Documentos de Académico

Documentos de Profesional

Documentos de Cultura

A Financial Ratio Analysis of Krishak Bharati Co-Operative Limited

Cargado por

krishnajigan0 calificaciones0% encontró este documento útil (0 votos)

17 vistas14 páginasThis document summarizes a research paper that analyzes the financial ratios of Krishak Bharati Co-operative Limited to evaluate its profitability performance. The paper provides background on KRIBHCO's history and operations. It reviews previous literature on using financial ratio analysis and outlines the research methodology, objectives, and data collection sources. Financial ratios will be calculated for KRIBHCO from 2000-2001 to 2008-2009 using annual reports to analyze profitability and assess the company's growth potential.

Descripción original:

Título original

16

Derechos de autor

© © All Rights Reserved

Formatos disponibles

PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoThis document summarizes a research paper that analyzes the financial ratios of Krishak Bharati Co-operative Limited to evaluate its profitability performance. The paper provides background on KRIBHCO's history and operations. It reviews previous literature on using financial ratio analysis and outlines the research methodology, objectives, and data collection sources. Financial ratios will be calculated for KRIBHCO from 2000-2001 to 2008-2009 using annual reports to analyze profitability and assess the company's growth potential.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

17 vistas14 páginasA Financial Ratio Analysis of Krishak Bharati Co-Operative Limited

Cargado por

krishnajiganThis document summarizes a research paper that analyzes the financial ratios of Krishak Bharati Co-operative Limited to evaluate its profitability performance. The paper provides background on KRIBHCO's history and operations. It reviews previous literature on using financial ratio analysis and outlines the research methodology, objectives, and data collection sources. Financial ratios will be calculated for KRIBHCO from 2000-2001 to 2008-2009 using annual reports to analyze profitability and assess the company's growth potential.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

Está en la página 1de 14

IRJC

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 10, October 2012, ISSN 2277 3622

w

w

w

.

i

n

d

i

a

n

r

e

s

e

a

r

c

h

j

o

u

r

n

a

l

s

.

c

o

m

1

8

6

A FINANCIAL RATIO ANALYSIS OF KRISHAK BHARATI CO-

OPERATIVE LIMITED

PROF. VIJAY S PATEL*; PROF. CHANDRESH B. MEHTA**

*Assistant Professor,

Shri C. J. Patel Vidhyadham Commerce College,

Variyav, Surat.

**Assistant Professor,

Shree J. D. Gabani Commerce College &

Shree Swami Atmanand Saraswati College of Management,

Surat.

ABSTRACT

The Financial Statements are generally prepared for the measurement of financial position of a

particular company for a particular period of time. The financial statements i.e. (i) Profit and

loss account and (ii) Balancesheet provide useful information regarding financial situation of

company. The information has its own value, but if some one wants to have better judgment of

the concern, he has to analyse them. This paper provides the guidelines about analysis of

profitability ratio of Krishak Bharati Co-operative Ltd. located at Kawas-Hazira in Surat District.

___________________________________________________________________________

INTRODUCTION

HISTORY OF KRIBHCO

Co-operative activity was started in 1904 in India. It has passed a century at its existence. Co-

operative sector played a remarkable role to uplift the lifestyle of lower class people and to form

exploitation free society and to keep down the economic imbalance profiteering and bureaucracy

of the private sector and on the other hand public enterprises have failed at all. Whereas co-

operative activity is getting solid, powerful and modern according to democratic formation.

Co-operative activities have progressed in the field like economical banking field, agriculture,

milk production, irrigation, traders unions, oil seeds, home, sugar factories, fertilizer factories,

co-operative activities have progressed well in Gujarat. People of South Gujarat have taken more

benefit of it rather than the people of Saurashtra and North Gujarat. Therefore the wealth of the

farmers in this area is also increased. There are some big and successful co-operative enterprises

in Gujarat. KRIBHCO fertilizer factory near Surat is one of them.

Krishak Bharati Co-operative Limited is the national co-operative organization which produces

large quantity of fertilizers, associated with the co-operative field. KRIBHCO produces and

distributes some agricultural products like fertilizers (urea, ammonia) bio-Culture and improved

seeds to the big states of India, with the help of co-operative organizations.

IRJC

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 10, October 2012, ISSN 2277 3622

w

w

w

.

i

n

d

i

a

n

r

e

s

e

a

r

c

h

j

o

u

r

n

a

l

s

.

c

o

m

1

8

7

KRIBHCO is a leading unit working with co-operative field by which we can know how is

the production management, personnel management, and financial management of this

organization.

KRIBHCO has got brilliant success because of its efficiency of management in co-operative

field; this success is the best example to inspire other organizations.Today in this competitive

era, while private sectors are giving importance to the maximum benefit by profiteering, it is

necessary to study this organization which covers many field.

Name Krishak Bharti Co-Operative Ltd,

Joint Sector Government, IFFCO and NCDC

Foundation stone laid by Smt. Indira Gandhi 5

th

February, 1982

Trial Production of Urea 26

th

November, 1985

Start of Commercial Production 1

st

March 1986

Year of Business 27 Years

Legal Status Multi state co-operative society

Number of Employees 2635

Manufacturing and Marketing Urea, Ammonia and Bio-fertilizer

Urea-Ammonia Plant Location Distance from Surat, Hazira, Gujarat

LITERATURE REVIEW

Ahmed Arif Karim Almazari had written an article in Journal of Accounting and Finance, Oct-

Nov 2009 on the subject Analyzing Profitability Ratios of the Jourdanian Phosphate Mines

Company:. He discusses about different types of profitability ratios and how to interpret them.

Types of analysis like cross-selection analysis and time-series analysis are also explained. The

main objectives of the study were-

- Emphasizing the importance of using financial ratios as the indicators of a firms

performance and financial situation.

- To analyze the time series behaviour of the profitability ratio of the Joururdanian

Phosphate Mines Company especially how these ratios behave during different business

cycles?

IRJC

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 10, October 2012, ISSN 2277 3622

w

w

w

.

i

n

d

i

a

n

r

e

s

e

a

r

c

h

j

o

u

r

n

a

l

s

.

c

o

m

1

8

8

- Identifying the obstacles and difficulties facing this company as regards to its profitability

ratios.

- Recommending solutions which can be a source of help to the financial department of the

Jordan Phosphate Mines Company.

Conclusions and recommendations are also given how the company increases its profit.

A M.Phil. Dissertation entitled Financial Analysis case study of sugar factory in Valsad and

Navsari District was conducted by Jayesh R. Patel in March 2002. The Primary purpose of the

present study is to evaluate analyses and appraise the financial performance of the three sugar

factories selected for the study, the present work is a modest attempt in this direction. Analysis of

financial statements has been done by adopting various tools of analysis such as financial ratio

and funds flows statements etc. An endeavour has been made by means of a number of examples

from actual financial statements to accustom the analysis to seize upon salient features and to

turn a critical eye upon points of weakness. The period of the study was from 1989-90 to 1998-

99.

Lal C. Jagetia has given an article in the journal Management Accountant March, 1996 on the

subject, Ratio Analysis in Evaluation of Financial Health of a Company:. The main objective of

this article was that the ratio analysis is often under-rated but extremely helpful in providing

valuable insight into a companys financial picture. He observed that the ratios normally pinpoint

business strengths and weakness in two ways-Ratios provide an easy way to compare todays

performance with the past. Ratios depict the areas in which a particular business is competitively

advantageous or disadvantageous through comparing ratios to those of other business of the

same size within the same industry. He concluded that the ratio analysis should not be viewed as

an end but should be viewed as a starting point. Ratios by themselves do not answer the

questions. One must look at other sources of data in order to make a judgment about the future of

the company

Lal C. Jagetia has given an article in the journal Management Accountant March, 1996 on the

subject, Ratio Analysis in Evaluation of Financial Health of a Company:. The main objective of

this article was that the ratio analysis is often under-rated but extremely helpful in providing

valuable insight into a companys financial picture. He observed that the ratios normally pinpoint

business strengths and weakness in two ways-Ratios provide an easy way to compare todays

performance with the past.Ratios depict the areas in which a particular business is competitively

advantageous or disadvantageous through comparing ratios to those of other business of the

same size within the same industry. He concluded that the ratio analysis should not be viewed as

an end but should be viewed as a starting point. Ratios by themselves do not answer the

questions. One must look at other sources of data in order to make a judgment about the future of

the company.

RESEARCH METHODOLOGY

According to J.W.B. est, Research is considered to be formal, systematic, intensive process of

carrying on the scientific method of analysis. It involves a more systematic structure of

IRJC

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 10, October 2012, ISSN 2277 3622

w

w

w

.

i

n

d

i

a

n

r

e

s

e

a

r

c

h

j

o

u

r

n

a

l

s

.

c

o

m

1

8

9

investigation usually resulting in some sort of formal record of procedures and report of result or

conclusions.

RESEARCH STATEMENT

The research statement studied is entitled, A financial ratio Analysis of Krishak Bharati Co-

Operative Ltd.The present study focuses on the analysis of the performance of kribhco co ltd.

Profitability and t- test.

OBJECTIVES OF THE STUDY

These objectives are classified in a following manner:

To analysis the profitability performance of the company

To assess the growth potential of the industry

To study the organizational structure and the present position of the KRIBHCO

LIMITED.

NATURE OF DATA AND SOURCES OF DATA

Collection of the data is essential part of research. The nature of data which is collected and used

for this research is secondary in nature. The relevant and required data has been collected from

journals, dailies, annual reports, magazines, literature and websites of selected companies and

through various search engines.

SAMPLE SELECTION

Kribhco Co.Ltd operating in India from 2000-01 to 2008-09 was selected for the study.

TOOLS AND METHODS OF DATA ANALYSIS

The present study involves calculation of profitability ratios to evaluate the financial

performance of kribhco Ltd. in India from 2000-01 to 2008-09. Statistical measures like

percentage, mean, ratio analysis and t test are used in this study. Being a mathematical method it

is not flexible - the addition of even one more observation makes it necessary to do all the

computations again.

RATIO ANALYSIS

INTRODUCTION

Of all the tools of financial analysis available with analyst, the most important and the most

widely used tool is Ratio analysis. Simply stated Ratio analysis is an analysis of financial

statements done with the help of Ratios. A Ratio expresses the relationship that exists between

two numbers taken from the financial statements. Ratio analysis is among the best tools available

IRJC

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 10, October 2012, ISSN 2277 3622

w

w

w

.

i

n

d

i

a

n

r

e

s

e

a

r

c

h

j

o

u

r

n

a

l

s

.

c

o

m

1

9

0

to analyze the financial performance of a company as it allows intercompany and intra company

comparison. Ratio also provides a birds eye view of the financial condition of the company. The

following ratios have been computed for the present study.

PROFITABILITY RATIO

Profitability is an indication of the efficiency with which the operations of the business are

carried out. The profitability of a firm can be measured by its profitability Ratio. The amount and

rate of profits earned depend upon the quantum of investment committed, so the profitability

Ratio can be calculated on the basis of either sales or investment. Owners are interested to know

the profitability as is indicates the return which they can get on their investments. The

profitability Ratio in relation to sales are (1) Gross profit ratio, (2) Net profit ratio, (3)

Expenses or operating ratio, while profitability Ratio related to investments are (1) Return on

assets ratio, (2) Return on shareholders equity or investment ratio.

The profitability in relation to sales can be used to assess the ability of the firms management to

control the various expenses involved in generating sales.

[1] GROSS PROFIT RATIO

This ratio expresses the relationship between gross profit and net sales.

Gross Profit s

Gross Profit Ratio =

Net Sales

This ratio shows profit relative to sales after the deduction of production cost and indicates the

relation between production cost and selling price.

[2] NET PROFIT RATIO

This ratio known as profit margin or return on sales ratio. It measures the relationship between

net profit and net sales of a firm. Net profit ratio indicates what portion of sales is left to the

proprietors after meeting all expenses.

Net Profit s

Gross Profit Ratio =

Net Sales

The ratio indicates the managements efficiency in manufacturing, administration, and selling of

products. If the net profit is low, the firm will fail to achieve satisfactory return on owners

equity. This ratio indicates the firms capacity to withstand against adverse economic conditions.

A firm with high net profit margin can make better use of favorable conditions.

X 100

X 100

IRJC

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 10, October 2012, ISSN 2277 3622

w

w

w

.

i

n

d

i

a

n

r

e

s

e

a

r

c

h

j

o

u

r

n

a

l

s

.

c

o

m

1

9

1

[3] OPERATING OR EXPENSES RATIO

This ratio is complementary of net profit ratio. In case, the net profit ratio is 20%, it means that

the operating ratio is 80%. This ratio is the test of the operational efficiency with which the

business is being carried on. There are different concepts of operating expenses such as (i) total

expenses including cost of goods sold, selling, general and administrative expenses etc. (ii) cost

of goods sold and (iii) specific operating expenses.

Cost of Goods Sold

s

Operating Ratio =

Net Sales

This ratio is very important for analyzing the profitability of concern. A high operating ratio is

not good since it would leave a small amount of operating income to meet interest, dividends etc.

for getting a proper idea of behavior of operating expenses, the ratio has to be compared with

different companies. The variations in operating ratio may occur due to different factors which

are as follows:

[4] EARNING PER SHARE (EPS) RATIO

The Profitability of equity shareholders investment can be measured in other ways also. One

such measure is to calculate earning per share. It is calculated by dividing net profit after taxes

and preference divided by total number of shareholders.

Net Profit After Taxes

s

Earning per share {EPS} Ratio =

No. of Equity Shares

EPS simply shows the profitability of the firm on per share basis. It does not reflect how much is

paid as dividend and how much is retained in the business. As profitability ratio the EPS can be

used to draw inferences on the basis of

[5] RETURN ON CAPITAL EMPLOYED

This ratio explains the relationship between total profits earned by the business and total

investments made or total assets employed. This ratio thus measures the overall efficiency of the

business operations.

X 100

IRJC

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 10, October 2012, ISSN 2277 3622

w

w

w

.

i

n

d

i

a

n

r

e

s

e

a

r

c

h

j

o

u

r

n

a

l

s

.

c

o

m

1

9

2

Net Profit

s

Return on Capital Employed=

Capital Employed

This ratio is a clear index of the earning capacity of the business and shows the optimum

utilization of the assets or resources employed, i.e. return on capital employed including long-

term borrowings.

IMPORTANCE OF THE STUDY

The study is helpful to different types of users like:

MANAGEMENT:This study helps to assess its pass performance and to plan about its future

programmes. It also helps to know up to what extent the funds were efficiently utilized or

misappropriated.

CREDITORS:This study is very useful to the creditors to judge liquidity position and financial

soundness of the company.

SHAREHOLDERS:The shareholders can know the prospects of the business and to what extent

their interest will be affected by the result of the business operation, the profitability and

financial condition and as to the future earnings and the return on their capital.

SCOPE OF THE STUDY

The study covers analysis of financial statements of KRIBHCO Limited for the period 2001-

2002 to 2008-2009. The present analysis is carried up to financial year 2008-09. It can be

extended to future period also. With the help of statistical analysis, the forecasting of subsequent

years can also be made for particular item such as sales, inventory, profit, etc. The statistical

analysis can also be applied to every ratio and by there upon more comprehensive results can be

obtained. The statistical analysis can also be applied to other similar companies as well as the

industry as a whole in order to know the prevailing situation in the whole industry.

LIMITATIONS OF THE STUDY

It is based on historical data.

It considers only monetary aspect. In absence of human resources accounting the same

has been excluded from the review.

Financial statements are primarily based on cost concept. Hence, It can not give the

current position.

In the absence of availability of information of another company in the fertilizer, the

comparison between two companies can not be made. The various ratios of the company

X 100

IRJC

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 10, October 2012, ISSN 2277 3622

w

w

w

.

i

n

d

i

a

n

r

e

s

e

a

r

c

h

j

o

u

r

n

a

l

s

.

c

o

m

1

9

3

are compared with ideal or of the previous years ratio. The data used is primarily on the

basis of annual reports only.

DATA ANALYSIS

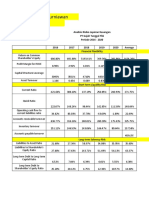

GROSS PROFIT RATIO

Year Gross profit

(Rs. In lacs)

Growth rate

per year (In

%)

Net Sales (Rs.

In lacs)

Growth

rate per

year

(In %)

Ratio (In

%)

2000-2001 36,198 - 96,239 - 37.61

2001-2002 36,800 1.66 98,159 2.00 37.49

2002-2003 21,181 -42.44 88,606 -9.73 23.90

2003-2004 45,938 116.88 120,096 35.54 38.25

2004-2005 40,993 -10.76 114,007 -5.07 35.96

2005-2006 45,561 11.14 150,808 32.28 30.21

2006-2007 48,629 6.73 185,556 23.04 26.21

2007-2008 62,798 29.14 223,041 20.20 28.16

2008-2009 49,786 -20.72 255,913 14.74 19.45

Average 43,098 148,047 30.80

Correlation 0.79

t 4.54

This ratio indicates the relationship between the sales and gross profit higher gross profit

indicates good condition of the company. When the ratio of various year was compared with

average gross profit, it is found that the gross profit in the year 2000-01, 2001-02, 2002-03 &

2004-05 was lower and was higher in the year 2003-04, & 2005-06 to 2008-09.

Gross Profit (t = 4.54)

The hypothesis to be tested is that,H0: There is no linear relationship between gross profit and

net sales (i.e. H0 = = 0) against the alternative hypothesis H1 = > 0 is accepted because

the calculated value of t ( =4.54) is greater than table value of t ( = 2.37) at 5% level of

IRJC

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 10, October 2012, ISSN 2277 3622

w

w

w

.

i

n

d

i

a

n

r

e

s

e

a

r

c

h

j

o

u

r

n

a

l

s

.

c

o

m

1

9

4

significance for 7 degree of freedom. This indicates that there is linear relationship between

gross profit and net sales. Hence, we can say that gross profit and net sales are correlated.

Correlation (r = 0.79)

The correlation between net sales and total assets is positive. So, it is indicates that there is linear

relationship between gross profit and net sales.

NET PROFIT RATIO

Year Net profit

(Rs. In lacs)

Growth

rate per

year (In %)

Net Sales

(Rs. In lacs)

Growth

rate per

year

(In %)

Ratio

(In %)

2000-2001 13,810 - 96,239 - 14.35

2001-2002 18,733 35.65 98,159 2.00 19.08

2002-2003 3,402 -81.84 88,606 -9.73 3.84

2003-2004 15,270 348.85 120,096 35.54 12.71

2004-2005 14,059 -7.93 114,007 -5.07 12.33

2005-2006 19,245 36.89 150,808 32.28 12.76

2006-2007 19,324 0.41 185,556 23.04 10.41

2007-2008 20,920 8.26 223,041 20.20 9.38

2008-2009 25,014 19.57 255,913 14.74 9.77

Average 16,642 148,047 11.63

Correlation 0.77

t 3.19

This ratio indicates the relationship between sales and net profit. when average sales is compared

for the period covered it was revealed that it was lower in the year 2000-01 to 2004-05 where as

the year 2005-06 to 2008-09 the sales was higher than average sales.

Net Profit: (t = 3.19)

IRJC

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 10, October 2012, ISSN 2277 3622

w

w

w

.

i

n

d

i

a

n

r

e

s

e

a

r

c

h

j

o

u

r

n

a

l

s

.

c

o

m

1

9

5

The hypothesis to be tested is that, H0: There is no linear relationship between net profit and net

sales (i.e. H0 = . = 0) against the alternative hypothesis H1 = > 0 is accepted because

the calculated value of t ( =3.19) is greater than table value of t ( = 2.37) at 5% level of

significance for 7 degree of freedom. This indicates that there is linear relationship between net

profit and net sales. Hence; we can say that the net profit and net sales are correlated.

Correlation (r = 0.77)

The correlation between net profit and net sales is positive. So, it is indicates that there is linear

relationship between net profit and net sales.

OPERATING RATIO

Year Cost of goods

sold (Rs. In

lacs)

Growth rate

per year

(In %)

Net Sales

(Rs. In lacs)

Growth rate

per year

(In %)

Ratio

(In %)

2000-2001 91,094 - 96,239 - 91.68

2001-2002 93,413 2.55 98,159 -1.21 95.16

2002-2003 97,655 4.54 88,606 -9.73 110.21

2003-2004 108,469 11.07 120,096 35.54 90.32

2004-2005 106,378 -1.93 114,007 -5.07 93.31

2005-2006 146,381 37.60 150,808 32.28 97.06

2006-2007 185,304 26.59 185,556 23.04 99.86

2007-2008 219,672 18.55 223,041 20.20 98.49

2008-2009 266,162 21.16 255,913 14.74 104.00

Average 146,059 148,394 97.79

Correlation 0.99

t 18.71

This ratio establishes the relationship between sales and cost of goods sold. When operating ratio

is higher then the condition of the company is not sound. Average cost of goods sold and

operating expenses was Rs. 146059 lacs, the cost of goods sold and operating expenses was

IRJC

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 10, October 2012, ISSN 2277 3622

w

w

w

.

i

n

d

i

a

n

r

e

s

e

a

r

c

h

j

o

u

r

n

a

l

s

.

c

o

m

1

9

6

lower than average in the year 2000-01 to 2004-05 whereas higher in the year 2005-06 to 2008-

09. The highest was Rs. 255913 lacs in the year 2008-09 and the lowest in the year 2002-03

amount to Rs. 88606 lacs. The average sales was Rs. 148394 lacs in the year 2000-01 to 2004-05

the sales was lower than average and higher from the year 2005-06 to 2008-09.

Operating Ratio: (t=18.71)

The hypothesis to be tested is that Ho: There is no linear relationship between cost of goods

sold and net sales (i.e. Ho: =0) against the alternative hypothesis H1: >0 is accepted

because the calculated value of t(=18.71) is greater than the table value of t(=2.37) for 7 d.f. This

indicates that, there is linear relationship between cost of goods sold and net sales. Hence we can

say that cost of goods sold and net sales are correlated.

Correlation (r=0.99)

The correlation between cost of goods sold and net sales is highly positive. So its indicates that,

there is linear relationship between cost of goods sold and net sales.

EARNINGS PER SHARE RATIO

Year Profit after

tax

(Rs. In lacs)

Growth

rate per

year In %)

No. Of

equity

shares

Growth

rate per

year (In %)

Ratio

(In Rs.)

2000-2001 13,810 - 48,907 - 282,373

2001-2002 18,733 35.65 49,034 0.26 382,041

2002-2003 3,402 -81.84 49,326 0.60 68,970

2003-2004 15,270 348.85 49,217 -0.22 310,259

2004-2005 14,059 -7.93 39,399 -19.95 356,836

2005-2006 19,245 36.89 39,506 0.27 487,141

2006-2007 19,324 0.41 39,650 0.36 487,364

2007-2008 20,920 8.26 39,648 -0.01 527,643

2008-2009 25,014 19.57 39,116 -1.34 639,483

Average 16,642 43,756 393,567.78

Correlation -0.61

t 2.05

IRJC

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 10, October 2012, ISSN 2277 3622

w

w

w

.

i

n

d

i

a

n

r

e

s

e

a

r

c

h

j

o

u

r

n

a

l

s

.

c

o

m

1

9

7

This ratio indicates the earning of the company per share. The highest PAT was in the year 2008-

09 which amounts to Rs 25014 lacs and the lowest was in 2002-03 amounting to Rs. 3402 lacs.

The average PAT was Rs.16642 lacs. When the PAT of various year was compared with average

then it is found that it was lower in the year 2000-01, 2002-03, 2003-04& 2004-05, where as it

was higher in 2001-02 and from 2005-06 to 2008-09. The numbers of equity share go on

changing from year to year i.e. the highest number of equity share was in the year 2002-03 and

lowest number of equity share were in 2008-09.

Earning Per Share [EPS] Ratio: (t = 2.05)

The hypothesis to be tested is that, H0: There is no linear relationship between profit after tax

and number of equity shares (i.e. H0 = = 0) against the alternative hypothesis H1 = > 0 is

rejected because the calculated value of t ( = 2.05) is less than table value of t ( = 2.37) at 5%

level of significance for 7 degree of freedom. This indicates that there is no linear relationship

between profit after tax and number of equity shares. Hence, we can say that profit after tax and

numbers of equity shares are uncorrelated.

Correlation (r = -0.61)

The correlation between profit after tax and number. of equity shares is negative. So, it is

indicates the partial negative correlation between profit after tax and number of equity shares.

RETURN ON CAPITAL EMPLOYED

Year Ebit

(Rs. In lacs)

Growth

rate per

year (In %)

Capital

employed

(Rs. in lacs)

Growth

rate per

year

(In %)

Ratio

(In %)

2000-2001 21,047 - 198,102 - 10.62

2001-2002 24,848 18.06 206,969 4.48 12.01

2002-2003 4,228 -82.98 207,192 0.11 2.04

2003-2004 22,037 421.22 209,481 1.10 10.52

2004-2005 18,861 -14.41 206,035 -1.65 9.15

2005-2006 28,250 49.78 217,369 5.50 13.00

2006-2007 23,300 -17.52 228,793 5.26 10.18

2007-2008 27,746 19.08 260,323 13.78 10.66

IRJC

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 10, October 2012, ISSN 2277 3622

w

w

w

.

i

n

d

i

a

n

r

e

s

e

a

r

c

h

j

o

u

r

n

a

l

s

.

c

o

m

1

9

8

2008-2009 27,973 0.82 264,156 1.47 10.59

Average 22,032 222,047 9.86

Correlation 0.51

t 1.57

This ratio indicate what is the rate of return on capital employed. The average capital employed

was Rs. 222407 lacs. From the year 2000-01 to 2005-06 the capital employed is lower than

average and was higher from the year 2006-07 to 2008-09.

Return on Capital Employed: (t = 1.57)

The hypothesis to be tested is that,

H0: There is no linear relationship between EBIT and capital employed (i.e. H0 = = 0)

against the alternative hypothesis H1 = > 0 is rejected because the calculated value of t ( =

1.57) is less than table value of t ( = 2.37) at 5% level of significance for 7 degree of freedom.

This indicates that there is no linear relationship between EBIT and capital employed. Hence, we

can say that EBIT and capital employed are uncorrelated.

Correlation (r = 0.51)

The correlation between EBIT and capital employed is positive. So, it is indicating that the EBIT

and capital employed are correlated.

CONCLUSION RECOMMENDATION

Gross profit ratio from the year 2000-01 to 2008-09 lies between 19.45% to 38.25%. Gross profit

of the year 2003-04 was the highest at 38.25% which displayed the good sign for the company.

Where as in the year 2008-09 it was 19.45% which is not good sign for the company. Gross

profit ratio is very much satisfactory.Net profit ratio from the year 2000-01 to 2008-09 lies

between 3.84% to 19.08%. The average ratio was 11.63% net profit ratio was found to be below

the gross profit ratio. It discloses that operating expenses are more in all the year which shows

very critical situation of the Company.Earning Per Share was very satisfactory in all the years

except in the year 2002-03. The EPS in the year 2008-09 was Rs. 639483, which is six times

more than original value, which is good sign for the company. Return on capital employed from

the year 2000-01 to 2008-09 lies between 2.04% to 13%. Except 2002-03, this ratio shows minor

difference in it. The highest ratio was 13% in the year 2005-06, which shows the good sign of the

company.

Conclusions should be considered as guiding factors to determine how far the goals were

deviated and what should be done to improve the existing financial position. The following

IRJC

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 10, October 2012, ISSN 2277 3622

w

w

w

.

i

n

d

i

a

n

r

e

s

e

a

r

c

h

j

o

u

r

n

a

l

s

.

c

o

m

1

9

9

recommendations are The company should increase the production vis-a-vis sales. The company

should also concentrate on quality products. Looking to the total investment made, this is one of

primary steps to strengthen the company. The gross profit ratio is satisfactory. However, net

profit ratio is not in commensurate with gross profit ratio. Hence the post production expenses

and financial charges need to be curbed.company has made the use of ownership capital. Since

the rate of profit of the company is more than the rate of interest prevailing in the market on the

borrowed capital, the company can obtain borrowed capital in order to take the advantage of

trading on equity and ultimately increase the earning per share. The credit policy for the debtor is

not favorable the company does not receive collection from the debtor at the right time. The

credit policy should be made effective so that collection from debtor can be received at the

earliest.

Income of the company is based on the subsidy provided by the government, The Company

should try to minimize the operating expenses so as to maintain profit and it should not put much

reliance on the subsidy.

REFERENCES

Pandey I.M. : Financial Management, p. 425.

Baty J. : Management Accountancy, Ed. 1975, p. 431.

Hunt P, Williams C. and Donaldson G. : Basic Business Finance

Text and Cases, Ed. 1971, p. 116.

Kuchhal S. C. : Financial Management, p. 60.

Helfert Erich A. : Techniques of Financial Analysis, Ed. 1957, p. 57.

También podría gustarte

- A Financial Ratio Analysis of Krishak Bharati Co-Operative LimitedDocumento14 páginasA Financial Ratio Analysis of Krishak Bharati Co-Operative Limiteds.muthuAún no hay calificaciones

- SuvithaDocumento84 páginasSuvithaVenkatram PrabhuAún no hay calificaciones

- Project Report Sem 4 BbaDocumento43 páginasProject Report Sem 4 BbaTanya RajaniAún no hay calificaciones

- Measuring Financial Health of A Public Limited Company Using Z' Score Model - A Case StudyDocumento18 páginasMeasuring Financial Health of A Public Limited Company Using Z' Score Model - A Case Studytrinanjan bhowalAún no hay calificaciones

- Trend Analysis Final Project by ArjitDocumento37 páginasTrend Analysis Final Project by Arjitsandeepkaur1131992Aún no hay calificaciones

- "A Study of Financial Statement Analysis Through Ratio Analysis at Sids Farm Pvt. LTDDocumento14 páginas"A Study of Financial Statement Analysis Through Ratio Analysis at Sids Farm Pvt. LTDAbdul WadoodAún no hay calificaciones

- Sudeshnaa Final Yr ProjectDocumento15 páginasSudeshnaa Final Yr ProjectShri hariniAún no hay calificaciones

- Research PaperDocumento10 páginasResearch PapervvpatelAún no hay calificaciones

- 139 April2019Documento11 páginas139 April2019vaibhav pachputeAún no hay calificaciones

- Nexus Between Working Capital Management and Sectoral PerformanceDocumento17 páginasNexus Between Working Capital Management and Sectoral Performancemohammad bilalAún no hay calificaciones

- An Empirical Study of Profitability Anal PDFDocumento12 páginasAn Empirical Study of Profitability Anal PDFsurajcool999Aún no hay calificaciones

- An Empirical Study of Profitability Analysis of Selected Steel Companies in IndiaDocumento17 páginasAn Empirical Study of Profitability Analysis of Selected Steel Companies in Indiamuktisolia17Aún no hay calificaciones

- Financial Performance Analysis Through Position Statements of Selected FMCG CompaniesDocumento8 páginasFinancial Performance Analysis Through Position Statements of Selected FMCG Companiesswati jindalAún no hay calificaciones

- A Relative Study between Financial Healthiness of Community Division Oil Selling Companies in IndiaDocumento9 páginasA Relative Study between Financial Healthiness of Community Division Oil Selling Companies in IndiamurugesanAún no hay calificaciones

- Research Paper On "Efficient Management of Working Capital: A Study of Automobile Industry in India"Documento8 páginasResearch Paper On "Efficient Management of Working Capital: A Study of Automobile Industry in India"yash sultaniaAún no hay calificaciones

- A Study On Financial Analysis and Performance of Kotak Mahindra BankDocumento12 páginasA Study On Financial Analysis and Performance of Kotak Mahindra BankAkash DevAún no hay calificaciones

- FinancialPerformanceAnalysis GIMDocumento16 páginasFinancialPerformanceAnalysis GIMdemionAún no hay calificaciones

- Financial Statement Analysis of S.S EnterprisesDocumento48 páginasFinancial Statement Analysis of S.S Enterprisessahil mehtaAún no hay calificaciones

- FINANCIAL HEALTH OF STEEL AUTHORITY OF INDIADocumento11 páginasFINANCIAL HEALTH OF STEEL AUTHORITY OF INDIAvamshivarkutiAún no hay calificaciones

- Mariya 888Documento48 páginasMariya 888jacob tomsAún no hay calificaciones

- Executive SummaryDocumento70 páginasExecutive SummaryAdarsh GiladaAún no hay calificaciones

- Impact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysisDocumento8 páginasImpact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysissaefulAún no hay calificaciones

- Ratio Analysis: A Comparative Study of National Petrochemicals Co. and Sahara Petrochemicals Co. of Saudi ArabiaDocumento10 páginasRatio Analysis: A Comparative Study of National Petrochemicals Co. and Sahara Petrochemicals Co. of Saudi ArabiaSuman BansalAún no hay calificaciones

- JisnaDocumento45 páginasJisnaSarin SayalAún no hay calificaciones

- Small Industry Financial AnalysisDocumento22 páginasSmall Industry Financial AnalysisSwami Yog BirendraAún no hay calificaciones

- Manage-Working Capital Management of Paper Mills-K MadhaviDocumento10 páginasManage-Working Capital Management of Paper Mills-K MadhaviImpact JournalsAún no hay calificaciones

- Working Capital Management in Tata Steel LimitedDocumento8 páginasWorking Capital Management in Tata Steel LimitedImpact JournalsAún no hay calificaciones

- Project ArticleDocumento12 páginasProject ArticleAkash SAún no hay calificaciones

- 2 9 40 367 PDFDocumento7 páginas2 9 40 367 PDFAnish BhatAún no hay calificaciones

- RAPTURE FOOTCARE FINANCIAL ANALYSISDocumento96 páginasRAPTURE FOOTCARE FINANCIAL ANALYSISmanesh100% (2)

- Maheshwar FPDocumento15 páginasMaheshwar FPkhayyumAún no hay calificaciones

- University School of Business Studies Talwandi Sabo: SynopsisDocumento10 páginasUniversity School of Business Studies Talwandi Sabo: SynopsisInder Dhaliwal KangarhAún no hay calificaciones

- 1252am - 140.EPRA Journals - 4180Documento7 páginas1252am - 140.EPRA Journals - 4180Kishore ThirunagariAún no hay calificaciones

- A Study On Financial Analysis of Maruthi Suzuki India Limited CompanyDocumento9 páginasA Study On Financial Analysis of Maruthi Suzuki India Limited CompanyVandanaAún no hay calificaciones

- N19070293101 PDFDocumento9 páginasN19070293101 PDFOwais KadiriAún no hay calificaciones

- Ksfe MINI PROJECT 2016Documento47 páginasKsfe MINI PROJECT 2016jayan panangadanAún no hay calificaciones

- Financial Performance Analysis of KSFEDocumento47 páginasFinancial Performance Analysis of KSFEjayan panangadanAún no hay calificaciones

- Ijrmec 749 54572Documento14 páginasIjrmec 749 54572eunkyung ChoiAún no hay calificaciones

- Financial ratio analysis and performance reviewDocumento8 páginasFinancial ratio analysis and performance reviewMaha LakshmiAún no hay calificaciones

- A Study On Financial Performance Analysis at City Union BankDocumento30 páginasA Study On Financial Performance Analysis at City Union BankArnab BaruaAún no hay calificaciones

- Financial Statement Analysis of RSB Transmissions (I) LtdDocumento103 páginasFinancial Statement Analysis of RSB Transmissions (I) LtdKomal KorishettiAún no hay calificaciones

- "Financial Analysis of Auto Majors": "Tata Motors LTD."Documento42 páginas"Financial Analysis of Auto Majors": "Tata Motors LTD."Anjali SinghAún no hay calificaciones

- UntitledDocumento68 páginasUntitledSurendra SkAún no hay calificaciones

- Ijcrt1812260 - Analysis of Capital Structure of Selected Power (Generation and Distribution) Companies in Developing India - An Empirical StudyDocumento8 páginasIjcrt1812260 - Analysis of Capital Structure of Selected Power (Generation and Distribution) Companies in Developing India - An Empirical Studykislay.shahiAún no hay calificaciones

- IJCRT2105257Documento9 páginasIJCRT2105257DebitCredit Accounts LearningAún no hay calificaciones

- The Effect of Working Capital ManagementDocumento11 páginasThe Effect of Working Capital ManagementTesfu AknawAún no hay calificaciones

- Social benefits and problems of newspaper workersDocumento8 páginasSocial benefits and problems of newspaper workersANKIT SHENDEAún no hay calificaciones

- Analyzing the Financial Performance of Andhra Bank from 2006-2010Documento21 páginasAnalyzing the Financial Performance of Andhra Bank from 2006-2010Mane DaralAún no hay calificaciones

- Working CapitalDocumento12 páginasWorking Capitalchirag PatwariAún no hay calificaciones

- DOC-20240407-WA0004.Documento50 páginasDOC-20240407-WA0004.pradhanraja05679Aún no hay calificaciones

- Assessment of Capital Budgeting Technique in Evaluating The Profitability of Manufacturing Firm With Reference To SME in RajasthanDocumento5 páginasAssessment of Capital Budgeting Technique in Evaluating The Profitability of Manufacturing Firm With Reference To SME in RajasthanSunita MishraAún no hay calificaciones

- Evaluation of Financial Performance Using Value Addition Metrics - A Select Study of 'It' Companies in IndiaDocumento6 páginasEvaluation of Financial Performance Using Value Addition Metrics - A Select Study of 'It' Companies in IndiaAnonymous CwJeBCAXpAún no hay calificaciones

- Ratio Analysis With Referance To SR Steel Ind ProjectDocumento57 páginasRatio Analysis With Referance To SR Steel Ind ProjectshaileshAún no hay calificaciones

- Financial Performance Analysis of Some Selected Investment Banks of BangladeshDocumento14 páginasFinancial Performance Analysis of Some Selected Investment Banks of BangladeshAfifah Afrose EshaAún no hay calificaciones

- Literature Review Analysis of Recorded Facts of Business PDFDocumento8 páginasLiterature Review Analysis of Recorded Facts of Business PDFMohammed YASEENAún no hay calificaciones

- A Study On Financial Performance Analysis of Dabur India LimitedDocumento7 páginasA Study On Financial Performance Analysis of Dabur India Limitedutsav9maharjanAún no hay calificaciones

- A Study On Financial Perfomance of Alakode Service Co-Operative BankDocumento58 páginasA Study On Financial Perfomance of Alakode Service Co-Operative BankjineshshajiAún no hay calificaciones

- AStudyon Working Capital Management Efficiencyof TCSIndias Top 1 CompanyDocumento13 páginasAStudyon Working Capital Management Efficiencyof TCSIndias Top 1 CompanySUNDAR PAún no hay calificaciones

- Translating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationDe EverandTranslating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationAún no hay calificaciones

- The Balanced Scorecard: Turn your data into a roadmap to successDe EverandThe Balanced Scorecard: Turn your data into a roadmap to successCalificación: 3.5 de 5 estrellas3.5/5 (4)

- List of Tables Sl. No Table Title Page No: ST ST ST ST STDocumento2 páginasList of Tables Sl. No Table Title Page No: ST ST ST ST STkrishnajiganAún no hay calificaciones

- ABSTRACT Prakash GovindarajDocumento1 páginaABSTRACT Prakash GovindarajkrishnajiganAún no hay calificaciones

- New Moorthy - Docx1Documento73 páginasNew Moorthy - Docx1krishnajiganAún no hay calificaciones

- Financial Performance Analysis of Revathi Equipment LimitedDocumento6 páginasFinancial Performance Analysis of Revathi Equipment LimitedkrishnajiganAún no hay calificaciones

- Financial Performance Analysis of Revathi Equipment LimitedDocumento6 páginasFinancial Performance Analysis of Revathi Equipment LimitedkrishnajiganAún no hay calificaciones

- Sugar IndustryDocumento54 páginasSugar IndustrykrishnajiganAún no hay calificaciones

- List of Tables Sl. No Table Title Page No: ST ST ST ST STDocumento2 páginasList of Tables Sl. No Table Title Page No: ST ST ST ST STkrishnajiganAún no hay calificaciones

- 10 Chapter 2Documento24 páginas10 Chapter 2krishnajiganAún no hay calificaciones

- 07 Chapter 1Documento17 páginas07 Chapter 1krishnajiganAún no hay calificaciones

- Gold Price 2012 OnlyDocumento27 páginasGold Price 2012 OnlykrishnajiganAún no hay calificaciones

- FABM2 Module 03 (Q1-W4)Documento6 páginasFABM2 Module 03 (Q1-W4)Christian ZebuaAún no hay calificaciones

- The Complete Guide To Careers in Business & FinanceDocumento37 páginasThe Complete Guide To Careers in Business & FinanceJakeAún no hay calificaciones

- BMAN 21020: Financial Reporting and AccountabilityDocumento24 páginasBMAN 21020: Financial Reporting and AccountabilityPat100% (2)

- Reformulation - Analysis of SCFDocumento17 páginasReformulation - Analysis of SCFAkib Mahbub KhanAún no hay calificaciones

- Acctg. QuizzesuntitledDocumento78 páginasAcctg. QuizzesuntitledJulie Velasquez0% (2)

- Finance Case Study 1Documento2 páginasFinance Case Study 1kazi A.R RafiAún no hay calificaciones

- Business Plan in Work ImmersionDocumento25 páginasBusiness Plan in Work Immersionmarialuz quijoteAún no hay calificaciones

- Cash Flow Statement for 2016 and 2017Documento2 páginasCash Flow Statement for 2016 and 2017AnikaAún no hay calificaciones

- Business PlanDocumento27 páginasBusiness PlanJustine Marie Louise AninangAún no hay calificaciones

- 2016 COA Report For NaujanDocumento190 páginas2016 COA Report For NaujanJ JaAún no hay calificaciones

- Corporate Finance Tutorial Questions on Financial StatementsDocumento2 páginasCorporate Finance Tutorial Questions on Financial StatementsAmy LimnaAún no hay calificaciones

- 10 Pointers Working CapitalDocumento15 páginas10 Pointers Working CapitalSudhir Kochhar Fema AuthorAún no hay calificaciones

- Analysis of Financial StatementsDocumento15 páginasAnalysis of Financial StatementsKrupa VagalAún no hay calificaciones

- Tarun Das, Economic Adviser, MOF, India: Accounting of Balance of PaymentsDocumento30 páginasTarun Das, Economic Adviser, MOF, India: Accounting of Balance of PaymentsProfessor Tarun DasAún no hay calificaciones

- Test Bank For New Zealand Financial Accounting 6th Edition by CraigDocumento67 páginasTest Bank For New Zealand Financial Accounting 6th Edition by CraigCarolparker100% (1)

- Law and EconomicsDocumento31 páginasLaw and EconomicsHồ Ngọc Yến MinhAún no hay calificaciones

- Fsa Solved ProblemsDocumento27 páginasFsa Solved ProblemsKumarVelivela100% (1)

- Compilation of ProblemsDocumento9 páginasCompilation of ProblemsCorina Mamaradlo CaragayAún no hay calificaciones

- Financial Analysis ProjectDocumento21 páginasFinancial Analysis Projectapi-464140568Aún no hay calificaciones

- ch12 SolutionsDocumento49 páginasch12 Solutionsaboodyuae2000Aún no hay calificaciones

- Test Paper 12Documento6 páginasTest Paper 12Sukhjinder SinghAún no hay calificaciones

- 01 BIWS Accounting Quick Reference PDFDocumento2 páginas01 BIWS Accounting Quick Reference PDFcarminatAún no hay calificaciones

- Bondor Steel PDFDocumento63 páginasBondor Steel PDFriad riduAún no hay calificaciones

- JP Morgan PresentationDocumento22 páginasJP Morgan PresentationramleaderAún no hay calificaciones

- Recitation Quiz 2Documento5 páginasRecitation Quiz 2BlairEmrallafAún no hay calificaciones

- Midterm Exam BuscomDocumento8 páginasMidterm Exam BuscomJustine FloresAún no hay calificaciones

- Mgac CustomDocumento123 páginasMgac CustomJoana TrinidadAún no hay calificaciones

- PT Gajah Tunggal Tbk Financial Risk Analysis 2016-2020Documento26 páginasPT Gajah Tunggal Tbk Financial Risk Analysis 2016-2020Ananda LukmanAún no hay calificaciones

- Annual Report 2019Documento157 páginasAnnual Report 2019Fani Dwi PutraAún no hay calificaciones

- Chapter 11 Investments Additional Concepts LectureDocumento13 páginasChapter 11 Investments Additional Concepts Lecturesantillan.arnaldo.duranAún no hay calificaciones