Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Adjusting Journal Entries

Cargado por

sudershan9Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Adjusting Journal Entries

Cargado por

sudershan9Copyright:

Formatos disponibles

Adjusting Journal Entries

Adjusting Journal Entries All adjusting entries (other than error corrections) will always involve at least one account on the balance sheet and at least one account on the income statement. I. Deferral Adjustments A deferral involves a past exchange of cash that has initially been recorded on the balance sheet rather than on the income statement. The name deferral comes about because the recording on the income statement is deferred (postponed) to a later time. A. Deferred Expenses A deferred expense is initially recorded on the balance sheet as an asset than being immediately expensed. An adjusting entry becomes necessary as the asset is consumed and becomes an expense. 1. Illustration for a short-term asset > Past exchange of cash Asset Cash XXX XXX

> Adjusting entry necessary as the asset is consumed Expense Asset XXX (Income statement) XXX (Balance sheet)

Example: The supplies account currently shows a $300 balance. A count of the supplies determines that only $250 remains. Supplies Expense Supplies 50 50

2. Illustration for a long-term asset The adjusting entry for long-term assets differs in that instead ofreducing the asset directly, a contra account is used that is subtracted from the asset on the balance sheet. > Past exchange of cash Asset Cash XXX XXX

> Adjusting entry necessary as the asset is consumed Depreciation Expense Accumulated Depreciation XXX (Income statement) XXX (Balance sheet)

Adjusting Journal Entries

Example: Current year depreciation is $2,500. Depreciation Expense Accumulated Depreciation 2,500 2,500

Note: Accumulated depreciation is a contra account that is subtracted from the asset on the balance sheet. It has a normal credit balance. B. Deferred Revenues A revenue cannot be recorded until the income has been earned. Cash received in advance of income realization should be initially recorded in a liability account such as "Unearned Revenue". An adjusting entry later becomes necessary as the revenue is earned. The liability should be reduced and the revenue recorded. > Past exchange of cash Cash Unearned Revenue XXX XXX

> Adjusting entry necessary as revenue is earned Unearned Revenue Revenue XXX (Balance sheet) XXX (Income statement)

Example: Adams CPA previously received $500 for bookkeeping services in advance of providing the services. Adams has now earned $300 of the money. Unearned Revenue Revenue 300 300

II. Accrual Adjustments An accrual involves a future exchange of cash that must be recorded on the income statement before cash is exchanged. A. Accrued Expenses > Adjusting entry Expense Liability > Future exchange of cash Liability Cash XXX XXX XXX (Income statement) XXX (Balance sheet)

Example: Interest accrued on a loan at the end of the month is $550 Interest Expense 550

Adjusting Journal Entries

Interest Payable B. Accrued Revenues > Adjusting entry Receivable Revenue > Future exchange of cash Cash Receivable XXX XXX XXX (Balance sheet) XXX (Income statement) 550

Example: Performed $400 of services for a customer on account. Accounts Receivable Revenue 400 400

También podría gustarte

- Traditional Rules of Journal EntriesDocumento19 páginasTraditional Rules of Journal EntriesKumar AbhishekAún no hay calificaciones

- 7cost Sheet 7Documento4 páginas7cost Sheet 7Jyoti GuptaAún no hay calificaciones

- Costing Sheet - Easiest WayDocumento11 páginasCosting Sheet - Easiest Waypankajkuma981100% (1)

- Final Accounts: Manufacturing, Trading and P&L A/cDocumento51 páginasFinal Accounts: Manufacturing, Trading and P&L A/cAnit Jacob Philip100% (1)

- Financial RatiosDocumento7 páginasFinancial RatiosarungarAún no hay calificaciones

- Standard (I Unit Produced) ParticularsDocumento11 páginasStandard (I Unit Produced) ParticularsForam Raval100% (1)

- Contract CostingDocumento11 páginasContract CostingCOMEDSCENTREAún no hay calificaciones

- Capital Vs Revenue Exp..... Point PresentationDocumento16 páginasCapital Vs Revenue Exp..... Point PresentationVinay Kumar100% (1)

- f5 Smart NotesDocumento98 páginasf5 Smart Notessakhiahmadyar100% (1)

- Contract Costing SolutionsDocumento7 páginasContract Costing SolutionsSumon Kumar DasAún no hay calificaciones

- Chapter 12 Cost Sheet or Statement of CostDocumento16 páginasChapter 12 Cost Sheet or Statement of CostNeelesh MishraAún no hay calificaciones

- UNit Costing Study MaterialDocumento42 páginasUNit Costing Study MaterialChetana SoniAún no hay calificaciones

- Lecture 4 Lecture Notes 2011Documento27 páginasLecture 4 Lecture Notes 2011Misu NguyenAún no hay calificaciones

- Final Exam - 2020Documento10 páginasFinal Exam - 2020mshan lee100% (1)

- CA Final AMA Theory Complete R6R7GKB0 PDFDocumento143 páginasCA Final AMA Theory Complete R6R7GKB0 PDFjjAún no hay calificaciones

- Cost Accounting 2013Documento3 páginasCost Accounting 2013GuruKPO0% (1)

- Chapter One Introdutoin: 1.1. What Is Cost Accounting?Documento156 páginasChapter One Introdutoin: 1.1. What Is Cost Accounting?NatnaelAún no hay calificaciones

- Edu-Care Professional Academy:, 243, Sundaram Coplex, Bhanwerkuan Main Road, IndoreDocumento10 páginasEdu-Care Professional Academy:, 243, Sundaram Coplex, Bhanwerkuan Main Road, IndoreCA Gourav Jashnani100% (1)

- Notes On Cost AccountingDocumento86 páginasNotes On Cost AccountingZeUs100% (2)

- Notes - Contract CostingDocumento13 páginasNotes - Contract CostingBlessMarcKupiAún no hay calificaciones

- Contract CostingDocumento22 páginasContract Costingrikesh radheAún no hay calificaciones

- The Accounting CycleDocumento14 páginasThe Accounting CyclezainjamilAún no hay calificaciones

- PM Study Notes MayDocumento234 páginasPM Study Notes May77 Raj Bhanushali100% (1)

- Ch13. Flexible BudgetDocumento36 páginasCh13. Flexible Budgetnicero555Aún no hay calificaciones

- Measuring Relevant Costs and Revenues for Decision MakingDocumento44 páginasMeasuring Relevant Costs and Revenues for Decision MakingMzimasi MjanyelwaAún no hay calificaciones

- SEM II Cost-Accounting Unit 1Documento23 páginasSEM II Cost-Accounting Unit 1mahendrabpatelAún no hay calificaciones

- Unit Costing and Cost SheetDocumento15 páginasUnit Costing and Cost SheetAyush100% (1)

- Contract CostingDocumento15 páginasContract CostingUjjwal BeriwalAún no hay calificaciones

- Statement of Comprehensive IncomeDocumento18 páginasStatement of Comprehensive IncomeCharies Dingal100% (1)

- 05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFDocumento22 páginas05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFsengpisalAún no hay calificaciones

- Cost Accounting Systems A. Traditional Cost Accounting TheoriesDocumento47 páginasCost Accounting Systems A. Traditional Cost Accounting TheoriesalabwalaAún no hay calificaciones

- 7 Costing Formulae Topic WiseDocumento86 páginas7 Costing Formulae Topic WiseHimanshu Shukla100% (1)

- Gbagada General HospitalDocumento1 páginaGbagada General HospitalChijioke PaschalAún no hay calificaciones

- 2 Adjusting Journal EntriesDocumento6 páginas2 Adjusting Journal EntriesJerric CristobalAún no hay calificaciones

- The Accounting Cycle FundamentalsDocumento53 páginasThe Accounting Cycle FundamentalsGonzalo Jr. Ruales100% (1)

- Service CostingDocumento4 páginasService CostingDr. Mustafa KozhikkalAún no hay calificaciones

- Sales Mix Break-Even CalculationDocumento1 páginaSales Mix Break-Even Calculationlaur33nAún no hay calificaciones

- Cost Accounting Notes Fall 19-1Documento11 páginasCost Accounting Notes Fall 19-1AnoshiaAún no hay calificaciones

- Manufacturing AccountDocumento15 páginasManufacturing Accountbalachmalik50% (2)

- Adjusting Journal EntriesDocumento35 páginasAdjusting Journal EntriesGerald TeañoAún no hay calificaciones

- Cost Accounting IIDocumento62 páginasCost Accounting IIShakti S SarvadeAún no hay calificaciones

- Cost Concepts & Classification ShailajaDocumento30 páginasCost Concepts & Classification ShailajaPankaj VyasAún no hay calificaciones

- Job Costing and Contract Costing ExplainedDocumento25 páginasJob Costing and Contract Costing ExplainedParminder Bajaj100% (1)

- 0568-Cost and Management AccountingDocumento7 páginas0568-Cost and Management AccountingWaqar AhmadAún no hay calificaciones

- ADL 56 Cost & Managerial AccountingDocumento23 páginasADL 56 Cost & Managerial AccountingAshish Rampal0% (1)

- Chapter-2: Information For Budgeting, Planning and Control Purposes (Master Budget) BudgetDocumento35 páginasChapter-2: Information For Budgeting, Planning and Control Purposes (Master Budget) Budgetፍቅር እስከ መቃብርAún no hay calificaciones

- Accounting ConceptsDocumento4 páginasAccounting ConceptsAjmal KhanAún no hay calificaciones

- Adjustment Entries for Air & Sea TravelDocumento3 páginasAdjustment Entries for Air & Sea TravelAli Sher BalochAún no hay calificaciones

- 10 Accounting ConceptsDocumento9 páginas10 Accounting ConceptsVijaya ShreeAún no hay calificaciones

- Definition of Job Order CostingDocumento8 páginasDefinition of Job Order CostingWondwosen AlemuAún no hay calificaciones

- 6Documento459 páginas6sunildubey02100% (1)

- Cost AccountingDocumento28 páginasCost Accountingrenjithrkn12Aún no hay calificaciones

- Unit - 1: Introduction To Cost AccountingDocumento262 páginasUnit - 1: Introduction To Cost AccountingSamuel AnthrayoseAún no hay calificaciones

- Understanding The Income StatementDocumento4 páginasUnderstanding The Income Statementluvujaya100% (1)

- Short-Run Decision Making and CVP AnalysisDocumento43 páginasShort-Run Decision Making and CVP AnalysisHy Tang100% (1)

- Costing FormulaesDocumento8 páginasCosting FormulaesNItesh GawasAún no hay calificaciones

- I. Deferral Adjustments: A. Deferred ExpensesDocumento4 páginasI. Deferral Adjustments: A. Deferred ExpensesFlorentina AndreAún no hay calificaciones

- Accounting: Adjusting EntriesDocumento11 páginasAccounting: Adjusting EntriesCamellia100% (2)

- Adjustment Trial BalanceDocumento3 páginasAdjustment Trial BalanceRR SarkarAún no hay calificaciones

- Deferral & Accural EntriesDocumento3 páginasDeferral & Accural Entriesindlaf85Aún no hay calificaciones

- NEW Asset AccountingDocumento52 páginasNEW Asset AccountingAptWorks Solutions Private LimitedAún no hay calificaciones

- BS FormatDocumento12 páginasBS Formatsudershan90% (1)

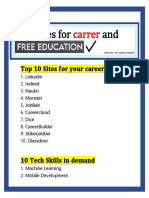

- Top Sites For Career and Education 1673268327Documento3 páginasTop Sites For Career and Education 1673268327sudershan9Aún no hay calificaciones

- GL List - NewDocumento48 páginasGL List - Newsudershan9Aún no hay calificaciones

- Sudershan CVDocumento6 páginasSudershan CVsudershan9Aún no hay calificaciones

- Integrated Goods and Services Tax ActDocumento17 páginasIntegrated Goods and Services Tax Actdkgupta28Aún no hay calificaciones

- TaxcodesDocumento15 páginasTaxcodessudershan9Aún no hay calificaciones

- Product costing introductionDocumento43 páginasProduct costing introductionsudershan9Aún no hay calificaciones

- Integrated Goods and Services Tax ActDocumento17 páginasIntegrated Goods and Services Tax Actdkgupta28Aún no hay calificaciones

- Top 50 SAP FICO Interview Questions and Answers 1673535378Documento14 páginasTop 50 SAP FICO Interview Questions and Answers 1673535378sudershan9Aún no hay calificaciones

- Income Tax UpdatesDocumento18 páginasIncome Tax Updatessudershan9Aún no hay calificaciones

- TDS UpdatesDocumento11 páginasTDS Updatessudershan9Aún no hay calificaciones

- Integrated Goods and Services Tax ActDocumento17 páginasIntegrated Goods and Services Tax Actdkgupta28Aún no hay calificaciones

- SAP ValidationDocumento47 páginasSAP Validationsapfico2k8Aún no hay calificaciones

- Create Budget Profile and Activate Availability Control in SAPDocumento6 páginasCreate Budget Profile and Activate Availability Control in SAPsudershan9Aún no hay calificaciones

- LSMW Manual For DataDocumento16 páginasLSMW Manual For Datasudershan9Aún no hay calificaciones

- Special Purpose Ledger ConfigDocumento81 páginasSpecial Purpose Ledger Configsrinivaspanchakarla67% (3)

- GST Eway Bill Brochure PDFDocumento6 páginasGST Eway Bill Brochure PDFsudershan9Aún no hay calificaciones

- GL Acc. (Customer CLR Acc) Change For Part2 Posting in Import Case Instead of Cenvat CLR Acc. in Company SettingsDocumento3 páginasGL Acc. (Customer CLR Acc) Change For Part2 Posting in Import Case Instead of Cenvat CLR Acc. in Company Settingssudershan9Aún no hay calificaciones

- Co-Cca ReportingDocumento20 páginasCo-Cca Reportingsudershan9Aún no hay calificaciones

- WDV Dep MethodDocumento24 páginasWDV Dep Methodsudershan9Aún no hay calificaciones

- Accounting principles and the five groups of accountsDocumento23 páginasAccounting principles and the five groups of accountsioweu100% (3)

- Foreign Currency Valuation PDFDocumento12 páginasForeign Currency Valuation PDFyunesk100% (3)

- Free Sap Tutorial On Invoice VerificationDocumento46 páginasFree Sap Tutorial On Invoice VerificationAnirudh SinghAún no hay calificaciones

- Materials Management User Training GuideDocumento194 páginasMaterials Management User Training Guidesudershan9100% (4)

- Defining Z Cells in A Report Painter ReportDocumento13 páginasDefining Z Cells in A Report Painter Reportsudershan9Aún no hay calificaciones

- CO-PC ConfigurationDocumento57 páginasCO-PC Configurationnsricardo100% (1)

- Cost CenterDocumento59 páginasCost Centersudershan9Aún no hay calificaciones

- Balance SheetDocumento12 páginasBalance Sheetsudershan9Aún no hay calificaciones

- Chapter 2 Forensic Auditing and Fraud InvestigationDocumento92 páginasChapter 2 Forensic Auditing and Fraud Investigationabel habtamuAún no hay calificaciones

- Indian Capital Goods - HSBC Jan 2011Documento298 páginasIndian Capital Goods - HSBC Jan 2011didwaniasAún no hay calificaciones

- Credit Card ETB Customer - Mar29 - 06 04Documento4 páginasCredit Card ETB Customer - Mar29 - 06 04tanvir019Aún no hay calificaciones

- Role of Financial IntermediariesDocumento7 páginasRole of Financial IntermediariesSelvanesan G100% (2)

- World Transfer Pricing 2016Documento285 páginasWorld Transfer Pricing 2016Hutapea_apynAún no hay calificaciones

- A.investment A Pays $250 at The Beginning of Every Year For The Next 10 Years (A Total of 10 Payments)Documento4 páginasA.investment A Pays $250 at The Beginning of Every Year For The Next 10 Years (A Total of 10 Payments)EjkAún no hay calificaciones

- Peer Analysis of Major Players in Cement Industry: ACC, Ambuja, Dalmia, Shree, UltratechDocumento6 páginasPeer Analysis of Major Players in Cement Industry: ACC, Ambuja, Dalmia, Shree, Ultratechsai chandraAún no hay calificaciones

- Cambridge O Level: Accounting 7707/22 May/June 2022Documento16 páginasCambridge O Level: Accounting 7707/22 May/June 2022Kutwaroo GayetreeAún no hay calificaciones

- Instructions for Excel templatesDocumento4 páginasInstructions for Excel templatespcsriAún no hay calificaciones

- Bank Reconciliation Best PracticesDocumento3 páginasBank Reconciliation Best Practiceshossainmz100% (1)

- CPEM 2014 - TOC - PracticeAids Audit File DocumentationDocumento6 páginasCPEM 2014 - TOC - PracticeAids Audit File DocumentationranibarAún no hay calificaciones

- Corp Liquidation - QuizDocumento5 páginasCorp Liquidation - QuizKj Banal0% (1)

- 2020 Form M706, Estate Tax Return: For Estates of A Decedent Whose Date of Death Is in Calendar Year 2020Documento3 páginas2020 Form M706, Estate Tax Return: For Estates of A Decedent Whose Date of Death Is in Calendar Year 2020daveyAún no hay calificaciones

- Letter requests bank honor chequeDocumento2 páginasLetter requests bank honor chequeANNAPRASADAún no hay calificaciones

- 1962 - Malkiel - Expectations, Bond Prices, and The Term Structure of Interest RatesDocumento23 páginas1962 - Malkiel - Expectations, Bond Prices, and The Term Structure of Interest Ratesjoydiv4Aún no hay calificaciones

- Form 8 KDocumento23 páginasForm 8 KIkram IzkikAún no hay calificaciones

- Agreement To Sel1 - DulaniDocumento4 páginasAgreement To Sel1 - DulaniGirish SharmaAún no hay calificaciones

- State Bank of IndiaDocumento1 páginaState Bank of IndiaBala SundarAún no hay calificaciones

- Architecture StylesDocumento10 páginasArchitecture Stylesmarius_damiAún no hay calificaciones

- Dividend Discount ModelDocumento48 páginasDividend Discount ModelRajes DubeyAún no hay calificaciones

- Credit Risk ManagementDocumento92 páginasCredit Risk ManagementVenkatesh NAAún no hay calificaciones

- BANKING LAW AuditDocumento6 páginasBANKING LAW AuditPRIYANKA JHAAún no hay calificaciones

- PhonePe Statement Feb2024 Mar2024Documento7 páginasPhonePe Statement Feb2024 Mar2024jtularam15Aún no hay calificaciones

- Facebook ValuationDocumento13 páginasFacebook ValuationSunil Acharya100% (2)

- 2021 3Q Earnings PresentationDocumento26 páginas2021 3Q Earnings PresentationAlejandroStick GamesAún no hay calificaciones

- The 6 Secrets To Build Business CreditDocumento8 páginasThe 6 Secrets To Build Business CreditJake Song67% (3)

- NFLPA 2013 Dept of Labor LM-2Documento549 páginasNFLPA 2013 Dept of Labor LM-2Robert LeeAún no hay calificaciones

- OpTransactionHistory13 06 2020Documento2 páginasOpTransactionHistory13 06 2020MssAún no hay calificaciones

- Chapter 8 Master BudgetingDocumento40 páginasChapter 8 Master BudgetingLaraine Shawa100% (2)

- PMC Bank Scam: Banking OperationsDocumento10 páginasPMC Bank Scam: Banking Operationssakshi kaul0% (1)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantDe EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantCalificación: 4.5 de 5 estrellas4.5/5 (146)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDe EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindCalificación: 5 de 5 estrellas5/5 (231)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)De EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Calificación: 4.5 de 5 estrellas4.5/5 (5)

- Technofeudalism: What Killed CapitalismDe EverandTechnofeudalism: What Killed CapitalismCalificación: 5 de 5 estrellas5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDe EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanCalificación: 4.5 de 5 estrellas4.5/5 (79)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetDe EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetAún no hay calificaciones

- Profit First for Therapists: A Simple Framework for Financial FreedomDe EverandProfit First for Therapists: A Simple Framework for Financial FreedomAún no hay calificaciones

- Financial Accounting For Dummies: 2nd EditionDe EverandFinancial Accounting For Dummies: 2nd EditionCalificación: 5 de 5 estrellas5/5 (10)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)De EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Calificación: 4.5 de 5 estrellas4.5/5 (12)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDe EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesAún no hay calificaciones

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyDe EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyCalificación: 5 de 5 estrellas5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDe EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItCalificación: 5 de 5 estrellas5/5 (13)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCDe EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCCalificación: 5 de 5 estrellas5/5 (1)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesDe EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesCalificación: 4.5 de 5 estrellas4.5/5 (30)

- Financial Literacy for Managers: Finance and Accounting for Better Decision-MakingDe EverandFinancial Literacy for Managers: Finance and Accounting for Better Decision-MakingCalificación: 5 de 5 estrellas5/5 (1)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!De EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Calificación: 4.5 de 5 estrellas4.5/5 (14)

- Finance Basics (HBR 20-Minute Manager Series)De EverandFinance Basics (HBR 20-Minute Manager Series)Calificación: 4.5 de 5 estrellas4.5/5 (32)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsDe EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsCalificación: 4 de 5 estrellas4/5 (7)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)De EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Calificación: 4.5 de 5 estrellas4.5/5 (24)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsDe EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsAún no hay calificaciones

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesDe EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesAún no hay calificaciones

- Financial Accounting - Want to Become Financial Accountant in 30 Days?De EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Calificación: 5 de 5 estrellas5/5 (1)

- Accounting: The Ultimate Guide to Understanding More about Finances, Costs, Debt, Revenue, and TaxesDe EverandAccounting: The Ultimate Guide to Understanding More about Finances, Costs, Debt, Revenue, and TaxesCalificación: 5 de 5 estrellas5/5 (4)

- Basic Accounting: Service Business Study GuideDe EverandBasic Accounting: Service Business Study GuideCalificación: 5 de 5 estrellas5/5 (2)