Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Tax Form

Cargado por

RoulaBeblidakiDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Tax Form

Cargado por

RoulaBeblidakiCopyright:

Formatos disponibles

MINISTRY OF FINANCE INLAND REVENUE DEPARTMENT AMENDMENT OF TAXPAYERS DATA OR REGISTRATION OF NEW TAXPAYERS (INDIVIDUALS)

IMPORTANT NOTES:1. This form SHOULD be completed and submitted IMMEDIATELY to the Inland Revenue Department when there is a correction or change in the taxpayers data or upon registration of a new taxpayer. 2. If you are a new taxpayer you should complete ALL the fields applicable to you and submit a copy of your Identity Card or of the relevant Identification Document. 3. 4. The Identification Data is required when T.I.C. or Identity Card of the Republic are not available. For any correction or change of data you MUST complete the fields 1, 6a, 10a, 11a as well as the sections you wish to correct or change.

Amendment of Data 1 Tax Identification Code (T.I.C.) Number 2 Identity Card of the Republic Number 3 Social Insurance of the Republic Number 4 Identification Data

TYPE Passport (), foreign Identity Card (), foreign T.I.C. (), Social Insurance () 5 Deceased Persons: to be competed the Representative/Administrator

Registration of a New Taxpayer

DETAILS

Administered:- YES

NO

Date of Death (DD/MM/YYYY) Representatives / Administrators Tax Identification Code 6 a) District Income Tax Office to which you belong:Nicosia Limassol Larnaca Famagusta b) Change of District Income Tax Office. Please indicate the Office of your preference: Nicosia

Reason for request

Paphos Paphos

Limassol

Larnaca

Famagusta

7 Commencement Date of your FIRST Activity (DD/MM/YYYY) 8 Date of Temporary Cessation of Activity (DD/MM/YYYY)

Reason for request:-

9 Date of Recommencement of Activity (DD/MM/YYYY) 10 a) Name (CAPITAL LETTERS):b) Change of Name: - New Name 11 a) Surname (CAPITAL LETTERS):b) Change of Surname: - New Surname

12 Date of Birth (DD/MM/YYYY) 13 Nationality and Residence: if you are a new taxpayer you must state your: -

Male Nationality: -

Female

Country of usual Residence: 14 Taxpayers Classification Code: - (state your main activity) 01. Employee - Public Sector 02. Employee - Semi-Gov. Organisation 03. Employee - Municipalit./Improv. Boards 04. Employee - Private Company 05. Employee - International Business Com. 06. Employee - Sovereign Bases 08. Employee - Embassies or others without tax deduction 09. Pensioner 10. Director of Private Company 21. Self - Employed 92. Individual with Immovable Property obligation ONLY 95. Stamp Duty Taxpayer

07. Employee - Other 96. Taxpayers with Special Contribution for Defense Refund 15 Description of Main Economic Activity: - (to be completed by Self - Employed ONLY)

For official use

(Form I.R.163A) 2010

16 Marital Status:-

Single

Married

Widow/er

Divorced YES

Identity Card Number or Tax Identification Code of Spouse 17 Details of First / New Representative:TERMINATION OF CURRENT REPRESENTATION Tax Identification Code (T.I.C.) Name and Surname 18 Do you prepare audited Accounts 19 Details of Accountant / Auditor / Audit firm Name and Surname 20 Details as an Employer:Commencement/Recommencement date as an Employer (DD/MM/YYYY) Termination date as an Employer (DD/MM/YYYY) Number of Employees Employed Method of submission of I.R.7 form 21 Communication Language:22 Home Address (Capital letters) : Street Number Postal Code Electronic Mail Address Home Telephone Number Moble Telephone Number 23 Business Address (Capital letters) : Street Number

Postal Code

YES Tax Identification Code (T.I.C.)

Obligation to pay P.A.Y.E:Form Diskette

YES Greek

NO CD Other

Appt. No. Village & Town

DO NOT include building names in Streets or Villalges & Towns. Country @

Same as Home Address

Office No. Village & Town

DO NOT include building names in Streets or Villalges & Towns. Country @

Electronic Mail Address

Business Telephone Number 24 Corespondence Address:- In case you select Other, state either the full address or the P.O. Box No.. In both cases the Postal Code, Village & Town and Country fields are required.

Home Address To Business Address Other (Please complete a or b bellow accordingly)

()

Street Number

Postal Code

Appt/Office No. Village & Town

DO NOT include building names in Streets or Villalges & Towns. Country

()

Post Office Box

Postal Code Village & Town Country Bearing in mind the consequences of the Collection of Taxes Law, No. 4 of 1978 as amended, I declare that the information included in this form is true and correct. By virtue of the Processing of Personal Data (Protection of Individuals) Law 2001, I authorise the Inland Revenue Departement to obtain, from any other Government Departement or Authority, all information necessary for the purpose of validating the information given herewith.

Name Status : - Representative / Administrator / Auditor / Accountant:Signature

FOR OFFICIAL USE

T..C.

Date

Update Date Officers Name

Official Stamp

(Form I.R.163A) 2010

También podría gustarte

- Jet Airways Web Booking Eticket (GDVAIV) - Khanna PDFDocumento3 páginasJet Airways Web Booking Eticket (GDVAIV) - Khanna PDFVarun Khanna100% (1)

- GSTR 3B How To Guide by ClearTaxDocumento53 páginasGSTR 3B How To Guide by ClearTaxagopal.gAún no hay calificaciones

- Business Plan TemplateDocumento7 páginasBusiness Plan TemplateJacinta SaveridassAún no hay calificaciones

- Profit & Loss StatementDocumento1 páginaProfit & Loss StatementNabila Ayuningtias100% (1)

- Bloomberg Keyboard 4 GuideDocumento8 páginasBloomberg Keyboard 4 GuideMarcus SugarAún no hay calificaciones

- Network18 Annual ReportDocumento235 páginasNetwork18 Annual ReportjigarchhatrolaAún no hay calificaciones

- MoneyLion Investor Presentation VFinalDocumento42 páginasMoneyLion Investor Presentation VFinalJ AAún no hay calificaciones

- Nikhil Sinha: Work Experience SkillsDocumento1 páginaNikhil Sinha: Work Experience SkillsNikhil SinhaAún no hay calificaciones

- Cleartax Investment Handbook2019 20 PDFDocumento12 páginasCleartax Investment Handbook2019 20 PDFYFAAún no hay calificaciones

- Claim Form For Interview, Travel & Subsistence Expenses For 2013 Specialty Recruitment ProcessDocumento2 páginasClaim Form For Interview, Travel & Subsistence Expenses For 2013 Specialty Recruitment ProcessblebeacristinaAún no hay calificaciones

- Deloitte Internship Application FormDocumento3 páginasDeloitte Internship Application FormNguyen Xuan HongAún no hay calificaciones

- Outsourcing Accounting and Payroll Services Saves TimeDocumento11 páginasOutsourcing Accounting and Payroll Services Saves TimeMohammed A. AbuShanabAún no hay calificaciones

- DV Process FlowDocumento2 páginasDV Process FlowEfren Ver SiaAún no hay calificaciones

- TFN Declaration FormDocumento6 páginasTFN Declaration FormTim DunnAún no hay calificaciones

- DOL RDWSU 2020 Form 5500Documento205 páginasDOL RDWSU 2020 Form 5500seanredmondAún no hay calificaciones

- Netoven Financials PresentationDocumento18 páginasNetoven Financials Presentationapi-261274957Aún no hay calificaciones

- Letter To Vendor - Request For Quotation Under GHBSDocumento1 páginaLetter To Vendor - Request For Quotation Under GHBSJuancho PaduaAún no hay calificaciones

- This Is A Sample Text. Enter Your Text Here: Current Gap Future GapDocumento2 páginasThis Is A Sample Text. Enter Your Text Here: Current Gap Future GapNeeraj VashishtAún no hay calificaciones

- Individual Paper Income Tax Return 2016Documento39 páginasIndividual Paper Income Tax Return 2016aarizahmadAún no hay calificaciones

- Reliance Total Investment Plan Series Sales Pitch and Competitor ComparisonDocumento15 páginasReliance Total Investment Plan Series Sales Pitch and Competitor Comparisonmahendrak100% (2)

- Sample Payroll System Codes Via Visual Fox ProDocumento6 páginasSample Payroll System Codes Via Visual Fox ProDiana Hermida100% (1)

- AT&T World's Largest Telecom CompanyDocumento3 páginasAT&T World's Largest Telecom CompanyPalos DoseAún no hay calificaciones

- IEQP-03-F07 Job Offer Letter-215 For BimanDocumento3 páginasIEQP-03-F07 Job Offer Letter-215 For BimanLion TigerAún no hay calificaciones

- Tor For Design Development and Maintenance of Intranet For Un in IndiaDocumento5 páginasTor For Design Development and Maintenance of Intranet For Un in Indiadaprc100% (1)

- Fillable Resume TemplateDocumento1 páginaFillable Resume TemplatepitherstaranAún no hay calificaciones

- GST PlatformDocumento8 páginasGST PlatformsagarAún no hay calificaciones

- Travel Itinerary: Departing FlightDocumento3 páginasTravel Itinerary: Departing FlightAnh Ha ThaoAún no hay calificaciones

- Sample QuotationDocumento1 páginaSample QuotationxincubeAún no hay calificaciones

- The Chairperson Bids and Awards Committee Depertment of Education Reional Office No. 5 Directors Conference Room, DEPED ROV, Rawis, Legazpi CityDocumento9 páginasThe Chairperson Bids and Awards Committee Depertment of Education Reional Office No. 5 Directors Conference Room, DEPED ROV, Rawis, Legazpi CityAnonymous GYG8WaiTJ0% (1)

- WAG BID Proposal 2009Documento12 páginasWAG BID Proposal 2009Tri H HarinantoAún no hay calificaciones

- Bpo AgreementDocumento19 páginasBpo AgreementAnkur NigamAún no hay calificaciones

- Business Startup Costs TemplateDocumento12 páginasBusiness Startup Costs TemplatezappyzaAún no hay calificaciones

- Layoff LetterDocumento1 páginaLayoff LetterLe Huyen TramAún no hay calificaciones

- Rent Receipt: One Thousand Two Hundred Thirty-Four and 56/100 DollarsDocumento5 páginasRent Receipt: One Thousand Two Hundred Thirty-Four and 56/100 DollarsSuresh DevarajanAún no hay calificaciones

- Tender Application Submission Stark IndustriesDocumento15 páginasTender Application Submission Stark Industriesapi-355627007Aún no hay calificaciones

- E-Commerce Agreement - GSI Commerce Solutions Inc. and Palm IncDocumento25 páginasE-Commerce Agreement - GSI Commerce Solutions Inc. and Palm IncBIPINAún no hay calificaciones

- Payroll: Assessment QuestionsDocumento30 páginasPayroll: Assessment QuestionsdanielAún no hay calificaciones

- Mainframe Automation PDFDocumento5 páginasMainframe Automation PDFVivek Reddy DevagudiAún no hay calificaciones

- Expense Claim: Personal Information Contact Number PIN Cost CentreDocumento3 páginasExpense Claim: Personal Information Contact Number PIN Cost CentreMansiAroraAún no hay calificaciones

- Contract Agreement 2023Documento6 páginasContract Agreement 2023kashifAún no hay calificaciones

- Guide to Writing Effective RFPsDocumento5 páginasGuide to Writing Effective RFPsFredrick Ombako100% (1)

- Why CleartaxDocumento4 páginasWhy Cleartaxrsood6Aún no hay calificaciones

- Responce To RFPDocumento25 páginasResponce To RFPAnuj Iwarkar100% (1)

- Xcel Cover Letter To Boulder Requirements RFP ResponseDocumento3 páginasXcel Cover Letter To Boulder Requirements RFP ResponseMatt SebastianAún no hay calificaciones

- Free Square Milestones Timeline Template: Step 01Documento9 páginasFree Square Milestones Timeline Template: Step 01Amarildo CésarAún no hay calificaciones

- Mahkota PowerPoint TemplateDocumento46 páginasMahkota PowerPoint TemplateMuhamed IslamovićAún no hay calificaciones

- Agency Budget TemplateDocumento7 páginasAgency Budget TemplateJohn ZappeAún no hay calificaciones

- Terms and ConditionsDocumento10 páginasTerms and ConditionsJAún no hay calificaciones

- Employment Agency by SlidesgoDocumento44 páginasEmployment Agency by SlidesgoDayanara Medina AldazAún no hay calificaciones

- Quotation TemplateDocumento1 páginaQuotation TemplatexincubeAún no hay calificaciones

- FinalResponsewithRevisedRFP D81df17e C6a3 4434 9ff6 73cfd44ed7de SP PURCHASEDocumento178 páginasFinalResponsewithRevisedRFP D81df17e C6a3 4434 9ff6 73cfd44ed7de SP PURCHASEOOOJJJAAASSSAún no hay calificaciones

- Salary Payment Voucher FormatDocumento1 páginaSalary Payment Voucher FormatHashit Dholakia100% (1)

- Spectra Net 2Documento4 páginasSpectra Net 2nitinAún no hay calificaciones

- Https Dmierpext - Dmi.ae OA HTML Pyshpslp - JSP DbcName PROD&p Output Apps01 Oracle PROD Apps Apps ST Comn Webapps Oacore HTML FWK T Pay Slip 33971071Documento1 páginaHttps Dmierpext - Dmi.ae OA HTML Pyshpslp - JSP DbcName PROD&p Output Apps01 Oracle PROD Apps Apps ST Comn Webapps Oacore HTML FWK T Pay Slip 33971071المخرج علي الحماديAún no hay calificaciones

- Deloitte Application Form - Graduate Recruitment 2013Documento3 páginasDeloitte Application Form - Graduate Recruitment 2013Jill HoangAún no hay calificaciones

- Direct Deposit Authorization Form1Documento1 páginaDirect Deposit Authorization Form1utahlegalservicesAún no hay calificaciones

- Form12 PDFDocumento16 páginasForm12 PDFAsder DareAún no hay calificaciones

- How To Fill-Out BIR Form 1905Documento11 páginasHow To Fill-Out BIR Form 1905Jhon Michael VillafloresAún no hay calificaciones

- Tin IndividualDocumento60 páginasTin IndividualrajdeeppawarAún no hay calificaciones

- Form 11: Tax Return and Self-Assessment For The Year 2014Documento32 páginasForm 11: Tax Return and Self-Assessment For The Year 2014garyjenkins82Aún no hay calificaciones

- Heinle Samples 13Documento7 páginasHeinle Samples 13RoulaBeblidakiAún no hay calificaciones

- Cyprus Inventory November 2011Documento149 páginasCyprus Inventory November 2011RoulaBeblidakiAún no hay calificaciones

- Vocabulary: Name: Date: Mark: / 40 MarksDocumento2 páginasVocabulary: Name: Date: Mark: / 40 MarksRoulaBeblidakiAún no hay calificaciones

- Secta Institute LTD 1804S017 Account Pearson Pearson SupplierDocumento1 páginaSecta Institute LTD 1804S017 Account Pearson Pearson SupplierRoulaBeblidakiAún no hay calificaciones

- Ευρωγνωση Ιδαλιου 1802E170 Account Pearson Pearson SupplierDocumento1 páginaΕυρωγνωση Ιδαλιου 1802E170 Account Pearson Pearson SupplierRoulaBeblidakiAún no hay calificaciones

- How Video Games Impact KidsDocumento1 páginaHow Video Games Impact KidsRoulaBeblidakiAún no hay calificaciones

- Kie ListDocumento2 páginasKie ListRoulaBeblidakiAún no hay calificaciones

- Premier 2014Documento2 páginasPremier 2014RoulaBeblidakiAún no hay calificaciones

- Potato gratin with zucchini and mushroom saladDocumento2 páginasPotato gratin with zucchini and mushroom saladRoulaBeblidakiAún no hay calificaciones

- Family Tree 06Documento1 páginaFamily Tree 06RoulaBeblidakiAún no hay calificaciones

- Preliminary 1994 Paper ADocumento2 páginasPreliminary 1994 Paper ARoulaBeblidakiAún no hay calificaciones

- Sammy and Kite Lesson PlansDocumento59 páginasSammy and Kite Lesson PlansRoulaBeblidakiAún no hay calificaciones

- Cosmic and MyCosmicLab Presentation For Cyprus PART 1Documento11 páginasCosmic and MyCosmicLab Presentation For Cyprus PART 1RoulaBeblidaki100% (1)

- KMC Property Tax FormDocumento13 páginasKMC Property Tax FormbitunmouAún no hay calificaciones

- Spar R61.16Documento1 páginaSpar R61.16Karen PillayAún no hay calificaciones

- PCU Capstone Project Analyzes Demand for Job Order Contact Tracers at BIRDocumento3 páginasPCU Capstone Project Analyzes Demand for Job Order Contact Tracers at BIRdaniela riveraAún no hay calificaciones

- Nism Series 8 Pay SlipDocumento2 páginasNism Series 8 Pay SlipHritik SharmaAún no hay calificaciones

- RMC No. 73-2018Documento3 páginasRMC No. 73-2018Madi KomoaAún no hay calificaciones

- Financial Services: An OverviewDocumento13 páginasFinancial Services: An OverviewKarthick KumarAún no hay calificaciones

- Report On NSC 2019Documento10 páginasReport On NSC 2019Viper VenomAún no hay calificaciones

- Plan Fiscal Del CRIMDocumento34 páginasPlan Fiscal Del CRIMEl Nuevo DíaAún no hay calificaciones

- Chapter 13 - ADocumento3 páginasChapter 13 - ARena Jocelle NalzaroAún no hay calificaciones

- Bookkeeping Course Syllabus - SDPDFDocumento0 páginasBookkeeping Course Syllabus - SDPDFjasonmendez2010Aún no hay calificaciones

- Commissioner of Internal Revenue v. Procter and Gamble G.R. L-66838Documento11 páginasCommissioner of Internal Revenue v. Procter and Gamble G.R. L-66838Dino Bernard LapitanAún no hay calificaciones

- Micro 2013 ZA QPDocumento8 páginasMicro 2013 ZA QPSathis JayasuriyaAún no hay calificaciones

- Municipal bond yieldsDocumento2 páginasMunicipal bond yieldsDaniyal AliAún no hay calificaciones

- STF 2023-03-20 1679339081483Documento4 páginasSTF 2023-03-20 1679339081483ayogboloAún no hay calificaciones

- G.R. No. L-19727Documento14 páginasG.R. No. L-19727Amicus CuriaeAún no hay calificaciones

- Let NDocumento3 páginasLet NEllen Mae OlaguerAún no hay calificaciones

- Aircraft Purchase AgreementDocumento82 páginasAircraft Purchase AgreementKnowledge GuruAún no hay calificaciones

- Andrew Bradley, Positive Rights, Negative Rights and Health CareDocumento5 páginasAndrew Bradley, Positive Rights, Negative Rights and Health CareBonAún no hay calificaciones

- Accounting for Inventory Valuation Methods Research ProposalDocumento66 páginasAccounting for Inventory Valuation Methods Research ProposalAyman Ahmed Cheema100% (1)

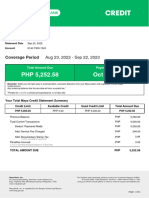

- MayaCredit SoA 2023SEPDocumento3 páginasMayaCredit SoA 2023SEPjepoy palaruanAún no hay calificaciones

- Infrastructure Development Plan for Chhattisgarh - Road Project Viability OptionsDocumento3 páginasInfrastructure Development Plan for Chhattisgarh - Road Project Viability Optionsjavedarzoo50% (2)

- Business Project Report Template Eng 351 RepairedDocumento57 páginasBusiness Project Report Template Eng 351 RepairedVathana SorAún no hay calificaciones

- Group 6 - AirBnB UK - PESTELDocumento15 páginasGroup 6 - AirBnB UK - PESTELJames SheikhAún no hay calificaciones

- Invoice TemplateDocumento9 páginasInvoice Templaten100% (1)

- Ind As 12Documento74 páginasInd As 12Akhil AkhyAún no hay calificaciones

- Soudamini Resume 1Documento2 páginasSoudamini Resume 1Soudamini MohapatraAún no hay calificaciones

- JD Edwards EnterpriseOne Applications 1099 Year-End Processing Guide 2013Documento148 páginasJD Edwards EnterpriseOne Applications 1099 Year-End Processing Guide 2013Sivakumar VellakkalpattiAún no hay calificaciones

- Refunds: Chapter - 19Documento28 páginasRefunds: Chapter - 19Ashma KhanalAún no hay calificaciones

- OD126087849924560000Documento1 páginaOD126087849924560000pugazhAún no hay calificaciones

- CHAPTER 13 A - Regular Allowable Itemized DeductionsDocumento4 páginasCHAPTER 13 A - Regular Allowable Itemized DeductionsDeviane CalabriaAún no hay calificaciones