Documentos de Académico

Documentos de Profesional

Documentos de Cultura

MP Budget 2013-14 PDF

Cargado por

tarun_mishra876Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

MP Budget 2013-14 PDF

Cargado por

tarun_mishra876Copyright:

Formatos disponibles

- 1 -

Press Note

Bhopal dated 22 February 2013

Honble Finance Minister Shri Raghavji has presented the budget for the financial year 2013-14 today.

The salient features of the budget estimates of 2013-14 are as follows:-

Total expenditure of ` 91946.86 crores for the year 2013-14.

Revenue surplus of `. 5214.83 crores for the year 2013-14.

Fiscal Deficit for the year 2013-14 is estimated to be ` 12218.53 crores.

Targets set under the Madhya Pradesh Fiscal Responsibility and Budget Management Act, 2005 are expected to be

met.

Total Revenue Receipts for the year 2013-14 are estimated to be ` 79603.47 crores. Components of the Revenue

Receipts are ` 33381.68 crores as States Own Tax Revenue; ` 23693.61 crores as share in Central Taxes; `

7583.39 crores as States Own Non-Tax Revenue and ` 14944.79 crores of Central Grants.

States own Tax Revenue estimates are 17.91 percent higher in 2013-14 (B.E) as compared to 2012-13 (B.E).

Revenue Expenditure of ` 74388.64 crores has been estimated for the year 2013-14 which is 10845.14 crores more

than ` 63543.50 crores for the year 2012-13 (B.E)

Opening balance of ` (-) 195.33 crores is estimated for the year 2013-14. Net transactions during the year are

estimated to be ` 72.24 crores. Hence, closing balance at the end of the year is estimated to be ` (-)123.09 crores.

Plan expenditure for the year 2013-14 is estimated to be ` 37608.17 crores as against ` 31473.48 crores for the

year 2012-13, which is a 18 percent increase.

Budget estimates in Tribal sub-plan have increased from ` 6109.88 crores for the year 2012-13 to ` 6907.15 crores

for the year 2013-14, which is a 13.05 percent increase.

Budget estimates in Scheduled caste sub-plan have increased from ` 4241.82 crores for the year 2012-13 to `

4889.99 crores for the year 2013-14, which is a 15.28 percent increase.

Fiscal Indicators.

Fiscal Deficit estimated at 2.98 percent of GSDP.

Revenue Surplus estimated at 1.27 percent of GSDP.

Interest payments estimated at 8.19 percent of Revenue Receipts.

Total net debt of the state has come down to 14.30 percent of GSDP.

Agriculture and Allied Sectors

Separate Agriculture Budget for Agriculture and Allied Sectors.

Total provision of ` 4765 crores for the development of irrigation facilities.

Work on 2 large and 10 medium irrigation schemes will be started in the year 2013-14.

Provision of subsidy of ` 1700 crores for electricity supply to farmers.

Investment of `3000 crores in the year 2013-14 for Feeder separation scheme to ensure 8 hours continuous

electricity supply to farmers.

Provision of ` 400 crores for free electricity for 5HP agricultural pumps (land upto 1 hectare) and upto 25 unit per

month domestic electricity consumption to SC and ST farmers/consumers.

Provision of ` 500 crores to provide loan at 0 percent interest rate to farmers.

Provision for bonus of ` 150 per quintal on wheat procurement. Provision of ` 1050 crores for this incentive.

New scheme for incentivising organic agriculture along with scheme to reward agricultural farmers at block level too.

Provision of ` 12 crores made.

Seed cum organic fertilizer drill grant to induce linear sowing.

Target of cent percent seed treatment.

Mukhya Mantri Kisan Videsh Adhayayan Yojana.

Provision of ` 9 crore and five fold increase in the goals of State Micro Irrigation scheme.

Provision of ` 32 crores to establish 250 custom hiring centres for young entrepreneurs and agricultural graduates.

Provision of ` 4 crores for semen transplantation lab to rear superior breed.

Provision of veterinary doctors at door-step extended to 89 tribal blocks.

Initiation of core banking facility in Central Cooperative Banks.

Provision of assistance in RBC 6(4) for damage of crops by black buck and blue bull.

Provision of ` 12 crores for proper storage of Wheat/Rice.

Provision of 18 crores for establishment of 50 new and upgradation of 123 Veterinary Hospitals.

Provision of ` 55 crores for integrated cooperative development projects.

Provision of ` 350 crores for the year 2013-14 under Annapurna Scheme.

Provision of ` 27 crores for fish farming for Plan expenditure which is 50 percent more than the last year.

Short term working capital loan to fishermen at 0 percent interest rate.

Infrastructure Development

Provision of ` 8856 crores in the energy sector for the year 2013-14, which is 1146 crores more than 2012-13.

Provision of ` 2681 crores for upgradation and strengthening of electricity distribution and sub-distribution.

Provision of ` 405 crores to enhance power generation capacity.

Provision of ` 29 crores to promote non-conventional energy.

Provision of ` 4970 crores for road construction and maintenance.

Provision of ` 501 crores for Mukya Mantri Gramin Sadak Yojana.

Provision of ` 4765 crores for irrigation schemes.

2 large and 10 medium irrigation schemes to be started in 2013-14.

Panchayat and Rural Development

Provision of ` 7444 crores for panchayat and rural development.

Provision of ` 100 crores under Mukhya Mantri Grameen Awas Mission .

Provision of ` 35 crores under Mukhya Mantri Antyodaya Awas Yojana.

`4527 crore to be transferred as grant in aid to Urban/Rural local bodies which is 21.6 percent more than the last

year.

- 2 -

Drinking Water

Provision of ` 1743 crores for drinking water schemes.

Provision of drinking water through handpump/water supply schemes in 13200 rural habitats.

Provision of ` 432 crores to initiate Kshipra-Narmada link project.

Provision for drinking water facilities in 5794 Aanganwadis.

Investment of ` 15 crores in Jal Nigam.

Education

Provision of ` 13,763 crores in education sector which is ` 1644 crores more than last year.

Provision of ` 71 crores for reimbursement of fees for 2.65 lac students belonging to weaker sections.

Extension of Gaon Ki Beti and Pratibha Kiran Yojana.

Establishment of new engineering colleges at Nowgaon, Chhatarpur.

Increase of ` 500 for stationery and ` 1500 for books to students of SCs and STs.

Two fold increase in scholarship for research work to students of SCs and STs.

Establishment of ITIs at Deosar in Singrauli District, Kasravad in Ujjain, Patan in Jabalpur and Majhgawan in Satna

district.

Stipend of ITI apprentice of SCs and STs students raised from ` 140 per month to ` 235 per month.

Health

Provision of ` 4147 crores for health sector which is 551 crores higher than 2012-13.

100 additional vehicles for 108 ambulance services (renamed as Sanjeevani-108).

Establishment of G.N.M. schools at Dewas, Mandsaur, Vidisha, Raisen, Jhabua, Sidhi, Rajgarh, Narsinghpur, Satna

and Seoni.

Sanction for operation of 150 additional ambulances.

Provision of stipend of ` 2500 to A.N.M., ` 3000 to G.N.M. and ` 3500 to B.Sc. Nursing trainees.

Decision to enhance the daily diet allowance from ` 30 to ` 40 for patients.

Women and Child Development

Provision of ` 5,106 crores for women and child development which is 26 percent higher than last year.

Provision of ` 850 crores for Ladli Laxmi Yojana which is 30 percent higher than the last year.

Provision of ` 111 crores for construction of anganwadi buildings and ` 5 crore for maintenance.

Introduction of new scheme to give prizes to persons protecting the dignity of women.

Social Justice

Provision of ` 1397 crores for the year 2013-14 which is 31 percent higher than last year.

Provision of ` 17 crores for Antoyadaya Melas extended upto block levels

Provision of ` 100 crores under Mukhya Mantri Kanya Daan Yojana and Mukhya Mantri Nikah Yojana which is

67 percent higher than last year.

State of M.P. awarded with National Award for excellent work as employer of disabled persons on reserved seats.

Constitution of State Senior Citizen commission.

Urban Administration

Provision of ` 5168 crores for urban administration and development which is 22 percent higher than last year.

Provision of ` 258 crores for Mukhya Mantri Shahri Peyjal Yojana , Mukhya Mantri Shahri Swachhata

Mission and Mukhya Mantri Urban Infrastructure Development Scheme.

Initiation of schemes for conservation and development of ponds and lakes. Provision of ` 1 crore made.

New Urban Reform Scheme for reforms in urban bodies for financial, administrative, e-governance, wealth tax and

consumer tariff.

Initiation of Valmiki Yojana to inspire cleanliness drive.

Provision of ` 150 crores for Simhastha-2016.

Sports

Provision of ` 126 crores for 2013-14 which is 21 percent higher than last year.

Players of the state have achieved glory for the state by winning 1586 medals at national and international level in

2012-13.

New scheme Olympic - 2020 from 2013-14.

Provision of ` 3 crores to lay down Hockey astroturf in 15 cities.

Tourism and Culture

Provision of ` 158 crores for tourism activities for 2013-14 which is 31 percent higher than last year.

Provision of ` 11 crores to develop tourist centres in each district.

Provision of ` 141 crores for culture which is 22 percent higher than last year.

Allocation of ` 10 crore for establishment of "Sanchi Baudh Bharatiya Gyan Adhyayan Vishwavidyalaya".

Decision to establish "Atal Bihari Bajpai Centre for Art and Culture" at Morena.

Provision of ` 1 crore for celebration of 150th Birth Anniversary of Swami Vivekanand.

Industry and Mining

Provision of ` 907 crores for industrial sector which is 40 percent higher than last year.

Provision of ` 340 crores for Industrial Investment Promotion Assistance.

Decision to award Dattopant Thengdi Prize of ` 5 lac, ` 3 lac and ` 2 lac respectively to first three units creating

opportunities for maximum employment as against capital investment in MSME sectors.

Provision of ` 54 crore to benefit 50,000 youths under a new scheme Mukhya Mantri Swarojgar Yojana .

SC and ST Development

Provision of 2013-14 is ` 1447 crores higher than the last year.

More than two fold increase under the provision of SC and ST Atrocities Act.

Relief amount enhanced from ` 2 lacs to ` 5 lacs.

Decision to provide laptop to first year students of engineering and medical colleges belonging to SCs and STs.

Provision of ` 14 crores in 2013-14.

Upgradation of 40 High Schools to Higher Secondary Schools, 20 Middle schools to High schools and 20 primary

English medium schools to middle schools in tribal areas in 2013-14.

Proposal to open 20 new girl education centres (parisar).

Proposal of additional faculty in 20 Higher Secondary schools.

Proposal of new 20 post matric hostels, 10 pre-matric hostels and 10 ashram schools.

Proposal to begin two new sports centres(parisar) for students of STs.

- 3 -

Decision to enhance per day diet allowance from ` 25 to ` 100 and sports kit allowance from ` 850 to Rs. 3000 for

players residing in sports centres (parisar).

Establishment of 119 new hostels for SC students and proposal of increase of 3000 seats in the existing hostels.

Provision of ` 24 crores for Vimukt, Ghumakkad and Ardh Ghumakkad communities.

Backward Classes and Minorities Development

Provision of ` 749 crores for different welfare schemes for the backward classes and minority sections which is 37

percent higher than last year.

Necessary resources have been made available to all districts for monitoring and implementation of different

schemes for the welfare of minorities and backward classes.

Law and Order

Provision of ` 3962 crores for police force which is 37 percent higher than last year.

5000 new posts to be filled in the year 2013-14.

Constitution of new women crime cell. 500 new posts and provision of ` 23 crores in 2013-14.

Necessary provisions for the new schemes like Police health infrastructure, community police, social empowerment

and tourism police, state highway security and conservation, Centralized Police Call Centre and Control Room

System, Automatic Finger Identification System etc.

Sanction of 1208 posts including 52 new district and session judge and 86 Class II Civil judges. Provision of ` 29

crore for this in 2013-14.

Decision to constitute Adhivakta Kalyan Nidhi for the welfare of lawyers.

Decision to enhance the fee of penal lawyers in Madhyamastha Adhikaran from ` 5,000 per case to ` 20,000.

Administrative Reforms

No ban imposed on purchases in the year 2013-14 which is the living testimony of the efficient financial

management.

Decision to enhance the relief amount by 50 percent in road accident cases to the victims family by raising

assistance from `10,000 to ` 15,000 in death case and ` 5000 to ` 7500 for serious injuries.

Decision to enhance the monthly honorarium of elected representatives and office bearers of 50 zila panchayats, 313

Janpad Panchayat and 23006 Gram Panchayat.

Employees Welfare

Payment of 72 percent D.A. to state government employees and pensioners as Central Government employees as

per promises made by the state government.

Decision of ` 725 kit allowance per year for constables and head constables of police forces.

Decision to enhance the allowances of part time sweepers, part time peons and part time clerks in schools by ` 300,

` 400 and ` 500 respectively. Their allowances will respectively now be ` 1000, ` 2000 and ` 2500.

Major Schemes

(Amount in crores)

Road development, maintenance and repair (PWD) 3279

District establishment and special police in Home Deptt. 3005

Sarva Shiksha Abhiyan 2067

Transfer from Entry tax to urban bodies 1938

Tariff Grant 1700

Loans for working capital to Electricity companies 1500

Strengthening of sub-distribution system 1346

Nutrition diet 1203

Impetus for food-grain procurement under PDS 1050

Post Matric Scholarship 1008

Ladli Laxmi Yojana 850

Backward Region Grant Fund 819

Transfer of VAT compensation to Urban bodies 620

Minimum Requirement Programme (including rural roads) 582

Canal and allied construction works (water resources) 556

Rashtriya Krishi Vikas Yojana 555

Grant for short term loan to farmers/ fishermen 500

Primary Health Centres 498

Disaster Relief 455

Indira Gandhi National Old Age Pension 433

Establishment expenditure in Law Deptt. 416

Grameen Nal Jal Praday Yojana 412

NRHM 400

JNNRUM 380

General grant and Implementation grant for Local Bodies 376

Singhaji Taap Vidyut Pariyojana 365

Industrial Investment Promotion Assistance Scheme 340

Canal and allied construction works (NVDA) 311

Infrastructure Development scheme for Small and Medium Cities 310

Dams and Allied works 246

- 4 -

Central Road Fund 234

One time grant for fundamental services to local bodies 223

Grant for new electricity connection to farmers 223

Supply of bicycles 220

Bargi Diversion Project 204

M.P.Vidhan Sabha Nirvachan Kshetra Vikas Yojana 178

Jan Bhagidari Yojana(General) 177

Rajiv Gandhi Kishori Balika Sashaktikaran Yojana(Sabla) 170

Transfer of surcharge on Registration and Stamp Duty to Urban Bodies 150

Arrangements for Simhasta Mela 150

Rani Avanti Bai Sagar Pariyojana 133

Integrated Urban Slum Development Prog. 122

Grant for road repair from taxes on vehicles to urban bodies 121

Compensation for rehabilitation of forest villages 120

Sardar Sarovar submergence affected areas 114

Rajeev Awas Yojana 100

State Assistance for Teerth Darshan Yojana 70

Water supply to Aanganwadi centres 58

Mukhya Mantri Yuva Swarojgar Yojana 54

Mukhya Mantri Discretionary Grant 50

Drinking water facility for Aanganwadi centres 58

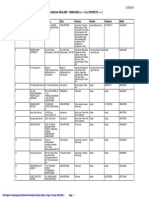

Status of Fiscal Indicators in ten years ( 2003-04 to 2013-14)

Sl. No. Fiscal Indicator Year 2003-04 2013-14 Remarks

1. Total expenditure Rs. 21,647 crs. Rs. 91,946 crs More than four fold

increase.

2. Revenue receipts from states

own tax

Rs. 6,805 crs Rs. 33,381 crs Five fold increase.

3. State Plan Expenditure. Rs. 5,684 crs. Rs. 37,608 crs. Six fold increase.

4. Capital Outlay Rs. 2,883 crs. Rs. 17,558 crs. More than six fold

increase.

5. Interest Payment Rs. 3,206 crs. Rs. 6,518 crs. Only two times increase

against four times

increase in budget.

6. Revenue deficit/excess Rs. 4,475 crs

(revenue deficit)

Rs. 5,215 crs

(revenue excess)

Revenue excess position

continue since 2004-05.

7. Percentage of interest payment

to total revenue receipts.

22.44 % 8.19% Reduction by two and

half times.

8. Percentage of Total Plan

expenditure to Total expenditure

26.26% 41% Appx. one and half times

increase.

9. Percentage of Capital Outlay in

comparison to GSDP

2.80 % 4.28% Appx. one and half times

increase.

10. Percentage of revenue deficit in

comparison to GSDP

7.12% 2.98% Within 3%as stipulated

by the FRBM Act.

11. Percentage of Gross debt in

comparison to GSDP

33.71 % 22.55% One third reduction.

12. Percentage of net debt in

comparison to GSDP

31.18% 14.30% Appx. two times

reduction.

13. GSDP at current prices Rs. 1,02,839 crs Rs. 4,09,877 crs Four times increase.

También podría gustarte

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Thick Hair PDFDocumento23 páginasThick Hair PDFtarun_mishra876Aún no hay calificaciones

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- Bbet+tre-2018-C-Viii (Paper-1) - At+pcmbDocumento22 páginasBbet+tre-2018-C-Viii (Paper-1) - At+pcmbSatish50% (2)

- Babylonian AriesDocumento5 páginasBabylonian Ariesmarijap7Aún no hay calificaciones

- Half Girlfriend Free PDFDocumento5 páginasHalf Girlfriend Free PDFRANE SWAPNEEL73% (59)

- Project Proposal For 100 Has Banana ProductionDocumento18 páginasProject Proposal For 100 Has Banana ProductionOrsua Janine April65% (20)

- Top Farm Machine Dealers ListDocumento33 páginasTop Farm Machine Dealers ListPavan Kumar100% (2)

- JAIIB/CAIIB Mock TestDocumento53 páginasJAIIB/CAIIB Mock TestManoj Kumar99% (71)

- Click Here To Play:: Plant TissuesDocumento2 páginasClick Here To Play:: Plant Tissuestarun_mishra876Aún no hay calificaciones

- FD I DescriptionDocumento6 páginasFD I Descriptiontarun_mishra876Aún no hay calificaciones

- Click Here To Play:: Plant TissuesDocumento2 páginasClick Here To Play:: Plant Tissuestarun_mishra876Aún no hay calificaciones

- Essay Compulsory 2012-1993Documento21 páginasEssay Compulsory 2012-1993karnatisharathAún no hay calificaciones

- HINDU REVIEW SEP 2016 EXAMSDocumento12 páginasHINDU REVIEW SEP 2016 EXAMSSukumar AbburiAún no hay calificaciones

- Hormone That Restrict FibrosisDocumento1 páginaHormone That Restrict Fibrosistarun_mishra876Aún no hay calificaciones

- Hormone That Restrict FibrosisDocumento1 páginaHormone That Restrict Fibrosistarun_mishra876Aún no hay calificaciones

- Railways and Tourism: Steam TrainDocumento2 páginasRailways and Tourism: Steam Traintarun_mishra876Aún no hay calificaciones

- Guide4BankExams SyllogismDocumento23 páginasGuide4BankExams SyllogismShiv Ram Krishna67% (3)

- Pib Oct 2016Documento66 páginasPib Oct 2016tarun_mishra876Aún no hay calificaciones

- Mobile CommunicationDocumento12 páginasMobile Communicationtarun_mishra876Aún no hay calificaciones

- Microprocessor Micro ControllersDocumento25 páginasMicroprocessor Micro Controllersg.ramamohan5073997Aún no hay calificaciones

- Antennas Wave PropagationDocumento44 páginasAntennas Wave Propagationtarun_mishra876Aún no hay calificaciones

- Signals SystemsDocumento22 páginasSignals Systemstarun_mishra876Aún no hay calificaciones

- Electromagnetic TheoryDocumento23 páginasElectromagnetic Theorytarun_mishra876Aún no hay calificaciones

- SezDocumento5 páginasSezPraveen Kumar ThotaAún no hay calificaciones

- Will India Go Back To 1991Documento4 páginasWill India Go Back To 1991tarun_mishra876Aún no hay calificaciones

- Banks N HeadquartersDocumento1 páginaBanks N Headquarterstarun_mishra876Aún no hay calificaciones

- Atms BasicsDocumento2 páginasAtms Basicstarun_mishra876Aún no hay calificaciones

- Cheque Truncation SystemDocumento5 páginasCheque Truncation Systemtarun_mishra876Aún no hay calificaciones

- Rbi Grade B PDFDocumento7 páginasRbi Grade B PDFtarun_mishra876Aún no hay calificaciones

- Census 2011Documento4 páginasCensus 2011jeetendrasidhiAún no hay calificaciones

- Causes and Effect of Free Fall of Rupee Against DollarDocumento2 páginasCauses and Effect of Free Fall of Rupee Against Dollarsaharan49Aún no hay calificaciones

- Iyt6rt68t87y09 0i0 o OhuguhiDocumento7 páginasIyt6rt68t87y09 0i0 o Ohuguhisoumya1234paniAún no hay calificaciones

- Indian TribesDocumento5 páginasIndian Tribestarun_mishra876Aún no hay calificaciones

- Fighting Corruption: Moral Values Must PrevailDocumento4 páginasFighting Corruption: Moral Values Must PrevailPilania VivekAún no hay calificaciones

- Phosphorus Content in FoodsDocumento9 páginasPhosphorus Content in FoodsShane GitterAún no hay calificaciones

- Review of Litreature PDFDocumento44 páginasReview of Litreature PDFNANDHU BMAún no hay calificaciones

- A Brief Presentation On Seed Quality and Seed Development ProgrammesDocumento21 páginasA Brief Presentation On Seed Quality and Seed Development Programmesc.k.nivedhaAún no hay calificaciones

- MULGAN-Power and Pork-A Japanese Political LifeDocumento283 páginasMULGAN-Power and Pork-A Japanese Political Lifeapi-3729424Aún no hay calificaciones

- EthiDocumento212 páginasEthiDani LacatusuAún no hay calificaciones

- VHSE Curriculum Focuses on Agribusiness & Farm ServicesDocumento61 páginasVHSE Curriculum Focuses on Agribusiness & Farm ServicesAnnAún no hay calificaciones

- Community Landing Page - Asian AgribizDocumento4 páginasCommunity Landing Page - Asian AgribizRadia IslamAún no hay calificaciones

- Forage Sorghum Agfact48 Cropsoil PsuEDUDocumento4 páginasForage Sorghum Agfact48 Cropsoil PsuEDUJdoe3399Aún no hay calificaciones

- Neonicotinoid: Neonicotinoids (Sometimes Shortened To NeonicsDocumento21 páginasNeonicotinoid: Neonicotinoids (Sometimes Shortened To NeonicsMonica DiazAún no hay calificaciones

- Thời Gian Làm Bài 150 Phút, Không Kể Thời Gian Giao ĐềDocumento5 páginasThời Gian Làm Bài 150 Phút, Không Kể Thời Gian Giao ĐềPluvi OphileAún no hay calificaciones

- Tugas Parafrase Jurnal MIPKI RevisiDocumento2 páginasTugas Parafrase Jurnal MIPKI RevisiAl-aminAún no hay calificaciones

- Sewage-Fed AquacultureDocumento15 páginasSewage-Fed Aquacultureapi-3803371100% (2)

- Detailed Lesson Plan 1Documento8 páginasDetailed Lesson Plan 1Generose Querin AnchoAún no hay calificaciones

- ICID - WEF Nexus Model - IcidtemplateDocumento30 páginasICID - WEF Nexus Model - Icidtemplatekrishnamondal160Aún no hay calificaciones

- Explore Kentish CountrysideDocumento2 páginasExplore Kentish CountrysideJavier DelgadoAún no hay calificaciones

- Australian Chocolates, History in The MakingDocumento4 páginasAustralian Chocolates, History in The MakingelaineediblejourneysAún no hay calificaciones

- The Implication of Political Dynasty Towards Governance in Inabanga Final 1Documento27 páginasThe Implication of Political Dynasty Towards Governance in Inabanga Final 1Gerard JaposAún no hay calificaciones

- Sygenta R D 2Documento4 páginasSygenta R D 2api-505775092Aún no hay calificaciones

- ACF Supply and Demand Report - October 18Documento6 páginasACF Supply and Demand Report - October 18Ishan SaneAún no hay calificaciones

- Major Cropping Seasons in IndiaDocumento3 páginasMajor Cropping Seasons in IndiaAmol PandeyAún no hay calificaciones

- News Analysis (21 May, 2022) : States' Power To Make GST LawsDocumento14 páginasNews Analysis (21 May, 2022) : States' Power To Make GST LawsEternal WisdomAún no hay calificaciones

- Ecological ProfileCABADBARAN...Documento100 páginasEcological ProfileCABADBARAN...ermorsAún no hay calificaciones

- Agronomy: Response of Drip Irrigation and Fertigation On Cumin Yield, Quality, and Water-Use E Arid Climatic ConditionsDocumento16 páginasAgronomy: Response of Drip Irrigation and Fertigation On Cumin Yield, Quality, and Water-Use E Arid Climatic ConditionsAli HamzaAún no hay calificaciones

- PHD in Sustainable Development and Climate ChangeDocumento31 páginasPHD in Sustainable Development and Climate ChangeMohamed HeshamAún no hay calificaciones

- Agricultural Economics All Courses 1Documento9 páginasAgricultural Economics All Courses 1Rashmi RaniAún no hay calificaciones