Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Tamilnadu Budget

Cargado por

Elaya RajaDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Tamilnadu Budget

Cargado por

Elaya RajaCopyright:

Formatos disponibles

TAMILNADU BUDGET 2013-2014 The Tamil Nadu government presented its Annual Budget in Assmebly on Thursday.

It was a tax free budget that is bound to have happy takers. However, no new announcements or schemes were made for education. State Finance Minister O. Paneerselvam said that the coming years projected revenue surplus would be Rs. 664.06 crores and the fiscal deficit will be Rs. 22,938.57 crores. He also announced that two new cancer centres will be opened in Tirunelveli and Thanjavur, and operation theatres will be upgraded in district headquarters hospitals. Highlights -Tamil Nadu State Budget 2013-14 - Rs 21,000 cr for new Power Plant Projects - Rs 880.69 crore for Environmental - Rs 16,965 cr for School Education - Rs 6,452 cr for Road Highways. Chennai-Mamallapuran road to be made 4way - Rs 271.68 Crore for 4 new flyovers in Chennai - Rs 2000 crore for infrastructure - Rs 4,900 crore for Food Subsidy through Ration Shops - Rs 250 crore allotted to distribute 12,000 free cows, 6 lakh free goats to women this year - Rs 750 crore for Metro Rail - Rs 32.5 cr to set up 7 new Rice Mills - 2 lakh Free house land pattas to be distributed in 2013-14 - Aadhar Linked schemes to be implemented throughout the state - Rs 5,189 crore allotted for Agri sector. up Rs 1,385 crore from last year - Drought Relief of Rs. 15,000 per acre to benefit nearly 3 lakh farmers. To cost Rs 541 crore to Govt - Rs 15.85 crore foe Animal Husbandary - Rs 5 crore to develop skill of youth - Aadhar Linked schemes to be implemented throughout the state - 9914 vacancies filled in Cooperative societies - Rs 695 Crore for judiciary - 17,000 vacancies to be filled in Police Dept - Rs. 4,706 crore for Polce Dept - Rs. 208 Cr for Fire Dept - Rs 50 crore allotted for Police Station building infrastructure

TAMILNADU BUDGET 2014-2015

Tamil Nadu Legislative Assembly for the 2014-2015 fiscal year budget (Budget) was tabled today by the Minister of Finance, Mr. O. Panneerselvam. The main features:

2014-15 - the budget allocation for the year increased to Rs.42,185 Crores Rs.16,021 millions has been allocated for pension benefits. Pottery workers providing livelihood assistance of Rs.4,000 . Rs.751.09 Crore earmarked for projects to help the wedding. Rs.17,731.71 crore allotted for provision of free quality education for all school children including health aspect. Monthly allowance will be increased to Rs.1,500 for people with disabilities. Solid waste management in rural areas, Rs.200 crore Road infrastructure and increased funding of Rs.2,800 crore. Rs.198.25 Crores for beneficiaries of sheep, goats. Rs.242.54 crore as crop insurance. Commencement of Public Service at 200 centers in the city of Chennai and other municipal corporations, municipalities. . 36,233 Centers for free supply of cooking stove & cooking gas connection, grinders, fans. 118 primary health care centers, Hospitals and 64 primary health centers to be upgraded. Housing Board Apartments for the poor in Chennai, Erode, Coimbatore, Madurai, Trichy Rs.100 crore allocated for solar energy projects. 60 thousand to Rs.46.58 crore to set up solar power street lights. 1,260 crore to Rs.60,000 green homes with solar power allocation. 4,887 Village Administrative Officers will be given laptops. Disaster preparedness program will be allocated Rs.106.29 crore. Law and Order: Rs.5,168 million increase in funding for the police department.

Ahead of 2014 Lok Sabha elections, the Tamil Nadugovernment today presented a tax-free and revenue surplus Budget. The state government also announced a few initiatives to ease pressure on the common man. This Budget is yet another firm stride in our march towards growth and prosperity, said Finance Minister O Panneerselvam in his Budget speech at the state Assembly. The state administration had been striving hard to ensure equitable growth. However, failure of the Centre to stimulate growth and improve the failing macro-economic environment continued to adversely impact the investments and economic growth consecutively for the second year, he added. ALSO READ: Tamil Nadu increases food subsidy to Rs 5,300 cr Adherence to the Tamil Nadu Fiscal Responsibility (TNFR) Act target without impinging on the states ability to invest in critical sectors has, thus, become a daunting task, he said, adding though there were signs of revival, with the state's economic growth expected to exceed five per cent in 2013-14, massive efforts were needed to put the economy back on the path of accelerated growth. As a positive sign, the power situation had improved significantly in the state and industrial growth was showing recovery, he said. With the proposed investment of Rs 42,185 crore under Plan schemes in 2014-15, the Plan expenditure will cross Rs 107,000 crore as against the overall 12th Plan target of Rs 211,000 crore. The estimated revenue surplus in 2014-15 would be around Rs 289.36 crore and guided the state would continue to maintain a surplus in 2015-16 and 2016-17. Total revenue receipts are estimated at Rs 1,27,389.83 crore in 2014-15. ALSO READ: TN Govt allocates Rs 200 cr for monorail project Fiscal deficit for 2014-15 is estimated at Rs 25,714.31 crore (2.73 per cent of the GSDP). However, the fiscal deficit -gross state domestic product ratio -- would be 2.70 per cent in

2015-16 and 2.67 per cent in 2016-17. The continued economic stagnation has also caused a substantial shortfall in the states projected tax revenues, he said. The states own tax revenue was pegged at Rs 83,363.21 crore as per the revised estimates of 2013-14. It is estimated to increase to Rs 91,835.35 crore in the Budget Estimates for 2014-15. This would mean a growth of 10.16 per cent. The states own tax revenue - GSDP ratio for 2014-2015 will be 9.75 per cent as per BE 2014-15. A growth rate of 13.13 per cent is assumed for 2015-16, he said. The non-tax revenue was estimated at Rs 8,083.98 crore in the BE 2014-15. Since there was very limited mining potential in the state and most of the government services are delivered free of cost or only at nominal rate, non-tax revenue is estimated only marginally higher than the Revised Estimates 2013-14. A growth rate of 2.26 per cent is assumed for 2015-16 and 10.40 per cent for 2016-17. The state had recovered in the last two years from the revenue deficit of 2010-11. With prudent fiscal management, the state would achieve all the targets set by the 13th Finance Commission during 2014-15 and would also be able to maintain the same success in the future, said Panneerselvam. ALSO READ: Tamil Nadu to host Global Investors Meet in Chennai Food subsidy The state government has increased food subsidy to Rs 5,300 crore. Besides, it has decided to launch low cost pharmacy chains. Panneerselvam said this year food subsidy had been increased to Rs 5,300 crore from Rs 4900 crore in 2013-14, which was later revised to Rs 5,000 crore. Besides, it had been supplying essential products like rice, dal, pal oil and others through its

public distribution scheme (PDS) and had also opened low-cost canteens, low-cost food and vegetable shops. He said, already 210 medical chains were being operated by state co-operatives and another 100 would be opened. Besides it was decided to launch Amma Pharmacy. These medical shops run to ensure the sale of medicines at reasonable prices to the public. A sum of Rs 20 crore will be used from the Price Stabilisation Fund, he said. The state government currently operates 297 Amma canteens, where idly is served for Re 1 and a variety rice for Rs 5 across the state. Rs 200 crore for monorail The government has allocated Rs 200 crore for the proposed monorail project in the state. The bid process was in progress, the minister said. The estimated length of the project is 20.68 km and the estimated cost is $522 million (around Rs 3,235 crore). The project will be taken up through public, private partnership (PPP), on design, build, finance operate and transfer (DBFOT) basis. Realty slowdown hits revenues Slowdown in the real estate sector has impacted revenue from registration and stamp duty, said Panneerselvam. However, tax income from the sale of alcohol gave a helping hand. To assess the slowdown in the real estate sector, we have only the tool of stamp duty and registration and it has seen a fall of 10 per cent, said K Shanmugam, principal secretary, Department of Finance. The minister, in his speech, said, In accordance with this low growth, the estimates have been reduced by Rs 652.24 crore in the Revised Estimates 2013-14. In the Budget Estimates 2014-15, the revenue from registration and stamp duty is estimated to be Rs 10,470.18 crore, assuming a growth of 13.54 per cent. In a press conference later, he added, the general sentiments is that the sector would pick

up now. The supply side is doing well, but the demand has to pick up. The modified target for commercial taxes for 2013-14 was Rs 64,626.46 crore, which has now been downsized to Rs 61,891.74 crore in the Revised Estimates of 2013-14. Similarly, the target for excise revenue was modified after the streamlining of excise duty. Thus, the original estimate of Rs.14,469.87 crore has been revised to Rs 5,868.65 crore in the Revised Estimates 2013-2014. Assuming a 10.47 per cent growth, the estimated excise revenue in 2014-2015 will be Rs 6,483.04 crore, the minister said. Rs 50 crore Cotton Cultivation Mission The state announced its plans to launch Cotton Cultivation Mission to increase the cultivation of cotton to 600,000 acres in the next five years. The Southern India Mills Association (SIMA) welcomed this stating this would go a long way in reaching selfsufficiency in cotton production. As the production of cotton within the state was inadequate, an ambitious Tamil Nadu Cotton Cultivation Mission will be launched in the state with an initial outlay of Rs 5 0 crore. Cotton is at present cultivated in the state in 334,000 acres, with a production of 400,000 bales. There are 1,948 spinning mills functioning in the state with an annual requirement of 11 million bales. T Rajkumar, chairman, Sima, said it was timely as the textile mills in the state were spending huge amount towards transportation of cotton from upcountry states and selling the cotton yarn in the same markets. The industry also expressed happiness in wind power evacuation, as the sector suffered considerably during the current wind season due to partial non-evacuation of wind power. Inclusive and growth-oriented: SICCI The Southern India Chamber of Commerce & Industry (SICCI) welcomed the decision to

increase crop loans to Rs 5,000 crore and provision of Rs 200 crore as interest subvention. Other proposals like green energy corridor for evacuation of wind power, pharmacies that sell medicines at reasonable prices and Chennai City Transportation System to link all modes of transport were timely, said Jawahar Vadivelu, president of SICCI. Besides, creation of a special purpose vehicle to implement the Madurai-Thoothukudi Industrial Corridor was a step in right direction, he said. ALSO READ: TN to take TANGEDCO's liabilities worth Rs 2,000 cr in FY15

También podría gustarte

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

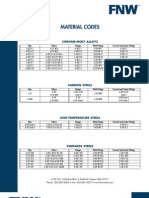

- Cast IronDocumento5 páginasCast Ironsairam2234Aún no hay calificaciones

- BIS Programme of Work for MEDDocumento128 páginasBIS Programme of Work for MEDElaya RajaAún no hay calificaciones

- Cast IronDocumento5 páginasCast Ironsairam2234Aún no hay calificaciones

- TN's reservation system contrasts rest of IndiaDocumento7 páginasTN's reservation system contrasts rest of IndiaElaya Raja100% (1)

- Urban Scenario in Tamil NaduDocumento18 páginasUrban Scenario in Tamil NaduSherine David SAAún no hay calificaciones

- Limited Use Software & Database License For Ashrae Handbookcd Software and DatabaseDocumento2 páginasLimited Use Software & Database License For Ashrae Handbookcd Software and DatabaseElaya RajaAún no hay calificaciones

- 2011 Census Primary Census Abstract - FinalDocumento62 páginas2011 Census Primary Census Abstract - FinalElaya RajaAún no hay calificaciones

- Indian National Movement Que Ans HeadDocumento7 páginasIndian National Movement Que Ans HeadElaya RajaAún no hay calificaciones

- FNW MaterialCodesDocumento2 páginasFNW MaterialCodessenioor2004Aún no hay calificaciones

- Tamil Baby Girl NamesDocumento46 páginasTamil Baby Girl NamesAnbu Mano75% (4)

- Firefighting Hydraulic CalculationDocumento27 páginasFirefighting Hydraulic CalculationElaya Raja82% (17)

- Malleable Iron Threaded FittingsDocumento16 páginasMalleable Iron Threaded Fittingsenvitech72Aún no hay calificaciones

- OSY Gate Valve 300 Psi UL FM 1Documento2 páginasOSY Gate Valve 300 Psi UL FM 1Elaya RajaAún no hay calificaciones

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- MCS Practical For StudentsDocumento10 páginasMCS Practical For StudentsrohitkoliAún no hay calificaciones

- ADBI Working Paper Series: Asian Development Bank InstituteDocumento30 páginasADBI Working Paper Series: Asian Development Bank InstituteNA NAAún no hay calificaciones

- Review Materials Chapters 8, 10, 3 & 4 Term 3 Y18-19 PDFDocumento19 páginasReview Materials Chapters 8, 10, 3 & 4 Term 3 Y18-19 PDFKrizelle Anne TaguinodAún no hay calificaciones

- Culver Company Sells Its Product For 165 Per Unit ItsDocumento2 páginasCulver Company Sells Its Product For 165 Per Unit ItsAmit PandeyAún no hay calificaciones

- Historic St. Mary's City Commission: Audit ReportDocumento14 páginasHistoric St. Mary's City Commission: Audit ReportBella N.Aún no hay calificaciones

- The Importance and Use of Budgets Within An OrganizationDocumento6 páginasThe Importance and Use of Budgets Within An OrganizationAndrei MunteanuAún no hay calificaciones

- Draft Resume Re RevisedDocumento3 páginasDraft Resume Re RevisedDale CharlesAún no hay calificaciones

- ECE 202 Notes Study Economics Yr1 Prt2Documento106 páginasECE 202 Notes Study Economics Yr1 Prt2gavin henning100% (1)

- General AwarenessDocumento525 páginasGeneral AwarenessAshitha M R Dilin100% (1)

- Ch12 Planning For Capital InvestmentsDocumento62 páginasCh12 Planning For Capital Investmentsعبدالله ماجد المطارنهAún no hay calificaciones

- Chap 10Documento43 páginasChap 10Ryan SukrawanAún no hay calificaciones

- BOM For LGUs 2023 Edition - Fin1 - UnlockedDocumento329 páginasBOM For LGUs 2023 Edition - Fin1 - UnlockedNatacia Rimorin-Dizon100% (2)

- Acctg 13 07 Acctg For Governmental NGO With Answers 1Documento9 páginasAcctg 13 07 Acctg For Governmental NGO With Answers 1Calvin Joseph Tino100% (2)

- CWG - Chapter 311 Tax Increment FinancingDocumento2 páginasCWG - Chapter 311 Tax Increment FinancingTPPFAún no hay calificaciones

- Evaluation GridDocumento6 páginasEvaluation GridDaniel BWINO AMANYAAún no hay calificaciones

- EBIT vs. EBITDA vs. Net Income Valuation Metrics and MultiplesDocumento3 páginasEBIT vs. EBITDA vs. Net Income Valuation Metrics and MultiplesSanjay Rathi100% (1)

- Coca ColaDocumento13 páginasCoca Colaramonese100% (1)

- Robert Kiyosaki - Cashflow Management SecretsDocumento23 páginasRobert Kiyosaki - Cashflow Management SecretsPrekash Menon100% (6)

- Gemoknyer Soalan..Documento6 páginasGemoknyer Soalan..Nurulizwa Bte Abdul RashidAún no hay calificaciones

- Intro To MacroeconimicsDocumento128 páginasIntro To MacroeconimicsVikas Kumar0% (1)

- Economics AQA As Unit 2 Workbook AnswersDocumento20 páginasEconomics AQA As Unit 2 Workbook AnswersFegsdf Sdasdf0% (1)

- Intertemporal ChoiceDocumento4 páginasIntertemporal Choicepatelshivani033Aún no hay calificaciones

- Karnataka Co-Operative Milk Producers Federation Limited - India Ratings and ResearchDocumento11 páginasKarnataka Co-Operative Milk Producers Federation Limited - India Ratings and ResearchDebabrata SahanaAún no hay calificaciones

- Government Accounting and BudgetingDocumento56 páginasGovernment Accounting and BudgetingMheng Glico100% (1)

- Annex M - Trust Receipts and Fund TransfersDocumento4 páginasAnnex M - Trust Receipts and Fund TransfersMark Ronnier VedañaAún no hay calificaciones

- Foreign Aid Scenario in BangladeshDocumento6 páginasForeign Aid Scenario in BangladeshMd Mostafijur Rahman MishukAún no hay calificaciones

- 100 Questions and AnswersDocumento74 páginas100 Questions and Answersrajaaju100% (4)

- Capital budgeting decision methods chapter questionsDocumento2 páginasCapital budgeting decision methods chapter questionsGabriela GoulartAún no hay calificaciones

- DLG Chapter 4 (Combined)Documento14 páginasDLG Chapter 4 (Combined)Puth RathanaAún no hay calificaciones

- The Language of Economics - Keywords and Concepts for Understanding Economic TermsDocumento22 páginasThe Language of Economics - Keywords and Concepts for Understanding Economic TermsEma JeaninaAún no hay calificaciones