Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Joan Robinson, The Production Function and The Theory of Capital

Cargado por

didoltanevTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Joan Robinson, The Production Function and The Theory of Capital

Cargado por

didoltanevCopyright:

Formatos disponibles

T h e Production Function a nd th e T h e ory

of C a p ita l

INT RODUC T ION

T h e domina nce in ne o-cl a ssica l e conomic te a ch ing of th e conce p t of a p roduction

f unction, in wh ich th e re l a tive p rice s of th e f a ctors of p roduction a re e xh ibite d a s a

f unction of th e ra tio in wh ich th e y a re e mp l oy e d in a give n sta te of te ch nica l know-

l e dge , h a s h a d a n e ne rva ting e f f e ct up on th e de ve l op me nt of th e subje ct, f or by con-

ce ntra ting up on th e que stion of th e p rop ortions of f a ctors it h a s distra cte d a tte ntion

f rom th e more dif f icul t but more re wa rding que stions of th e inf l ue nce s gove rning th e

sup p l ie s of th e f a ctors a nd of th e ca use s a nd conse que nce s of ch a nge s in te ch nica l

knowl e dge .

More ove r, th e p roduction f unction h a s be e n a p owe rf ul instrume nt of mis-

e duca tion. T h e stude nt of e conomic th e ory is ta ugh t to write 0 f

f

(L, C ) wh e re L is

a qua ntity of l a bour, C a qua ntity of ca p ita l a nd 0 a ra te of outp ut of commoditie s.'

He is instructe d to a ssume a l l worke rs a l ike , a nd to me a sure L in ma n-h ours of

l a bour;

h e is tol d some th ing a bout th e inde x-numbe r p robl e m invol ve d in ch oosing a unit of

outp ut ; a nd th e n h e is h urrie d on to th e ne xt que stion, in th e h op e th a t h e wil l f orge t

to a sk in wh a t units C is me a sure d. Be f ore e ve r h e doe s a sk, h e h a s be come a p rof e ssor,

a nd so sl op p y h a bits of th ough t a re h a nde d on f rom one ge ne ra tion to th e ne xt.

T h e que stion is ce rta inl y not a n e a sy one to a nswe r. T h e ca p ita l in e xiste nce a t

a ny mome nt ma y be tre a te d simp l y a s " p a rt of th e e nvironme nt in wh ich l a bour

works."2 We th e n h a ve a p roduction f unction in te rms of l a bour a l one . T h is is th e

righ t p roce dure f or th e sh ort p e riod with in wh ich th e sup p l y of concre te ca p ita l goods

doe s not a l te r, but outside th e sh ort p e riod it is a ve ry we a k l ine to ta ke , f or it me a ns

th a t we ca nnot distinguish a ch a nge in th e stock of ca p ita l (wh ich ca n be ma de ove r

th e l ong run by a ccumul a tion) f rom a ch a nge in th e we a th e r (a n a ct of God).

We ma y l ook up on a stock of ca p ita l a s th e sp e cif ic l ist of a l l th e goods in e xiste nce

a t a ny mome nt (incl uding work-in-p rogre ss in th e p ip e l ine s of p roduction). But

th is a ga in is of no use outside th e strict bounds of th e sh ort p e riod, f or a ny ch a nge in

th e ra tio of ca p ita l to l a bour invol ve s a re -orga nisa tion of me th ods of p roduction a nd

re quire s a ch a nge in th e sh a p e s, size s a nd sp e cif ica tions of ma ny or a l l th e goods

a p p e a ring in th e origina l l ist. 3

As soon a s we l e a ve th e sh ort p e riod, h owe ve r, a h ost of dif f icul tie s a p p e a r. Sh oul d

ca p ita l be va l ue d a ccording to its f uture e a rning p owe r or its p a st costs ?

Wh e n we know th e f uture e xp e cte d ra te of outp ut a ssocia te d with a ce rta in

ca p ita l good, a nd e xp e cte d f uture p rice s a nd costs, th e n, if we a re give n a ra te of inte re st,

we ca n va l ue th e ca p ita l good a s a discounte d stre a m of f uture p rof it wh ich it wil l

e a rn. But to do so, we h a ve to be gin by ta king th e ra te of inte re st a s give n, wh e re a s

th e ma in p urp ose of th e p roduction f unction is to sh ow h ow wa ge s a nd th e ra te of

inte re st (re ga rde d a s th e wa ge s of ca p ita l ) a re de te rmine d by te ch nica l conditions a nd

th e f a ctor ra tio.

i

T h rough out th is e ssa y we sh a l l be a bstra cting f rom l a nd a s a f a ctor of p roduction, so we wil l not

both e r th e stude nt with it.

2

Ke y ne s, Ge ne ra l T h e ory , p . 2 I 4

.

8 In Prof e ssor Robe rtson's e xa mp l e , wh e n a te nth ma n joins nine wh o a re digging

a

h ol e , nine more

e xp e nsive sp a de s a re turne d into nine ch e a p e r sp a de s a nd a bucke t to f e tch be e r. (Economic Fra gme nts,

P. 47-)

8I

Joan Robinson,

Review of Economic Studies, 21(2), 1953-1954, pp. 81-106

82 T HE REVIEW OF EC ONOMIC ST UDIES

Are we th e n to va l ue ca p ita l goods by th e ir cost of p roduction ? C l e a rl y mone y

cost of p roduction is ne ith e r h e re nor th e re unl e ss we ca n sp e cif y th e p urch a sing p owe r

of mone y , but we ma y cost th e ca p ita l goods in te rms of wa ge units, th a t is, in e f f e ct, to

me a sure th e ir cost in te rms of a unit of sta nda rd l a bour.

T o tre a t ca p ita l a s a qua ntity of l a bour time e xp e nde d in th e p a st is conge nia l to

th e p roduction-f unction p oint of vie w,

f or it corre sp onds to th e e sse ntia l na ture of

ca p ita l re ga rde d a s a f a ctor of p roduction. Inve stme nt consists, in e sse nce , in e mp l oy -

ing l a bour now in a wa y wh ich wil l y ie l d its f ruits in th e f uture wh il e sa ving is ma king

curre nt p roducts a va il a bl e f or th e worke rs to consume in th e me a ntime ; a nd th e

p roductive ne ss of ca p ita l consists in th e f a ct th a t a unit of l a bour th a t wa s e xp e nde d

a t a ce rta in time in th e p a st is more va l ua bl e to-da y th a n a unit e xp e nde d to-da y ,

be ca use its f ruits a re a l re a dy rip e .

But h e re we e ncounte r a f unda me nta l dif f icul ty wh ich l ie s a t th e root of th e wh ol e

p robl e m of ca p ita l . A unit of l a bour is ne ve r e xp e nde d in a p ure f orm. Al l work is

done with th e a ssista nce of goods of some kind or a noth e r. Wh e n Ada m de l ve d a nd

Eve sp a n th e re we re e vide ntl y a sp a de a nd a sp indl e a l re a dy in e xiste nce . T h e cost

of ca p ita l incl ude s th e cost of ca p ita l goods, a nd since th e y must be constructe d be f ore

th e y ca n be use d, p a rt of th e cost of ca p ita l is inte re st ove r th e p e riod of time be twe e n

th e mome nt wh e n work wa s done in constructing ca p ita l goods a nd th e time wh e n

th e y a re p roducing a stre a m of outp ut. T h is is not just a conse que nce of ca p ita l ism,

f or e qua l l y in a socia l ist socie ty a unit of l a bour, e xp e nde d to-da y , wh ich wil l y ie l d a

p roduct in f ive y e a rs' time , is not th e sa me th ing a s a unit wh ich wil l y ie l d a p roduct

to-morrow.

Fina l l y , e ve n if it we re p ossibl e to me a sure ca p ita l simp l y in te rms of l a bour

time , we stil l sh oul d not h a ve a nswe re d th e que stion: of wh a t units is C comp ose d ?

Wh e n we a re discussing a ccumul a tion, it is na tura l to th ink of ca p ita l a s me a sure d in

te rms of p roduct. T h e p roce ss of a ccumul a tion consists in re f ra ining f rom consuming

curre nt outp ut in orde r to a dd to th e stock of we a l th . But wh e n we conside r wh a t a ddi-

tion to p roductive re source s a give n a mount of a ccumul a tion ma ke s, we must me a sure

ca p ita l in l a bour units, f or th e a ddition to th e stock of p roductive e quip me nt ma de by

a dding a n incre me nt of ca p ita l de p e nds up on h ow much work is done in constructing

it, not up on th e cost, in te rms of f ina l p roduct, of a n h our's l a bour. T h us, a s we move

f rom one p oint on a p roduction f unction to a noth e r, me a suring ca p ita l in te rms of

p roduct, we h a ve to know th e p roduct-wa ge ra te in orde r to se e th e e f f e ct up on p ro-

duction of ch a nging th e ra tio of ca p ita l to l a bour. Or if we me a sure in l a bour units,

we h a ve to know th e p roduct-wa ge in orde r to se e h ow much a ccumul a tion woul d be

re quire d to p roduce a give n incre me nt of ca p ita l . But th e wa ge ra te a l te rs with th e

ra tio of th e f a ctors : one sy mbol , C , ca nnot sta nd both f or a qua ntity of p roduct a nd

a qua ntity of l a bour time .

Al l th e sa me , th e p robl e m wh ich th e p roduction f unction p rof e sse s to a na l y se ,

a l th ough it h a s be e n too much p uf f e d up by th e a tte ntion p a id to it, is a ge nuine

p robl e m. T o-da y , in country Al p h a , a l e ngth of roa dwa y is be ing cl e a re d by a f e w

me n with bul l doze rs ; in Be ta a roa d (of ne a r-e nough th e sa me qua l ity ) is be ing ma de

by some h undre ds of me n with p icks a nd ox-ca rts. In Ga mma th ousa nds of me n a re

working with woode n sh ove l s a nd l ittl e ba ske ts to re move th e soil . Wh e n a l l p ossibl e

a l l owa nce s h a ve be e n ma de f or dif f e re nce s in na tiona l ch a ra cte r a nd cl ima te , a nd f or

dif f e re nce s in th e sta te of knowl e dge , it se e ms p re tty cl e a r th a t th e ma in re a son f or

th is sta te of a f f a irs is th a t ca p ita l in some se nse is more p l e ntif ul in Al p h a th a n in

Ga mma . Looke d a t f rom th e p oint

of vie w of a n individua l ca p ita l ist, it woul d not

p a y to use Al p h a me th ods in Ga mma (e ve n if unl imite d f ina nce we re a va il a bl e ) a t th e

ra te of inte re st wh ich is rul ing, a nd l ooke d a t f rom th e p oint of vie w of socie ty , it

T HE PRODUC T ION FUNC T ION AND T HE T HEORY OF C APIT AL 83

woul d ne e d a p rodigious e f f ort of a ccumul a tion to ra ise a l l th e l a bour a va il a bl e in

Ga mma e ve n to th e Be ta l e ve l of te ch nique . T h e p robl e m is a re a l one . We ca nnot

a ba ndon th e p roduction f unction with out a n e f f ort to re scue th e e l e me nt of common-

se nse th a t h a s be e n e nta ngl e d in it.

T HE QUANT IT Y OF C APIT AL

"C a p ita l " is not wh a t ca p ita l is ca l l e d, it is wh a t its na me is ca l l e d. T h e ca p ita l

goods in e xiste nce a t a mome nt of time a re a l l th e goods in e xiste nce a t th a t mome nt.

It is not a l l th e th ings in e xiste nce . It incl ude s ne ith e r a rubbish h e a p nor Mont Bl a nc.

T h e ch a ra cte ristic by wh ich " goods " a re sp e cif ie d is th a t th e y h a ve va l ue , th a t is

p urch a sing p owe r ove r e a ch oth e r. T h us, in country Al p h a a n e mp ty p e trol tin is not a

"

good," wh e re a s in Ga mma wh e re ol d tins a re a source of va l ua bl e industria l ra w

ma te ria l , it is.

T h e l ist of goods is quite sp e cif ic. It is so ma ny a ctua l p a rticul a r obje cts, ca l l e d

bl a st f urna ce s, ove rcoa ts,

e tc., e tc. Goods group e d unde r th e sa me na me dif f e r f rom

e a ch oth e r in th e de ta il s of th e ir p h y sica l sp e cif ica tions a nd th e se must not be ove r-

l ooke d. Dif f e re nce s in th e ir a ge s a re a l so imp orta nt. A bl a st f urna ce twe nty y e a rs

ol d is not e quiva l e nt to a bra nd ne w one of th e sa me sp e cif ica tion in oth e r re sp e cts,

nor is a n e gg twe nty da y s ol d e quiva l e nt to a bra nd ne w one . T h e re is a noth e r re l e va nt

ch a ra cte ristic of th e goods. An ove rcoa t re quire s one body to we a r it, a nd a n e gg one

mouth to e a t it. With out one body , or one mouth , th e y a re use l e ss, a nd two bodie s or

mouth s (a t a give n mome nt of time ) ca nnot sh a re in using th e m. But a bl a st f urna ce

ca n be use d by a ce rta in ra nge of numbe rs of bodie s to turn iron ore into iron. T h e re f ore

th e de scrip tion of a bl a st f urna ce incl ude s a n a ccount of its ra te of outp ut a s a f unction

of th e numbe r of bodie s op e ra ting it. (Since we sh a l l not discuss sh ort-p e riod p robl e ms,

th e numbe r of bodie s a ctua l l y working e a ch p ie ce of e quip me nt, in th e situa tions with

wh ich we sh a l l be conce rne d, is th e numbe r wh ich is te ch nica l l y most a p p rop ria te to it.)

T h e re is a noth e r a sp e ct of th e goods wh ich is quite dif f e re nt. Of two ove rcoa ts,

comp l e te l y simil a r in a l l th e a bove re sp e cts, one is on th e body of Mrs. Jone s, wh o is

p urring with inwa rd de l igh t a t h e r f ine a p p e a ra nce . Anoth e r is on th e body of Mrs.

Snooks, wh o is grizzl ing be ca use , h e r h usba nd's income be ing wh a t it is, sh e is obl ige d

to buy ma ss-p roduce d cl oth e s. In wh a t f ol l ows we sh a l l not discuss th is a sp e ct of

goods a t a l l . We ta ke it th a t a n ove rcoa t (Ma rk IV) is a n ove rcoa t (Ma rk IV), a nd

no nonse nse .

Now, th is e normous wh o's wh o of individua l goods is not a th ing wh a t we ca n

h a ndl e a t a l l e a sil y . T o e xp re ss it a s a qua a ntity of goods we h a ve to e va l ua te th e ite ms

of wh ich it is comp ose d. We ca n e va l ua te th e goods in te rms of th e re a l cost of p ro-

ducing th e m-th a t is, th e work a nd th e f orme rl y e xisting goods re quire d to ma ke

th e m, or in te rms of th e ir va l ue e xp re sse d in some unit of p urch a sing p owe r, or we ca n

e va l ua te th e m a ccording to th e ir p roductivity -th a t is, wh a t th e stock of goods wil l

be come in th e f uture if work is done in conjunction with it.

In a p osition of e quil ibrium a l l th re e e va l ua tions y ie l d e quiva l e nt re sul ts ; th e re

is a qua ntity wh ich ca n be tra nsl a te d f rom one numbe r to a noth e r by ch a nging th e

unit. T h is is th e de f inition of e quil ibrium. It e nta il s th a t th e re h a ve be e n no e ve nts

ove r th e re l e va nt p e riod of p a st time wh ich h a ve disturbe d th e re l a tion be twe e n th e

va rious va l ua tions of a give n stock of goods, a nd th a t th e h uma n be ings in th e situa tion

a re e xp e cting th e f uture to be just l ike th e p a st-e ntire l y de void of such disturbing

e ve nts. T h e n th e ra te of p rof it rul ing to-da y is th e ra te wh ich wa s e xp e cte d to rul e

to-da y wh e n th e de cision to inve st in a ny ca p ita l good now e xta nt wa s ma de , a nd th e

e xp e cte d f uture re ce ip ts, ca p ita l ise d a t th e curre nt ra te of p rof it, a re e qua l to th e

cost of th e ca p ita l goods wh ich a re e xp e cte d to p roduce th e m.

84 T HE REVIEW OF EC ONOMIC ST UDIES

Wh e n a n une xp e cte d e ve nt occurs, th e th re e wa y s of e va l ua ting th e stock of goods

p a rt comp a ny a nd no a mount of juggl ing with units wil l bring th e m toge th e r a ga in.

We a re a ccustome d to ta l k of th e ra te of p rof it on ca p ita l e a rne d by a busine ss a s

th ough p rof its a nd ca p ita l we re both sums of mone y . C a p ita l wh e n it consists of a s

y e t uninve ste d f ina nce is a sum of mone y , a nd th e ne t re ce ip ts of a busine ss a re sums

of mone y . But th e two ne ve r co-e xist in time . Wh il e th e ca p ita l is a sum of mone y ,

th e p rof its a re not y e t be ing e a rne d. Wh e n th e p rof its (qua si-re nts) a re be ing e a rne d,

th e ca p ita l h a s ce a se d to be mone y a nd be come a p l a nt. Al l sorts of th ings ma y h a p p e n

wh ich ca use th e va l ue of th e p l a nt to dive rge f rom its origina l cost. Wh e n a n e ve nt

h a s occurre d, sa y , a f a l l in p rice s, wh ich wa s not f ore se e n wh e n inve stme nt in th e p l a nt

wa s ma de , h ow do we re ga rd th e ca p ita l re p re se nte d by th e p l a nt ?

T h e ma n of de e ds, wh o h a s de cisions to ma ke , is conside ring h ow f uture p rosp e cts

h a ve a l te re d. He is conce rne d with ne w f ina nce or a ccrue d a mortisa tion f unds, wh ich

h e must de cide h ow to use . He ca nnot do a ny th ing a bout th e p l a nt (unl e ss th e

situa tion is so de sp e ra te th a t h e de cide s to scra p it). He is not p a rticul a rl y inte re ste d

(e xce p t wh e n h e h a s to ma ke out a ca se be f ore a Roy a l C ommission) in h ow th e ma n

of words, wh o is me a suring ca p ita l , ch oose s to va l ue th e p l a nt.'

T h e ma n of words h a s a wide ch oice of p ossibl e me th ods of e va l ua tion but none

of th e m is ve ry sa tisf a ctory . First, ca p ita l ma y be conce ive d of a s consisting e ith e r in

th e cost or in th e va l ue of th e p l a nt. If cost is th e me a sure , sh oul d mone y cost a ctua l l y

incurre d be re ckone d ? It is onl y of h istorica l inte re st, f or th e p urch a sing p owe r of

mone y h a s since ch a nge d. Is th e mone y cost to be de f l a te d ? T h e n by wh a t inde x ?

Or is ca p ita l to be me a sure d a t curre nt re p l a ce me nt cost ? T h e situa tion ma y be such

th a t no one in h is se nse s woul d buil d a p l a nt l ike th is one if h e we re to buil d now.

Re p l a ce me nt cost ma y be p ure l y a ca de mic. But e ve n if th e p l a nt is, in f a ct, due to be

re p l a ce d by a re p l ica of itse l f a t some f uture da te , we stil l h a ve to a sk wh a t p rop ort-ion

of th e va l ue of a bra nd ne w p l a nt is re p re se nte d by th is e l de rl y p l a nt? And th e

a nswe r to th a t que stion invol ve s f uture e a rnings, not cost a l one .

If th e ca p ita l is to be me a sure d by va l ue , h ow de cide wh a t th e p re se nt va l ue of

th e p l a nt is ? T h e p rice a t wh ich it coul d be sol d a s a n inte gra l wh ol e h a s not much

signif ica nce , a s th e ma rke t f or such tra nsa ctions is na rrow. T o ta ke its p rice on th e

Stock Exch a nge (if it is quote d) is to go be f ore a tribuna l wh ose cre de ntia l s a re dubious.

If th e ca p ita l -me a sure r ma ke s h is own judgme nt, h e ta ke s wh a t h e re ga rds a s l ike l y

to be th e f uture e a rnings of th e p l a nt a nd discounts th e m a t wh a t h e re ga rds a s th e

righ t ra te of inte re st f or th e p urp ose , th us triump h a ntl y sh owing th a t th e most

p roba bl e ra te of p rof it on th e ca p ita l inve ste d in th e p l a nt is e qua l to th e most a p p ro-

p ria te ra te of inte re st.

Al l th e se p uzzl e s a rise be ca use th e re is a ga p in time be twe e n inve sting mone y

ca p ita l a nd re ce iving mone y p rof its, a nd in th a t ga p e ve nts ma y occur wh ich a l te r

th e va l ue of mone y .

T o a bstra ct f rom unce rta inty me a ns to p ostul a te th a t no such e ve nts occur, so

th a t th e e x a nte e xp e cta tions wh ich gove rn th e a ctions of th e ma n of de e ds a re ne ve r

out of ge a r with th e e x p ost e xp e rie nce wh ich gove rns th e p ronounce me nts of th e ma n

of words, a nd to sa y th a t e quil ibrium obta ins is to sa y th a t no such e ve nts h a ve

occurre d f or some time , or a re th ough t l ia bl e to occur in th e f uture .

T h e a mbiguity of th e conce p tion of a qua ntity of ca p ita l is conne cte d with a

p rof ound me th odol ogica l e rror, wh ich ma ke s th e ma jor p a rt of ne o-cl a ssica l doctrine

sp urious.

I

A ma n of words but not of de e ds

Is l ike a ga rde nf ul l of we e ds."

T h is is sa dl y true of th e th e ory of ca p ita l .

T HE PRODUC T ION FUNC T ION AND T HE T HEORY OF C APIT AL 85

T h e ne o-cl a ssica l e conomist th inks of a p osition of e quil ibrium a s a p osition

towa rds wh ich a n e conomy is te nding to move a s time goe s -by . But it is imp ossibl e f or

a sy ste m to ge t into a p osition of e quil ibrium, f or th e ve ry na ture of e quil ibrium is

th a t th e sy ste m is a l re a dy in it, a nd h a s be e n in it f or a ce rta in l e ngth of p a st time .

T ime is unl ike sp a ce in two ve ry striking re sp e cts. In sp a ce , bodie s moving f rom

A to B ma y p a ss bodie s moving f rom B to A, but in time th e stricte st p ossibl e rul e of

one -wa y tra f f ic is a l wa y s in f orce . And in sp a ce th e dista nce f rom A to B is of th e

sa me orde r of ma gnitude (wh a te ve r a l l owa nce y ou l ike to ma ke f or th e T ra de Winds)

a s th e dista nce f rom B to A ; but in time th e dista nce f rom to-da y to to-morrow is

twe nty -f our h ours, wh il e th e dista nce f rom to-da y to y e ste rda y is inf inite , a s th e

p oe ts h a ve of te n re ma rke d. T h e re f ore a sp a ce me ta p h or a p p l ie d to time is a ve ry

tricky knif e to h a ndl e , a nd th e conce p t of e quil ibrium of te n cuts th e a rm th a t wie l ds it.

Wh e n a n e ve nt h a s occurre d we a re th rown ba ck up on th e wh o's wh o of goods in

e xiste nce , -a nd th e " qua ntity of ca p ita l " ce a se s to h a ve a ny oth e r me a ning. T h e n

onl y th a t p a rt of th e th e ory of va l ue wh ich tre a ts of th e sh ort p e riod, in wh ich th e

p h y sica l stock of ca p ita l e quip me nt is give n, h a s a ny a p p l ica tion.

Ne ve rth e l e ss, some of th e inte rna l re l a tions be twe e n th e p a rts of a sy ste m ca n

be most e a sil y th ough t a bout by ima gining it to be in e quil ibrium, a nd a n e xa mina tion

of th e se re l a tions is use f ul , p rovide d th a t it is conducte d with due re ga rd to its l imita -

tions.

In wh a t f ol l ows we a re conce rne d with such inte rna l re l a tions, sh own by th e

p rop e rtie s of a n e quil ibrium situa tion-in p a rticul a r with th e inte rre l a tions be twe e n

th re e of its p rop e rtie s-th e qua ntity of ca p ita l , th e l a bour f orce , a nd th e sta te of

te ch nica l knowl e dge .

ASSUMPT IONS AND DEFINIT IONS

We must ma ke ce rta in dra stic a ssump tions in orde r to isol a te our p robl e m.

I

(I) La bour is p e rf e ctl y h omoge ne ous. Al l me n a re a l ike , a nd e a ch (wh e n e mp l oy e d)

p e rf orms a re gul a r numbe r of h ours' work ove r a y e a r.

(2) La nd, incl uding a l l non-p roduce d. me a ns of p roduction, is h omoge ne ous.

T h is invol ve s th a t th e re a re no sp e cia l ise d f a ctors of p roduction such a s p a rticul a r

kinds of soil or mine ra l de p osits, a nd no inf l ue nce of ge ogra p h y up on p roduction.

(3) Al l h ouse h ol ds consume commoditie s in th e sa me p rop ortions, irre sp e ctive of

ch a nge s in th e ir re l a tive p rice s ; dif f e re nce s in a ve ra ge income p e r h e a d a nd in th e

distribution of income be twe e n individua l s h a ve no e f f e ct up on th e comp osition of

de ma nd f or f ina l outp ut. We ca n th e n me a sure outp ut simp l y in units of a comp osite

commodity , re p re se nting e a ch good in th e p rop ortion in wh ich it is be ing p roduce d.

In so f a r a s ne t inve stme nt is going on, ca p ita l goods a re re p re se nte d

in th e unit of

f ina l outp ut.'

(4)

T h e re a re no e conomie s or dise conomie s of sca l e f or outp ut a s a wh ol e or f or

p a rticul a r commoditie s.

I ca l l th e se a ssump tions th e trick a ssump tions, be ca use th e y a re onl y a sca re crow

to ke e p th e inde x numbe r birds of f our f ie l ds until a f te r th e h a rve st.

T h e re is a ce rta ina wkwa rdne ss in a ssuming th a t th e p rop ortionof ne t inve stme nt in tota l income is

inde p e nde ntof th e distributionof income , but th is dif f icul ty doe s not imp inge up onth e que stions th a t we

h a ve to discuss.

86 T HE REVIEW OF EC ONOMIC ST UDIES

II

T h e a rgume nt is conf ine d to a two-f a ctor e conomy , a nd a two-cl a ss socie ty .

(i) T o isol a te th e p robl e m of ca p ita l we a bstra ct f rom l a nd a nd a l l non-p roduce d

me a ns of p roduction. T h e " f re e gif ts of na ture " a re comp l e te l y f re e , p l e ntif ul a nd

una p p rop ria te d. Sp a ce a nd a ir a re ne ce ssa ry to p roduction, but ne ith e r comma nds

a p rice .

(2) We rul e out a sse ts, such a s th e goodwil l of a busine ss, wh ich a re we a l th to a n

individua l but not to socie ty ; we me a n by ca p ita l p h y sica l p roductive re source s,

wh ich woul d h a ve th e sa me signif ica nce in a n a rtiza n, a ca p ita l ist a nd a socia l ist

e conomy .

(3)

T o e l imina te th e inf l ue nce of th e e ntre p re ne ur, we a ssume th a t e conomie s of

sca l e inte rna l to a p roductive unit a re e xh a uste d, in e a ch l ine of p roduction, a t a

mode ra te ra te of outp ut, a nd th a t a n e xp e rie nce d e ntre p re ne ur h a s no a dva nta ge

ove r a ne w h a nd. T h e know-h ow of p roduction is wide l y dif f use d a nd dif f e re nce s in

skil l of ma na ge me nt a re unimp orta nt. T h e onl y qua l if ica tion re quire d f or e mp l oy ing

l a bour is th e n th e owne rsh ip of suf f icie nt ca p ita l (or comma nd of suf f icie nt cre dit) to

se t up a p roductive unit of th e minimum size . (T h e a ssump tion of no e conomie s of

sca l e ( I, 2 ) a p p e a rs h e re a s we l l a s in th e sca re crow.) In th e se conditions, th e distinction

be twe e n inte re st a nd p rof it ce a se s to be signif ica nt. T h e re is no sp e cif ic " re wa rd of

e nte rp rise " a p a rt f rom th e re wa rd of owning ca p ita l , a nd no owne r of ca p ita l wil l

p rovide f ina nce f or a n e ntre p re ne ur a t a p p re cia bl y l e ss th a n th e ra te of p rof it wh ich

h e ca n e xp e ct to obta in by using h is ca p ita l h imse l f to e mp l oy l a bour. T h us in our

sy ste m, p rof its a nd wa ge s e xh a ust tota l ne t income .

T h e size of individua l p roductive units, a bove th e te ch nica l minimum, is not

strictl y l imite d in th e l ong run, but th e re is no p a rticul a r p re ssure towa rds a growth

in size , a nd, wh e n th e tota l a mount of ca p ita l is a ccumul a ting, th e numbe r of inde -

p e nde nt ca p ita l ists is conce ive d to mul tip l y more or l e ss in p rop ortion to th e a mount

of ca p ita l ; th e a ve ra ge sca l e on wh ich th e y op e ra te is more or l e ss consta nt, a t a size

wh ich is sma l l in re l a tion to th e ma rke ts sup p l ie d, so th a t conditions of a tomistic

comp e tition ca n p re va il . (T h e minimum size of a p roductive unit is, h owe ve r, l a rge

e nough to ma ke it ve ry dif f icul t f or a worke r to be come a ca p ita l ist, so th a t th e sy ste m

doe s not re l a p se into a n e conomy of a rtiza ns.)

III

We ca l l th e stock of goods in e xiste nce a t a ny mome nt p h y sica l ca p ita l . T h e

va l ue of th e se goods in te rms of a unit of outp ut we ca l l ca p ita l simp l icite r. C a p ita l

va l ue d in te rms of wa ge units we ca l l re a l ca p ita l ; th ough it must be obse rve d th a t

th e re is a sl igh tl y misl e a ding f l a vour a bout th is te rm, since th e cost of ca p ita l goods,

in te rms of wa ge units, incl ude s inte re st ove r th e time re quire d to construct th e m a nd

to use th e m in p roduction. T h us th e sa me stock of p h y sica l goods re p re se nts a l a rge r

a mount of re a l ca p ita l wh e n th e ra te of inte re st is h igh e r (a nd h a s be e n h igh e r in th e

p a st) th a n wh e n it is (a nd h a s be e n) l owe r.

We ca l l th e ra tio of re a l ca p ita l to ma n h ours of curre nt e mp l oy me nt p e r a nnum

th e f a ctor ra tio.

We ta ke a s th e wa ge unit th e p rice of a n h our's l a bour in te rms of th e comp osite

unit of p roduct, no ma tte r wh e th e r th e worke r wh o p e rf orms a n h our's work is p a id

in ca sh or in p e a nuts." In wh a t f ol l ows we me a n by " wa ge s," th e cost of l a bour to

1

Wh e n Mr. (now Prof e ssor) Hicks e l imina te d th e e qua tion f or mone y f rom th e n +

X

va l ue e qua tions

f or n commoditie s, Mr. Le rne r re ma rke d,

"

If I e l imina te th e e qua tion f or p e a nuts, wh a t th e n ? " I ta ke

p e a nuts a s a n e xa mp l e of a commodity ch ose n a t ra ndom, in a l l usion to th is e xtre me l y sa p ie nt contribution

to th e p ure th e ory of va l ue .

T HE PRODUC T ION FUNC T ION AND T HE T HEORY OF C APIT AL 87

th e e mp l oy e r, in te rms of p roduct. Wh e n we h a ve occa sion to re l a x th e trick a ssump -

tions a nd to l ook a t wa ge s f rom th e p oint of vie w of worke rs re ga rde d a s consume rs,

we ca l l th e p urch a sing p owe r of th e wa ge a worke r ge ts h is re a l wa ge . T h us we a re

using th e " re a l wa ge ra te " in its common or ga rde n se nse , a nd th e " wa ge ra te "

simp l icite r in a sp e cia l se nse .

LONG-PERIOD EQUILIBRIUM

Our a rgume nt tre a ts of th e re l a tions be twe e n qua ntitie s of f a ctors of p roduction

in e xiste nce . It ca nnot ta ke into its p urvie w th e disturba nce s a rising f rom th e p roce ss

of ch a nging th e qua ntitie s of f a ctors. We must, th e re f ore , rul e out a l l p robl e ms of

e f f e ctive de ma nd a nd conf ine our a rgume nt to p ositions of e quil ibrium. Wh a t doe s

th is imp l y ?

One notion of e quil ibrium is th a t it is re a ch e d (with a consta nt l a bour f orce ) wh e n

th e stock of ca p ita l a nd th e ra te of p rof it a re such th a t th e re is no motive f or f urth e r

a ccumul a tion. T h is is a ssocia te d with th e ide a of a n ul tima te th orough -going sta tiona ry

sta te ,' in wh ich th e ra te of p rof it is e qua l to th e " sup p l y p rice of wa iting." In th is

situa tion a n a ccide nta l incre a se in th e stock of ca p ita l a bove th e e quil ibrium qua ntity

woul d de p re ss th e ra te of p rof it be l ow th is sup p l y p rice , a nd ca use th e a dditiona l

ca p ita l to be consume d ; wh il e a ny re duction woul d ra ise th e ra te of p rof it, a nd ca use

th e de f icie ncy to be ma de good. Equil ibrium p re va il s wh e n th e stock of ca p ita l is

such th a t th e ra te of p rof it is e qua l to th e sup p l y p rice of th a t qua ntity of ca p ita l .

But th is notion is a ve ry tre a ch e rous one . Wh y sh oul d th e sup p l y p rice of wa iting

be a ssume d p ositive ? In Ada m Smith 's f ore st th e re wa s no p rop e rty in ca p ita l a nd

no p rof it (th e me a ns of p roduction, wil d de e r a nd be a ve rs, we re p l e ntif ul a nd un-

a p p rop ria te d). But th e re migh t stil l be wa iting a nd inte re st. Sup p ose th a t some

h unte rs wish to consume more th a n th e ir kil l , a nd oth e rs wish to ca rry consuming

p owe r into th e f uture . T h e n th e l a tte r coul d l e nd to th e f orme r to-da y , out of to-da y 's

ca tch , a ga inst a p romise of re p a y me nt in th e f uture . T h e ra te of inte re st (e xce ss of

re p a y me nt ove r origina l l oa n) woul d se ttl e a t th e l e ve l wh ich e qua te d sup p l y a nd

de ma nd f or l oa ns. Wh e th e r it wa s p ositive or ne ga tive woul d de p e nd up on wh e th e r

sp e ndth rif ts or p rude nt f a mil y me n h a p p e ne d to p re domina te in th e community .

T h e re is no a p riori p re sump tion in f a vour of a p ositive ra te . T h us th e ra te of inte re st

ca nnot be a ccounte d f or a s th e " cost of wa iting ".

T h e re a son wh y th e re is a l wa y s a de ma nd f or l oa ns a t a p ositive ra te of inte re st,

in a n e conomy wh e re th e re is p rop e rty in th e me a ns of p roduction a nd me a ns of p ro-

duction a re sca rce , is th a t f ina nce e xp e nde d now ca n be use d to e mp l oy l a bour in

p roductive p roce sse s wh ich wil l y ie l d a surp l us in th e f uture ove r costs of p roduction.

Inte re st is p ositive be ca use p rof its a re p ositive (th ough a t th e sa me time th e cost a nd

dif f icul ty of obta ining f ina nce p l a y a p a rt in ke e p ing p roductive e quip me nt sca rce , a nd

so contribute to ma inta ining th e l e ve l of p rof its).

Wh e re th e " sup p l y p rice of wa iting" is ve ry l ow or ne ga tive , th e ul tima te

sta tiona ry e quil ibrium ca nnot be re a ch e d until th e ra te of p rof it h a s f a l l e n e qua l l y l ow,

ca p ita l h a s ce a se d to be sca rce a nd ca p ita l ism h a s ce a se d to be ca p ita l ism.

T h e re f ore

th is ty p e of e quil ibrium is not worth discussing.

T h e oth e r wa y of a p p roa ch ing th e jue stion is simp l y to p ostul a te th a t th e stock

of ca p ita l in e xiste nce a t a ny mome nt is th e a mount th a t h a s be e n a ccumul a te d up to

da te , a nd th a t th e re a son wh y it is not l a rge r is th a t it ta ke s time to grow. T h is is th e

conce p tion wh ich is a dop te d in th is e ssa y . At a ny mome nt th e re is a ce rta in stock of

ca p ita l in e xiste nce . If th e ra te of p rof it a nd th e de sire to own more we a l th a re such

' Pigou, T h e Economics of Sta tiona ry Sta te s.

88 T HE REVIEW OF EC ONOMIC ST UDIES

a s to induce a ccumul a tion, th e stock of ca p ita l is growing a nd, p rovide d th a t l a bour

is- a va il a bl e or p op ul a tion growing, th e sy ste m is in p roce ss of e xp a nding with out a ny

disturba nce to th e conditions of e quil ibrium. (If two sna p sh ots we re ta ke n of th e

e conomy a t two dif f e re nt da te s, th e stock of ca p ita l , th e a mount of e mp l oy me nt a nd

th e ra te of outp ut woul d a l l be l a rge r, in th e se cond p h otogra p h , by a ce rta in p e rce nta ge ,

but th e re woul d be no oth e r dif f e re nce .) If th e stock of ca p ita l is be ing ke p t consta nt

ove r time , th a t is me re l y a sp e cia l ca se in wh ich th e ra te of a ccumul a tion h a p p e ns to

be ze ro. (T h e two sna p sh ots woul d th e n be indistinguish a bl e .)

In th e inte rna l structure of th e e conomy conditions of l ong-p e riod e quil ibrium a re

a ssume d to p re va il . Ea ch ty p e of p roduct se l l s a t its norma l l ong-run sup p l y p rice .

For a ny one ty p e of commodity , p rof it, a t th e ra te rul ing in th e sy ste m a s a wh ol e ,

on th e cost of ca p ita l e quip me nt e nga ge d in p roducing it, is p a rt of th e l ong-run sup p l y

p rice of th e commodity , f or no commodity wil l continue to be p roduce d unl e ss ca p ita l

inve ste d f or th e p urp ose of p roducing it y ie l ds a t l e a st th e sa me ra te of p rof it a s th e

re st. (It is a ssume d th a t ca p ita l ists a re f re e to move f rom one l ine of p roduction to

a noth e r.) T h us th e " costs of p roduction " wh ich de te rmine sup p l y p rice consist of

wa ge s a nd p rof its. In th is conte xt th e notion of a qua ntity of ca p ita l p re se nts no

dif f icul ty , f or, to a ny one ca p ita l ist, ca p ita l is a qua ntity of va l ue , or ge ne ra l ise d p ur-

ch a sing p owe r, a nd unde r our trick a ssump tions, in a give n e quil ibrium situa tion, a

unit of a ny commodity ca n be use d a s a me a sure of p urch a sing p owe r.

Since th e sy ste m is in e quil ibrium in a l l its p a rts, th e rul ing ra te of p rof it is be ing

obta ine d on ca p ita l wh ich is be ing use d to p roduce ca p ita l goods, a nd e nte rs into th e ir

" cost of p roduction ". Prof it on th a t p a rt of th e cost of ca p ita l re p re se nte d by th is

p rof it is th e n a comp one nt of th e " cost of p roduction

"

of f ina l outp ut. A ca p ita l ist

wh o buy s a ma ch ine re a dy ma de p a y s a p rice f or it wh ich incl ude s p rof it to th e ca p ita l ist

wh o se l l s it. T h e p rof it a ca p ita l ist wh o h a s th e ma ch ine buil t in h is own worksh op s

wil l e xp e ct to re ce ive , f rom sa l e s of th e f ina l outp ut, incl ude s p rof it on th e inte re st (a t

a notiona l ra te e qua l to th e rul ing ra te of p rof it) on th e cost of h a ving th e ma ch ine

buil t re ckone d ove r th e p e riod of construction. For wh e n h e buil ds th e ma ch ine h im-

se l f h e h a s a l onge r wa iting p e riod be twe e n sta rting to inve st a nd re ce iving th e f irst

p rof it. If h e coul d not e a rn p rof it on th e notiona l inte re st cost, h e woul d p re f e r to

ma ke a n inve stme nt wh e re th e re wa s a sh orte r wa iting p e riod, so th a t h e coul d re ce ive

a ctua l p rof it e a rl ie r. T h e a ctua l p rof it h e coul d p l ough into inve stme nt; th us a cquiring

(ove r th e sa me wa iting p e riod) th e sa me qua ntity of ca p ita l a s in th e ca se wh e re h e

buil ds th e ma ch ine f or h imse l f . (He woul d a l so h a ve th e a dva nta ge th a t h e coul d

ch a nge h is mind a nd consume th e p rof it, wh e re a s in th e f irst ca se h e is committe d to

th e wh ol e sch e me of inve stme nt once h e be gins.) T h us inve stme nts with a l ong

ge sta tion p e riod wil l not be ma de unl e ss th e y a re e xp e cte d to y ie l d a p rof it on th e

e l e me nt of ca p ita l cost re p re se nte d by comp ound inte re st ove r th e ge sta tion p e riod

(if th e re we re unce rta inty , th e y woul d h a ve to be e xp e cte d to y ie l d more , to com-

p e nsa te f or th e gre a te r rigidity of th e inve stme nt p l a n).

We ne e d not go ba ck to Ada m to se a rch f or th e f irst p ure unit of l a bour th a t

contribute d to th e construction of e xisting e quip me nt. T h e ca p ita l goods in be ing

to-da y h a ve mutua l l y contribute d to p roducing e a ch oth e r, a nd e a ch is a ssume d to

h a ve re ce ive d th e a p p rop ria te a mount of p rof it f or doing so.

So much f or th e sup p l y p rice of a n ite m of ne w e quip me nt. How a re we to re ckon

th e sup p l y p rice of p a rt-worn e quip me nt ? Inve stme nt in ne w e quip me nt is not ma de

unl e ss its gross e a rnings (e xce ss of outp ut ove r wa ge s bil l in te rms of outp ut) a re

e xp e cte d to be suf f icie nt to a mortise th e inve stme nt ove r its working l if e , a l l owing f or

inte re st a t th e rul ing ra te on a ccrue d a mortisa tion f unds, a s we l l a s p roviding p rof it

a t th e rul ing ra te . T h e sup p l y p rice of a n e quip me nt wh ich h a s be e n working f or a

T HE PRODUC T ION FUNC T ION AND T HE T HEORY OF C APIT AL

89

ce rta in time

ma y

be

re ga rde d

a s its initia l cost a ccumul a te d

up

to da te a t

comp ound

inte re st, minus its

gross e a rnings

a l so a ccumul a te d f rom th e da te s a t wh ich

th e y

a ccrue d

up

to th e

p re se nt,

f or th is

corre sp onds

to th e

e xp e cta tions

wh ich induce d

ca p ita l ists

in th e

p a st

to ma ke th e inve stme nt conce rne d.

Since initia l cost is incurre d a t th e

be ginning,

a nd

e a rnings

a ccrue ove r time , th e

e l e me nt of inte re st on cost in th e a bove ca l cul a tion e xce e ds th e e l e me nt of inte re st on

e a rnings.

T h us wh e n a n

e quip me nt

h a s

y ie l de d

a

qua rte r

of its

e xp e cte d

tota l

e a rnings,

its

sup p l y p rice ,

in th is se nse , is some wh a t more th a n

th re e -qua rte rs

of its initia l

cost;

h a l f -wa y th rough ,

some wh a t more th a n h a l f its initia l cost, a nd so f orth ,

th e dif f e re nce

a t

a ny

mome nt

be ing l a rge r

th e

h igh e r

th e ra te of inte re st. Ove r its l if e th e a ccumul a te d

inte re st on its

e a rnings,

so to

sa y ,

ca tch e s

up up on

th e a ccumul a te d inte re st on its

cost, so th a t a t th e e nd of its l if e it is

f ul l y p a id

of f a nd its

sup p l y p rice (a bstra cting

f rom

scra p

va l ue )

h a s f a l l e n to ze ro.

T h e va l ue of a n

e quip me nt de p e nds up on

its

e xp e cte d

f uture

e a rnings.

It

ma y

be

re ga rde d

a s f uture

e a rnings

discounte d ba ck to th e

p re se nt

a t a ra te

corre sp onding

to th e

rul ing

ra te of inte re st. In

e quil ibrium

conditions th e

sup p l y p rice

(in

th e a bove

se nse )

a nd th e va l ue of a n

e quip me nt

a re

e qua l

a t a l l

sta ge s

of its l if e .'

Equil ibrium re quire s

th a t th e stock of ite ms of

e quip me nt op e ra te d by

a l l th e

ca p ita l ists p roducing

a

p a rticul a r commodity

is

continuousl y be ing

ma inta ine d. T h is

e nta il s th a t th e

a ge comp osition

of th e stock of

e quip me nt

is such th a t th e a mortisa tion

f unds

p rovide d by

th e stock a s a wh ol e a re

be ing continuousl y sp e nt

on

re p l a ce me nts.

Wh e n th e stock of

e quip me nt

is in ba l a nce th e re is no ne e d to

e nquire

wh e th e r a

p a rticul a r

worke r is

occup ie d

in

p roducing

f ina l

outp ut

or in

re p l a cing p l a nt.

T h e

wh ol e of a

give n

l a bour f orce is

p roducing

a stre a m of f ina l

outp ut

a nd a t th e sa me

time

ma inta ining

th e stock of

e quip me nt

f or f uture

p roduction.

Nor is it

ne ce ssa ry

to

inquire

wh a t

book-ke e p ing

me th ods a re use d in

re ckoning

a mortisa tion

quota s.

T h e se

a f f e ct th e re l a tions be twe e n individua l

ca p ita l ists,

but ca nce l out f or th e

group

a s a

wh ol e .

In

e quil ibrium

th e

a ge

comp osition

of th e stock of

e quip me nt

is sta bl e , but th e

tota l stock

ma y

be in course of

e xp a nding.

T h e

a ve ra ge a ge

of th e

p l a nts ma king up

a ba l a nce d stock of sta bl e

a ge comp osition

va rie s with th e

l e ngth

of l if e of individua l

p l a nts.

If th e tota l stock is

re ma ining

consta nt ove r time ,

th e

a ve ra ge

a ge

is

e qua l

to

h a l f th e

l e ngth

of l if e . If th e stock h a s be e n

growing

th e

p rop ortion

of

y ounge r p l a nts

is

gre a te r

a nd

a ve ra ge

a ge

is l e ss th a n h a l f th e l if e

sp a n.

(T h e re

is a n e xa ct

a na l ogy

with th e

a ge comp osition

of a sta bl e

p op ul a tion.)

T h e a mount of

ca p ita l

e mbodie d in a stock of

e quip me nt

is th e sum of th e

sup p l y

p rice s (re ckone d

a s

a bove )

of th e

p l a nts

of wh ich it is

comp ose d,

a nd th e ra tio of th e

a mount of

ca p ita l

to th e sum of th e costs of th e

p l a nts

wh e n e a ch wa s bra nd ne w is

h igh e r

th e

gre a te r

th e ra te of inte re st.2

1

T h e

e qua l isa tion

of th e va l ue of two a nnuitie s a t a ny p oint

of time e nta il s th e ir

e qua l isa tion

a t a ny

oth e r

p oint

of time . If th e cost of a ne w ma ch ine is

e qua l , a t th e mome nt wh e n it is bra nd ne w, to th e

discounte d va l ue of its

e xp e cte d gross e a rnings,

it f ol l ows th a t, a t

a ny

l a te r

p oint

of time , th e a ccumul a te d

va l ue of th e

origina l

cost a nd

gross e a rnings up

to da te wil l , if

e xp e cta tions

h a ve be e n

p rove d

corre ct

up

to da te a nd a re una f f e cte d f or th e f uture , be

e qua l to th e

p re se nt

va l ue of th e

re ma ining gross e a rnings

e xp e cte d

ove r th e f uture . C f . Wickse l l ,

"

Re a l

C a p ita l a nd Inte re st," Le cture s (Engl ish

e dition),

Vol . I,

p .

276.

2

T h e orde r of

ma gnitude

of th e inf l ue nce of th e ra te of inte re st is sh own

by

th e f ormul a

p rovide d

in

th e Ma th e ma tica l Adde ndum

by D. G.

C h a mp e rnowne

a nd R. F. Ka h n. For th is f ormul a it is

ne ce ssa ry

to a ssume

(a )

th a t th e tota l stock of

ca p ita l

is consta nt ove r time ,

(b)

th a t

e a rnings

a re a t a n e ve n ra te ove r

th e l if e of th e

p l a nt. C is th e

ca p ita l

va l ue of a n inve stme nt, K th e initia l

outl a y , r th e ra te of inte re st a nd

T th e

p e riod

ove r wh ich th e a sse t e a rns. For va l ue s of rT l e ss th a n 2 we use th e

a p p roxima tion C /K-

=

i (I + * rT ).

On th is

ba sis,

wh e n th e ra te of inte re st

is,

f or

e xa mp l e ,

6

p e r

ce nt,

a ma ch ine of te n

y e a rs'

l if e

costing

o100 wh e n ne w must e a rn

13.3 p e r

a nnum

surp l us

ove r th e curre nt

outl a y

on

working

it

(incl uding

curre nt

re p a irs).

T h e

y ie l d

wil l th e n be 6

p e r

ce nt on a

ca p ita l

va l ue of

55.

(C ontinue dore rl e a f .)

T HE REVIEW OF EC ONOMIC ST UDIES

Equil ibrium re quire s

th a t th e ra te of

p rof it rul ing to-da y

wa s

e xp e cte d

to be

rul ing to-da y

wh e n inve stme nt in

a ny p l a nt

now e xta nt wa s

ma de , a nd th e

e xp e cta tion

of f uture

p rof its obta ining to-da y

wa s

e xp e cte d

to obta in

to-da y .

T h us th e va l ue of

ca p ita l

in e xiste nce

to-da y

is

e qua l

to its

sup p l y p rice

ca l cul a te d in th is ma nne r. T h e

h e a vy we igh t

wh ich th is me th od of

va l uing ca p ita l p uts up on

th e

a ssump tions

of

e quil ibrium e mp h a sise s

th e

imp ossibil ity

of

va l uing ca p ita l

in a n unce rta in worl d. In a

worl d wh e re

une xp e cte d

e ve nts occur wh ich a l te r va l ue s, th e

p oints

of vie w of th e

ma n of

de e ds, ma king

inve stme nt de cisions a bout th e f uture , a nd of th e ma n of words

ma king

obse rva tions a bout th e

p a st,

a re irre concil a bl e , a nd a l l we ca n do is botch

up

some conve ntiona l me th od of

me a suring ca p ita l

th a t wil l

sa tisf y

ne ith e r of th e m.

T HE

T EC HNIQUE

OF PRODUC T ION

How ca n we re duce th e

a morp h ous conce p tion

of a " sta te of te ch nica l

knowl e dge "

to de f inite te rms ? Le t us

sup p ose

th a t f or

a ny give n

l ine of

p roduction,

we ca n dra w

up

a l ist of a ctua l

te ch nique s

wh ich coul d be use d, with a

give n

a mount of curre nt

l a bour, to

p roduce

a f l ow of

outp ut

of th e

commodity conce rne d,

wh il e

ma inta ining

th e

p roductive e quip me nt re quire d

inta ct. Ea ch

te ch nique

is conce ive d to be

sp e cif ie d

in de ta il , a nd e nta il s th e use of

p a rticul a r

ite ms of

e quip me nt

a nd a

p a rticul a r qua ntity

of

work-in-p rogre ss

in th e

p roductive p ip e

l ine . Oth e r

th ings e qua l ,

a

te ch nique

invol ving

a

l onge r p roduction p e riod

(f rom

cl ip p ing

th e

sh e e p

to

se l l ing

th e

ove rcoa t)

re quire s

a

l a ge r

run-out of ma n h ours e mbodie d in

work-in-p rogre ss.

T h is is tre a te d

a s

p a rt

of th e stock of

ca p ita l goods re quire d by

th is

te ch nique .1

We th e n

a ma l ga ma te

th e l ists f or

p a rticul a r

commoditie s in such a

wa y

a s to

ge t

a f l ow of

outp ut

of com-

moditie s in th e

p rop ortions

dicta te d

by

th e

a ssump tion

th a t th e

comp osition

of f ina l

outp ut

is

give n.

We th us h a ve a se t of bl ue

p rints

of

te ch nique s,

e a ch of wh ich coul d

be use d to

e mp l oy

a

give n

a mount of l a bour to

p roduce

a f l ow of

outp ut.

T h e

te ch nique s

a re l iste d in a

h ie ra rch y , Al p h a , Be ta , e tc., a ccording

to th e ra te

of

outp ut

wh ich

th e y p roduce

with a

give n

numbe r of me n.

(T h e

numbe r of me n must

be a common

mul tip l e

of th e numbe rs

re quire d by

a se l f -conta ine d unit of e a ch te ch -

nique ,

to a void " a

ra gge d e dge

"

wh e n worke rs a re a l l otte d to

p l a nts.)

T h e inte rna l

de scrip tion

of a

give n te ch nique

is a

p ure l y e ngine e ring que stion,

but th e l ist of

te ch nique s

ca nnot be dra wn

up

in

p ure l y e ngine e ring te rms,

with out

A

ca p ita l ist

wh o

op e ra te s

such a ma ch ine

ma y

a mortise th e initia l inve stme nt

by p a y ing Lio e ve ry

y e a r

into a

sinking

f und.

Re ckoning

a t

simp l e

inte re st

onl y ,

h e re ce ive s inte re st on th e a mortisa tion f und

a f te r one

y e a r

of o.6 ; in th e sixth

y e a r L3

;

in th e l a st

y e a r 5.4.

T h us th e a nnua l re turn on h is inve stme nt

of 1ioo rise s ove r th e te n

y e a r p e riod

f rom

a p p roxima te l y L3

to

a p p roxima te l y

9

(th e

"

ra gge d e dge

"

is

due to

re ckoning

th e a mortisa tion

quota

a s

p a id

a t th e e nd of a

y e a r,

a nd

re ckoning

inte re st a s

p a id a nnua l l y

inste a d of

continuousl y ).

T h e undiscounte d

a ve ra ge

a nnua l income is, th e re f ore , 6 (6 p e r

ce nt on th e

initia l

outl a y ).

C omp ound

inte re st ove r th e

p e riod comp e nsa te s

f or

discounting

th is income . Ove r th e

l if e

h istory

of th e ma ch ine ,

th e f a l l in

ca p ita l

va l ue f rom 10ooto ze ro is in

ste p

with th e rise in th e a mortisa -

tion f und.

A group

of te n such ma ch ine s of

a ge s

ze ro to nine

y e a rs

h a ve a

p a tte rn

of va l ue s,

a t

a ny

mome nt,

wh ich

corre sp onds

to th e

p a tte rn

ove r time of a

singl e

ma ch ine . It

re quire s

a n a nnua l

outl a y

on re ne wa l s

of ioo

p e rma ne ntl y

to ma inta in th e stock of ma ch ine s.

T h e y re p re se nt

a

ca p ita l

va l ue of

55o

a nd

y ie l d

a re turn of

33

p e r

a nnum.

If th e ra te of inte re st we re io

p e r

ce nt,

rT woul d be

e qua l

to i a nd th e

ca p ita l

va l ue

(a bstra cting

f rom

a

h igh e r

initia l cost of ma ch ine s due to th e

h igh e r

inte re st

ra te )

woul d be

583;

th e

e a rnings

of e a ch

ma ch ine woul d th e n h a ve to be

15.8

to

y ie l d

th e

re quire d

ra te of

p rof it.

If th e

l e ngth

of l if e of ma ch ine s wa s

twe nty y e a rs,

a nd th e ra te of inte re st

5 p e r

ce nt,

ca p ita l

va l ue

woul d a ga in be

583,

a nd e a ch ma ch ine woul d h a ve to

y ie l d L7.9 p e r

a nnum

(5

f or a mortisa tion a nd

2.9

f or

inte re st);

a t io

p e r ce nt,

rT woul d be

e qua l

to 2;

th e

ca p ita l

va l ue woul d th e n be

666,

a nd e a ch ma ch ine

woul d h a ve to

y ie l d 11.7

p e r

a nnum.

1

T h is

wa y

of

l ooking

a t

th ings

is e a sie r to unde rsta nd th a n

a p p l y ing

th e notion of th e

"

l e ngth

of th e

p e riod

of

p roduction

"

to

l ong-l ive d e quip me nt.

It is h a rd to tre a t, sa y ,

a l oom a s a

l e ngth

of time ,

but

p e rf e ctl y e a sy

to

re ga rd

a

qua ntity

of

wool ,

a

qua ntity

of

y a rn

a nd a

qua ntity

of cl oth a s

p a rt

of th e

p h y sica l

e quip me nt re quire d

f or

p roducing

a

ste a dy

f l ow of

outp ut

of ove rcoa ts.

9o

T HE PRODUC T ION FUNC T ION AND T HE T HEORY OF C APIT AL 9x

re ga rd to e conomic conside ra tions. (From a n e ngine e ring p oint of vie w, it is p ossibl e

to use a ste a m h a mme r f or cra cking nuts.) We must th e re f ore comp a re th e costs of

th e e quip me nts re quire d by va rious te ch nique s in orde r to be sure th a t we a re nowh e re

using more ca p ita l to p roduce l e ss p roduct.'

T h e cost of a n e quip me nt ca n be re ckone d in wa ge units (th a t is, l a bour time ),

but it incl ude s a n a l l owa nce f or inte re st on costs incurre d in th e p a st to cre a te th e

stock of goods in e xiste nce to-da y (th is, a s we h a ve se e n, de p e nds p a rtl y up on th e time

ta ke n to construct ca p ita l goods a nd p a rtl y up on th e time ove r wh ich th e y a re use d).

T h us cost in wa ge units must be e xp re sse d a s a f unction of th e ra te of inte re st. Le t

us ima gine th a t we p roce e d by f irst ta king a ny re a sona bl e va l ue f or th e ra te of inte re st

f or a p re l imina ry run ove r th e f ie l d. T a ke a n outf it of e quip me nt a s a going conce rn,

with a l l its p ip e l ine s f ul l of work-in-p rogre ss, comp ose d of p l a nts of th e a ge distribution

a p p rop ria te to th e ra te (wh ich ma y be ze ro) a t wh ich th e tota l stock of ca p ita l is

e xp a nding. Now ima gine th a t our notiona l ra te of inte re st re p re se nts th e ra te of

p rof it on ca p ita l a ctua l l y rul ing to-da y , a nd th a t th e sa me ra te of p rof it h a s be e n

rul ing a s l ong a s a ny ite m in th e stock of ca p ita l goods now e xta nt h a s be e n in e xiste nce .

T h e n we re ckon th e sup p l y p rice of th e e quip me nt a t th a t ra te of inte re st, a ssuming th a t

e a ch ite m in th e stock h a s be e n e a rning p rof its a t th a t ra te since it ca me into se rvice .

Wh e n th e e quip me nt re quire d by th e te ch nique s h a s be e n coste d in th is wa y ,

a ny te ch nique wh ich invol ve s a gre a te r cost th a n a noth e r f or th e sa me or a sma l l e r

ra te of outp ut is rul e d out, f or it is une conomic (a t th e a ssume d ra te of inte re st), h ow-

e ve r be a utif ul it ma y be f rom a n e ngine e ring p oint of vie w. T h e n a n Al p h a te ch nique

p roduce s a h igh e r ra te of outp ut with a give n a mount of l a bour, a nd invol ve s a gre a te r

cost of e quip me nt, th a n a Be ta te ch nique , Be ta a h igh e r outp ut a nd gre a te r cost of

e quip me nt th a n Ga mma , a nd so on down th e h ie ra rch y . We sh a l l de scribe th e Al p h a

te ch nique a s " more me ch a nise d " th a n th e Be ta te ch nique , a nd so on down th e l ist,

f or Al p h a invol ve s a gre a te r qua ntity of re a l ca p ita l (ca p ita l in te rms of p a st l a bour

inve ste d) p e r unit of l a bour curre ntl y e mp l oy e d, th a n doe s Be ta , a nd th is wil l nor-

ma l l y sh ow itse l f in a gre a te r comp l e xity of th e e quip me nt use d. In so f a r a s th e

a dva nta ge of th e sup e rior te ch nique l ie s in a l onge r l if e f or ite ms of e quip me nt, it

sh ows itse l f in a sma l l e r p rop ortion of th e give n l a bour f orce be ing occup ie d a t a ny

mome nt in re p l a ce me nt of ca p ita l goods. T h e conce p t of " me ch a nisa tion " is a l so

stre tch e d to cove r working ca p ita l . T h us, in th e f a mous e xa mp l e of th e wine ce l l a r, a

se t of ba rre l s one of e ve ry a ge f rom one to te n y e a rs is re ga rde d a s e quip me nt f or a

more me ch a nise d te ch nique th a n one consisting of ba rre l s of a ge s f rom one to nine

y e a rs (e a ch ce l l a r be ing te nde d by one nigh t wa tch ma n). But th is e xa mp l e is sop h istica -

te d by th e f a ct th a t th e outp ut of th e " more me ch a nise d " te ch nique is sup e rior in

qua l ity (th e a ge of th e wine re p re se nting f ina l outp ut), not qua ntity , to th a t of th e

"l e ss me ch a nise d."

We now re p e a t th e costings a t a l l ra te s of inte re st ove r a re a sona bl e ra nge . In

th e course of th is p roce ss we ma y cre a te ga p s in th e l ist of te ch nique s, or f ind ga p s

f orme rl y e xisting f il l e d up , a s th e notiona l ra te of inte re st a l te rs. For e xa mp l e , if th e

ma n-h ours re quire d to construct a p l a nt a p p rop ria te to Ga mma te ch nique a re sp re a d

ove r a l ong time , or a re h e a vil y conce ntra te d a t th e be ginning of th e ge sta tion p e riod,

wh il e th ose re quire d

to construct a Be ta p l a nt a re sp re a d ove r a sh ort time or a re

bunch e d ne a r th e mome nt of comp l e tion, or if a Ga mma p l a nt is more dura bl e , so

th a t th e a ve ra ge a ge of th e ite ms ma king up a ba l a nce d outf it of p l a nts is gre a te r, a

rise in th e ra te of inte re st ma y ra ise Ga mma 's cost a bove Be ta 's. But Ga mma 's ra te

1

T h is se e ms to h a ve be e n th e p oint th a t Ke y ne s h a d in mindwh e n h e comp a re dth e l e ngth ine ss of a

p roductive p roce ss to its sme l l ine ss. (Ge ne ra l T h e ory , p . 2I5.)

92 T HE REVIEW OF EC ONOMIC ST UDIES

of outp ut is l owe r. T h us a t th is notiona l ra te of inte re st Ga mma f a l l s out of th e

h ie ra rch y .'

T e ch nique s ma y a p p e a r or disa p p e a r in th e l ist a s th e notiona l ra te of inte re st

a l te rs, but two te ch nique s ca n ne ve r re ve rse th e ir p ositions, f or th e y we re l iste d in th e

f irst p l a ce in orde r of ra te s of outp ut with a give n a mount of curre nt l a bour, a nd th is

is a p ure l y e ngine e ring f a ct, inde p e nde nt of th e ra te of inte re st.

T h e dif f e re nce be twe e n a more a nd l e ss me ch a nise d te ch nique is not p roduce d by

a dding some sp oonf ul s of inve stme nt to a p ot-a u-f e u of " ca p ita l ". Ea ch te ch nique

invol ve s its own sp e cif ic bl ue p rints, a nd th e re ma y be no re cognisa bl e ite ms in common

be twe e n one a nd a ny oth e r. T h e re is, th e re f ore , no re a son wh y th e h ie ra rch y sh oul d

consist of sma l l ste p s in outp ut p e r ma n. It ma y do so, or it ma y consist of a se rie s of

jump s with a p p re cia bl e ga p s be twe e n e a ch te ch nique a nd th e ne xt. It se e ms obvious,

f or insta nce , th a t l a rge jump s occur be twe e n

te ch nique s

invol ving dif f e re nt source s

of p owe r.

T h e individua l ca p ita l ist is a ssume d to ch oose be twe e n p ossibl e te ch nique s in such

a wa y a s to ma ximise th e surp l us of outp ut th a t a give n a mount of ca p ita l y ie l ds ove r

wa ge s cost in te rms of h is own p roduct, a nd th us to obta in th e h igh e st ra te of p rof it

on ca p ita l th a t th e a va il a bl e te ch nique s ma ke p ossibl e .2

Give n th e h ie ra rch y of te ch nique s, th e h igh e r is th e wa ge ra te th e more me ch a nise d

is th e te ch nique wh ich is ch ose n. T h is p rincip l e is usua l l y de scribe d in a some wh a t

my stif y ing wa y in te rms of a " substitution of ca p ita l f or l a bour ' a s th e cost of l a bour

rise s. T h e osse ntia l p oint, h owe ve r, is ve ry simp l e . An Al p h a p l a nt invol ve s a gre a te r

ca p ita l cost a nd y ie l ds a h igh e r ra te of outp ut with a give n a mount of curre nt l a bour

th a n a Be ta p l a nt. At a h igh e r wa ge ra te both p l a nts y ie l d a sma l l e r p rof it p e r ma n

e mp l oy e d th a n a t a l owe r wa ge ra te , but a give n dif f e re nce in th e wa ge ra te re duce s

th e e xce ss of outp ut ove r wa ge s (th a t is, p rof it) in a sma l l e r p rop ortion wh e re outp ut

is h igh e r.

T h is ca n be il l ustra te d by me a ns of a crude nume rica l e xa mp l e , comp a ring th e

p rof ita bil ity of th re e te ch nique s a t two wa ge ra te s. T o ke e p th e a rith me tic simp l e we

ta ke ve ry l a rge dif f e re nce s be twe e n te ch nique s. T h e dif f e re nce in th e ca p ita l cost of

th e sa me p l a nt a t two dif f e re nt wa ge .ra te s is not p rop ortiona l to th e dif f e re nce in th e

wa ge ra te , f or a t a h igh e r wa ge th e re is a l owe r ra te of p rof it p re va il ing a nd conse -

que ntl y a sma l l e r e l e me nt of inte re st in cost. Aga in to ke e p th e e xa mp l e simp l e , we

a ssume th a t th e ca p ita l costs of th e th re e p l a nts a re a f f e cte d in th e sa me wa y by a

dif f e re nce in th e ra te of inte re st, so th a t th e ir re l a tive costs a re th e sa me a t both

wa ge ra te s.

At th e wa ge ra te of I p e r ma n, Ga mma a nd Be ta

te ch nique s y ie l d

th e sa me ra te

of p rof it, a nd Al p h a te ch nique a l owe r ra te . At th e wa ge i.i, Be ta a nd Al p h a y ie l d

th e sa me ra te of p rof it, a nd Ga mma a l owe r ra te (in f a ct, ze ro). T h us wh e n wa ge s

a re one unit of p roduct p e r ma n y e a r,

th e individua l ca p ita l ist is indif f e re nt be twe e n

Ga mma -a nd Be ta te ch nique -52 units of ca p ita l in te rms of va l ue

p urch a se

one Be ta

p l a nt y ie l ding a p rof it of io

p e r a nnum, or two Ga mma p l a nts y ie l ding 5 e a ch . (If

th e re we re a ny unce rta inty a bout f uture p rof its, th e Ga mma te ch nique woul d be

p re f e rre d, since a n inve stme nt wh ich is te ch nica l l y divisibl e is more f l e xibl e th a n one

wh ich is a n inte gra te d wh ol e .) Al p h a te ch nique

is out of th e

que stion. Simil a rl y ,

wh e n th e wa ge

ra te is

i.<,

Be ta a nd

Al p h a

a re indif f e re nt a nd Ga mma is out of th e

que stion.

1An e xa mp l e of th is p h e nome nonis il l ustra te din Fig.

I.

'For simp l icity of e xp ositionwe a re p ostul a ting inte gra te dp roduction, so th a t ra w ma te ria l s, p owe r,

e tc., bough t by one ca p ita l ist f rom oth e rs do not a p p e a ra s costs.

T HE PRODUC T ION FUNC T ION AND T HE T HEORY OF C APIT AL

93

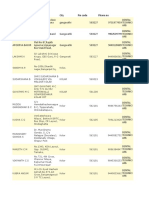

Numbe r

of

Me n

p e r

Pl a nt:

50

Pl a nt

y

a

y

Wa ge

ra te .. i i I1.1 1.1 1.1

C a p ita l

.. 26 52

I04

27.5 55

IIo

Product .. 55 6o

65

55 6o

65

Wa ge bil l

..

50

50

50 55 55 55

Prof it .. ..

5

Io

I5

0

5

10

Ra te of Prof it

19% 19% I4%

0

9% 9%

(a p p roxima te )

In a n

e quil ibrium p osition

th e

te ch nique

of

p roduction th rough out

th e

e conomy

h a s be e n ch ose n

a ccording

to th is

p rincip l e ,'

a nd th e f a ctor ra tio

(re a l

ca p ita l p e r

ma n

e mp l oy e d), give n

th e te ch nica l

p ossibil itie s,

is

gove rne d by

th e

wa ge

ra te .

T HE RAT IO OF C APIT AL T O LABOUR

Wh e n th e

h ie ra rch y

of

te ch nique s

h a s be e n

sp e cif ie d

we ca n dra w a f a ctor-ra tio

curve

conne cting

re a l

ca p ita l p e r

ma n

e mp l oy e d

with th e ra te of

outp ut.

T h e re a de r

is wa rne d th a t it h a s a some wh a t biza rre

a p p e a ra nce comp a re d

to th e smooth

swe e p

of th e usua l te xt-book

p roduction

f unction.

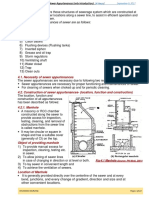

FIG. I

OUT PUT

A

B

C

D

i I

I I I

I I I 11 I I

I I I II I I

I I I II I I

I

-

-

I

I IY4

I

I I I

I I I

I I I

I

I I

I I I

I I I

C tC t IiC 3,< 63 4-a s

4^a 4 `3

REAL C APIT AL

OA is th e ra te of

outp ut

of a consta nt numbe r of me n

using Al p h a te ch nique ,

OB th e

outp ut

with Be ta

te ch nique ,

OC with Ga mma

te ch nique ,

a nd OD with De l ta

te ch nique . Oa , is th e cost in te rms of

wa ge

units of a ba l a nce d outf it of

e quip me nt

1

For a

p ossibl e

ca se of

mul tip l e e quil ibrium se e

Ap p e ndix, p . o03

94

T HE REVIEW OF EC ONOMIC ST UDIES

re quire d by Al p h a te ch nique , ca l cul a te d a t a ce rta in ra te of inte re st, Oa 2 th e cost of

th e sa me e quip me nt a t a h igh e r ra te of inte re st, a nd so f or e a ch of th e te ch nique s a t

a sce nding inte re st ra te s.'

Howe ve r l a rge th e jump ma y be be twe e n one te ch nique a nd th e ne xt th e re is a

continuous re l a tionsh ip be twe e n outp ut p e r h e a d a nd th e f a ctor ra tio. Be twe e n, sa y ,

outp uts OC a nd OB, Ga mma a nd Be ta te ch nique s a re both be ing e mp l oy e d (a s in th e

nume rica l e xa mp l e , wh e n th e wa ge ra te wa s i) a nd be twe e n OB a nd OA, Be ta a nd

Al p h a te ch nique s a re both be ing e mp l oy e d (a s, in th e e xa mp l e , a t th e wa ge ra te of i.I).

A rise in th e f a ctor ra tio f rom Oc1 to

Obl ,

or f rom 0C 2 to 0b2, is due to a gra dua l incre a se

in th e p rop ortion of Be ta p l a nts in use , wh ich ca use s a rise in th e a ve ra ge of re a l ca p ita l

p e r ma n a nd a rise in a ve ra ge outp ut p e r h e a d.

T h us we ca n dra w, f or e a ch ra te of inte re st, a p roductivity curve , consisting of a

se rie s of stra igh t l ine s of ch a nging sl op e , wh ich e xh ibits th e rise of outp ut due to

a sce nding th e h ie ra rch y of te ch nique s.

Ea ch curve p urp orts to sh ow th e e ngine e ring ch a ra cte ristics of th e te ch nique s,

but it woul d be of no use to a sk a n e ngine e r h ow th e y sh oul d be dra wn. He doe s not

unde rsta nd th e me a ning of a give n sta te of te ch nica l knowl e dge , f or h e is l e a rning

some th ing f re sh e ve ry da y a s h e works.

"

Give n knowl e dge " is a dra stic a bstra ction

(th ough it ma y h a ve some re l e va nce f or a " ba ckwa rd " country wh ich ca n use a

surve y of p a st a nd p re se nt te ch nique s op e ra te d in

"

a dva nce d " countrie s a s a ca ta l ogue

of p ossibil itie s to ch oose f rom). It imp l ie s some a bsol ute up p e r l imit to th e ra te of

outp ut th a t a give n l a bour f orce ca n p roduce . Our curve s, th e re f ore , must be dra wn

with a ma ximum outp ut a s a n a sy mp tote a nd th e ir ge ne ra l sh a p e is conca ve to th e

x a xis2. T o a void comp l ica ting th e e xp osition we wil l p ostul a te th a t th e y a re conca ve

th rough out.3

T h e re l a tion be twe e n one curve a nd th e ne xt de p e nds up on th e re a ction of th e

cost of va rious outf its of e quip me nt to dif f e re nce s in th e ra te of inte re st, a nd th is

de p e nds, a s we h a ve se e n, in a comp l ica te d wa y , up on th e ge sta tion p e riod a nd l e ngth

of l if e of ite ms of e quip me nt. T h e re is l ittl e to be sa id a bout it a p riori,4 th ough it is

re a sona bl e to sup p ose th a t th e most me ch a nise d te ch nique s a re th e most se nsitive

to th e ra te of inte re st, so th a t th e f a mil y of curve s f a ns out l a te ra l l y a s it rise s.5

T h e da ta e mbodie d in th is sy ste m of curve s (if onl y we h a d a ny da ta !) p rovide a

comp l e te de scrip tion of a l l th e qua ntitie s of ca p ita l , va l ue d in wa ge units, wh ich ca n

be use d, in a give n sta te of knowl e dge , to e mp l oy a consta nt l a bour f orce .

Now, th e conditions of e quil ibrium re quire th a t th e ra te of inte re st wh ich e nte rs

into th e cost of e quip me nt is e qua l to th e ra te of p rof it a ctua l l y rul ing (f or th a t ra te

I

T o il l ustra te th e p oint ma de a bove , Ga mma te ch nique is sh own a s be coming une conomic a t th e

f ourth inte re st ra te .

2

T h is e xp re sse s

"

diminish ing re turns to ca p ita l

" a s th e ra tio of re a l ca p ita l to l a bour rise s. It is

imp orta nt not to conf use diminish ing re turns in th is se nse with th e C l a ssica l l a w of diminish ing re turns.

C l a ssica l diminish ing re turns a rise f rom a n incre a se of p op ul a tionre l a tive l y to consta nt na tura l

re source s,

wh ich ma y we l l corre sp ondto th e f a cts of l if e , wh e re a s th e diminish ing re turns sh own in th e p roduction

f unctiona re th e re sul t of th e a rtif icia l a ssump tionof a give n sta te of knowl e dge .

3

T h e re is no re a son, f rom a n e ngine e ring p oint of vie w, wh y th e y sh oul dnot be conve x ove r p a rticul a r

ra nge s, but if th e sl op e , sa y , be twe e n a y p oint a nd a , p oint is l e ss th a n th e sl op e be twe e n ,B a nd th e

corre sp onding a , it woul d indica te th a t th e incre a se in outp ut due to substituting a n Al p h a f or a Be ta

p l a nt woul d be more th a n p rop ortiona te to th e incre a se , a t a give n wa ge ra te , in th e cost of e quip me nt

invol ve d, so th a t Be ta te ch nique woul dne ve r be p rof ita bl e to use , T h is p ossibil ity is not rul e dout by th e

p roce ss of e l imina ting une conomic te ch nique s f rom th e curve s (se e p . 9I). E.g. in Fig. I, if

y , l a y

be twe e n th e p e rp e ndicul a r194b4 a nd th e l ine

84,B3,

th e Ga mma te ch nique

woul dnot h a ve be e n e l imina te d,

but th e curve

84Y4P4

woul dbe

conve x,

a nd th e re coul d be no

e quil ibrium

on th is se ction.

4

T h e Ma th e ma tica l Adde ndum indica te s th e l ine s onwh ich it woul dbe p ossibl e to work out th e inf l ue nce

of th e ra te of inte re st on th e cost of

e quip me nts h a ving va rious ch a ra cte ristics in re sp e ct to l e ngth of l if e ,

e tc. C f . p . 89, note 2.

6 For a "

p e rve rse

" ca se wh ich ma y occurwh e nth is is not true se e Ap p e ndix, p . Io6.

T HE PRODUC T ION FUNC T ION AND T HE T HEORY OF C APIT AL 95

of p rof it h a s be e n rul ing ove r th e p e riod wh e n th e e xisting stock of ca p ita l goods wa s

be ing constructe d). We must, th e re f ore , ima gine th a t, by a p roce ss of tria l a nd e rror,

we f ind a p osition, f or e a ch f a ctor ra tio, wh e re th e two a re congrue nt. T h e p roductivity

curve , sa y s,

y .82a 2,

is dra wn up on th e ba sis of a ra te of inte re st e qua l to th e ra te of

p rof it wh ich woul d obta in if th e wa ge ra te we re such a s to ma ke Ga mma a nd Be ta

te ch nique s e qua l l y p rof ita bl e . T h e th ick l ine in th e dia gra m is th e f a ctor-ra tio curve .

At 72 th e f a ctor ra tio is OC 2, a nd a l l me n a re e mp l oy e d with Ga mma te ch nique .

An incre a se in th e f a ctor ra tio f rom 0C 2 towa rds Ob2 a nd a rise of outp ut f rom OC

towa rds OB woul d come a bout by substituting Be ta f or Ga mma p l a nts. Wh e n th e

f a ctor ra tio h a s rise n to Ob2 a l l worke rs a re e mp l oy e d with Be ta te ch nique , a nd outp ut

is OB. A f urth e r incre a se in th e f a ctor ra tio ca n come a bout onl y by th e introduction

of Al p h a p l a nts, but th is re quire s a rise in th e wa ge ra te a nd e nta il s a f a l l in th e ra te

of p rof it. We , th e re f ore , jump h orizonta l l y , f rom 2 to

P,

onto th e p roductivity curve

corre sp onding to th e ra te of p rof it wh ich obta ins wh e n th e wa ge ra te is such th a t

Al p h a a nd Be ta te ch nique s a re e qua l l y p rof ita bl e . T h e f a ctor ra tio incre a se s f rom

Ob1 to

Oa ,

by th e substitution of Al p h a f or Be ta p l a nts until , a t Oa 1 a l l me n a re e m-

p l oy e d with Al p h a te ch nique . A f urth e r incre a se in th e f a ctor ra tio th e n re quire s a

rise in th e wa ge ra te . And so on, up th e h ie ra rch y of te ch nique s, f rom one p roductivity

curve to a noth e r. At th e f ina l up p e r l imit, wh e re a f urth e r incre a se in th e f a ctor ra tio

ca nnot f urth e r incre a se outp ut p e r ma n, we re a ch th e sta te of Bl iss, wh e re wa ge s

a bsorb th e wh ol e p roduct a nd ca p ita l h a s ce a se d to be sca rce re l a tive l y to th e sta te

of knowl e dge .

T h e f ore going a na l y sis sh ows th a t th e re l a tion of ca p ita l to l a bour, in a n e quil i-

bnrum p osition, ca n be re ga rde d a s th e re sul ta nt of th e inte ra ction of th re e distinct

inf l ue nce s: th e wa ge ra te , th e ra te of inte re st a nd th e de gre e of me ch a nisa tion.

T h e inf l ue nce of th e wa ge ra te up on th e va l ue in te rms of p roduct of give n

p h y sica l ca p ita l wa s e mp h a sise d by Wickse l l ,1 a nd h a s be e n ca l l e d th e Wickse l l e f f e ct.2

Wh e n we re ga rd a stock of ca p ita l a s th e re sul t of a ccumul a tion brough t a bout by

sa ving-th a t is, re f ra ining f rom consuming income -we me a sure th e sa ving in te rms

of consump tion f orgone , a nd th e a ccumul a te d ca p ita l a s a sum of va l ue in te rms of

p roduct. T h e inf l ue nce of th e Wickse l l e f f e ct (l e a ving a side f or th e mome nt th e

inf l ue nce of inte re st on th e cost of ca p ita l goods) de te rmine s th e a mount of p h y sica l

ca p ita l wh ich a give n a mount of p a st a ccumul a tion h a s brough t into e xiste nce .

T h is inf l ue nce ca n be distinguish e d f rom th e e f f e ct of me ch a nisa tion by con-

side ring a ca se in wh ich th e re is onl y one te ch nique known. Sup p ose th a t to e mp l oy a

ma n re quire s a sp e cif ic se t of ca p ita l goods, -wh ich we ma y ca l l f or conve nie nce a

ma ch ine , th ough it incl ude s work-in-p rogre ss a s we l l a s l ong-l ive d e quip me nt. With out

just th is ma ch ine , a worke r ca n p roduce noth ing, a nd no oth e r kind of e quip me nt

h a s e ve r be e n th ough t of . T h e n comp a ring two situa tions in one of wh ich , Be ta -one ,