Documentos de Académico

Documentos de Profesional

Documentos de Cultura

CTP Ass Solution

Cargado por

bhavinvadhelTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

CTP Ass Solution

Cargado por

bhavinvadhelCopyright:

Formatos disponibles

Easy chart of deductions u/s 80C to 80U every individual

should aware of !

January 11, 2011 by taxworry 16 Comments

The season of tax has arrived. Therefore , there is need for easy chart of all

tax deduction u/s 80c to 80U for an Individual taxpayer?Under Income tax , deduction u/s

80C,80CCC, 80D, 80DD,80DDB,80G , 80GG, 80GGA, 80GGC , 80IAB , 80IB , 80IC , 80ID ,80IE ,

80JJA , 80QQB ,80RRB , 80U are relevant to Individuals depending on the condition fulfillment. The

following chart of deductions will give instant and fair idea about certain deductions to individual tax

payers. (section 80IAB to 80IE are not discussed which are specific to business men ) .

Sl No Section Details of deductions Quantum

1 80C General deduction for investment in

PPF,PF,Life Insurance, ULIP, Stamp

duty on house, Fixed deposits for 5

years , bonds etc

Maximum Rs1 ,00,000 is allowed.

Investment need not be from taxable

income.

2 80CCC Deduction in case of contribution to

pension fund. However, it should be

noted that surrender value or employer

contribution is considered income.

Maximum is Rs 1,00,000

3 80CCD Deduction in respect to contribution to

new pension scheme. Employees of

central and others are eligible.

Maximum is sum of employers and

employees contribution to the

maximum : 10 % of salary.

4 It should be noted that as per section 80CCE , the maximum amount of

deduction which can be claimed in aggregate of 80C ,80CCC & 80CCD

is Rs 1,00,0000

5 80D Medical insurance on self, spouse ,

children or parents

Rs 15,000 for self , spouse & children

Extra Rs 15,000 for insurance on

parents. IF parents are above 65 years,

extra sum should be read as Rs 20,000

Thus maximum is RS 35,000 per

annum

6 80DD For maintenance including treatment

or 7insurance the lives of physical

disable dependent relatives

Rs50,000 . In case disability is severe

, the amount is Rs 1,00,000.

7 80DDB For medical treatment of self or

relatives suffering from specified

disease

Acutal amount paid to the extent of Rs

40,000. In case of patient being Sr

Citizen , amount is Rs 60,000

8 80E For interest payment on loan taken

for higher studies for self or

education of spouse or children

Actual amount paid as interest and

start from the financial year in which

he /she starts paying interest and runs

till the interest is paid in full.

9 80G Donations to charitable institution 100% or 50% of amount of donation

made to 19 entities (National defense

fund , Prime minister relief fund etc. )

10 80GG For rent paid. This is only for people not getting any

House Rent Allowance. Maximum is

Rs 2000 per month. Rule 11B is

method of computation.

11 80GGA For donation to entities in scientific

research or rural development f

Only those tax payers who have no

business income can claim this

deduction .Maximum is equivalent to

100 % of donation.

12 80GGC For contribution to political parties 100 % of donations

13 80QQB Allowed only to resident authors for

royalty income for books other than

text book

Royalty income or Rs 3,00,000

whichever is less.

14 80RRB For income receipt as royalty on

patents of resident individuals

Actual royalty or Rs 3,00,000

whichever is less.

15 80U Deduction in respect of permanent

physical disability including

blindness to taxpayer

RS 50,000 which goes to Rs 1,00,000

in case taxpayer is suffering from

severe disability.

Perm

From Wikip

This article

(disambigu

Ju

He

Po

manent a

pedia, the free

e is about Per

uation).

Perm

Formed

urisdiction

eadquarters

www.income

Republic

This article is pa

olitics and Gove

accoun

encyclopedia

rmanent Accou

Thisarticled

addingcitatio

bechallenge

anentAccoun

Agencyoverv

1961

IndianIncome

NewDelhi

Website

etaxindia.gov.in/

ofIndia

art of the series:

ernment of Indi

nt numb

unt Number. F

doesnot cite an

onstoreliable

dandremoved

ntNumber

iew

eTaxDepartmen

/PAN/Overview.a

ia

ber

For other uses

ny references

sources.Unso

d.(August2011)

nt

sp

of the acrony

orsources.Ple

ourcedmateria

ym PAN, see P

easehelpimpr

almay

PAN

rovethisarticlee by

Permanen

identifiable

supervisio

number. It

This numb

salary or p

The prima

indirectly p

The PAN i

[edit]Stru

PAN s

letter

Each

If the

The fo

C

UnionGov

Elect

Political

Local&St

Other countries

Government o

view ta

nt Account N

e under the Ind

on of the Centr

t also serves a

ber is almost m

professional fe

ary purpose of

prevent tax ev

is unique, nati

ucture an

structure is as

assesse is un

PAN does not

ourth characte

C Company

vernment

ions

Parties

ateGovt.

Politics Portal

of India Portal

alk edit

umber (PAN)

dian Income T

ral Board for D

as an importan

mandatory for

ees, sale or pu

PAN is to brin

vasion by keep

onal, and perm

nd validati

follows: AAAA

iquely identifie

t follow the abo

er of the PAN m

) is unique alp

Tax Act 1961.

Direct Taxes (C

nt ID proof.

financial trans

urchase of ass

ng a universal

ping a track of

manent. It is u

ion

AA9999A: Firs

ed by the PAN

ove structure,

must be one o

hanumeric com

It is issued by

CBDT) and is

sactions such

sets above spe

identification

monetary tran

unaffected by a

st five characte

N

then the PAN

of the following

mbination issu

y the Indian Inc

almost equiva

as opening a

ecified limits.

key factor for

nsactions of hi

a change of ad

ers are letters

N will be shown

g, depending o

ued to all jurist

come Tax Dep

alent to a natio

bank account,

all financial tra

igh net worth i

ddress, even b

, next 4 nume

n invalid

on the type of

tic entities

partment unde

onal identificati

, receiving tax

ansactions an

individuals.

between state

erals, last char

assesse:

er the

ion

xable

d

es.

acter

P Person

H HUF(Hindu Undivided Family)

F Firm

A Association of Persons (AOP)

T AOP (Trust)

B Body of Individuals (BOI)

L Local Authority

J Artificial Juridical Person

G Government

The fifth character of the PAN is the first character

(a) of the surname / last name of the person, in the case of a "Personal" PAN card, where the

fourth character is "P" or

(b) of the name of the Entity/ Trust/ Society/ Organisation in the case of Company/ HUF/ Firm/

AOP/ BOI/ Local Authority/ Artificial Jurdical Person/ Govt, where the fourth character is

"C","H","F","A","T","B","L","J","G".

Nowadays, the DOI (Date of Issue) of PAN card is mentioned at the right (vertical) hand side of the photo

on the PAN card.

[edit]See also

Fringe Benefits Tax (India)

Indian Revenue Service

Tax Deduction Account Number

[edit]External links

Indian Income Tax Department Website

Permanent account number overview from Income Tax India

Categories:

Taxation in India

Universal identifiers

Tax Deduction At Source (TDS)

Nothing is as tangled and knotty as the TDS provisons. While some TDS rates are specified in the

individual section which deal with the tax treatment of the particular stream of income, some rates are

included as part of a separate schedule. To make matters worse, these rates get tampered and modified

every year. This result in so much chaos and confusion, that sometimes those who have to apply TDS, do

not have a clue about what rate to use. Imagine the plight of tax payer.

The genasis of the problem lies in the complicated nature of the tax laws. The authorities complain that

less than 2% of our population actually pays taxes. However, simpliflying the provisions is not viewed as

a possible solution. On the other hand, in an effort to bring more and more people into the tax net, the

lawmakers simply endup complicating the law. And the rule is simple more the complexity more the room.

TDS is final tax payable- at the time of filling his returns, the assessee pays the balance if any or asks for

refund, as the case maybe. Ergo, it behooves the Department to have a standard uniform rate -

convenient both for itself as well as the taxpayers.

The most unfortunate part is that we could have easily done away with any TDS provided the deparrtment

had good infrastructure to apprehend assessees avoiding tax only through TDS.

Types of payment, relevant provisions, person responsible for deduction of tax and type of payee.

Rates For TDS In India.

TDS Return.

Tax Deduction Account Number (TAN).

How To Deposit In TDS.

Exemption From TDS.

TDS Exemption For Individual.

Certificate Of Deduction.

No Objection Certificate In TDS.

Special Cases In TDS.

Service Tax In India

Dr. Manmohan Singh, the then Union Finance Minister, in his Budget speech for the year 1994-95

introduced the new concept of Service Tax and stated that '' There is no sound reason for exempting

services from taxation, therefore, I propose to make a modest effort in this direction by imposing a tax on

services of telephones, non-life insurance and stock brokers.''

Service Tax has been introduced in order to explore new avenues for taxation and to bring more people

into the tax net. Service Tax generated revenue of Rs 2612 crores in 2000-2001. In 2001-2002 it is

estimated at 3600 crores.

Bringing services under taxation is not simple as the services are intangible and are provided by large

groups of organized as well as unorganized service providers including retailers who are scattered across

the country. Further, there are several services, which are of intermediate nature. The low level of

education of service providers also poses difficulties to both-tax administration and assessees.

The Service Tax assessee is the person/firm who provides the service. Hence, the Service Tax must be

paid by the person/firm providing the service.

As stated earlier, service tax was introduced in India for the first time in 1994. Chapter V of the Finance

Act, 1994 (32 of 1994) (Sections 64 to 96) deals with imposition of Service Tax interalia on-

a. Service rendered by the telegraph authorities to the subscribers in relation to telephone

connections.

b. Service provided by the insurer to the policy-holder in relation to general insurance business.

c. Service provided by a stockbroker.

The Finance Acts of 1996, 1997, 1998, 2001, 2002 and 2003 added more services to tax net by way of

amendments to Finance Act, 1994. At present total number of services on which Service Tax is levied

has gone upto 58 despite withdrawal of certain Services from the tax net or grant of exemptions (Goods

Transport Operators, Outdoor Caterers, Pandal and Shamiana Contractors, and Mechanized Slaughter

Houses).

Service tax Includes

Service tax is a form of indirect tax that is applicable to the services that are taxable in nature. This tax

came into existence as government wants an easy option that is transparent in nature that can generate

revenue for the nation in an easy way. In past few years service tax is applied on various new services.

Unlike value added tax that is applicable on goods and commodities, this tax is imposed on various

services that is provided by the financial institutions such as banks, stock exchange, colleges, transaction

providers, telecom providers. Banks are the first that charges service tax to its customer since inception

often they termed service charges as processing fees. The responsibility of collecting the tax lies with the

Central Board of Excise and Customs (CBEC) its a body under the Ministry of Finance. This body

formulates the tax structure in the country.

Service tax was imposed first in India in July 1994. The service tax is applicable all over India however

due to the national interest and for the betterment of the people of Jammu and Kashmir it is waved off. In

2006- 2007 service tax was increased from 10% to 12% however it was again reduced from 12% to 10%

in the Union budget of 2009. It is often noticed that there is a lack of service tax information among the

people. Government has gradually increased the list of taxable services to increase the revenue. Lets

have a look at the major services that comes under the scanner of service tax:

Value Added Taxes (VAT) in India

Value Added Tax (VAT) is nothing but a general consumption tax that is assessed on the value added to

goods & services. It is the indirect tax on the consumption of the goods, paid by its original producers

upon the change in goods or upon the transfer of the goods to its ultimate consumers. It is based on the

value of the goods, added by the transferor. It is the tax in relation to the difference of the value added by

the transferor and not just a profit.

All over the world, VAT is payable on the goods and services as they form a part of national GDP. More

than130 countries worldwide have introduced VAT over the past 3 decades; India being amongst the last

few to introduce it.

It means every seller of goods and service providers charges the tax after availing the input tax credit. It is

the form of collecting sales tax under which tax is collected in each stage on the value added of the

goods. In practice, the dealer charges the tax on the full price of the goods, sold to the consumer and at

every end of the tax period reduces the tax collected on sale and tax charged to him by the dealers from

whom he purchased the goods and deposits such amount of tax in government treasury.

VAT is a multi-stage tax, levied only on value that is added at each stage in the cycle of production of

goods and services with the provision of a set-off for the tax paid at earlier stages in the cycle/chain. The

aim is to avoid 'cascading', which can have a snowballing effect on the prices. It is assumed that because

of cross-checking in a multi-staged tax; tax evasion would be checked, hence resulting in higher revenues

to the government.

Importance of VAT in India

India, particularly being a trading community, has always believed in accepting and adopting loopholes in

any system administered by State or Centre. If a well-administered system comes in, it will not only close

options for traders and businessmen to evade paying their taxes, but also make sure that they'll be

compelled to keep proper records of sales and purchases.

Under the VAT system, no exemptions are given and a tax will be levied at every stage of manufacture of

a product. At every stage of value-addition, the tax that is levied on the inputs can be claimed back from

tax authorities.

At a macro level, two issues make the introduction of VAT critical for India

Industry watchers believe that the VAT system, if enforced properly, will form part of the fiscal

consolidation strategy for the country. It could, in fact, help address issues like fiscal deficit problem. Also

the revenues estimated to be collected can actually mean lowering of fiscal deficit burden for the

government.

International Monetary Fund (IMF), in the semi-annual World Economic Outlook expressed its concern for

India's large fiscal deficit - at 10 per cent of GDP.

Moreover any globally accepted tax administrative system would only help India integrate better in the

World Trade Organization regime.

Advantages of VAT

1. Coverage If the tax is considered on a retail level, it offers all the economic advantages of a

tax of the entire retail price within its scope. The direct payment of tax spreads out over a large

number of firms instead of being concentrated only on particular groups, such as wholesalers &

retailers.

2. Revenue Security - Under VAT only buyers at the final stage have an interest in undervaluing

their purchases, as the deduction system ensures that buyers at earlier stages are refunded the

taxes on their purchases. Therefore, tax losses due to undervaluation will be limited to the value

added at the last stage.

Secondly, under VAT, if the payment of tax is avoided at one stage nothing will be lost if it is

picked up at later stage. Even if it is not picked up later, the government will at least have

collected the VAT paid at previous stages. Where as if evasion takes place at the final/last stage

the state will lose only tax on the value added at that particular point.

3. Selectivity - VAT is selectively applied to specific goods & business entities. In addition, VAT

does not burden capital goods because of the consumption-type. VAT gives full credit for tax

included on purchases of capital goods.

4. Co-ordination of VAT with direct taxation - Most taxpayers cheat on sales not to evade VAT

but to evade their personal and corporate income taxes. Operation of VAT resembles that of the

income tax and an effective VAT greatly helps in income tax administration and revenue

collection.

To know more about advantages of VAT click here: Advantages of VAT

Disadvantages of VAT

1. VAT is regressive

2. VAT is difficult to operate from position of both administration and business

3. VAT is inflationary

4. VAT favors capital intensive firms

Items covered under VAT

All business transactions that are carried on within a State by individuals/partnerships/ companies

etc. will be covered under VAT.

More than 550 items are covered under the new Indian VAT regime out of which 46 natural &

unprocessed local products will be exempt from VAT

Nearly 270 items including drugs and medicines, all industrial and agricultural inputs, capital

goods as well as declared goods would attract 4 % VAT in India.

The remaining items would attract 12.5 % VAT. Precious metals such as gold and bullion will be

taxed at 1%.

Petrol and diesel are kept out of the VAT regime in India.

Tax implication under Value Added Tax Act

Seller Buyer

Selling

Price

(Excluding

Tax)

Tax

Rate

Invoice

value

(InclTax)

Tax

Payable

Tax

Credit

Net

TaxOutflow

A B 100

4%

CST

104 4 0 4.00

B C 114

12.5%

VAT

128.25 14.25 0* 14.25

C D 124

12.5%

VAT

139.50 15.50 14.25 1.25

D Consumer 134

12.5%

VAT

150.75 16.75 15.50 1.25

Total to Govt.

VAT

CST

16.75 4.00

Methods Of Collecting And Charging The VAT

Generally, there are 2 methods that are followed while charging and collecting the VAT:

1. Invoice or tax credit method The tax is collected and charged separately on the basis of the tax

that is paid on the purchase and the tax that is payable on the sale, shown separately in the

invoice. Therefore, the difference between the tax paid on purchase and the tax payable on sale

as per the invoice is the VAT.

2. Subtraction Method Under this method, the tax is collected and charged on the aggregate value

of the tax payable on sale and purchase by applying the rate of tax, applicable to the goods.

Therefore, the difference between the sale price and purchase price would be VAT. It means VAT

is the tax which consumers ultimately face. It is collected at each stage. The tax earlier paid can

be allowed as set off or credit. Therefore, it is called as Last Point Tax

Top

Constitutional Framework Which Deals With The Levy Of Sale Tax

The states are empowered to impose sale tax on the goods that are subject to purchase or sale by

enacting laws. The Parliament has enacted the CST Act and the states are in the process of enacting

laws. The sale of goods or purchase includes:

a. the sale of goods, defined under the Sale of Goods Act.

b. transfer of goods used as otherwise in pursuance of the contract.

c. transfer of goods used otherwise in Works Contracts.

d. delivery of goods in pursuance to Hire Purchase Agreement or on installment.

e. transfer of right to use to goods on lease or otherwise.

f. supply of food by the club or body to its members.

g. supply of food articles or drinks for consumption.

The transaction referred above from (c) to (g) are considered to be deemed sale and power can be

exercised to impose tax on such sale by the states. States are also empowered to provide levy, creating a

liability to pay tax and other payment assessment and certain procedural formalities like maintenance of

accounts, records, appeals and issue of declaration of Tax Invoice, Input Tax Credit, etc.

To determ

and class

assessme

rate of tax

manners o

Levies Of

1. S

go

W

2. P

ce

3. C

de

al

Incom

From Wikip

The gover

Families (H

associatio

is governe

the Centra

Finance, G

mine the cost

ified goods a

ent. Under VA

x at the point

of set-off.

f Tax Under

ale Tax or Ou

oods, under t

Works Contrac

urchase Tax,

ertain circums

Composition ta

ealers like ret

llowed to pay

me tax

pedia, the free

T

s

rnment of India

HUFs), compa

n of persons)

ed by the India

al Board for Di

Govt. of India.

of tax on cert

nd computatio

AT laws, tax is

of levy upon s

The VAT

utput Tax incl

the Sale of Go

ct delivery of g

, including De

stances.

ax, that is in li

tailers whose

y the amount a

in India

encyclopedia

Thisarticlema

suggestionsma

a imposes an

anies, firms, co

and any other

an Income Tax

rect Taxes (C

There were 3

tain commodi

on of tax on t

s imposed on

such goods. T

uding Deeme

oods Act inclu

goods on the

eemed Purcha

ieu of tax by w

turnover is b

at his option.

a

aybeconfusing

aybefoundon

income tax on

o-operative so

r artificial pers

x Act, 1961. Th

BDT) and is p

3 million incom

ties, the VAT

the turnover o

the sale or p

They are also

ed Sale within

uding deemed

basis of a hir

ase within the

way of lump s

below the spec

gorunclearto

nthetalkpage

n taxable incom

ocieties and tru

son. Levy of ta

he Indian Inco

part of the Dep

me taxpayers

law maybe c

of sale and the

purchase of th

o empowered

n the state. It

d sale that is

re purchase a

e state. The ta

sum tax. This

cified limit of

oreaders.Plea

e.(November2010)

me of individua

usts (identified

x is separate o

ome Tax Depa

partment of Re

in 2008.

classified as p

e taxable turn

he goods. The

to prescribe

covers all kin

transfer of go

agreement or

ax paid on pu

means the a

the taxable tu

sehelpclarify

)

als, Hindu Und

d as body of in

on each of the

artment is gove

evenue under

prescribed go

nover and

e states levy t

modes and

nds of transfer

oods by way o

installment, e

urchase of goo

mount paid b

urnover that is

thearticle;

divided

ndividuals and

e persons. The

erned by

the Ministry of

ods

the

Top

r of

of

etc.

ods in

by the

s

e levy

f

Contents

[hide]

1IncomeTaxDepartment

2Overview

o 2.1ChargetoIncometax

o 2.2ResidentialStatus

o 2.3HeadsofIncome

o 2.4IndividualHeadsofIncome

2.4.1IncomefromSalary

2.4.2IncomefromHouseproperty

2.4.3IncomefromBusinessorProfession

2.4.4IncomefromCapitalGains

2.4.5IncomefromOtherSources

3Deduction

o 3.1Section80CDeductions

o 3.2Section80CCF:InvestmentinInfrastructureBonds

o 3.3Section80D:MedicalInsurancePremiums

o 3.4InterestonHousingLoansSection

4UseofDeductions

5TaxRates

o 5.1Surcharge

o 5.2TaxRatefornonIndividuals

o 5.3RefundStatusforSalariedtaxpayers

6CorporateIncometax

o 6.1TaxPenalties

7Seealso

8References

9Externallinks

[edit]Income Tax Department

The CBDT is a part of Department of Revenue in the Ministry of Finance. On one hand, CBDT provides

essential inputs for policy and planning of direct taxes in India,at the same time it is also responsible for

administration of direct tax laws through the Income Tax Department. The Central Board of Direct Taxes is a

statutory authority functioning under the Central Board of Revenue Act, 1963. The officials of the Board in their

ex-officio capacity also function as a Division of the Ministry dealing with matters relating to levy and collection

of direct taxes. The Central Board of Revenue as the Department apex body charged with the administration of

taxes came into existence as a result of the Central Board of Revenue Act, 1924. Initially the Board was in

charge of both direct and indirect taxes. However, when the administration of taxes became too unwieldy for

one Board to handle, the Board was split up into two, namely the Central Board of Direct Taxes and Central

Board of Excise and Customs with effect from 1.1.1964. This bifurcation was brought about by constitution of

the two Boards u/s 3 of the Central Boards of Revenue Act, 1963. Income Tax in India was introduced by

James Wilson.

Organisational Structure of the Central Board of Direct Taxes : The CBDT is headed by Chairman and

also comprises of six members, all of whom are ex-officio Special Secretary to Government of India.

Member (Income Tax) Member (Legislation and Computerisation) Member (Revenue) Member (Personnel &

Vigilance) Member (Investigation) Member (Audit & Judicial)

The Chairman and Members of CBDT are selected from Indian Revenue Service (IRS), a premier civil service

of India, whose members constitute the top management of Income Tax Department.

Responsibilities of Chairman and Members, Central Board of Direct Taxes

Various functions and responsibilities of CBDT are distributed amongst Chairman and six Members, with only

fundamental issues reserved for collective decision by CBDT. In addition, the Chairman and every Member of

CBDT are responsible for exercising supervisory control over definite areas of field offices of Income Tax

Department, known as Zones.

[edit]Overview

[edit]Charge to Income-tax

Every Person whose total income exceeds the maximum amount which is not chargeable to the income tax is

an assesse, and shall be chargeable to the income tax at the rate or rates prescribed under the finance act for

the relevant assessment year, shall be determined on basis of his residential status.

Income tax is a tax payable, at the rate enacted by the Union Budget (Finance Act) for every Assessment Year,

on the Total Income earned in the Previous Year by every Person.

The changeability is based on nature of income, i.e., whether it is revenue or capital. The principles of taxation

of income are-:

Income Tax Rates/Slabs Rate (%)

for men:

Up to 1,80,000 = NIL ,

1,80,001 5,00,000 = 10%,

5,00,001 8,00,000 = 20%,

8,00,001 upwards = 30%,

Up to 1,90,000 (for resident women)= NIL

Up to 2,50,000 (for resident individual of 60 years or above)= 0,

Up to 5,00,000 (for very senior citizen of 80 years or above)= 0.

Education cess is applicable @ 3 per cent on income tax, surcharge = NA

[edit]Residential Status

The three residential status, viz.,

Resident Ordinarily Residents

Under this category ,person must be living in India at least 182 days during previous year Or must

have been in India 365 days during 4 years preceding previous year and 60 days in previous year.

Ordinary residents are always taxable.

Resident but not Ordinarily Residents

Must have been a non-resident in India 9 out of 10 years preceding previous year or have been in

India in total 729 or less days out of last 7 years preceding the previous year. Not Ordinarily

residents are taxable in relation to income received in India or income accrued or deemed to be

accrue or arise in India and income from business or profession controlled from India.

Non Residents

Non Residents are exempt from tax if accrue or arise or deemed to be accrue or arise outside

India. Taxable if income is earned from business or profession setting in India or having their head

office in India.

[1]

[2]

[edit]Heads of Income

The total income of a person is divided into five heads, viz., taxable

[3]

:

[edit]Individual Heads of Income

[edit]Income from Salary

All income received as salary under Employer-Employee relationship is taxed under this head.

Employers must withhold tax compulsorily, if income exceeds minimum exemption limit, as Tax

Deducted at Source (TDS), and provide their employees with a Form 16 which shows the tax

deductions and net paid income. In addition, the Form 16 will contain any other deductions

provided from salary such as:

1. Medical reimbursement: Up to Rs. 15,000 per year is tax free if supported by bills.

2. Conveyance allowance: Up to Rs. 800 per month (Rs. 9,600 per year) is tax free if

provided as conveyance allowance. No bills are required for this amount.

3. Professional taxes: Most states tax employment on a per-professional basis, usually a

slabbed amount based on gross income. Such taxes paid are deductible from income

tax.

4. House rent allowance: the least of the following is available as deduction

1. Actual HRA received

2. 50%/40%(metro/non-metro) of basic 'salary'

3. Rent paid minus 10% of 'salary'. basic Salary for this purpose is basic+DA

forming part+commission on sale on fixed rate.

Income from salary is the least of all the above deductions.

[edit]Income from House property

Income from House property is computed by taking into account what is called Annual Value of

the property. The annual value (in the case of a let out property) is the maximum of the following:

Rent received

Municipal Valuation

Fair Rent (as determined by the I-T department)

If a house is not let out and not self-occupied, annual value is assumed to have accrued to the

owner. Annual value in case of a self occupied house is to be taken as NIL. (However if there is

more than one self occupied house then the annual value of the other house/s is taxable.) From

this, deduct Municipal Tax paid and you get the Net Annual Value. From this Net Annual Value,

deduct :

30% of Net value as repair cost (This is a mandatory deduction)

Interest paid or payable on a housing loan against this house

In the case of a self occupied house interest paid or payable is subject to a maximum limit of

Rs,1,50,000 (if loan is taken on or after 1 April 1999 and construction is completed within 3 years)

and Rs.30,000 (if the loan is taken before 1 April 1999). For all non self-occupied homes, all

interest is deductible, with no upper limits.

The balance is added to taxable income.

[edit]Income from Business or Profession

carry forward of losses

An example .. An architect works out of home and co-ordinates work for his clients. All the

following expenses would be deductible from his professional fees.

he uses a computer,

he travels to sites in his car,

he has a peon to help him collect payments

He has a maid who comes in daily

part of the society maintenance bills

entertainment expenses incurred..

books and magazines for his professional practice.

The income referred to in section 28, i.e, the incomes chargeable as "Income from Business or

Profession" shall be computed in accordance with the provisions contained in sections 30 to 43D.

However, there are few more sections under this Chapter, viz., Sections 44 to 44DA (except

sections 44AA, 44AB & 44C), which contain the computation completely within itself. Section 44C

is a disallowance provision in the case non-residents. Section 44AA deals with maintenance of

books and section 44AB deals with audit of accounts.

In summary, the sections relating to computation of business income can be grouped as under: -

1. Deductible Expenses - Sections 30 to 38 [except 37(2)].

2. Inadmissible Expenses - Sections 37(2), 40, 40A, 43B & 44-C.

3. Deemed Incomes - Sections 33AB, 33ABA, 33AC, 35A, 35ABB & 41.

4. Special Provisions - Sections 42 & 43D

5. Self-Coded Computations - Sections 44, 44A, 44AD, 44AE, 44AF, 44B, 44BB, 44BBA,

44BBB, 44-D & 44-DA.

The computation of income under the head "Profits and Gains of Business or Profession"

depends on the particulars and information available.

[4]

If regular books of accounts are not maintained, then the computation would be as under: -

Income (including Deemed Incomes) chargeable as income under this head xxx Less: Expenses

deductible (net of disallowances) under this head xxx Profits and Gains of Business or

Profession xxx

However, if regular books of accounts have been maintained and Profit and Loss Account has

been prepared, then the computation would be as under: -

Net Pr of i t as per Pr of i t and Loss Account

xxx

Add : I nadmi ssi bl e Expenses debi t ed t o Pr of i t and Loss Account

xxx

Deemed I ncomes not cr edi t ed t o Pr of i t and Loss Account

xxx

xxx

Less: Deduct i bl e Expenses not debi t ed t o Pr of i t and Loss Account

xxx

I ncomes char geabl e under ot her heads cr edi t ed t o Pr of i t & Loss

A/ c xxx

xxx

Pr of i t s and Gai ns of Busi ness or Pr of essi on

xxx

[edit]Income from Capital Gains

Transfer of capital assets results in capital gains. A Capital asset is defined under section 2(14) of

the I.T. Act, 1961 as property of any kind held by an assessee such as real estate, equity shares,

bonds, jewellery, paintings, art etc. but does not include some items like any stock-in-trade for

businesses and personal effects. Transfer has been defined under section 2(47) to include sale,

exchange, relinquishment of asset, extinguishment of rights in an asset, etc. Certain transactions

are not regarded as 'Transfer' under section 47.

For tax purposes, there are two types of capital assets: Long term and short term. Long term

asset are held by a person for three years except in case of shares or mutual funds which

becomes long term just after one year of holding. Sale of such long term assets gives rise to long

term capital gains. There are different scheme of taxation of long term capital gains. These are:

1. As per Section 10(38) of Income Tax Act, 1961 long term capital gains on shares or

securities or mutual funds on which Securities Transaction Tax (STT) has been

deducted and paid, no tax is payable. STT has been applied on all stock market

transactions since October 2004 but does not apply to off-market transactions and

company buybacks; therefore, the higher capital gains taxes will apply to such

transactions where STT is not paid.

2. In case of other shares and securities, person has an option to either index costs to

inflation and pay 20% of indexed gains, or pay 10% of non indexed gains. The

indexation rates are released by the I-T department each year.

3. In case of all other long term capital gains, indexation benefit is available and tax rate is

20%.

All capital gains that are not long term are short term capital gains, which are taxed as such:

Under section 111A, for shares or mutual funds where STT is paid, tax rate is 10% From

AsstYr 2005-06 as per Finance Act 2004. For AsstYr 2009-10 the tax rate is 15%.

In all other cases, it is part of gross total income and normal tax rate is applicable.

For companies abroad, the tax liability is 20% of such gains suitably indexed (since STT is not

paid).

[edit]Income from Other Sources

This is a residual head, under this head income which does not meet criteria to go to other heads

is taxed. There are also some specific incomes which are to be taxed under this head.

1. Income by way of Dividends

2. Income from horse races

3. Income from winning bull races

4. Any amount received from key man insurance policy as donation.

5. Income from shares (dividend otherthanindian company)

[edit]Deduction

While exemptions is on income some deduction in calculation of taxable income is allowed for

certain payments.

[edit]Section 80C Deductions

Section 80C of the Income Tax Act [1] allows certain investments and expenditure to be deducted

from total income upto the maximum of 1 lac. The total limit under this section is Rs. 100,000

(Rupees One lac) which can be any combination of the below:

Contribution to Provident Fund or Public Provident Fund. PPF provides 8% return

compounded annually. Maximum limit to contribute in it is 70,000 for each year. It is a long

term investment with complete withdrawal not possible till 15 years though partial withdrawal

is possible after 5 years. Besides, there is employee providend fund which is deducted from

the salary of the person. This is about 10% to 12% of the BASIC salary component. Recent

changes are being discussed regarding reducing the instances of withdrawal from EPF

especially when one changes the job. EPF has the option of full settlement on leaving the

job, taking VRS, retirement after 58. It also has options of withdrawal for certain expenses

related to home, marriage or medical. EPF contribution includes 12% of basic salary from

employee and employer. It is distributed in ratio of 8.33:3.67 in Pension fund and Providend

fund

Payment of life insurance premium

Investment in pension Plans. National Pension Scheme is meant to save money for the post

retirement which invests money in different combination of equity and debt. depending upon

age up to 50% can go in equity. Annuity payable after retirement is dependent upon age.

NPS has six fund managers. Individual can make minimum contribution of Rs6000/- . It has

22 point of purchase (banks).

Investment in Equity Linked Savings schemes (ELSS) of mutual funds. Among other

investment opportunities, ELSS has the least lock-in period of 3 years. However, one should

note that after the Direct Tax Code is in place, ELSS will no longer be an investment for 80C

deduction.

Investment in National Savings Certificates (interest of past NSCs is reinvested every year

and can be added to the Section 80 limit)

Tax saving Fixed Deposits provided by banks for a tenure of 5 years. Interest is also taxable.

Payments towards principal repayment of housing loans. Also any registration fee or stamp

duty paid.

Payments towards tuition fees for children to any school or college or university or similar

institution. (Only for 2 children)or towards coaching fee of various competitive exams.

Post office investments

The investment can be from any source and not necessarily from income chargeable to tax.

[edit]Section 80CCF: Investment in Infrastructure Bonds

From April, 1 2010, a maximum of Rs. 20,000is deductible under section 80CCF provided that

amount is invested in infrastructure bonds. This is in addition to the 100,000 deduction allowed

under Section 80(C).

[edit]Section 80D: Medical Insurance Premiums

Health insurance, popularly known as Mediclaim Policies, provides a deduction of up to Rs.

35,000.00 (Rs. 15,000.00 for premium payments towards policies on self, spouse and children

and (read as in addition to) Rs. 15,000.00 for premium payment towards non-senior citizen

dependent parents or Rs. 20,000.00 for premium payment towards senior citizen dependent).

This deduction is in addition to Rs. 1,00,000 savings under IT deductions clause 80C. For

consideration under a senior citizen category, the incumbent's age should be 65 years during any

part of the current fiscal, eg. for the fiscal year 2010-11, the incumbent should already be 65 as

on March 31, 2011), This deduction is also applicable to the cheques paid by proprietor firm..

[edit]Interest on Housing Loans Section

For self occupied properties, interest paid on a housing loan up to Rs 150,000 per year is exempt

from tax.(Excluding Rs.1,00,000/p.a. u/s 80c Saving) However, this is only applicable for a

residence constructed within three financial years after the loan is taken and also the loan if taken

after April 1, 1999.

If the house is not occupied due to employment, the house will be considered self occupied.

For let out properties, the entire interest paid is deductible under section 24 of the Income Tax

act. However, the rent is to be shown as income from such properties. 30% of rent received and

municipal taxes paid are available for deduction of tax.

The losses from all properties shall be allowed to be adjusted against salary income at the source

itself. Therefore, refund claims of T.D.S. deducted in excess, on this count, will no more be

necessary.

[5]

[edit]Use of Deductions

While the use of the above sections helps one to pay less or no money as tax if one falls in the

tax bracket, one should look at this more as an investment-return opportunity. One should still file

income tax return, even if one is not paying any tax. Except ELSS (Equity Linked Savings

Scheme) and the NPS (National Pension Scheme), other schemes under 80C typically offer a

relatively risk-free investment and guaranteed returns.

[edit]Tax Rates

In India, Individual income tax is a progressive tax with three slabs. About 10 per cent of the

population meets the minimum threshold of taxable income

[6][7]

From April 1, 2011 new tax slabs apply, which are as follows:

No income tax is applicable on all income up to Rs. 1,80,000 per year. (Rs. 1,90,000 for

women, Rs. 2,50,000 for senior citizens of 60 till 80 yrs (excluding 80) and Rs. 5,00,000 for

very senior citizens of 80 yrs and above and must be resident of india)

From 1,80,001 to 5,00,000 : 10% of amount greater than Rs. 1,80,000 (Lower limit changes

appropriately for women and senior citizens)

From 5,00,001 to 8,00,000 : 20% of amount greater than Rs. 5,00,000 + 32,000 ( Rs. 31,000

for women and Rs. 25,000 for senior citizens)

Above 8,00,000 : 30% of amount greater than Rs. 8,00,000 + 92,000 ( Rs. 91,000 for women

and Rs. 85,000 for senior citizens)

[edit]Surcharge

Surcharge has been abolished for personal income tax in the financial year 2009-10.

A 7.5% surcharge (tax on tax) is applicable if the taxable income (taking into consideration all the

deductions) is above Rs. 10 lakh (Rs. 1 million). The limit of 10 lacs was increased to Rs. 10

crore (Rs. 100 million) with effect from 1 June 2009

All taxes in India are subject to an education cess, which is 3% of the total tax payable. With

effect from assessment year 2009-10, Secondary and Higher Secondary Education Cess of 1% is

applicable on the subtotal of income tax. The education cess is mainly applicable on excise duty

and service tax

From income tax year 2010-11, education cess would be 3% and no surcharge would be levied.

[edit]Tax Rate for non-Individuals

There are special rates prescribed for Firms, Corporates, Local Authorities & Co-operative

Societies.

[8]

[edit]Refund Status for Salaried tax payers

The Income Tax Department has put on its website the list of income tax refunds of all salary tax

payers which could not be sent to the concerned persons for want of correct address. (link to

check refund)

Salary taxpayers who have not received refunds for assessment years 2003-04 to 2006-07 can

click on the link below and query using the PAN number and assessment year whether any

refund due to them has been returned undelivered. .

[9]

[edit]Corporate Income tax

For companies, income is taxed at a flat rate of 30% for Indian companies, with a 5% surcharge

applied on the tax paid by companies with gross turnover over Rs. 1 crore (10 million). Foreign

companies pay 40%.

[10]

An education cess of 3% (on both the tax and the surcharge) are

payable, yielding effective tax rates of 32.5% for domestic companies and 41.2% for foreign

companies.

[11]

From 2005-06, electronic filing of company returns is mandatory.

[12]

[edit]Tax Penalties

The major number of penalties initiated every year as a ritual by I T Authorities is under section

271(1)(c) which is for either concealment of income or for furnishing inaccurate particulars of

income. What is inaccurate particulars of income is not defined under Income Tax Act 1961 ,

however recently Supreme Court in case of CIT vs Reliance Petroproducts states as under "If

we accept the contention of the Revenue then in case of every Return where the claim made is

not accepted by Assessing Officer for any reason, the assessee will invite penalty under Section

271(1)(c). That is clearly not the intendment of the Legislature."

Read more: http://taxworry.com/landmark-judgment-by-supreme-court-on-penalty-us-2711c-in-

favour-of-taxpayers/#ixzz1F5mJSvsn "If the Assessing Officer or the Commissioner (Appeals) or

the Commissioner in the course of any proceedings under this Act, is satisfied that any person-

(b) has failed to comply with a notice under sub-section (1) of section 142 or sub-section (2) of

section 143 or fails to comply with a direction issued under sub-section (2A) of section 142, or

(c) has concealed the particulars of his income or furnished inaccurate particulars of such

income,

he may direct that such person shall pay by way of penalty,-

(ii) in the cases referred to in clause (b), in addition to any tax payable by him, a sum of ten

thousand rupees for each such failure;

(iii) in the cases referred to in clause (c), in addition to any tax payable by him, a sum which shall

not be less than, but which shall not exceed three times, the amount of tax sought to be evaded

by reason of the concealment of particulars of his income or the furnishing of inaccurate

particulars of such income.

[edit]See also

Service tax in India

Central Excise (India)

[edit]References

1. ^ Determination of Residential Status

2. ^ A Study of the Indian Tax System - Part I and II - Sunil Thacker

3. ^ Taxable heads of income

4. ^ Business Income

5. ^ http://www.incometaxindia.gov.in/publications/1_Compute_Your_Salary_Income/2_Income

_from_house_property.asp

6. ^ Income Tax Rates changed for 2011-12

7. ^ Finance Act 2011 comes into effect

8. ^ Tax Rates for Assessment Year 2008-09

9. ^ NSDL Refund Status Check

10. ^ Income Tax Act, Tax rates for foreign companies

11. ^ Finance Act 2010

12. ^ Surcharge has been revised from 10% to 7.5% w.e.f AY 2010-11.Corporate taxpayers must

file electronically, point 4 of IT circular.

[edit]External links

Indian Income

79

[CHAPTER XII-D

SPECIAL PROVISIONS RELATING TO TAX ON DISTRIBUTED PROFITS OF

DOMESTIC COMPANIES

Tax on distributed profits of domestic companies.

115-O.

80

[(1) Notwithstanding anything contained in any other provision of this Act and subject

to the provisions of this section, in addition to the income-tax chargeable in respect of the total

income of a domestic company for any assessment year, any amount declared, distributed or paid

by such company by way of dividends (whether interim or otherwise) on or after the 1st day of

April, 2003, whether out of current or accumulated profits shall be charged to additional income-

tax (hereafter referred to as tax on distributed profits) at the rate of twelve and one-half per cent.]

(2) Notwithstanding that no income-tax is payable by a domestic company on its total income

computed in accordance with the provisions of this Act, the tax on distributed profits under sub-

section (1) shall be payable by such company.

(3) The principal officer of the domestic company and the company shall be liable to pay the tax

on distributed profits to the credit of the Central Government within fourteen days from the date

of

(a) declaration of any dividend; or

(b) distribution of any dividend; or

(c) payment of any dividend,

whichever is earliest.

(4) The tax on distributed profits so paid by the company shall be treated as the final payment of

tax in respect of the amount declared, distributed or paid as dividends and no further credit

therefor shall be claimed by the company or by any other person in respect of the amount of tax

so paid.

(5) No deduction under any other provision of this Act shall be allowed to the company or a

shareholder in respect of the amount which has been charged to tax under sub-section (1) or the

tax thereon.

80a

[(6) Notwithstanding anything contained in this section, no tax on distributed profits shall be

chargeable in respect of the total income of an undertaking or enterprise engaged in developing

or developing and operating or developing, operating and maintaining a Special Economic Zone

for any assessment year on any amount declared, distributed or paid by such Developer or

Enterprise, by way of dividends (whether interim or otherwise) on or after the 1st day of April,

2005 out of its current income either in the hands of the Developer or Enterprise or the person

receiving such dividend not falling under clause (23G) of section 10.]

Advance Tax

Al l per sons i ncl udi ng sal ar i ed empl oyees and pensi oner s,

i n

whose case t ax payabl e dur i ng a Fi nanci al Year i s Rs.

10, 000/ = or mor e af t er adj ust i ng al l deduct i ons, r ebat es

&

TDS ar e r equi r ed t o pay Advance Tax. The r at es f or

payment

of Advance Tax ar e announced i n t he Fi nance Act ever y

year .

For Compani es

By 15t h J une - 15%of Advance Tax

By 15t h Sept ember - 30%of Advance Tax

By 15t h December - 30%of Advance Tax

By 15t h Mar ch- 25%of Advance Tax

By 31st Mar ch - Tax on Capi t al Gai ns or Casual I ncomes

ar i si ng

af t er 15Th Mar ch, i f any.

For Non- Compani es

By 15t h J une - NI L

By 15t h Sept ember - 30%of Advance Tax

By 15t h December - 30%of Advance Tax

By 15t h Mar ch- 40%of Advance Tax

By 31st Mar ch - Tax on Capi t al Gai ns or Casual I ncomes

ar i si ng

af t er 15Th Mar ch, i f any.

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Reward Management My Combined NotesDocumento23 páginasReward Management My Combined Notesshalarachel100% (1)

- Internal Audit Plan 2021Documento19 páginasInternal Audit Plan 2021Chris Ian Locsin100% (2)

- SM Mall of AsiaDocumento3 páginasSM Mall of AsiabhavinvadhelAún no hay calificaciones

- About National InsuranceDocumento1 páginaAbout National InsurancebhavinvadhelAún no hay calificaciones

- GKDocumento4 páginasGKbhavinvadhelAún no hay calificaciones

- CTP - Assignment QuestionsDocumento1 páginaCTP - Assignment QuestionsbhavinvadhelAún no hay calificaciones

- Usefull AbbreviationsDocumento1 páginaUsefull AbbreviationsbhavinvadhelAún no hay calificaciones

- Kansas Public Employees Retirement System 611 S Kansas Ave Suite 100 TOPEKA KS 66603 - 3869Documento4 páginasKansas Public Employees Retirement System 611 S Kansas Ave Suite 100 TOPEKA KS 66603 - 3869ChuckAún no hay calificaciones

- Legion 2017-05-06Documento100 páginasLegion 2017-05-06Adrian Cin100% (1)

- AnnuitiesDocumento12 páginasAnnuitiesRishi CharanAún no hay calificaciones

- Taxation of Estates and TrustsDocumento42 páginasTaxation of Estates and TrustsAngelica Joyce DyAún no hay calificaciones

- Federal Worksheet Tax DetailsDocumento8 páginasFederal Worksheet Tax DetailsPragya ParmarAún no hay calificaciones

- New Microsoft Office Word DocumentDocumento6 páginasNew Microsoft Office Word Documentstevejac__bAún no hay calificaciones

- CH 10Documento47 páginasCH 10maschip313Aún no hay calificaciones

- Gen BankDocumento70 páginasGen Bankdivya kumariAún no hay calificaciones

- Retirement Gratuity Calculation For West Bengal Govt EmployeeDocumento4 páginasRetirement Gratuity Calculation For West Bengal Govt EmployeePranab Banerjee100% (1)

- Retirement Case StudyDocumento27 páginasRetirement Case StudyAllieMikelleAún no hay calificaciones

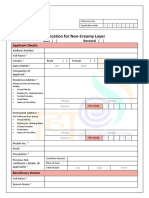

- Non-Creamy Layer ApplicationDocumento4 páginasNon-Creamy Layer ApplicationHanamant BhanseAún no hay calificaciones

- Nps One PagerDocumento2 páginasNps One PagerldorayaAún no hay calificaciones

- Unit Trust of Tanzania: Application FormDocumento4 páginasUnit Trust of Tanzania: Application FormadolfAún no hay calificaciones

- SAP HR ReportsDocumento3 páginasSAP HR ReportsBharathk KldAún no hay calificaciones

- Labour Law and Employment in Hungary - 2017 GuideDocumento15 páginasLabour Law and Employment in Hungary - 2017 GuideAccaceAún no hay calificaciones

- CHAPTER 5 and 6 Lea2Documento26 páginasCHAPTER 5 and 6 Lea2maryAún no hay calificaciones

- Bangladesh Income Tax RatesDocumento5 páginasBangladesh Income Tax RatesShaheen MahmudAún no hay calificaciones

- Daily Monitoring Report For CGDF: Senior Finance Controller, Air ForcesDocumento4 páginasDaily Monitoring Report For CGDF: Senior Finance Controller, Air ForcesShihab HasanAún no hay calificaciones

- U.S. Individual Income Tax Return: Filing StatusDocumento17 páginasU.S. Individual Income Tax Return: Filing StatusCristian BurnAún no hay calificaciones

- A Project Report On Recruitment and Selection At: HDFC Standard Life Insurance CompanyDocumento68 páginasA Project Report On Recruitment and Selection At: HDFC Standard Life Insurance CompanysiarockstarAún no hay calificaciones

- File by Mail Instructions For Your Federal Amended Tax ReturnDocumento14 páginasFile by Mail Instructions For Your Federal Amended Tax ReturnRyan MayleAún no hay calificaciones

- Intercontinental Vs AmarillaDocumento2 páginasIntercontinental Vs AmarillaJep Echon TilosAún no hay calificaciones

- Accounting Policies Some Important Concepts: Group 7:-Neha Jainy SanjitDocumento60 páginasAccounting Policies Some Important Concepts: Group 7:-Neha Jainy SanjitTanay SamantaAún no hay calificaciones

- Statcon - RecitDocumento6 páginasStatcon - RecitMagr EscaAún no hay calificaciones

- Mergers May Rescue Declining Suburbs: Aaron M. RennDocumento16 páginasMergers May Rescue Declining Suburbs: Aaron M. RennAnn DwyerAún no hay calificaciones

- Assignment MBA III: Business Taxation: TH THDocumento4 páginasAssignment MBA III: Business Taxation: TH THShubham NamdevAún no hay calificaciones

- Mizoram Statistical Handbook 2010Documento186 páginasMizoram Statistical Handbook 2010jacoblbawlteAún no hay calificaciones

- TAMBAOAN - Termination of Employee Relationship - 06.04.22v2.5Documento10 páginasTAMBAOAN - Termination of Employee Relationship - 06.04.22v2.5NOLI TAMBAOANAún no hay calificaciones