Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Labour Laws For IHRM

Cargado por

Rimsha LatifTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Labour Laws For IHRM

Cargado por

Rimsha LatifCopyright:

Formatos disponibles

INTERNATIONAL HUMAN RESOURCE MANAGEMENT

ASSIGNMENT ON LABOUR LAWS

SUBMITTED BYName- RIMSHA Roll Number-3104 PRN- 11020621203 Batch- IHRM-B

INTRODUCTION

Indian labour law refers to laws regulating employment in India. There are over fifty national laws and many more state-level laws. Traditionally Indian governments at federal and state level have sought to ensure a high degree of protection for workers (allegedly). For instance, a permanent worker can be terminated only for proven misconduct or for habitual absence

Labour law also known as employment law is the body of laws, administrative rulings, and precedents which address the legal rights of, and restrictions on, working people and their organizations. As such, it mediates many aspects of the relationship between trade unions, employers and employees. In other words, Labour law defines the rights and obligations as workers, union members and employers in the workplace. Generally, labour law covers: Industrial relations certification of unions, labour-management relations, collective bargaining and unfair labour practices; Workplace health and safety; Employment standards, including general holidays, annual leave, working hours, unfair dismissals, minimum wage, layoff procedures and severance pay. There are two broad categories of labour law. First, collective labour law relates to the tripartite relationship between employee, employer and union. Second, individual labour law concerns employees' rights at work and through the contract for work. The labour movement has been instrumental in the enacting of laws protecting labour rights in the 19th and 20th centuries. Labour rights have been integral to the social and economic development since the industrial revolution.

THE FACTORIES ACT, 1948

Statement of the Act: According to Section 2 (m) of Factories Act, 1948, Factory means any premises where ten or more persons are or were employed for wages on any day of the preceding twelve months and in which a manufacturing process is being carried on with the aid of power or is ordinarily so carried on, or where twenty or more persons are or were employed and in any part of which a manufacturing process is being carried on without the aid of power or is ordinarily so carried on.

Objective of the Act To ensure adequate safety measures and to promote the health and welfare of the workers employed in factories. To prevent haphazard growth of factories through the provisions related to the approval of plans before the creation of a factory.

Applicability of the Act Applicable to the whole of India including Jammu & Kashmir. Covers all manufacturing processes and establishments falling within the definition of factory. Applicable to all factories using power and employing 10 or more workers, and if not using power, employing 20 or more workers on any day of the preceding 12 months.

Conditions and Criteria for the Applicability It is a place where a "manufacturing process" is carried on. It employs the prescribed minimum number of "workers" i.e. 10 or more workers, and if not using power, employing 20 or more workers on any day of the preceding 12 months. It is not a mine coming within the purview of the Indian Mines Act of 1952, a railway running shed, mobile unit belonging to the armed forces of the Union, a hotel, restaurant or eating place.

Exceptions to the Act Not applicable to the prejudice of any right of workman under any law or under agreement or settlement or contract of service Not applicable to a mine coming within the purview of the Indian Mines Act of 1952, a railway running shed, mobile unit belonging to the armed forces of the Union, a hotel, restaurant or eating place.

Important provisions the Act Facilities and Conveniences The factory should be kept clean. There should be arrangement to dispose of wastes and effluents. Ventilation should be adequate. Reasonable temperature for comfort of employees should be maintained. Dust and fumes should be controlled below permissible limits. Artificial humidification should be at prescribed standard level. Overcrowding should be avoided. Adequate lighting, drinking water, latrines, urinals and spittoons should be provided. Adequate spittoons should be provided. Welfare - Adequate facilities for washing, sitting, storing clothes when not worn during working hours. If a worker has to work in standing position, sitting arrangement to take short rests should be provided. Adequate First aid boxes should be provided and maintained

Facilities in case of large factories Ambulance room if 500 or more workers are employed; Canteen if 250 or more workers are employed. It should be sufficiently lighted and ventilated and suitably located. Rest rooms / shelters with drinking water when 150 or more workmen are employed Crches if 30 or more women workers are employed. Full time Welfare Officer if factory employs 500 or more workers Safety Officer if 1,000 or more workmen are employed.

The following are a few other statutory requirements as provided under the Factories Act, 1948:

The Inspection Staff The Factories Act empowers the State Government to appoint Inspectors, Chief Inspectors of Factories, Additional Chief Inspectors, Joint Chief Inspectors and Deputy Chief Inspectors. Every District Magistrate is an Inspector for his district. No person can act as an Inspector if he is or becomes directly or indirectly interested in a factory or in any process or business carried on therein or in any patent or machinery connected.

Safety Policy The act requires preparation of a written statement of policy in respect of health and safety of workers at work by the factories. In addition, the Chief Inspector may require the occupier of any of the factories or class or description of factories to comply with the requirements of Safety Policy if in his opinion it is expedient to do so.

Criteria for the Appointment of Safety Officers As per the provisions of Section 40-B of the Factories Act, 1948, Safety Officer is required to be appointed for the units meeting the following criteria: Units employing more than 1000 workers, units wherein any manufacturing process or operation is carried on Units involving any risk of bodily injury, poisoning or diseases or any hazard to health.

Criteria for a Safety Committee The Factories Act, 1948 require constitution of Safety Committee in the factories meeting the following criteria: Units employing 250 or more workers Units covered under Section 87 of the Factories Act, 1948 and employing more than 50 workers Units covered under Section 2(cb) of the Factories Act, 1948 and employing more than 50 workers

Welfare The act deals with the Welfare facilities e.g. appointment of Welfare officer, crche facilities, canteen facilities, shelters, rest room and lunch room. As per the Factories Act, 1948 any factory employing more than 500 workers is required to employ a Welfare Officer.

Examples and Case Laws The nature of the work in certain industries requires exceptional treatment, e.g., workers. Engaged in engine rooms and boilers or in the printing of newspapers. The State Government may exempt persons holding positions of supervision and management or in confidential positions in a factory from the operation of the rules regarding working hours. The manager of a factory must send notice to the authorities whenever a worker contacts any -of the diseases mentioned in the Schedule to the Act. Examples: poisoning by lead, mercury, phosphorus etc.; anthrax; silicosis; cancer of the skin; toxic anaemia or jaundice; etc.

THE MINIMUM WAGES ACT, 1948

Statement of the act: The concept of Minimum Wages was first evolved by ILO in 1928 with reference to remuneration of workers in those industries where the, level of wages was substantially low and the labour was vulnerable to exploitation, being not well organised and having less effective bargaining power. The minimum rates of wages also include Special Allowance (Variable Dearness Allowance) linked to Consumer Price Index Number which are revised twice a year effective from April and October. The rates of wages once fixed are revised at an interval not exceeding of five years. The employer must pay every employee wages as fixed by the Government.

Regulations of the Act: 1. Wages must be paid in cash. 2. For the fixation of minimum wages, the employment must have been in Schedule originally or added to the Schedule by a notification under Section 27 of the Act. 3. The employer can take actual work on any day up to 9 hours in a 12 hours shift, but he must pay double the rate for any hour or part of an hour of actual work in excess of 9 hours or for more than 48 hours in any week. 4. Once a minimum wage is fixed according to the provisions of the Act, the employer must pay to every employee engaged in a Scheduled employment, minimum wages notification for that class of employees. 5. The employer should fix wage-period for the payment of wages at intervals not exceeding one month or such other larger period as may be prescribed. 6. The employer should pay wages on a working day within seven days of the end of wage period or within 10 days if 1000 or more persons are employed in an establishment. 7. The employer should pay the wages to a person discharged not later than the second working day after his discharge. 8. Every employer should get the signature or the thumb impression of every person employed on the wage book and the wage slips.

Applicability It extends to the whole of India and applies to scheduled employments in respect of which minimum rates of wages have been fixed under this act. The Act is expected to fix the minimum wages in respect of employees whether they are casual, daily rated, temporary or permanent. The Act is applicable to daily rates employees also.

Exceptions A teacher would not come within the definition of "employee" given under Section 2(i) of the Act. It is beyond the competence of a Government to bring the teachers of an educational institution under the purview of the Act. The appropriate Government may direct that the provisions of this Act shall not apply in relation to the wages payable to disabled employees. The appropriate Government may direct that the provisions of this Act or any of them shall not apply to all or any class of employees employed in any scheduled employment or to any locality where there is carried on a scheduled employment

Fixing of minimum wages The appropriate government shall fix the minimum rates of wages payable to employees employed in a scheduled employment. Review at such intervals not exceeding five years, the minimum rates of wages so fixed and revise the minimum rates if necessary. The minimum rates of wages may be fixed as a minimum time rate or a minimum piece rate or as a guaranteed time rate.

Payment of Minimum wages The employer shall pay to every employee in a scheduled employment under him wages at the rate not less than the minimum rates of wages fixed under the Act.

Claims under the Act This section makes provisions to appoint authorities to hear and decide all claims arising out of payment less than the minimum rates of wages or any other monetary payments due under the Act. The presiding officers of the Labour court and Deputy Labour Commissioners are the authorities appointed.

Procedure the employee has to follow for making a claim under the Act:

I.

II.

III.

IV.

V.

VI.

An employee having any claim under the Act has to make an application to the Authority appointed under the Act. Such application can be made by the employee himself, or any legal practitioner or any official of a registered trade union. Such application has to be made within six months from the date on which the claim amount became payable. In appropriate case the Authority can, over and above directing the payment of the difference between minimum wages payable and wages actually paid, award compensation up to ten times the amount of the difference. The amount directed to be paid by the Authority can be recovered as if it were a fine imposed by a Magistrate. Every direction of the Authority will be final

Example and case-laws 1. People's Union for Democratic Rights vs Union of India: Non payment of minimum wages is denial of the right to live with basic human dignity to the labourer and hence is violation of Article 21 of the Constitution Object of Article 23 is to abolish every form of forced labor. State cannot escape from the liability by saying the laborers are employed by contractors. 2. Bandhu Mukti Morcha vs Union of India and others: Central and State Governments are criticized for not implementing labour laws. Financial capacity of the industry is not a criteria for the payment of minimum wages. Article 24 prohibits the employment of children (below the age of 14).

THE PAYMENT OF WAGES ACT, 1936

The main objective of the Act is to avoid unnecessary delay in the payment of wages and to prevent unauthorized deductions from the wages. The benefit of the Act prescribes for the regular and timely payment of wages (on or before 7th day or 10th day of after wage period is greater than 1000 workers) and Preventing unauthorized deductions being made from wages and arbitrary fines.

Application of the Act Every person employed in any factory, upon any railway or through subcontractor in a railway and a person employed in an industrial or other establishment. The State Government may by notification extend the provisions to any class of persons employed in any establishment or class of establishment. Applies to wages payable to an employed person in respect of a wage period if such wages for that wage period do not exceed Rs 6500/- per month or such other higher sum.

Exceptions to the Act The appropriate Government maydirect that the provisions of this Act shall not apply in relation to the wages payable to disabled employees. The appropriate Government may specify the provisions of this Act or any of them shall not apply to all or any class of employees employed in any scheduled employment or to any locality where there is carried on a scheduled employment. Nothing in this Act shall apply to the wages payable by an employer to a member of his family who is living with him and is dependent on him.

Conditions and Criteria of the Act Wages must be paid on a working day and not on a holiday. Establishments employing less than 1000 persons must pay wages before the expiry of the 7th day of every month and other establishments must pay wages before the expiry of the 10th day of every month. When the employment of any person is terminated, the wages earned by him must be paid before the expiry of the second working day from the day of termination.

Basic Provisions of the Act The person responsible for payment of wages shall fix the wage period upto which wage payment is to be made. All wages shall be paid in current legal tender, that is, in current coin or currency notes or both All payment of wages shall be made on a working day Although the wages of an employed person shall be paid to him without deductions of any kind, the Act allows deductions from the wages of an employee on the account of the following: fines; absence from duty; damage to or loss of goods expressly entrusted to the employee; housing accommodation and amenities provided by the employer; recovery of advances or adjustment of over-payments of wages; Income-tax;

The following payments are not included Expenses Pension Redundancy payments Any payment to the employee other than in his/her capacity as an employee Benefit in kind

Rights of employees Where contrary to the provisions of this Act any deduction has been made from the wages of an employed person, or any payment of wages has been delayed, than following persons may apply to such authority: Such person himself, Any legal practitioner or Any official of a registered trade union authorized in writing to act on his behalf, or Any Inspector under this Act, or Any other person acting with the permission of the authority appointed by the state government. Every such application shall be presented within 12 months from the date on which the deduction from the wages was made or from the date on which the payment of the wages was due to be made.

Examples and Case-Laws Deductions can be challenged before Authority under Payment of Wages Act only when wages are less than prescribed ceiling. Deductions in respect of damage or loss occurring in the course of a manufacturing process, for example in respect of spoilt cloth, are not permissible, because such goods are not entrusted to the employees custody. Deductions can only be made for damage or loss to goods entrusted to the custody of the employed person or for loss of money which he is required to account for, due to the neglect or default of the employed person. It appears that no deduction can be made for loss of damage to tools and instruments supplied to an employed person for purposes of his employment, because these cannot be said to be entrusted for custody. The legislature intended to affect employees like store-keepers, etc. to whom goods are entrusted for custody.

PAYMENT OF GRATUITY ACT, 1972

The Act enforces the payment of 'gratuity', a reward for long service, as a statutory retiring benefit. Every employee, irrespective of his wages is entitled to receive gratuity if he has rendered continuous service of 5 years or more than 5 years. Gratuity is payable to an employee on termination of his employment after he has rendered continuous service for not less than five years: On his superannuation On his resignation On his death or disablement due to employment injury or disease

Applicability of the Act An employee shall be said to be in continuous service if he delivered uninterrupted service, including service which may be interrupted on account of sickness, accident, leave, absence from duty without leave, lay off, strike or a lock-out or cessation of work not due to any fault of the employee Every factory, mine, oilfield, plantation, port and railway company; Every shop or establishment within the meaning of any law. Other establishment or class of establishments, in which 10 or more employees are employed or were employed, on any day of the preceding 12 months.

Exceptions to the law Any act, wilful omission or negligence causing any damage or loss to, or destruction of, property belonging to the employer; or Act of riotous or disorderly conduct or any other act of violence on part of employee; or Any act which constitutes an offence involving moral turpitude, in the course of his employment

Nomination In case of death, the gratuity is payable to any of the following persons: Nominee Heirs (in absence of nomination) In case nominee/ heir is a minor, such amount will be deposited with the controlling authority who shall invest the same for the benefit of such minor in such bank or other financial institution, until such minor attains majority.

Calculation of Gratuity For every completed year of service or part in excess of 6 months, the employer shall pay gratuity to an employee at the rate of 15 days wages based on the rate of wages last drawn by the employee concerned: Provided that in the case of a piece-rated employee, daily wages shall be computed on the average of the total wages received by him for a period of 3 months immediately preceding the termination of his employment In the case of an employee employed in seasonal establishment, the employer shall pay the gratuity at the rate of 7 days wage for each season. Formula- Monthly Salary x 15 days x No. of yrs. of service 26 Max. Gratuity payable under the Act is Rs. 10,00,000/-

Example In case of a monthly rated employee, the 15 days wages shall be calculated by dividing the monthly rate of wages last drawn by him by 26 and multiplying quotient by 15.

EMPLOYEE STATE INSURANCE ACT, 1948

Statement of the Act: The Employee State Insurance Act, [ESIC] 1948 was enacted primarily with the object of providing certain benefits to employees in case of sickness, maternity and employment injury and also to make provision for certain others matters incidental thereto. The act strives to materialize the provision for securing, the right to work, to education and public assistance in cases of unemployment, old age, sickness and disablement. This act becomes a wider spectrum than factory act. In the sense that while the factory act concerns with the health, safety, welfare, leave etc of the workers employed in the factory premises only. But the benefits of this act extend to employees whether working inside the factory or establishment or elsewhere or they are directly employed by the principal employee or through an intermediate agency, if the employment is incidental or in connection with the factory or establishment.

Objectives: The ESI Act is a social welfare legislation enacted with the object of providing certain benefits to employees in case of sickness, maternity and employment injury. Under the Act, employees will receive medical relief, cash benefits, maternity benefits, pension to dependents of deceased workers and compensation for fatal or other injuries and diseases.

Applicability: The ESI Act extends to the whole of India. It applies to all the factories including Government factories (excluding seasonal factories), which employ 10 or more employees and carry on a manufacturing process with the aid of power and 20 employees where manufacturing process is carried out without the aid of power. The act also applies to shops and establishments. Generally, shops and establishments employing more than 20 employees are covered by the Act.

Shop includes an office, a store-room, godown, warehouse or workhouse or work place, whether in the same premises or otherwise, used in or in connection with such trade or business. The act also applies to commercial establishment, residential hotel, restaurant, eating-house, theatre or other places of public amusement or entertainment All employees including casual, temporary or contract employees drawing wages less than Rs 10,000 per month are covered.

Where a workman is covered under the ESI scheme, Compensation under the Workmen's Compensation Act and Maternity Benefits Act cannot be claimed.

Exemptions from ESIC The act does not include a shop or a factory registered under the Factories Act, 1948, or theatres, cinemas, restaurants, eating houses, residential hotels, clubs or other places of public amusements or entertainment. Apprentices covered under the Apprenticeship Act are not covered under this act. The act does not apply to any member of Indian Naval, Military or Air Forces. The provisions of the ESI Act are not applicable to factories or establishments, run by the State Governments / Central Government, whose employees are, otherwise, in receipt of social security benefits substantially similar or superior to the benefits provided under the ESI Act. Does not include a mine subject to the operation of the Mines Act, 1952 or a railway running shed. It applies to all the factories including Government factories but excluding seasonal factories.

Employers / Employees Contribution Like most of the social security schemes, the world over, ESI scheme is a selffinancing health insurance scheme. Contributions are raised from covered employees and their employers as a fixed percentage of wages. Presently covered employees contribute 1.75% of the wages, whereas as the employers contribute 4.75% of the wages, payable to the insured persons. Employees earning less than and up to Rs. 50 per day are exempted from payment of contribution.

Benefits under the Scheme Employees covered under the scheme are entitled to the following benefits Medical facilities for self and dependants. Cash benefits in the event of specified contingencies resulting in loss of wages or earning capacity. Women are entitled to maternity benefit for confinement. If death of an insured employee occurs due to employment injury or occupational disease, the dependants are entitled to family pension. Medical benefits from day one of entering insurable employment for self and dependants such as spouse, parents and children own or adopted. Sickness benefit. Dependants benefit [family pension] is payable to dependants of a deceased insured person where death occurs due to employment or occupational disease. Other benefits like funeral expenses, vocational rehabilitation, free supply of physical aids and appliances, preventive health care and medical bonus.

Examples and Case-Laws If a person who sustains temporary disablement for not less than 3 days (excluding the day of accident) shall be entitled to periodical payment as may be prescribed by the central govt. If any employee dies during any period for which he is entitled to a cash benefit, the amount of such benefit shall be payable up to & including the day of his death.

También podría gustarte

- Optimizing Talent in the Federal WorkforceDe EverandOptimizing Talent in the Federal WorkforceAún no hay calificaciones

- Human Capital Management HCM The Ultimate Step-By-Step GuideDe EverandHuman Capital Management HCM The Ultimate Step-By-Step GuideAún no hay calificaciones

- Car Policy: Salient FeaturesDocumento2 páginasCar Policy: Salient FeaturesZahid Shaikh100% (1)

- New HRCS 8 Competency Model Focuses On Simplifying ComplexityDocumento3 páginasNew HRCS 8 Competency Model Focuses On Simplifying ComplexityBAún no hay calificaciones

- Final SKMDocumento48 páginasFinal SKMzee100% (2)

- CH 04 Managing Organizational CultureDocumento38 páginasCH 04 Managing Organizational CultureAbdul AhadAún no hay calificaciones

- Managing HR in Turbulent TimesDocumento47 páginasManaging HR in Turbulent TimesSushilAún no hay calificaciones

- Gratuity Law in Pakistan ExplainedDocumento4 páginasGratuity Law in Pakistan Explainedmohammad yasinAún no hay calificaciones

- Gratuity Law in PakistanDocumento7 páginasGratuity Law in PakistanWaseem HyderAún no hay calificaciones

- HR Knowledge: Employer Branding and Retention Strategies - SHRM IndiaDocumento38 páginasHR Knowledge: Employer Branding and Retention Strategies - SHRM IndiaSHRM IndiaAún no hay calificaciones

- Transport Policy: Designati Ons Tiers Vehicle Fuel / MonthDocumento10 páginasTransport Policy: Designati Ons Tiers Vehicle Fuel / MonthzubairabaigAún no hay calificaciones

- Skill Matrix Identifies Employee Skills & Training NeedsDocumento3 páginasSkill Matrix Identifies Employee Skills & Training Needsjagansd3Aún no hay calificaciones

- Presentation On Strategic HR Management From HR Philipppines Eyeball Learning SessionDocumento34 páginasPresentation On Strategic HR Management From HR Philipppines Eyeball Learning SessionEdwin Ebreo100% (1)

- Interview Assessment FormDocumento2 páginasInterview Assessment FormNeha AroraAún no hay calificaciones

- PH MSC Professional HRDocumento382 páginasPH MSC Professional HRDr ShabbirAún no hay calificaciones

- HR Policies and Procedures GuideDocumento36 páginasHR Policies and Procedures GuideImaad ImtiyazAún no hay calificaciones

- Sr HRBP RoleDocumento4 páginasSr HRBP RoleEdson VenturaAún no hay calificaciones

- HRIS in Talent ManagementDocumento11 páginasHRIS in Talent ManagementSolanki SamantaAún no hay calificaciones

- Career Style Interview A ContextualizedDocumento15 páginasCareer Style Interview A ContextualizedMakkai BarbaraAún no hay calificaciones

- Making HR A Strategic AssetDocumento20 páginasMaking HR A Strategic AssetFenny EkaAún no hay calificaciones

- Competency and Review ModelsDocumento31 páginasCompetency and Review Modelspolar103009Aún no hay calificaciones

- Competency Approach To Human Resource ManagementDocumento52 páginasCompetency Approach To Human Resource ManagementUtkarshJaiswalAún no hay calificaciones

- Change ManagementDocumento28 páginasChange ManagementSohaib RaufAún no hay calificaciones

- HR GSR ManagementDocumento53 páginasHR GSR Managementsumanth_0678100% (1)

- Performance Management System: Course Instructor: Ms. Hina ShahabDocumento50 páginasPerformance Management System: Course Instructor: Ms. Hina ShahabFaizan KhanAún no hay calificaciones

- 2016 PWC Q1 HR QuarterlyDocumento14 páginas2016 PWC Q1 HR QuarterlyDebbie CollettAún no hay calificaciones

- Why Should Anyone Be Led by YouDocumento2 páginasWhy Should Anyone Be Led by YouFaviola Denise CubiloAún no hay calificaciones

- Employee Profile & Career Development PlanDocumento3 páginasEmployee Profile & Career Development PlanNothing786Aún no hay calificaciones

- Croatian Employment Service HR Strategy 2007-2009Documento40 páginasCroatian Employment Service HR Strategy 2007-2009Christian MirandaAún no hay calificaciones

- Monika SHRMDocumento35 páginasMonika SHRMANKIT SINGHAún no hay calificaciones

- COMPANY (Only LHR Branch Listing) Website ContactDocumento3 páginasCOMPANY (Only LHR Branch Listing) Website Contactsyed furqan javedAún no hay calificaciones

- Improve The Employee ExperienceDocumento16 páginasImprove The Employee ExperiencenirmaliAún no hay calificaciones

- HR Manager or Sr. HR Generalist or HR Business Partner or Sr. emDocumento2 páginasHR Manager or Sr. HR Generalist or HR Business Partner or Sr. emapi-121342565100% (1)

- HR As Career ChoiceDocumento9 páginasHR As Career ChoicePoonam SinghAún no hay calificaciones

- EOBI Pension Calculation Formula in ExcelDocumento4 páginasEOBI Pension Calculation Formula in ExcelAdeelAún no hay calificaciones

- List of HR CitesDocumento14 páginasList of HR CitesSwapnil SalunkheAún no hay calificaciones

- Boundaryless Organisation ArticleDocumento2 páginasBoundaryless Organisation ArticleVivek SinghAún no hay calificaciones

- Annual Leave Record Template 1016Documento1 páginaAnnual Leave Record Template 1016Walter MazibukoAún no hay calificaciones

- Difference Between Job Analysis and Job Description: Job Analysis Can Be Understood As The Process of GatheringDocumento19 páginasDifference Between Job Analysis and Job Description: Job Analysis Can Be Understood As The Process of Gatheringrishabhverma934540Aún no hay calificaciones

- Building a World-Class OrientationDocumento43 páginasBuilding a World-Class OrientationNghia PtAún no hay calificaciones

- Talent Management An Integrated VisionDocumento4 páginasTalent Management An Integrated VisionRAfaelAún no hay calificaciones

- Future of Organization Development (OD)Documento14 páginasFuture of Organization Development (OD)DkdarpreetAún no hay calificaciones

- The Future of HR - Preliminary ResultsDocumento31 páginasThe Future of HR - Preliminary Resultsgabik1gAún no hay calificaciones

- HR ConsultingDocumento13 páginasHR ConsultingRachna PatelAún no hay calificaciones

- Transformational LeadershipDocumento8 páginasTransformational LeadershipArdana RaffaliAún no hay calificaciones

- HR For Non HR ManagersDocumento66 páginasHR For Non HR ManagersAnderson Butarbutar0% (1)

- Talent MNG ToolkitDocumento17 páginasTalent MNG Toolkitanon_751658564Aún no hay calificaciones

- Leadership Functions OrganizationsDocumento30 páginasLeadership Functions OrganizationsNaveenAún no hay calificaciones

- Human Resource Management Cia 2: by Anjali Nambiar Iibbma 0911030Documento22 páginasHuman Resource Management Cia 2: by Anjali Nambiar Iibbma 0911030anjali747Aún no hay calificaciones

- 5 Human Resources Models Every HR Practitioner Should Know PDFDocumento14 páginas5 Human Resources Models Every HR Practitioner Should Know PDFShivangi RuparelAún no hay calificaciones

- Unit 2 Conceptual Framework of Organizational DevelopmentDocumento48 páginasUnit 2 Conceptual Framework of Organizational DevelopmentShiwangi Alind Tiwary100% (1)

- Transformation Change A Complete Guide - 2019 EditionDe EverandTransformation Change A Complete Guide - 2019 EditionAún no hay calificaciones

- Trends in TalentDocumento10 páginasTrends in TalentKevin J RuthAún no hay calificaciones

- Competency Based HR Systems Developed by Chandramowly For An IT CompanyDocumento33 páginasCompetency Based HR Systems Developed by Chandramowly For An IT CompanyChandramowly100% (1)

- HRM and Performance: Achievements and ChallengesDe EverandHRM and Performance: Achievements and ChallengesDavid E GuestAún no hay calificaciones

- VP BSA Candidate PackDocumento7 páginasVP BSA Candidate PackMariana PopaAún no hay calificaciones

- Hewlett-Packard's Total Rewards ProgramDocumento3 páginasHewlett-Packard's Total Rewards Programambarps13Aún no hay calificaciones

- Job Description Assembly ManagerDocumento2 páginasJob Description Assembly ManagerSarah ChaudharyAún no hay calificaciones

- HR Officer Apraisal Form UpdatedDocumento8 páginasHR Officer Apraisal Form Updatedkitderoger_391648570Aún no hay calificaciones

- Netflix HR Strategy Behind Streaming SuccessDocumento2 páginasNetflix HR Strategy Behind Streaming SuccessShabana NaveedAún no hay calificaciones

- Appraisal Methods GuideDocumento11 páginasAppraisal Methods GuideAli BiomyAún no hay calificaciones

- Bollywood Night PosterDocumento1 páginaBollywood Night PosterRimsha LatifAún no hay calificaciones

- PM Roadmap To Design Implement Eval PulakosDocumento56 páginasPM Roadmap To Design Implement Eval Pulakosapi-270994825Aún no hay calificaciones

- Project Management PDFDocumento11 páginasProject Management PDFluis anchayhua pradoAún no hay calificaciones

- FMProject Shashvat 38263Documento12 páginasFMProject Shashvat 38263Rimsha LatifAún no hay calificaciones

- Takes Place. Civil Disobedience Movement Launched. Disobedience MovementDocumento1 páginaTakes Place. Civil Disobedience Movement Launched. Disobedience MovementRimsha LatifAún no hay calificaciones

- Cases in HRDocumento5 páginasCases in HRRimsha LatifAún no hay calificaciones

- Baaghi's action-packed promotionsDocumento2 páginasBaaghi's action-packed promotionsRimsha LatifAún no hay calificaciones

- Sales HULDocumento2 páginasSales HULRimsha LatifAún no hay calificaciones

- Factories Act, 1948Documento25 páginasFactories Act, 1948Rimsha LatifAún no hay calificaciones

- Sources of Quality in The Pharmaceutical Industry PDFDocumento28 páginasSources of Quality in The Pharmaceutical Industry PDFMostofa RubalAún no hay calificaciones

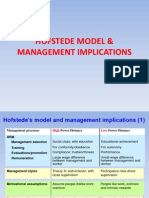

- Hofstede Model & Management ImplicationsDocumento7 páginasHofstede Model & Management ImplicationsRimsha LatifAún no hay calificaciones

- Food Industry PeculiaritiesDocumento15 páginasFood Industry PeculiaritiesRimsha LatifAún no hay calificaciones

- Hofstede Model & Management ImplicationsDocumento7 páginasHofstede Model & Management ImplicationsRimsha LatifAún no hay calificaciones

- Services Unit - 1Documento39 páginasServices Unit - 1Rimsha LatifAún no hay calificaciones

- QUALITY MANAGEMENT USER MANUAL OF GOOGLE DOCSDocumento17 páginasQUALITY MANAGEMENT USER MANUAL OF GOOGLE DOCSRimsha LatifAún no hay calificaciones

- Evolution and Concept of HRDDocumento42 páginasEvolution and Concept of HRDRimsha LatifAún no hay calificaciones

- Nirmal Neer2Documento13 páginasNirmal Neer2Rimsha LatifAún no hay calificaciones

- Questionnaire On Effect of Brand Ambassadors On ConsumersDocumento4 páginasQuestionnaire On Effect of Brand Ambassadors On ConsumersRimsha Latif0% (1)

- OCTAPACE and Organizational CommitmentDocumento11 páginasOCTAPACE and Organizational CommitmentRimsha LatifAún no hay calificaciones

- QUALITY MANAGEMENT USER MANUAL OF GOOGLE DOCSDocumento17 páginasQUALITY MANAGEMENT USER MANUAL OF GOOGLE DOCSRimsha LatifAún no hay calificaciones

- Assignment On Islamic BankingDocumento8 páginasAssignment On Islamic BankingRimsha LatifAún no hay calificaciones

- Assignment On Islamic BankingDocumento8 páginasAssignment On Islamic BankingRimsha LatifAún no hay calificaciones

- Social Security For All: A Continuous Challenge For Workers in IndonesiaDocumento6 páginasSocial Security For All: A Continuous Challenge For Workers in IndonesiaFelix SimarillosAún no hay calificaciones

- Kerala Tailoring Workers' Welfare Fund Act, 1994Documento16 páginasKerala Tailoring Workers' Welfare Fund Act, 1994Latest Laws TeamAún no hay calificaciones

- Consumer, Producers and Efficiency of MarketsDocumento7 páginasConsumer, Producers and Efficiency of MarketsShruti S KumarAún no hay calificaciones

- Louise Tillin - Indian Federalism-Oxford University Press (2019)Documento57 páginasLouise Tillin - Indian Federalism-Oxford University Press (2019)Rohit Amorso RanjanAún no hay calificaciones

- Lesson 03 - Public Expenditure PolicyDocumento18 páginasLesson 03 - Public Expenditure PolicyMetoo ChyAún no hay calificaciones

- Study of Factory Act 1948 in Baidyanath AyurvedDocumento74 páginasStudy of Factory Act 1948 in Baidyanath AyurvedSantosh FranAún no hay calificaciones

- Prak AlpaDocumento4 páginasPrak AlpaDhiman DharAún no hay calificaciones

- Labour Rights in ConstitutionDocumento3 páginasLabour Rights in Constitutionsaleem8727Aún no hay calificaciones

- MWESELI - Cooperatives Notes (2006)Documento81 páginasMWESELI - Cooperatives Notes (2006)SheeAún no hay calificaciones

- The Impact of Social Amelioration Program (SAP) To The Families of Selected AB Political Science Students of The University of Caloocan CityDocumento29 páginasThe Impact of Social Amelioration Program (SAP) To The Families of Selected AB Political Science Students of The University of Caloocan CityKaryl Crystal100% (1)

- Barangay Assembly Resolutions for Kalahi-CIDSS NCDDP ProjectsDocumento10 páginasBarangay Assembly Resolutions for Kalahi-CIDSS NCDDP ProjectsNawal AbdulgaforAún no hay calificaciones

- Montenegro Development Directions 2018-2021 PDFDocumento194 páginasMontenegro Development Directions 2018-2021 PDFAna BozovicAún no hay calificaciones

- Rewards & Incentives in Compensation MGMT With Case StudiesDocumento43 páginasRewards & Incentives in Compensation MGMT With Case Studiesrashmi_shantikumar0% (1)

- Social SecurityDocumento15 páginasSocial SecurityVicky DAún no hay calificaciones

- City of San Antonio Master PlanDocumento72 páginasCity of San Antonio Master PlanRick De La CruzAún no hay calificaciones

- FEDERALISM Federalism and The Welfare State, New World and European ExperiencesDocumento381 páginasFEDERALISM Federalism and The Welfare State, New World and European ExperiencesKarla Sousa100% (1)

- 100 Marks Bms Project Topic ListDocumento6 páginas100 Marks Bms Project Topic ListAshish Pandey0% (4)

- Minister ListDocumento5 páginasMinister ListManasi ChanduAún no hay calificaciones

- Andaman and Nicobar Island (UT) Designation GuideDocumento581 páginasAndaman and Nicobar Island (UT) Designation GuideSunil Pandey100% (1)

- Republic Act For MidwifreyDocumento1 páginaRepublic Act For Midwifreyjocef28Aún no hay calificaciones

- Labour Law 2. Sem v. Special Repeat. Roll No. 100.Documento16 páginasLabour Law 2. Sem v. Special Repeat. Roll No. 100.Pankaj SharmaAún no hay calificaciones

- 399 Isbn9789351611660 240105 130325Documento11 páginas399 Isbn9789351611660 240105 130325Roja SenthilAún no hay calificaciones

- Canada EnglishDocumento334 páginasCanada EnglishZiadHammad67% (3)

- IRC 501 C 4 OrganizationsDocumento40 páginasIRC 501 C 4 OrganizationsjamesAún no hay calificaciones

- Sine Die Adjournment Speech As DeliveredDocumento5 páginasSine Die Adjournment Speech As Deliveredpribhor2Aún no hay calificaciones

- Pakistan's Five Labour Policies 1955-2002: Objectives, Goals and ImpactDocumento5 páginasPakistan's Five Labour Policies 1955-2002: Objectives, Goals and ImpactSalman Rashid Malghani67% (3)

- Guidebook For Living in KoreaDocumento154 páginasGuidebook For Living in KoreaTatianaRSAún no hay calificaciones

- Accounting Transactions of PCSODocumento26 páginasAccounting Transactions of PCSOnicahAún no hay calificaciones

- Chapter 8 - RIT - Exclusions in Gross IncomeDocumento2 páginasChapter 8 - RIT - Exclusions in Gross Incomeclaritaquijano526Aún no hay calificaciones

- HNG01 ECON1588 Diverse Perspectives On The World Economy Team 5 Group Presentation Happiness 1Documento32 páginasHNG01 ECON1588 Diverse Perspectives On The World Economy Team 5 Group Presentation Happiness 1mai quynhAún no hay calificaciones