Documentos de Académico

Documentos de Profesional

Documentos de Cultura

CIMA P3 Notes - Performance Strategy - Chapter 12

Cargado por

Mark Horance HawkingDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

CIMA P3 Notes - Performance Strategy - Chapter 12

Cargado por

Mark Horance HawkingCopyright:

Formatos disponibles

CIMA P3 Course Notes

www.astranti.com

CIMA P3 Course Notes

c

Chapter 12 Currency hedging techniques

Strategic Business Coaching Ltd 2013 Personal use only - not licensed for use on courses

119

CIMA P3 Course Notes

www.astranti.com

1.

Hedging

A hedge is an investment position intended to offset potential losses that may be incurred by a companion investment. There are 4 key techniques for hedging currency risk: Forwards Money market hedge Futures ptions

2.

Forwards

hat is a !orward contract"

A !orward contract or simply a forward is a non!standardised contract between two parties to buy or sell a fi"ed amount of foreign currency at a specified future time at a price agreed upon today. The forward price of such a contract is commonly contrasted with the spot price# which is the current e"change rate. The difference between the spot and the forward price is the forward premium or forward discount.

How a !orward contract wor#s

$eneric e%amp&e $uppose that %ob wants to buy a house a year from now. At the same time# suppose that Andy currently owns a &'((#((( house that he wishes to sell a year from now. %oth parties could enter into a forward contract with each other. $uppose that they both agree on the sale price in one year)s time of &'(4#(((. Andy and %ob have entered into a forward contract. %ob has now fi"ed the amount he will pay for this house# ensuring he never has to pay any more than &'(4#(((. This helps him to manage his cashflows and reduce his e"posure to fluctuations in the property market.

Strategic Business Coaching Ltd 2013 Personal use only - not licensed for use on courses

120

CIMA P3 Course Notes

www.astranti.com

Currency e%amp&e A similar situation works for currency forwards# where one party opens a forward contract to buy or sell a currency *for e"ample a contract to buy +uros, to e"pire-settle at a future date# as they do not wish to be e"posed to e"change rate-currency risk over a period of time. $ometimes# the buy forward is opened because the investor will actually need +uros at a future date such as to pay a debt owed that is denominated in +uros therefore avoiding the risk that they have to pay more due to unfavourable e"change rate movements. This is the typical use of forwards by accountants. .t is also possible that# the party opening a forward does so# not because they need +uros because they are hedging currency risk# but because they are speculating on the currency# e"pecting the e"change rate to move favourably to generate a gain on closing the contract. Forwards are popular# as they are simple and fle"ible. ther characteristics include: '. /egally binding contract *so it must be completed even .f the need for the foreign currency or amount changes, 0. 1ou set any date for e"ercising# but that date is set and agreed 2. Agree any amount required 4. %ank offers a forward e"change rate

Numerica& e%amp&e

The current forward price quoted for the 3-& in 4 months time is '.5 ! '.50. .f a 6$ company needs 3'm for a contract to be paid in 4 months. Firstly we need to work out which of the two values is spread is the relevant one here. 7emember 8 the bank always wins. ne rate would cost them &'.5m and the second &'.50m. The worst for the company and best for the bank is the second option# so that9s the relevant forward rate# and that9s the amount payable in 4 months time.

Strategic Business Coaching Ltd 2013 Personal use only - not licensed for use on courses

121

CIMA P3 Course Notes

www.astranti.com

3.

Money mar#et hedge

hat is a money mar#et hedge"

There are two types of money market hedge: Paying in a !oreign currency in the !uture The home currency is converted at the spot rate# and monies held in a foreign currency bank account until required for payment in the future. The e"change rate used was the rate now# and hence the risk of rates changing by the payment date is removed. 'ecei(ing money in a currency in the !uture A loan is taken out in a foreign currency# and that converted at the spot rate now. :hen the monies are received in the foreign currency they are used to pay off the foreign currency loan. Again note that the e"change rate used was the rate now# and hence the risk of rates changing by the receipt date is removed.

)%amp&e question

A%; plc will be required to make a &0m payment in < months time. The current e"change rate is 3' = &0. The e"change rate for the & is highly volatile. The company9s banks are willing to undertake a forward contract at a rate of 3' = &'.>. A 3 loan would incur rates of interest are '(? per annum# while a & deposit would secure a return of '2? per annum. ;ompare the costs of leading*paying now,# with using a future or money market hedge.

Strategic Business Coaching Ltd 2013 Personal use only - not licensed for use on courses

122

CIMA P3 Course Notes

www.astranti.com

)%amp&e *o&ution

Payment now 8 Amount payable = &0m 0 = 3'm

Forward rates 8 Amount payable = &0m '.> Money mar#et hedge

= 3'#(50#420m

A%; plc will +1, borrow money now in 3# convert this at the spot rate to & +2,. This will then earn interest for < months when the payment can be made +3,.The @effective cost9 of this +-, can then be calculated by applying the 3 interest rate to the amount borrowed. (1) Borrow 920, 245.50 and covert now to $ at 1 = $2 $ (2)Deposit 1,840, 491 into a $ account This grows at 13% for 8 months effective interest rate = 13% x 8 = 8.66% 12

NOW

Interest payable at 10% for 8 months = 6.66%

8 months

(4) After 8 months the effective amount due would be 981,595

(3) Make payment of $2m

Aote that to do the calculation you have to start with amount *2,# then work out amount *0,# then *', and then *4,. +ffective amount payable in < months is 3><'#5>5 Conc&usion The money market hedge is the lowest cost method of hedging the risk.

Strategic Business Coaching Ltd 2013 Personal use only - not licensed for use on courses

123

CIMA P3 Course Notes

www.astranti.com

-.

Currency !utures

hat is a currency !uture"

A currency future is a futures contract to e"change one currency for another at a specified date in the future at a price *e"change rate, that is fi"ed on the purchase date. They differ from forwards in that the contracts are standardised amounts *e.g. 3'05#((( is typical, which are traded on currency e"changes Typically# one of the currencies is the 6$ dollar. The price of a future is then in terms of 6$ dollars per unit of other currency. .f you hold a contract at the end of the last trading day# actual payments are made in each currency. Bowever# most contracts are closed out before that. .nvestors can close out the contract at any time prior to the contract)s delivery date by selling it on the market. .nvestors use these futures contracts to hedge against foreign e"change risk. .f an investor will receive a cashflow denominated in a foreign currency on some future date# that investor can lock in the current e"change rate by entering into an offsetting currency futures position that e"pires on the date of the cashflow. Further notes on how futures work: '. ;ontrolled by an e"change *in 6$, 8 gives security 0. Ceposit required by e"change from both parties *in a client9s margin account, 2. Drofits and losses in the margin account are adEusted daily 4. Futures are always a standard siFe i.e. G40#5(( 5. Maturity dates are fi"ed at end of March# Hune# $eptember and Cecember

Futures Ca&cu&ation

A 6I company has to pay &04(#((( on 2'st May. The current spot rate is &'.>-G. Futures are sold in contract siFes of G40#5(( and the current price of a future to the end of Hune is &'.>0((-G. n 2' May# the spot rate and the futures rate on that date are both &'.<-G. To do futures questions you can always follow the same standard steps which are as follows:

Strategic Business Coaching Ltd 2013 Personal use only - not licensed for use on courses

124

CIMA P3 Course Notes *tep 1 . or# out the num/er o! contracts needed"

www.astranti.com

Civide the total amount *&04(#(((, by the current futures price *&'.>0, to get the G amount needed 8 G'05#((( Therefore 0 contracts of G40#5(( are needed. *tep 2 . Are you /uying or se&&ing !utures" 6se the following rule: 0we 1 or 2 . 3uying 1 or 2 !utures 0wed 1 or 2 4 *e&&ing 1 or 2 !utures 0we 5 . *e&&ing 1 or 2 !utures 0wed 5 4 3uying 1 or 2 !utures .n this case the company owes & so is selling futures.

*tep 3 . C&ose out the contract +31 May, 6se the following rule: *e&&ing !utures6 opening price 4 c&osing price 3uying !utures6 c&osing price . opening price Bere we are selling futures *step 0, so take the opening price 8 closing price: pening price ;losing price Drofit-*loss, &'.>0(( &*'.<(((, &(.'0((

which is positive so is a profit

Total profit = 0 contracts " G40#5(( " &(.'0 = &'5#((( profit *tep - 7nderta#e the spot mar#et transaction +31 May, Total needed &04(#((( /ess profit from future *&'5#(((, 3a&ance at spot rate+1.8, 5229:;;; In 2 this is 229:;;;<1.8 = 2129:;;;

*add on if step 2 is a loss,

9.

Currency options

Strategic Business Coaching Ltd 2013 Personal use only - not licensed for use on courses

125

CIMA P3 Course Notes

www.astranti.com

hat is a currency option"

A currency option gives the owner the right /ut not the o/&igation to e"change money denominated in one currency into another currency at a pre!agreed e"change rate on a specified date. The key is to note that there is no o/&igation to undertake the option# which gives much more fle"ibility to the purchaser than a forward as they can pull out of the deal if e"change rates move favourably. f course# this increases risk to the bank and so options are more e"pensive. A premium is the fee paid when an option is taken out.

)%amp&e

For e"ample a G-& contract could give the owner the right to sell G'#(((#((( and buy &0#(((#((( on Cecember 2'. .n this case the pre!agreed e"change rate# or stri#e price# is &0 per G' and the notiona& amounts are G'#(((#((( and &0#(((#(((. n the e"ercise date *2' Cecember,# if the spot rate is higher than 0# the option is lapsed# as it is better to take the spot rate. .f the rate is lower than 0 on Cecember 2' *say at '.>,# meaning that the dollar is stronger and the pound is weaker# then the option is e"ercised# allowing the owner to sell G at 0 and immediately buy it back in the spot market at '.># making a profit of: *0 8 '.>, " '#(((#((( = &'((#(((

.f they immediately convert the profit into G this amounts to '((#(((-'.>((( = G50#42'.5< foreign!e"change option.

3&ac#4*cho&es options pricing mode&

The %lack8$choles model provides a formula which can be used to price options. Many empirical tests have shown the %lack8$choles price is Jfairly closeK to the observed prices 1ou do not need to know the model for the e"am# but should know that the options price depends on the following factors: >he current price *e.g. current e"change rate, 8 sets the underlying value of the option

Strategic Business Coaching Ltd 2013 Personal use only - not licensed for use on courses

126

CIMA P3 Course Notes

www.astranti.com

>he stri#e price o! the option 8 the more favourable the price to the buyer the more e"pensive the option will be as the more likely the seller will have to pay out >he annua&ised ris#4!ree interest rate 8 like a present value calculationL future returns need to be discounted to present value to find the current price ?o&ati&ity 8 the greater the volatility the higher the risk to the seller so the higher the price >ime unti& e%piry 8 the longer into the future# the longer the period to be discounted and the greater the chance of a change in value of the underlying asset.

Strategic Business Coaching Ltd 2013 Personal use only - not licensed for use on courses

127

CIMA P3 Course Notes

www.astranti.com

*trategic Moc# )%ams . )3: F3 and P3 %ased around the &atest Preseen 0 full mocks are available for each strategic subEect Fu&& mar#ing and detai&ed !eed/ac# Full mock marking Cetailed and personalised feedback to focus on helping to pass the e"ams Persona& coaching on your moc# e%am 'hr personal coaching session with your marker Dersonalised feedback and guidance +"am technique and technical review *trategic and Financia& ana&ysis o! the Pre4seen *trategic ana&ysis ! all key business strategy models in +2 Financia& ana&ysis 8 based around the F2 syllabus 'is# ana&ysis 8 based around the D2 syllabus 2( page strategic report Full video analysis of how all key models apply to the unseen Mideo introduction to all the key models Persona& Coaching Courses Dersonal coaching to get you through the e"am >uition Course 8 Dersonalised tuition to give you the required syllabus knowledge 8 tailored to your needs 'e(ision Course ! Dractise past e"am questions with personal feedback on your technical weaknesses and e"am approach and technique 'esit Course 8 .dentifying weaknesses from past attempts and providing personalised guidance and study guides to get you through the e"am

Strategic Business Coaching Ltd 2013 Personal use only - not licensed for use on courses

128

También podría gustarte

- CIMA P3 Notes - Performance Strategy - Chapter 13Documento8 páginasCIMA P3 Notes - Performance Strategy - Chapter 13Suresh Madhusanka Rodrigo50% (2)

- Cima P3 DumpsDocumento6 páginasCima P3 DumpsKatty Steve100% (1)

- CIMA P3 Notes - Performance Strategy - Chapter 8Documento6 páginasCIMA P3 Notes - Performance Strategy - Chapter 8Mark Horance Hawking100% (1)

- 01 CIMA E3 Notes - Enterprise Strategy - Chapters 1 & 2 PDFDocumento28 páginas01 CIMA E3 Notes - Enterprise Strategy - Chapters 1 & 2 PDFpiyalhassanAún no hay calificaciones

- Corporate Finance Crasher 1Documento116 páginasCorporate Finance Crasher 1Arpita PatraAún no hay calificaciones

- SCS MAY_AUG22: E3 APPLIEDDocumento61 páginasSCS MAY_AUG22: E3 APPLIEDSanjay MehrotraAún no hay calificaciones

- CIMA E3 Study Text - 2017Documento21 páginasCIMA E3 Study Text - 2017Ottone Chipara NdlelaAún no hay calificaciones

- CIMA F2 2020 NotesDocumento140 páginasCIMA F2 2020 NotesJonathan Gill100% (1)

- Cima p3 Nov201Documento28 páginasCima p3 Nov201Rony BanikAún no hay calificaciones

- Cima F2Documento1 páginaCima F2Sruthi RadhakrishnanAún no hay calificaciones

- CIMA E3 Notes - Enterprise Strategy - Chapter 4 PDFDocumento17 páginasCIMA E3 Notes - Enterprise Strategy - Chapter 4 PDFLuzuko Terence NelaniAún no hay calificaciones

- CFITS BrochureDocumento6 páginasCFITS BrochureSiddhartha GaikwadAún no hay calificaciones

- FRM N2018 Brochure SchweserDocumento8 páginasFRM N2018 Brochure SchweserYawAún no hay calificaciones

- SCS FamiliarisationDocumento26 páginasSCS FamiliarisationKAH MENG KAMAún no hay calificaciones

- Get More Past Papers FromDocumento110 páginasGet More Past Papers FromRehman Muzaffar100% (1)

- CIMA P3 - May 2012Documento130 páginasCIMA P3 - May 2012mrshami7754100% (1)

- CIMA F3 Notes - Financial Strategy - Chapter 7Documento25 páginasCIMA F3 Notes - Financial Strategy - Chapter 7Sajid AliAún no hay calificaciones

- DocumentCIMA P3 Course NotesDocumento11 páginasDocumentCIMA P3 Course Notesjony test0% (1)

- E3 Cima Workbook Q PDFDocumento54 páginasE3 Cima Workbook Q PDFgrandoverall100% (1)

- Valid F2 CIMA Braindumps - F2 Dumps PDF Exam Questions CimaDumpsDocumento9 páginasValid F2 CIMA Braindumps - F2 Dumps PDF Exam Questions CimaDumpsCarly MartinAún no hay calificaciones

- CIMA P3 Notes - Performance Strategy - Chapter 1Documento14 páginasCIMA P3 Notes - Performance Strategy - Chapter 1Mark Horance HawkingAún no hay calificaciones

- Entrepreneurship: Successfully Launching New Ventures: Feasibility AnalysisDocumento5 páginasEntrepreneurship: Successfully Launching New Ventures: Feasibility Analysisziyad albednah100% (1)

- E2 SummaryDocumento152 páginasE2 SummaryPablo Ruibal100% (1)

- R48 Derivative Markets and InstrumentsDocumento179 páginasR48 Derivative Markets and InstrumentsAaliyan Bandealy100% (1)

- CIMA P3 Notes - Chapters 1 and 2Documento27 páginasCIMA P3 Notes - Chapters 1 and 2Jon Loh Soon WengAún no hay calificaciones

- Exam and Question Tutorial Operational Case Study 2019 CIMA Professional QualificationDocumento61 páginasExam and Question Tutorial Operational Case Study 2019 CIMA Professional QualificationMyDustbin2010100% (1)

- Corporate FinanceDocumento4 páginasCorporate FinanceMogul Dodger Kevin100% (1)

- E3 Cima Workbook Q & A PDFDocumento100 páginasE3 Cima Workbook Q & A PDFJerome ChettyAún no hay calificaciones

- Citg Materials CombinedDocumento779 páginasCitg Materials CombinedHubert AnipaAún no hay calificaciones

- CIMA P3 2020 NotesDocumento96 páginasCIMA P3 2020 NotesJonathan Gill100% (2)

- CFA Preparation RecommendationsDocumento3 páginasCFA Preparation RecommendationsShynara MuzapbarovaAún no hay calificaciones

- CFA Level 2 FSADocumento3 páginasCFA Level 2 FSA素直和夫Aún no hay calificaciones

- F2 Revision SummariesDocumento97 páginasF2 Revision Summarieswakomoli100% (2)

- Astranti MCS (E, F, P Pillars)Documento331 páginasAstranti MCS (E, F, P Pillars)isuri abeykoonAún no hay calificaciones

- CFA BrochureDocumento11 páginasCFA Brochuremohammad10000Aún no hay calificaciones

- SFM QbookDocumento366 páginasSFM QbookKaran KashyapAún no hay calificaciones

- Premium Version With AnswerDocumento87 páginasPremium Version With Answermuhammad bilalAún no hay calificaciones

- Derivatives CfaDocumento3 páginasDerivatives CfavAún no hay calificaciones

- CIMA Management Case Study Analysis PDFDocumento33 páginasCIMA Management Case Study Analysis PDFAli RaziAún no hay calificaciones

- CIMA F3 Notes - Financial Strategy - Chapter 3Documento11 páginasCIMA F3 Notes - Financial Strategy - Chapter 3athancox5837100% (2)

- BPP P3 Step 6 AnswersDocumento29 páginasBPP P3 Step 6 AnswersRavi Pall100% (1)

- Concepts of Financial Management 2014Documento9 páginasConcepts of Financial Management 2014blokeyesAún no hay calificaciones

- Cima E2 NotesDocumento102 páginasCima E2 Notesbanra89Aún no hay calificaciones

- ACCA P6 (FA17) Course NotesDocumento414 páginasACCA P6 (FA17) Course NotesVinay NaiduAún no hay calificaciones

- CIMA E3 Notes - Enterprise Strategy - Chapter 3 PDFDocumento14 páginasCIMA E3 Notes - Enterprise Strategy - Chapter 3 PDFLuzuko Terence Nelani100% (1)

- CIMA P3 2019 Notes PDFDocumento132 páginasCIMA P3 2019 Notes PDFJoe BurnsAún no hay calificaciones

- 2024 l1 Topics CombinedDocumento27 páginas2024 l1 Topics CombinedShaitan LadkaAún no hay calificaciones

- CFA Level 1 - Section 2 QuantitativeDocumento81 páginasCFA Level 1 - Section 2 Quantitativeapi-376313867% (3)

- ETHICS AND PROFESSIONAL STANDARDS IN FINANCEDocumento144 páginasETHICS AND PROFESSIONAL STANDARDS IN FINANCESimran SangwanAún no hay calificaciones

- Time Saving Tips!: Wiley © 2015Documento4 páginasTime Saving Tips!: Wiley © 2015CMAún no hay calificaciones

- Cfa QaDocumento21 páginasCfa QaM Fani MalikAún no hay calificaciones

- E2 PasscardDocumento144 páginasE2 PasscardCecilia Mfene SekubuwaneAún no hay calificaciones

- eFRM CompleteDocumento5 páginaseFRM CompletePhindile MvelaseAún no hay calificaciones

- CFA Level 1Documento2 páginasCFA Level 1beta3737100% (4)

- Cima E1 Notes Organisational ManagementDocumento120 páginasCima E1 Notes Organisational ManagementLamar BrownAún no hay calificaciones

- Akin SecurityAnalysisPresentation2014 1p80bskDocumento50 páginasAkin SecurityAnalysisPresentation2014 1p80bskgarych72Aún no hay calificaciones

- Cfa Level2 ExamDocumento74 páginasCfa Level2 ExamLynn Hollenbeck BreindelAún no hay calificaciones

- Interpretation and Application of International Standards on AuditingDe EverandInterpretation and Application of International Standards on AuditingAún no hay calificaciones

- CFA Level I Exam Companion: The 7city / Wiley Study Guide to Getting the Most Out of the CFA Institute CurriculumDe EverandCFA Level I Exam Companion: The 7city / Wiley Study Guide to Getting the Most Out of the CFA Institute CurriculumAún no hay calificaciones

- CIMA P3 Notes - Performance Strategy - Chapter 1Documento14 páginasCIMA P3 Notes - Performance Strategy - Chapter 1Mark Horance HawkingAún no hay calificaciones

- Learn about random text documentDocumento1 páginaLearn about random text documentMark Horance HawkingAún no hay calificaciones

- Citation Guide - IEEE StyleDocumento6 páginasCitation Guide - IEEE StyleMark Horance HawkingAún no hay calificaciones

- My SchoolDocumento1 páginaMy SchoolSuresh Madhusanka RodrigoAún no hay calificaciones

- My School and Country With VillageDocumento1 páginaMy School and Country With VillageMark Horance HawkingAún no hay calificaciones

- My Cat Is Pet. He Is Very Innocent and Play With Me Every TimeDocumento1 páginaMy Cat Is Pet. He Is Very Innocent and Play With Me Every TimeMark Horance HawkingAún no hay calificaciones

- IHM HCI2001PanelPatternsPapDocumento3 páginasIHM HCI2001PanelPatternsPapMark Horance HawkingAún no hay calificaciones

- CEO email IDs in Android app developmentDocumento1 páginaCEO email IDs in Android app developmentIshanku BorahAún no hay calificaciones

- 7-Business Ethics & Corporate Governance.Documento15 páginas7-Business Ethics & Corporate Governance.sheetaljerryAún no hay calificaciones

- Fauji Cement PDFDocumento96 páginasFauji Cement PDFtahirAún no hay calificaciones

- King ReportDocumento254 páginasKing ReportMavy MauAún no hay calificaciones

- Shareholder Primacy, ControllingDocumento23 páginasShareholder Primacy, ControllinganonymouseAún no hay calificaciones

- Quasem Industries Limited - Annual Report 2019Documento122 páginasQuasem Industries Limited - Annual Report 2019JayedAún no hay calificaciones

- Fair Value Measurement - December 2020Documento182 páginasFair Value Measurement - December 2020HammadAún no hay calificaciones

- BAT AR20 F 2018 Financial StatementsDocumento138 páginasBAT AR20 F 2018 Financial StatementsK DonovichAún no hay calificaciones

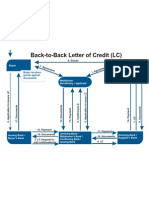

- Back To Back LCDocumento1 páginaBack To Back LCJayant Nair0% (1)

- Strategic Management: Creating Competitive Advantages: True / False QuestionsDocumento80 páginasStrategic Management: Creating Competitive Advantages: True / False QuestionsmichaelliangAún no hay calificaciones

- Hexaware Sustainability ReportDocumento72 páginasHexaware Sustainability ReportMAún no hay calificaciones

- The Failure of Corporate Governance at Infrastructure Leasing and Financial Services Limited: Lessons LearntDocumento14 páginasThe Failure of Corporate Governance at Infrastructure Leasing and Financial Services Limited: Lessons LearntGaurav GuptaAún no hay calificaciones

- HSBC Who Is The BossDocumento7 páginasHSBC Who Is The BossT FaizAún no hay calificaciones

- BMW Group Corporate GovernanceDocumento23 páginasBMW Group Corporate GovernanceAmeya Dalal0% (1)

- EASTERN SILK ANNUAL REPORTDocumento30 páginasEASTERN SILK ANNUAL REPORTNaveen KumarAún no hay calificaciones

- Business Environment and Concepts - Version 1 NotesDocumento27 páginasBusiness Environment and Concepts - Version 1 Notesaffy714Aún no hay calificaciones

- DRM Quiz2 AnswersDocumento4 páginasDRM Quiz2 Answersde4thm0ng3rAún no hay calificaciones

- Minutes of General Meeting of Shareholders TemplateDocumento5 páginasMinutes of General Meeting of Shareholders TemplatewhatevernameAún no hay calificaciones

- CH 11Documento34 páginasCH 11PetersonAún no hay calificaciones

- Maruti Udyog LTDDocumento21 páginasMaruti Udyog LTDsamyashamimAún no hay calificaciones

- Compiled Mailing List - IoT WebinarDocumento476 páginasCompiled Mailing List - IoT WebinarGirish GuptaAún no hay calificaciones

- AFM Passcard BPP PDFDocumento161 páginasAFM Passcard BPP PDFAzeez100% (1)

- Social Responsibility and Financial Performance - The Role of Good Corporate GovernanceDocumento15 páginasSocial Responsibility and Financial Performance - The Role of Good Corporate GovernanceRiyan Ramadhan100% (1)

- Derivatives Project PaperDocumento2 páginasDerivatives Project Paperirfan sururiAún no hay calificaciones

- Executive Assistant Office in Toronto Canada Resume Diane KearneyDocumento2 páginasExecutive Assistant Office in Toronto Canada Resume Diane KearneyDianeKearneyAún no hay calificaciones

- Corporate Governance and Firms Financial Performance in The United KingdomDocumento15 páginasCorporate Governance and Firms Financial Performance in The United KingdomYoung On Top BaliAún no hay calificaciones

- Strategic Case Study Paper 3.4 July 2023Documento42 páginasStrategic Case Study Paper 3.4 July 2023johny SahaAún no hay calificaciones

- WNISEF Experience in UkraineDocumento21 páginasWNISEF Experience in UkraineVitaliy HamuhaAún no hay calificaciones

- Syllabus-CORPORATE GOVERNANCEDocumento3 páginasSyllabus-CORPORATE GOVERNANCEshaleena chameriAún no hay calificaciones

- MIA Competency Framework Exposure DraftDocumento58 páginasMIA Competency Framework Exposure DraftLuqman HakimAún no hay calificaciones