Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Instructions: All Questions Carry Equal Marks

Cargado por

nisarg_Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Instructions: All Questions Carry Equal Marks

Cargado por

nisarg_Copyright:

Formatos disponibles

CHIMANBHAI PATEL INSTITUTE OF MANAGEMENT & RESEARCH

MBA SEMESTER- IV

Internal Evaluation Ea!ination" Ma# $%&$

Na!e o' (u)*e+t" Mer,er( & A+-ui(ition(

.ate" %$/%0/$%&1 2Ti!e" &%31% AM 4 &31% PM5

Total Mar6(" 7%

Instructions: All questions carry equal marks.

Q-1 Explain the following terms in brief:

a! "hat is corporate restructuring# Explain $arious forms of corporate

restructuring.

%&!

b! "hat are the $arious areas in which 'ue 'iligence is carrie' on# Explain each

in brief. (ighlight the common aspects examine' in )ue )iligence by the

acquirer team in corporate *estructuring.

%&!

Q-+

a! , -t' an' . -t' agree' to amalgamate their business by transferring their

/n'ertaking to a new company0 ,. -t'. 1n the 'ate of amalgamation0

balance sheets of the two companies were as un'er :

-iabilities , -t'. . -t'. Assets , -t'. . -t'.

Equity

2hare

3apital

*s. 1%

each!

40%%0%%% 50%%0%%% 6ixe'

Assets

708%0%%% +04%0%%%

*eser$es ------ 4%0%%% 9roperty +0%%0%%% 10%%0%%%

9 : - A;c 5%0%%% +%0%%% In$estments 4%0%%% +%0%%%

4<

)ebentures

+0%%0%%% 10%%0%%% )ebtors +04%0%%% 104%0%%%

=ortgage

-oan

4%0%%% ------ 9reliminary

Expenses

+%0%%% 8%0%%%

3re'itors +0+%0%%% 105%0%%%

1%0%%0%%% >0%%0%%% 1%0%%0%%% >0%%0%%%

9urchase consi'eration consiste' of the following:

)ischarge of 'ebentures of both companies by the issues of equi$alent amount

of >< 'ebentures in ,. -t'.

-iabilities of both companies will be taken o$er by the new company.

?he issue of equity shares of *s. 1% each in ,. -t'. at a premium of *s. + per

share.

6or the purpose of amalgamation0 the assets were $alue' at un'er:

Assets , -t'. . -t'.

@oo'will 10%%0%%% &40%%%

9roperty +0>%0%%% 107%0%%%

In$estments 410%%% +%0%%%

6ixe' Assets 701%0%%% +08%0%%%

)ebtors +0+40%%% 10540%%%

9repare the balance sheet of ,. -t'. after Amalgamation

%&!

b! Explain the pro$isions un'er $arious sections of the In'ian 3ompanies Act

which are rele$ant for =ergers : Acquisitions.

%&!

1*

Q-+ %&!

b! "hat are the tactics use' by a company as a 'efense against the threat of an

acquisition#

Q-5 17!

a! "hat are the moti$es behin' international acquisitions# "hat are the

'ifficulties face' by a company in cross-bor'er acquisition#

b! *am -t'. is trying to buy 2hyam -t'. which is a small pharma firm that

'e$elops pro'ucts that are license' to maAor pharmaceutical firms. ?he

'e$elopment costs are expecte' to generate a negati$e cash flow of *s. 1% lakh

'uring the first year of the forecast. -icensing fee is expecte' to generate

positi$e cash flows of *s. 40 1%0 14 an' +% lakh 'uring +-4 years respecti$ely.

)ue to the emergence of competiti$e pro'ucts0 cash flows are expecte' to

grow annually at the rate of 4< after fifth year fore$er. ?he 'iscount rate for

first fi$e years is estimate' to be 14< an' then 'rop to 8< beyon' fifth year.

3alculate the $alue of the firm.

1*

Q-5 17!

a! "rite a short note on Asset Base' Caluation an' Earnings Base' Caluation.

b! Base' on the comparable companies approach0 fin' out the $alue of ( -t'.0

which is a prospecti$e target0 from the following information:

9articulars 9 -t'. Q -t'. * -t'.

9rice ; 2ales 1.&> 1.>% 1.8+

9rice ; Book 1.D+ 1.&% +.%4

9rice ; Earnings +4 +8 5%

?he current sales of ( -t'. are *s. 1>+ crore0 Book $alue of equity is *s. 1+%

crore an' earnings are *s. +4 crore.

Q-7 17!

a! "hat are the a'$antages of strategic alliances# )ifferentiate between strategic

alliances : EC.

b! Brief 2EBIFs gui'elines for buyback of shares.

1*

Q-7 17!

a! "hat are 'i$estitures# "hy 'o companies go for 'i$estitures#

b! "hat are GE219sF# Explain in 'etail $arious types an' uses of E219s.

Q-4 17!

a! "rite a note on three recent acquisitions in In'ia.

b! )escribe the pro$ision relating to minimum offer price an' payment of

consi'eration un'er 2EBI ?akeo$er co'e.

1*

a! 2tate the essential characteristics of -B1 can'i'ate. Also explain =B1.

b! Explain 'ifferent types of mergers with suitable example.

HHHHHHHHHHHHHH

También podría gustarte

- Financial Ratios for Capital Structure and Risk AssessmentDocumento17 páginasFinancial Ratios for Capital Structure and Risk Assessmentsamuel_dwumfourAún no hay calificaciones

- FIN621 Final solved MCQs under 40 charsDocumento23 páginasFIN621 Final solved MCQs under 40 charshaider_shah882267Aún no hay calificaciones

- Comparative Financial Analysis of Prism Cement and Ambuja CementDocumento55 páginasComparative Financial Analysis of Prism Cement and Ambuja Cementsauravv7Aún no hay calificaciones

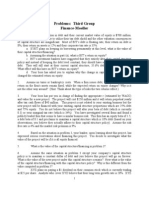

- Problems: Third Group Finance-MoellerDocumento4 páginasProblems: Third Group Finance-MoellerEvan BenedictAún no hay calificaciones

- Chapter 1-The Scope of Corporate Finance: Multiple ChoiceDocumento7 páginasChapter 1-The Scope of Corporate Finance: Multiple ChoiceEuxine AlbisAún no hay calificaciones

- MAS FS Analysis 40pagesDocumento50 páginasMAS FS Analysis 40pageskevinlim186Aún no hay calificaciones

- Chapter 3 Test Bank QuestionsDocumento33 páginasChapter 3 Test Bank Questionsbobdole00Aún no hay calificaciones

- Ch04 TestDocumento3 páginasCh04 TestxvkgpuszAún no hay calificaciones

- Consolidated Financial Statements After Acquisition: Complete Equity Method On Books of InvestorDocumento5 páginasConsolidated Financial Statements After Acquisition: Complete Equity Method On Books of Investorsalehin1969Aún no hay calificaciones

- Chap 016Documento77 páginasChap 016limed1100% (1)

- Categories of RatiosDocumento6 páginasCategories of RatiosNicquainCTAún no hay calificaciones

- Discuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Documento24 páginasDiscuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Henry PanAún no hay calificaciones

- Chap 003Documento89 páginasChap 003sah108_pk796Aún no hay calificaciones

- Leach TB Chap09 Ed3Documento8 páginasLeach TB Chap09 Ed3bia070386Aún no hay calificaciones

- Financial Accounting 7th EditionDocumento7 páginasFinancial Accounting 7th Editiongilli1tr100% (1)

- Capital-Budgeting Principles and TechniquesDocumento14 páginasCapital-Budgeting Principles and TechniquesPradeep HemachandranAún no hay calificaciones

- Capital BudgetingDocumento34 páginasCapital BudgetingHija S YangeAún no hay calificaciones

- 1) Introduction: Choice of Organization". There Are Three Reasons For Choosing This Topic A) My PersonalDocumento21 páginas1) Introduction: Choice of Organization". There Are Three Reasons For Choosing This Topic A) My PersonalTheWritersAún no hay calificaciones

- ABC Group's statement of cash flows analysisThe title "TITLE ABC Group's statement of cash flows analysisDocumento16 páginasABC Group's statement of cash flows analysisThe title "TITLE ABC Group's statement of cash flows analysissamuel_dwumfourAún no hay calificaciones

- Shapiro CHAPTER 2 SolutionsDocumento14 páginasShapiro CHAPTER 2 Solutionsjimmy_chou1314100% (1)

- FBE 432 - Midterm Examination March 8, 2001 Name - Student No.Documento7 páginasFBE 432 - Midterm Examination March 8, 2001 Name - Student No.Maitri BarotAún no hay calificaciones

- Short-term debt securities markets introduction overview agency relationship corporate forms business organization present valueDocumento3 páginasShort-term debt securities markets introduction overview agency relationship corporate forms business organization present valueGrad Student100% (1)

- Chapter 04 - AnswerDocumento9 páginasChapter 04 - AnswerCrisalie Bocobo0% (1)

- Concept Questions: NPV and Capital BudgetingDocumento23 páginasConcept Questions: NPV and Capital BudgetingGianni Stifano P.Aún no hay calificaciones

- Testbank - Chapter 15Documento4 páginasTestbank - Chapter 15naztig_0170% (1)

- Mock Cpa Board Exams Rfjpia R 12 W AnsDocumento17 páginasMock Cpa Board Exams Rfjpia R 12 W AnsRheneir MoraAún no hay calificaciones

- Chapter 23 Ratio Analysis: 1. ObjectivesDocumento26 páginasChapter 23 Ratio Analysis: 1. Objectivessamuel_dwumfourAún no hay calificaciones

- Revision Pack 2009-10Documento9 páginasRevision Pack 2009-10Tosin YusufAún no hay calificaciones

- Solution For The Analysis and Use of Financial Statements (White.G) ch03Documento50 páginasSolution For The Analysis and Use of Financial Statements (White.G) ch03Hoàng Thảo Lê69% (13)

- Chapter 14 Capital Structure and Financial RatiosDocumento12 páginasChapter 14 Capital Structure and Financial Ratiossamuel_dwumfourAún no hay calificaciones

- Paper 1akkxbDocumento3 páginasPaper 1akkxbhinagarg373Aún no hay calificaciones

- Everything Positive About Negative Working Capital: A Conceptual Analysis of Indian FMCG SectorDocumento36 páginasEverything Positive About Negative Working Capital: A Conceptual Analysis of Indian FMCG SectorAritrika PaulAún no hay calificaciones

- Capital StructureDocumento13 páginasCapital StructureAjay ManchandaAún no hay calificaciones

- BEC 0809 AICPA Newly Released QuestionsDocumento22 páginasBEC 0809 AICPA Newly Released Questionsrajkrishna03Aún no hay calificaciones

- Analyze Financial StatementsDocumento111 páginasAnalyze Financial StatementsOther Side100% (3)

- CA"H #$%& E"T'MAT'%( CHAPTE A(D !!'") A(ADocumento77 páginasCA"H #$%& E"T'MAT'%( CHAPTE A(D !!'") A(ANguyễn Minh ThôngAún no hay calificaciones

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDocumento12 páginasCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085Aún no hay calificaciones

- Question and Answer - 24Documento30 páginasQuestion and Answer - 24acc-expertAún no hay calificaciones

- Advanced Financial Accounting CH 6 NotesDocumento18 páginasAdvanced Financial Accounting CH 6 NotesLiz HopeAún no hay calificaciones

- Analyzing Financial Performance of Bata BangladeshDocumento54 páginasAnalyzing Financial Performance of Bata BangladeshCarbon_AdilAún no hay calificaciones

- Weighted Average Cost of CapitalDocumento13 páginasWeighted Average Cost of CapitalAkhil RupaniAún no hay calificaciones

- Income Statement & Cash Flows Chapter 5Documento101 páginasIncome Statement & Cash Flows Chapter 5Joey LessardAún no hay calificaciones

- How Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueDocumento3 páginasHow Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueSaakshi AroraAún no hay calificaciones

- The Cost of Capital Cost of Capital, Discounts Rates, and The Required Rate of ReturnDocumento12 páginasThe Cost of Capital Cost of Capital, Discounts Rates, and The Required Rate of ReturnAveek ChatterjeeAún no hay calificaciones

- OPTIONS ANALYSISDocumento10 páginasOPTIONS ANALYSISWaleed MinhasAún no hay calificaciones

- Final Exam/2: Multiple ChoiceDocumento4 páginasFinal Exam/2: Multiple ChoiceJing SongAún no hay calificaciones

- p4sgp 2010 Jun Q PDFDocumento10 páginasp4sgp 2010 Jun Q PDFsabrina006Aún no hay calificaciones

- Ratio Analysis of Singer Bangladesh LimitedDocumento22 páginasRatio Analysis of Singer Bangladesh LimitedHamed RiyadhAún no hay calificaciones

- Analyzing financial statements of Kingston, IncDocumento5 páginasAnalyzing financial statements of Kingston, Inclucano350% (1)

- Seatwork 01 Financial Statement Analysis PDFDocumento5 páginasSeatwork 01 Financial Statement Analysis PDFHannah Mae VestilAún no hay calificaciones

- FM11 Financial management accounting assignment solutionsDocumento3 páginasFM11 Financial management accounting assignment solutionsA Kaur MarwahAún no hay calificaciones

- Leverage TheoryDocumento5 páginasLeverage TheorySuman SinghAún no hay calificaciones

- Ch24 Full Disclosure in Financial ReportingDocumento31 páginasCh24 Full Disclosure in Financial ReportingAries BautistaAún no hay calificaciones

- Creating Shareholder Value: A Guide For Managers And InvestorsDe EverandCreating Shareholder Value: A Guide For Managers And InvestorsCalificación: 4.5 de 5 estrellas4.5/5 (8)

- Summary of Joshua Rosenbaum & Joshua Pearl's Investment BankingDe EverandSummary of Joshua Rosenbaum & Joshua Pearl's Investment BankingAún no hay calificaciones

- Summary of Aswath Damodaran's The Little Book of ValuationDe EverandSummary of Aswath Damodaran's The Little Book of ValuationAún no hay calificaciones

- Applied Corporate Finance. What is a Company worth?De EverandApplied Corporate Finance. What is a Company worth?Calificación: 3 de 5 estrellas3/5 (2)

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationDe EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationAún no hay calificaciones

- Finance Theory and Future Trends - The Shift To Integration PDFDocumento7 páginasFinance Theory and Future Trends - The Shift To Integration PDFnisarg_Aún no hay calificaciones

- Types of BondDocumento35 páginasTypes of Bondnisarg_Aún no hay calificaciones

- KanchiDocumento11 páginasKanchinisarg_Aún no hay calificaciones

- Social Surveyors in Flood Hit Areas-Case Let Chapter 4 - Job Analysis HRM: by Gary DesslerDocumento1 páginaSocial Surveyors in Flood Hit Areas-Case Let Chapter 4 - Job Analysis HRM: by Gary Desslernisarg_40% (5)

- SIP GuidesDocumento6 páginasSIP Guidesnisarg_Aún no hay calificaciones

- NehaDocumento2 páginasNehanisarg_Aún no hay calificaciones

- EFM RemedialDocumento4 páginasEFM Remedialnisarg_Aún no hay calificaciones

- Perception TheoriesDocumento16 páginasPerception Theoriesnisarg_100% (2)

- Questionnaire For AIMSDocumento7 páginasQuestionnaire For AIMSnisarg_Aún no hay calificaciones

- Report On IDBI BankDocumento9 páginasReport On IDBI Banknisarg_Aún no hay calificaciones

- Law IMP QuestionsDocumento5 páginasLaw IMP Questionsnisarg_Aún no hay calificaciones

- Fund Management Under CMS.Documento49 páginasFund Management Under CMS.nisarg_100% (1)

- For 2001 For 2000: Dupont Analysis ChartDocumento1 páginaFor 2001 For 2000: Dupont Analysis Chartnisarg_Aún no hay calificaciones

- 10 Chapter 2Documento49 páginas10 Chapter 2nisarg_Aún no hay calificaciones

- Debt Restructuring SchemeDocumento2 páginasDebt Restructuring SchemeChristine GorospeAún no hay calificaciones

- Spss Table For NJ SirDocumento11 páginasSpss Table For NJ Sirnisarg_Aún no hay calificaciones

- Ac PG2010Documento1 páginaAc PG2010Pratik KariaAún no hay calificaciones

- Yogesh ProjectDocumento52 páginasYogesh Projectnisarg_Aún no hay calificaciones

- Consolidated Balance Sheets of Public Sector BanksDocumento2 páginasConsolidated Balance Sheets of Public Sector Banksnisarg_Aún no hay calificaciones

- Iv2bt Tpa11111lDocumento1 páginaIv2bt Tpa11111lnisarg_Aún no hay calificaciones

- MBA Semester - IIIDocumento102 páginasMBA Semester - IIIPriti KakkadAún no hay calificaciones

- Akash BrahmbhattDocumento73 páginasAkash Brahmbhattnisarg_Aún no hay calificaciones

- Academic Calendar (1 Semester) (Me / Mtech/M Pharm / Mba / Mca)Documento1 páginaAcademic Calendar (1 Semester) (Me / Mtech/M Pharm / Mba / Mca)nisarg_Aún no hay calificaciones

- SectoralDocumento2 páginasSectoralDinesh RominaAún no hay calificaciones

- Micro Economics Chapter 1-5 QuestionsDocumento2 páginasMicro Economics Chapter 1-5 Questionsnisarg_Aún no hay calificaciones

- Rbi Npa ReportDocumento2 páginasRbi Npa ReportDinesh RominaAún no hay calificaciones

- Sol 1 To 3Documento5 páginasSol 1 To 3nisarg_Aún no hay calificaciones

- Commercial Banks Functions & RoleDocumento23 páginasCommercial Banks Functions & Rolenisarg_Aún no hay calificaciones

- Chapter 1 To 3Documento3 páginasChapter 1 To 3nisarg_Aún no hay calificaciones

- Commercial BankDocumento26 páginasCommercial BankBhanu JoshiAún no hay calificaciones

- Merger and Consolidation of TechnipfmcDocumento8 páginasMerger and Consolidation of TechnipfmcIvanLeeAún no hay calificaciones

- Double-Bottom 102808 PDFDocumento16 páginasDouble-Bottom 102808 PDFanalyst_anil14Aún no hay calificaciones

- Sources and Uses of Short Term and Long Term FundsDocumento30 páginasSources and Uses of Short Term and Long Term FundsLilyfhel VenturaAún no hay calificaciones

- Financial accounting and reporting lease sale and leasebackDocumento2 páginasFinancial accounting and reporting lease sale and leasebackAireyAún no hay calificaciones

- ACCTG 028 - MOD 5 Corporate LiquidationDocumento4 páginasACCTG 028 - MOD 5 Corporate LiquidationAlliah Nicole RamosAún no hay calificaciones

- Financial Management-Juraz-Short NotesDocumento32 páginasFinancial Management-Juraz-Short Notesrealthe277Aún no hay calificaciones

- A Study On Financial Statement Analysis in Mokshwa Soft Drinks at CoimbatoreDocumento23 páginasA Study On Financial Statement Analysis in Mokshwa Soft Drinks at Coimbatorek eswariAún no hay calificaciones

- A Study On Security Analysis and Portfolio Management Using Modern Portfolio TheoryDocumento55 páginasA Study On Security Analysis and Portfolio Management Using Modern Portfolio TheorySharan ChowdaryAún no hay calificaciones

- Investment in Equity SecuritiesDocumento3 páginasInvestment in Equity SecuritiesNicole Galnayon100% (1)

- 144 LWMA Trend Scalper Forex StrategyDocumento11 páginas144 LWMA Trend Scalper Forex StrategySumathiAún no hay calificaciones

- Economic Analysis Chapter 5Documento32 páginasEconomic Analysis Chapter 5School BackupAún no hay calificaciones

- J. P Morgan - NMDCDocumento12 páginasJ. P Morgan - NMDCvicky168Aún no hay calificaciones

- Kitov China DealDocumento1 páginaKitov China DealAnonymous ipErpL6Aún no hay calificaciones

- Applying The CAMELS Performance Evaluation Approach For HDFC Bank Company OverviewDocumento9 páginasApplying The CAMELS Performance Evaluation Approach For HDFC Bank Company OverviewDharmesh Goyal100% (1)

- Working Capital PolicyDocumento46 páginasWorking Capital PolicyAzureBlazeAún no hay calificaciones

- An Empirical Estimation & Model Selection of The Short-Term Interest RatesDocumento24 páginasAn Empirical Estimation & Model Selection of The Short-Term Interest RatesGary BirginalAún no hay calificaciones

- Philippine Management Review 2018, Vol. 25, 99-114. Stock Market Betas for Cyclical and Defensive SectorsDocumento16 páginasPhilippine Management Review 2018, Vol. 25, 99-114. Stock Market Betas for Cyclical and Defensive SectorsJia QuijanoAún no hay calificaciones

- Long-Term Assets: Study GuideDocumento19 páginasLong-Term Assets: Study GuideJaspreet GillAún no hay calificaciones

- Unilever Indonesia Financial AnalysisDocumento17 páginasUnilever Indonesia Financial AnalysissaridAún no hay calificaciones

- CFAS Quiz 1 Final ADocumento5 páginasCFAS Quiz 1 Final ADesiree Angelique RebonquinAún no hay calificaciones

- Assignment2 FMDocumento2 páginasAssignment2 FMSiva Kumar0% (1)

- Bramer Listing Particlars Bookletpg Whole DocDocumento32 páginasBramer Listing Particlars Bookletpg Whole DocRavi KureemunAún no hay calificaciones

- The Foreign Exchange Market: All Rights ReservedDocumento52 páginasThe Foreign Exchange Market: All Rights ReservedSwapnil NaikAún no hay calificaciones

- Illustrative Condensed Interim Financial StatemenstDocumento44 páginasIllustrative Condensed Interim Financial Statemenstalina6523305Aún no hay calificaciones

- What Is Sweat EquityDocumento2 páginasWhat Is Sweat EquityKaushu NaikAún no hay calificaciones

- Trading Volatility Ny 2016Documento84 páginasTrading Volatility Ny 2016sebab1Aún no hay calificaciones

- Corporate Finance Ross 10th Edition Test BankDocumento15 páginasCorporate Finance Ross 10th Edition Test Bankotoscopyforklesslx8v100% (29)

- Forex Terminology Free PDFDocumento7 páginasForex Terminology Free PDFKiran Krishna100% (1)

- BCG Matrix ExplainedDocumento2 páginasBCG Matrix Explaineddip_g_007Aún no hay calificaciones

- Inventory Management For EM StudentsDocumento24 páginasInventory Management For EM StudentsShahriar KabirAún no hay calificaciones