Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Finance

Cargado por

FurqangreatDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Finance

Cargado por

FurqangreatCopyright:

Formatos disponibles

Implications of Financial Statements

Submitted to Sir Aaqib Raza

Submitted by Furqan-ul-Islam

BAHND-13689

Submission Date: 29/May/2013

Financial Accounting & Reporting

Acknowledgement

I am very thankful to our respected teacher Mr. Aaqib Raza who guides me very well to create this report. When I attend his lecture I feel so motivated and encouraged. I would like to show my greatest appreciation to Mr. Aaqib Raza. Without his efforts and guidance this report would not have completed

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 2

Financial Accounting & Reporting

Table of Contents

Executive Summary ........................................................................................................................ 5 Sole proprietorship Business: ......................................................................................................... 6 AL-Furqan Traders ......................................................................................................................... 6 Products of AL-Furqan Traders .................................................................................................. 6 Interview and Visit .................................................................................................................. 7 Users of AL-Furqan Traders ........................................................................................................... 7 Owner: ......................................................................................................................................... 8 Customers: ............................................................................................................................... 8 Partnership Business: .................................................................................................................... 11 Ramzan Super Store...................................................................................................................... 11 Interview and Visit .................................................................................................................... 11 Users of Ramzan Super Store ....................................................................................................... 11 Owners: ..................................................................................................................................... 12 Management: ......................................................................................................................... 12 Company: ...................................................................................................................................... 15 Nishat Mills Limited ..................................................................................................................... 15 Introduction: .............................................................................................................................. 15 With an array of 938 modern new generation sewing machines, the Home Textile Division consists of 2 stitching facilities. The two facilities combined have an average production capacity of approximately 24 million meters per annum. The product line is customized to manufacture products of various styles and sizes according to the requirements of our customers, wholesalers, retailers and contract textile business. (Nishatmillsltd) ................................................................ 16 Product Range: .............................................................................................................................. 16 Impact of local and International rules and regulations on preparation of financial statements ............................................................................................................................................... 17 SECP TIERS (IAS) ....................................................................................................................... 20 Tier 1: Publicly Accountable Entities: ...................................................................................... 20 Tier 2: Medium Sized Entities (MSEs) ................................................................................. 20 Different Users of Nishat Mills Limited ....................................................................................... 22 Owners / Shareholders .............................................................................................................. 22 Management: ......................................................................................................................... 23

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS Page 3

Financial Accounting & Reporting

Muslim Commercial Bank (MCB) ............................................................................................... 27 International Standards on Financial Statements of MCB ........................................................ 28 Different Users of MCB................................................................................................................ 29 Owners/Shareholders: ............................................................................................................... 30 Employees: ............................................................................................................................ 30 IFRS Framework ........................................................................................................................... 34 The Reporting Entity: ................................................................................................................ 35 The Elements of financial Statements: .................................................................................. 35 Financial Statements: .................................................................................................................... 36 Income Statement: ..................................................................................................................... 36 Balance Sheet: ....................................................................................................................... 37 Conclusion .................................................................................................................................... 44 Self Evaluation and Self Criticism................................................................................................ 45 Bibliography ................................................................................................................................. 46

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 4

Financial Accounting & Reporting

Executive Summary

This assignment is given by the college related to subject Financial Accounting & Reporting. The basic intension of this assignment to choose for types of business one from sole trader Second from partnership third from Service sector company and fourth from manufacturing sector company so from sole trader I choose my own family business by the name of AL-Furqan Traders and from partnership business I chose Ramzan Super Store and from Service sector company I chose Muslim Commercial Bank (MCB) and from Manufacturing sector I choose Nishat Mills limited. So after selecting a businesss the requirement of this assignment to explore the users and user needs of this business so I explore all the users and their needs of all the businesses which I chose for this assignment. Another requirement of this assignment and that is explain the effects of different local (SECP) and international regulations/Standards like IFRS Framework on financial statement of selected companies so I also explain it of my selected companies and that is MCB and Nishat Textile mills. In the end I give conclusion of this assignment and also give self evaluation of this assignment.

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 5

Financial Accounting & Reporting

Sole proprietorship Business:

A sole proprietorship, also known as the sole trader or simply a proprietorship, is a type of business entity that is owned and run by one individual and in which there is no legal distinction between the owner and the business. (wikipedia)

AL-Furqan Traders

AL-Furqan Traders is a sole trader business. The owner of this business is Muhammad Arshad Saeed. Al-Furqan Traders deals water pumps basically they import water pumps from china and sell throughout Pakistan basically the business of Mr. Arshad Saeed perform a role of whole seller in the market.

Products of AL-Furqan Traders

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 6

Financial Accounting & Reporting

Above u can see the range of different products of AL-Furqan Traders. The owner of this business is very strict to maintain the quality of their products and because of this Mr. Arshad Saeed visit china at least two times in a year and told the main supplier of the business about the demand of the customers.

Interview and Visit

According of the assignment of this assignment I visit AL-Furqan Traders to get information it is so essay for me because the owner of AL-Furqan Traders M.Arshad Saeed is my father so he give me all the information related to this assignment and I also work there as inventory manager so I easily get information about all the operations of AL-Furqan Traders.

Users of AL-Furqan Traders

Following are the users of AL-Furqan Traders: Internal Users: Owner Employees Management

External Users: Customers External labor ( pump fitter) Taxation Authorities ( FBR etc) Competitors (Golden pumps etc) Suppliers Banks

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 7

Financial Accounting & Reporting

User Needs of AL-Furqan Traders

Owner:

The owner of AL-Furqan Traders M.Arshad Saeed manage the business very well he did not maintain a proper financial statement of their business but he record daily sales daily expenses and monthly basis as well on the sale register. User Needs: The owner of Al-Furqan Traders needs to Increase the profit of the business and because of this the accountant of Al-Furqan Traders calculate the profitability ratios of the business The owner of Al-Furqan Traders want decrease the expenses of the business The owner of Al-Furqan Traders want to increase the goodwill of the business

Customers:

Basically the main customers of AL-Furqan Traders is water pumps dealers who purchase in bulk from AL-Furqan Traders at low price as compare to local market prices and also have a very big local market of AL-Furqan Traders because water is basic need of human beings and almost every house needs at least one water pump to suck water from main water line. User Needs: Customer of AL-Furqan Traders needs Good quality product Customer of AL-Furqan Traders needs Good Repairing service Customers of AL-Furqan Traders needs Satisfaction Customers of AL-Furqan Traders need Product Value

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 8

Financial Accounting & Reporting

Government:

The owner of AL-Furqan Traders runs his business with the government institute life for electricity and taxation authorities like Federal Board and Revenue (FBR). User Needs: Government Department (FBR) collects Tax from the business. Government collects electricity bills from the AL-Furqan Traders Government Want to know the business is legal or not.

Employees:

AL-Furqan Traders has six employees and they are satisfied with their jobs. User Needs: Employees of AL-Furqan Traders need their Salaries on time Employees of AL-Furqan Traders need Job Security Employees of AL-Furqan Traders need all items related to their job. Employees of AL-Furqan need Increments & bonuses

External Labor:

External labor like pumps fitter wants more business from AL-Furqan Traders if more local customer come on Al-Furqan Traders who do not purchase on bulk and purchase just one piece so this type of customer wants pump fitter to fit the pump so more customers more earn money by pump fitters. User Needs: External labor wants More Customers from Al-Furqan Traders.

Banks:

The owner of Al-Furqan Traders open some business accounts in different banks like HBL and MCB to maintain a business transaction like customers checks etc.

Page 9

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Financial Accounting & Reporting

User Needs: Banks want to more balance in account of AL-Furqan Traders Banks want regular transactions of Al-Furqan Traders

Competitors:

Basically two main competitors of Al-Furqan Traders first are Golden Pumps and Hico pumps. User Needs: Competitors of AL-Furqan Traders need Information of new products of AL-Furqan Traders. Competitors want to know way working style of Al-Furqan Traders Competitors want to know weaknesses of Al-Furqan Traders Competitors need to know selling prices of the products

Suppliers:

Suppliers are the most important user of AL-Furqan Traders because without suppliers business never runs basically AL-Furqan Traders imports goods from china so the main suppliers of AL-Furqan Traders are Chinese water pumps companies so the owner of AL-Furqan Traders M. Arshad Saeed creates very good relationships with their suppliers. User Needs: Suppliers of AL-Furqan Traders need more business from Al-Furqan Traders Suppliers of Al-Furqan Traders want payment on time from Al-Furqan Traders, Suppliers of AL-Furqan Traders need good price or high profitable dealings with ALFurqan Traders Suppliers of Al-Furqan Traders want no Complains from Al-Furqan Traders and also want to build very good business relations with Al-Furqan Traders.

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 10

Financial Accounting & Reporting

Partnership Business:

A business organization in which two or more individuals manage and operate the business both owners are equally and personally liable for the debts from the business. (investopedia ) According to requirement of this assignment I choose partnership business by the name of Ramzan Super Store.

Ramzan Super Store

Ramzan super store is partnership business two partners runs the business the name of first partner is Hafiz zahoor elahi and second is Muhammad Ramzan these two partners are the owners of the business they deals all the products and items that are required in every field of our life. There is almost every item in Ramzan Super Store that is needed daily.

Interview and Visit

According of the assignment of this assignment I visit Ramzan super store to get information it is so essay for me because one owner of Ramzan is a very good friend of my father so he give me all the information related to this assignment I asked some question to Mr. Ramzan related to this assignment like how many partners in this business and how to prepare financial statements of your business etc. he is very friendly and give me all the answers of my questions.

Users of Ramzan Super Store

Following are the users of Ramzan Super Store: Internal: Owners Management Employees

External: Customers

Page 11

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Financial Accounting & Reporting

Taxation authorities(FBR) Banks (Alied bank) Suppliers Competitors

User Needs of Ramzan Super Store

Owners:

Ramzan super store is basically partnership business so two owners of this business first is Hafiz Zahoor Elahi and second is Muhammad Ramzan. Both owners are very responsible and manage the business very well they did not maintain a proper financial statement of their business but they record daily sales daily expenses and monthly basis as well on the sale and expense register. User Needs: The owners of Ramzan Super store need to increase the profit of the business and because of this they increase regular sale of the business. The owners of Ramzan Super store want to decrease the expenses of the business. The owners of Ramzan Super store want to increase the goodwill of the business.

Management:

The management of Ramzan super store is very hard working six people manage all the business and both the owners also part of the management. User Needs: The management of Ramzan Super store wants to achieve the objectives and goals of the business and because of this they planned that how to achieve those goals. The management of Ramzan Super store needs customers interaction and because of this they give special discounts for different products The management of Ramzan Super store fulfills the customers and their employees needs.

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 12

Financial Accounting & Reporting

Employees:

Fifteen employees work at Ramzan Super Store and all are satisfied from their job. User Needs: Employees of AL-Furqan Traders need their Salaries on time Employees of AL-Furqan Traders need Job Security Employees of AL-Furqan Traders need all items related to their job. Employees of AL-Furqan need Increments & bonuses

Customers:

Ramzan super store have a very big market because they deals all the products and items that are required in every field of our life so the amount of customer of Ramzan super store is very high. Ramzan super store also sell their goods to small stores or shops that purchase in bulk at competitive low price. User Needs: Customers of Ramzan Super Store need good quality product from store. Customers of Ramzan super store need special discounts from the business Customers of Ramzan super store needs satisfaction from the business Customers of Ramzan super store needs Product Value from the business

Taxation authorities:

Ramzan Super Store pays tax regularly to federal board of revenue (FBR). The owners of Ramzan Super store are very responsible about the liabilities of their business.

User Needs: FBR Need financial information of the business to check the tax transactions FBR need information about the sources of incomes of Ramzan super store.

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 13

Financial Accounting & Reporting

Banks:

Basically the owners of Ramzan Super Store open his business accounts in Habib Bank and Habib bank also clear the checks of Ramzan Super Store. User Needs: Banks want to more balance in account of Ramzan super store Banks want regular transactions of Ramzan super store

Suppliers:

Basically Ramzan Super store has a lot of suppliers for different things like Punjab rice mill for rice and others mills for sugar etc. User Needs: Suppliers of Ramzan super store need more business from Ramzan store. Suppliers of Ramzan super store want payment on time from Ramzan super store. Suppliers of Ramzan super store wants good price or high profitable dealings with Ramzan super store. Suppliers of Suppliers of Ramzan super store want no Complains from Ramzan super store want and also want to build very good business relations with Ramzan super store.

Competitors:

There is the number of competitors of Ramzan Super Store but AL-Gani and Hafiz Super Stores are the main competitors of Ramzan Super Store. User Needs: Competitors of Ramzan super store want Information of new products of Ramzan super store. Competitors of Ramzan super store want to know way working style of Ramzan Super Store Competitors of Ramzan super store want to know weaknesses of Ramzan Super Store

Page 14

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Financial Accounting & Reporting

Competitors of Ramzan super store need to know selling prices of the products.

Company:

A voluntary association formed and organized to carry on a business. Types of companies include sole proprietorship, partnership, limited liability, corporation, and public limited company. (businessdictionary) According to requirement of this assignment I choose two companies first is Nishat Mills Limited and second is Muslim Commercial Bank (MCB).

Nishat Mills Limited

Introduction:

Nishat Mills Limited is the flagship company of Nishat Group. It was established in 1951. It is one of the most modern, largest vertically integrated textile companies in Pakistan. Nishat Mills Limited has 198,120 spindles, 655 Toyota air jet looms. The Company also has the most modern textile dyeing and processing units, 2 stitching units for home textile, one stitching unit for garments and Power Generation facilities with a capacity of 89 MW. The Companys total export for the year 2011 was Rs. 36.015 billion (US$ 416 million). Due to the application of prudent management policies, consolidation of operations, a strong balance sheet and an effective marketing strategy, the growth trend is expected to continue in the years to come. The Company's production facilities comprise of spinning, weaving, processing, stitching and power generation. (Nishatmills.ltd)

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 15

Financial Accounting & Reporting

Products of Nishat Textile Mills Limited

With an array of 938 modern new generation sewing machines, the Home Textile Division consists of 2 stitching facilities. The two facilities combined have an average production capacity of approximately 24 million meters per annum. The product line is customized to manufacture products of various styles and sizes according to the requirements of our customers, wholesalers, retailers and contract textile business. (Nishatmillsltd) Product Range: Quilt Covers Quilted Throw-over Flat Sheet Fitted Sheet Pillow Cases Cushions Valances Curtains Baby Sets Table Linen Embroidery

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 16

Financial Accounting & Reporting

Impact of local and International rules and regulations on preparation of financial statements The Company financial statements have been prepared in accordance with approved accounting standards as applicable in Pakistan. Approved accounting standards comprise of such International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board as are notified under the Companies Ordinance, 1984, provisions of and directives issued under the Companies Ordinance, 1984. In case requirements differ, the provisions or directives of the Companies Ordinance, 1984 shall prevail.

Following standards and amendments to existing standards have been published and are mandatory for the Companys accounting periods beginning on or after 01 July 2012 or later periods: IFRS 7 (Amendment), Financial Instruments: Disclosures (effective for annual periods beginning on or after 01 January 2013). The International Accounting Standards Board (IASB) has amended the accounting requirements and disclosures related to offsetting of financial assets and financial liabilities by issuing amendments to IAS 32 Financial Instruments: Presentation and IFRS 7. These amendments are the result of IASB and US Financial Accounting Standard Board undertaking a joint project to address the differences in their respective accounting standards regarding offsetting of financial instruments. The clarifying amendments to IAS 32 are effective for annual periods beginning on or after 01 January 2014. However, these amendments are not expected to have a material impact on the Companys financial statements. IFRS 9 Financial Instruments (effective for annual periods beginning on or after 01 January 2015). It addresses the classification, measurement and recognition of financial assets and financial liabilities. This is the first part of a new standard on classification and measurement of financial assets and financial liabilities that shall replace IAS 39 Financial Instruments: Recognition and Measurement. IFRS 9 has two measurement categories: amortized cost and fair value. All equity instruments are measured at fair value. A debt instrument is measured at amortized cost only if the entity is holding it to collect contractual cash flows and the cash flows represent principal and interest. For liabilities, the standard retains most of the IAS 39 requirements. These include amortizedcost accounting for most financial liabilities, with bifurcation of embedded derivatives. The main

Page 17

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Financial Accounting & Reporting

change is that, in cases where the fair value option is taken for financial liabilities, the part of a fair value change due to an entitys own credit risk is recorded in other comprehensive income rather than the income statement, unless this creates an accounting mismatch. This change shall mainly affect financial institutions. There shall be no impact on the Companys accounting for financial liabilities, as the new requirements only affect the accounting for financial liabilities that are designated at fair value through profit or loss, and the Company does not have any such liabilities. IFRS 10 Consolidated Financial Statements (effective for annual periods beginning on or after 01 January 2013). Concurrent with the issuance of IFRS 10, the IASB has also issued IFRS 11 Joint Arrangements, IFRS 12 Disclosure of Interests in Other Entities, IAS 27 (revised 2011) Consolidated and Separate Financial Statements and IAS 28 (revised 2011) Investments in Associates. The objective of IFRS 10 is to have a single basis for consolidation for all entities, regardless of the nature of the investee, and that basis is control. The definition of control includes three elements: power over an investee, exposure or rights to variable returns of the investee and the ability to use power over the investee to affect the investors returns. IFRS 10 replaces those parts of IAS 27 Consolidated and Separate Financial Statements that address when and how an investor should prepare consolidated financial statements and replaces Standing Interpretations Committee (SIC) 12 Consolidation Special Purpose Entities in its entirety. The management of the Company is in the process of evaluating the impacts of the aforesaid standard on the Companys financial statements. IFRS 12 Disclosures of Interests in Other Entities (effective for annual periods beginning on or after 01 January 2013). This standard includes the disclosure requirements for all forms of interests in other entities, including joint arrangements, associates, special purpose vehicles and other off-balance sheet vehicles. This standard is not expected to have a material impact on the Companys financial statements. IFRS 13 Fair value Measurement (effective for annual periods beginning on or after 01 January 2013).This standard aims to improve consistency and reduce complexity by providing a precise definition of fair value and a single source of fair value measurement and disclosure requirements for use across IFRSs. The requirements, which are largely aligned between IFRSs and US GAAP, do not extend the use of fair value accounting but provide guidance on how it

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS Page 18

Financial Accounting & Reporting

should be applied where its use is already required or permitted by other standards within IFRSs or US GAAP. This standard is not expected to have a material impact on the Companys financial statements. IAS 1 (Amendment), Presentation of Financial Statements (effective for annual periods beginning on or after 01 July 2012). The main change resulting from this amendment is the requirement for entities to group items presented in Other Comprehensive Income (OCI) on the basis of whether they are potentially recycled to profit or loss (reclassification adjustments). The amendment does not address which items are presented in OCI. However, this amendment is not expected to have a material impact on the Companys financial statements. IAS 16 (Amendment), Property, Plant and Equipment (effective for annual periods beginning on or after 01 January 2013).This amendment requires that spare parts, stand-by equipment and servicing equipment should be classified as property, plant and equipment when they meet the definition of property, plant and equipment in IAS 16 and as inventory otherwise. However, this amendment is not expected to have a material impact on the Companys financial statements. On 17 May 2012, IASB issued Annual Improvements to IFRSs: 2009 2011 Cycle, incorporating amendments to five IFRSs more specifically in IAS 1 Presentation of Financial Statements and IAS 32 Financial instruments: Presentation, that are considered relevant to the Companys financial statements. These amendments are effective for annual periods beginning on or after 01 January 2013.These amendments are unlikely to have a significant impact on the Companys financial statements and have therefore not been analyzed in detail.

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 19

Financial Accounting & Reporting

SECP TIERS (IAS)

The Securities and Exchange Commission of Pakistan (SECP) is empowered under Section 234 of the Companies Ordinance to prescribe the appropriate international accounting standards. SECP notifies the accounting standard based on the recommendation of institute of Chartered Accountants of Pakistan (ICAP). These are mainly formulated in line with the principles underlined in international Financial Reporting Standard (IFRS). To provide a comprehensive framework of accounting and financial reporting that covers all entities of varying sizes addresses the degree of public interest involved in such entities, three tiers segregate the requirements for preparations of financial Statements:

Tier 1: Publicly Accountable Entities:

Listed companies It has filed, or is in the process of filling its financial statements with the Securities and Exchange Commission of Pakistan. It holds assets in a fiduciary capacity for a broad group of outsiders, such as a bank, insurance company, pension fund, mutual fund or investment banking entity. It is a public utility or similar entity that provides an essential public service. It is economically significant on the basis of criteria such as total assets, total income, number of employees, degree of market dominance, and nature and extent of external borrowings The criteria for economically significant would be as follow: Turnover in excess of Rs.1 billion, excluding other income Number of employees in excess of 750 Total borrowings (excluding normal trade credit and accrued liabilities) in excess of Rs, 500 million.

Tier 2: Medium Sized Entities (MSEs)

Not a listed company or a subsidiary of a listed company. Not filed, or is not in the process of filing its financial statements with the Securities and Exchange Commission of Pakistan (SECP).

Page 20

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Financial Accounting & Reporting

Does not hold assets in fiduciary capacity for a broad group of outsiders, such as a bank, insurance company, securities broker/dealer, pension fund, mutual fund or investment banking entity.

Not a public utility or similar entity that provides an essential public service Not economically significant on the basis of criteria as defined above. Not a small-Sized Entity (SSE) as defined below.

Tier 3: Small Sized Entities (SSEs) Has paid up capital plus undistributed reserves (total equity after taking into account any dividend propose for the year) not exceeding Rs. 25 million. Has annual turnover not exceeding Rs.200 million, excluding other income. In order to qualify as a Small-Sized Entity, both of the above-mentioned conditions must be satisfied.

Three-Tiered Structure Standards Application:

Tier 1 Publicly Accountable Entities Tier 2 Medium-Sized Entities

The complete set of IFRS that is approved by ICAP and notified by SECP shall be applicable to these entities. The Accounting and Financial Reporting Framework and Standard for Medium-Sized Entity issued by the ICAP are applicable to these entities.

Tier 3 Small-Sized Entities

The Accounting and Financial Reporting Framework and Standard for Small-Sized Entities issued by the ICAP are applicable to these entities.

Figure 1: http://stocksobserver.blogspot.com/2013/01/secp-to-increase-its-enforcement.html

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 21

Financial Accounting & Reporting

Different Users of Nishat Mills Limited Internal

Owners / Shareholders Employees Management

External

Suppliers Competitors Regulatory Authorities Taxation Authorities Consumers Lenders Media

User Needs of Nishat Textile Mills Limited Internal

Owners / Shareholders:

In 2012 Nishat Mills Limited issued share (351,599,848) at Rupees 10 each and two other companies also purchase 31,548,151 shares of Nishat Mills and the name of these companies are D.G. Khan Cement Company and second one is Adamjee Insurance Company Limited. User Needs: Shareholders need to know about dividend pay ratio of the company. Owners need to improve profitability ratio of the company. Shareholders wants to increase the incomes of the company Owners wants to improve the share price and book value of the company

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 22

Financial Accounting & Reporting

Management:

In the list of directors are Mr. Muhammad Azam, Mian Umer Mansha, Mr. Khalid Qadeer Qureshi, Syed Zahid Hussain, Mr. Maqsood Ahmad, and Mian Hassan Mansha these are directors of the company. User Needs: Management needs to increase the productivity of the company and because of this company give training to the employees. Management needs to increase overall profit of the company and because of this the accountants of the company calculate the profitability ratios of the company. Management needs to increase the Goodwill of the company and because of this company manufacture good quality products. Management needs to increase the value of per share of the company

Employees:

Nishat mills have a very high qualified employees overall Nishat Groups have 30,000 employees. User Needs: Employees wants Salary on time Employees need Job Security Employees need all items related to their job. Employees Increments & bonuses Employees need regular training to overcome weaknesses.

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 23

Financial Accounting & Reporting

External Following are the external user of the Company

Customers:

Nishat mills have a very huge local and international market last year in 2012 Nishat mills sales 44,924,101,000 rupees which is very huge amount. User Needs: Customers wants a very good quality Customers wants special discounts Customers need to know about new product of Nishat mills limited.

Suppliers:

In 2012 Nishat mills limited purchase raw material by Rs.10, 127,755,000. User Needs: Suppliers need more order from Nishat Mills. Suppliers need payments on time from Nishat mills. Supplier need to build good relationship with Nishat mills limited.

Regulatory Authorities:

Regulatory Authorities like SECP and ICAP are the user of the company. User Needs: They need to know that company makes their financial statements according to the standards like IFRS.

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 24

Financial Accounting & Reporting

Taxation Authorities:

Taxation Authorities like FBR. Nishat mills limited pay regular tax to FBR infects Nishat mills is the one who pay huge amount as a tax in Pakistan. In 2012 Nishat mills pay 553,000,000 Rupees as a tax and in 2011 company pay 568,000,000 Rupees as a tax. User Needs: FBR officers need to know true picture of financial statements of the company. FBR need to the sources of income of the company. FBR need to know about property information of the company for property tax.

Competitors:

The competitors of Nishat textile mills like Orient textile mills and Orient Textile Mills has been awarded as the best textile manufacture at 7th Consumers Choice Award 2011 by Consumers Association of Pakistan. User Needs: Competitors need Information of new products of Nishat mills limited Competitors want to know way working style of Nishat Mills limited, Competitors want to know weaknesses of Nishat mills limited. Competitors need to know the selling prices of the products of Nishat textile mills limited.

Lenders:

In 2012 Company took long term loans from different lenders like Allied Bank limited, Saudi Pak industrial and agricultural investment Company Limited, HSBC bank Middle East limited, Habib bank limited, silk bank limited, Faysal bank limited, City bank limited and Standard chartered bank (Pakistan) Limited. So these are the lenders of the company who provides the loan to the Nishat textile Mills limited.

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 25

Financial Accounting & Reporting

User Needs: Lenders needs true financial information of the company to check reliability of the Nishat mills limited. Lenders need to pay back money as given loan to the Nishat textile mills limited. Lenders need to increase interest rate.

Media:

Media is also the user of Nishat Textile mills limited because media advertised Nishat mills limited and also cover the new products of the Nishat textile mills limited. User Needs: Media need information of current situation of the Nishat Mills Limited. Media need to know about the new clothes style of the Nishat Mills Limited. Media need more business from Nishat mills like advertising etc.

Figure 2: http://accentsandfurnishings.com/Pakistani-plus/nishat-mills.html

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 26

Financial Accounting & Reporting

Muslim Commercial Bank (MCB)

MCB Bank Limited, with more than 60 years of experience as one of the leading banks in Pakistan, was incorporated on July 9 in 1947. The bank has journeyed remarkable tenure of more than half a century of competitively edged and well positioned heights of success by deploying quality banking, heads on technological developments, professionally leading management and prudent and ethical work methodologies. MCB was nationalized along with other private banks in 1974 as part of Government of Pakistan's economic reform movement and was later privatized to Nishat Group lead consortium in 1991. Since privatization, MCB's growth has been phenomenal. Today, MCB in one of the largest foreign banks in Sri Lanka, the first bank in Pakistan to launch Global Depository Receipts (GDR) in 2006, has strategic foreign partnership with May bank of Malaysia which holds 20% shares in MCB through its wholly owned subsidiary May ban International Trust (Labuan) Berhad since 2008, has international indirect regional presence in Dubai (UAE), Bahrain, Azerbaijan, Hong Kong and Sri Lanka and serving through a domestic network of over 1,150 branches and over 690 ATMs across Pakistan with a customer base of 4.96 million. MCB is reputed as one of the soundest financial institution and as one of the leading banks in Pakistan with a deposit base of PKR. 545 bln and total assets of PKR 766 bln (The bank is versed as one of the oldest and most responsible banks in Pakistan and has played pivotal role in representing the country on global platforms while being one of the few institutions that are recognized and traded in the international market. The bank has also been acknowledged though prestigious recognition and awards by Euro money, MMT, Asia Money, SAFA (SAARC), The Asset and The Asian Banker. (MBC.COM)

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 27

Financial Accounting & Reporting

International Standards on Financial Statements of MCB

These financial statements have been prepared in accordance with the approved accounting standards as applicable in Pakistan. Approved Accounting Standards comprise of such International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board and Islamic Financial Accounting Standards (IFAS) issued by the Institute of Chartered Accountants of Pakistan as are notified under the Companies Ordinance, 1984, provisions of and directives issued under the Companies Ordinance, 1984and Banking Companies Ordinance, 1962. In case requirements differ, the provisions and directives given in Companies Ordinance, 1984 and Banking Companies Ordinance, 1962 shall prevail. The State Bank of Pakistan has deferred the applicability of International Accounting Standard (IAS) 39, Financial Instruments: Recognition and Measurement and IAS 40, Investment Property for Banking Companies through BSD Circular No. 10 dated August 26, 2002. The Securities and Exchange Commission of Pakistan (SECP) has deferred Applicability of IFRS-7 Financial Instruments: Disclosures on banks through S.R.O 411(1) /2008 dated April 28, 2008. Accordingly, the requirements of these standards have not been considered in the preparation of these financial statements. However, investments have been classified and valued in accordance with the requirements prescribed by the State Bank of Pakistan through various circulars. IFRS 8, Operating Segments is effective for the Banks accounting period beginning on or after January 1, 2009. All banking companies in Pakistan are required to prepare their annual financial statements in line with the format prescribed under BSD Circular No. 4 dated February 17, 2006, Revised Forms of Annual Financial Statements, effective from the accounting year ended December 31, 2006. The management of the Bank believes that as the SBP has defined the segment categorization in the above mentioned circular, the IAS 28 Investments in Associates and Joint Ventures (2011) - (effective for annual periods beginning on or after January 1, 2013) . IAS 28 (2011) supersedes IAS 28 (2008). IAS 28 (2011) makes the amendments to apply IFRS 5 to an investment, or a portion of an investment, in an associate or a joint venture that meets the criteria to be classified as held for sale; and on cessation of significant influence or joint control, even if an investment in an associate becomes an investment in a joint venture. The amendments have no impact on financial statements of the Bank. IAS 19 Employee Benefits (amended 2011) - effective for annual periods beginning on or after January 01, 2013The amended IAS 19 includes the amendments that require actuarial gains and losses to be recognized immediately in

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS Page 28

Financial Accounting & Reporting

other comprehensive income; to immediately recognize all past service costs; and to replace interest cost and expected return on plan assets with a net interest amount that is calculated by applying the discount rate to the net defined benefit liability / asset. This change will remove the corridor method and eliminate the ability for entities to recognize all changes in the defined benefit obligation and in plan assets in profit or loss, which currently is allowed under IAS 19. The application of the amendments to IAS 19 would result in the recognition of cumulative unrecognized actuarial gain amounting Rs. 1,107.512 million in other comprehensive income in the period of initial application. There are other new and amended standards and interpretations that are mandatory for the Banks. accounting periods beginning on or after January 1, 2013 but are considered not to be relevant or do not have any significant effect on the Banks operations and are therefore not detailed in these financial statements. (Annual Report , 2012)

Different Users of MCB

Internal

Owners / Shareholders Employees Management

External

Suppliers Competitors Regulatory Authorities Taxation Authorities Consumers Lenders

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 29

Financial Accounting & Reporting

Owners/Shareholders:

In year 2012 MCB issue 1000,000,000 at Rs 10 each and in year 2011 MCB also same amount of shares issued 1000,000,000 at Rs. 10 each. In year 2012 some different companies also purchase MCB shares like Adamjee Insurance, Nishat Mills limited, D.G Khan Cement Company Limited, Din Leather (Private) Limited, Siddiqsons Limited and Mayban International Trust (Labuan) Berhad. User Needs: Shareholders need to know about dividend pay ratio of the company. Owners need to improve profitability ratio of the company. Shareholders wants to increase the incomes of the company Owners wants to improve the share price and book value of the company

Employees:

Muslim Commercial Bank (MCB) very high qualified employees overall MCB have 11614 employees. Employees wants Salary on time Employees need Job Security Employees need all items related to their job. Employees Increments & bonuses Employees need regular training to overcome weaknesses.

Management:

The management of MCB is very professional and well educated in the list of Board of directors Mian Muhammad Mansha (chairman), S.M.Muneer (voice chairman) and other directors are Tariq Rafi, Shahzad Saleem, Mian Raza Mansha, Mian Umer Mansha, Aftab Ahmed Khan, Imran Maqbool (CEO) these are directors of the MCB. User Needs: Management needs to increase the productivity of the company and because of this company give training to the employees.

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS Page 30

Financial Accounting & Reporting

Management needs to increase overall profit of the company and because of this the accountants of the company calculate the profitability ratios of the company. Management needs to increase the Goodwill of the company and because of this company manufacture good quality products. Management needs to increase the value of per share of the company.

Suppliers:

The depositors of MCB perform the function of suppliers for the bank as they keep their money with the bank whereas on the other hand it enhances the banks lending ability which is then invested in some other business activities like providing personal and business loans etc. The profit earned from these is then paid back to the customers in the name of interest. User Needs: Depositors of MCB need protection of their money from the bank. Depositors of MCB want their money on time from the bank. Depositors of MCB need a good amount of interest from the bank. Depositors of MCB want to improve the profitability ratio of the bank.

Competitors:

MCB have a lot of competitors because market always has a room for new entrants. Different Islamic banks have entered the market claiming that their banking system is according to the sharia complaint solutions commonly known as Islamic Banking, certified by a distinguished sharia board and another banks also the competitors of MCB like Habib Bank, Allied Bank, Meezan Bank etc. User Needs: Competitors of MCB need to know the working style of MCB. They need information about the services which is given to the customers by MCB. They need information about charging rates of MCB.

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 31

Financial Accounting & Reporting

Regulatory Authorities:

Regulatory authorities like SECP MCB prepare their financial statements according the requirement of these Regulatory authorities User Needs: Regulatory authorities need to know while MCB prepare its financial statements according to the requirements or not.

Taxation Authorities:

MCB pay tax to Federal Board of Revenue (FBR). In 2012 MCB pay 11,241,252,000 Rupees as a tax and in 2011 MCB pay 12,019,299 Rupees as a tax. User Needs: FBR officers need to know true picture of financial statements of the company. FBR need to the sources of income of the company. FBR need to know about property information of the company for property tax.

Customers:

The customer of MCB is a person who is utilizing one or more of the services by the bank. A customer is a person through whom the bank gets an opportunity to make an earning in return to the service they can provide the customer with for example an individual who has a checking account with a bank or an individual who has a mortgage or a loan with the bank or an individual who has a fixed deposit with the bank are all customers of the bank. The management of MCB are committed to customer satisfaction and they are constantly looking for opportunities to improve service standards and understand the customer satisfaction level in order to improve the overall performance of MCB. User Needs: Customers of MCB need satisfaction from the services of MCB. Customers of MCB need protection of their money from the bank. Customers of MCB need to improve the profitability ratio of the MCB.

Page 32

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Financial Accounting & Reporting

Lenders:

MCB borrowings from State Bank of Pakistan (SBP) and another financial institutions but the main lender of MCB is State Bank of Pakistan. In year 2012 MCB borrowings is 78,951,103,000 Rupees and in year 2011 MCB borrowings is 39,100,627 Rupees. The Bank has entered into agreements for financing with the State Bank of Pakistan (SBP) for extending export finance to customers. As per the agreements, the Bank has granted SBP the right to recover the outstanding amount from the Bank at the date of maturity of the finance by directly debiting the current account maintained by the Bank with SBP.

User Needs:

Lenders needs true financial information of the company to check reliability of the MCB. Lenders need to pay back money as given loan to the Nishat textile mills limited. Lenders need to increase interest rate.

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 33

Financial Accounting & Reporting

IFRS Framework

The IFRS Framework describes the basic concept about preparation and presentation of financial statements of the companies for external users. The IFRS Framework serves as a guide to the Board in developing future IFRS and as a guide to resolving accounting issues that are not addressed directly in an international Accounting Standard or International Financial Reporting Standard or interpretation.

IFRS Framework

Following are the different tiers of IFRS Framework which companies should consider during preparing its financial statements. The objective of financial reporting. The qualitative characteristics of useful financial information. The reporting entity. The definition, recognition and measurement of the elements from which financial statements are constructed. Concepts of capital and capital maintenance.

The objective of financial Reporting:

The primary users of general purpose financial reporting are present and potential investors, lenders and other creditors, who use that information to make decisions about buying, selling or holding equity or debt instruments and providing or settling loans or other forms of credit. The IFRS Framework notes that general purpose financial reports cannot provide all the information that users may need to make economic decisions. They will need to consider pertinent information from other sources as well. The IFRS Framework notes that other parties, including prudential and market regulators, may find general purpose financial reports useful. However, the Board considered that the objectives of general purpose financial reporting and the objectives of financial regulation may not be consistent. Hence, regulators are not considered a primary user and general purpose financial reports are not primarily directed to regulators or other parties.

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 34

Financial Accounting & Reporting

The qualitative characteristics of useful financial information

The qualitative characteristics of useful financial reporting identify the types of information are likely to be most useful to users in making decisions about the reporting entity on the basis of information in its financial report. The qualitative characteristics apply equally to financial information in general purpose financial reports as well as to financial information provided in other ways. Financial information is useful when it is relevant and represents faithfully what it purports to represent. The usefulness of financial information is enhanced if it is comparable, verifiable, timely and understandable.

The Reporting Entity:

The reporting entity means the company report their financial statements in this assignment I use Nishat mills ltd and Muslim Commercial Bank (MCB) as a reporting entity.

The Elements of financial Statements: The elements of financial statements means the elements directly related to financial position like Assets, Liabilities, Equity and the elements which are directly related to income statement like incomes expenses so according the IFRS Framework a company should give true information of these elements of financial statements.

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 35

Financial Accounting & Reporting

Financial Statements:

Financial statements are written records of a business`s financial situation in financial statements include standard reports like the balance sheet, income or profit and loss statements and cash flow statements. Generally financial statements are designed to meet the needs of many diverse users and potential owners and creditors.

Types of Financial Statements

The three types of financial statements: 1) 2) 3) 4) Income Statement. Balance Sheet. Statement of Cash Flows. Statement of owner equity.

Income Statement:

The financial statement that will provide information about expenses incurred and revenue earned during a particular time period. Sole trader and partnership business use liquidity preference method to create business financial statements. Example of income statement of sole trader and partnership:

Income Statement Incomes

Sale of inventory Sale of Assets Interest received Interest received Rent Received

PKR

20000 30000 5000 2000 2500

Expenses

Cost of Sales Admin Heat & Light Vehicle Tax paid Total Expenses

PKR 9000 10000 6000 2000 1500

30500

Total Income

59500

Profit = 59500 30500 = 29000

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS Page 36

Financial Accounting & Reporting

Balance Sheet:

The financial statement that will provide information about assets, liabilities and owners equity on a particular date of an organization. The companies use permanency preference method to create their financial statements. Example Balance sheet:

Particulars

Liabilities & Owners Equity Owners Equity Capital Add: Net Profit Less: Drawings Total Equity

PKR

PKR

320,000 167,600 (90,000) 397,600 Liabilities

Current Liabilities Creditors Bill Payables

140,000 67600 207,600 607,200

Total Current Liabilities

Total Liabilities & Owners Equity

Assets Fixed Assets

Building Machinery Furniture Total Fixed Assets

300,000 80,000 50,800 430,800

Current Assets

Bill Receivable

6000

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 37

Financial Accounting & Reporting

Debtors Cash in hand Closing Stock Total Current Assets Total Assets

90,000

8400 70,000 174,400 605,200

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 38

Financial Accounting & Reporting

Nishat Mills Annual Balance Sheet

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 39

Financial Accounting & Reporting

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 40

Financial Accounting & Reporting

Income Statement of Nishat Mills

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 41

Financial Accounting & Reporting

Balance Sheet of MCB

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 42

Financial Accounting & Reporting

Income statement of MCB

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 43

Financial Accounting & Reporting

Conclusion

This assignment has been designed to enable you to evaluate the different users and user needs of different businesses I explore all the users and their needs of all the businesses which I chose for this assignment. Another requirement of this assignment and that is explain the effects of different local (SECP) and international regulations/Standards like IFRS Framework on financial statement of selected companies so I also explain it of my selected companies and that is MCB and Nishat Textile mills.

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 44

Financial Accounting & Reporting

Self Evaluation and Self Criticism

It was very good experience for me because during making this assignment I learn a lot its increase my knowledge about different users of financial statements of different kind of businesses. Because of this assignment I know the role of different regulatory authorities in the business. During making this assignment I faced some problems like because of requirement of this assignment I took interview from sole trader business and partnership business so from sole trader I took all the information easily because the owner of this business is my father but the owners of partnership business never corporate with me but in the end I took information through so much requesting. This assignment have some strengths and also have some weaknesses like the part of user and user needs is sergeants of this assignment and the some part of international regulations standards on financial statement I try my level best to do this part best but I think its not enough. In the end I am very enjoy to do work on this assignment and I try my level best to overcome my weaknesses and I am very thankful to Sir Aaqib who guide me very well to making this assignment.

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 45

Financial Accounting & Reporting

Bibliography

1: Retrieved 5 Friday, 2013, from investopedia : http://www.investopedia.com/terms/p/partnership.asp 2:Retrieved May Monday, 2013, from businessdictionary: http://www.businessdictionary.com/definition/company.html 3:Retrieved May Monday, 2013, from Nishatmills.ltd: http://www.nishatmillsltd.com/nishat/company-profile.htm 4: Retrieved june Monday, 2013, from Nishatmillsltd: http://www.nishatmillsltd.com/nishat/home-textile-2.htm 5: Retrieved JUNE MONDAY, 2012, from MBC.COM: http://www.mcb.com.pk/mcb/about_mcb.asp (2012). Annual Report . MCB. 6:wikipedia. (n.d.). Retrieved 5 monday, 2013, from http://en.wikipedia.org/wiki/Sole_proprietorship

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS

Page 46

También podría gustarte

- Ikea Ki Kya Aat GeDocumento37 páginasIkea Ki Kya Aat GeFurqangreatAún no hay calificaciones

- Executive Summary: Business". in This Assignment I Did Various Tasks Which Are Required To Complete This Report. IDocumento2 páginasExecutive Summary: Business". in This Assignment I Did Various Tasks Which Are Required To Complete This Report. IFurqangreatAún no hay calificaciones

- Assignment DeadlinesDocumento3 páginasAssignment DeadlinesFurqangreatAún no hay calificaciones

- Zumba Case Study JhvahdvhavdavdvadadvadvadvjadvajdvjadvkadvakdvakdDocumento2 páginasZumba Case Study JhvahdvhavdavdvadadvadvadvjadvajdvjadvkadvakdvakdFurqangreatAún no hay calificaciones

- Working Hours HBLIDDocumento1 páginaWorking Hours HBLIDFurqangreatAún no hay calificaciones

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Alstom Code of Ethics GB 2016Documento28 páginasAlstom Code of Ethics GB 2016sujit5584Aún no hay calificaciones

- Entrepreneurship: Quarter 3 Week 4Documento9 páginasEntrepreneurship: Quarter 3 Week 4michelleAún no hay calificaciones

- Adoption Status of BFRS, BAS, BSADocumento7 páginasAdoption Status of BFRS, BAS, BSAAl RajeeAún no hay calificaciones

- Bookkeeping Services Agreement ContractDocumento5 páginasBookkeeping Services Agreement ContractSohail Adnan100% (2)

- 2021 Text Book Corporate Financial Accounting Non BsaDocumento168 páginas2021 Text Book Corporate Financial Accounting Non BsaRemuel A. PascuaAún no hay calificaciones

- Ch17 TB Leung 6eDocumento15 páginasCh17 TB Leung 6eDonald RajAún no hay calificaciones

- International Standard On Quality Management (ISQM) 1 (Previously International Standard On Quality Control 1)Documento44 páginasInternational Standard On Quality Management (ISQM) 1 (Previously International Standard On Quality Control 1)ALEJANDRA MATOSAún no hay calificaciones

- Chapter 1Documento133 páginasChapter 1Maria Sarah Santos0% (2)

- 1942510Documento6 páginas1942510mohitgaba19Aún no hay calificaciones

- Advanced Financial Accounting - Paper 8 CPA PDFDocumento10 páginasAdvanced Financial Accounting - Paper 8 CPA PDFAhmed Suleyman100% (1)

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocumento29 páginasPaper - 1: Principles & Practice of Accounting Questions True and FalseMayur bhujadeAún no hay calificaciones

- Bachelor of Science in AccountancyDocumento3 páginasBachelor of Science in Accountancyhershey alexanderAún no hay calificaciones

- Merchandising Lecture MRFDDocumento59 páginasMerchandising Lecture MRFDMaria Louella MagadaAún no hay calificaciones

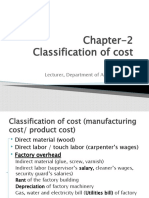

- Chapter 2 (Cost Classification)Documento13 páginasChapter 2 (Cost Classification)Najia MuktaAún no hay calificaciones

- T7Q Absorption Costing and Marginal Costing 20170213Documento4 páginasT7Q Absorption Costing and Marginal Costing 20170213janice0% (1)

- BA-AC101 Accounting Principles - MODULE 1Documento14 páginasBA-AC101 Accounting Principles - MODULE 1praise ferrerAún no hay calificaciones

- General Ledger (GL) Account/ Commitment ItemDocumento3 páginasGeneral Ledger (GL) Account/ Commitment ItemMahesh KamdeyAún no hay calificaciones

- Balabac Executive Summary 2022Documento5 páginasBalabac Executive Summary 2022Gray XoxoAún no hay calificaciones

- ACCT2522 - Topic 0 - Introduction - Lecture 2023 Student Slides - 1 Per PageDocumento16 páginasACCT2522 - Topic 0 - Introduction - Lecture 2023 Student Slides - 1 Per PageFreda DengAún no hay calificaciones

- Accounting For Income Taxes: June 6, 2020Documento18 páginasAccounting For Income Taxes: June 6, 2020Andrea Marie CalmaAún no hay calificaciones

- Trail BlanceDocumento9 páginasTrail Blanceujjwalkumar02090Aún no hay calificaciones

- ZQB Database ContentsDocumento1 páginaZQB Database ContentsWiratmojo NugrohoAún no hay calificaciones

- Quiz1 Answer SheetDocumento12 páginasQuiz1 Answer SheetSittie Ainna A. UnteAún no hay calificaciones

- Chazpter One Accounting For InventoriesDocumento11 páginasChazpter One Accounting For InventoriesyebegashetAún no hay calificaciones

- International Federation of Accountants (IFAC)Documento4 páginasInternational Federation of Accountants (IFAC)Nurul Aliah ShuhaimiAún no hay calificaciones

- Chap. 1 Managerial Accounting in The Information AgeDocumento10 páginasChap. 1 Managerial Accounting in The Information AgeAnand DubeyAún no hay calificaciones

- 7110 s14 Ms 22Documento8 páginas7110 s14 Ms 22Muhammad UmairAún no hay calificaciones

- Classified 2015 11 09 000000Documento7 páginasClassified 2015 11 09 000000Anonymous QRT4uuQAún no hay calificaciones

- CV Lilia Ouabadi EnglishDocumento2 páginasCV Lilia Ouabadi Englishrachid.benelkadiAún no hay calificaciones

- Mubashir Hassan: Time-LineDocumento4 páginasMubashir Hassan: Time-Linemubashir hassanAún no hay calificaciones