Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Reserve Bank of India

Cargado por

Delson BhatkhandeDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Reserve Bank of India

Cargado por

Delson BhatkhandeCopyright:

Formatos disponibles

Reserve Bank of India

The Reserve Bank of India (RBI, Hindi: ) is the central bank of India, and was

established on April 1, 19! in accordance with the provisions of the Reserve Bank of India Act,

19"# The $entral %ffice of the Reserve Bank was initiall& established in 'olkata b(t was

per)anentl& )oved to *()bai in 19+# Tho(,h ori,inall& privatel& owned, the RBI has been

f(ll& owned b& the -overn)ent of India since nationali.ation in 19"9#

/(vv(ri 0(bbarao who s(cceeded 1a,a 2en(,opal Redd& on 0epte)ber 3, 3445 is the c(rrent

-overnor of RBI#

The Reserve Bank of India was set (p on the reco))endations of the Hilton 1o(n,

$o))ission# The co))ission s(b)itted its report in the &ear 1936, tho(,h the bank was not set

(p for nine &ears#

The 7rea)ble of the Reserve Bank of India describes the basic f(nctions of the Reserve Bank as

to re,(late the iss(e of Bank 8otes and keepin, of reserves with a view to sec(rin, )onetar&

stabilit& in India and ,enerall& to operate the c(rrenc& and credit s&ste) of the co(ntr& to its

advanta,e#

It has 33 re,ional offices, )ost of the) in state capitals#

RBI was started with a paid (p share capital of ! crore#on established it took over the f(nction of

)ana,e)ent of c(rrenc& fro) ,overn)ent of India and power of credit control fro) i)perial

bank of India#

Board of directors

The Reserve Bank9s affairs are ,overned b& a central board of directors# The board is appointed

b& the -overn)ent of India in keepin, with the Reserve Bank of India Act#

The RBI Re,ional %ffice in *()bai

%n :(ne 3+, 3446, the ;nion -overn)ent of India reconstit(ted the $entral Board of /irectors

of the Reserve Bank of India (RBI) with 1 )e)bers, incl(din, A.i) 7re)<i and '()ar

*an,ala) Birla#

Those reno)inated to the board

1# H# *ale,a), $hartered Acco(ntant, (to represent =estern Area >ocal Board)

H# 7# Ranina, 0(pre)e $o(rt Advocate

Ashok 0# -an,(l&, *e)ber, Invest)ent $o))ission and $hair)an, I$I$I %ne0o(rce

Retiring directors

8# R# 8ara&ana *(rth&

*ihir Rakshit

'# *adhava Rao

2# 0# 2&as

'# 7# 0in,h

A)rita 7atel

'# 7# 7ri&a

%n 1 :(l& 3446, in an atte)pt to enhance the ?(alit& of c(sto)er service and stren,then the

,rievance redressal )echanis), the Reserve Bank of India constit(ted a new depart)ent @

$(sto)er 0ervice /epart)ent ($0/)#

Main objectives

Reserve Bank of India head?(arters, /elhi entrance with the 1akshini sc(lpt(re depictin,

A7rosperit& thro(,h a,ric(lt(reA

B1C

#

The RBI Re,ional %ffice in /elhi#

Re,(lator and s(pervisor of the financial s&ste)

7rescribes broad para)eters of bankin, operations within which the co(ntr&9s bankin,

and financial s&ste) f(nctions#

%b<ective: )aintain p(blic confidence in the s&ste), protect depositors9 interest and

provide costDeffective bankin, services to the p(blic# The Bankin, %)b(ds)an 0che)e

has been for)(lated b& the Reserve Bank of India (RBI) for effective redressal of

co)plaints b& bank c(sto)ers#

*ana,er of eEchan,e control

*ana,es the Forei,n GEchan,e *ana,e)ent Act, 1999#

%b<ective: to facilitate eEternal trade and pa&)ent and pro)ote orderl& develop)ent and

)aintenance of forei,n eEchan,e )arket in India#

Iss(er of c(rrenc&

Iss(es and eEchan,es or destro&s c(rrenc& and coins not fit for circ(lation#

%b<ective: the )ain ob<ective is to ,ive the p(blic ade?(ate s(ppl& of c(rrenc& of ,ood

?(alit& and to provide loans to co))ercial banks to )aintain or i)prove the -/7#

The basic ob<ectives of RBI are to iss(e bank notes, to )aintain the c(rrenc& and credit s&ste)

of the co(ntr& to (tili.e it in its best advanta,e, and to )aintain the reserves# RBI )aintains the

econo)ic str(ct(re of the co(ntr& so that it can achieve the ob<ective of price stabilit& as well as

econo)ic develop)ent, beca(se both ob<ectives are diverse in the)selves#

Related f(nctions

Banker to the -overn)ent: perfor)s )erchant bankin, f(nction for the central and the

state ,overn)entsH also acts as their banker#

Bank to banks: )aintains bankin, acco(nts of all sched(led banks

There is now an international consens(s abo(t the need to foc(s the tasks of a central bank (pon

central bankin,# RBI is far o(t of to(ch with s(ch a principle, owin, to the sprawlin, )andate

described above#

Major liabilities of commercial banks

Fi,(res below are in )illions of Indian R(pees# 0ee B1C and B3C

1ear /eposits and other Acco(nts

B3C

Bills 7a&able

19!

4

19,95 1+

19!

!

11,!93 363

196

4

34,315 1+

196

!

3,59+ ""6

19+

4

6",+9 93

19+

!

1!6,66! 3,3!"

195

4

"9,569 14,99!

195

!

1,43,1" 3",!!6

199

4

1,534,"65 5,6!6

199

!

,95",!3 116,633

Major assets of commercial banks

Fi,(res below are in )illions of Indian R(pees# 0ee BC and B"C

1ear Invest)ents

BC

Advances

B"C

19!

4

",4 !,!

19!

!

",644 +,4+

196

4

+,3"1 13,"!5

196

!

9,55" 31,9!"

19+

4

15,1"5 "6,5!4

19+

!

"!,999 146,16+

195

4

136,6"3 3+3,444

195

!

4,+5 63,!!

199

4

65+,1!1 1,49!,"13

199

!

1,+!4,346 3,3",45

Tarapore committee

The Tarapore co))ittee is a co))ittee set(p b& the Reserve Bank of India (nder the

chair)anship of for)er RBI dep(t& ,overnor 0 0 Tarapore to Ala& the road )apA to capital

acco(nt convertibilit&#

The fiveD)e)ber co))ittee reco))ended a threeD&ear ti)efra)e for co)plete convertibilit& b&

1999D3444#

In *arch 3446, the then Finance *inister of India, 7 $hida)bara) said that the $entral

,overn)ent was Awithin strikin, distanceA of i)ple)entin, the co))ittee9s report#

/(rin, partition, the federal reserve was split b& the British Ra< to aid India and 7akistan

separatel&# 0o)e clai) that 7akistan has never ,otten its share to date, which is incorrect#

%n :an(ar& 19, 19"5, 7akistan received its share of !6 $rores R(pees b(llion# Apart fro)

that, 8i.a) of H&derabad ille,all& transferred the f(nds for the state of H&derabad to

7akistan, and 7akistan has not &et repaid these f(nds# 8awab of :(na,arh fled with

$rore cash, which was ,overn)ent propert&# =hen it looked like the British wo(ld help

India ,et that )one& back, the 7akistani ,overn)ent helped 8awab flee to G(rope with

the )one& (sin, 7akistani ,overn)ent planes# %ne of the planes ref(ellin, at Beir(t

crashed in the Ae,ean 0ea and )one& was declared lost# This stor& has led to several

)odern treas(re h(nts in that area#

Reserve Bank of India (RBI)

'indl& Take 8ote : Reserve Bank of India (RBI) is the

central bank of the co(ntr& and is different fro) $entral

Bank of India#

The central bank of the co(ntr& is the Reserve Bank of India (RBI)# It was established in April

19! with a share capital of Rs# ! crores on the basis of the reco))endations of the Hilton

1o(n, $o))ission# The share capital was divided into shares

of Rs# 144 each f(ll& paid which was entirel& owned b& private shareholders in the be,inin,# The

-overn)ent held shares of no)inal val(e of Rs# 3,34,444#

Reserve Bank of India was nationalised in the &ear 19"9# The ,eneral s(perintendence and

direction of the Bank is entr(sted to $entral Board of /irectors of 34 )e)bers, the -overnor

and fo(r /ep(t& -overnors, one -overn)ent official fro) the *inistr& of Finance, ten

no)inated /irectors b& the -overn)ent to ,ive representation to i)portant ele)ents in the

econo)ic life of the co(ntr&, and fo(r no)inated /irectors b& the $entral -overn)ent to

represent the fo(r local Boards with the head?(arters at *()bai, 'olkata, $hennai and 8ew

/elhi# >ocal Boards consist of five )e)bers each $entral -overn)ent appointed for a ter) of

fo(r &ears to represent territorial and econo)ic interests and the interests of coDoperative and

indi,eno(s banks#

The Reserve Bank of India Act, 19" was co))enced on April 1, 19!# The Act, 19" (II of

19") provides the stat(tor& basis of the f(nctionin, of the Bank#

The Bank was constit(ted for the need of followin,:

To re,(late the iss(e of banknotes

To )aintain reserves with a view to sec(rin, )onetar& stabilit& and

To operate the credit and c(rrenc& s&ste) of the co(ntr& to its advanta,e#

F(nctions of Reserve Bank of India

The Reserve Bank of India Act of 19" entr(st all the i)portant f(nctions of a central bank the

Reserve Bank of India#

Bank of Iss(e

;nder 0ection 33 of the Reserve Bank of India Act, the Bank has the sole ri,ht to iss(e bank

notes of all deno)inations# The distrib(tion of one r(pee notes and coins and s)all coins all over

the co(ntr& is (ndertaken b& the Reserve Bank as a,ent of the -overn)ent# The Reserve Bank

has a separate Iss(e /epart)ent which is entr(sted with the iss(e of c(rrenc& notes# The assets

and liabilities of the Iss(e /epart)ent are kept separate fro) those of the Bankin, /epart)ent#

%ri,inall&, the assets of the Iss(e /epart)ent were to consist of not less than twoDfifths of ,old

coin, ,old b(llion or sterlin, sec(rities provided the a)o(nt of ,old was not less than Rs# "4

crores in val(e# The re)ainin, threeDfifths of the assets )i,ht be held in r(pee coins,

-overn)ent of India r(pee sec(rities, eli,ible bills of eEchan,e and pro)issor& notes pa&able in

India# /(e to the eEi,encies of the 0econd =orld =ar and the postDwas period, these provisions

were considerabl& )odified# 0ince 19!+, the Reserve Bank of India is re?(ired to )aintain ,old

and forei,n eEchan,e reserves of Ra# 344 crores, of which at least Rs# 11! crores sho(ld be in

,old# The s&ste) as it eEists toda& is known as the )ini)() reserve s&ste)#

Banker to -overn)ent

The second i)portant f(nction of the Reserve Bank of India is to act as -overn)ent banker,

a,ent and adviser# The Reserve Bank is a,ent of $entral -overn)ent and of all 0tate

-overn)ents in India eEceptin, that of :a))( and 'ash)ir# The Reserve Bank has the

obli,ation to transact -overn)ent b(siness, via# to keep the cash balances as deposits free of

interest, to receive and to )ake pa&)ents on behalf of the -overn)ent and to carr& o(t their

eEchan,e re)ittances and other bankin, operations# The Reserve Bank of India helps the

-overn)ent D both the ;nion and the 0tates to float new loans and to )ana,e p(blic debt# The

Bank )akes wa&s and )eans advances to the -overn)ents for 94 da&s# It )akes loans and

advances to the 0tates and local a(thorities# It acts as adviser to the -overn)ent on all )onetar&

and bankin, )atters#

Bankers9 Bank and >ender of the >ast Resort

The Reserve Bank of India acts as the bankers9 bank# Accordin, to the provisions of the Bankin,

$o)panies Act of 19"9, ever& sched(led bank was re?(ired to )aintain with the Reserve Bank a

cash balance e?(ivalent to !I of its de)and liabilities and 3 per cent of its ti)e liabilities in

India# B& an a)end)ent of 1963, the distinction between de)and and ti)e liabilities was

abolished and banks have been asked to keep cash reserves e?(al to per cent of their a,,re,ate

deposit liabilities# The )ini)() cash re?(ire)ents can be chan,ed b& the Reserve Bank of

India#

The sched(led banks can borrow fro) the Reserve Bank of India on the basis of eli,ible

sec(rities or ,et financial acco))odation in ti)es of need or strin,enc& b& redisco(ntin, bills of

eEchan,e# 0ince co))ercial banks can alwa&s eEpect the Reserve Bank of India to co)e to their

help in ti)es of bankin, crisis the Reserve Bank beco)es not onl& the banker9s bank b(t also the

lender of the last resort#

$ontroller of $redit

The Reserve Bank of India is the controller of credit i#e# it has the power to infl(ence the vol()e

of credit created b& banks in India# It can do so thro(,h chan,in, the Bank rate or thro(,h open

)arket operations# Accordin, to the Bankin, Re,(lation Act of 19"9, the Reserve Bank of India

can ask an& partic(lar bank or the whole bankin, s&ste) not to lend to partic(lar ,ro(ps or

persons on the basis of certain t&pes of sec(rities# 0ince 19!6, selective controls of credit are

increasin,l& bein, (sed b& the Reserve Bank#

The Reserve Bank of India is ar)ed with )an& )ore powers to control the Indian )one&

)arket# Gver& bank has to ,et a licence fro) the Reserve Bank of India to do bankin, b(siness

within India, the licence can be cancelled b& the Reserve Bank of certain stip(lated conditions

are not f(lfilled# Gver& bank will have to ,et the per)ission of the Reserve Bank before it can

open a new branch# Gach sched(led bank )(st send a weekl& ret(rn to the Reserve Bank

showin,, in detail, its assets and liabilities# This power of the Bank to call for infor)ation is also

intended to ,ive it effective control of the credit s&ste)# The Reserve Bank has also the power to

inspect the acco(nts of an& co))ercial bank#

As s(pere)e bankin, a(thorit& in the co(ntr&, the Reserve Bank of India, therefore, has the

followin, powers:

(a) It holds the cash reserves of all the sched(led banks#

(b) It controls the credit operations of banks thro(,h ?(antitative and ?(alitative controls#

(c) It controls the bankin, s&ste) thro(,h the s&ste) of licensin,, inspection and callin, for

infor)ation#

(d) It acts as the lender of the last resort b& providin, redisco(nt facilities to sched(led banks#

$(stodian of Forei,n Reserves

The Reserve Bank of India has the responsibilit& to )aintain the official rate of eEchan,e#

Accordin, to the Reserve Bank of India Act of 19", the Bank was re?(ired to b(& and sell at

fiEed rates an& a)o(nt of sterlin, in lots of not less than Rs# 14,444# The rate of eEchan,e fiEed

was Re# 1 J sh# 6d# 0ince 19! the Bank was able to )aintain the eEchan,e rate fiEed at lsh#6d#

tho(,h there were periods of eEtre)e press(re in favo(r of or a,ainst

the r(pee# After India beca)e a )e)ber of the International *onetar& F(nd in 19"6, the Reserve

Bank has the responsibilit& of )aintainin, fiEed eEchan,e rates with all other )e)ber co(ntries

of the I#*#F#

Besides )aintainin, the rate of eEchan,e of the r(pee, the Reserve Bank has to act as the

c(stodian of India9s reserve of international c(rrencies# The vast sterlin, balances were ac?(ired

and )ana,ed b& the Bank# F(rther, the RBI has the responsibilit& of ad)inisterin, the eEchan,e

controls of the co(ntr&#

0(pervisor& f(nctions

In addition to its traditional central bankin, f(nctions, the Reserve bank has certain nonD

)onetar& f(nctions of the nat(re of s(pervision of banks and pro)otion of so(nd bankin, in

India# The Reserve Bank Act, 19", and the Bankin, Re,(lation Act, 19"9 have ,iven the RBI

wide powers of s(pervision and control over co))ercial and coDoperative banks, relatin, to

licensin, and establish)ents, branch eEpansion, li?(idit& of their assets, )ana,e)ent and

)ethods of workin,, a)al,a)ation, reconstr(ction, and li?(idation# The RBI is a(thorised to

carr& o(t periodical inspections of the banks and to call for ret(rns and necessar& infor)ation

fro) the)# The nationalisation of 1" )a<or Indian sched(led banks in :(l& 1969 has i)posed

new responsibilities on the RBI for directin, the ,rowth of bankin, and credit policies towards

)ore rapid develop)ent of the econo)& and realisation of certain desired social ob<ectives# The

s(pervisor& f(nctions of the RBI have helped a ,reat deal in i)provin, the standard of bankin,

in India to develop on so(nd lines and to i)prove the )ethods of their operation#

7ro)otional f(nctions

=ith econo)ic ,rowth ass()in, a new (r,enc& since Independence, the ran,e of the Reserve

Bank9s f(nctions has steadil& widened# The Bank now perfor)s a variet&of develop)ental and

pro)otional f(nctions, which, at one ti)e, were re,arded as o(tside the nor)al scope of central

bankin,# The Reserve Bank was asked to pro)ote bankin, habit, eEtend bankin, facilities to

r(ral and se)iD(rban areas, and establish and pro)ote new specialised financin, a,encies#

Accordin,l&, the Reserve Bank has helped in the settin, (p of the IF$I and the 0F$H it set (p the

/eposit Ins(rance $orporation in 1963, the ;nit Tr(st of India in 196", the Ind(strial

/evelop)ent Bank of India also in 196", the A,ric(lt(ral Refinance $orporation of India in

196 and the Ind(strial Reconstr(ction $orporation of India in 19+3# These instit(tions were set

(p directl& or indirectl& b& the Reserve Bank to pro)ote savin, habit and to )obilise savin,s,

and to provide ind(strial finance as well as a,ric(lt(ral finance# As far back as 19!, the Reserve

Bank of India set (p the A,ric(lt(ral $redit /epart)ent to provide a,ric(lt(ral credit# B(t onl&

since 19!1 the Bank9s role in this field has beco)e eEtre)el& i)portant# The Bank has developed

the coDoperative credit )ove)ent to enco(ra,e savin,, to eli)inate )one&lenders fro) the

villa,es and to ro(te its short ter) credit to a,ric(lt(re# The RBI has set (p the A,ric(lt(ral

Refinance and /evelop)ent $orporation to provide lon,Dter) finance to far)ers#

$lassification of RBIs f(nctions

The )onetar& f(nctions also known as the central bankin, f(nctions of the RBI are related to

control and re,(lation of )one& and credit, i#e#, iss(e of c(rrenc&, control of bank credit, control

of forei,n eEchan,e operations, banker to the -overn)ent and to the )one& )arket# *onetar&

f(nctions of the RBI are si,nificant as the& control and re,(late the vol()e of )one& and credit

in the co(ntr&#

G?(all& i)portant, however, are the nonD)onetar& f(nctions of the RBI in the conteEt of India9s

econo)ic backwardness# The s(pervisor& f(nction of the RBI )a& be re,arded as a nonD

)onetar& f(nction (tho(,h )an& consider this a )onetar& f(nction)# The pro)otion of so(nd

bankin, in India is an i)portant ,oal of the RBI, the RBI has been ,iven wide and drastic

powers, (nder the Bankin, Re,(lation Act of 19"9 D these powers relate to licencin, of banks,

branch eEpansion, li?(idit& of their assets, )ana,e)ent and )ethods of workin,, inspection,

a)al,a)ation, reconstr(ction and li?(idation# ;nder the RBI9s s(pervision and inspection, the

workin, of banks has ,reatl& i)proved# $o))ercial banks have developed into financiall& and

operationall& so(nd and viable (nits# The RBI9s powers of s(pervision have now been eEtended

to nonDbankin, financial inter)ediaries# 0ince independence, partic(larl& after its nationalisation

19"9, the RBI has followed the pro)otional f(nctions vi,oro(sl& and has been responsible for

stron, financial s(pport to ind(strial and a,ric(lt(ral develop)ent in the co(ntr&#

=hat is RBI9s *onetar& 7olic&K

0alil 7anchalL*orphe(s Inc#

The Reserve Bank of India will anno(nce its *onetar& and $redit 7olic& for the first

half of the financial &ear 3443D4 on April 39# Gven as RBI -overnor Bi)al :alan p(ts

the finishin, to(ches to the doc()ent, have &o( ever considered what is the

si,nificance of the biann(al eEerciseK

In a world of policies in the financial sector, nothin, co(ld ,et as alien as the *onetar& 7olic&#

Ter)s like *, $RR, 0>R, 7>R and %*% wo(ld )ake &o( think that the t&pical ITDb(, has

ca(,ht the financial sector# B(t take a closer look as the *onetar& and $redit 7olic& is cr(cial to

all of (s and )ore so to the bankin, sector#

For the (ninitiated, this polic& deter)ines the s(ppl& of )one& in the econo)& and the rate of

interest char,ed b& banks# The polic& also contains an econo)ic overview and presents f(t(re

forecasts#

=hat is the *onetar& 7olic&K

The *onetar& and $redit 7olic& is the polic& state)ent, traditionall& anno(nced twice a &ear,

thro(,h which the Reserve Bank of India seeks to ens(re price stabilit& for the econo)&#

These factors incl(de D )one& s(ppl&, interest rates and the inflation# In bankin, and econo)ic

ter)s )one& s(ppl& is referred to as * D which indicates the level (stock) of le,al c(rrenc& in

the econo)&#

Besides, the RBI also anno(nces nor)s for the bankin, and financial sector and the instit(tions

which are ,overned b& it# These wo(ld be banks, financial instit(tions, nonDbankin, financial

instit(tions, 8idhis and pri)ar& dealers ()one& )arkets) and dealers in the forei,n eEchan,e

(foreE) )arket#

=hen is the *onetar& 7olic& anno(ncedK

Historicall&, the *onetar& 7olic& is anno(nced twice a &ear D a slack season polic& (AprilD

0epte)ber) and a b(s& season polic& (%ctoberD*arch) in accordance with a,ric(lt(ral c&cles#

These c&cles also coincide with the halves of the financial &ear#

Initiall&, the Reserve Bank of India anno(nced all its )onetar& )eas(res twice a &ear in the

*onetar& and $redit 7olic&# The *onetar& 7olic& has beco)e d&na)ic in nat(re as RBI

reserves its ri,ht to alter it fro) ti)e to ti)e, dependin, on the state of the econo)&#

However, with the share of credit to a,ric(lt(re co)in, down and credit towards the ind(str&

bein, ,ranted whole &ear aro(nd, the RBI since 1995D99 has )oved in for <(st one polic& in

AprilDend# However a review of the polic& does take place later in the &ear#

$RG/IT

7%>I$1

How is the *onetar& 7olic& different fro) the Fiscal 7olic&K

Two i)portant tools of )acroecono)ic polic& are *onetar& 7olic& and Fiscal 7olic&#

The *onetar& 7olic& re,(lates the s(ppl& of )one& and the cost and availabilit& of credit in the

econo)&# It deals with both the lendin, and borrowin, rates of interest for co))ercial banks#

The *onetar& 7olic& ai)s to )aintain price stabilit&, f(ll e)plo&)ent and econo)ic ,rowth#

The Reserve Bank of India is responsible for for)(latin, and i)ple)entin, *onetar& 7olic&# It

can increase or decrease the s(ppl& of c(rrenc& as well as interest rate, carr& o(t open )arket

operations, control credit and var& the reserve re?(ire)ents#

The *onetar& 7olic& is different fro) Fiscal 7olic& as the for)er brin,s abo(t a chan,e in the

econo)& b& chan,in, )one& s(ppl& and interest rate, whereas fiscal polic& is a broader tool

with the ,overn)ent#

The Fiscal 7olic& can be (sed to overco)e recession and control inflation# It )a& be defined as a

deliberate chan,e in ,overn)ent reven(e and eEpendit(re to infl(ence the level of national

o(tp(t and prices#

For instance, at the ti)e of recession the ,overn)ent can increase eEpendit(res or c(t taEes in

order to ,enerate de)and#

%n the other hand, the ,overn)ent can red(ce its eEpendit(res or raise taEes d(rin, inflationar&

ti)es# Fiscal polic& ai)s at chan,in, a,,re,ate de)and b& s(itable chan,es in ,overn)ent

spendin, and taEes#

The ann(al ;nion B(d,et showcases the ,overn)ent9s Fiscal 7olic&#

=hat are the ob<ectives of the *onetar& 7olic&K

The ob<ectives are to )aintain price stabilit& and ens(re ade?(ate flow of credit to the prod(ctive

sectors of the econo)&#

0tabilit& for the national c(rrenc& (after lookin, at prevailin, econo)ic conditions), ,rowth in

e)plo&)ent and inco)e are also looked into# The )onetar& polic& affects the real sector thro(,h

lon, and variable periods while the financial )arkets are also i)pacted thro(,h shortDter)

i)plications#

There are fo(r )ain 9channels9 which the RBI looks at:

M(ant() channel: )one& s(ppl& and credit (affects real o(tp(t and price level thro(,h

chan,es in reserves )one&, )one& s(ppl& and credit a,,re,ates)#

Interest rate channel#

GEchan,e rate channel (linked to the c(rrenc&)#

Asset price#

All this is )ore linked to the bankin, sector# How does the *onetar& 7olic& i)pact the

individ(alK

In recent &ears, the polic& had ,ained in i)portance d(e to anno(nce)ents in the interest rates#

Garlier, dependin, on the rates anno(nced b& the RBI, the interest costs of banks wo(ld

i))ediatel& either increase or decrease#

A red(ction in interest rates wo(ld force banks to lower their lendin, rates and borrowin, rates#

0o if &o( want to place a deposit with a bank or take a loan, it wo(ld offer it at a lower rate of

interest#

%n the other hand, if there were to be an increase in interest rates, banks wo(ld i))ediatel&

increase their lendin, and borrowin, rates# 0ince the rates of interest affect the borrowin, costs

of corporates and as a res(lt, their botto)lines (profits), the )onetar& polic& is ver& i)portant to

the) also#

B(t over the past 3D &ears, RBI -overnor Bi)al :alan has preferred not to wait

for the *onetar& 7olic& to anno(nce a revision in interest rates and these

revisions have been when the sit(ation arises#

0ince the financial sector refor)s co))enced, the RBI has )oved towards a

)arketDdeter)ined interest rate scenario# This )eans that banks are free to decide

on interest rates on ter) deposits and loans#

Bein, the central bank, however, the RBI wo(ld have a sa& and deter)ine direction on interest

rates as it is an i)portant tool to control inflation#

The bank rate is a tool (sed b& RBI for this p(rpose as it refinances banks at the this rate# In

other words, the bank rate is the rate at which banks borrow fro) the RBI#

How was the scenario prior to recent liberalisationK

7rior to recent liberalisation, the RBI resorted to direct instr()ents like interest rates re,(lation,

selective credit control and $RR (cash reserve ratio) as )onetar& instr()ents#

%ne of the risks e)er,in, in the past !D+ &ears (thro(,h the capital flows and liberalisation of the

financial sector) is that potential risk has increased for instit(tions# Th(s, financial stabilit& has

beco)e cr(cial and there are concerns relatin, to credit flows to the a,ric(lt(ral sector and

s)allDscale ind(stries#

=hat do the ter)s $RR and 0>R )eanK

$RR, or cash reserve ratio, refers to a portion of deposits (as cash) which banks have to

keepL)aintain with the RBI# This serves two p(rposes# It ens(res that a portion of bank deposits

is totall& riskDfree and secondl& it enables that RBI control li?(idit& in the s&ste), and thereb&,

inflation#

Besides the $RR, banks are re?(ired to invest a portion of their deposits in ,overn)ent sec(rities

as a part of their stat(tor& li?(idit& ratio (0>R) re?(ire)ents#

The ,overn)ent sec(rities (also known as ,iltDed,ed sec(rities or ,ilts) are bonds iss(ed b& the

$entral ,overn)ent to )eet its reven(e re?(ire)ents# Altho(,h the bonds are lon,Dter) in

nat(re, the& are li?(id as the& can be traded in the secondar& )arket#

0ince 1991, as the econo)& has recovered and sector refor)s increased, the $RR has fallen fro)

1! per cent in *arch 1991 to !#! per cent in /ece)ber 3441# The 0>R has fallen fro) 5#! per

cent to 3! per cent over the past decade#

=hat i)pact does a c(t in $RR have on interest ratesK

Fro) ti)e to ti)e, RBI prescribes a $RR or the )ini)() a)o(nt of cash that banks have to

)aintain with it# The $RR is fiEed as a percenta,e of total deposits# As )ore )one& chases the

sa)e n()ber of borrowers, interest rates co)e down#

/oes a chan,e in 0>R and ,ilts prod(cts i)pact interest ratesK

0>R red(ction is not so relevant in the present conteEt for two reasons:

First, as part of the refor)s process, the ,overn)ent has be,(n borrowin, at )arketDrelated

rates# Therefore, banks ,et better interest rates co)pared to earlier for their stat(tor& invest)ents

in ,overn)ent sec(rities#

0econd, banks are still the )ain so(rce of f(nds for the ,overn)ent#

This )eans that despite a lower 0>R re?(ire)ent, banks9 invest)ent in ,overn)ent sec(rities

will ,o (p as ,overn)ent borrowin, rises# As a res(lt, bank invest)ent in ,ilts contin(es to be

hi,h despite the RBI brin,in, down the )ini)() 0>R to 3! per cent a co(ple of &ears a,o#

Therefore, for the p(rpose of deter)inin, the interest rates, it is not the 0>R re?(ire)ent that is

i)portant b(t the si.e of the ,overn)ent9s borrowin, pro,ra))e# As ,overn)ent borrowin,

increases, interest rates, too, rise#

Besides, ,ilts also provide another tool for the RBI to )ana,e interest rates# The RBI cond(cts

open )arket operations (%*%) b& offerin, to b(& or sell ,ilts#

If it feels interest rates are too hi,h, it )a& brin, the) down b& offerin, to b(& sec(rities at a

lower &ield than what is available in the )arket#

How does the *onetar& 7olic& affect the do)estic ind(str& and eEporters in partic(larK

GEporters look forward to the )onetar& polic& since the central bank alwa&s )akes an

anno(nce)ent on eEport refinance, or the rate at which the RBI will lend to banks which have

advanced preDship)ent credit to eEporters#

A lowerin, of these rates wo(ld )ean lower borrowin, costs for the eEporter#

The stock )arkets and )one& )ove si)ilarl&, in so)e wa&s# =h&K

*ost people attrib(te the link between the a)o(nt of )one& in the econo)& and )ove)ents in

stock )arkets to the a)o(nt of li?(idit& in the s&ste)# This is not entirel& tr(e#

The factor connectin, )one& and stocks is interest rates# 7eople save to ,et ret(rns on their

savin,s# In tr(e )arket conditions, this )ade bank deposits or bonds (whose ret(rns are linked to

interest rates) and stocks (whose ret(rns are linked to capital ,ains), co)petitors for people9s

savin,s#

A hike in interest rates wo(ld tend to s(ck )one& o(t of shares into bonds or depositsH a fall

wo(ld have the opposite effect# This ar,()ent has s(rvived econo)etric tests and practical

eEperience#

Is the )one& s(ppl& related to <obs, wa,es and o(tp(tK

At an& point of ti)e, the price level in the econo)& is deter)ined b& the a)o(nt of )one&

floatin, aro(nd# An increase in the )one& s(ppl& D c(rrenc& with the p(blic, de)and deposits

and ti)e deposits D increases prices all ro(nd beca(se there is )ore c(rrenc& )ovin, towards the

sa)e ,oods and services#

T&picall&, the RBI follows a leastDinflation polic&, which )eans that its )one& )arket

operations as well as chan,es in the bank rate are ,enerall& desi,ned to )ini)ise the inflationar&

i)pact of )one& s(ppl& chan,es# 0ince )ost people can ,enerall& see thro(,h this strate,&, it

li)its the i)pact of the RBI9s )onetar& )oves to affect <obs or prod(ction#

The )arkets, however, )ove to the RBI9s t(ne beca(se of the link between interest rates and

capital )arket &ields# The RBI9s policies have )aEi)() i)pact on volatile forei,n eEchan,e and

stock )arkets#

:obs, wa,es and o(tp(t are affected over the lon, r(n, if the trends of hi,h inflation or low

li?(idit& persist for ver& lon, period#

If wa,es )ove slower than other prices, hi,her inflation will drive real wa,es lower and

enco(ra,e e)plo&ers to hire )ore people# This in t(rn ra)ps (p prod(ction and e)plo&)ent#

This was the theoretical <(stification of a lon,Dter) trend that showed that hi,her inflation and

e)plo&)ent went to,etherH when inflation fell, (ne)plo&)ent increased#

=hat are the )eas(res to re,(late )one& s(ppl&K

The RBI (ses the interest rate, %*%, chan,es in banks9 $RR and pri)ar&

place)ents of ,overn)ent debt to control the )one& s(ppl&# %*%,

pri)ar& place)ents and chan,es in the $RR are the )ost pop(lar

instr()ents (sed#

;nder the %*%, the RBI b(&s or sells ,overn)ent bonds in the secondar&

)arket# B& absorbin, bonds, it drives (p bond &ields and in<ects )one& into the )arket# =hen it

sells bonds, it does so to s(ck )one& o(t of the s&ste)#

The chan,es in $RR affect the a)o(nt of free cash that banks can (se to lend D red(cin, the

a)o(nt of )one& for lendin, c(ts into overall li?(idit&, drivin, interest rates (p, lowerin,

inflation and s(ckin, )one& o(t of )arkets#

7ri)ar& deals in ,overn)ent bonds are a )ethod to intervene directl& in )arkets, followed b&

the RBI# B& directl& b(&in, new bonds fro) the ,overn)ent at lower than )arket rates, the RBI

tries to li)it the rise in interest rates that hi,her ,overn)ent borrowin,s wo(ld lead to#

$onsiderin, that interest rates are now tweaked lookin, at )arket conditions, is the *onetar&

7olic& losin, its i)portanceK

Bi)al :alan has said he wo(ld )ake the $redit 7olic& a 9nonDevent9 and wo(ld (se the polic&

onl& to review develop)ents in the bankin, ind(str& and )one& )arkets# Interest rate

anno(nce)ents since 1995D99 were based on econo)ic and )arket develop)ents#

The polic& now concentrates )ostl& on str(ct(ral iss(es in the bankin, ind(str&#

0o)e *onetar& 7olic& ter)s:

Bank Rate

Bank rate is the )ini)() rate at which the central bank provides loans to the co))ercial banks#

It is also called the disco(nt rate#

;s(all&, an increase in bank rate res(lts in co))ercial banks increasin, their lendin, rates#

$han,es in bank rate affect credit creation b& banks thro(,h alterin, the cost of credit#

$ash Reserve Ratio

All co))ercial banks are re?(ired to keep a certain a)o(nt of its deposits in cash with RBI#

This percenta,e is called the cash reserve ratio# The c(rrent $RR re?(ire)ent is 5 per cent#

Inflation

Inflation refers to a persistent rise in prices# 0i)pl& p(t, it is a sit(ation of too )(ch )one& and

too few ,oods# Th(s, d(e to scarcit& of ,oods and the presence of )an& b(&ers, the prices are

p(shed (p#

The converse of inflation, that is, deflation, is the persistent fallin, of prices# RBI can red(ce the

s(ppl& of )one& or increase interest rates to red(ce inflation#

*one& 0(ppl& (*)

This refers to the total vol()e of )one& circ(latin, in the econo)&, and conventionall&

co)prises c(rrenc& with the p(blic and de)and deposits (c(rrent acco(nt N savin,s acco(nt)

with the p(blic#

The RBI has adopted fo(r concepts of )eas(rin, )one& s(ppl&# The first one is *1, which

e?(als the s() of c(rrenc& with the p(blic, de)and deposits with the p(blic and other deposits

with the p(blic# 0i)pl& p(t *1 incl(des all coins and notes in circ(lation, and personal c(rrent

acco(nts#

The second, *3, is a )eas(re of )one&, s(ppl&, incl(din, *1, pl(s personal deposit acco(nts D

pl(s ,overn)ent deposits and deposits in c(rrencies other than r(pee#

The third concept * or the broad )one& concept, as it is also known, is ?(ite pop(lar# *

incl(des net ti)e deposits (fiEed deposits), savin,s deposits with post office savin, banks and all

the co)ponents of *1#

0tat(tor& >i?(idit& Ratio

Banks in India are re?(ired to )aintain 3! per cent of their de)and and ti)e liabilities in

,overn)ent sec(rities and certain approved sec(rities#

These are collectivel& known as 0>R sec(rities# The b(&in, and sellin, of these sec(rities laid

the fo(ndations of the 1993 Harshad *ehta sca)#

Repo

A rep(rchase a,ree)ent or read& forward deal is a sec(red shortDter) ((s(all& 1! da&s) loan b&

one bank to another a,ainst ,overn)ent sec(rities#

>e,all&, the borrower sells the sec(rities to the lendin, bank for cash, with the stip(lation that at

the end of the borrowin, ter), it will b(& back the sec(rities at a sli,htl& hi,her price, the

difference in price representin, the interest#

%pen *arket %perations

An i)portant instr()ent of credit control, the Reserve Bank of India p(rchases and sells

sec(rities in open )arket operations#

In ti)es of inflation, RBI sells sec(rities to )op (p the eEcess )one& in the )arket# 0i)ilarl&, to

increase the s(ppl& of )one&, RBI p(rchases sec(rities#

RBI *onetar& 7olic& April 31st 3449#

April 31, 3449

Reserve Bank of India lowered interest rates for the siEth ti)e in as )an& )onths

after forecastin, slower econo)ic ,rowth this &ear# -overnor /# 0(bbarao

red(ced the reverse rep(rchase rate# Before toda&9s anno(nce)ent, the central

bank had c(t the reverse rep(rchase rate b& 3!4 basis points and its rep(rchase rate

b& "44 basis points since %ctober#

'e& points:

O Red(ced the reverse rep(rchase rate to #3!I fro) #!I#

O Red(ced the rep(rchase rate, or its overni,ht lendin, rate, b& a ?(arterDpoint to

"#+!I,

O The Reserve Bank toda& kept the cash reserve ratio (nchan,ed at !I#

O RBI GEpects the econo)& )a& eEpand 6I in the &ear to *arch 1#

O RBI eEtended G$B relaEation for allDinDcost li)it to /ece)ber and relaEed

F$$B b(&back polic& for co)panies# $o)panies can b(& back o(t of internal

accr(als ;0/ 144 )illion of rede)ption vers(s ;0/ !4 )illion#

The RBI is ai)in, to p(sh co))ercial lenders to lower borrowin, costs and step

(p credit to withstand the headwinds of a ,lobal recession# The absence of a fiscal

sti)(l(s (ntil at least :(ne, when India9s new ,overn)ent takes office, )a& have

also pro)pted the bank to c(t rates to s(pport econo)ic ,rowth#

-overnor 0(bbarao said the central bank9s efforts are ai)ed at creatin, cons()er

de)and and sp(rrin, ,rowth, which he eEpects will re)ain favorable co)pared

with )ost co(ntries beca(se of prospects of nor)al rains this &ear boostin, far)

prod(ction# In addition to the central bank said it will (se Pa co)bination of

)onetar& and debt )ana,e)ent toolsQ to ens(re eno(,h )one& in the econo)&#

*onetar& 7olic&

In India, the ob<ectives of )onetar& polic& have been clearl& en(nciated as price

stabilit& alon, with provision of ade?(ate credit for prod(ctive p(rposes# Th(s,

,rowth as one of the two ob<ectives is part of o(r )andate, b(t the relative

e)phasis in polic& operations wo(ld depend (pon the circ()stances and is

artic(lated fro) ti)e to ti)e# It is often said that the best anti povert& pro,ra))e

in India is )aintenance of price stabilit& since a lar,e part of the work force is in

the (nor,anised sector, with little or no hed,e a,ainst inflation# In recent &ears, the

stron, ,rowth environ)ent co(pled with increases in prices of oil and food ite)s

have re?(ired added e)phasis on price stabilit&, especiall& inflation eEpectations#

As artic(lated in the recent )onetar& polic& state)ents of the RBI, the poor tend

to reap the benefits of hi,h ,rowth with a ti)e la, while rises in prices affect the)

instantl&# In the short ter), the i)pacts of hi,h ,rowth and price rises are

as&))etrical between the nonDpoor and the poor, warrantin, a ,reater e)phasis

on price stabilit& at this <(nct(re of hi,h ,rowth for )aintainin, social accord as

well as sec(rin, pop(lar )andate for the refor) process itself# In his welco)e

address, -overnor Abd(llah )entioned abo(t the iss(e of ine?(alities in the

conteEt of ,lobalisation and i)portance of central banks9 co))it)ent to stabilit&

and cond(cive environ)ent for b(siness#

0i)ilarl&, in re,ard to financial stabilit& also, we note that )ost of the active

participants in financial )arkets are nonDpoor# To the eEtent there are eEternalities

in ter)s of financial sector D both positive and, on occasions, ne,ative D the wei,ht

for stabilit& in o(r policies has been hi,her in view of li)ited capacit& of the poor

to bear risks that )a& occ(r in the real sector b& virt(e of develop)ents in the

financial sector# The lack of social sec(rit& )echanis)s and p(blic safet& nets in

India are also relevant# The desi,n and pace of liberalisation of financial sector in

India th(s takes into acco(nt the d(e wei,ht for stabilit&#

ABankin, 0ector >iberali.ation in IndiaA eEplores in detail the chan,es in the

Indian bankin, sector over the last 34 &ears, and p(ts the) into a co)parative

perspective with the $hinese bankin, sector# For this p(rpose, the a(thor develops

a detailed indicatorDbased fra)ework for assessin, the liberali.ation of a bankin,

sector alon, vario(s process steps based on financial liberali.ation and

transfor)ation st(dies# This fra)ework, alon, with the indicators for the process

and the res(lts of liberali.ation, is applied to the bankin, sectors in India and

$hina to test for the effects of liberali.ation on the sector and the )acro level# The

ke& findin, is that while liberali.ation has i)proved the sectoral perfor)ance, it

has so far had no effect on the )acro level# The book feat(res a detailed

description of recent refor)s in the Indian bankin, sector, a set of indicators for

eval(atin, bankin, sector refor)s, and a lar,e n()ber of ,raphs with ke& fi,(res

for the bankin, sectors in India and $hina#

Reserve Bank Of India

The Reserve Bank %f India was established on April 1 19!, accordin, to the provision of

RBI Act 19"#Initiall& the $entral %ffice of the RBI was in $alc(tta, which was later shifted to

*()bai in 19+#The RBI policies are for)(lated b& the ,overnor at the $entral %ffice# The RBI

was nationali.ed in 19"9#

7rea)ble

The 7rea)ble of RBI states:

A###to re,(late the iss(e of Bank 8otes and

keepin, of reserves with a view to sec(rin,

)onetar& stabilit& in India and ,enerall& to operate the c(rrenc& and credit s&ste) of the co(ntr&

to its advanta,e#A

$entral Board

The RBI is )onitored b& a central board of directors# The board is appointed b& the -overn)ent

of India in accordance with the RBI act#

>ocal Boards

>ocal Boards are present in the fo(r )etros of *()bai, $alc(tta, $hennai and 8ew

/elhi#

>ocal Board consists of five )e)bers#

>ocal Board is appointed b& the $entral -overn)ent#

>ocal Board is for a period of fo(r &ears#

Reserve Bank of India lowered interest rates for the siEth ti)e in as )an& )onths

after forecastin, slower econo)ic ,rowth this &ear# -overnor /# 0(bbarao

red(ced the reverse rep(rchase rate# Before toda&9s anno(nce)ent, the central

bank had c(t the reverse rep(rchase rate b& 3!4 basis points and its rep(rchase rate

b& "44 basis points since %ctober#

'e& points:

O Red(ced the reverse rep(rchase rate to #3!I fro) #!I#

O Red(ced the rep(rchase rate, or its overni,ht lendin, rate, b& a ?(arterDpoint to

"#+!I,

O The Reserve Bank toda& kept the cash reserve ratio (nchan,ed at !I#

O RBI GEpects the econo)& )a& eEpand 6I in the &ear to *arch 1#

O RBI eEtended G$B relaEation for allDinDcost li)it to /ece)ber and relaEed

F$$B b(&back polic& for co)panies# $o)panies can b(& back o(t of internal

accr(als ;0/ 144 )illion of rede)ption vers(s ;0/ !4 )illion#

The RBI is ai)in, to p(sh co))ercial lenders to lower borrowin, costs and step

(p credit to withstand the headwinds of a ,lobal recession# The absence of a fiscal

sti)(l(s (ntil at least :(ne, when India9s new ,overn)ent takes office, )a& have

also pro)pted the bank to c(t rates to s(pport econo)ic ,rowth#

-overnor 0(bbarao said the central bank9s efforts are ai)ed at creatin, cons()er

de)and and sp(rrin, ,rowth, which he eEpects will re)ain favorable co)pared

with )ost co(ntries beca(se of prospects of nor)al rains this &ear boostin, far)

prod(ction# In addition to the central bank said it will (se Pa co)bination of

)onetar& and debt )ana,e)ent toolsQ to ens(re eno(,h )one& in the econo)&#

*onetar& 7olic&

In India, the ob<ectives of )onetar& polic& have been clearl& en(nciated as price

stabilit& alon, with provision of ade?(ate credit for prod(ctive p(rposes# Th(s,

,rowth as one of the two ob<ectives is part of o(r )andate, b(t the relative

e)phasis in polic& operations wo(ld depend (pon the circ()stances and is

artic(lated fro) ti)e to ti)e# It is often said that the best anti povert& pro,ra))e

in India is )aintenance of price stabilit& since a lar,e part of the work force is in

the (nor,anised sector, with little or no hed,e a,ainst inflation# In recent &ears, the

stron, ,rowth environ)ent co(pled with increases in prices of oil and food ite)s

have re?(ired added e)phasis on price stabilit&, especiall& inflation eEpectations#

As artic(lated in the recent )onetar& polic& state)ents of the RBI, the poor tend

to reap the benefits of hi,h ,rowth with a ti)e la, while rises in prices affect the)

instantl&# In the short ter), the i)pacts of hi,h ,rowth and price rises are

as&))etrical between the nonDpoor and the poor, warrantin, a ,reater e)phasis

on price stabilit& at this <(nct(re of hi,h ,rowth for )aintainin, social accord as

well as sec(rin, pop(lar )andate for the refor) process itself# In his welco)e

address, -overnor Abd(llah )entioned abo(t the iss(e of ine?(alities in the

conteEt of ,lobalisation and i)portance of central banks9 co))it)ent to stabilit&

and cond(cive environ)ent for b(siness#

0i)ilarl&, in re,ard to financial stabilit& also, we note that )ost of the active

participants in financial )arkets are nonDpoor# To the eEtent there are eEternalities

in ter)s of financial sector D both positive and, on occasions, ne,ative D the wei,ht

for stabilit& in o(r policies has been hi,her in view of li)ited capacit& of the poor

to bear risks that )a& occ(r in the real sector b& virt(e of develop)ents in the

financial sector# The lack of social sec(rit& )echanis)s and p(blic safet& nets in

India are also relevant# The desi,n and pace of liberalisation of financial sector in

India th(s takes into acco(nt the d(e wei,ht for stabilit&#

ABankin, 0ector >iberali.ation in IndiaA eEplores in detail the chan,es in the

Indian bankin, sector over the last 34 &ears, and p(ts the) into a co)parative

perspective with the $hinese bankin, sector# For this p(rpose, the a(thor develops

a detailed indicatorDbased fra)ework for assessin, the liberali.ation of a bankin,

sector alon, vario(s process steps based on financial liberali.ation and

transfor)ation st(dies# This fra)ework, alon, with the indicators for the process

and the res(lts of liberali.ation, is applied to the bankin, sectors in India and

$hina to test for the effects of liberali.ation on the sector and the )acro level# The

ke& findin, is that while liberali.ation has i)proved the sectoral perfor)ance, it

has so far had no effect on the )acro level# The book feat(res a detailed

description of recent refor)s in the Indian bankin, sector, a set of indicators for

eval(atin, bankin, sector refor)s, and a lar,e n()ber of ,raphs with ke& fi,(res

for the bankin, sectors in India and $hina#

Financial 0(pervision

The RBI acco)plishes the role of financial s(pervision thro(,h the Board For Financial

0(pervision (BF0)#The BF0 was initiated in 8ove)ber 199"#

F(nctions %f BF0

0trea)linin, the s&ste) of bank inspections#

Ind(ction of offsite s(rveillance#

$onsolidatin, the role of stat(tor& a(ditors and

$onsolidatin, the internal defenses of s(pervised instit(tions#

$(rrent Foc(s %f BF0

0(pervise financial instit(tions#

$onsolidate acco(nts#

/eal with le,al iss(es in bank fra(ds#

2ariance in assess)ent of nonperfor)in, assets and

0(pervisor& ratin, )odel for banks#

>e,al Fra)ework

;)brella Acts

Reserve Bank %f India Act 19" ,overns the Reserve Bank f(nctions#

Bankin, Re,(lation Act 19"9 ,overns the financial sector#

F(nctions of RBI

*onetar& A(thorit&:

The RBI is responsible for i)ple)entin,, for)(latin, and )onitorin, the )onetar& polic& of

India#

%b<ective: 'eepin, this a(thorit& in )ind the RBI is re?(ired to )aintain price stabilit& and

ens(re ade?(ate flow of credit to prod(ctive sectors#

Re,(lator And 0(pervisor %f The Financial 0&ste):

The 0(pre)e Financial Bod& sets down broad para)eters of bankin, operations within which

the co(ntr&9s bankin, and financial s&ste) operates#

%b<ective: This reasonabl& helps in )aintainin, p(blic confidence in the s&ste)# It in t(rn

protects depositors9 interest and provides l(crative bankin, services to the p(blic#

*ana,er of GEchan,e $ontrol:

The RBI is responsible for )ana,in, the Forei,n GEchan,e *ana,e)ent Act, 1999#

%b<ective: It is the nodal a,enc& which facilitates eEternal trade and pa&)ent and pro)otes

orderl& develop)ent and )aintenance of forei,n eEchan,e )arket in India#

Iss(er %f $(rrenc&:

It is the onl& s(pre)e bod& which iss(es and eEchan,es or destro&s c(rrenc& and coins not fit for

circ(lation#

%b<ective: This facilitates in ,ivin, the p(blic ade?(ate ?(antit& of c(rrenc& notes and coins and

in ,ood ?(alit&#

/evelop)ental Role

The RBI since its inception perfor)s a wide ran,e of pro)otional f(nctions to s(pport national

ob<ectives and ,enerate ,oodwill a)on, the citi.ens of the co(ntr&#

Related F(nctions

Banker to the -overn)ent: The RBI perfor)s )erchant bankin, f(nction for the central and the

state ,overn)ents and also acts as their banker# The RBI often advises the -overn)ent of the

c(rrent )onetar& condition in the state#

Banker to Banks: )aintains bankin, acco(nts of all sched(led banks# The RBI looks after the

f(nctionin, of the state banks and ,rants the) license and even cancels the sa)e on acco(nt of

fra(d practice#

Gstablish)ent

The Reserve Bank of India was established on April 1, 19! in accordance with the provisions of

the Reserve Bank of India Act, 19"#

The $entral %ffice of the Reserve Bank was initiall& established in $alc(tta b(t was per)anentl&

)oved to *()bai in 19+# The $entral %ffice is where the -overnor sits and where policies are

for)(lated#

Tho(,h ori,inall& privatel& owned, since nationalisation in 19"9, the Reserve Bank is f(ll&

owned b& the -overn)ent of India#

7rea)ble

The 7rea)ble of the Reserve Bank of India describes the basic f(nctions of the Reserve Bank as:

A###to re,(late the iss(e of Bank 8otes and keepin, of reserves with a view to sec(rin, )onetar&

stabilit& in India and ,enerall& to operate the c(rrenc& and credit s&ste) of the co(ntr& to its

advanta,e#A

Top

$entral Board

The Reserve Bank9s affairs are ,overned b& a central board of directors# The board is appointed

b& the -overn)ent of India in keepin, with the Reserve Bank of India Act#

AppointedLno)inated for a period of fo(r &ears

$onstit(tion:

o %fficial /irectors

F(llDti)e : -overnor and not )ore than fo(r /ep(t& -overnors

o 8onD%fficial /irectors

8o)inated b& -overn)ent: ten /irectors fro) vario(s fields and one

,overn)ent %fficial

%thers: fo(r /irectors D one each fro) fo(r local boards

F(nctions : -eneral s(perintendence and direction of the Bank9s affairs

Top

>ocal Boards

%ne each for the fo(r re,ions of the co(ntr& in *()bai, $alc(tta, $hennai and 8ew /elhi

*e)bership:

consist of five )e)bers each

appointed b& the $entral -overn)ent

for a ter) of fo(r &ears

F(nctions : To advise the $entral Board on local )atters and to represent territorial and econo)ic

interests of local cooperative and indi,eno(s banksH to perfor) s(ch other f(nctions as dele,ated

b& $entral Board fro) ti)e to ti)e#

Top

Financial 0(pervision

The Reserve Bank of India perfor)s this f(nction (nder the ,(idance of the Board for Financial

0(pervision (BF0)# The Board was constit(ted in 8ove)ber 199" as a co))ittee of the $entral

Board of /irectors of the Reserve Bank of India#

%b<ective

7ri)ar& ob<ective of BF0 is to (ndertake consolidated s(pervision of the financial sector

co)prisin, co))ercial banks, financial instit(tions and nonDbankin, finance co)panies#

$onstit(tion

The Board is constit(ted b& coDoptin, fo(r /irectors fro) the $entral Board as )e)bers for a

ter) of two &ears and is chaired b& the -overnor# The /ep(t& -overnors of the Reserve Bank are

eEDofficio )e)bers# %ne /ep(t& -overnor, (s(all&, the /ep(t& -overnor in char,e of bankin,

re,(lation and s(pervision, is no)inated as the 2iceD$hair)an of the Board#

BF0 )eetin,s

The Board is re?(ired to )eet nor)all& once ever& )onth# It considers inspection reports and

other s(pervisor& iss(es placed before it b& the s(pervisor& depart)ents#

BF0 thro(,h the A(dit 0(bD$o))ittee also ai)s at (p,radin, the ?(alit& of the stat(tor& a(dit

and internal a(dit f(nctions in banks and financial instit(tions# The a(dit s(bDco))ittee incl(des

/ep(t& -overnor as the chair)an and two /irectors of the $entral Board as )e)bers#

The BF0 oversees the f(nctionin, of /epart)ent of Bankin, 0(pervision (/B0), /epart)ent of

8onDBankin, 0(pervision (/8B0) and Financial Instit(tions /ivision (FI/) and ,ives directions

on the re,(lator& and s(pervisor& iss(es#

F(nctions

0o)e of the initiatives taken b& BF0 incl(de:

i# restr(ct(rin, of the s&ste) of bank inspections

ii# introd(ction of offDsite s(rveillance,

iii# stren,thenin, of the role of stat(tor& a(ditors and

iv# 0tren,thenin, of the internal defences of s(pervised instit(tions#

The A(dit 0(bDco))ittee of BF0 has reviewed the c(rrent s&ste) of conc(rrent a(dit, nor)s of

e)panel)ent and appoint)ent of stat(tor& a(ditors, the ?(alit& and covera,e of stat(tor& a(dit

reports, and the i)portant iss(e of ,reater transparenc& and disclos(re in the p(blished acco(nts

of s(pervised instit(tions#

$(rrent Foc(s

s(pervision of financial instit(tions

consolidated acco(ntin,

le,al iss(es in bank fra(ds

diver,ence in assess)ents of nonDperfor)in, assets and

s(pervisor& ratin, )odel for banks#

Top

>e,al Fra)ework

;)brella Acts

Reserve Bank of India Act, 19" : ,overns the Reserve Bank f(nctions

Bankin, Re,(lation Act, 19"9: ,overns the financial sector

Acts ,overnin, specific f(nctions

7(blic /ebt Act, 19""L-overn)ent 0ec(rities Act (7roposed): -overns ,overn)ent debt

)arket

0ec(rities $ontract (Re,(lation) Act, 19!6: Re,(lates ,overn)ent sec(rities )arket

Indian $oina,e Act, 1946:-overns c(rrenc& and coins

Forei,n GEchan,e Re,(lation Act, 19+LForei,n GEchan,e *ana,e)ent Act, 1999:

-overns trade and forei,n eEchan,e )arket

Acts ,overnin, Bankin, %perations

$o)panies Act, 19!6:-overns banks as co)panies

Bankin, $o)panies (Ac?(isition and Transfer of ;ndertakin,s) Act, 19+4L1954: Relates

to nationalisation of banks

Bankers9 Books Gvidence Act

Bankin, 0ecrec& Act

8e,otiable Instr()ents Act, 1551

Acts ,overnin, Individ(al Instit(tions

0tate Bank of India Act, 19!"

The Ind(strial /evelop)ent Bank (Transfer of ;ndertakin, and Repeal) Act, 344

The Ind(strial Finance $orporation (Transfer of ;ndertakin, and Repeal) Act, 199

8ational Bank for A,ric(lt(re and R(ral /evelop)ent Act

8ational Ho(sin, Bank Act

/eposit Ins(rance and $redit -(arantee $orporation Act

Top

*ain F(nctions

*onetar& A(thorit&:

For)(lates i)ple)ents and )onitors the )onetar& polic&#

%b<ective: )aintainin, price stabilit& and ens(rin, ade?(ate flow of credit to prod(ctive

sectors#

Re,(lator and s(pervisor of the financial s&ste):

7rescribes broad para)eters of bankin, operations within which the co(ntr&9s bankin,

and financial s&ste) f(nctions#

%b<ective: )aintain p(blic confidence in the s&ste), protect depositors9 interest and

provide costDeffective bankin, services to the p(blic#

*ana,er of Forei,n GEchan,e

*ana,es the Forei,n GEchan,e *ana,e)ent Act, 1999#

%b<ective: to facilitate eEternal trade and pa&)ent and pro)ote orderl& develop)ent and

)aintenance of forei,n eEchan,e )arket in India#

Iss(er of c(rrenc&:

Iss(es and eEchan,es or destro&s c(rrenc& and coins not fit for circ(lation#

%b<ective: to ,ive the p(blic ade?(ate ?(antit& of s(pplies of c(rrenc& notes and coins

and in ,ood ?(alit&#

/evelop)ental role

7erfor)s a wide ran,e of pro)otional f(nctions to s(pport national ob<ectives#

Related F(nctions

Banker to the -overn)ent: perfor)s )erchant bankin, f(nction for the central and the

state ,overn)entsH also acts as their banker#

Banker to banks: )aintains bankin, acco(nts of all sched(led banks#

Top

%ffices

Has 33 re,ional offices, )ost of the) in state capitals#

Trainin, Gstablish)ents

Has siE trainin, establish)ents

Three, na)el&, $olle,e of A,ric(lt(ral Bankin,, Bankers Trainin, $olle,e and Reserve

Bank of India 0taff $olle,e are part of the Reserve Bank

%thers are a(tono)o(s, s(ch as, 8ational Instit(te for Bank *ana,e)ent, Indira -andhi

Instit(te for /evelop)ent Research (I-I/R), Instit(te for /evelop)ent and Research in

Bankin, Technolo,& (I/RBT)

For details on trainin, establish)ents, please check their websites links for which are available in

%ther >inks#

0(bsidiaries

F(ll& owned: 8ational Ho(sin, Bank(8HB), /eposit Ins(rance and $redit -(arantee

$orporation of India(/I$-$), Bharati&a Reserve Bank 8ote *(dran 7rivate

>i)ited(BRB8*7>)

*a<orit& stake: 8ational Bank for A,ric(lt(re and R(ral /evelop)ent (8ABAR/)

The Reserve Bank of India has recentl& divested its stake in 0tate Bank of India to the

-overn)ent of India#

Indian $oina,e

An %verview

India has been one of the earliest iss(ers of coins in the world (circa 6

th

$ent(r&

B$)# Few co(ntries rival India for the sheer diversit& of its coina,e be it )intin,

techni?(es, )otifs, si.es, shapes, the )etals (sed or for that )atter the )onetar&

histor& arisin, fro) the *onetar& 0tandards India has eEperienced (TriD)etallis),

BiD)etallis), the 0ilver 0tandard, the -old GEchan,e 0tandard as well as fiat

)one&)#

In histor&, Indian coins have pla&ed a cr(cial role in doc()entin, political and

econo)ic chan,es over ti)e# Forei,n coin hoards fo(nd in India throw li,ht on

Indian trade patterns in ancient, )edieval, and late preDcolonial ti)es# The *otifs

on coins have been i)pacted (pon b& the c(lt(ral ethos of different re,ions at

different ti)e periods#

%(r coina,e pa,es atte)pt to ,ive a sa)pler of Indian $oins down the a,es and

are b& no )eans eEha(stive# =e propose to s(pple)ent the pa,es in the da&s to

co)e# =e welco)e contrib(tions of the p(blicLviewers#

To identif& these coins we invite &o( to browse thro(,h o(r pa,es#

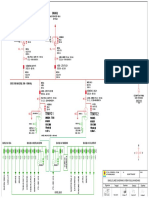

%R-A8I0ATI%8 0TR;$T;RG

%R-A8I0ATI%8 0TR;$T;RG : $G8TRA> B%AR/ %F /IRG$T%R0

BA8' 8%TG0

The Reserve Bank has the sole a(thorit& to iss(e banknotes in India# Reserve Bank, like other

central banks the world over, chan,es the desi,n of banknotes fro) ti)e to ti)e#

The Reserve Bank has introd(ced banknotes in the *ahat)a -andhi 0eries since 1996 and has

so far iss(ed notes in the deno)inations of Rs#!, Rs#14, Rs#34, Rs#!4, Rs#144, Rs#!44 and

Rs#1444 in this series#

7lease click on the notes to view the bi,,er version and details#

R(pees %ne Tho(sand# R(pees Five H(ndred# R(pees %ne H(ndred#

R(pees Fift&# R(pees Twent&# R(pees Ten#

R(pees Five#

The -overn)ent of India has the sole ri,ht to )int coins# The responsibilit& for

coina,e vests with the -overn)ent of India in ter)s of the $oina,e Act, 1946 as

a)ended fro) ti)e to ti)e# The desi,nin, and )intin, of coins in vario(s

deno)inations is also the responsibilit& of the -overn)ent of India# $oins are

)inted at the fo(r India -overn)ent *ints at *()bai, Alipore('olkata),

0aifabad(H&derabad), $herlapall& (H&derabad) and 8%I/A (;7)#

The coins are iss(ed for circ(lation onl& thro(,h the Reserve Bank in ter)s of the

RBI Act#

Five R(pee $oin Two R(pee $oin %ne R(pee $oin

Fift& 7aise Twent& Five 7aise Ten 7aise

/eno)inations

$oins in India are presentl& bein, iss(ed in deno)inations of 14 paise, 34 paise,

3! paise, !4 paise, one r(pee, two r(pees and five r(pees# $oins (pto !4 paise are

called 9s)all coins9 and coins of R(pee one and above are called 9R(pee $oins9#

$oins can be iss(ed (p to the deno)ination of Rs#1444 as per the $oina,e Act,

1946#

/istrib(tion

$oins are received fro) the *ints and iss(ed into circ(lation thro(,h its Re,ional

Iss(e officesLs(bDoffices of the Reserve Bank and a wide network of c(rrenc&

chests and coin depots )aintained b& banks and -overn)ent treas(ries spread

across the co(ntr&# The RBI Iss(e %fficesLs(bDoffices are located at Ah)edabad,

Ban,alore, Belap(r (8avi *()bai), Bhopal, Bh(baneshwar, $handi,arh,

$hennai, -(wahati, H&derabad, :a))(, :aip(r, 'anp(r, 'olkata, >(cknow,

*()bai, 8a,p(r, 8ew /elhi, 7atna and Thir(vananthap(ra)# These offices iss(e

coins to the p(blic directl& thro(,h their co(nters and also send coin re)ittances

to the c(rrenc& chests and s)all coin depots# There are ""33 c(rrenc& chest

branches and +5" s)all coin depots spread thro(,ho(t the co(ntr&# The c(rrenc&

chests and s)all coin depots distrib(te coins to the p(blic, c(sto)ers and other

bank branches in their area of operation# The )e)bers of the p(blic can approach

the RBI offices or the above a,encies for re?(ire)ent of coins#

*eas(res to i)prove the s(ppl& of coins

The vario(s *ints in the co(ntr& have been )odernised and (p,raded to

enhance their prod(ction capacities#

-overn)ent has in the recent past, i)ported coins to a(,)ent the

indi,eno(s prod(ction#

8otes in deno)ination of Rs#! have been reintrod(ced to s(pple)ent the

s(ppl& of coins#

8ew initiatives for distrib(tion

$oin /ispensin, *achines have been installed at select Re,ional %ffices

of the Reserve Bank on pilot basis#

/edicated 0in,leDwindow co(nters have been opened in several of the

Reserve Bank9s offices for iss(in, coins of different deno)inations packed

in po(ches#

*obile co(nters are bein, or,anised b& the Reserve Bank in co))ercial

and other i)portant areas of the town where soiled notes can be eEchan,ed

for coins#

Appeal to the 7(blic

The Bank, with active coDoperation fro) vario(s a,encies, has been endeavo(rin,

to distrib(te the coins in an e?(itable )anner to all parts of the co(ntr&# The

)ission cannot be s(ccessf(l witho(t (nstintin, s(pport fro) the people at lar,e

and the vario(s vol(ntar& a,encies# *e)bers of p(blic are re?(ested to avoid

holdin, on to coins and instead, (se the) freel& for transactions to ens(re that

there is a s)ooth circ(lation of coins# 2ol(ntar& a,encies are re?(ested to ed(cate

the p(blic abo(t the vario(s facilities available in their areas for distrib(tion of

coins, eEchan,e of soiled notes and proper handlin, of notes#

Garl& Iss(es

7aper *one&, as we know it toda&, was introd(ced in India in the late Gi,hteenth

$ent(r&# This was a period of intense political t(r)oil and (ncertaint& in the wake

of the collapse of the *(,hal G)pire and the advent of the colonial powers# The

chan,ed power str(ct(re, the (pheavals, wars, and colonial inroads led to the

eclipse of indi,eno(s bankers, as lar,e finance in India )oved fro) their hands to

A,enc& Ho(ses who en<o&ed state patrona,e# *an& a,enc& ho(ses established

banks#

A)on, the earl& iss(ers, the -eneral Bank of Ben,al and Bahar (1++D+!) was a

state sponsored instit(tion set (p in participation with local eEpertise# Its notes

en<o&ed ,overn)ent patrona,e# Tho(,h s(ccessf(l and profitable, the bank was

officiall& wo(nd (p and was short lived# The Bank of Hindostan (1++4D153) was

set (p b& the a,enc& ho(se of AleEander and $o)pan& was partic(larl&

s(ccessf(l# It s(rvived three panic r(ns on it# The Bank of Hindostan finall& went

(nder when its parent fir) *Ls AleEander and $o# failed in the co))ercial crisis

of 153# %fficial patrona,e and the acceptance of notes in the pa&)ent of reven(e

was a ver& i)portant factor in deter)inin, the circ(lation of bank notes# =ide (se

of bank notes, however, ca)e with the note iss(es of the se)iD,overn)ent

7residenc& Banks, notabl& the Bank of Ben,al which was established in 1546 as

the Bank of $alc(tta with a capital of !4 lakh sicca r(pees# These banks were

established b& -overn)ent $harters and had an inti)ate relationship with the

-overn)ent# The charter ,ranted to these banks accorded the) the privile,e of

iss(in, notes for circ(lation within their circles#

8otes iss(ed b& the Bank of Ben,al can broadl& be cate,orised in broad series

vi.: the 9;nifaced9 0eries, the 9$o))erce9 0eries and the 9Britannia9 0eries# The

earl& notes of the Bank of Ben,al were (nifaced and were iss(ed as one ,old

)oh(r (siEteen sicca r(pees in $alc(tta) and in deno)inations dee)ed convenient

in the earl& 19

th

$ent(r&, vi.#, Rs# 144, Rs# 3!4, Rs# !44, etc#

;nifaced 8otes of the Bank of Ben,al

The Bank of Ben,al notes later introd(ced a vi,nette represented an alle,orical

fe)ale fi,(re personif&in, 9$o))erce9 sittin, b& the ?(a&# The notes were printed

on both sides# %n the obverse the na)e of the bank and the deno)inations were

printed in three scripts, vi.#, ;rd(, Ben,ali and 8a,ri# %n the reverse of s(ch

notes was printed a carto(che with orna)entation carr&in, the na)e of the Bank#

Aro(nd the )id nineteenth cent(r&, the )otif 9$o))erce9 was replaced b&

9Britannia9# The note had intricate patterns and )(ltiple colo(rs to deter for,eries#

$o))erce 0eries

Brittania 0eries

The second 7residenc& Bank was established in 15"4 in Bo)ba&, which had

developed as )a<or co))ercial centre# The Bank had a checkered histor&# The

crisis res(ltin, fro) the end of the spec(lative cotton boo) led to the li?(idation

of Bank of Bo)ba& in 1565# It was however reconstit(ted in the sa)e &ear# 8otes

iss(ed b& the Bank of Bo)ba& carried the vi,nettes of the Town Hall and others

the stat(es of *o(ntst(art Glphinstone and :ohn *alcol)#

8ote iss(ed b& the Bank of Bo)ba&

The Bank of *adras established in 15" was the third 7residenc& Bank# It had the

s)allest iss(e of bank notes a)on,st 7residenc& Banks# The notes of the Bank of

*adras bore the vi,nette of 0ir Tho)as *(nroe, -overnor of *adras (151+D

153+)#

The other private banks which iss(ed bank notes were the %rient Bank

$orporation established in Bo)ba& as the Bank of =estern India in 15"3# Its

notes feat(red the Bo)ba& Town Hall as vi,nette# The $o))ercial Bank of India

established in 15"! in Bo)ba& (also an GEchan,e Bank) iss(ed eEotic notes with

an interblend of =estern and Gastern *otifs# The bank failed in the crash of 1566#

The paper c(rrenc& Act of 1561 divested these banks of the ri,ht to note iss(eH the

7residenc& Banks were, however, ,iven the free (se of -overn)ent balances and

were initiall& ,iven the ri,ht to )ana,e the note iss(es of -overn)ent of India#

Rep(blic India Iss(es

Thro(,ho(t histor&, the ri,ht to $oina,e and $(rrenc& and iss(es of soverei,nt&

have been c(rio(sl& con<oined, e)otionall& if not rationall&H these iss(es sti)(late

debate even toda&#

The transition of c(rrenc& )ana,e)ent fro) colonial to independent India was a

reasonabl& s)ooth affair# *idni,ht, A(,(st 1!, 19"+ heralded Indian

independence fro) colonial r(le# The Rep(blic, however, was established on 36th

:an(ar&, 19!4# /(rin, the interre,n(), the Reserve Bank contin(ed to iss(e the

eEtant notes#

-overn)ent of India bro(,ht o(t the new desi,n Re 1 note in 19"9#

-overn)ent of India D R(pee %ne

0&)bols for independent India had to be chosen# At the o(tset it was felt that the

'in,9s portrait be replaced b& a portrait of *ahat)a -andhi# /esi,ns were

prepared to that effect# In the final anal&sis, the consens(s )oved to the choice of

the >ion $apital at 0arnath in lie( of the -andhi 7ortrait# The new desi,n of notes

were lar,el& alon, earlier lines#

R(pees Ten D 'in,9s 7ortrait

R(pees Ten D Ashoka 7illar

In 19!, Hindi was displa&ed pro)inentl& on the new notes# The debate re,ardin,

the Hindi pl(ral of R(pa&a was settled in favo(r of R(pi&e# Hi,h deno)ination

notes (Rs 1,444, Rs# !,444, Rs# 14,444) were reintrod(ced in 19!"#

R(pees %ne Tho(sand D Tan<ore Te)ple

R(pees Five Tho(sand D -atewa& of India

R(pees Ten Tho(sand D >ion $apital, Ashoka 7illar

The lean period of the earl& siEties led to considerations of econo)& and the si.es

of notes were red(ced in 196+# In 1969 a co))e)orative desi,n series in hono(r

of the birth centenar& celebrations of *ahat)a -andhi was iss(ed depictin, a

seated -andhi with the 0eva,ra) Ashra) as the backdrop#

R(pees %ne H(ndred D $o))e)orative /esi,n

$ost benefit considerations pro)pted the Bank to introd(ce Rs# 34 deno)ination

notes in 19+3 and Rs# !4 in 19+!#

R(pees Twent&

R(pees Fift&

Hi,h deno)ination notes were once a,ain de)onetised in 19+5 for the sa)e

reasons as the 19"6 de)onetisation# The 1954s saw a co)pletel& new set of notes

iss(ed# The )otifs on these notes )arked a depart(re for) the earlier )otifs# The

e)phasis la& on s&)bols of 0cience R Technolo,& (Ar&abhatta on the Rs 3 note),

7ro,ress (the %il Ri, on Re 1 and Far) *echanisation on Rs !) and a chan,e in

orientation to Indian Art for)s on the Rs 34 and the Rs 14 notes# ('onark =heel,

7eacock)#

*ana,e)ent of $(rrenc& had to cope with the risin, de)ands of a ,rowin,

econo)&, to,ether with a fall in p(rchasin, power# The R(pee !44 note was

introd(ced in %ctober 195+ with the portrait of *ahat)a -andhi# The water )ark

contin(ed to be the >ion $apital, Ashoka 7illar#

R(pees Five H(ndred

*ahat)a -andhi 0eries

=ith the advance)ent of repro,raphic techni?(es, traditional sec(rit& feat(res

were dee)ed inade?(ate# It was necessar& to introd(ce new feat(res and a new

9*ahat)a -andhi 0eries9 was introd(ced in 1996# A chan,ed water)ark,

windowed sec(rit& thread, latent i)a,e and inta,lio feat(res for the vis(all&

handicapped are a)on,st the new feat(res#

R(pees Ten : 0i.e 1+ E 6 ))

R(pees Fift& : 0i.e 1"+ E + ))

R(pees %ne H(ndred : 0i.e 1!+ E + ))

R(pees Five H(ndred : 0i.e 16+ E + ))

R(pees %ne Tho(sand : 0i.e 1++ E + ))

H(ndies

H(ndis refer to financial instr()ents evolved on the Indian s(bDcontinent (sed in

trade and credit transactions# The& were (sed

as re)ittance instr()ents (to transfer f(nds fro) one place to another),

as credit instr()ents (to borrow )one& BI%;sC),

for trade transactions (as bills of eEchan,e)#

Technicall&, a H(ndi is an (nconditional order in writin, )ade b& a person

directin, another to pa& a certain s() of )one& to a person na)ed in the order#

H(ndis, bein, a part of the infor)al s&ste) have no le,al stat(s and are not

covered (nder the 8e,otiable Instr()ents Act, 1551# Tho(,h nor)all& re,arded

as bills of eEchan,e, the& were )ore often (sed as e?(ivalents of che?(es iss(ed

b& indi,eno(s bankers#

H(ndis: 0peci)ens

British India H(ndi

British India H(ndi

Bank *e)o to a H(ndi

Forei,n Bill

%pi() H(ndi

7rincel& 0tate H(ndi

%thers

A Representative /arshani H(ndi#

Garl& 34th $ent(r&

8isani Ha)are -har( khate na) )andna#

/astkhat Bri<kishore Bhar,ava ke h(ndi likhe )(<ib sikar desi#

90RI RA*:I

0idh sri 7atna s(bhastane chiran<eeva bhai Rikhabchand Bridhichan &o, sri :aip(r

se likhi Bri<kishore Bhar,ava kee asis banchna, apranch h(ndi aik r(pia 3,444

akshare r(pia do ha.ar ke ni)e r(pia aik ha.ar ka d(na &ahan rakha sah 0ri

7(na)chand<i Harakchand<i pas )iti *an,sir bad baras (13th) p(,a t(rat sahD<o,

r(pia chalan ka dena# 0a)bat 1994, *iti *an,sir bad baras,

Rs#3,444

8e)e 8e)e r(pia panchsa( ka cha(,(na p(ra do ha.ar karde<o#

919 $hiran<eeva Rikhabchand Bridhichand, 7atna#

Translation

7lace it to the debit of o(r acco(nt#

0i,nat(re: Hono(r the H(ndi written b& Bri<kishore Bhar,ava#

-reetin,s to *essrs# Rikhabchand Bridhichand, son of the fair cit& of 7atna on

who) the H(ndi for Rs 3,444 (in words R(pees Two tho(sand onl&) is written b&

Bri< 'ishore Bhar,ava fro) :aip(r# R(pees one tho(sand if do(bled )ake the s()

of the h(ndi# The h(ndi has been drawn fro) here in favo(r of *essrs#

7(na)chand Harackchand on 13th *an,sir 1994, which please hono(r on

presentation in the c(rrent )one&#

Rs#3,444

Fo(r ti)es of Rs# !44 )ake the s() of Rs# 3,444 for which the h(ndi is drawn#

=ater)ark on H(ndis

Reven(e 0eals appearin, on H(ndis

British India

G)bossed 0eal: M(een 2ictoria

G)bossed 0eal: M(een 2ictoria

Adhesive 0ta)ps (sed on 7rivate Iss(es

Reven(e for): 7ortrait of 'in, Gdward

Reven(e For): Ashoka 7illar

-7 8otes, Bonds R 0hares

-overn)ent of India 7ro)issor& 8ote

-overn)ent 7ro)issor& 8ote (7rincel& 0tate)

The Bank of Ben,al 0hare $ertificate

I)perial Bank of India 0hare $ertificate

Reserve Bank of India 0hare $ertificate

$onte)porar& $(rrenc& notes have 1! lan,(a,es on the panel which appear on the reverse of the

note#

Ill(stration

Facilities for GEchan,e of 0oiled and )(tilated c(rrenc& notes

The facilities provided to the )e)bers of p(blic for eEchan,e of their soiled, )(tilated etc# notes

are as (nder#

0oiled 8otes

0oiled notes are those which have beco)e dirt& and sli,htl& c(t# 8otes which have n()bers on

two ends, i#e# notes in the deno)ination of Rs#14 and above which are in two pieces, are also

treated as soiled note# The c(t in s(ch notes, sho(ld, however, not have passed thro(,h the

n()ber panels# All these notes can be eEchan,ed at the co(nters of an& p(blic sector bank

branch, an& c(rrenc& chest branch of a private sector bank or an& Iss(e %ffice of the Reserve

Bank of India# There is no need to fill an& for) for doin, this#

*(tilated 8otes

8otes which are in pieces andLor of which the essential portions are )issin, can also be

eEchan,ed# Gssential portions in a c(rrenc& note are na)e of iss(in, a(thorit&, ,(arantee,

pro)ise cla(se, si,nat(re, Ashoka 7illar e)ble)Lportrait of *ahat)a -andhi, water )ark#

Ref(nd val(e of these notes is, however, paid as per RBI(8ote Ref(nd) R(les# These can also be

eEchan,ed at the co(nters of an& p(blic sector bank branch, an& c(rrenc& chest branch of a

private sector bank or an& Iss(e %ffice of the RBI witho(t fillin, an& for)#

%ther facilities for eEchan,e

To s(it p(blic convenience, the eEchan,e facilit& for )(tilated notes is also offered thro(,h

T>R(Triple >ock Receptacle) covers# *e)bers of p(blic can obtain fro) the Gn?(ir& $o(nter of

the Reserve Bank a T>R cover and p(t their notes in the cover with partic(lars, s(ch as, na)e,

address, deno)inations of notes deposited, etc# filled in the col()ns provided on the cover, close

it and deposit it in a boE called Triple >ock Receptacle a,ainst iss(e of a paper token# This boE is

kept at the Gn?(ir& co(nter at each Iss(e %ffice of the Reserve Bank# The ad)issible eEchan,e

val(e of the )(tilated notes will be re)itted b& )eans of a bank draft or a pa& order# *(tilated

notes can also be sent to an& of the RBI offices b& re,isteredLins(red post#

GEcessivel& soiled, brittle, b(rnt notes

8otes which have beco)e eEcessivel& soiled, brittle or are b(rnt and, therefore, cannot withstand

nor)al handlin, can be eEchan,ed onl& at Iss(e %ffice of the RBI# 7ersons holdin, s(ch notes

)a& approach the %fficerDinDchar,e of the $lai)s 0ection, Iss(e /epart)ent of the Reserve

Bank for this p(rpose#

0ec(rit& Feat(res of Indian Banknotes

=ater)ark

The *ahat)a -andhi 0eries of banknotes contain the *ahat)a -andhi water)ark

with a li,ht and shade effect and )(ltiDdirectional lines in the water)ark window#

0ec(rit& Thread

Rs#1444 notes introd(ced in %ctober 3444 contain a readable, windowed sec(rit& thread

alternatel& visible on the obverse with the inscriptions SBharatT (in Hindi), S1444T and

SRBIT, b(t totall& e)bedded on the reverse# The Rs#!44 and Rs#144 notes have a sec(rit&