Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Macroeconomics

Cargado por

Truong Cai0 calificaciones0% encontró este documento útil (0 votos)

13 vistas4 páginaslkmdklfsaklfmlkfm

Derechos de autor

© © All Rights Reserved

Formatos disponibles

DOCX, PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentolkmdklfsaklfmlkfm

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

13 vistas4 páginasMacroeconomics

Cargado por

Truong Cailkmdklfsaklfmlkfm

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

Está en la página 1de 4

Macroeconomics

Difference between micro and macro?

Micro: how many computers produced in US?

Macro: how much of everything produced in US?

Measured by GDP: value of all good

Define standard of living

Infant mortality/ Life expectancy

Adult literacy

National Income

Money out there = Productive capacity

US about 15 Trillion per year

Conclusion

What is money?

Money is only a tool used to make economic exchange easier

Measure the value of something

Money has been many forms: stone, seashells, animal skins, cigarettes, precious metal,

etc.

Define value of a dollar: what we all think it should be!

Inflation: value of money goes down

Supply of money and prices goes up.

Kind of money:

Currency 1/3 (fewer) -) become data

Checking account 2/3

Saving and money market accounts (M2)

Credit card is not money

Conclusion

How did bank develop money?

Coin is inconvenient

Banks issued notes, widely accepted on banks reputation

Federal Reserve established to set up standard currency

Strength and stability of US gov

Productive value behind that money

Measure of value

Store of value medium exchange

Conclusion:

How do banks work?

Money goes to banks by depositing

Banks lend money to borrower and collect interest

Banking system and gov monitors $ as it goes

Banks cannot lend all money, must reserve some

Lend to people who cannot return -) have some money to pay

Insures $ up to 250K

Basic idea of banking

Critical in managing the sote of values of nations productive capacity

Fed regulates banks

What Fed do?

Main banks of all banks

Run by Fed of Governors

Have a chairman: Ben Bernanke

Power: manage the flow of money

Money out = productive capacity

Use monetary policy to get the right amount of money in and out: so not much

unemployment and too much inflation

Buy and sells bonds to affect interest rate

Rate high not enough money in the market

Rate low too much supply of money

Conclusion

How can I protect myself from inflation?

I have 1000 Im not spending now

Assume: __ inflation rate

Assume 10%

10% is terrible acceptable is about 2-3%

Back in 1980, inflation rate got to around 15%

Let say you save 1000 and put it under the mattress

After a year, that 1000 is not worth 1000 anymore

With 10% rate it only is worth 900

Under the mattress = 0% return

Inflation kills my money

How about putting it in the bank to get interest? Not enough since usually low

2% interest -) $920

Special account: holding for a longer time for greater interest

5% (generous) -) $950

Investment

20% -) 1100

Best investment: Yourself -) education,

Lottery

Dug, gamble, stock

Typical: house, business, real estate, stocks, bonds.commodities

You may lose money but yolo

Taxes

También podría gustarte

- Failure CriterionDocumento40 páginasFailure CriterionTruong CaiAún no hay calificaciones

- Failure Theories..Documento93 páginasFailure Theories..adnanmominAún no hay calificaciones

- MIT Course 10-ENG Curriculum Planning FormDocumento4 páginasMIT Course 10-ENG Curriculum Planning FormTruong CaiAún no hay calificaciones

- AfsdfasdfDocumento15 páginasAfsdfasdfTruong CaiAún no hay calificaciones

- Liquid Metal Better yDocumento25 páginasLiquid Metal Better yTruong CaiAún no hay calificaciones

- 5.111 Principles of Chemical Science: Mit OpencoursewareDocumento6 páginas5.111 Principles of Chemical Science: Mit OpencoursewareTruong CaiAún no hay calificaciones

- Beth 1Documento274 páginasBeth 1Truong CaiAún no hay calificaciones

- Mathematics Competition PracticeDocumento5 páginasMathematics Competition PracticeTruong CaiAún no hay calificaciones

- Conformal Mapping PDFDocumento78 páginasConformal Mapping PDFClinton PromotingJesusAún no hay calificaciones

- Energy Conversion AssessmentDocumento10 páginasEnergy Conversion AssessmentTruong CaiAún no hay calificaciones

- Ta NotesDocumento25 páginasTa NotesTruong CaiAún no hay calificaciones

- Answers To Extra Spectroscopy ProblemsDocumento8 páginasAnswers To Extra Spectroscopy ProblemsTruong CaiAún no hay calificaciones

- Lec Notes 01Documento4 páginasLec Notes 01shoulditbeAún no hay calificaciones

- Spring 2012 10.491 Course ScheduleDocumento1 páginaSpring 2012 10.491 Course ScheduleTruong CaiAún no hay calificaciones

- Mohammed AlDajaniE1V1Documento4 páginasMohammed AlDajaniE1V1Truong CaiAún no hay calificaciones

- Plan of Study for Applied Mathematics DegreeDocumento1 páginaPlan of Study for Applied Mathematics DegreeAntonio JeffersonAún no hay calificaciones

- Research Proposal Summer 2014Documento1 páginaResearch Proposal Summer 2014Truong CaiAún no hay calificaciones

- Home1 PDFDocumento1 páginaHome1 PDFTruong CaiAún no hay calificaciones

- D 2 Group 13Documento2 páginasD 2 Group 13Truong CaiAún no hay calificaciones

- Outline 13Documento3 páginasOutline 13Truong CaiAún no hay calificaciones

- Wealth NationsDocumento786 páginasWealth NationsTruong CaiAún no hay calificaciones

- Sing ValueDocumento2 páginasSing ValueTruong CaiAún no hay calificaciones

- Clinical Curriculum Chart 2014 2015Documento6 páginasClinical Curriculum Chart 2014 2015Truong CaiAún no hay calificaciones

- Sing ValueDocumento2 páginasSing ValueTruong CaiAún no hay calificaciones

- Setup Guide For Modela Pro II MDXDocumento1 páginaSetup Guide For Modela Pro II MDXTruong CaiAún no hay calificaciones

- Topics Covered in ChemistryDocumento6 páginasTopics Covered in ChemistryTruong CaiAún no hay calificaciones

- Pset 10Documento1 páginaPset 10Truong CaiAún no hay calificaciones

- Dual DegreesDocumento2 páginasDual DegreesTruong CaiAún no hay calificaciones

- MitDocumento76 páginasMitTruong CaiAún no hay calificaciones

- Nuclear PhysicsDocumento9 páginasNuclear PhysicsTruong CaiAún no hay calificaciones

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Mini Ice Plant Design GuideDocumento4 páginasMini Ice Plant Design GuideDidy RobotIncorporatedAún no hay calificaciones

- EDI810Documento11 páginasEDI810ramcheran2020Aún no hay calificaciones

- Nature of ConversionDocumento18 páginasNature of ConversionKiranAún no hay calificaciones

- Chapter 3: Elements of Demand and SupplyDocumento19 páginasChapter 3: Elements of Demand and SupplySerrano EUAún no hay calificaciones

- Law of TortsDocumento22 páginasLaw of TortsRadha KrishanAún no hay calificaciones

- Enerflex 381338Documento2 páginasEnerflex 381338midoel.ziatyAún no hay calificaciones

- Leases 2Documento3 páginasLeases 2John Patrick Lazaro Andres100% (1)

- AWC SDPWS2015 Commentary PrintableDocumento52 páginasAWC SDPWS2015 Commentary PrintableTerry TriestAún no hay calificaciones

- Well Control Kill Sheet (Low Angle Wells)Documento8 páginasWell Control Kill Sheet (Low Angle Wells)Tatita ValenciaAún no hay calificaciones

- POS CAL SF No4 B2 BCF H300x300 7mmweld R0 PDFDocumento23 páginasPOS CAL SF No4 B2 BCF H300x300 7mmweld R0 PDFNguyễn Duy QuangAún no hay calificaciones

- Chill - Lease NotesDocumento19 páginasChill - Lease Notesbellinabarrow100% (4)

- UKIERI Result Announcement-1Documento2 páginasUKIERI Result Announcement-1kozhiiiAún no hay calificaciones

- Khadi Natural Company ProfileDocumento18 páginasKhadi Natural Company ProfileKleiton FontesAún no hay calificaciones

- Chapter 1: The Investment Environment: Problem SetsDocumento5 páginasChapter 1: The Investment Environment: Problem SetsGrant LiAún no hay calificaciones

- 3) Stages of Group Development - To StudsDocumento15 páginas3) Stages of Group Development - To StudsDhannesh SweetAngelAún no hay calificaciones

- Cercado VsDocumento1 páginaCercado VsAnn MarieAún no hay calificaciones

- 1st Exam Practice Scratch (Answer)Documento2 páginas1st Exam Practice Scratch (Answer)Tang Hing Yiu, SamuelAún no hay calificaciones

- Unit 1 2marksDocumento5 páginasUnit 1 2marksLokesh SrmAún no hay calificaciones

- CFEExam Prep CourseDocumento28 páginasCFEExam Prep CourseM50% (4)

- Meanwhile Elsewhere - Lizzie Le Blond.1pdfDocumento1 páginaMeanwhile Elsewhere - Lizzie Le Blond.1pdftheyomangamingAún no hay calificaciones

- Impact of Coronavirus On Livelihoods of RMG Workers in Urban DhakaDocumento11 páginasImpact of Coronavirus On Livelihoods of RMG Workers in Urban Dhakaanon_4822610110% (1)

- Portable dual-input thermometer with RS232 connectivityDocumento2 páginasPortable dual-input thermometer with RS232 connectivityTaha OpedAún no hay calificaciones

- 5.PassLeader 210-260 Exam Dumps (121-150)Documento9 páginas5.PassLeader 210-260 Exam Dumps (121-150)Shaleh SenAún no hay calificaciones

- Distribution of Laptop (Ha-Meem Textiles Zone)Documento3 páginasDistribution of Laptop (Ha-Meem Textiles Zone)Begum Nazmun Nahar Juthi MozumderAún no hay calificaciones

- Broker Name Address SegmentDocumento8 páginasBroker Name Address Segmentsoniya_dps2006Aún no hay calificaciones

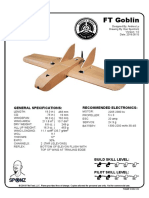

- FT Goblin Full SizeDocumento7 páginasFT Goblin Full SizeDeakon Frost100% (1)

- CompactLogix 5480 Controller Sales GuideDocumento2 páginasCompactLogix 5480 Controller Sales GuideMora ArthaAún no hay calificaciones

- ContactsDocumento10 páginasContactsSana Pewekar0% (1)

- ASME Y14.6-2001 (R2007), Screw Thread RepresentationDocumento27 páginasASME Y14.6-2001 (R2007), Screw Thread RepresentationDerekAún no hay calificaciones

- Short Term Training Curriculum Handbook: General Duty AssistantDocumento49 páginasShort Term Training Curriculum Handbook: General Duty AssistantASHISH BARAWALAún no hay calificaciones