Documentos de Académico

Documentos de Profesional

Documentos de Cultura

SEC 109 Exempt Transactions VAT

Cargado por

Ranin, Manilac Melissa S0 calificaciones0% encontró este documento útil (0 votos)

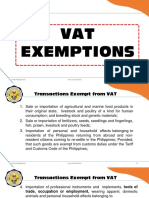

537 vistas3 páginasThis document lists various transactions that are exempt from value-added tax (VAT) in the Philippines. It exempts the sale of agricultural products, food items, fertilizers, fuel, ships, imports of personal effects by settlers, educational and medical services, art sales, and transactions below certain thresholds. It also exempts cooperatives, exports, real estate below a price threshold, low rental housing, publishing, and small businesses below a revenue threshold. The exemptions do not apply if the seller issues a VAT invoice.

Descripción original:

Section 109 of the Tax Code of the Philippines

Título original

TAX Code- Section 109

Derechos de autor

© © All Rights Reserved

Formatos disponibles

DOCX, PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoThis document lists various transactions that are exempt from value-added tax (VAT) in the Philippines. It exempts the sale of agricultural products, food items, fertilizers, fuel, ships, imports of personal effects by settlers, educational and medical services, art sales, and transactions below certain thresholds. It also exempts cooperatives, exports, real estate below a price threshold, low rental housing, publishing, and small businesses below a revenue threshold. The exemptions do not apply if the seller issues a VAT invoice.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

537 vistas3 páginasSEC 109 Exempt Transactions VAT

Cargado por

Ranin, Manilac Melissa SThis document lists various transactions that are exempt from value-added tax (VAT) in the Philippines. It exempts the sale of agricultural products, food items, fertilizers, fuel, ships, imports of personal effects by settlers, educational and medical services, art sales, and transactions below certain thresholds. It also exempts cooperatives, exports, real estate below a price threshold, low rental housing, publishing, and small businesses below a revenue threshold. The exemptions do not apply if the seller issues a VAT invoice.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

Está en la página 1de 3

SEC. 109. Exempt Transactions.

- The following shall be exempt from the value-

added tax:

(a) Sale of nonfood agricultural products; marine and forest products in their

original state by the primary producer or the owner of the land where the

same are produced;

(b) Sale of cotton seeds in their original state; and copra;

(c) Sale or importation of agricultural and marine food products in their

original state, livestock and poultry of or king generally used as, or yielding

or producing foods for human consumption; and breeding stock and genetic

materials therefor.

Products classified under this paragraph and paragraph (a) shall be

considered in their original state even if they have undergone the simple

processes of preparation or preservation for the market, such as freezing,

drying, salting, broiling, roasting, smoking or stripping.

Polished and/or husked rice, corn grits, raw cane sugar and molasses, and

ordinary salt shall be considered in their original state;

(d) Sale or importation of fertilizers; seeds, seedlings and fingerlings; fish,

prawn, livestock and poultry feeds, including ingredients, whether locally

produced or imported, used in the manufacture of finished feeds (except

specialty feeds for race horses, fighting cocks, aquarium fish, zoo animals

and other animals generally considered as pets);

(e) Sale or importation of coal and natural gas, in whatever form or state,

and petroleum products (except lubricating oil, processed gas, grease, wax

and petrolatum) subject to excise tax imposed under Title VI;

(f) Sale or importation of raw materials to be used by the buyer or importer

himself in the manufacture of petroleum products subject to excise tax,

except lubricating oil, processed gas, grease, wax and petrolatum;

(g) Importation of passenger and/or cargo vessels of more than five

thousand tons (5,000) whether coastwise or ocean-going, including engine

and spare parts of said vessel to be used by the importer himself as operator

thereof;

(h) Importation of personal and household effects belonging to the residents

of the Philippines returning from abroad and nonresident citizens coming to

resettle in the Philippines: Provided, That such goods are exempt from

customs duties under the Tariff and Customs Code of the Philippines;

(i) Importation of professional instruments and implements, wearing

apparel, domestic animals, and personal household effects (except any

vehicle, vessel, aircraft, machinery other goods for use in the manufacture

and merchandise of any kind in commercial quantity) belonging to persons

coming to settle in the Philippines, for their own use and not for sale, barter

or exchange, accompanying such persons, or arriving within ninety (90) days

before or after their arrival, upon the production of evidence satisfactory to

the Commissioner, that such persons are actually coming to settle in the

Philippines and that the change of residence is bona fide;

(j) Services subject to percentage tax under Title V;

(k) Services by agricultural contract growers and milling for others of palay

into rice, corn into grits and sugar cane into raw sugar;

(l) Medical, dental, hospital and veterinary services subject to the provisions

of Section 17 of Republic Act No. 7716, as amended:

(m) Educational services rendered by private educational institutions, duly

accredited by the Department of Education, Culture and Sports (DECS) and

the Commission on Higher Education (CHED), and those rendered by

government educational institutions;

(n) Sale by the artist himself of his works of art, literary works, musical

compositions and similar creations, or his services performed for the

production of such works;

(o) Services rendered by individuals pursuant to an employer-employee

relationship;

(p) Services rendered by regional or area headquarters established in the

Philippines by multinational corporations which act as supervisory,

communications and coordinating centers for their affiliates, subsidiaries or

branches in the Asia-Pacific Region and do not earn or derive income from

the Philippines;

(q) Transactions which are exempt under international agreements to which

the Philippines is a signatory or under special laws, except those under

Presidential Decree Nos. 66, 529 and 1590;

(r) Sales by agricultural cooperatives duly registered with the Cooperative

Development Authority to their members as well as sale of their produce,

whether in its original state or processed form, to non-members; their

importation of direct farm inputs, machineries and equipment, including

spare parts thereof, to be used directly and exclusively in the production

and/or processing of their produce;

(s) Sales by electric cooperatives duly registered with the Cooperative

Development authority or National Electrification Administration, relative to

the generation and distribution of electricity as well as their importation of

machineries and equipment, including spare parts, which shall be directly

used in the generation and distribution of electricity;

(t) Gross receipts from lending activities by credit or multi-purpose

cooperatives duly registered with the Cooperative Development Authority

whose lending operation is limited to their members;

(u) Sales by non-agricultural, non- electric and non-credit cooperatives duly

registered with the Cooperative Development Authority: Provided, That the

share capital contribution of each member does not exceed Fifteen thousand

pesos (P15,000) and regardless of the aggregate capital and net surplus

ratably distributed among the members;

(v) Export sales by persons who are not VAT-registered;

(w) Sale of real properties not primarily held for sale to customers or held for lease in the

ordinary course of trade or business or real property utilized for low-cost and socialized

housing as defined by Republic Act No. 7279, otherwise known as the Urban Development and

Housing Act of 1992, and other related laws, house and lot and other residential dwellings

valued at One million pesos (P1,000,000) and below: Provided, That not later than January

31st of the calendar year subsequent to the effectivity of this Act and each calendar year

thereafter, the amount of One million pesos (P1,000,000) shall be adjusted to its present

value using the Consumer Price Index, as published by the national Statistics Office (NSO);

(x) Lease of a residential unit with a monthly rental not exceeding Eight thousand

pesos(P8,000); Provided, That not later than January 31st of the calendar year subsequent to

the effectivity of Republic Act No. 8241 and each calendar year thereafter, the amount of Eight

thousand pesos (P8,000) shall be adjusted to its present value using the Consumer Price

Index as published by the National Statistics Office (NS0);

(y) Sale, importation, printing or publication of books and any newspaper, magazine review

or bulletin which appears at regular intervals with fixed prices for subscription and sale and

which is not devoted principally to the publication of paid advertisements; and

(z) Sale or lease of goods or properties or the performance of services other than the

transactions mentioned in the preceding paragraphs, the gross annual sales and/or receipts do

not exceed the amount of Five hundred fifty thousand pesos (P550,000): Provided, That not

later than January 31st of the calendar year subsequent to the effectivity of Republic Act No.

8241 and each calendar year thereafter, the amount of Five hundred fifty thousand pesos

(550,000) shall be adjusted to its present value using the Consumer Price Index, as published

by the National Statistics Office (NSO).

The foregoing exemptions to the contrary notwithstanding, any person whose sale of goods or

properties or services which are otherwise not subject to VAT, but who issues a VAT invoice or

receipt therefor shall, in addition to his liability to other applicable percentage tax, if any, be

liable to the tax imposed in Section 106 or 108 without the benefit of input tax credit, and

such tax shall also be recognized as input tax credit to the purchaser under Section 110, all of

this Code.

También podría gustarte

- 6th GATEDocumento33 páginas6th GATESamejiel Aseviel LajesielAún no hay calificaciones

- AP Research Survival Guide - RevisedDocumento58 páginasAP Research Survival Guide - RevisedBadrEddin IsmailAún no hay calificaciones

- Application For VAT Zero RatingDocumento9 páginasApplication For VAT Zero RatingHanabishi RekkaAún no hay calificaciones

- Vat NotesDocumento11 páginasVat NotesStephen CabalteraAún no hay calificaciones

- Facebook Facing Off Againt TencentDocumento6 páginasFacebook Facing Off Againt TencentWai Shan Lee0% (1)

- Risk and Return LectureDocumento67 páginasRisk and Return LectureRanin, Manilac Melissa S100% (3)

- Philippine Auditing Standards on Agreed-Upon Procedures EngagementsDocumento14 páginasPhilippine Auditing Standards on Agreed-Upon Procedures EngagementsTeresa RevilalaAún no hay calificaciones

- TAX-302 (VAT-Exempt Transactions) PDFDocumento5 páginasTAX-302 (VAT-Exempt Transactions) PDFclara san miguelAún no hay calificaciones

- 04 Vat Exempt TransactionsDocumento4 páginas04 Vat Exempt TransactionsJaneLayugCabacunganAún no hay calificaciones

- Topic 7 - Absorption & Marginal CostingDocumento8 páginasTopic 7 - Absorption & Marginal CostingMuhammad Alif100% (5)

- Handouts 56Documento11 páginasHandouts 56Omar CabayagAún no hay calificaciones

- Time Value of Money LectureDocumento54 páginasTime Value of Money LectureRanin, Manilac Melissa SAún no hay calificaciones

- Domondon Reviewer - Tax 2Documento38 páginasDomondon Reviewer - Tax 2Mar DevelosAún no hay calificaciones

- Stocks and Their Valuation LectureDocumento54 páginasStocks and Their Valuation LectureRanin, Manilac Melissa SAún no hay calificaciones

- TAX-302 (VAT-Exempt Transactions)Documento7 páginasTAX-302 (VAT-Exempt Transactions)Edith DalidaAún no hay calificaciones

- Singular and Plural NounsDocumento3 páginasSingular and Plural NounsJosé BulquesAún no hay calificaciones

- 2015 Nutrition Diagnosis Terminologi 2015Documento9 páginas2015 Nutrition Diagnosis Terminologi 2015Vivin Syamsul ArifinAún no hay calificaciones

- Psa 200 PDFDocumento7 páginasPsa 200 PDFDanzen Bueno ImusAún no hay calificaciones

- Oblicon Questions and AnswersDocumento2 páginasOblicon Questions and AnswersRanin, Manilac Melissa SAún no hay calificaciones

- SEC. 109. Exempt Transactions.Documento3 páginasSEC. 109. Exempt Transactions.Airon Keith AlongAún no hay calificaciones

- VAT-Exempt Transactions Under TRAIN LawDocumento2 páginasVAT-Exempt Transactions Under TRAIN LawFabiano JoeyAún no hay calificaciones

- XDM-300 IMM ETSI B00 8.2.1-8.2.2 enDocumento386 páginasXDM-300 IMM ETSI B00 8.2.1-8.2.2 enHipolitomvn100% (1)

- VAT Guide: Understanding Value-Added Tax PrinciplesDocumento32 páginasVAT Guide: Understanding Value-Added Tax Principlessei1davidAún no hay calificaciones

- REAL ESTATE REVIEWER (Excerpt From RA 7160 - Local Government Code)Documento14 páginasREAL ESTATE REVIEWER (Excerpt From RA 7160 - Local Government Code)KatsMendoza50% (2)

- Adzu Tax02 A Learning Packet 2 Value Added TaxDocumento9 páginasAdzu Tax02 A Learning Packet 2 Value Added TaxJustine Paul Pangasi-an100% (1)

- Value Added Tax NotesDocumento6 páginasValue Added Tax NotesPatrickHidalgoAún no hay calificaciones

- SEC. 109. Exempt Transactions. - The Following Shall Be Exempt From The Value-Added TaxDocumento3 páginasSEC. 109. Exempt Transactions. - The Following Shall Be Exempt From The Value-Added TaxLycka Bernadette MarceloAún no hay calificaciones

- SECTION 109. Exempt TransactionsDocumento4 páginasSECTION 109. Exempt TransactionsMarjorie Joyce BarituaAún no hay calificaciones

- VAT Exempt SalesDocumento5 páginasVAT Exempt SalesKristine CamposAún no hay calificaciones

- Tax 30222Documento5 páginasTax 30222Ronariza BondocAún no hay calificaciones

- Vat Exempt ChartDocumento1 páginaVat Exempt ChartmrsScaevolaAún no hay calificaciones

- Section 109 Should Be Read in Relation To Section 116Documento5 páginasSection 109 Should Be Read in Relation To Section 116Stephanie LopezAún no hay calificaciones

- VAT-Exempt TransactionsDocumento38 páginasVAT-Exempt TransactionsAkemiAún no hay calificaciones

- SUMMARY OF TAX TABLES AND RATES Train LawDocumento5 páginasSUMMARY OF TAX TABLES AND RATES Train LawErnest Christopher Viray GonzaludoAún no hay calificaciones

- TAX 302 VAT Exempt Transactions 1Documento6 páginasTAX 302 VAT Exempt Transactions 1Jeen JeenAún no hay calificaciones

- Sec 109Documento4 páginasSec 109David Harrison PascualAún no hay calificaciones

- VAT EXEMPTIONS GUIDEDocumento5 páginasVAT EXEMPTIONS GUIDERizzle RabadillaAún no hay calificaciones

- Tax 302 - Vat-Exempt TransactionsDocumento6 páginasTax 302 - Vat-Exempt TransactionsiBEAYAún no hay calificaciones

- Vat Taxable Vat Zero-Rated Vat-ExemptDocumento5 páginasVat Taxable Vat Zero-Rated Vat-ExemptNgan TuyAún no hay calificaciones

- R.A. No. 9238Documento6 páginasR.A. No. 9238Jesselle De GuzmanAún no hay calificaciones

- SEC. 109. Exempt Transactions.Documento12 páginasSEC. 109. Exempt Transactions.mayAún no hay calificaciones

- Value Added TaxDocumento13 páginasValue Added TaxKatrina FregillanaAún no hay calificaciones

- Ra 9238 GRT Vat On BanksDocumento8 páginasRa 9238 GRT Vat On Banksapi-247793055Aún no hay calificaciones

- VAT Exempt TransactionsDocumento7 páginasVAT Exempt Transactionsela kikayAún no hay calificaciones

- VAT Exempt SalesDocumento29 páginasVAT Exempt SalesNEstandaAún no hay calificaciones

- (G5 P2) VatDocumento76 páginas(G5 P2) VatFiliusdeiAún no hay calificaciones

- Value Added TaxDocumento114 páginasValue Added TaxDa Yani ChristeeneAún no hay calificaciones

- LawDocumento43 páginasLawMARIAAún no hay calificaciones

- 4 VAT ExemptionsDocumento28 páginas4 VAT ExemptionsMobile LegendsAún no hay calificaciones

- VatDocumento13 páginasVatJohn Derek GarreroAún no hay calificaciones

- Joan REPORTING TAX 1Documento6 páginasJoan REPORTING TAX 1Jasmin CaoileAún no hay calificaciones

- VAT Exempt Transactions GuideDocumento10 páginasVAT Exempt Transactions GuideMichelle NacisAún no hay calificaciones

- PT, Excise and DST NotesDocumento10 páginasPT, Excise and DST NotesFayie De LunaAún no hay calificaciones

- Philippines Tax Services BIR Issues Rules TRAIN Law VAT ProvisionsDocumento6 páginasPhilippines Tax Services BIR Issues Rules TRAIN Law VAT ProvisionsWilmar AbriolAún no hay calificaciones

- Digest RR 13-2018Documento9 páginasDigest RR 13-2018Maria Rose Ann BacilloteAún no hay calificaciones

- Republic Act No 6135Documento42 páginasRepublic Act No 6135Chewy ChocoAún no hay calificaciones

- VAT Exempt TransactionsDocumento4 páginasVAT Exempt TransactionsAndehl AguinaldoAún no hay calificaciones

- Value Added TaxDocumento14 páginasValue Added TaxWyndell AlajenoAún no hay calificaciones

- Vat Exempt Transactions: Page 3 of 6Documento4 páginasVat Exempt Transactions: Page 3 of 6Lei Anne GatdulaAún no hay calificaciones

- VatDocumento6 páginasVatKenneth Bryan Tegerero TegioAún no hay calificaciones

- REVENUE REGULATIONS NO. 9-2021 Issued On June 11, 2021 Amends CertainDocumento3 páginasREVENUE REGULATIONS NO. 9-2021 Issued On June 11, 2021 Amends CertainLady Paul SyAún no hay calificaciones

- Secret Files For TXDocumento118 páginasSecret Files For TXGrace EnriquezAún no hay calificaciones

- VAT ModuleDocumento50 páginasVAT ModuleRovi Anne IgoyAún no hay calificaciones

- Republic vs. CaguioaDocumento23 páginasRepublic vs. CaguioaVictoria aytonaAún no hay calificaciones

- SEC. 118. Prohibited Importation and Exportation. - The ImportationDocumento31 páginasSEC. 118. Prohibited Importation and Exportation. - The ImportationPaul EsparagozaAún no hay calificaciones

- Preferential TaxationDocumento2 páginasPreferential TaxationPrankyJellyAún no hay calificaciones

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocumento4 páginasBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledLeizel ZafraAún no hay calificaciones

- Certified Accounting Technician: Understanding Business TaxesDocumento33 páginasCertified Accounting Technician: Understanding Business TaxesAnonymous Lz2qH7Aún no hay calificaciones

- Imposition of TaxDocumento12 páginasImposition of TaxchriskhoAún no hay calificaciones

- Republic vs. CaguioaDocumento10 páginasRepublic vs. CaguioaMichelle Jude TinioAún no hay calificaciones

- RTC Order Staying Implementation of RA 9334 Increasing Excise Taxes on Alcohol, TobaccoDocumento17 páginasRTC Order Staying Implementation of RA 9334 Increasing Excise Taxes on Alcohol, TobaccoChristine Rose Bonilla LikiganAún no hay calificaciones

- To Print TaxDocumento13 páginasTo Print TaxVee SyAún no hay calificaciones

- PSRS-4410 Engagement To Compile Fin InfoDocumento14 páginasPSRS-4410 Engagement To Compile Fin InfocolleenyuAún no hay calificaciones

- PSRE-2400 Engagement To Review FSsDocumento26 páginasPSRE-2400 Engagement To Review FSscolleenyuAún no hay calificaciones

- Contract of Sale and Contract To SellDocumento2 páginasContract of Sale and Contract To SellRanin, Manilac Melissa SAún no hay calificaciones

- Lang - Ac516 r01Documento16 páginasLang - Ac516 r01Ranin, Manilac Melissa SAún no hay calificaciones

- Philippine Standards On Auditing 220 RedraftedDocumento20 páginasPhilippine Standards On Auditing 220 RedraftedJayAún no hay calificaciones

- PSA 700 RedraftedDocumento34 páginasPSA 700 RedraftedRanin, Manilac Melissa SAún no hay calificaciones

- PSAE-3000 Assurance Engagements Other Than Audits and Review of Historical Fin InfoDocumento23 páginasPSAE-3000 Assurance Engagements Other Than Audits and Review of Historical Fin InfocolleenyuAún no hay calificaciones

- PSAE 3400 (Previously PSA 810)Documento15 páginasPSAE 3400 (Previously PSA 810)Gon FreecsAún no hay calificaciones

- Psa 250Documento14 páginasPsa 250Ranin, Manilac Melissa SAún no hay calificaciones

- PSA 560 RedraftedDocumento14 páginasPSA 560 RedraftedMan DiAún no hay calificaciones

- PSA 120 Framework of Philippine Standards on AuditingDocumento9 páginasPSA 120 Framework of Philippine Standards on AuditingMichael Vincent Buan SuicoAún no hay calificaciones

- EnronDocumento7 páginasEnronRanin, Manilac Melissa SAún no hay calificaciones

- 01 Glossary of Terms December 2002Documento20 páginas01 Glossary of Terms December 2002Tracy KayeAún no hay calificaciones

- Audited Financial Statements: San Miguel CorporationDocumento1 páginaAudited Financial Statements: San Miguel CorporationRanin, Manilac Melissa SAún no hay calificaciones

- AC 512 Comprehensive ExamDocumento5 páginasAC 512 Comprehensive ExamRanin, Manilac Melissa S100% (1)

- The Basics of Capital BudgetingDocumento56 páginasThe Basics of Capital BudgetingRanin, Manilac Melissa SAún no hay calificaciones

- BAZERMAN ET AL Why Good Accountants Do Bad AuditsDocumento10 páginasBAZERMAN ET AL Why Good Accountants Do Bad AuditsFrancisco EstradaAún no hay calificaciones

- Bonds and Their ValuationDocumento41 páginasBonds and Their ValuationRenz Ian DeeAún no hay calificaciones

- Wall ClimbingDocumento4 páginasWall ClimbingRanin, Manilac Melissa SAún no hay calificaciones

- The Cost of Capital Lecture (Revised)Documento50 páginasThe Cost of Capital Lecture (Revised)Ranin, Manilac Melissa S50% (4)

- Sun CellularDocumento4 páginasSun CellularRanin, Manilac Melissa SAún no hay calificaciones

- Stupid CupidDocumento2 páginasStupid CupidRanin, Manilac Melissa SAún no hay calificaciones

- Vortex: Opencl Compatible Risc-V Gpgpu: Fares Elsabbagh Blaise Tine Priyadarshini Roshan Ethan Lyons Euna KimDocumento7 páginasVortex: Opencl Compatible Risc-V Gpgpu: Fares Elsabbagh Blaise Tine Priyadarshini Roshan Ethan Lyons Euna KimhiraAún no hay calificaciones

- Pantone and K100 Reverse White MedicineDocumento16 páginasPantone and K100 Reverse White MedicinepaanarAún no hay calificaciones

- What Is Gross Income - Definition, Formula, Calculation, and ExampleDocumento7 páginasWhat Is Gross Income - Definition, Formula, Calculation, and ExampleKapil SharmaAún no hay calificaciones

- Ipaspro Co PPP ManualDocumento78 páginasIpaspro Co PPP ManualCarlos Alberto Mucching MendozaAún no hay calificaciones

- Product 243: Technical Data SheetDocumento3 páginasProduct 243: Technical Data SheetRuiAún no hay calificaciones

- DesignWS P1 PDFDocumento673 páginasDesignWS P1 PDFcaubehamchoi6328Aún no hay calificaciones

- Reasons for Conducting Qualitative ResearchDocumento12 páginasReasons for Conducting Qualitative ResearchMa. Rhona Faye MedesAún no hay calificaciones

- ms360c Manual PDFDocumento130 páginasms360c Manual PDFEdgardoCadaganAún no hay calificaciones

- Certification of Psychology Specialists Application Form: Cover PageDocumento3 páginasCertification of Psychology Specialists Application Form: Cover PageJona Mae MetroAún no hay calificaciones

- Cross-Sectional Tomography: Oral and Maxillofacial RadiologyDocumento7 páginasCross-Sectional Tomography: Oral and Maxillofacial RadiologyPhanQuangHuyAún no hay calificaciones

- PronPack 5 Sample MaterialDocumento13 páginasPronPack 5 Sample MaterialAlice FewingsAún no hay calificaciones

- New Directions Formative TestDocumento1 páginaNew Directions Formative TestAnonymous xGQcti3qK100% (1)

- Viviana Rodriguez: Education The University of Texas at El Paso (UTEP)Documento1 páginaViviana Rodriguez: Education The University of Texas at El Paso (UTEP)api-340240168Aún no hay calificaciones

- High Volume InstrumentDocumento15 páginasHigh Volume Instrumentcario galleryAún no hay calificaciones

- All Paramedical CoursesDocumento23 páginasAll Paramedical CoursesdeepikaAún no hay calificaciones

- Aditi Pant Internship ReportDocumento14 páginasAditi Pant Internship ReportDR.B.REVATHYAún no hay calificaciones

- Data Structures LightHall ClassDocumento43 páginasData Structures LightHall ClassIwuchukwu ChiomaAún no hay calificaciones

- Liebert PEX+: High Efficiency. Modular-Type Precision Air Conditioning UnitDocumento19 páginasLiebert PEX+: High Efficiency. Modular-Type Precision Air Conditioning Unitjuan guerreroAún no hay calificaciones

- KEC115/6/7x: Ac Generator Short Circuit and Over Current GuardDocumento4 páginasKEC115/6/7x: Ac Generator Short Circuit and Over Current GuardRN NAún no hay calificaciones

- Coca Cola Live-ProjectDocumento20 páginasCoca Cola Live-ProjectKanchan SharmaAún no hay calificaciones

- Job Interview CV TipsDocumento2 páginasJob Interview CV TipsCarlos Moraga Copier100% (1)

- Chapter 27 Protists I. Evolution of EukaryotesDocumento7 páginasChapter 27 Protists I. Evolution of EukaryotesNadeem IqbalAún no hay calificaciones

- Affidavit of 2 Disinterested Persons (Haidee Gullodo)Documento1 páginaAffidavit of 2 Disinterested Persons (Haidee Gullodo)GersonGamasAún no hay calificaciones

- VNACS Final Case ReportDocumento9 páginasVNACS Final Case ReportVikram Singh TomarAún no hay calificaciones