Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Account Determination MM en US

Cargado por

Jiny ThakrarTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Account Determination MM en US

Cargado por

Jiny ThakrarCopyright:

Formatos disponibles

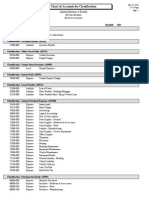

Account-Determination - Fabricated Metals US

Balance Sheet Accounts Listing of accounts depending on valuation class used by Baseline scenarios Profit & Loss Accounts Listing of accounts depending on valuation class used by Baseline scenarios Accounts OBYC Download of content of table T030 (with general modification as used by Baseline) Material Type Material types use by Baseline Valuation Class Valutation Classes used by Baseline General Settings Gerneral customizing settings concerning MM-Account-Determination Transaction Explanation of transaction keys of MM account posting FI Account Determination Tables T030(x)s and T001U contain entries to determine the financial and intercompany transactions, respectively FI Special GL List of all Special GL Fi Tax Accounts FI Tax Accounts Assets (AO90) Asset Account Determination CO (OKB9) Default Cost Center Assignment Auto SD (VKOA) Account Assignment for SD HCM HR Account Determination

ons, respectively

Account Determination MM

Fabricated Metals U

Transaction Key General Modification Debit / Credit * ROH ROH ROH HIBE HIBE ERSA LEIH HAWA DIEN DIEN HALB FERT * Raw materials 1 Raw materials 2 Raw materials DM 249 Operating supplies Operating supplies 2 Spare parts Packaging and empties Trading goods Services Services Semifinished products Finished products * 0001 0001 0001 0002 0002 0003 0004 0005 0006 0006 0008 0009 "blank" 3000 3001 YD30 3030 3031 3040 3050 3100 3200 YS01 7900 7920

Valuation Class

Acct Category Reference

Material Type

Material Type Description

D/C

Transaction Key General Modification Debit / Credit * ROH * Raw materials 1 * 0001 "blank" 3000

Valuation Class

Acct Category Reference

Material Type

Material Type Description

DEL D/C

Del credere

Agency business: income AG1

ROH ROH HIBE HIBE ERSA LEIH HAWA DIEN DIEN HALB FERT

Raw materials 2 Raw materials DM 249 Operating supplies Operating supplies 2 Spare parts Packaging and empties Trading goods Services Services Semifinished products Finished products

0001 0001 0002 0002 0003 0004 0005 0006 0006 0008 0009

3001 YD30 3030 3031 3040 3050 3100 3200 YS01 7900 7920

Acct Category Reference

Transaction Key General Modification Debit / Credit * ROH ROH ROH HIBE HIBE ERSA LEIH HAWA DIEN DIEN HALB FERT * * Raw materials 1 Raw materials 2 Raw materials DM 249 Operating supplies Operating supplies 2 Spare parts Packaging and empties Trading goods Services Services Semifinished products Finished products * * * 0001 0001 0001 0002 0002 0003 0004 0005 0006 0006 0008 0009 "blank" 3000 3001 YD30 3030 3031 3040 3050 3100 3200 YS01 7900 7920 PRA

Valuation Class/General Modifier

Material Type

Material Type Description

KON D/C 211100

Consignment liabilities

PRF

Transaction Key General Modification Debit / Credit * ROH ROH ROH HIBE HIBE ERSA LEIH HAWA DIEN DIEN HALB FERT * Raw materials 1 Raw materials 2 Raw materials DM 249 Operating supplies Operating supplies 2 Spare parts Packaging and empties Trading goods Services Services Semifinished products Finished products * 0001 0001 0001 0002 0002 0003 0004 0005 0006 0006 0008 0009 "blank" 3000 3001 YD30 3030 3031 3040 3050 3100 3200 YS01 7900 7920

Valuation Class

Acct Category Reference

Material Type

Material Type Description

D/C

530000 / 530000 530000 / 530000

530000 / 530000 530000 / 530000 530000 / 530000 530000 / 530000 530000 / 530000

530000 / 530000 530000 / 530000

Price differences for material ledger PRY

Account Determination MM / Template Baseline <--> used transactions <-> V1.604 Fabricated Metals US / Chart of Account 0010 / Company Code 1000 BALANCE SHEET ACCOUNTS

Expense/revenue from consumption of consignment material

Expenditure/income from transfer posting

AG2 D/C

AG3 D/C

AKO D/C

AUM D/C

530000 / 530000 530000 / 530000

520020 /520020 520020 /520020

530000 / 530000 530000 / 530000 530000 / 530000 530000 / 530000 530000 / 530000

520020 /520020 520020 /520020 520020 /520020 520020 /520020 520020 /520020

530000 / 530000 530000 / 530000

520020 /520020 520020 /520020

Small differences, Materials Management

customs duty clearing

provision for freight charges

DIF D/C 530030 / 530030

FR1 D/C 217300 / 217300

FR2 D/C 217300 / 217300

FR3/FR4 D/C 217400 / 217400

FRL D/C 650085 /650085

External service

Freight clearing

Provisions for subsequent (end-ofperiod rebate) settlement BO1 D/C 217700

Agency business: turnover

Agency business: expense

KTR LKW PRC PRD Price differences Differences (AVR Price) Accruals and deferrals account (material ledger)

D/C D/C D/C D/C

Offsetting entry for price differences in cost object hierarchies

530000 / 530000 PRG D/C 520020 / 520020

530000 / 530000

Price Differences (Material Ledger, AVR)

530050 / 530050

Revenue/expense from revaluation

RKA D/C 213500

RUE D/C 217300

UMB D/C

UPF D/C

VST G1 D/C

520000 / 520000 520000 / 520000

520000 / 520000 520000 / 520000 520000 / 520000 520000 / 520000 520000 / 520000

520000 / 520000 520000 / 520000

Input tax, Purchasing

Provision for delivery costs

Invoice reductions in Logistics Invoice Verification

Unplanned delivery costs

Income from subsequent settlement after actual settlement

Income from subsequent settlemen

Change in stock

BO2 D/C 700050

BO3 D/C 530000

BSV D/C

BSX D/C

520085/520085 520085/520085

131000 / 131000 131000 / 131000 131000 / 131000

520085/520085 520085/520085 520085/520085 520085/520085 520085/520085

131000 / 131000 131000 / 131000 131000 / 131000 135030 / 135030 135075 / 135075

520085/520085 520085/520085

133000 / 133000 134000 / 134000

FRN D/C 650085 /650085

KDM D/C 700400 / 700400

KDR D/C 700400 / 700400

Exchange Rate Differences from Lower Levels KDV D/C

Exchange rate differences in the case of open items

Differences due to exchange rate rounding, Materials Management

External service, delivery costs

Stock posting

PRK PRP Price differences, product cost collector

D/C Price differences in cost object hierarchies D/C PRQ D/C PRV Price Differences from Lower Levels Offsetting entry: price differences, product cost collector 530050 / 530050

WRX GR/IR clearing

D/C WRY D/C GR/IR clearing for material ledger

211200

Account Determination MM

Fabricated Metals U

Transaction Key General Modification Movement Type Debit / Credit * ROH ROH ROH HIBE HIBE ERSA LEIH HAWA DIEN DIEN HALB FERT * Raw materials 1 Raw materials 2 Raw materials DM 249 Operating supplies Operating supplies 2 Spare parts Packaging and empties Trading goods Services Services Semifinished products Finished products * 0001 0001 0001 0002 0002 0003 0004 0005 0006 0006 0008 0009 "blank" 3000 3001 YD30 3030 3031 3040 3050 3100 3200 YS01 7900 7920

Valuation Class

Acct Category Reference

Material Type

Material Type Description

GBB

D/C

Transaction Key General Modification Movement Type Debit / Credit * * * "blank"

Valuation Class

Acct Category Reference

Material Type

Material Type Description

sales order account assignment (for example, for individual purchase order) GBB VKA 231 D/C

ROH ROH ROH HIBE HIBE ERSA LEIH HAWA DIEN DIEN HALB FERT

Raw materials 1 Raw materials 2 Raw materials DM 249 Operating supplies Operating supplies 2 Spare parts Packaging and empties Trading goods Services Services Semifinished products Finished products

0001 0001 0001 0002 0002 0003 0004 0005 0006 0006 0008 0009

3000 3001 YD30 3030 3031 3040 3050 3100 3200 YS01 7900 7920

510000 / 510000 510000 / 510000

510000 / 510000 510000 / 510000 510006 / 510006 510005 / 510005 510080 / 510080

510010 / 510010 510020 / 510020

Account Determination MM / Template Baseline <--> used transactions <-> V1.604 Fabricated Metals US / Chart of Account 0010 / Company Code 1000 PROFIT & LOSS ACCOUNTS

goods receipts orders (without account assignment) and order settlement if AUA is not maintained

GBB AUA D/C

GBB AUF 101 D/C

GBB BSA 561 D/C

GBB INV 701 D/C

510000

399110 399110 399110 399110 399110

520010 / 520010 520010 / 520010 520010 / 520010 520010 / 520010 520010 / 520010 520010 / 520010 520010 / 520010 520010 / 520010

500000 / 500000 500000 / 500000

500000 / 500000 500000 / 500000 500000 / 500000 500000 / 500000 500000 / 500000

510006

399110 399110 399175

610010 / 610010 520110 520110 520100 520100 399130 399140 520010 / 520010 520010 / 520010 500000 / 500000 500000 / 500000

GBB VNG 551 D/C

GBB ZNG 951 D/C

GBB VQP 331 D/C

GBB VQY 331 D/C

GBB ZOB 501 D/C

goods receipts without purchase orders

scrapping/destruction

scrapping/destruction (customer movement type)

sample withdrawals without account assignment

sample withdrawals with account assignment

goods issues for sales orders without account assignment object (the account is not a cost element) GBB VAX 601 D/C

expenditure/income from inventory differences

initial entry of stock balances

order settlement

520060 / 520060 520060 / 520060

510090 / 510090 510090 / 510090

520040 / 520040 520040 / 520040

520040 / 520040 520040 / 520040

520075 / 520075 520075 / 520075

520060 / 520060 520060 / 520060 520060 / 520060 520060 / 520060 520060 / 520060

510090 / 510090 510090 / 510090 510090 / 510090 510090 / 510090 510090 / 510090

520040 / 520040 520040 / 520040 520040 / 520040 520040 / 520040 520040 / 520040

520040 / 520040 520040 / 520040 520040 / 520040 520040 / 520040 520040 / 520040

520075 / 520075 520075 / 520075 520075 / 520075 520075 / 520075 520075 / 520075

520060 / 520060 520060 / 520060

510090 / 510090 510090 / 510090

520040 / 520040 520040 / 520040

520040 / 520040 520040 / 520040

520075 / 520075 520075 / 520075

goods issues for sales orders with account assignment object (account is a cost element)

internal goods issues (for example, for cost center)

GBB VAY 601 D/C

GBB VBO 543/545 D/C

GBB VBR 201/261 D/C 510000

510000 / 510000 510000 / 510000

510085 / 510085 510085 / 510085 510086 / 510086

510000 / 510000 510000 / 510000 510000 / 510000 510000 / 510000 510000 / 510000 510006 / 510006 510005 / 510005 510080 / 510080 610010 / 610010 610010 / 610010

650005 / 650005 650005 / 650005

510000 / 510000 510000 / 510000 510000 / 510000 510005 / 510005 510080 / 510080 610010 / 610010

510085 / 510085 510085 / 510085 510085 / 510085 510085 / 510085 510085 / 510085

650005 / 650005 650005 / 650005 650005 / 650005 650005 / 650005 650005 / 650005

510010 / 510010 510020 / 510020

510085 / 510085 510085 / 510085

510010 / 510010 510020 / 510020

650005 / 650005 650005 / 650005

GBB ZOF 521/531 D/C

goods receipts without production orders

internal goods issues (for example, for cost center) (customer movement type) GBB ZBR 961 D/C

consumption from stock of material provided to vendor

520076 / 520076

520076 / 520076 520076 / 520076

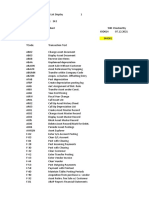

Chart of Accounts 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010

Account key AKO AKO AKO AKO AKO AKO AKO AKO AKO AUM AUM AUM AUM AUM AUM AUM AUM AUM BO1 BO2 BO3 BSV BSV BSV BSV BSV BSV BSV BSV BSV BSX BSX BSX BSX BSX BSX BSX BSX BSX BSX DIF EIN EIN EIN EIN EIN EIN EIN EKG

Valuation Group 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001

General Modifier

0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001

0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010

EKG EKG EKG EKG EKG EKG FR1 FR2 FR3 FR4 FRE FRL FRN GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB

0001 0001 0001 0001 0001 0001

0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001

AUA AUA AUF AUF AUF AUF BSA BSA BSA BSA BSA BSA BSA BSA BSA BSA INV INV INV INV INV INV INV INV INV INV VAX VAX VAX VAX VAX VAX VAX VAX VAX VAX VAY VAY

0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010

GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB

0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001

VAY VAY VAY VAY VAY VAY VAY VAY VBO VBO VBO VBO VBO VBO VBO VBO VBO VBO VBR VBR VBR VBR VBR VBR VBR VBR VBR VBR VBR VBR VBR VKA VKA VKA VKA VKA VKA VKA VKA VKA VNG VNG VNG VNG VNG VNG VNG VNG VNG VQP VQP

0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010

GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB GBB KDM KDR KON PRD PRD

0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001 0001

VQP VQP VQP VQP VQP VQP VQP VQY VQY VQY VQY VQY VQY VQY VQY VQY ZBR ZBR ZBR ZBR ZBR ZBR ZBR ZBR ZBR ZNG ZNG ZNG ZNG ZNG ZNG ZNG ZNG ZNG ZOB ZOB ZOB ZOB ZOB ZOB ZOB ZOB ZOB ZOF ZOF ZOF

PRA

PRD PRG PRP PRY PRY PRY PRY PRY PRY PRY PRY PRY RAP RKA RUE UMB UMB UMB UMB UMB UMB UMB UMB UMB

PRF

0001 0001 0001 0001 0001 0001 0001 0001 0001 0001

0001 0001 0001 0001 0001 0001 0001 0001 0001

Valuation Class Account 3000 3001 3030 3031 3040 3050 3100 7900 7920 3000 3001 3030 3031 3040 3050 3100 7900 7920

Account 530000 530000 530000 530000 530000 530000 530000 530000 530000 520020 520020 520020 520020 520020 520020 520020 520020 520020 217700 700050 530000 520085 520085 520085 520085 520085 520085 520085 520085 520085 131000 131000 131000 131000 131000 135030 135075 133000 134000 131000 530030 530000 530000 530000 530000 530000 530000 530000 530000 530000 520020 520020 520020 520020 520020 520020 520020 520020 520020 217700 700050 530000 520085 520085 520085 520085 520085 520085 520085 520085 520085 131000 131000 131000 131000 131000 135030 135075 133000 134000 131000 530030

3000 3001 3030 3031 3040 3050 3100 7900 7920 3000 3001 3030 3031 3040 3050 3100 7900 7920 YD30 3000 3001 3030 3031 3040 3050 3100 3000

3001 3030 3031 3040 3050 3100 217300 217300 217400 217400 650085 650085 520110 520110 510000 510006 520100 520100 399110 399110 399110 399110 399110 399110 399175 399130 399140 399110 520010 520010 520010 520010 520010 520010 520010 520010 520010 520010 500000 500000 500000 500000 500000 500000 500000 500000 500000 610010 510000 510000 217300 217300 217400 217400 650085 650085 520110 520110 510000 510006 520100 520100 399110 399110 399110 399110 399110 399110 399175 399130 399140 399110 520010 520010 520010 520010 520010 520010 520010 520010 520010 520010 500000 500000 500000 500000 500000 500000 500000 500000 500000 610010 510000 510000

7900 7920 3000 3040 7900 7920 3000 3001 3030 3031 3040 3050 3100 7900 7920 YD30 3000 3001 3030 3031 3040 3050 3100 7900 7920 7920 3000 3001 3030 3031 3040 3050 3100 7900 7920 YS01 3000 3001

3030 3031 3040 3050 3100 3200 7900 7920 3000 3001 3030 3031 3040 3050 3100 7900 7920 YD30 3000 3001 3030 3031 3040 3050 3100 3200 7900 7920 YD30 YS01 3000 3001 3030 3031 3040 3050 3100 7900 7920 3000 3001 3030 3031 3040 3050 3100 7900 7920 3000 3001

510000 510000 510000 510005 510080 610010 510010 510020 510085 510085 510085 510085 510085 510085 510085 510085 510085 510086 510000 510000 510000 510000 510000 510006 510005 510080 610010 510010 510020 510000 610010 510000 510000 510000 510000 510006 510005 510080 510010 510020 520060 520060 520060 520060 520060 520060 520060 520060 520060 520040 520040

510000 510000 510000 510005 510080 610010 510010 510020 510085 510085 510085 510085 510085 510085 510085 510085 510085 510086 510000 510000 510000 510000 510000 510006 510005 510080 610010 510010 510020 510000 610010 510000 510000 510000 510000 510006 510005 510080 510010 510020 520060 520060 520060 520060 520060 520060 520060 520060 520060 520040 520040

3030 3031 3040 3050 3100 7900 7920 3000 3001 3030 3031 3040 3050 3100 7900 7920 3000 3001 3030 3031 3040 3050 3100 7900 7920 3000 3001 3030 3031 3040 3050 3100 7900 7920 3000 3001 3030 3031 3040 3050 3100 7900 7920 3050 7900 7920

520040 520040 520040 520040 520040 520040 520040 520040 520040 520040 520040 520040 520040 520040 520040 520040 650005 650005 650005 650005 650005 650005 650005 650005 650005 510090 510090 510090 510090 510090 510090 510090 510090 510090 520075 520075 520075 520075 520075 520075 520075 520075 520075 520076 520076 520076 700400 700400 211100 530000 530000

520040 520040 520040 520040 520040 520040 520040 520040 520040 520040 520040 520040 520040 520040 520040 520040 650005 650005 650005 650005 650005 650005 650005 650005 650005 510090 510090 510090 510090 510090 510090 510090 510090 510090 520075 520075 520075 520075 520075 520075 520075 520075 520075 520076 520076 520076 700400 700400 211100 530000 530000

3000 3001 3030 3031 3040 3050 3100 7900 7920

3000 3001 3030 3031 3040 3050 3100 7900 7920

530050 520020 530050 530000 530000 530000 530000 530000 530000 530000 530000 530000 530000 213500 217300 520000 520000 520000 520000 520000 520000 520000 520000 520000

530050 520020 530050 530000 530000 530000 530000 530000 530000 530000 530000 530000 530000 213500 217300 520000 520000 520000 520000 520000 520000 520000 520000 520000

Note Expense/revenue from consign.mat.consum. Expense/revenue from consign.mat.consum. Expense/revenue from consign.mat.consum. Expense/revenue from consign.mat.consum. Expense/revenue from consign.mat.consum. Expense/revenue from consign.mat.consum. Expense/revenue from consign.mat.consum. Expense/revenue from consign.mat.consum. Expense/revenue from consign.mat.consum. Expense/revenue from stock transfer Expense/revenue from stock transfer Expense/revenue from stock transfer Expense/revenue from stock transfer Expense/revenue from stock transfer Expense/revenue from stock transfer Expense/revenue from stock transfer Expense/revenue from stock transfer Expense/revenue from stock transfer Rebates Rebates Rebates Change in stock account Change in stock account Change in stock account Change in stock account Change in stock account Change in stock account Change in stock account Change in stock account Change in stock account Inventory Posting Inventory Posting Inventory Posting Inventory Posting Inventory Posting Inventory Posting Inventory Posting Inventory Posting Inventory Posting Inventory Posting Materials management small differences Purchase account Purchase account Purchase account Purchase account Purchase account Purchase account Purchase account Purchase offsetting account

Purchase offsetting account Purchase offsetting account Purchase offsetting account Purchase offsetting account Purchase offsetting account Purchase offsetting account Freight clearing Freight provisions Customs clearing Customs provisions Purchasing freight account External activity Incidental costs of external activities Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting

Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting

Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Offsetting entry for inventory posting Materials management exch.rate diffs MM exchange rate rounding differences Consignment payables Cost (price) differences Cost (price) differences

Cost (price) differences Price Differences (Mat. Ledger, AVR) Product cost collector price differences Cost (price) differences (mater.ledger) Cost (price) differences (mater.ledger) Cost (price) differences (mater.ledger) Cost (price) differences (mater.ledger) Cost (price) differences (mater.ledger) Cost (price) differences (mater.ledger) Cost (price) differences (mater.ledger) Cost (price) differences (mater.ledger) Cost (price) differences (mater.ledger) Expense/revenue from revaluation Inv.reductions from log.inv.verification Neutral provisions Gain/loss from revaluation Gain/loss from revaluation Gain/loss from revaluation Gain/loss from revaluation Gain/loss from revaluation Gain/loss from revaluation Gain/loss from revaluation Gain/loss from revaluation Gain/loss from revaluation

Material Type / Baseline US

Material Type ROH HIBE ERSA LEIH HAWA DIEN HALB FERT

Description Raw materials Operating supplies Spare Parts Returnable packaging Trading Goods Service Semifinished Product Finished Product

Acct cat. ref. 0001 0002 0003 0004 0005 0006 0008 0009

Description Reference for raw materials Ref. for operating supplies Reference for spare parts Reference for packaging Reference for trading goods Reference for services Ref. for semifinished products Ref. for finished products

Valuation Classes / Baseline US

Valuation Classes 3000 3001 YD30 3030 3031 3040 3050 3100 3200 YS01 7900 7920

Description Raw materials 1 Raw materials 2 Raw materials DM 249 Operating supplies Operating supplies 2 Spare parts Packaging and empties Trading goods Services Services Semifinished products Finished products

Acct cat. ref. 0001 0001 0001 0002 0002 0003 0004 0005 0006 0006 0008 0009

Description Reference for raw materials Reference for raw materials Reference for raw materials Ref. for operating supplies Ref. for operating supplies Reference for spare parts Reference for packaging Reference for trading goods Reference for services Reference for services Ref. for semifinished products Ref. for finished products

General Settings / Baseline US

Valuation area: Spit material valuation: Valuation grouping code: General modification GBB: General modification PRD: General modification KON: Chart of accounts:

plant not active active active active not active 10

Transactions Agency business: income (AG1)

Agency business: turnover (AG2)

Agency business: expense (AG3)

Expense/revenue from consumption of consignment material (AKO)

Expenditure/income from transfer posting (AUM)

Provisions for subsequent (end-of-period rebate) settlement (BO1)

Income from subsequent settlement (BO2) The rebate income generated in the course of "subsequent settlement" (end-of-period rebate settlement) is posted via this transaction. Income from subsequent settlement after actual settlement (BO3)

Supplementary entry for stock (BSD)

Change in stock (BSV)

Stock posting (BSX)

This transaction is used for all postings to stock accounts. Such postings are effected, for example: In inventory management in the case of goods receipts to own stock and goods issues from own stock

Caution Take care to ensure that: A stock account is not used for any transaction other than BSX Postings are not made to the account manually The account is not changed in the productive system before all stock has been booked out of it Otherwise differences would arise between the total stock value of the material master records and the balance on the stock account. Account determination of valuated sales order stock and project stock

Revaluation of other consumption (COC) This transaction/event key is required for the revaluation of consumption in Actual Costing/Material Ledger.

The header account is determined using the transaction/event key COC. Del credere (DEL)

Small differences, Materials Management (DIF)

Purchase account(EIN), purchase offsetting account (EKG), freight purchase account (FRE) These transactions are used only if Purchase Account Management is active in the company code. Note

Before you use this function, check whether you need to use it in your country.

Freight clearing (FR1), provision for freight charges (FR2), customs duty clearing (FR3), provision for customs duty (FR4)

You can also enter your own transactions for delivery costs in condition types. External service (FRL) The transaction is used for goods and invoice receipts in connection with subcontract orders.

External service, delivery costs (FRN) This transaction is used for delivery costs (incidental costs of procurement) in connection with subcontract orders.

Offsetting entry for stock posting (GBB)

AUA: for order settlement AUF: for goods receipts for orders (without account assignment) and for order settlement if AUA is not maintained AUI: Subsequent adjustment of actual price from cost center directly to material (with account assignment) BSA: for initial entry of stock balances INV: for expenditure/income from inventory differences VAX: for goods issues for sales orders without account assignment object (the account is not a cost element) VAY: for goods issues for sales orders with account assignment object (account is a cost element) VBO: for consumption from stock of material provided to vendor VBR: for internal goods issues (for example, for cost center) VKA: for sales order account assignment (for example, for individual purchase order) VKP: for project account assignment (for example, for individual PO) VNG: for scrapping/destruction VQP: for sample withdrawals without account assignment

VQY: for sample withdrawals with account assignment ZOB: for goods receipts without purchase orders (mvt type 501) ZOF: for goods receipts without production orders (mvt types 521 and 531)

Caution

Note that the goods movement is valuated with the valuation price of the material if no external amount has been entered.

Account determination of valuated sales order stock and project stock

Purchase order with account assignment (KBS)

Exchange Rate Differences Materials Management(AVR) (KDG)

Exchange rate differences in the case of open items (KDM)

Differences due to exchange rate rounding, Materials Management (KDR)

Exchange Rate Differences from Lower Levels (KDV)

Consignment liabilities (KON)

None for consignment liabilities PIP for pipeline liabilities Offsetting entry for price differences in cost object hierarchies (KTR)

Accruals and deferrals account (material ledger) (LKW)

Price Difference from Exploded WIP (Lar.) (PRA)

Differences (AVR Price) (PRC)

Price differences (PRD)

None for goods and invoice receipts against purchase orders PRF for goods receipts against production orders and order settlement PRA for goods issues and other movements PRU for transfer postings (price differences in the case of external amounts) Price Differences (Material Ledger, AVR) (PRG)

Price differences in cost object hierarchies (PRK)

Price Difference from Exploded WIP (Mat.) (PRM)

Price differences, product cost collector (PRP)

This transaction is currently used in the following instances only: Production cost collector in Release 4.0 Product cost collector in IS Automotive Release 2.0 (product cost collector in connection with APO) Offsetting entry: price differences, product cost collector (PRQ)

This transaction is currently used in the following instances only: Production cost collector in Release 4.0 Product cost collector in IS Automotive Release 2.0 (product cost collector in connection with APO) Price Differences from Lower Levels (PRV)

Price differences for material ledger (PRY) In the course of settlement in the material ledger, price differences from the material ledger are posted with the transaction PRY. Expense and revenue from revaluation (retroactive pricing, RAP)

Invoice reductions in Logistics Invoice Verification (RKA)

Provision for delivery costs (RUE)

Taxes in case of transfer posting GI/GR (TXO) This transaction/event key is only relevant to Brazil (nota fiscal). Revenue/expense from revaluation (UMB)

Expenditure/income from revaluation (UMD)

Unplanned delivery costs (UPF)

Input tax, Purchasing (VST)

Inflation posting (WGB) Transaction/event key that posts inflation postings to a different account, within the handling of inflation process for the period-end closing. Goods issue, revaluation (inflation) (WGI)

Goods receipt, revaluation (inflation) (WGR)

WIP from Price Differences (Internal Activity) (WPA)

WIP from Price Differences (Material) (WPM)

GR/IR clearing (WRX)

Caution

GR/IR clearing for material ledger (WRY) This transaction/event key is not used from Release 4.0 onwards.

Transactions Agency business: income (AG1) This transaction can be used in agency business for income deriving from commission (e.g. del credere commission). The account key is used in the calculation schemas for agency business to determine the associated revenue accounts. Agency business: turnover (AG2) This transaction can be used in agency business if turnover (business volume) postings are activated in Customizing for the payment types. The account key is specified in Customizing for the billing type. Agency business: expense (AG3) This transaction can be used in agency business for commission expenses. The account key is used in the calculation schemas for agency business to determine the associated expense accounts. Expense/revenue from consumption of consignment material (AKO) This transaction is used in Inventory Management in the case of withdrawals from consignment stock or when consignment stock is transferred to own stock if the material is subject to standard price control and the consignment price differs from the standard price. Expenditure/income from transfer posting (AUM) This transaction is used for transfer postings from one material to another if the complete value of the issuing material cannot be posted to the value of the receiving material. This applies both to materials with standard price control and to materials with moving average price control. Price differences can arise for materials with moving average price if stock levels are negative and the stock value becomes unrealistic as a result of the posting. Transaction AUM can be used irrespective of whether the transfer posting involves a transfer between plants. The expenditure/income is added to the receiving material. Provisions for subsequent (end-of-period rebate) settlement (BO1) If you use the "subsequent settlement" function with regard to conditions (e.g. for period-end volume-based rebates), provisions for accrued income are set up when goods receipts are recorded against purchase orders if this is defined for the condition type. Income from subsequent settlement (BO2) The rebate income generated in the course of "subsequent settlement" (end-of-period rebate settlement) is posted via this transaction. Income from subsequent settlement after actual settlement (BO3) If a goods receipt occurs after settlement accounting has been effected for a rebate arrangement, no further provisions for accrued rebate income can be managed by the "subsequent settlement" facility. No postings should be made to the account normally used for such provisions. As an alternative, you can use this transaction to post provisions for accrued rebate income to a separate account in cases such as the one described. Supplementary entry for stock (BSD) This account is posted when closing entries are made for a cumulation run. This account is a supplementary account to the stock account; that is, the stock account is added to it to determine the stock value that was calculated via the cumulation. In the process, the various valuation areas (for example, commercial, tax), that are used in the balance sheet are taxed separately. Change in stock (BSV) Changes in stocks are posted in Inventory Management at the time goods receipts are recorded or subsequent adjustments made with regard to subcontract orders. If the account assigned here is defined as a cost element, you must specify a preliminary account assignment for the account in the table of automatic account assignment specification (Customizing for Controlling) in order to be able to post goods receipts against subcontract orders. In the standard system, cost center SC-1 is defined for this purpose. Stock posting (BSX)

This transaction is used for all postings to stock accounts. Such postings are effected, for example: In inventory management in the case of goods receipts to own stock and goods issues from own stock In invoice verification, if price differences occur in connection with incoming invoices for materials valuated at moving average price and there is adequate stock coverage In order settlement, if the order is assigned to a material with moving average price and the actual costs at the time of settlement vary from the actual costs at the time of goods receipt Because this transaction is dependent on the valuation class, it is possible to manage materials with different valuation classes in separate stock accounts. Caution Take care to ensure that: A stock account is not used for any transaction other than BSX Postings are not made to the account manually The account is not changed in the productive system before all stock has been booked out of it Otherwise differences would arise between the total stock value of the material master records and the balance on the stock account. Account determination of valuated sales order stock and project stock Note that for valuated sales order stock and project stock (special stock E and Q) and for the transaction/event keys BSX and GBB, you must maintain an account determination to avoid receiving warning messages when entering data (purchase order or transfer posting) for valuated stock. During data entry, the system attempts to execute a provisional account determination for GBB for valuated stock. The system will only replace the provisional account determination for GBB with the correct account determination for the stock account (BSX), in the background, if you enter the data for valuated stock at a later point in time. Revaluation of other consumption (COC) This transaction/event key is required for the revaluation of consumption in Actual Costing/Material Ledger. Revaluation of consumption valuates single-level consumption using the actual prices determined in the Actual Costing/Material Ledger application. This revaluation can either take place in the account where the original postings were made, or in a header account. The header account is determined using the transaction/event key COC. Del credere (DEL) Transaction/event key for the payment/invoice list documents in Purchasing. The account key is needed in the calculation schema for payment/settlement processing to determine the associated revenue accounts. Small differences, Materials Management (DIF) This transaction is used in Invoice Verification if you define a tolerance for minor differences and the balance of an invoice does not exceed the tolerance. Purchase account(EIN), purchase offsetting account (EKG), freight purchase account (FRE) These transactions are used only if Purchase Account Management is active in the company code. Note Due to special legal requirements, this function was developed specially for certain countries (Belgium, Spain, Portugal, France, Italy, and Finland). Before you use this function, check whether you need to use it in your country.

Freight clearing (FR1), provision for freight charges (FR2), customs duty clearing (FR3), provision for customs duty (FR4) These transactions are used to post delivery costs (incidental procurement costs) in the case of goods receipts against purchase orders and incoming invoices. Which transaction is used for which delivery costs depends on the condition types defined in the purchase order. You can also enter your own transactions for delivery costs in condition types. External service (FRL) The transaction is used for goods and invoice receipts in connection with subcontract orders. If the account assigned here is defined as a cost element, you must specify a preliminary account assignment for the account in the table of automatic account assignment specification (Customizing for Controlling) in order to be able to post goods receipts against subcontract orders. In the standard system, cost center SC-1 is defined for this purpose. External service, delivery costs (FRN) This transaction is used for delivery costs (incidental costs of procurement) in connection with subcontract orders. If the account assigned here is defined as a cost element, you must specify a preliminary account assignment for the account in the table of automatic account assignment specification (Customizing for Controlling) in order to be able to post goods receipts against subcontract orders. In the standard system, cost center SC-1 is defined for this purpose. Offsetting entry for stock posting (GBB) Offsetting entries for stock postings are used in Inventory Management. They are dependent on the account grouping to which each movement type is assigned. The following account groupings are defined in the standard system: AUA: for order settlement AUF: for goods receipts for orders (without account assignment) and for order settlement if AUA is not maintained AUI: Subsequent adjustment of actual price from cost center directly to material (with account assignment) BSA: for initial entry of stock balances INV: for expenditure/income from inventory differences VAX: for goods issues for sales orders without account assignment object (the account is not a cost element) VAY: for goods issues for sales orders with account assignment object (account is a cost element) VBO: for consumption from stock of material provided to vendor VBR: for internal goods issues (for example, for cost center) VKA: for sales order account assignment (for example, for individual purchase order) VKP: for project account assignment (for example, for individual PO) VNG: for scrapping/destruction VQP: for sample withdrawals without account assignment

VQY: for sample withdrawals with account assignment ZOB: for goods receipts without purchase orders (mvt type 501) ZOF: for goods receipts without production orders (mvt types 521 and 531) You can also define your own account groupings. If you intend to post goods issues for cost centers (mvt type 201) and goods issues for orders (mvt type 261) to separate consumption accounts, you can assign the account grouping ZZZ to movement type 201 and account grouping YYY to movement type 261. Caution If you use goods receipts without a purchase order in your system (movement type 501), you have to check to which accounts the account groupings are assigned ZOB If you expect invoices for the goods receipts, and these invoices can only be posted in Accounting, you can enter a clearing account (similar to a GR/IR clearing account though without open item management), which is cleared in Accounting when you post the vendor invoice. Note that the goods movement is valuated with the valuation price of the material if no external amount has been entered. As no account assignment has been entered in the standard system, the assigned account is not defined as a cost element. If you assign a cost element, you have to enter an account assignment via the field selection or maintain an automatic account assignment for the cost element. Account determination of valuated sales order stock and project stock Note that for valuated sales order stock and project stock (special stock E and Q) and for the transaction/event keys BSX and GBB, you must maintain an account determination to avoid receiving warning messages when entering data (purchase order or transfer posting) for valuated stock. During data entry, the system attempts to execute a provisional account determination for GBB for valuated stock. The system will only replace the provisional account determination for GBB with the correct account determination for the stock account (BSX), in the background, if you enter the data for valuated stock at a later point in time. Purchase order with account assignment (KBS) You cannot assign this transaction/event key to an account. It means that the account assignment is adopted from the purchase order and is used for the purpose of determining the posting keys for the goods receipt. Exchange Rate Differences Materials Management(AVR) (KDG) When you carry out a revaluation of single-level consumption in the material ledger for an alternative valuation run, the exchange rate difference accounts of the materials are credited with the exchange rate differences that are to be assigned to the consumption. Exchange rate differences in the case of open items (KDM) Exchange rate differences in the case of open items arise when an invoice relating to a purchase order is posted with a different exchange rate to that of the goods receipt and the material cannot be debited or credited due to standard price control or stock undercoverage/shortage. Differences due to exchange rate rounding, Materials Management (KDR) An exchange rate rounding difference can arise in the case of an invoice made out in a foreign currency. If a difference arises when the posting lines are translated into local currency (as a result of rounding), the system automatically generates a posting line for this rounding difference. Exchange Rate Differences from Lower Levels (KDV) In multi-level periodic settlement in the material ledger, some of the exchange rate differences that have been posted during the period in respect of the raw materials, semifinished products and cost centers performing the activity used in the manufacture of a semifinished or finished product are debited or credited to that semifinished or finished product. Consignment liabilities (KON) Consignment liabilities arise in the case of withdrawals from consignment stock or from a pipeline or when consignment stock is transferred to own stock.

Depending on the settings for the posting rules for the transaction/event key KON, it is possible to work with or without account modification. If you work with account modification, the following modifications are available in the standard system: None for consignment liabilities PIP for pipeline liabilities Offsetting entry for price differences in cost object hierarchies (KTR) The contra entry for price difference postings (transaction PRK) arising through settlement via material account determination is carried out with transaction KTR. Accruals and deferrals account (material ledger) (LKW) If the process of material price determination in the material ledger is not accompanied by revaluation of closing stock, the price and exchange rate differences that should actually be applied to the stock value are contra-posted to accounts with the transaction/event key LKW. If, on the other hand, price determination in the material ledger is accompanied by revaluation of the closing stock, the price and exchange rate differences are posted to the stock account (i.e. the stock is revalued). Price Difference from Exploded WIP (Lar.) (PRA) If you use the WIP revaluation of the material ledger, the price variances of the exploded WIP stock of an activity type or a business process are posted to the price differences account with transaction/event key PRA. Differences (AVR Price) (PRC) In the alternative valuation run in the material ledger, some of the variances that accrue interest in the cost centers, are transfer posted to the semifinished or finished product. Price differences (PRD) Price differences arise for materials valuated at standard price in the case of all movements and invoices with a value that differs from the standard price. Examples: goods receipts against purchase orders (if the PO price differs from the standard pricedardpreis), goods issues in respect of which an external amount is entered, invoices (if the invoice price differs from the PO price and the standard price). Price differences can also arise in the case of materials with moving average price if there is not enough stock to cover the invoiced quantity. In the case of goods movements in the negative range, the moving average price is not changed. Instead, any price differences arising are posted to a price difference account. Depending on the settings for the posting rules for transaction/event key PRD, it is possible to work with or without account modification. If you use account modification, the following modifications are available in the standard system: None for goods and invoice receipts against purchase orders PRF for goods receipts against production orders and order settlement PRA for goods issues and other movements PRU for transfer postings (price differences in the case of external amounts) Price Differences (Material Ledger, AVR) (PRG) When you carry out a revaluation of single-level consumption in the material ledger during the alternative valuation run, the price difference accounts of the materials are credited with the price differences that are to be assigned to the consumption. Price differences in cost object hierarchies (PRK) In cost object hierarchies, price differences occur both for the assigned materials with standard price and for the accounts of the cost object hierarchy. In the course of settlement for cost object hierarchies after settlement via material account determination, the price differences are posted via the transaction PRK.

Price Difference from Exploded WIP (Mat.) (PRM) If you use the WIP revaluation of the material ledger, the price and exchange rate differences of the exploded WIP stock of a material are posted to the price difference account with transaction/event key PRM. Price differences, product cost collector (PRP) During settlement accounting with regard to a product cost collector in repetitive manufacturing, price differences are posted with the transaction PRP in the case of the valuated sales order stock. This transaction is currently used in the following instances only: Production cost collector in Release 4.0 Product cost collector in IS Automotive Release 2.0 (product cost collector in connection with APO) Offsetting entry: price differences, product cost collector (PRQ) The offsetting (contra) entry to price difference postings (transaction PRP) in the course of settlement accounting with respect to a product cost collector in repetitive manufacturing in the case of the valuated sales order stock is carried out via transaction PRQ. This transaction is currently used in the following instances only: Production cost collector in Release 4.0 Product cost collector in IS Automotive Release 2.0 (product cost collector in connection with APO) Price Differences from Lower Levels (PRV) In multi-level periodic settlement in the material ledger, some of the price differences posted during the period in respect of the raw materials, semifinished products, and cost centers performing the activity used in a semifinished or finished product, are transfer posted to that semifinished or finished product. Price differences for material ledger (PRY) In the course of settlement in the material ledger, price differences from the material ledger are posted with the transaction PRY. Expense and revenue from revaluation (retroactive pricing, RAP) This transaction/event key is used in Invoice Verification within the framework of the revaluation of goods and services supplied for which settlement has already taken place. Any difference amounts determined are posted to the accounts assigned to the transaction/event key RAP (retroactive pricing) as expense or revenue. At the time of the revaluation, the amounts determined or portions thereof) are posted neither to material stock accounts nor to price difference accounts. The full amount is always posted to the "Expense from Revaluation" or "Revenue from Revaluation" account. The offsetting (contra) entry is made to the relevant vendor account. Invoice reductions in Logistics Invoice Verification (RKA) This transaction/event key is used in Logistics Invoice Verification for the interim posting of price differences in the case of invoice reductions. If a vendor invoice is reduced, two accounting documents are automatically created for the invoice document. With the first accounting document, the amount invoiced is posted in the vendor line. An additional line is generated on the invoice reduction account to partially offset this amount. With the second accounting document, the invoice reduction is posted in the form of a credit memo from the vendor. The offsetting entry to the vendor line is the invoice reduction account. Hence the invoice reduction account is always balanced off by two accounting documents within one transaction. Provision for delivery costs (RUE) Provisions are created for accrued delivery costs if a condition type for provisions is entered in the purchase order. They must be cleared manually at the time of invoice verification.

Taxes in case of transfer posting GI/GR (TXO) This transaction/event key is only relevant to Brazil (nota fiscal). Revenue/expense from revaluation (UMB) This transaction/event key is used both in Inventory Management and in Invoice Verification if the standard price of a material has been changed and a movement or an invoice is posted to the previous period (at the previous price). Expenditure/income from revaluation (UMD) This account is the offsetting account for the BSD account. It is posted during the closing entries for the cumulation run of the material ledger and has to be defined for the same valuation areas. Unplanned delivery costs (UPF) Unplanned delivery costs are delivery costs (incidental procurement costs) that were not planned in a purchase order (e.g. freight, customs duty). In the SAP posting transaction in Logistics Invoice Verification, instead of distributing these unplanned delivery costs among all invoice items as hitherto, you have the option of posting them to a special account. A separate tax code can be used for this account. Input tax, Purchasing (VST) Transaction/event key for tax account determination within the "subsequent settlement" facility for debit-side settlement types. The key is needed in the settlement schema for tax conditions. Inflation posting (WGB) Transaction/event key that posts inflation postings to a different account, within the handling of inflation process for the period-end closing. Goods issue, revaluation (inflation) (WGI) This transaction/event key is used if already-posted goods issues have to be revaluated following the determination of a new market price within the framework of inflation handling. Goods receipt, revaluation (inflation) (WGR) This transaction/event key is used if already-effected transfer postings have to be revaluated following the determination of a new market price within the framework of inflation handling. This transaction is used for the receiving plant, whereas transaction WGI (goods receipt, revaluation (inflation)) is used for the plant at which the goods are issued. WIP from Price Differences (Internal Activity) (WPA) When you use the WIP revaluation of the material ledger, the price variances from the actual price calculation that are to be assigned to the WIP stock, an activity type or a business process are posted to the WIP account for activities. WIP from Price Differences (Material) (WPM) When you use the WIP revaluation of the material ledger, the price and exchange rate differences that are to be assigned to the WIP stock of a material are posted to the WIP account for material. GR/IR clearing (WRX) Postings to the GR/IR clearing account occur in the case of goods and invoice receipts against purchase orders. For more on the GR/IR clearing account, refer to the SAP Library (documentation MM Material Valuation). Caution You must set the Balances in local currency only indicator for the GR/IR clearing account to enable the open items to be cleared. For more on this topic, see the field documentation.

GR/IR clearing for material ledger (WRY) This transaction/event key is not used from Release 4.0 onwards. Prior to 4.0, it was used for postings to the GR/IR clearing account if the material ledger was active. As of Release 4.0, the transaction is no longer necessary, since postings to the GR/IR account in parallel currencies are possible. Customers who used the transaction WRY prior to Release 4.0 must make a transfer posting from the WRY account to the WRX account in order to ensure that the final balance on the WRY account is zero.

Movement Types MvT 101 102 103 104 105 106 107 108 109 110 121 122 123 124 125 131 132 141 142 161 162 201 202 221 222 231 232 241 242 251 252 261 262 281 282 291 292 301 302 303 304 305 306 309 310 311 312 313 314 315 316 317 318 319 320 Movement Type Text GR goods receipt GR for PO reversal GR into blocked stck GR to blocked rev. GR from blocked stck GR from blocked rev. GR to Val. Bl. Stock GR to Val. Bl. Rev. GR fr. Val. Bl. St. GR fr. Val. Bl. Rev. GR subseq. adjustm. RE return to vendor RE rtrn vendor rev. GR rtrn blocked stck GR rtn blkd stck rev Goods receipt Goods receipt GR G subseq. adjustm GR G subseq. adjustm GR returns GR rtrns reversal GI for cost center RE for cost center GI for project RE for project GI for sales order RE for sales order GI for asset RE for asset GI for sales RE for sales GI for order RE for order GI for network RE for network GI all acc. assigmts RE all acct assigmts TF trfr plnt to plnt TR trfr plnt to plnt TF rem.fm stor.to pl TR rem.fm stor.to pl TF pl.in stor.in pl. TR pl.in stor.in pl. TF tfr ps.mat.to mat TR tfr ps.mat.to mat TF trfr within plant TR transfer in plant TF rem.fm str.toSLoc TR rem.fm str.toSLoc TF pl.in str.in SLoc TR pl.in stor.inSLoc Create struct. mat. RE create struc. mat Split structured mat RE split struct.mat.

321 322 323 324 325 326 331 332 333 334 335 336 340 341 342 343 344 349 350 351 352 411 412 413 414 415 416 441 442 451 452 453 454 455 456 457 458 459 460 501 502 503 504 505 506 511 512 521 522 523 524 525 526 531 532 541 542 551 552

TF quality to unrest TR quality to unr. TF quality in plant TR quality in plant TF blocked in plant TR blocked in plant GI to sampling QI RE to sampling QI GI to sampling unre. RE to sampling unre. GI to sampl. blocked RE to sampling blkd Batch revaluation TF unrestr.to restr. TF rstricted to unr. TF blocked to unre. TR blocked to unre. TF blocked to QI TR blocked to QI TF to stck in trans. TR to stck in trans. TF SLoc to SLoc TR SLoc to SLoc TF SLoc to sls order TR SLoc to sls order TF SLoc to project TR SLoc to proj. TP unrstr.to tiedEmp TP tiedEmp.to unrstr GI returns RE returns reversal TP returns to own TP own to returns TF st. trfr returns TR st. trfr returns TP Returns to own QI TP Own QI to returns TP Ret. to own blckd TP Own blckd to ret. Receipt w/o PO RE receipt w/o PO Receipt to QI RE receipt to QI Receipt to blocked RE receipt to blockd Delivery w/o charge RE deliv. w/o charge Receipt w/o order RE receipt w/o prOrd Rcpt QI w/o prOrder RE quality w/o prOrd Rcpt blkd w/o pr.ord RE blocked w/o PrOrd Receipt by-product RE by-product GI whse to subc.stck RE subctrStck toWhse GI scrapping RE scrapping

553 554 555 556 557 558 561 562 563 564 565 566 571 572 573 574 575 576 581 582 601 602 603 604 605 606 621 622 631 632 635 636 641 642 643 644 645 646 647 648 651 652 653 654 655 656 657 658 661 662 671 672 673 674 675 676 677 678 6A1

GI scrapping QI RE scrapping QI GI scrapping blocked RE scrapping blocked GI adjust. transit GI adjust. transit Init.entry of stBal. RE in.entry stk bals Init. entrStBals: QI RE ent.st.bals: QI In.ent.stBals: blckd RE ent.stBals: blckd Receipt assembly RE receipt assembly Rcpt QI assembly RE rcpt QI assembly Rcpt blckd assmbly RE rcpt blkd assmbly Rcpt by-prod network RE by-prod. network GD goods issue:delvy RE goods deliv. rev. TF rem.fm stor.to pl TR rem.fm stor.to pl TF pl.in stor.in pl. TR pl.in stor.in pl. GI ret.pack.:lending GI ret.pack:ret.del. GI consgmt: lending GI consgmt:ret.delvy TF consgmt lending TR consgmt ret. del. TF to stck in trans. TR to stck in trans. TF to cross company TR to cross company TF cross company TR cross company TF to stck in trans. TR to stck in trans. GD ret.del. returns GD ret.del. retn rev GD returns unrestr. GD returns unr. rev. GD returns QI GD returns QI rev. GD returns blocked GD returns blk. rev. GI returns to vendor RE ret. to vdr revrs TR to stck in trans. TF to stck in trans. TF to cross company TR to cross company TR cross company TF cross company TR to stck in trans. TF to stck in trans. TF GI1

6A2 6A3 6A4 6A5 6A6 6A7 6A8 6B1 6B2 6B3 6B4 6B5 6B6 6B7 6B8 6K5 6K6 6W5 6W6 701 702 703 704 707 708 711 712 713 714 715 716 717 718 721 722 731 732 901 902 951 952 961 962

TR GI1 TF CC GI1 TR CC GI1 TF CC GI1 TR CC GI1 TF GI1 TR GI1 TF GI2 TR GI2 TF CC GI2 TR CC GI2 TF CC GI2 TR CC GI2 TF GI2 TR GI2 TF GI2 consi TR GI2 consi TF GI1 consi TR GI1 consi GR phys.inv.: whse GI phys.inv.: whse GR phys.inv: QI GI phys.inv: QI GR phys.inv.:blocked GI phys.inv.:blocked GI InvDiff.:whouse GR InvDiff.:wrhouse GI InvDiff: QI GR InvDiff: QI GI InvDiff.:returns GR InvDiff.:returns GI InvDiff.: blocked GR InvDiff.: blocked SlsVal.rec.n.afftMgs SlsVal.iss.n.afftMgs SlsVal.rec. afftgMgs SlsVal.iss. afftgMgs GD goods issue:delvy RE goods deliv. rev. GI scrapping to PA RE scrapping to PA GI for OH order RE for OH order

Usage Withholding Tax CO - FI reconciliation posting Retained Earning Account Gain and Loss for Exchange Rate Difference Clearing Account Cash Discount Clearing

Transaction QST CO1 BIL KDF GA0 SKV

GL Account 216030 690000 330000 For Detail Refer table below for KDF 269000 217500

Cash Discount Received Lost Cash Discount

SKE VSK

700210 700210

Bank Charges Payment Difference Cash Discount Expenses A/R Down Payment Request A/P Down Payment Request

BSP ZDI SKT

700000 440000 700800 214010 121100

Exchange Rate Dif.: Open Items/GL Acct Transaction KDF GL account Exchange rate diffrence realizedExchange rate diffrence Loss realized- Gain 121000 700400 700400 121200 700400 700400 211000 700400 700400 212000 700400 700400 Note Tables T030(x)s and T001U contain entries to determine the financial and intercompany transactions, respectively. You can see these tables by using IMG t

Comments FICO Reconciliation account Trade accounts receivable (121000, 121200) and Trade accounts payable (211000, 212000) are used for both realized gain and loss. Reconcile between functional areas and company codes A cash discount clearing account for the net procedure is defined here. The amount posted to the expense or balance sheet accounts is reduced by this cash discount amount. This posting takes place when the invoice is posted. The system posts the cash discount to this account when clearing open items. For net-posted invoices, the system automatically posts the difference between the cash discount amount that was originally calculated and the discount that was actually claimed. The bank charge is posted to this account The over or under payment of customer invoices is posted to this account along with a customized reason code The cash discount account is debited when payments of the gross amount less the cash discount are received within the allowable time period. For A/R reconciliation account 121000 For A/P reconciliation account 211000

Valuation Loss Valuation Balance Gain sheet Adj 700400 121020 700420 121020 700400 211020 700420 211020

700400 700420 700400 700420

ansactions, respectively. You can see these tables by using IMG transaction FBKP . The processing key that codes the account determination is captured in the field BSEG-

n is captured in the field BSEG-KTOSL of the FI transaction file BSEG .

CoA 0010 0010 0010 0010 0010

Account Type D D K K K

Special GL A F A F H

Recon Account Special GL Account 121000 214010 121000 214010 211000 121100 211000 121100 211000 214070

The account keys (for example, VS1VS4 and MW1MW4) used in the tax procedure TAXUSX are defined. The following G/L accounts are assigned to the Sales & Use tax codes. Tax Code O0 and O1 O0 and O1 O0 and O1 O0 and O1 O0 and O1 U1 U1 U1 U1 I0, I1 and U1 Account Key MW1 MW2 MW3 MW4 MWS MW1 MW2 MW3 MW4 NVV Account Number 216100 216110 216120 216130 216100 216200 216210 216220 216230 Distribute to relevant expense items

These settings can be verified using transaction OB40 ..

4 and MW1MW4) used in the tax procedure TAXUSX are defined. to the Sales & Use tax codes. Description Sales Tax Accrued (AR) State Sales Tax Accrued (AR) County Sales Tax Accrued (AR) City Sales Tax Accrued (AR) Others Sales Tax Accrued (AR) State Use Tax Accrued (AP) State Use Tax Accrued (AP) County Use Tax Accrued (AP) City Use Tax Accrued (AP) Others N/A

Asset Account Determination

1.1 Account Assignments by Account Determination Category

Account Determination Category 160000 160010 160020 160030 160040 160050 160060 160070 160080 160090 160200 193300 900000 Acquisition Account Accumulated Depreciation Account 170000 170010 170020 170030 170040 170050 170060 170070 170080 170200 170200 194300

Appropriate accounts are assigned for all Asset Accounting transactions (acquisition, retirement, and depreciation) for each acc In the Command field, enter transaction AO90 and choose Enter (or in the IMG, choose Financial Accounting Asset Acco

The accounts assigned to each category are shown in the table below. Additional G/L accounts common to each account assig

160000 160010 160020 160030 160040 160050 160060 160070 160080 160090 160200 193300

Depreciation expense accounts are created as primary cost elements (type 01 ) so depreciation can be posted to cost centers. Although accounts are maintained for depreciation of assets under construction, the asset classes should be configured so tha

1.2 Asset Acquisitions

For each account For each account

determination category, G/L account 660000 (Other Expenses) is assigned to depreciation area 01 (b

1.3 Asset Retirement 1.4 Asset Under Construction

G/L account 660000 (Other

determination category, G/L account 700130 (Disposal/Sale Fixed Assets Proceeds) is assigned as a cl

Expenses) is assigned for asset under construction settlement to CO objects, for account assig

1.5 Depreciation

For each account determination category, G/L account 701000 (Extraordinary Expenses/Income) is assigned as the account fo For each of the account determination categories, the same depreciation expense and accumulated depreciation accounts are

on, retirement, and depreciation) for each account determination category. choose Financial Accounting Asset Accounting Integration with the General Ledger Assign G/L Accounts).

mination Category

Depreciation Expense Account

G/L accounts common to each account assignment category are also assigned and are discussed in a later section.

640000 640010 640020 640030 640040 640050 640060 640070 640080 640200 640200 640430

depreciation can be posted to cost centers. The acquisition accounts for most categories are created as a statistical cost element (type 90. e asset classes should be configured so that no depreciation is calculated or posted. Tax-only assets post only in the Asset Accounting mod

nses) is assigned to depreciation area 01 (book depreciation in local currency) as a contra-acquisition account. This contra account is neces

e Fixed Assets Proceeds) is assigned as a clearing revenue account for fixed asset disposal. In addition, G/L account 701000 (Extraordinary

n settlement to CO objects, for account assignment category 160090 (Assets under Construction). This account is also created as a cost ele

enses/Income) is assigned as the account for revenue from write-up of ordinary and unplanned depreciation. The exceptions are categories and accumulated depreciation accounts are used for both ordinary and unplanned depreciation.

G/L Accounts).

s a statistical cost element (type 90. No account assignments are maintained for category 60000 (Leasing). ost only in the Asset Accounting module. This posting has no impact on asset balances in FI. Since tax-only assets are only valued in the su

account. This contra account is necessary when processing nonintegrated (FI) asset acquisitions. The exception is for category 193300 (Go

, G/L account 701000 (Extraordinary Expenses/Income) is assigned for profit and loss on the disposal of fixed assets.

account is also created as a cost element. G/L account 701000 is assigned for revenue from post-capitalization which represents subseque

ation. The exceptions are categories

900000 (Tax-only and negative value assets) and 193300 (Goodwill), for which no accounts are de

ets are only valued in the subledger, no postings are made in FI for asset class

9000 , and its corresponding acquisition G/L account 90000

is for category 193300 (Goodwill), which has no contra account.

which represents subsequent corrections to the acquisition and production costs (APC) of a fixed asset.

or which no accounts are defined.

ing acquisition G/L account 900000 does not appear in the chart of accounts.

Company Code Cost element Valuation Area Cost Center 1000 440000 1801 1000 440010 1000 1201 1000 440010 1100 1202 1000 510086 1000 520000 1000 1201 1000 520000 1100 1202 1000 520010 1000 1201 1000 520010 1100 1202 1000 520020 1000 1201 1000 520020 1100 1202 1000 520040 1000 1201 1000 520040 1100 1202 1000 530000 1000 1201 1000 520060 1201 1000 530000 1100 1202 1000 530030 1201 1000 650085 1000 1201 1000 650085 1100 1202 1000 654000 1000 1201 1000 654000 1100 1202 1000 700000 1000 1201 1000 700000 1100 1202 1000 700210 1000 1201 1000 700210 1100 1202 1000 700800 1801

Account assignment details Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory Valuation area is mandatory

Account Assignment Table 1-cust grp/Material grp/Acct Key

Application V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V V

Condition Type KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI KOFI

Chart of Accounts 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010 0010

Sales Org 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000

2 - Cust Grp/ Account Key

3 - Mat Grp/ Acct Key

4 - General 5 - Acct Key

V V V V V V

KOFI KOFI KOFI KOFI KOFI KOFI

0010 0010 0010 0010 0010 0010

1000 1000 1000 1000 1000 1000

Customer AAG 01 01 01 01 01 01 01 01 01 01 02 02 02 02 02 02 02 03 03 03 03 01 02 03 YM 01 01 01 02 02 02 03 01 01 02 03 03 Y1 Y2

Material AAG 01 01 02 02 03 03 Y1 Y1 Y2 Y3 01 01 02 02 03 03 Y2 01 02 03 Y2 Y4 Y4 Y4 Y4

Account Key ERL ERS ERL ERS ERL ERS ERL ERS ERL ERL ERL ERS ERL ERS ERL ERS ERL ERL ERL ERL ERL ERL ERL ERL ERS ERL ERS YB2 ERL ERS YB2 YB2 ERL YG1 ERL ERL YG1 ERL ERL

Account 410000 440020 410000 440020 410000 440020 410010 410010 410000 410070 410000 440020 410000 440020 410000 440020 217900 410015 410015 410015 217900 410000 410000 410000 410000 410000 440020 440030 410000 440020 440030 440030 410000 440040 410000 410000 440040 410010 217900 410000

Accrual Account

217900

217900 Fabricated Metals Fabricated Metals Fabricated Metals Fabricated Metals

125500

125500

217900

BO1 BO2 ERB ERF ERL ERS ERU

217700 217700 217700 217300 410000 440020 217700

125500 125500 217700

EVV IEP MWS UML VST YB3

410000

260000 217800

217800

Chart of Accounts

Account key HRC HRC HRC HRC HRC HRC HRC HRC HRC HRC HRC HRC HRC HRC HRC HRC HRC HRC HRC HRF HRF HRF HRF HRF HRF HRF HRF HRF HRF HRF HRF HRF HRF HRF HRP HRT HRT HRT HRT HRT HRT HRT HRT HRT HRT HRT

Valuation Group 1100 1100 1190 1190 1210 1230 1230 1240 1250 1260 1270 1271 1310 1310 1311 1320 1390 1400 1500 2110 2120 2190 2210 2212 2213 2220 2240 2250 2260 2290 3100 3200 3300 9100

General Modifier 1 2 1 2 2 1 2

Account 611030 611000 611030 611000 611030 610510 610510 610100 610100 610100 610100 610100 612000 612000 610100 610100 610100 610600 610600 215010 215050 215160 215030 215030 217200 215020 215080 217200 217200 217200 125100 141070 215080 215170 *KP 110 120 130 140 150 160 180 190 195 469990 610030 610040 610070 610080 610060 214500 610060 265200 265250 469990

1 2

1RR

1BS

Note: You can see these tables by using IMG transaction FBKP, Postings from payroll (HR) and Postings from Travel Expenses Accounting

Account 611030 611000 611030 611000 611030 610510 610510 610100 610100 610100 610100 610100 612000 612000 610100 610100 610100 610600 610600 215010 215050 215160 215030 215030 217200 215020 215080 217200 217200 217200 125100 141070 215080 215170 *KP 469990 610030 610040 610070 610080 610060 214500 610060 265200 265250 469990

Note HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, expense accounts HR postings, financial accounts HR postings, financial accounts HR postings, financial accounts HR postings, financial accounts HR postings, financial accounts HR postings, financial accounts HR postings, financial accounts HR postings, financial accounts HR postings, financial accounts HR postings, financial accounts HR postings, financial accounts HR postings, financial accounts HR postings, financial accounts HR postings, financial accounts HR postings, financial accounts Customer/vendor trip costs postings Trip costs postings, expense accounts Trip costs postings, expense accounts Trip costs postings, expense accounts Trip costs postings, expense accounts Trip costs postings, expense accounts Trip costs postings, expense accounts Trip costs postings, expense accounts Trip costs postings, expense accounts Trip costs postings, expense accounts Trip costs postings, expense accounts Trip costs postings, expense accounts

avel Expenses Accounting

También podría gustarte

- Streamlined AP accounting flow for DIV modelDocumento2 páginasStreamlined AP accounting flow for DIV modelKiran Kumar MuraleedharanAún no hay calificaciones

- GL Chart of Accounts by ClassificationDocumento5 páginasGL Chart of Accounts by ClassificationJack777100Aún no hay calificaciones

- Important Tables in SAP FI: Financial AccountingDocumento19 páginasImportant Tables in SAP FI: Financial AccountingVarun BisariaAún no hay calificaciones

- SAP COPA ConfigurationDocumento0 páginasSAP COPA ConfigurationDeepak Gupta50% (2)

- Accounting T Codes91011245389659Documento18 páginasAccounting T Codes91011245389659Jayanth MaydipalleAún no hay calificaciones

- Exhibits To Full Deposition of Patricia Arango of Marshall C WatsonDocumento25 páginasExhibits To Full Deposition of Patricia Arango of Marshall C WatsonForeclosure FraudAún no hay calificaciones