Documentos de Académico

Documentos de Profesional

Documentos de Cultura

KLBF

Cargado por

Luqman Hakim Bin As'ariDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

KLBF

Cargado por

Luqman Hakim Bin As'ariCopyright:

Formatos disponibles

PT Kalbe Farma Tbk.

Head Ofce KALBE Building Jl. Letjend. Suprapto Kav. 4, Jakarta 10510 Phone (021) 4287-3888 Fax (021) 4287-3680 Website: www.kalbe.co.id Kawasan Industri Delta Silicon Jl. M.H. Thamrin Blok A3-I Lippo Cikarang, Bekasi 17550 Phone (021) 8990-7337, 8990-7333 Fax (021) 8990-7360 Pharmaceuticals PMDN

Pharmaceuticals Summary of Financial Statement

(Million Rupiah) 2007 2008 2009

Total Assets Current Assets of which Cash and cash equivalents Time deposits Trade receivables Inventories Non-Current Assets of which Fixed Assets-Net Deffered Tax Assets-Net Investments Other Assets Liabilities Current Liabilities of which Short-term debt Trade payables Taxes payable Non-Current Liabilities Minority Interest in Subsidiaries Shareholders' Equity Paid-up capital Paid-up capital in excess of par value Revaluation of fixed assets Retained earnings (accumulated loss) Net Sales Cost of Goods Sold Gross Profit Operating Expenses Operating Profit Other Income (Expenses) Profit (Loss) before Taxes Profit (Loss) after Taxes Per Share Data (Rp) Earnings (Loss) per Share Equity per Share Dividend per Share Closing Price Financial Ratios PER (x) PBV (x) Dividend Payout (%) Dividend Yield (%) Current Ratio (x) Debt to Equity (x) Leverage Ratio (x) Gross Profit Margin (x) Operating Profit Margin (x) Net Profit Margin (x) Inventory Turnover (x) Total Assets Turnover (x) ROI (%) ROE (%) PER = 20.57x ; PBV = 4.59x (June 2010) Financial Year: December 31 Public Accountant: Purwantono, Sarwoko & Sandjaja 5,138,213 3,760,008 1,116,346 175,833 869,572 1,427,068 1,378,205 1,204,148 31,109 704 15,013 1,121,539 754,629 43,717 328,291 127,042 366,910 629,812 3,386,862 507,801 2,640 4,153 2,872,268 7,004,910 3,453,279 3,551,631 2,422,276 1,129,355 29,313 1,158,667 705,694 69 333 n.a 1,260 18.13 3.78 n.a n.a 4.98 0.33 0.22 0.51 0.16 0.10 2.42 1.36 13.73 20.84 5,703,832 4,168,055 1,321,798 124,749 935,357 1,606,124 1,535,778 1,327,347 33,064 n.a 19,757 1,359,297 1,250,372 145,889 305,568 177,901 108,925 722,137 3,622,399 507,801 2,640 n.a 3,111,958 7,877,366 4,073,726 3,803,641 2,660,928 1,142,712 35,309 1,178,022 706,822 70 357 n.a 400 5.75 1.12 n.a n.a 3.33 0.38 0.24 0.48 0.15 0.09 2.54 1.38 12.39 19.51 6,482,447 4,701,893 1,562,664 62,596 1,203,941 1,561,382 1,780,554 1,398,128 29,354 n.a 26,101 1,691,775 1,574,137 339,132 481,511 273,181 117,637 480,234 4,310,438 507,801 2,640 n.a 3,799,997 9,087,348 4,575,407 4,511,940 2,946,066 1,565,875 (94,803) 1,471,072 929,004 91 424 25 1,300 14.21 3.06 27.33 5.89 2.99 0.39 0.26 0.50 0.17 0.10 2.93 1.40 14.33 21.55

Factory

Business Company Status

Financial Performance: Net income in 2009 soared to IDR929 billion compared to IDR706 billion booked in 2008. The higher income was partly due to increase in net sales from IDR7.877 trillion to IDR9.087 trillion. Brief History: Established in 1966, PT Kalbe Farma Tbk. (the Company or Kalbe) has gone a long way from its humble beginnings as a garage-operated pharmaceutical business in North Jakarta. Throughout its more than 40-year history, the Company has expanded by strategic acquisitions of pharmaceutical companies, building a leading brand positioning and reaching to international markets to transform itself into an integrated consumer health and nutrition enterprise with unrivalled innovation, marketing, branding, distribution, nancial strength and R&D and production expertise to promote its mission to improve health for a better life. The Kalbe Group has an extensive and strong portfolio of brands in the prescription pharmaceuticals, OTC pharmaceuticals, energy drink and nutrition products, complemented with a robust packaging and distribution arm that reaches over 1 million outlets. The Company has succeeded in promoting its brands as the undisputed market leaders not only in Indonesia but also in the international markets, establishing such household names across all healthcare and pharmaceutical segments as Promag, Mixagrip, Woods, Komix, Prenagen and Extra Joss. Also, fostering and expanding alliances with international partners have accelerated Kalbes advances in international markets and sophisticated R&D ventures as well as the latest pharmaceutical and healthcare developments, including stem cell and cancer research. The Groups consolidation in 2005 has further enhanced production, marketing and nancial capabilities, providing greater leverage to widen local and international exposure. Today, Kalbe is the largest publicly-listed pharmaceutical company in Southeast Asia with over US$ 1 billion in market capitalization and revenues of over Rp 7 trillion. Its cashrich position today also provides for unlimited expansion opportunities in the future. Shareholders PT Gira Sole Prima PT Santa Seha Sanadi PT Diptanala Bahana PT Lucasta Murni Cemerlang PT Ladang Ira Panen PT Bina Artha Charisma Public 10.17% 9.62% 9.49% 9.47% 9.22% 8.69% 43.34%

(million rupiah) 2010 2009 June

Total Assets Current Assets Non-Current Assets Liabilities Shareholders' Equity Net Sales Profit after Taxes ROI (%) ROE (%) 6,876,153 5,027,924 1,848,230 1,733,413 4,649,763 4,706,810 572,337 8.32 12.31

June

6,528,633 5,010,908 1,517,725 1,856,978 3,906,121 4,217,478 398,709 6.11 10.21

414

Indonesian Capital Market Directory 2010

PT Kalbe Farma Tbk.

Board of Commissioners President Commissioner Drs. Johannes Setijono Commissioners Santoso Oen, BA, Yozef Darmawan Angkasa, Ferdinand Aryanto, Farid A. Moeloek, Wahjudi Prakarsa

No 1 2 3 4 5 6 7 8 9 10 11 12 13 Type of Listing First Issue Partial Listing Cooperative Company Listing Bonus Shares Right Issue Bonus Shares Dividend Shares Stock Split Stock Split Bonus Shares Stock Split Additional Listing (Merger) Listing Date 1991 1991 1992 1992 1992 1993 1994 1994 1996 1999 2000 2-Jan-04 21-Dec-05

Pharmaceuticals

Board of Directors President Director Bernadette Ruth Irawati Setiady Vice President Director Johanes Berchman Apik Ibrahim Directors Budi Dharma Wireksoatmodjo, Vidjongtius, Herman Widjaja Number of Employees 10,022

Trading Date 1991 1992 1999 1992 1992 1993 1994 1994 1996 1999 2000 2-Jan-04 21-Dec-05 Number of Shares per Listing 10,000,000 10,000,000 500,000 29,500,000 50,000,000 8,000,000 75,600,000 32,400,000 216,000,000 1,728,000,000 1,900,800,000 4,060,800,000 2,034,414,422 Total Listed Shares 10,000,000 20,000,000 20,500,000 50,000,000 100,000,000 108,000,000 183,600,000 216,000,000 432,000,000 2,160,000,000 4,060,800,000 8,121,600,000 10,156,014,422

Underwriters PT Ing Barings Securities, PT Merincorp Stock Price, Frequency, Trading Days, Number and Value of Shares Traded and Market Capitalization

Stock Price and Traded Chart

Stock Price (Rp) 2,500 Million Share 180 160 2,000 140 120 1,500 100 80 60 500 40 20 Jan-09 Feb-09Mar-09 Apr-09 May-09 Jun-09 Jul-09 Aug-09 Sep-09 Oct-09 Nov-09 Dec-09 Jan-10 Feb-10Mar-10 Apr-10 May-10 Jun-10 -

1,000

Institute for Economic and Financial Research

415

También podría gustarte

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- Bugle CompanyDocumento4 páginasBugle CompanyHannah Nolong100% (1)

- DSP Mutual Fund OverviewDocumento5 páginasDSP Mutual Fund OverviewSarika AroteAún no hay calificaciones

- Clean and Dirty PriceDocumento4 páginasClean and Dirty PriceAnkur GargAún no hay calificaciones

- Original PDF Financial Statement Analysis and Security Valuation 5th Edition PDFDocumento41 páginasOriginal PDF Financial Statement Analysis and Security Valuation 5th Edition PDFgordon.hatley642100% (31)

- BFA Putaran XXI 03-12Documento2 páginasBFA Putaran XXI 03-12Luqman Hakim Bin As'ariAún no hay calificaciones

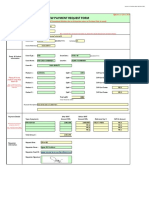

- FORM PRF DR - TangkasDocumento13 páginasFORM PRF DR - TangkasLuqman Hakim Bin As'ariAún no hay calificaciones

- Epm Penjualan Per Outlet 040215 (Secondary Care)Documento43 páginasEpm Penjualan Per Outlet 040215 (Secondary Care)Luqman Hakim Bin As'ariAún no hay calificaciones

- Break Sales April 2014Documento29 páginasBreak Sales April 2014Luqman Hakim Bin As'ariAún no hay calificaciones

- Lapbul Tahap 1 Herta September 2014Documento31 páginasLapbul Tahap 1 Herta September 2014Luqman Hakim Bin As'ariAún no hay calificaciones

- So TW IV 2014 - RSM LpiDocumento1 páginaSo TW IV 2014 - RSM LpiLuqman Hakim Bin As'ariAún no hay calificaciones

- MCL Agnes Q4Documento12 páginasMCL Agnes Q4Luqman Hakim Bin As'ariAún no hay calificaciones

- LUQMAN HAKIM - XAIJA - PD7S27 SalinDocumento1 páginaLUQMAN HAKIM - XAIJA - PD7S27 SalinLuqman Hakim Bin As'ariAún no hay calificaciones

- DENTAL SET - DikonversiDocumento2 páginasDENTAL SET - DikonversiLuqman Hakim Bin As'ariAún no hay calificaciones

- EPM Penjualan Per Outlet 111215 (Bima Sakti)Documento21 páginasEPM Penjualan Per Outlet 111215 (Bima Sakti)Luqman Hakim Bin As'ariAún no hay calificaciones

- Regression analysis of customer satisfaction survey and product attributesDocumento3 páginasRegression analysis of customer satisfaction survey and product attributesLuqman Hakim Bin As'ariAún no hay calificaciones

- EPM S Laporan Stock On Hand Su 260115 (Secondary CarE)Documento11 páginasEPM S Laporan Stock On Hand Su 260115 (Secondary CarE)Luqman Hakim Bin As'ariAún no hay calificaciones

- Organizational Behaviour Reassessed, The Impact of GenderDocumento9 páginasOrganizational Behaviour Reassessed, The Impact of GenderLuqman Hakim Bin As'ariAún no hay calificaciones

- Discv 30 Aug 14Documento45 páginasDiscv 30 Aug 14Luqman Hakim Bin As'ariAún no hay calificaciones

- PThe Learning Organisation, Myth or RealityDocumento1 páginaPThe Learning Organisation, Myth or RealityLuqman Hakim Bin As'ariAún no hay calificaciones

- Inquiring Into Organizational EnergyDocumento1 páginaInquiring Into Organizational EnergyLuqman Hakim Bin As'ariAún no hay calificaciones

- Automating BSC Business inDocumento14 páginasAutomating BSC Business inLuqman Hakim Bin As'ariAún no hay calificaciones

- A Shared Strategic VisionDocumento1 páginaA Shared Strategic VisionLuqman Hakim Bin As'ariAún no hay calificaciones

- A Note On The Effect of PriDocumento6 páginasA Note On The Effect of PriLuqman Hakim Bin As'ariAún no hay calificaciones

- Agents of Change Bank BrancDocumento23 páginasAgents of Change Bank BrancLuqman Hakim Bin As'ariAún no hay calificaciones

- Game Theory and OperationsDocumento12 páginasGame Theory and OperationsLuqman Hakim Bin As'ariAún no hay calificaciones

- A Lifestyle Analysis of NewDocumento4 páginasA Lifestyle Analysis of NewLuqman Hakim Bin As'ariAún no hay calificaciones

- An Elaborate Analysis of PRDocumento9 páginasAn Elaborate Analysis of PRLuqman Hakim Bin As'ariAún no hay calificaciones

- A New Perspective of BrandDocumento21 páginasA New Perspective of BrandLuqman Hakim Bin As'ariAún no hay calificaciones

- Capital Input and Total ProDocumento9 páginasCapital Input and Total ProLuqman Hakim Bin As'ariAún no hay calificaciones

- Complaints about advertising in AustraliaDocumento9 páginasComplaints about advertising in AustraliaLuqman Hakim Bin As'ariAún no hay calificaciones

- Project Management Theory ADocumento37 páginasProject Management Theory ALuqman Hakim Bin As'ariAún no hay calificaciones

- Productivity Improvement ADocumento11 páginasProductivity Improvement ALuqman Hakim Bin As'ariAún no hay calificaciones

- Back To Basics With ProductDocumento6 páginasBack To Basics With ProductLuqman Hakim Bin As'ariAún no hay calificaciones

- Competition and Price DiscrDocumento32 páginasCompetition and Price DiscrLuqman Hakim Bin As'ariAún no hay calificaciones

- Markit Itraxx Europe Series 30 RulebookDocumento14 páginasMarkit Itraxx Europe Series 30 RulebookeddjkAún no hay calificaciones

- 4Q16 PresentationDocumento20 páginas4Q16 PresentationMultiplan RIAún no hay calificaciones

- Problem Overview:: 2B PeopleDocumento5 páginasProblem Overview:: 2B PeopleSebastian AlexAún no hay calificaciones

- PR - Order in The Matter of M/s. Phenix Properties LimitedDocumento2 páginasPR - Order in The Matter of M/s. Phenix Properties LimitedShyam SunderAún no hay calificaciones

- Chapter 11: Arbitrage Pricing TheoryDocumento7 páginasChapter 11: Arbitrage Pricing TheorySilviu TrebuianAún no hay calificaciones

- Feed The Future, Tanzania Land Tenure Assistance: DAI GlobalDocumento57 páginasFeed The Future, Tanzania Land Tenure Assistance: DAI GlobalJacob PeterAún no hay calificaciones

- Unit 3: Ind As 110: Consolidated Financial StatementsDocumento49 páginasUnit 3: Ind As 110: Consolidated Financial StatementsA.S. Nooruddin AhmedAún no hay calificaciones

- Smart InvestingDocumento75 páginasSmart InvestingKumar NatarajanAún no hay calificaciones

- Airasia If GroupDocumento17 páginasAirasia If Groupamirul asyrafAún no hay calificaciones

- Questionnaire On Investment Pattern of IndividualsDocumento3 páginasQuestionnaire On Investment Pattern of IndividualsJoyal Anthony PintoAún no hay calificaciones

- GCG and ESG TheoryDocumento5 páginasGCG and ESG Theorypempi mlgAún no hay calificaciones

- Chapter 2 - Understanding The Balance SheetDocumento54 páginasChapter 2 - Understanding The Balance SheetNguyễn Yến NhiAún no hay calificaciones

- Data Interpretation Level 1 QuestionsDocumento19 páginasData Interpretation Level 1 Questionsaish2ksAún no hay calificaciones

- Ferrous at The LMEDocumento4 páginasFerrous at The LMEericmAún no hay calificaciones

- BNL StoresDocumento4 páginasBNL Storesshanul gawshindeAún no hay calificaciones

- Answers To Concepts Review and Critical Thinking QuestionsDocumento6 páginasAnswers To Concepts Review and Critical Thinking QuestionsHimanshu KatheriaAún no hay calificaciones

- Accounting: Pearson Edexcel International A Level Teacher Resource Pack 2Documento19 páginasAccounting: Pearson Edexcel International A Level Teacher Resource Pack 2Harvey SahotaAún no hay calificaciones

- Mbfs With 16 MarkDocumento16 páginasMbfs With 16 MarkPadmavathiAún no hay calificaciones

- Chapter No. 4: Currency Pairs, Foreign Exchange Market and ImsDocumento52 páginasChapter No. 4: Currency Pairs, Foreign Exchange Market and ImsCh MoonAún no hay calificaciones

- Virginia Key Marina RFP No 12-14-077 Presentation PDFDocumento54 páginasVirginia Key Marina RFP No 12-14-077 Presentation PDFal_crespoAún no hay calificaciones

- Chapter 12 Cash ManagementDocumento4 páginasChapter 12 Cash ManagementbibekAún no hay calificaciones

- Relaxations & Amendments in Companies Act WebinarDocumento37 páginasRelaxations & Amendments in Companies Act WebinarAbhishek PareekAún no hay calificaciones

- ADX CompaniesGuide2011Documento151 páginasADX CompaniesGuide2011joAún no hay calificaciones

- McDonald's Stock Clearly Benefits From Its Large Buybacks - Here Is Why (NYSE - MCD) - Seeking AlphaDocumento12 páginasMcDonald's Stock Clearly Benefits From Its Large Buybacks - Here Is Why (NYSE - MCD) - Seeking AlphaWaleed TariqAún no hay calificaciones

- Relationship Between Inflation and Stock Prices in ThailandDocumento6 páginasRelationship Between Inflation and Stock Prices in ThailandEzekiel WilliamAún no hay calificaciones

- Art em Is Capital Currency NoteDocumento35 páginasArt em Is Capital Currency NoteBen SchwartzAún no hay calificaciones