Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Health

Cargado por

KvvPrasadDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Health

Cargado por

KvvPrasadCopyright:

Formatos disponibles

Compare Health Insurance in India

Nobody wants to halt their life or work because of ill health and wish to stay happy all the

time. But, the escalating count of diseases and their mounting cost of treatments have

become a concern today. Even a single visit to doctor can suck your wallet. Health

insurance in India has emerged like a savior for all. Taking care of your wellbeing as well

as your pocket, it has made things simpler for all. It pays off your heavy medical bills,

consultation fees, accident or emergency case charges. Helping out to shoulder the

financial burdens, mediclaim in India comes with easy buying and satisfying assurance.

Health Policies in India

Individual - Designed to cover an individual against various illnesses with cashless

hospitalization and other features.

Family Floater Mediclaim - Covers family members against diseases under a single plan,

this cover offers a fixed sum insured for the members that can be either availed by

individual member or as a sum total for treatment of one person.

Surgery & Critical Illness - Availed as a standalone plan or a rider incase of treatment

against serious illnesses like- cancer, kidney failure, heart attack, paralysis etc.

Senior Citizen - Covering you when you turn old and unable to resist severe sickness

because of your growing age. According to IRDA norms, every insurer needs to provide

cover for people up to the age of 65 years.

Preventive Healthcare - In charge of concerns related to expensive preventive care

treatments which include consultation charges and other tests or x-ray fees concessions.

Benefits and Features

For treasuring well being one must have a comprehensive health policy. From individual

to family floater plan, all come with some features and benefits; lets check a few major

covers-

Cashless treatment - Every insurer displays a network of hospital where when treated

the insured does not require to pay a penny from his pocket unless it is a voluntary

discount case.

Pre and post hospitalization - Under the medical plan in India, the insured is paid for the

pre and post hospitalization charges which include tenure of 30 to 60 days depending on

the insurer.

Ambulance charges - The policy holder is free from burden of transportation or

ambulance charges.

Pre-existing disease cover -After a waiting period of 2-4 years, various policies offer a

cover against the pre-existing diseases -e.g. - diabetes, hypertension etc.

No Claim Bonus - NCB or no claim bonus is a benefit provided if the insured does not

claim for any treatment in the previous year. Benefit could be in any form, either an

increment in the sum assured or a discount in premium.

Medical check up -Free check up is provided by few insurers if there is a good history of

no claim bonus.

Tax Benefits - If you are paying premium for medical policy then you are liable to get tax

rebate under section 80D of Income Tax Act for a maximum value of Rs.15000 for

regular and Rs.20000 for senior citizen.

Co-Payment - Providing you option to cut short your premium amount, medical insurance

offers co-payment option wherein there is a define amount of voluntary deductibles

mentioned in the policy which are paid by the insured. So in case of treatment, some

amount is paid by the insured and rest by the insurer.

Critical illness cover - You can extend your cover by opting for critical illness or various

riders depending on your age and medical history of your family.

Criteria To Choose Best Health Insurance

Caps and sub-limits - Imposition of sub limits, Co-payments or other caps might reduce

the premium you pay for the insurance policy but would limit the benefits in a similar or a

worse proportion.

Claim settlement record -This might be an ultimate decider for weighing the insurance

plans credentials. Although this information might not be available publicly or might be

present in a manipulated state, experts expect it to be of more value to the customers in

near future than it is currently.

Scope of coverage -Weighing premium vs. plans benefits is more necessary while

defining the plan to be a comprehensive one. Buying a plan just because its cheaper

than other plans is bad decision making.

Renewability - Most of the diseases confront you after you reach a certain age which is

bracketed as old, therefore it becomes highly important to buy a plan which has a very

high or a lifetime renewability so that you are not left on your own, when you need a

medical cover the most.

Cashless Hospital Network - Checking for the hospitals around you those are covered as

a network hospital by the plan you consider is imperative, as this allows you to avail the

service of that hospital without getting into the hassles of claim reimbursements from the

insurer, rather benefiting from the cashless facility given by the network hospitals.

Premium Loading - We would suggest one to always check the terms and conditions

pertaining to premium loading, this might save you from paying a high incremental

premium once you make a claim for the sun insured. The best practice would be to verify

the premium fluctuation data of the plan for previous 5 years the least.

Internal team - Check for the plans from insurers which have an internal team for

mediclaim, this might help in expediting the claim settlement process to a good extent.

Floater(family) size - Everyone has a different family size, one should always look for the

family floater size allowed under the plan before considering buying it, so that no

member is left uncovered for health related problems.

Medical Insurance Comparison Helps:

It might sound tricky to select one policy from this array of mediclaim plans. But, we at

policybazaar.com intend to offer a comprehensive comparison of policies depending on

your requirements. Offering affordable quotes along with details of benefit or riders

available, we generate an analysis report of plans you can choose from. Assisting our

customers on the selection of the best medical insurance in this competitive market,

policybazaar.com understands and spreads awareness regarding the need of good plan

in India.

Health insurance companies in India

Indian insurance sector is a substantial one and currently there are 24 non-life or health

insurance providers in India. The insurance regulatory body (IRDA) opened this sector in

2000 and investment up to 26% is currently allowed to invest by foreign companies in

India. This sector consists of private as well as public sector companies to solicit

insurance within the regulations of IRDA. There are lots of options as far as insurance

companies are concerned, public as well as health insurance private operators as well.

List of Health insurance companies in India

Following are the medical insurance companies in India:

Apollo Munich Health Insurance Company limited

This is a joint venture between Apollo hospitals and Munich Health who both as

individual companies have succeeded in providing healthcare services. Their joint

venture is also their effort to provide quality insurance services to people.

Star Health and Allied insurance Co Ltd

This company is the countrys first stand-alone health insurance company in India

dealing in Personal Accident, Mediclaim and Travel insurance.

Future Generali India Insurance Company Ltd

Future Generali is a joint venture between the India-based Future Group and the Italy-

based Generali Group. It is present in both life and non-life insurance business.

Bajaj Allianz General Insurance Co Ltd

Bajaj Allianz General Insurance Company Limited is a joint venture between Bajaj

Finserv Limited (recently demerged from Bajaj Auto Limited) and Allianz SE. Bajaj

Finserv Limited holds 74% and the remaining 26% is held by Allianz, SE.

ICICI Lombard General Insurance Co Ltd

ICICI Lombard GIC Ltd. is a joint venture between ICICI Bank Limited, Indias second

largest bank and Fairfax Financial Holdings Limited, a Canada based diversified financial

services company engaged in general insurance, reinsurance, insurance claims

management and investment management.

National Insurance Co Ltd

It is a government controlled undertaking and provides motor, health and fire insurance.

Iffco Tokio General Insurance Co Ltd

It is a joint venture between the Indian Farmers Fertilizer Co-operative (IFFCO) and its

associates and Tokio Marine and Nichido Fire Group, the largest listed insurance group

in Japan.

The New India Assurance Co Ltd

It is a nationalized general insurance company with its presence abroad as well.

The Oriental Insurance CO Ltd

It is a central government undertaking providing general insurance and has operations in

Nepal, Kuwait and Dubai.

Reliance General Insurance Co Ltd

It is one of the private insurance company providing motor, health, travel insurance etc.

United India Insurance Co Ltd

It is a nationalized general insurance company having its operation in whole country.

Royal Sundaram Alliance Insurance Co Ltd

It is a joint venture between Sundaram Finance, one of the most respected non-banking

financial institutions in India, and RSA, one of the oldest and the second largest general

insurer in the UK.

TATA AIG General Insurance Co Ltd

Tata AIG General Insurance Company Limitedis a joint venture between Tata Group and

the renowned American International Group, Inc. This insurance firm started operations

on April 1, 2001.

Cholamandalam MS General Insurance Co Ltd

It is a private general and health insurer having pan India presence.

HDFC ERGO General Insurance Co Ltd

HDFC ERGO General Insurance Company Limited is a 74:26 joint venture between

HDFC Limited, Indias premier Housing Finance Institution and ERGO International AG,

the primary insurance entity of Munich Re Group.

Universal Sompo General Insurance Co Ltd

It is a joint venture of four Indian companies (with three banks and a FMCG company)

and Japanese general insurance provider. It is a health insurer having operations in

whole country.

Bharti AXA General Insurance Co Ltd

It is a joint venture between Bharti Enterprises of India and AXA group of Europe.

SBI General Insurance Company Ltd

SBI General Insurance Company Limited is a joint venture between the State Bank of

India and Insurance Australia Group (IAG). SBI owns 74% of the total capital and IAG

the remaining 26%.

Raheja QBE General Insurance Co Ltd

Raheja QBE General Insurance Company Limited, a joint venture general insurance

company promoted by Prism Cement Limited, India and QBE Holdings (AAP) Pty

Limited, a wholly owned subsidiary of QBE Insurance Group Limited, Australia.

MAX Bupa Health Insurance Company Ltd

MAX Bupa Health Insurance Company is formed with a joint venture between Max India

Limited and the UK based Bupa Finance PLC, UK.

L & T General Insurance Co Ltd

L & T General Insurance Company Limited (L & T Insurance) is a wholly owned

subsidiary of Larsen & Toubro Limited.

Religare Health Insurance Co Ltd

It is a company formed by Religare enterprises, Corporation Bank and Union Bank of

India.

Magna HDI General Insurance Co Ltd

Magma Fincorp Limited and its Promoters signed a Joint Venture agreement with HDI-

Gerling International Holding AG, Germany on 28 July 2009 at Kolkata to enter into the

general insurance sector in India.

Liberty Videocon General Insurance

It is newest health insurance provider and a company formed with joint venture between

Liberty Videocon General Insurance, a joint venture between the Videocon Group and

the US-based Liberty Mutual Insurance Group.

DETAILS OF INSURANCE COMPANIES PROVIDING HEALTH INSURANCE PLANS

A. GENERAL INSURANCE COMPANIES PROVIDING HEALTH INSURANCE PLANS

S.No Name Address Phone Fax Email Website

Health

Insurance

Products

1

Bajaj Allianz

General Insurance

Co Ltd

GE Plaza 1st Floor,

Airport Rd., Yerawada,

Pune 411006,

Maharashtra

020-66026666

020-

66026667

info@bajaja

llianz.co.in

www.bajaja

llianz.co.in

click here

2

Bharti Axa

General Insurance

Co. Ltd.

RMZ Infinity Tower B, II

Floor, Old Madras

Road, Bengalaru.

080-40260100

080-

40260101

media@bharti-

axagi.co.in

www.bhar

ti-axagi.co.in

click here

3

Cholamandlam

MS General

Insurance Co. Ltd

Dare House' 2nd Floor,

No. 2 N.S.C Bose

Road, Chennai-600001,

Tamil Nadu

044-42166000

044-

42166001

www.cholain

surance.com

click here

4

Future Generali

India

Insurance Co.Ltd.

001, Trade Plaza, 414,

Veer Savarkar Marg,

Prabhadevi, Mumbai-

400025, Maharashtra

022-40976666

022-

40976868

care@futu

regenerali.in

www.fut

uregenerali.in

click here

5

HDFC Ergo

Genral Insurance

Co Ltd

6th Floor, Leela

Business Park, Andheri

Kurla Road, Andheri(E),

Mumbai 400059,

Maharashtra

022-66383600

022-

66383699

care@hdf

ceergo.com

www.hdf

cergo.com

click here

6

ICICI Lombard

General Insurance

Co. Ltd.

2nd Floor, Zenith

House, Keshavrao

Khadye Marg, opp.

Race Course,

Mahalakshmi, Mumbai,

022-24906999

022-

24927624

www.

Icicilombard.com

click here

Maharashtra

7

IFFCO Tokio

General Insurance

Co. Ltd.

4th and 5th Floor,

IFFCO Tower, Plot#3,

Sector 29, Gurgaon,

Haryana-122001

0124-2850100

0124-

2577923,

2577924

www. Itgi.co.in click here

8

National

Insurance Co Ltd

3 Middleton Street,

Kolkatta-700071, West

Bengal

033-22831705.

22831706

033-

22831712

admin@national

insuranc

eindia.com

www.nationalin

suranceind ia.com

click here

9

Reliance General

Insurance Co. Ltd.

570, Niagaum Cross

Road, Next to Royal

Industrial Estate,

Wadala(W), Mumbai

400031, Maharashtra

022-30479602

022-

30479650

www.relian

cegeneral

.co.in

click here

10

Shriram General

Insurance

Company Limited

Greamns Dugar, 5th

Floor, No 149, Greams

road, Chennai 600006.

0141-3220896,

898,, 900, 902

0141-

2770426

www.sriram.com click here

11

Royal Sundaram

Alliance Insurance

Co. Ltd.

Sundaram Towers, 45

& 46, Whites Road,

Chennai-6000014,

Tamil Nadu

044-28517387,

42227373

044-

28517376

customer.service

@royalsun

daram.in

www.royals

undaram.in

click here

12

Tata AIG General

Insurance Co Ltd

Peninsula corporate

Park, Nicholas Piramal

Tower, 9th Floor,

Ganpatrao Kadam

Marg, Lower Parel

Mumbai 400013.

1800-11-9966,

022-66939500

customersupport

@tata.aig.com

www.tata-aig.com click here

13

The New India

Assurance Co.

Ltd.

New India Assurance

Building 87 M G Road,

Fort, Mumbai 400001.

22674617-22 022-

22652811

www.newindia.co.in click here

14

The Oriental

Insurance Co. Ltd.

Oriental House, A

25/27, Asaf Ali Road,

New Delhi-110002

011-23279221,

222,223,224,225

011-

23287192-

193

www.orientalins

urance.nic.in

click here

011-

23283971

15

United India

Insurance Co. Ltd.

24, Whites Road,

Chennai-600014 044-28520161

044-

28523825

www.uiic.co.in click here

16

Universal Sompo

General Insurance

Co. Ltd.

310-311, Trade Centre,

3rd Floor, opp. MTNL

office, Bandra Kurla

Complex, Bandra

(East), Mumbai

022-40287777

022-

40287781

contactus

@univers

alsompo.com

www.universal

sompo.com

click here

B. LIFE INSURANCE COMPANIES PROVIDING HEALTH INSURANCE PLANS

17

Life Insurance

Corporation of

India

P&GS Unit, 14th Floor,

Yoga Kshema J.B.

Marg, Mumbai-400001

022-26137545

www.lic india.com click here

18

Aviva Life

Insurance

2nd Floor, Prakash

Deep Bldg., 7-Tolstoy

Marg, New Delhi-

110001

011-23313310

www.aviva

india.com

click here

19

Birla Sun Life

Insurance

Vaman Centre, 6th

Floor, Makhwana Road,

opp. Andheri-Kurla

Road, Andheri (East)

Mumbai-400059

022-66783333

www.birlas

unlife.com

click here

20

Bajaj Allianz Life

Insurance Co Ltd

GE Plaza, Airport Rd.,

Yerawada, Pune

411006,

020-4026666

020-

4026789

www.bajajallia

nzlife.co.in

click here

21

Bharti AXA Life

Insurance Co Ltd

601-602 6th

Floor,Raheja Titanium

Off Western Express

Highway Goregaon (E)

Mumbai-400063

022-40306300

/6301

022-

40306347

www.bharti-

axalife.com

click here

22

Future Generali

India Life

Insurance

Company Limited

001, Delta

Plaza,Ground

Floor,414, Veer

Savarkar Marg,

Prabhadevi, Mumbai-

400025, Maharashtra

022-40976666

022-

40976600.

www.future

generali.in

click here

23

HDFC Standard

Life Insurance

Company Ltd.

2nd Floor, Trade Star

Kondivita Junction

Andheri Kurla Road

Andheri East Mumbai-

400059

022-67516666

022-

28228844

www.hdfcins

urance.com

click here

24

ICICI Prudential

Life Insurance Co.

Ltd.

ICICI Prulife Towers,

1089, Appasaheb

Marathe Marg,

Prabhadevi, Mumbai-

400025.

022-56621996

022-

56622031

www.icicip

rulife.com

click here

25

IDBI Fortis Life

Insurance Co, Ltd.

Tradeview, Oasis

Complex, Kamala City,

P.B. Marg, Lower Panel

(W), Mumbai-400013

022-24908109

/10

022-

24941016

www.idbifor

tis.com

click here

26

Max New York

Life Insurance Co.

Ltd.

11th Floor, DLF

Square, Jacaranda

Marg, DLF City, Phase-

II, Gurgaon-122002

0124-2561717

0124-

2561764

www.maxnewy

orklife.com

click here

27

MetLife India

Insurance Co. Ltd.

Brigade Seshamahal,

No. 5, Vani Vilas Road,

Basavanagudi,

Bangalore-560004

080-26438638,

1-600-44-6969

www.metlife .co.in click here

28

Reliance Life

Insurance Co. Ltd.

1st Floor, Midas, Sahar

Plaza, Andheri Kurla

Road, Andheri

East,Mumbai-400059

022-30883434

/30887261

022-

30886587

www.relia

ncelife.com

click here

29

SBI Life Insurance

Co. Ltd.

Turner Morrison

Building, 2nd Floor, 16,

Bank Street, Fort

Mumbai-400023.

022-56392000

022-

56621471

www.sbilife .co.in click here

30

Star Union Dai-

ichi Life Insurance

Co. Ltd.

Star House, 3rd Floor,

(West Wing), C-5

Bandra-Kurla Complex,

Bandra (East), Mumbai-

400051

022-39546211

www.sudl

ife.in

click here

31

TATA AIG Life

Insurance Co. Ltd.

5th, 7, 6th Floor,

Peninsula Tower,

Peninsula Corporate

Park Ganpatrao Kadam

Marg, Lower Paral,

Mumbai-400013

022-66516000

022-

66550711

www.tata -aig.com click here

C. HEALTH INSURANCE COMPANIES PROVIDING HEALTH INSURANCE PLANS

32

Apollo Munich

Insurance Co Ltd

Masterpiece Bldg., Gold

Course Rd., Sector-54,

Gaurgaon-122002,

Haryana

0124-4584101

0124-

4584111

customerservice

@apollodkv.co.in

www.apoll

odkv.co.in

click here

33

Max-Bupa Health

Insurance Co Ltd

2nd Floor, Salcon Ras

Vilas, D-1, District

Centre, Saket, New

Delhi 110017.

011-30902000,

30902120

1800-3070-

3000

customercare@

maxbupa.com

www.maxbupa.com click here

34

Star Health and

Allied Insurance

Co. Ltd.

Corporate Office No. 1,

1 New Tank Street,

Valluvar Kottam High

Road, Nungambakkam,

Chennai-600034

044-28260053

044-

28260062

info@star

health.ini

www.starh ealth.in click here

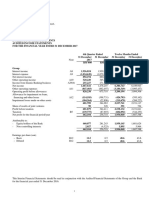

HDFC Ergo Star Bajaj Religare

Name of plan Health Suraksha Plus Silver Health Optima Health Guard Family Floater Care

Sum assured INR 5,00,000 INR 5,00,000 INR 5,00,000 INR 5,00,000

Premium (approx.) INR 15,116 INR 10,826 INR 13,834 INR 12,505

Medical Tests No No No No

Top Features -

Personalized for you

Room Rent Coverage No sub-limits applicable INR 7500 (Normal Room) No sub-limits applicable No sub-limits applicable

Waiting Period (PED) 4 years 4 years 4 years 4 years

Maternity Coverage

provided after

Not Covered Not Covered Not Covered Not Covered

Claim Settlement Ratio

OPD Coverage Not Covered Not Covered Not Covered Not Covered

Hospitalization Benefits

Pre Hospitalization

Coverage

60 days 30 days 60 days 30 days

Post Hospitalization

Coverage

90 days

Upto 7% of hospitalization

expenses (Max. INR 5000)

90 days

60 days

Domicillary Hospitalization

Covered up to

5 Lacs

Not Provided

Not Covered

50000

Daily Cash Benefit Covered

up to

Not Provided

Not Provided

Not Provided

Not Provided

Network Hospitals Covered 9 16 5 -

Medical Benefits

Day Care Procedures

Covered

141 Covered 130 All

Organ Donor Coverage INR 5 Lacs Not Covered Not Covered INR 1 Lacs

Ambulance Service Covered

upto

INR 2000 INR 1500 INR 1000 INR 2000

Additional Benefits

Free Health Check Up's After 4 claim free years (Rs

5000).

Not Provided After 4 claim free years Annually

No Claims Benefits provided INR 2.5 Lacs enhancement

in sum insured

INR 1.75 Lacs

enhancement in sum

insured

INR 2.5 Lacs enhancement

in sum insured

INR 2.5 Lacs enhancement

in sum insured

Claim based Loading Not Applicable Not Applicable Not Applicable Not Applicable

Co-Payment Required Not Applicable 20% if age is above 60 yrs

at entry level

For treatment in non -

network hospitals (50K)

20% (If entry age is above

60 years)

Renewability Lifelong Lifelong Lifelong Lifelong

Apollo Munich IFFCO-TOKIO Royal Sundaram L&T Insurance

Name of plan Optima Restore Swasthya Kavach (Wider) Family Good Health my:health Medisure

Classic

Sum assured INR 5,00,000 INR 5,00,000 INR 5,00,000 INR 5,00,000

Premium (approx.) 15337 11827 15362 14338

Medical Tests No No No No

Top Features -

Personalized for you

Room Rent Coverage No sub-limits applicable Room rent sub limit -

Rs.5000 (normal room)

Rs. 10000 (ICU)

Rs. 10000 (Normal

Room) ; Rs. 20000 (ICU)

No sub-limits applicable

Waiting Period (PED) 3 years 4 years 4 years 3 years

Maternity Coverage

provided after

Not Covered Not Covered Not Covered 4 years

Claim Settlement Ratio

OPD Coverage Not covered Not Covered Not Covered Not Covered

Hospitalization Benefits

Pre Hospitalization

Coverage

60 days 30 days 30 days 30 days

Post Hospitalization

Coverage

180 days 60 days 60 days 60 days

Domicillary Hospitalization

Covered up to

5 Lacs 1 Lacs Not Covered Covered

Daily Cash Benefit Covered

up to

Not Provided Provided (Rs. 250 per

day)

Provided Provided (Rs. 500 per

day)

Network Hospitals Covered - 5 15 9

Medical Benefits

Day Care Procedures

Covered

140 121 Covered All

Organ Donor Coverage Covered Covered Covered Covered

Ambulance Service Covered

upto

Rs. 2000 Rs. 1500 Rs. 1000 Rs. 1500

Additional Benefits

Free Health Check Up's Not Provided Not Provided After 4 claim free years

(Rs. 750)

After 4 claim free years

(Rs. 5000)

No Claims Benefits provided Rs. 5 Lacs enhancement

in sum insured

Rs. 2.5 Lacs

enhancement in sum

insured

Not Provided Rs. 2.5 Lacs

enhancement in sum

insured

Claim based Loading Not Applicable Not Applicable Not Applicable Not Applicable

Co-Payment Required Not Applicable Not Applicable Not Applicable Co-pay of 10%, after the

age of 80 yrs

Renewability Lifelong Lifelong Lifelong Lifelong

Max Bupa Reliance Cigna

Name of plan Heartbeat Gold Health Gain ProHealth Plus SB

Sum assured INR 5,00,000 INR 5,00,000 INR 5,00,000

Premium (approx.) INR 21161 INR 16329 INR 15816

Medical Tests No No No

Top Features -

Personalized for you

Room Rent Coverage No sub-limits applicable No sub-limits applicable Single Private Room

Waiting Period (PED) 4 years 4 years 3 years

Maternity Coverage

provided after

2 years Not Covered Covered Upto Max.

25000/-

Claim Settlement Ratio

OPD Coverage Covered Not Covered Rs. 2000/-

Hospitalization Benefits

Pre Hospitalization

Coverage

30 days 60 days 60 days

Post Hospitalization

Coverage

60 days 60 days 180 days

Domicillary Hospitalization

Covered up to

25000 60000 Covered Upto S.I

Daily Cash Benefit Covered

up to

- - 5

Network Hospitals Covered

Medical Benefits

Day Care Procedures All Covered 171

Covered

Organ Donor Coverage Covered Rs. 3 Lacs Rs. 5.5 Lacs

Ambulance Service Covered

upto

Rs. 2000 Rs. 1500 Rs. 3000

Additional Benefits

Free Health Check Up's Annually Not Provided Annually

No Claims Benefits provided Value added benefits of

10% Premium

Rs. 6 Lacs enhancement

in sum insured

Rs. 2.75 Lacs

enhancement in sum

insured

Claim based Loading

Co-Payment Required Co-pay of 20%, after the

age of 65 yrs

Upto Rs. 1.2L in case

eldest member >60 years

at entry level

Upto Rs. 110000/- in case

insured member > 65

years.

Renewability

The oriental insurance Future General National insurance HDFC Life

Name of plan Happy Family Floater Silver Health Suraksha Basic Parivar Health Assure (Silver)

Sum assured INR 5,00,000 INR 5,00,000 INR 5,00,000 INR 5,00,000

Premium (approx.) INR 10184 INR 11556 INR 10694 INR 44775

Medical Tests

Top Features -

Personalized for you

Room Rent Coverage Rs. 5000 (Normal Room) ;

Rs. 10000 (ICU)

No sub-limits applicable No sub-limits applicable Rs. 5000 (Normal Room) ;

Rs. 10000 (ICU)

Waiting Period (PED) 4 years 4 years 4 years 4 years

Maternity Coverage

provided after

Not Covered Not Covered Not Covered Not Covered

Claim Settlement Ratio

OPD Coverage Not Covered Not Covered Not Covered Not Covered

Hospitalization Benefits

Pre Hospitalization

Coverage

30 days 60 days 15 days 30 days

Post Hospitalization

Coverage

60 days 90 days 30 days 60 days

Domicillary Hospitalization

Covered up to

Covered Not Covered Covered 5 Lacs

Daily Cash Benefit Covered

up to

Not Provided Not Provided Provided Provided

Network Hospitals Covered 1 4 5 9

Medical Benefits

Day Care Procedures 35 130 141 200

Covered

Organ Donor Coverage Not Covered Not Covered Not Covered Rs. 5 Lacs

Ambulance Service Covered

upto

Rs. 3000 Rs. 1500 Rs. 2000 Rs. 2000

Additional Benefits

Free Health Check Up's After 4 claim free years (Rs.

5000)

After 4 claim free years After 4 claim free years (Rs.

5000)

After 3 claim free years

No Claims Benefits provided Not Provided Rs. 2.5 Lacs enhancement in

sum insured

Not Provided Rs. 5 Lacs enhancement in

sum insured

Claim based Loading Not Applicable Not Applicable Not Applicable Not Applicable

Co-Payment Required Not Applicable Not Applicable Total expenses payable for

any one illness is restricted

to 50% of the sum insured

20% - In case of non-

network hospitals

Renewability Lifelong Lifelong Lifelong Lifelong

This list of Indian insurance companies is based on the list of insurance companies registered and approved with the Insurance

Regulatory and Development Authority.

General insurance companies

Public Sector

Oriental Insurance Comp. Ltd.

United India Insurance Comp. Ltd.

New India Assurance comp. Ltd.

National Insurance Company

The Motor Assurance India Comp. Ltd.

Private Sector

Bajaj Allianz General Insurance

Bharti AXA General Insurance

Future Generali India Insurance

HDFC ERGO General Insurance

ICICI Lombard

IFFCO Tokio

Liberty Videocon General Insurance Co Ltd

L&T General Insurance

Magma HDI General Insurance Co Ltd

Raheja QBE General Insurance

[1]

Reliance General Insurance

Royal Sundaram

Aegon Religare

Shriram General Insurance

Tata AIG General

Universal Sompo General Insurance

Cholamandalam MS General Insurance Company Limited

Apollo Munich Health Insurance

Standalone health insurance companies

Private Sector

Star Health and Allied Insurance company Ltd

Apollo Munich Health Insurance

Max Bupa Health Insurance

Religare Health Insurance Company Ltd

Cigna general insurance

Universal Sompo General Insurance

Export credit guarantee insurance companies

Public Sector

Export Credit Guarantee Corporation of India

Agriculture Insurance Companies

Agriculture Insurance Company of India Ltd

Life insurance companies

Public Sector

Life Insurance Corporation of India

Employee's State Insurance Corporation

Private Sector

AEGON Religare Life Insurance

[2]

Edelweiss Tokio Life Insurance Co. Ltd

Aviva India

Shriram Life Insurance

Bajaj Allianz Life Insurance

Bharti AXA Life Insurance Co Ltd

Birla Sun Life Insurance

Canara HSBC Oriental Bank of Commerce Life Insurance

Star Union Dai-ichi Life Insurance

DHFL Pramerica Life Insurance

Future Generali Life Insurance Co Ltd

HDFC Standard Life Insurance Company Limited

ICICI Prudential Life Insurance Company Limited

IDBI Federal Life Insurance

IndiaFirst Life Insurance Company

Exide Life Insurance

Kotak Life Insurance

Max Life Insurance

PNB MetLife India Life Insurance

Reliance Life Insurance Company Limited

Sahara Life Insurance

SBILife Insurance Ltd.

TATA AIA Life Insurance

Re-insurance companies

Public Sector Government of India Fully owns 1 company:

GIC Re (General Insurance Corporation of India - Re-Insuer)

AVAILABLE MEDICLAIM/ HEALTH INSURANCE PLANS

1) Individual Health Insurance Plan

3) Senior Citizen Health Insurance Plan

5) Group Health Insurance Plan

7)Overseas Travel Health Insurance Plan

9) Special Plans

9a) Daily Cash Plan

9b) Maternity Benefit Plan

9c) OPD Coverage Health Insurance Plan

2) Family Floater Health Insurance Plan

4) Critical Care Health Insurance Plan

6) Accident Health Insurance Plan

8) Student Health Insurance Plan

10) Health Covers from Life Insurance Companies

1.Individual Health Insurance Plan:

Largely, an individual Health Insurance Plan (HIP), or mediclaim, would cover expenses if you are hospitalized for at least 24 hours. These plans are

indemnity policies, that is, they reimburse the actual expenses incurred to the amount of the cover that you buy. Some of the expenses that are covered are

room rent, doctors fees, anesthetists fees, cost of drugs, blood, oxygen, and investigations, and operation theatre charges.

In case of a claim under the above plans, expenses incurred are reimbursed. The remaining amount can be claimed during the remaining period of the

policy.

In case the insured has not made any claim during the entire period of policy:

No-claim bonus ranging usually between 5-10% is given on the premium of ensuing year.

Some companies also enhance the amount of cover without any extra premium.

Individual General/Health Insurance Companies Products

1. Apollo Munich Insurance Co Ltd

Easy Health Individual

2. Bajaj Allianz General Insurance Company Ltd

Health Guard

Hospital Cash

3. Bharti AXA General Insurance Company Limited

Smart Health Individual Policy

4. Cholamandalam MS General Insurance Company Limited

Individual Health

5. Future Generali India Insurance Co Ltd

Health Suraksha Individual Plan

6. HDFC Ergo General Insurance Company Limited

Health Suraksha

7. ICICI Lombard General Insurance Co Ltd

Health Advantage Plus

8. IFFCO Tokio General Insurance Co Ltd

Individual Medishield

9. National Insurance Company Limited

Mediclaim Policy

10. Reliance General Insurance Co Ltd

Individual Mediclaim Insurance Policy

11. Royal Sundaram Alliance Insurance Co Ltd

Health Shield Individual Insurance

12. Star Health and Allied Insurance Co Ltd

Medi Classic

Medi Premier

True Value

13. Tata AIG General Insurance Co Ltd

Maharaksha

14. The New India Assurance Co Ltd

Mediclaim 2007

15. The Oriental Insurance Co Ltd

Individual Mediclaim Policy

16. United India Insurance Co Ltd

Mediclaim Policy

United Indias Top-Up and Super Top Up Policies

17. Universal Sompo General Insurance Co Ltd

Universal Sompo Individual Health Insurance Policy

2.Family Floater Health Insurance Plan:

This is a fairly new entrant in the health insurance market policies. It takes advantage of the fact that the probability of all members of a family falling ill

at the same time or even within the same year is quite low. Under this plan, the entire sum insured can be availed by any or all members, and is not

restricted to one individual as is the case in an individual health plan.

Its operation can be explained simply through the following example. Say, a family consisting of five members has individual covers (under conventional

individual health plans for each member) of Rs. 1 lakh each such that their total cover cost is Rs 5 lakh. But if the cost of treating one person crosses Rs. 1

lakh, incase, the balance has to be paid by the family, beyond what it has paid for the policy. If on the other hand, the entire family is insured for Rs 5

lakh under the family floater policy, then any one or more than one of the members can avail reimbursement of the medical expenses upto to a total of 5

lakh during the insured period. Of course, there always is a small but real possibility that multiple members fall sick in the same year, in which case they

might still have to pay out of pocket beyond the total coverage.

A Family Floater can be brought by an individual, who becomes the proposer along with spouse, dependent children up to 25 years, and/or unmarried,

divorced or widowed daughter and/or either parents or parents in laws.

A discount of upto 10 per cent (may vary from company to company) is allowed on renewal premium, if there is no claim in the year immediately

preceding the year of policy renewal.

In other respects, they are broadly similar to Individual Health Insurance Plans.

In case the insured has not made any claims during the entire period policy:

No-claim bonus ranging usually between 5-10% is given on the premium of ensuing year.

Some companies also enhance the amount of cover without any extra premium.

1 Family Floater Health Insurance products from General Health Insurance Companies

1. Apollo Munich Insurance Company Limited

Easy Health Family Floater

2. Bajaj Allianz General Insurance Company Limited

Family Floater Health Guard

Insta Insurei Family Floater Policy for Rs 1 Lacs

Star Package

3. Bharti AXA General Insurance Company Limited

Smart Health Essential Insurance Policy

Smart Health High Deductibles Insurance Policy

Smart Health Insurance Policy.

4. Cholamandalam Ms General Insurance Company Limited

Family Health.

5. HDFC Ergo General Insurance Company Limited

Health Suraksha (Individual and Family floater)

6. ICICI Lombard General Insurance Company Limited

Family Floater Health Insurance

7. IFFCO-Tokio General Insurance Company Limited

Swasthya Kavach (Family Health)

8. National Insurance Company Limited

Parivar Mediclaim for Family

Star National Swasthya Bima Policy

BOI National Swasthya Bima

9. Reliance General Insurance Co Limited

Reliance Health Wise Policy

10. Royal Sundram Alliance Insurance Company Limited

Health Insurance for Individuals and Family

Health Shield Online

11. Star Health and Allied Insurance Company Limited

Family Health Optima.

12. The Oriental Insurance Company Limited

Happy Family floater Health Insurance/Policy Wording

13. United India Insurance Company Limited

Family Medicare Policy India

14. Universal Sompo General Insurance Company Limited

IOB Health Care Plus Policy

2. Family Floater Health Insurance Products from Life Insurance Companies

1. Aviva Life Insurance Company India Limited

Aviva Life Shield Plus

2. Bajaj Allianz Life Insurance Company Limited

Family Care First

3. Bharti AXA Life Insurance Company Limited

Easy Health

4. ICICI Prudential Life Insurance Company Limited

Health Saver, Medi Assure

5. Life Insurance Corporation of India

Health Protection Plus

Health Plus

6. Max New York Life Insurance Company Limited

Life Line Healthy Family Plan

7. MetLife India Insurance Company Limited

Met Health Care

3. Senior Citizen Health Insurance Plan:

These plans as the name suggests designed to cater to the senior citizens. This is significant as till a few years ago, it was difficult for a senior citizen to

get a health cover though they are the ones who need it most. Most of these have a fixed sum insured of Rs. 1 lakh or Rs 2 lakh. Some compulsorily

require co-payment. These are, in essence, Individual Health Insurance Plans with minor modifications. Check for sub-limits on specific ailments.

Age of entry varies from company to company, and is usually between 60 to 80 years. Age limit can be extended to 90 years with loading of some

extra premium.

Critical illness as an optional cover is also available in some of the plans on paying extra premium.

Senior Citizens Health Insurance

1. Bajaj Allianz General Insurance Company Limited

Silver Health Policy

2. National Insurance Company Limited

Varistha Mediclaim for Senior Citizens

3. Star Health and Allied Insurance Co Ltd

Senior Citizen Red Carpet

4. The New India Assurance Co Ltd

Senior Citizen Mediclaim Policy

5. The Oriental Insurance Co Ltd

Senior Citizen Specified Diseases Insurance

6. United India Insurance Co Ltd

Senior Citizen Policy

4. Critical Care Health Insurance Plan:

Critical illness plans work differently from other health insurance covers. They provide financial assistance when one develops a serious ailment such as

cancer or a stroke. In such cases, a critical illness plan pays the entire sum insured. Note that this is unlike a health cover which only reimburses the costs.

Such plans cover a specific number of ailments only and the cover ends once the sum insured is paid.

In case of a claim, the entire sum insured is paid on diagnosis of the specified illness

No-claim bonus is paid only by few companies

1. Critical Illness Health Plans From General Insurance Companies

1. Bajaj Allianz General Insurance Company Limited

Critical Illness

2. Bharti AXA General Insurance Company Limited

Smart Health

3. HDFC Ergo General Insurance Company Limited

Critical Illness

4. ICICI Lombard General Insurance Company Limited

Critical Care

5. IFFCO-Tokio General Insurance Company Limited

Critical Illness Policy

6. National Insurance Company Limited

Critical Illness Policy

7. Reliance General Insurance Co Limited

Reliance Critical Illness Policy

8. Star Health and Allied Insurance Company Limited

Star Criticare Plus

9. Tata AIG General Insurance Company Limited

Criticare

10. Universal Sompo General Insurance Company Limited

Aapat Suraksha Bima Policy

2. Critical Illness Health Plans From Life Insurance Companies

1. Aviva Life Insurance Company India Ltd

Aviva Health Plus

2. Bharti AXA Life Insurance Company Ltd

Swasthya Sanjeevani

3. HDFC Standard Life Insurance Company Ltd

HDFC Critical Care Plan

HDFC Surgicare Plan

4. ICICI Prudential Life Insurance Company Ltd

Crisis Cover

5. Max New York Life Insurance Company

LifeLine Wellness Plan

LifeLine-Safety Net Plan

Lifetime Wellness Plus Plan

6. Met Life India Insurance Company Limited

Met Health Care

7. SBI Life Insurance Company Limited

SBI Health Product

Group Schedule of Critical Illness

8. Tata AIG Life Insurance Company Limited

Tata AIG Life Group Health Plus

Tata AIG Life Health First

Tata AIG Life Health Investor

Tata AIG Life Health Protector

5. Group Health Insurance Plan:

Group Health Insurance is similar to Health Insurance for an individual or a family. The difference is that this product is taken by a group, which is in

existence at the time of submission of the proposal with specified names of members/being available. A group comprises of an existing set of

persons/individuals on the basis of certain norms. It is always permitted to add new members in the group and delete those members who have left the

group.

The rates applicable are more or less same as applicable to individuals with discount being given at the different rates by different companies.

Group should fall under some specified categories for example:

Employer-employee relationship including dependents of the employee.

Pre-identified segments/groups where the premium is to be paid by the State/Central Governments.

Members of a registered co-operative society.

Members of registered service clubs.

Holders of credit card of Bank/Diners/Visa.

Holders of deposit certificates issued by Banks/NBFCs.

Shareholders of Banks/Public Limited companies.

Minimum number of Person: 100

Age limited, basic premium, benefits and exclusions are same as per individual mediclaim policy.

There are no family discounts, cumulative bonus and cost of health checkup. The policy should not be issued through intermediaries. Maternity Benefits:

The maximum cover available up to Rs () for maternity or the sum insured opted by the members of group, whichever is lower. This is an optional

cover which can be obtained on payment 10% of the total Basic premium for all the insured persons under the policy at the time of policy inception only.

Total basic premium means the total premium computed before applying group discount and/or high claim leading low claim discount and any special

discounts.

Option for this cover has to be exercised at the inception of the policy period and no refund is available in case the insured cancels this option during the

policy.

A waiting period of 9 months is applicable for payment of any claim relating to normal delivery or caesarian section or abdominal operation for extra-

uterine pregnancy. The waiting period may be relaxed only in the case of delivery, miscarriage or abortion induced by accident or other medical

emergency.

Claim in respect of delivery for only first 2 children and/or operation associated therewith is considered.

Voluntary termination of pregnancy during the first 12 weeks from the date of conception is not covered.

Pre and post-natal expenses are not covered unless hospitalized.

Group Discount:

The final group discount increase/decrease will be adjusted on the policy period provided the policy is renewed for the next 12 months.

The above mentioned points are common features being adopted by the companies, but there is always variation between the offers of two companies.

Groups getting insured should check the details from different companies before selecting one.

Group Health Insurance Plans For Corporate/Organizations

1. Apollo Munich Insurance Company Limited

Group Health Insurance

2. Bajaj Allianz General Insurance Company Limited

Group Health Guard

Group Critical Illness

3. Cholamandalam MS General Insurance Company Limited

Group Health

4. Future Generali India Insurance Company Limited

Group Health Policy

5. HDFC ERGO General Insurance Company Limited

Group Health Insurance

6. ICICI Lombard General Insurance Company Limited

Group Mediclaim Insurance Policy

7. Reliance General Insurance Co Limited

Reliance Group Mediclaim Insurance Policy

8. Tata AIG General Insurance Co Ltd

Accident and Health

Group Multi Guard

Voluntary Employee Benefits

9. The Oriental Insurance Company Limited

Group Mediclaim Policy

10. United India Insurance Company Limited

Mediclaim Policy

11. Universal Sompo General Insurance Company Limited

Group Health Insurance Policy

6. Accident Health Insurance Plan:

The personal Accident Policy provides the following basic benefits against death and disablement resulting from an accident, but not more than one of the

following:

Death Only

Loss of sight of two eyes, or loss of two hands or feet, or loss of the use of one hand and one foot, or loss of vision in one eye and loss of use of

one hand or foot.

Loss of vision in one eye or loss of use of one hand or one foot.

Permanent total disablement from injuries other than named as above.

Permanent partial disablement for loss of limbs as shown below:

Loss of toe All

Great both Phalanges

Great One phalanx

Other than great, if more than one toe lost each

Loss of hearing in both ears

Loss of hearing in one ear

Loss of four fingers and thumb of one hand

Loss of four fingers

Loss of thumb-body phalanges

One phalanx

Loss of index fingers-Three phalanges

Two Phalanges

One phalanx

Loss of Middle finger : Three phalanges

Two Phalanges

One Phalanx

Loss of Ring finger-Three Phalanges

Two Phalanges

One Phalanx

Loss of Little finger-Three Phalanges

Two Phalanges

One Phalanx

Loss of Metacarples-1st or 2nd (additional)

3rd, 4th of 5th (additional)

Any other permanent partial disablement.

Permanent total disablement.

Temporary total disablement

In the event of death of the insured person due to accident outside his/her residence, reimbursement of expenses incurred for transportation of the

insureds dead body to the place of residence are subject to a maximum of 2% of the capital sum insured or Rs1000, whichever is less.

The following extra benefits may be covered on payment of additional premium:

Reimbursement of Medical Expenses incurred following an accident upto 40% of the valid claim payable or 10% of the Capital Sum Insured for Personal

Accident Cover, whichever is less.( may differ from company to company and plan to plan) Sums insured under notified conditions is increased by 5%

for every claim free year of the policy to a maximum limit of 50% once the policy is renewed in time.

The cumulative bonus will be lost if the policy is not renewed within 30 days after its expiry.(may differ from company to company).

Classification of Occupational Risks:

For classification of occupational risks not specified below reference should be made to the company.

Risk Group I:

Accountants, Doctors, Lawyers, Architects, Consulting Engineers, Teachers, Bankers, persons engaged in administrative functions and persons primarily

engaged in occupation of similar hazard.

Risk Group II:

Builders, Contractors and Engineers engaged inn superintending functions only, Veterinary Doctors, paid drivers of motor cars and light motor vehicles

and person engaged in occupation of similar hazard and not engaged in manual labour.

All persons engaged in manual labour (except those failing under group III) cash carrying employees, garage and motor mechanics, machines operators,

drivers of trucks or lorries and other heavy vehicles, professional athletes and sports men, woodworking machinists and persons engaged in

occupations/activities of similar hazards.

Risk Group III:

Persons working in underground mines, explosive magazines, workers involved in electrical installation with high tension supply jockeys, circus

personnel, persons engaged in activities like racing on wheels or horse back, big game, hunting, mountaineering, winter sports, skiing, ice hockey,

ballooning, polo and persons, engaged in occupations/activities of similar hazard.

Note: Occupations not included in the above will be decided by insurer depending upon the merits of each individual case. Exclusion:

The policy does not cover death, injury or disablement resulting from:

Service on duty with any armed force.

Intentional self injury, suicide or attempted suicide, insanity, venereal disease or the influence of intoxicating drink or drugs.

Medical or surgical treatment (except where such treatment is rendered necessary within the scope the policy).

Aviation other than as a passenger (fare-paying or otherwise) in any duly licensed standard type of aircraft any where in the world.

Nuclear radiation of nuclear weapons materials.

Any consequence of war, invasion, act of foreign enemy hostilities (whether war is declared or not), civil war, rebellion revolution, insurrection,

mutiny military or usurped power, seizure, capture, arrests, restraint and detainments of all kinds,

Child birth, pregnancy or other physical causes peculiar to the female sex.

Whilst committing any breach of law with criminal intent.

Notes:

The cover is worldwide.

The capital sum insured shall be fixed at the commencement of the policy. No change in the CSI in permissible during the tenure of the policy.

Occupations not included in the above will be decided by insurer depending upon the merit of each case in consultation with RO/HO Technical

Dept.

Sum insured usually does not exceed 2 years income with a maximum of six year income.

Sometimes persons avail accident benefits as a part of other policies just like Life Insurance, Car Insurance, etc. The insured should have a

complete record of all the policies providing accident benefits as under unforeseen circumstances, one is eligible to get reimbursement from all the

policies.

1. Individual Personal Accident Policy

1. Apollo Munich Insurance Company Limited

Individual Personal Accident Plan

2. Bajaj Allianz General Insurance Company Limited

Personal Guard

Sankat Mochan

Health Ensure

3. Bharti AXA General Insurance Co Ltd

Smart Personal Accident Individual Insurance

4. Cholamandalam Ms General Insurance Company Limited

Chola Accident Protection Plan

5. Future Generali India Insurance Co Ltd

Accident Protection Plan

Revive

6. HDFC Ergo General Insurance Company Limited

Accident Suraksha

7. ICICI Lombard General Insurance Company Limited

Individual Personal Accident Insurance

8. IFFCO-Tokio General Insurance Company Limited

Individual Personal Accident

9. National Insurance Company Limited

Personal Accident Policy

10. Raheja QBE General Insurance Co Ltd

Accident Personal

11.Reliance General Insurance Co Limited

Individual Personal Accident Policy

12. Royal Sundram Alliance Insurance Company Limited

Personal Accident Insurance Online

13. Shriram General Insurance Co Ltd

Personal Accident Insurance

14. Star Health And Allied Insurance Company Limited

Accident Care

15. Tata AIG General Insurance Co Ltd

Accident Guard

Healthcare+

Hospital Care

Secured Future Plan

16. The New India Assurance Co Ltd

Personal Accident Policy

17. The Oriental Insurance Company Limited

Personal Accident Individual

18. United India Insurance Company Limited

Janata Personal Accident

Gramin Accident Policy

19. Universal Sompo General Insurance Company Limited

Individual Personal Accident Policy.

2. Group Personal Accident Policy for Corporate/Organization

1. Apollo Munich Insurance Company Limited

Group Personal Accident

2. Bajaj Allianz General Insurance Company Limited

Group Personal Accident

3. Cholamandalam Ms General Insurance Company Limited

Group Personal Accident

4. Future Generali India Insurance Company Limited

Group Personal Accident Policy

5. HDFC Ergo General Insurance Company Limited

Group Personal Accident Insurance

6. ICICI Lombard General Insurance Company Limited

Group Personal Accident Insurance Policy

7. Reliance General Insurance Co Limited

Personal Accident Insurance Policy (Group)

8. Tata AIG General Insurance Company Limited

Group Personal Accident

Business Travel Accident

Small Business Travel Accident

9. The Oriental Insurance Company Limited

Personal Accident Group

10. United India Insurance Company Limited

Personal Accident Policy

11. Universal Sompo General Insurance Company Limited

Group Personal Accident Policy

7. Overseas Travel Health Insurance:

Overseas travel health insurance is required because medical services are exceptionally expensive to those in comparison to our country. Initially such

policies were primarily taking care of emergency hospitalization/medical treatment but today this product is available with several additional features

(may differ from company to company and plan to plan) as listed below:

Medical expenses

Dental treatment

Repatriation of remains (covers the funeral expenses or expenses of repatriating the remains back to India, in case of death overseas)

Checked in Baggage loss

Passport loss

Personal accident (compensation paid in case of accidental death and PTD due to an accident).

Personal liability (Compensation of damages to be paid to a third party, resulting from death, injury or damage to health or property caused

involuntarily by the insured).

Bail Bond (for the bail amount, if arrested or detained by police or judicial authorities of the place, for any bailable offense whilst abroad).

Study interruption (Reimbursement for the remaining part of the current school semester fee, if studies are interrupted on account of a medical

condition or compassionate reasons on the family front).

Sponsor protection (Reimbursement of tuition fees in case of demise of person paying for studies due to an accident).

Two-way compassionate visit (In case of hospitalization exceeding 7 days of student or a family member, where a family member visits student,

or student visits India. Round trip economy class tickets for student/family-members and accommodation for the family member visiting abroad

would be reimbursed).

Treatment for mental and nervous disorders.

In-patient medical expenses related to pregnancy, subject to a waiting period of 10 months.

Medical screening and mammography expenses.

Children benefits (If the child is above 90 days of age, and is hospitalized for more than two days for any ailment, hospital cash benefit of US

$100 per day will be paid, subject to a maximum of 7 days).

At present the policies can be divided into:

1. Single trip policy

2. Annual Multi trip policy.

As the name indicates, single trip covers a single trip starting on a specific date and ending on a specific date. It is possible to extend the date on payment

of additional premium subject to condition that no claim has been made. Extension of policy is at the discretion of the insurance company.

Annual Multi trip policy is having validity of one year. Multiple trips are allowed with the condition that no single trip can be greater than 30 days. Some

insurance companies now offer an option of a maximum duration for a single trip of 45 days.

The terms and conditions of issuing this policy differ from company to company. One is advised to compare various offers being made by different

companies specially keeping in view the following:

Permissible upper age limit.

Whether pre existing diseases would be covered or not.

Name of the hospitals attached with the policy.

Any upper limit of reimbursement amount.

Overseas Travel Health Insurance Products

1. Apollo Munich Insurance Company Limited

Easy Travel Individual Plan

Easy Travel Family

Easy Travel Senior Citizen

Easy Travel Annual Multi Trip

2. Baja Allianz General Insurance Company Limited

Travel Asia

Travel Assist

Travel Companion

Travel Elite

3. Cholamandalam Ms General Insurance Company Ltd

Short Term Travel

4. Future Generali India Insurance Co Ltd

Travel Suraksha

Overseas Travel

Multi Trip

Asia Travel

Superior Care

5. HDFC Ergo General Insurance Company Limited

Travel Insurance

6. ICICI Lombard General Insurance Company Limited

Annual Multi Trip

Senior Citizen Plan

Single Round Trip

7. IFFCO-Tokio General Insurance Company Limited

Travel Protector

8. National Insurance Company Limited

Overseas Mediclaim

9. Reliance General Insurance Co Limited

Reliance Travel Care Insurance Policy Asia

Reliance Travel Care Insurance Policy Schengen

Reliance Travel Care Insurance Policy for Individuals and Families

10. Royal Sundram Alliance Insurance Company Limited

Travel Shield Online

11. Star Health and Allied Insurance Company Limited

Travel Individual

Travel Family

12. Tata AIG General Insurance Co Ltd

Travel Guard

Asia Travel Guard

13. The New India Assurance Co Ltd

Overseas Mediclaim Policy

14. The Oriental Insurance Company Limited

Overseas Mediclaim Business and Holiday

15. United India Insurance Company Limited

Overseas Mediclaim Policy for Business and Holiday.

Group Overseas Travel Policy for Corporates and Organizations

1. Apollo Munich Insurance Company Limited

Easy Travel Corporate

2. Bajaj Allianz General Insurance Company Limited

Group Travel

3. HDFC Ergo General Insurance Company Limited

Group Travel Insurance

4. ICICI Lombard General Insurance Company Limited

Corporate Overseas Travel

5. Reliance General Insurance Co Limited

Reliance Travel Care Insurance Policy

6. Max New York Life Insurance Company Limited

Life Line Healthy Family Plan

7. MetLife India Insurance Company Limited

Met Health Care

8. Students Health Insurance Plan:

Policy for the students are being designed to provide health and personal accident cover to them. It also provides for the continuation of insured students

education in case of death or permanent total disablement of the guardian due to accident. Parents /Legal Guardian of an individual student in any

Registered Educational Institution affiliated to any State Board, Council, University and AICTE or any other Government Statutory Authority within the

territory of India, may take this policy. The Educational Institution may also take a Group Policy covering named students enrolled with them.

Policies for Students

National Insurance Company Limited

Vidyarthi-Mediclaim for Students (Domestic)

2-Star Health and Allied Insurance Co Ltd

Student Mediclaim (Domestic)

9a. Daily Hospital Cash Plans

As treatment moves away from home and towards hospitals, insurers have started offering daily hospital cash (DHC) plans. You can buy maximum daily

covers of anything between Rs. 500 and Rs. 5,000. The premium would depend on the age and amount. For stay in intensive care units, the amount is

automatically doubled. There is usually a cap on the number of days of claim per year. Expense benefit is paid on per day basis after hospitalization (most

plans mandate at least 48 hours of hospitalization). The pre-decided daily benefit amount is paid in full, irrespective of the actual expenses For example, a

person buys a DHC plan with a limit of Rs 2,000 per day. He gets hospitalized for 7 days and the total bill is Rs 35,000. He would be reimbursed Rs

14,000 (2,000x7). If the bill is Rs 8,000, he would still be reimbursed Rs 14,000.

9b. Maternity Hospitalization:

At present maternity hospitalization is being covered under group insurance policies by most of the companies. (See details under Group Insurance).

Some of the companies initially offered maternity cover as a part of individual policy but there was a paucity of information about the exact companies

providing this service.

9c. OPD Coverage Health Insurance Plans:

There are only two companies which are providing OPD coverage in their health insurance plans.

ICICI Lombards Health Advantage Plus ;

The Apollo Munichs Maxima.

The ICICI covers OPD expenses i.e. consultation, tests or medicines from the first day of the policy. The OPD cover may vary from Rs 2,000 to Rs

10,000 depending on the plan opted and the age profile of policy holder. One can claim OPD charges only once during the policy term so one has to keep

all the bills paid safely to get the reimbursements as and when the limit is reached.

The Apollo Munichs Maxima benefits includes, cash-less OPD expenses across trusted network of pharmacies for pharmacy bills, diagnostic centers for

diagnostic tests and annual health check up, dental and optical care centers for contact lenses, spectacles and dental treatments along with consultation

with family doctors.

OPD Coverage as a Part of Health Insurance

1. ICICI Lombard General Insurance Co Ltd

Health Advantage Plus

2. Apollo Munich Insurance Company Limited

Maxima Health Insurance Plan

10. Health Covers From Life Insurance

In a fairly recent development Life insurance companies too have started offering health covers. Usually, these have a longer term then those offered by

general insurance and often fixed premiums for three, five or even 10 yrs. Contrary to popular belief, however, not all health schemes from life insurance

companies give you the insured amount as a lump sum irrespective of your actual spending. The plans from life insurance typically fall into the categories

discussed above. But they are often packaged as combinations (See Health Plans From Life Insurers: Whats On Offer) with an IHIP, or DHC, or even

with surgeries. Since the insurer will pay only for the benefits mentioned, it is prudent to find the exact nature of the cover before the purchase.

1. Health Products of Life Insurance Companies

Aviva Life Insurance Company India Limited

Aviva Health Plus

Aviva Lifeshield Plus

Protection Riders

2. Health Products of Life Insurance Companies

Bajaj Allianz Life Insurance Company Limited

Family Care First

Care First

Health Care

3. Health Products of Life Insurance Companies

Bharti AXA Life Insurance Company Limited

Easy Health

Swasthya Sanjeevani (Group)

4 Health Products of Life Insurance Companies

Birla Sun Life Insurance Company Limited

BSLI Universal Health

BSLI Health Plan

5. Health Products of Life Insurance Companies

Future Generali India Life Insurance Company Limited

Future Sanjeevani (Riders)

Riders

6. Health Products of Life Insurance Companies

HDFC Standard Life Insurance Company Limited

HDFC Critical Care Plan

HDFC Surgicare Plan

7. Health Products of Life Insurance Companies

ICICI Prudential Life Insurance Company Limited

1. Comprehensive Health Coverage

Health Saver

2. Hospitalization Coverage

Medi Assure-(Family Floater)

Hospital Care

3. Critical Illness Coverage

Crisis Cover

4. Cancer Coverage

Cancer Care

5. Diabetes Coverage

Diabetes Care Active

8. Health Products of Life Insurance Companies

IDBI Fortis Life Insurance Company Limited

Wealth Insurance Plan

9. Health Products of Life Insurance Companies

Life Insurance Corporation of India

Health Protection Plus

Health Plus

10. Health Products of Life Insurance Companies

Max New York Life Insurance Company Limited

LifeLine Medicash

LifeLine Medicash Plus Plan

LifeLine Wellness Plan

LifeLine Wellness Plus Plan

LifeLine-Safety Net Plan

LifeLine Health Family Plan

11. Health Products of Life Insurance Companies

MetLife India Insurance Company Limited

Met Health Care

12. Health Products of Life Insurance Companies

Reliance Life Insurance Company Limited

Wealth Plus Health Plan

?Riders Plan

13. Health Products of Life Insurance Companies

SBI Life Insurance Company Limited

SBI Life-Group Criti9

14. Health Products of Life Insurance Companies

Star Union Dai-ichi Life Insurance Company Limited

Critical Illness Benefit Rider

Accidental Death and Total & Permanent Disability Benefit Rider

15. Health Products of Life Insurance Companies

Tata AIG Life Insurance Company Limited

Tata AIG Life Group Health Plus

Tata AIG Life Health First

Tata AIG Life Health Investor

Tata AIG Life Health Protector

Tata AIG Life Hospi CashBack

Tata AIG Life InvestAssure Care

Tata AIG Life InvestAssure Health

How to Choose Best Health Insurance in India

Today we will find out how to Choose Best Health Insurance in India . With so many Insurance companies , so many health insurance policies with

different names and complex features, it becomes an impossible task for a common man to pick a policy and be confident about it . So I requested

Mahavir Chopra from medimanage.com, a vetern in the Health Insurance sector having a vast experience to give some insights to readers on how to

choose health insurance product and explain the think step wise. Medimanage is a health insurance broker, which blends unbiased Health Insurance

Expertise, Technology Powered Delivery and Professional Claims Management into one integrated service model. Over to Mahavir from here on

Health Insurance, as its known worldwide is the only effective mechanism known and available that can ensure you to get the best healthcare at

affordable price. Whereas, the healthcare industry being more organized abroad, has resulted in insurance companies offering more comprehensive range

of products overseas. Comparing this to the Indian Healthcare system, in its current form, can be actually be called by Hospitalization Insurance. The

products that are available in country, only covers for the expenses related to hospitalization charges for accidents as well as sickness. This benefit of

course is subject to a looooong list of term and conditions.

Manish asked me to be very specific, and give the readers (of JagoInvestor.com, a blog I admire for its simplicity and rich content) a clear take away on

how they can zero in the best product in the market. With more than 25 General Insurance Companies marketing more than 40 Health Insurance products,

comparing multiple terms of such policies looks like a daunting task (see a common man complaint to a health insurance company) . Its not, if you first

come to terms with the following 2 things:

1. Settle to the fact that there is no Exact-match, no Perfect Product available.

2. You only compare the crucial features/benefits/terms that will affect your coverage in the long run.

Here are the most important things you must follow when you compare products. Of course, there are other features you can compare, which have been

left out in this article. These features (like 1, 2 year waiting periods, Pre and Post Hospitalization Expenses, Loading, No Claim Discounts have been left

out, looking at Health Insurance as a long-term product)

1. Cut out the frills. Go Basic

Most frilled products in India are not at all cost-effective. They are the products which take almost double the median premium and offers unnecessary

frills is a strict no no. We have all traditionally lived with and survived the cost of routine medical expenses like Consultation expenses, Dentists bills,

Medicine bills, and such costs are therefore manageable by most of us, unlike a huge hospitalization bill which could eat way more than a couple of

months salary or savings.

Bottom-line : You should first look at covering ALL members of your family for the larger unmanageable costs, which could burn a hole in your

overall financial planning before signing for any fancy product. (see two policies which are cost effective)

2. Dont Compare Premiums

Never start by comparing premiums. Health Insurance is long-term purchase and it is more than a Mumbai-Delhi Air Ticket, which you can compare and

buy from comparison/aggregator websites. Health Insurance is a long-term complex contract coupled with complex services. Comparison of premiums

could be largely misleading and could result in a disaster. Comparing Health Insurance requires deeper insights into the overall insurance contract (called

policy wordings) over and above price comparison. Either you need to get yourself into comparing the features in detail, or take help of an unbiased

health insurance advisor.

Bottom-line: Understanding the benefits and terms is more important than the cost you are paying.

3. Look for Maximum Renewal Age

Maximum Renewal age is the age on which the coverage on your health insurance would discontinue. This could be for all members or for a specific

proposer/member, depending on product to product. Remember, your core goal, when you buy Health Insurance is to save yourself from mounting

healthcare costs right through your life. A product, which ceases renewal, while you are still alive and when you need it more than any time before, is a

BAD product. Shift through all products and find out the maximum renewal age. Better, look for Lifetime products. Rule out all products, which do not

cover your family members for a reasonable lifetime. As medical science progresses and becomes more accessible to the common man, life expectancy in

India will move higher from the current average of around 70 years. A product with a lower renewal ceasing age than 70 years is a complete no no.

Bottom-line: An insurance product which does not work, when you most need it, is not insurance.

4. Look for Limits (Treatment wise limits & Copay)

Look for treatment wise limits in the products. Treatment wise limits basically cap the amount you can claim for a particular surgery under the policy.

Say, there could be limits for Cardiac treatments of Rs. 1.50 Lakhs or for Cataract for Rs. 20000 per eye. Such limits would cap your claim, even n when

you have a large sum insured under the policy. You need to weigh this in, before you sign up. Some products I remember are United Indias Family

Medicare, Star Healths Red Carpet have such limits. Bajaj Allianz General and ICICI Lombard have a limit only for Cataract. (Max Bupa Review)

Another condition is the COPAY it is basically the share of admissible claim that the customer would have to pay from their own pocket. For instance,

with copay option of 10%, the claim amount is of Rs. 50,000, and the admissible claim is Rs. 48,000 then the copay amount would be Rs. 4800. The

Total amount you would have to pay is Rs. 6800/- (Rs. 2000 deduction in the policy + Rs. 4800 of Copay) .

Couple of products which have Copay

Oriental Happy Family Floater at 10% of the Sum Insured upto Rs. 5 Lakhs Sum Insured.

Bajaj Allianz has a copay of 10% for treatment at Non-Network Hospitals in their Health Guard products, and 20% in Silver Health.

Star Senior Citizen Red Carpet has a copay of 30%. For Pre-existing the copay is 50%.

Bottom-line: Know what you will not get paid.

5. Understand Day wise Cash limit Health Products

There are some products marketed and sold as Health Insurance (Aegon Religare Life, Tata AIG General are the popular ones) which provide a daily cash

benefit for the no. of days one is hospitalization. Most surgeries require an average of 6-10 days, so at the Rs. 5000 per day limit multiplied by 10 Days

would pay Rs. 50000 per hospitalization, irrespective of the actual charges incurred. An Angioplasty in this will unknowingly burn a big hole in your

pocket. Please avoid this product for your core healthcare expenditure risks or as an alternative to a Standard Health Insurance product. This product is

more like an add-on cover, than the bigger solution.

Important Note : Do not confuse the above with products that have specific limits on Room Rent. Room Rent Limits, to an extent, make sense both for

the customer, as well as the Insurance Company, as they categorize people paying a higher premium in the higher eligibility bracket. This has been

further discussed in detail below in this article.

Bottom-line: All plans which are called Health Insurance may not be what you are looking for.

6. Zero in on a Coverage amount/Sum Insured

Sum Insured is the total annual liability under the policy. Since this is a long-term product, you

should look at the maximum available cover you can afford. Remember, a sum insured of Rs. 2 to 3 Lakhs will have no value, by the time you start using

it. As per a very recent report on Healthcare in India by Tower Watson, the medical inflation in India is rocketing anywhere between 17 to 20% annual

Option of Upgrading Sum Insured: The option of upgrading the cover at a later stage when you are older is dicey and complicated. There could be a

requirement for a medical test. Moreover, if you or any of the family members contact a new disease in the interim, the ailment would be excluded for the

upgraded amount. Upgrade would be almost like taking a new policy at that age, which I would not recommend.

Bottom-line: Look for the highest cover affordable. An I-will-upgrade-it-later option may not work.

7. Compare Premiums for age bands higher than 45 years

Premium in Health Insurance increases as per increase in your age, but, theres something about the no. 45. Insurance Companies dislike this no. Have a