 páginas30th June - 2182-10 - EShami MudunkotuwaAún no hay calificaciones

- 0 - Late Filing Charges 50000 & Should Not Exceed Duty Amount - csnt36-2018Documento3 páginas0 - Late Filing Charges 50000 & Should Not Exceed Duty Amount - csnt36-2018Aravind GovindarajaluAún no hay calificaciones

- Notification No. 32/97-Cus., Dated 1-4-1997 Jobbing-Export Order Goods Imported For Execution ofDocumento2 páginasNotification No. 32/97-Cus., Dated 1-4-1997 Jobbing-Export Order Goods Imported For Execution ofRavi ViswanadhaAún no hay calificaciones

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Documento5 páginasCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jAún no hay calificaciones

- Notfn 34-2021 CusDocumento2 páginasNotfn 34-2021 CusSri CharanAún no hay calificaciones

- Notification No. 11/2014-Customs (ADD)Documento3 páginasNotification No. 11/2014-Customs (ADD)stephin k jAún no hay calificaciones

- Central Goods and Services Tax (CGST) Rules, 2017 Part - A (Rules)Documento163 páginasCentral Goods and Services Tax (CGST) Rules, 2017 Part - A (Rules)Rakshit AgarwalAún no hay calificaciones

- Import Gatt DeclarationDocumento2 páginasImport Gatt Declarationishan guptaAún no hay calificaciones

- Notification On E Way Bill 27-2017Documento27 páginasNotification On E Way Bill 27-2017Suman AnandAún no hay calificaciones

- 18.07.2019 - CGST - Rules 2017 Part ADocumento159 páginas18.07.2019 - CGST - Rules 2017 Part AVeli RangeAún no hay calificaciones

- 2016 P T D 648Documento4 páginas2016 P T D 648haseeb AhsanAún no hay calificaciones

- CGST Rules, 2017Documento159 páginasCGST Rules, 2017Rahul RockzzAún no hay calificaciones

- Sro 327 PDFDocumento20 páginasSro 327 PDFOmer ToqirAún no hay calificaciones

- Notification No. 33 of 2012 Service TaxDocumento3 páginasNotification No. 33 of 2012 Service TaxAntyoday IndiaAún no hay calificaciones

- Y%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDocumento88 páginasY%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri Lankaharsha.dilan4320Aún no hay calificaciones

- Notification No. 41/2018-Customs (N.T.)Documento22 páginasNotification No. 41/2018-Customs (N.T.)ManikantaReddyAún no hay calificaciones

- Notification No. 84/97-Customs: Explanation. - For The Purposes of This NotificationDocumento2 páginasNotification No. 84/97-Customs: Explanation. - For The Purposes of This NotificationShrikant BudholiaAún no hay calificaciones

- Ce01 2019Documento4 páginasCe01 2019monuAún no hay calificaciones

- Government of India M1Nistrty of Finance Department of RevenueDocumento6 páginasGovernment of India M1Nistrty of Finance Department of Revenuepatelpratik1972Aún no hay calificaciones

- Circular 60Documento18 páginasCircular 60Mỹ Huỳnh Thị NgọcAún no hay calificaciones

- csnt07 2022Documento12 páginascsnt07 2022dharmaAún no hay calificaciones

- 30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Documento164 páginas30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Dost BhawanaAún no hay calificaciones

- GST Flyer Chapter25Documento9 páginasGST Flyer Chapter25S Radhakrishna BhandaryAún no hay calificaciones

- 01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Documento163 páginas01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)rdabliAún no hay calificaciones

- Notification 89 2023Documento1 páginaNotification 89 2023sarvagya.mishra448Aún no hay calificaciones

- Customs Tariff Notification No.24/2014 Dated 11th July, 2014Documento1 páginaCustoms Tariff Notification No.24/2014 Dated 11th July, 2014stephin k jAún no hay calificaciones

- Customs Tariff Notification No.20/2014 Dated 11th July, 2014Documento2 páginasCustoms Tariff Notification No.20/2014 Dated 11th July, 2014stephin k jAún no hay calificaciones

- ExportDocumento25 páginasExportBala VinayagamAún no hay calificaciones

- DGFT Notification No.08/2015-2020 Dated 4th June, 2015Documento5 páginasDGFT Notification No.08/2015-2020 Dated 4th June, 2015stephin k jAún no hay calificaciones

- Finance Department, Sachivalaya, Gandhinagar: NotificationDocumento59 páginasFinance Department, Sachivalaya, Gandhinagar: NotificationNaren VmdAún no hay calificaciones

- Central Sales Tax - Tamil Nadu - Rules 1957Documento13 páginasCentral Sales Tax - Tamil Nadu - Rules 1957omselvaAún no hay calificaciones

- Exports - Furnishing of Bond/Letter of Undertaking For Exports - ClarificationDocumento11 páginasExports - Furnishing of Bond/Letter of Undertaking For Exports - ClarificationRohan KulkarniAún no hay calificaciones

- GSTNTF55Documento7 páginasGSTNTF55JGVAún no hay calificaciones

- The Customs Tariff Act, 1975: EctionsDocumento1116 páginasThe Customs Tariff Act, 1975: EctionsAndrea RobinsonAún no hay calificaciones

- Chapter12 - VII - PDF Zero Rated SupplyDocumento3 páginasChapter12 - VII - PDF Zero Rated Supplyravi.pansuriya07Aún no hay calificaciones

- Finance Act 2023Documento105 páginasFinance Act 2023sgacrewariAún no hay calificaciones

- Notification No.108 of 95-Central ExciseDocumento5 páginasNotification No.108 of 95-Central ExciseSatyaRaoAún no hay calificaciones

- 201610251310532161FederalExciseAct2005updatedupto1 7 2016latestDocumento67 páginas201610251310532161FederalExciseAct2005updatedupto1 7 2016latesttylor32Aún no hay calificaciones

- Collection and Deduction of Tax at SourceDocumento64 páginasCollection and Deduction of Tax at SourceMohammad SaadAún no hay calificaciones

- GST ch2Documento8 páginasGST ch2Mahesh PawarAún no hay calificaciones

- Input Tax Credit 36. Documentary Requirements and Conditions For Claiming Input Tax Credit.Documento22 páginasInput Tax Credit 36. Documentary Requirements and Conditions For Claiming Input Tax Credit.KaranAún no hay calificaciones

- Budget SummaryDocumento23 páginasBudget SummaryAbdul Qayyum RazaAún no hay calificaciones

- CB Licence-Suspension-RenewalDocumento3 páginasCB Licence-Suspension-RenewalraviAún no hay calificaciones

- Notification 14Documento11 páginasNotification 14Amol MoreAún no hay calificaciones

- Notification No 15/2012Documento2 páginasNotification No 15/2012Ankit GuptaAún no hay calificaciones

- Decision 36.2008.Qd - BTC enDocumento2 páginasDecision 36.2008.Qd - BTC enPham Thuy TrangAún no hay calificaciones

- Imports and Exports (Control) Act, No. 1 of 1969: Mahinda RajapaksaDocumento45 páginasImports and Exports (Control) Act, No. 1 of 1969: Mahinda RajapaksaShami MudunkotuwaAún no hay calificaciones

- Module 6Documento19 páginasModule 6ASHISH SINGHAún no hay calificaciones

- TNVAT Act 2016Documento27 páginasTNVAT Act 2016Manjunath SubramaniamAún no hay calificaciones

- DTREDocumento15 páginasDTRESalman HamidAún no hay calificaciones

- India Carnet RulesDocumento4 páginasIndia Carnet RulesVinay PatilAún no hay calificaciones

- Customs Circular No.04/2015 Dated 9th February, 2016Documento5 páginasCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jAún no hay calificaciones

- Customs Circular No.03/2015 Dated 3rd February, 2016Documento4 páginasCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jAún no hay calificaciones

- Customs Circular No.05/2015 Dated 9th February, 2016Documento21 páginasCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jAún no hay calificaciones

- Customs Circular No. 25/2015 Dated 15th October, 2015Documento10 páginasCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jAún no hay calificaciones

- Customs Circular No. 20/2015 Dated 31st July 2015Documento15 páginasCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jAún no hay calificaciones

- Customs Circular No. 28/2015 Dated 23rd October, 2015Documento3 páginasCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jAún no hay calificaciones

- Customs Circular No. 27/2015 Dated 23rd October, 2015Documento13 páginasCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jAún no hay calificaciones

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Documento60 páginasCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jAún no hay calificaciones

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Documento2 páginasCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jAún no hay calificaciones

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Documento26 páginasCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jAún no hay calificaciones

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Documento22 páginasCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jAún no hay calificaciones

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Documento34 páginasCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Documento38 páginasCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jAún no hay calificaciones

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Documento5 páginasCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jAún no hay calificaciones

- DGFT Public Notice No.08/2015-2020 Dated 6th May, 2016Documento15 páginasDGFT Public Notice No.08/2015-2020 Dated 6th May, 2016stephin k jAún no hay calificaciones

- DGFT Public Notice No.10/2015-2020 Dated 18th May, 2016Documento1 páginaDGFT Public Notice No.10/2015-2020 Dated 18th May, 2016stephin k jAún no hay calificaciones

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Documento3 páginasCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jAún no hay calificaciones

- DGFT Public Notice No.64/2015-2020 Dated 17th March, 2015Documento3 páginasDGFT Public Notice No.64/2015-2020 Dated 17th March, 2015stephin k jAún no hay calificaciones

- BA5025-Logistics ManagementDocumento12 páginasBA5025-Logistics Managementjayasree.krishnan7785Aún no hay calificaciones

- Contoh CLDocumento1 páginaContoh CLsuciatyfaisalAún no hay calificaciones

- Chapter 2 Enterpise Structure & Global SettingsDocumento31 páginasChapter 2 Enterpise Structure & Global SettingsHasan Babu KothaAún no hay calificaciones

- List of HW Transporters May 2020 For PostingDocumento41 páginasList of HW Transporters May 2020 For Posting2020dlb121685Aún no hay calificaciones

- Musicroom BookingDocumento13 páginasMusicroom BookingDani Simón ColomarAún no hay calificaciones

- Company Profile EcaDocumento20 páginasCompany Profile EcaStephen Anderson100% (1)

- FEBRUARY 2020 Surplus Record Machinery & Equipment DirectoryDocumento717 páginasFEBRUARY 2020 Surplus Record Machinery & Equipment DirectorySurplus RecordAún no hay calificaciones

- Fyp ProjectDocumento5 páginasFyp ProjectUsman PashaAún no hay calificaciones

- P ChartDocumento21 páginasP ChartSumit Patil100% (1)

- 42 Master IndexDocumento734 páginas42 Master Indexapi-3702030Aún no hay calificaciones

- Chap 13 Quality AuditDocumento5 páginasChap 13 Quality AuditLili AnaAún no hay calificaciones

- Data ConverterDocumento37.849 páginasData ConvertermuralibhaiAún no hay calificaciones

- Rutgers Newark Course Schedule Spring 2018Documento2 páginasRutgers Newark Course Schedule Spring 2018abdulrehman786Aún no hay calificaciones

- BesorDocumento3 páginasBesorPaul Jures DulfoAún no hay calificaciones

- RTHD L3gxiktDocumento2 páginasRTHD L3gxiktRobin RahmanAún no hay calificaciones

- Tara Machines BrochureDocumento8 páginasTara Machines BrochureBaba Jee Shiva ShankarAún no hay calificaciones

- Dip Project ManagementDocumento112 páginasDip Project Managementthe_gov100% (1)

- PDFDocumento17 páginasPDFRAJAT DUBEYAún no hay calificaciones

- Chapter 8 - Notes - Part 2Documento7 páginasChapter 8 - Notes - Part 2Xiena100% (1)

- LA Metro - 608Documento4 páginasLA Metro - 608cartographicaAún no hay calificaciones

- Written Notice of Regular MeetingsDocumento6 páginasWritten Notice of Regular MeetingsLaBron JamesAún no hay calificaciones

- Webinar Manajemen Keuangan PerusahaanDocumento69 páginasWebinar Manajemen Keuangan PerusahaanDias CandrikaAún no hay calificaciones

- Question Paper Brand ManagementDocumento2 páginasQuestion Paper Brand ManagementJunaitha parveenAún no hay calificaciones

- Reichard Maschinen, GMBH: Nonnal MaintenanceDocumento4 páginasReichard Maschinen, GMBH: Nonnal MaintenanceJayanthi HeeranandaniAún no hay calificaciones

- Check-In Process at Lisbon Airport PDFDocumento120 páginasCheck-In Process at Lisbon Airport PDFfreeflyairAún no hay calificaciones

- Address Doctor in IDQDocumento4 páginasAddress Doctor in IDQravi_405Aún no hay calificaciones