Documentos de Académico

Documentos de Profesional

Documentos de Cultura

John Morgan - DLO 31 July - AM Questions/ Mark Agerton: Answers

Cargado por

THANGVUTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

John Morgan - DLO 31 July - AM Questions/ Mark Agerton: Answers

Cargado por

THANGVUCopyright:

Formatos disponibles

John Morgan DLO 31 July AM Questions/Answers Mark Agerton Can you comment on the changing role of long-term oil-indexed

ed contracts vs. spot and short-term contracts? Response: This is not my area of expertise. But maybe should direct a response first to oil-indexed prices which seem likely to become less common or favorable. But long-term pricing indexed to other than solely to oil is probably developing and will be reflected in financing for LNG projects. Spot contracts would likely continue to be much less common. Short-term contracts with an advance set of trading terms in place could become more common. Oil Indexed contracts have been the norm in SEA for decades, but in the last year Japan and Korea are challenging this and moving towards a hub-based pricing system, essentially gas-on-gas. Spot or Short-term LNG trades now represent some 25% of the business and are largely based on the spare capacity that exists in many of the production facilities. Prices are established by negotiation. Are there other technologies for liquefaction other than Air Products? Is there any new technology development in this area? Response: ConocoPhillips enjoy a significant ongoing market share; Shell technology is used in some major facilities but perhaps only where Shell have an equity interest; the B&V Prico technology is used in many smaller LNG facilities. There are other technologies used to a much lesser extent. "Do you see Micro LNG could be stronger in N America?" Response: I have little information other than the observation that gas prices are very low in North America. However there is interest in LNG as a transportation fuel in the USA and this might drive the development of Micro-scale LNG facilities. There are some interesting recent developments in this area by Expansion Energy, who have recently tied-up with Dresser. BOC and Linde also active in this area. For floating LNG, a developing technology, what are the capex and opex for the range of sizes being built? What are threshold recoverable reserve sizes? Response: Two projects are underway and there is not a history on floating LNG to estimate sound conclusions on costs, Shell quote $10Bln for their 3.5Mtpa Prelude, but this includes the upstream costs. Typically one reckons that 1tcf is required to justify a 1Mtpa facility, but for FLNG the threshold could be lower if a relocation strategy is envisaged. Do LNG buyers of rich LNG extract ethane and LPG for other uses? Response: there have studies but the demise of LNG imports to the USA has diverted attention from this topic. The extraction of LPG has been practiced in India for LNG supplied by RasGas, but generally the costs are too high to do this at a regasification terminal. The LNG producers are now designing liquefaction trains with the capability to extract LPG themselves when economically justified

Michael Strathman

Ankur Jariwala

Gerald Radke

Michael Strathman

Gerald Radke

Looking at relative costs in the value chain, what are the costs of each element - for each $1.00 of costs, how much is production, PNG, transportation by tanker, and regasification? Response: It all depends! The relative costs are project-specific. These will vary widely reflecting factors such as nature of the gas reserves/supply, LNG plant location, local construction cost structure, capital equipment inflation pressures etc etc. Here is one basis as quoted in John M Campbells G29 LNG Short Course there will be many other and differing relative cost splits: Gas Production (Well to site) 25% Liquefaction 50% Shipping 15% Regasification 10% Does a Different LNG i.e. Rich & Lean require different technology for Regasification? Response: Not fundamentally. The main problem is whether the gas is of the right quality for regasification and delivery into the receiving countrys pipeline network. The Wobbe Index (WI) of LNG is significantly higher than Pipeline Natural Gas (PNG) because there is no CO2 in the gas. So a rich gas from LNG may require ballasting (diluting) with say N2 and a lean gas spiking with say propane, What is the fraction cost of the utilities and offsite in the total cost of the LNG plant? Do we increase the number of utilities facility with the number of trains? Response: Again using data from G29 LNG short course: Process train (AGRU-Liquefaction) 50% Offsites (Storage and marine) 25% Utilities 10% Infrastructure (site, buildings etc) 15% clearly each project is different and these numbers could vary widely.

TEJASH SHETH

Majid Abdi

TEJASH SHETH

"Does a Different LNG i.e. Rich & Lean require different technology for Regasification? (Australia - Perth) " Response: Same question as-above. which form of LNG transportation/transfer is safer? Shipping or the Pipelines? Response: Not sure on what basis to compare safety. But LNG is an expensive pipeline to move gas from A-to-B. The LNG industry enjoys a very good safety record especially in the shipping sector. Good philosophical question: Pipeline Natural Gas (PNG) is typically at high pressure 50 100 barg and there have been several accidents and deaths. On the other hand there was major LNG leak (Cleveland) in the 1940s where 120 people were killed; but in this case the wrong materials were used, the design was wrong and operating procedures were suspect. So one view is that LNG, correctly handled, is pretty safe at atmospheric pressure.

Chris Ampiah

Jon Even Vale

when making power from LNG is the LNG regasified first or burnt directly? Response: regasified first.

Farrah Tan

What are some of the bigger examples of safety concerns related to LNG production and delivery? Response: The same as any gas handling facilities plus those associated with the handling of cold liquids in large quantities. Containment is the main issue With higher summer temperatures in some areas does that change the take or pay contract? Response: Im sorry but I dont have specific information on this. But the demand pattern will be a component of the Gas Sales Agreement Why does LNG prices vary so much across the globe? (Abhijeet from Denmark)? Response: presumably due to the supply and market conditions, in particular the availability of lower-priced gas by pipeline. Basically the Pacific region has developed LNG trades related to Oil prices, but in the USA gas sales are market driven (Hub Pricing). Europe has long-term Pipeline Natural Gas (PNG) contracts where the prices were established against oil products, but there is more flexibility than in South-East Asia. What is a "typical" production cost range per MMBTU for LNG (excluding the upstream portion)? Response: Liquefaction costs range from $36/MMBtu depending on capacity, quality of feed and location "there is a joint venture of few companies in Angola for LNG production, from your knowledge what are the biggest challenges of LNG production in Africa (more specifically in Angola)? Response: in general among the factors are likely to be quality of the infrastructure, availability of skilled labor, political stability etc. I dont have specific knowledge of Angola. Can we have the slides? Response: Please check with SPE HQ on the small file-size version. What is a "typical" transportation cost range per MMBTU for LNG? Response: Depends on distance but typically $1-2/MMBtu for 3-8,000 nm (nautical mile) Isn't the sloshing of the LNG within the partially filled storage compartments make the ship unstable? Response: You might contact the American Bureau of Shipping for further information. To some extent perhaps yes; but the task is to minimize the sloshing because the main risk is damage to the membrane tanks (which are the more common configuration). Recently GTT have developed a tank utilizing a central bulkhead which minimizes the problem (and will be used on Prelude)

K Smith

Abhijeet Kulkarni

Vily Frenk

Clarindo Chassungo

Majid Abdi

Vily Frenk

Vily Frenk

Thomas Wahlheim

"What is the potential to reuse underutilized USA import terminals as export terminals? Region (USA) Response: the potential is there but it is suggested to read the trade and business press as this is an evolving situation. There is one project (Freeport) underway and several others under development. So there is great potential and costs will be lower as the off-sites are already in place. is LPG also expensive to produce? Why is LNG more important? Is it because it is a better fuel? Response: LPG is less expensive to produce than LNG because LPG doesnt require such low-level refrigeration and is easier to transport. Also LPG and LNG serve different markets. What are the challenges of FLNG regarding each field characteristics? Water, CO2, H2S content..etc. Luber. Norway. Response: the gas pretreatment requirements will be the same for land-based or floating LNG. There is not enough history of FLNG to fully compare the two. How sustainable is the near parity oil-linked pricing that Asian LNG buyers currently pay? Response: the oil-parity as a structure is under some strain; For example $17/MMBtu gas is similar to $100/BBL oil in equivalent energy content. What is a "typical" transportation cost range per MMBTU for LNG ?? I forgot to add per mile? Response: please see previous answer "how long can be a pipe between LNG plant and LNG terminal?" Response: you might check the Bintulu LNG plants they are among the longer lines I believe. At Ras Laffan the distance from storage to loading is up to 6km. At Isle of Grain (UK) the distance from ship to tanks is 4km. Perhaps these distances could be longer. Issue is cost, these transfer lines cost $10k/m, heat gain (leading to more BOG) and pumping costs. Hello John, are there any examples of "small scale" - onshore based LNG business cases e.g. with rail based LNG carriers? (Raimund from Calgary, Canada) Response: Hello Raimund its great to hear from you. Ive not been active in the small scale LNG business so Im sorry not to be able to comment. But it is an active market. Not sure about rail cars, but there are dozens of examples of LNG being trucked. In China, LNG is trucked by road over 4,000km. There are other long distance hauls in Australia. The LNG tanks (vacuum 3 insulated up to 50 m ) are containerized so could be transported on a flat bed rail car. "Do you see LNG as a competitor to or complementary to gas storage? Particularly in the context of UK requirements? UK Question!" Response: I dont see LNG as a significant competitor for large-scale gas storage. But LNG has an established place as a peak-shaving supply. LNG is primarily a means of TRANSPORTING gas. It is used for storage (peak shaving) and in Korea there is massive seasonal storage. But it depends on how easy it is to construct salt-cavern gas-storage or

Iroro Eradajaye

Luber Perez

Karthik Murali

Vily Frenk

Yann Le Gallo

Raimund Wege

James Lobban

to re-purpose depleted gas- or oil fields for gas storage, generally these will be the cheaper option. Chassty Manuhutu What are the key success factors behind the excellent HSE track-record of LNG shipping? Australia. Response: It certainly has been a fine record but I dont have specific information. LNG carrier movements within harbors are closely monitored; no doubt the training of the ships crews and officers is a factor too. What is the safety record like in LNG? United Kingdom. Response: the LNG industry has enjoyed a very good record. Statistics to quantify this might be available through the industrys insurers. Maybe check the Marsh website as a starting point. What is the dominating technology for ship to ship LNG transfer, Cryogenic hoses or loading arms? Response: The only proven technology is cryogenic hoses which now have been extensively used by Excelerate. But hard arms are in use on the Adriatic GBS and several of the other FSRU which are moored on a jetty. Prelude plans to use Hard Arms Is it possible to recover some of the energy used for refrigeration at the Regas terminals? (Bangalore, India) Response: This has rarely been done. One problem could be matching the LNG supply business model with that of another industry. A few examples of LNG used to chill inlet gas to power station GTs. Several concepts tried in Japan, but probably NOT economically viable. "Is it possible to get value from the very low temperature of the LNG at the delivery point. Or is it a cost, a problem? United Kingdom." Response: As with the previous question this has rarely been done. One problem could be matching the LNG supply business model with that of another industry. In terms of development cost at what scale does it make sense to have Floating Regas vs Land Based Regas? Response: for Regas it might not be driven primarily by size factors. Environmental factors, permitting and the attitude of the surrounding populace/ authorities could assume greater importance in the decision. (For FLNG the project scale depends on the business model. Projects under way and consideration will have different business models. Right now Petronas are developing at 1.5Mtpa and Shell at 3.5Mtpa. Probably 4Mtpa is the largest size one could contemplate and <1Mtpa is probably not economically justifiable for FLNG.) "will the intnl. market evolve to be just like the crude oil and products markets? How long will it take? Response: Probably not because of the much more complex and costly infrastructure required for LNG and the consequent large financial commitments.

David Ruddock

Oddgeir Johansen

Vinay Pydah

Neil Dunlop

Ben Thuriaux

Simon Antunez

Michael Strathman

Are LNG and GTL competing technologies? USA. Response: No, they are completely different. Gas-to-Liquids (GTL) facilities for diesel are more costly than the cost of LNG facilities. Both require low cost gas supply. But they are targeting quite different markets: LNG is largely a stationary fuel supply to power stations; GTL is aimed at transportation fuels.

John Morgan DLO 31 July PM Questions/Answers Kai Eberspaecher [Australia] - What is your opinion in taking coal seam gas to feed an LNG plant? Do you see any challenges in comparison to conventional developments? Response: one factor is that coal seam gas is very dry and has no condensate production revenue stream. Another factor is the large number of low productivity wells which do not like to be shut in potentially leading to a high level of make-over requirements. Disposal of water is another problem which has raised serious concerns with the environmental lobby. But that said, several different companies are pursuing this business. With the increase of investment to build up LNG plant in Canada and or USA, will that help to increase natural gas price in Canada and USA? When and estimate by how much? Noordin, Malaysia. Response: LNG exports from North America could be expected to firm-up the market for gas production; but I have not seen any published numbers. LNG exports for the USA will undoubtedly affect prices to some degree which are set by a supply-demand scenario. It is not easy to estimate the impact on price levels but the timing is linked to the assets coming on stream. Current forecast for Sabine Pass is 2013, no other facility has placed an EPC contract. The cold temperatures must be hard on the turbines. What changes are made to compensate for cold temperatures? Response: lower temperatures improve the power output from GTs but the temperature must be limited to minimize the effect of inlet air icing. Recognize that aircraft engines work at very low temperatures, albeit at reduced pressure. In artic regions the power output may be controlled to a maximum power that results from the high air density due to the combination of very cold temperatures at atmospheric pressure. Sakhalin (in particular) and Melkoya experience very cold temperatures. How much of the LNG is used in re-gasification? (USA) Response: If the heat for regasification is provided by burning some of the gas, then typically in a submerged combustion vaporizer the fuel consumption is 1.5% of the throughput. How can I get a copy of the presentation materials? Noordin Malaysia. Response: please check with SPE HQ for the small file size version. Hi Guys does winter or summer effect the plant efficiency? Response: winter operation (cold weather) operation will make refrigeration cycles more energy efficient.

Noordin Abdul Rahman

Stephen Holtz

Gavin Longmuir

Noordin Abdul Rahman

Graeme Brown

Nishant Chadha

"What is more expensive to build: LNG or FLNG? Australia" Response: there is not enough project cost history to make a comparison at present. But the current increased interest and developments suggest that the costs are comparable. Its unlikely that the Prelude project would have been approved by Shell if it was wildly out of line with other LNG sources. The first FLNG facilities look to be more costly than a land-based project built using modular technology, but undoubtedly costs will come down with experience and also depending on the application. The Shell Prelude application is complex with a high level of NGLs in the feed which need to be processed. Directionally FLNG could be marginally cheaper, but as yet this is not proven. what processes are involved in the re-gasification? (USA) Response: either submerged combustion or sea-water vaporization. An air exchanger arrangement has been proposed and is in use on the Hazia terminal in India and installed on the Cameron (?) terminal in the US? how do you see the large coal seam methane to LNG projects fitting into the future and do you see it happening elsewhere?....Australia Response: the fact that there are a number of coal-seam-gas (CSG) projects (by different companies) underway in Australia suggest that it is an economic gas source. Unaware of possibilities elsewhere but they may exist. Like shale gas, there are large reserves of accessible CSG around the world. The most likely place for further development in the near future is in China. is there an option to use LNG to export future Arctic gas production? San Diego, Ca B Bernard. Response: see the paper at the recent GasTech 2012 conference in London regarding exports from Russia, icebreakers etc. But such a project would be vulnerable to one or more severe winters where ice-reinforced LNG ships couldnt move. The envisaged LNG projects in Arctic regions are where the sea temperature does not fall too low. This is not necessarily coincident with the availability of gas. So as often is the case in this Industry It Depends on the precise circumstances. LNG will not be a generic answer. ARE THERE LNG IN THE OFFSHORE RESERVOIRS, WHERE? Response: The reservoirs will only contain the gas. LNG is only produced in surface facilities using large refrigeration systems. "How frequent is the economics of a project done? Is it being monitored constantly during the LNG operations as well? Thank you" Response: the economics of both the construction and operational phases would be under constant cost-control observation.

Benjamin JOHNSON

Mike Mollison

Bruce Bernard

FERNANDO PLAZAS

Azlan Kassim

Graeme Brown

"Does a FLNG facility have a lower capital cost than and fixed land based plant? And does it as a result produce less LNG? Australia" Response: No long-tem history exists on FLNG costs. The production rate is limited by the size of the floating platform itself. The Prelude FLNG project is the first and the only emerging data-point. A lot more will be know when it is completed and in operation. Please also see earlier responses above. Could you please explain what a 'pay or take contract' is again? Australia. Response: at its most basic it means that the purchaser pays whether or not it takes LNG product. This is to guarantee a revenue stream to the LNG plant investors. In modern contracts the Buyer is seeking relief by being able to sell on any surplus LNG What is a typical cost of LNG generation (on a per-unit basis), so what would be a limiting maximum price an LNG producer can pay to a producer of natural gas? (USA) Response: I am not aware of these costs in the public domain. Perhaps try the Petroleum Economist or similar publications; private economic consultancies will likely have this information. Please also see earlier AM session answer, $3-6/MMBtu USA: What are some of the typical pricing bases for LNG contracts? For example, LNG may be priced as a function of crude oil prices... Response: See earlier discussion. Varies from region to region, country to country. In Asia typically LNG is related to oil prices, but the Japanese and Koreans are trying to break the link. Generally LNG has to compete with alternative fuels unless it is a niche product which is unlikely. In the USA gas is traded at Henry Hub on a demand-versus-supply basis, making the price very volatile and difficult to predict. Please recognize that LNG is simply a means of transporting LNG, it is a floating pipeline not truly a product in its own right.

Nishant Chadha

Benjamin JOHNSON

Randall Reed

Daiye Zheng

What are the key elements to be considered when evaluating the economics of a LNG project? Malaysia Response: Among the key elements will be the adequacy of the gas reserve; also the commercial terms all the way to the ultimate gas purchasers ability to pay for the gas consumed in the receiving country with a reliable stream of payments. CAPEX and OPEX clearly play a part as will the rate at which demand will build up. Note that the requirements of the funders (project financers) need to be accounted for. Large loans are required which will need to be serviced. Thanks for the webinar...our first time. It was really useful.

Mike Mollison

Id like to recognize input to many answers by my Campbell instructor colleague Mr. John A. Sheffield and Kindra Snow-McGregor as Kindra introduced me and moderated the two sessions. John

También podría gustarte

- Leaders On The Future of LNG and GasDocumento20 páginasLeaders On The Future of LNG and GasShekhrendu BhardwajAún no hay calificaciones

- Evolution of Short Term LNG MarketDocumento7 páginasEvolution of Short Term LNG MarketthawdarAún no hay calificaciones

- HeatRatesSparkSpreadTolling Dec2010Documento5 páginasHeatRatesSparkSpreadTolling Dec2010Deepanshu Agarwal100% (1)

- Conversion FactorDocumento4 páginasConversion Factorpks_2410Aún no hay calificaciones

- LNG Standard Form Charters March 2013 PDFDocumento10 páginasLNG Standard Form Charters March 2013 PDFFabián BischoffAún no hay calificaciones

- PNG LNG Project to Supply AsiaDocumento29 páginasPNG LNG Project to Supply Asiastavros7Aún no hay calificaciones

- ZZ 1207573397 IsoFraction LNG Sampling SystemR2Documento3 páginasZZ 1207573397 IsoFraction LNG Sampling SystemR2kaysb786133Aún no hay calificaciones

- Marine Pollution ConventionsDocumento4 páginasMarine Pollution Conventionssusnata236Aún no hay calificaciones

- Energy Recovery From The LNG Regasification ProcessDocumento25 páginasEnergy Recovery From The LNG Regasification ProcessAn TrAún no hay calificaciones

- Appendix E Preliminary Hazard AnalysisDocumento66 páginasAppendix E Preliminary Hazard Analysissusa2536Aún no hay calificaciones

- 4 - LNG ShippingDocumento29 páginas4 - LNG ShippingAhmed FaragAún no hay calificaciones

- LNG Fundamentals Presentation 2019Documento26 páginasLNG Fundamentals Presentation 2019endosporaAún no hay calificaciones

- Rubis Terminal GBDocumento21 páginasRubis Terminal GBsizwehAún no hay calificaciones

- Platts Asian Oil Products - Methodology&SpecificationGuideDocumento29 páginasPlatts Asian Oil Products - Methodology&SpecificationGuideStephen HohAún no hay calificaciones

- Hydrogen Processing: P A R T 1 4Documento68 páginasHydrogen Processing: P A R T 1 4Bharavi K SAún no hay calificaciones

- Understanding Natural Gas and LNG OptionsDocumento248 páginasUnderstanding Natural Gas and LNG OptionsTivani MphiniAún no hay calificaciones

- Qdoc - Tips LNG GlossaryDocumento93 páginasQdoc - Tips LNG GlossaryFernando Igor AlvarezAún no hay calificaciones

- LNG Terminals in IndiaDocumento20 páginasLNG Terminals in IndiaJyotishko BanerjeeAún no hay calificaciones

- BIMCO-IBIA Bunkering Guide Jun2018Documento28 páginasBIMCO-IBIA Bunkering Guide Jun2018indraAún no hay calificaciones

- DRY CARGO CHARTERING CAPITAL MARKETS DAYDocumento23 páginasDRY CARGO CHARTERING CAPITAL MARKETS DAYestotalAún no hay calificaciones

- Pricing of Port ServicesDocumento130 páginasPricing of Port ServicesvenkateswarantAún no hay calificaciones

- Outlook For Competitive LNG Supply NG 142Documento44 páginasOutlook For Competitive LNG Supply NG 142Suman KumarAún no hay calificaciones

- Intertanko Gas and Marine Seminar: Blending/Commingling of LPG Cargoes On Board Gas CarriersDocumento19 páginasIntertanko Gas and Marine Seminar: Blending/Commingling of LPG Cargoes On Board Gas Carriersmouloud miloud100% (1)

- 5NRJHL Saipem FY2020 Results JMEEBODocumento42 páginas5NRJHL Saipem FY2020 Results JMEEBOsudhakarrrrrrAún no hay calificaciones

- Corrosion Cost FactsDocumento1 páginaCorrosion Cost FactsDvs RamaraoAún no hay calificaciones

- PVGAS Term Sheet - BGLT Draft - 14 November 2011-HDK CommentDocumento4 páginasPVGAS Term Sheet - BGLT Draft - 14 November 2011-HDK CommentGamoChuphinhAún no hay calificaciones

- LNG Operational PracticesDocumento7 páginasLNG Operational Practicesatm4231Aún no hay calificaciones

- MethanolDocumento8 páginasMethanolSafwan OthmanAún no hay calificaciones

- LNG Contracts For StartersDocumento4 páginasLNG Contracts For Startersragola123100% (2)

- 27snii15 Week27 2015Documento151 páginas27snii15 Week27 2015Kunal SinghAún no hay calificaciones

- CV Parul WordDocumento5 páginasCV Parul Wordkkrish_nits867182Aún no hay calificaciones

- P&I Claims Analysis Web PDFDocumento76 páginasP&I Claims Analysis Web PDFMyo Htet LinnAún no hay calificaciones

- Gasasa Marine Fuel: Recommendations For Linked Emergency Shutdown (ESD) Arrangements For LNG BunkeringDocumento14 páginasGasasa Marine Fuel: Recommendations For Linked Emergency Shutdown (ESD) Arrangements For LNG Bunkeringmhientb100% (1)

- Introduction To LNG PDFDocumento33 páginasIntroduction To LNG PDFCitra Queen'zAún no hay calificaciones

- Voyage Estimating: Related NewsDocumento11 páginasVoyage Estimating: Related NewsNikhil SalviAún no hay calificaciones

- Freight Methodology PDFDocumento45 páginasFreight Methodology PDFNilesh JoshiAún no hay calificaciones

- Triality VLCCDocumento20 páginasTriality VLCCLeo ThomasAún no hay calificaciones

- Bonaparte Australia FLNGDocumento12 páginasBonaparte Australia FLNGLawrence LauAún no hay calificaciones

- Qualifying Criteria For Signing MSPA With GAIL For LNG Supply July 2010Documento2 páginasQualifying Criteria For Signing MSPA With GAIL For LNG Supply July 2010shashwatrishuAún no hay calificaciones

- JCC Crude Oil Index Price FormulasDocumento9 páginasJCC Crude Oil Index Price FormulasVijendra Sah100% (1)

- Guidelines For The Implementation of Marpol Annex V - 2012 EditionDocumento73 páginasGuidelines For The Implementation of Marpol Annex V - 2012 EditionTanvir ShovonAún no hay calificaciones

- Joint Industry Guidance On The Supply and Use of 0.50 Sulphur Marine FuelDocumento64 páginasJoint Industry Guidance On The Supply and Use of 0.50 Sulphur Marine FuelharrdyAún no hay calificaciones

- 2739 2009Documento68 páginas2739 2009Tim Wilson100% (1)

- Drafting of LNG ChartersDocumento13 páginasDrafting of LNG ChartersLelosPinelos1230% (1)

- LNG Supply Chain Infrastructure ConfigurationDocumento15 páginasLNG Supply Chain Infrastructure ConfigurationpadangiringAún no hay calificaciones

- ASM Masters Solved Past Question Papers Solved Numericals From Sept16 Till Nov21Documento302 páginasASM Masters Solved Past Question Papers Solved Numericals From Sept16 Till Nov21arivarasanAún no hay calificaciones

- Fixation of JLPL & VSPL Tariff by PNGRB: An Overview of Gail'S Submissions To The BoardDocumento10 páginasFixation of JLPL & VSPL Tariff by PNGRB: An Overview of Gail'S Submissions To The BoardSanjai bhadouriaAún no hay calificaciones

- M1703 AkashGuptaDocumento43 páginasM1703 AkashGuptaamartyadasAún no hay calificaciones

- LNG FuelDocumento6 páginasLNG FuelKaran DoshiAún no hay calificaciones

- Production Sharing Contract Review ReportDocumento7 páginasProduction Sharing Contract Review Reportdixit87Aún no hay calificaciones

- Services BunkerClauses BC Template Bunker 2017Documento13 páginasServices BunkerClauses BC Template Bunker 2017Mikhail ValkoAún no hay calificaciones

- Practical Guide to Resolving Bunker ProblemsDocumento32 páginasPractical Guide to Resolving Bunker Problemsdassi99Aún no hay calificaciones

- History of LNGDocumento9 páginasHistory of LNGNick Tarr0% (1)

- Crude Oil Prices and FactorsDocumento15 páginasCrude Oil Prices and FactorsGirish1412Aún no hay calificaciones

- Oil&Gas Sector AnalysisDocumento7 páginasOil&Gas Sector AnalysisAMEY PATALEAún no hay calificaciones

- LNG - Urn 05 - 1016Documento67 páginasLNG - Urn 05 - 1016kaspersky2009Aún no hay calificaciones

- Production Sharing Agreement - Wikipedia, The Free EncyclopediaDocumento3 páginasProduction Sharing Agreement - Wikipedia, The Free EncyclopediaandinumailAún no hay calificaciones

- Propane MsdsDocumento8 páginasPropane MsdssalcabesAún no hay calificaciones

- International Thermodynamic Tables of the Fluid State: Propylene (Propene)De EverandInternational Thermodynamic Tables of the Fluid State: Propylene (Propene)Aún no hay calificaciones

- Coal, Gas and Electricity: Reviews of United Kingdom Statistical SourcesDe EverandCoal, Gas and Electricity: Reviews of United Kingdom Statistical SourcesAún no hay calificaciones

- Test PPDocumento4 páginasTest PPTHANGVUAún no hay calificaciones

- Boiler Feed Water AnalysisDocumento1 páginaBoiler Feed Water AnalysisTHANGVUAún no hay calificaciones

- Downhole Chemical Injection Lines Why Do They Fail Experiences Challenges and Application of New Test MethodsDocumento11 páginasDownhole Chemical Injection Lines Why Do They Fail Experiences Challenges and Application of New Test MethodsAcbal AchyAún no hay calificaciones

- L30 31 Oilfield WatersDocumento10 páginasL30 31 Oilfield WatersfirocanAún no hay calificaciones

- IATMI 09-024 - Case History: Bekasap Area Scale Mitigation, the Way to Improve Well ReliabilityDocumento6 páginasIATMI 09-024 - Case History: Bekasap Area Scale Mitigation, the Way to Improve Well ReliabilityTHANGVU100% (1)

- Scale TestDocumento2 páginasScale TestTHANGVUAún no hay calificaciones

- Water ResistivityDocumento12 páginasWater Resistivityashish08394Aún no hay calificaciones

- Petroskills Cat: (Competency Analysis Tool)Documento2 páginasPetroskills Cat: (Competency Analysis Tool)profmkc2001Aún no hay calificaciones

- Interpretating A Water AnalysisDocumento12 páginasInterpretating A Water AnalysisTHANGVUAún no hay calificaciones

- D 3921 - 2003Documento7 páginasD 3921 - 2003THANGVU100% (1)

- Scale Inhibitor - Gyptron IT-265 - MSDS - ENGDocumento5 páginasScale Inhibitor - Gyptron IT-265 - MSDS - ENGTHANGVUAún no hay calificaciones

- Monitoring ScaleDocumento25 páginasMonitoring ScaleTHANGVUAún no hay calificaciones

- BasementDocumento3 páginasBasementTHANGVUAún no hay calificaciones

- Re-evaluating Scale Management in a Maturing FieldDocumento15 páginasRe-evaluating Scale Management in a Maturing FieldTHANGVUAún no hay calificaciones

- Interpretating A Water AnalysisDocumento12 páginasInterpretating A Water AnalysisTHANGVUAún no hay calificaciones

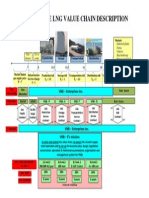

- Value Chain Description.12Feb14Documento1 páginaValue Chain Description.12Feb14THANGVUAún no hay calificaciones

- Scaling ReportDocumento6 páginasScaling ReportTHANGVUAún no hay calificaciones

- Scaling ReportDocumento6 páginasScaling ReportTHANGVUAún no hay calificaciones

- Optimising Standard and Produced Water Injection Systems: BackgroundDocumento6 páginasOptimising Standard and Produced Water Injection Systems: BackgroundTHANGVUAún no hay calificaciones

- ESP PerformanceDocumento19 páginasESP PerformanceTHANGVUAún no hay calificaciones

- 295Documento9 páginas295THANGVUAún no hay calificaciones

- Wax StoveDocumento0 páginasWax StoveTHANGVUAún no hay calificaciones

- Water ResistivityDocumento12 páginasWater Resistivityashish08394Aún no hay calificaciones

- Water Chemistry Analysis For Water Conveyance, Storage, and Desalination ProjectsDocumento18 páginasWater Chemistry Analysis For Water Conveyance, Storage, and Desalination ProjectsTHANGVUAún no hay calificaciones

- View Inc.: Business Plan OverviewDocumento0 páginasView Inc.: Business Plan OverviewPavankumar KarnamAún no hay calificaciones

- Brazil Plastics 2013Documento31 páginasBrazil Plastics 2013THANGVUAún no hay calificaciones

- BasementDocumento3 páginasBasementTHANGVUAún no hay calificaciones

- Alc Stove Models 113 226 ManualDocumento7 páginasAlc Stove Models 113 226 ManualTHANGVUAún no hay calificaciones

- The Practical Application of Ion Association Model Saturation Level Indices To Commercial Water Treatment Problem SolvingDocumento16 páginasThe Practical Application of Ion Association Model Saturation Level Indices To Commercial Water Treatment Problem SolvingTHANGVUAún no hay calificaciones

- CED-2021 EnergyTransition ReportDocumento75 páginasCED-2021 EnergyTransition ReportCityNewsTorontoAún no hay calificaciones

- Electric Current and Ohm's LawDocumento2 páginasElectric Current and Ohm's LawSheldon MillerAún no hay calificaciones

- ADocumento3 páginasAcristinandreeamAún no hay calificaciones

- 2017 09Documento164 páginas2017 09sowabar100% (1)

- 3D Model Files Presentation 1Documento9 páginas3D Model Files Presentation 1SolidSpy24Aún no hay calificaciones

- MAG Infinite S 10SC-017XIBDocumento3 páginasMAG Infinite S 10SC-017XIBPedro Garcia DiazAún no hay calificaciones

- SAP MM Purchase Info Record GuideDocumento3 páginasSAP MM Purchase Info Record GuidevikneshAún no hay calificaciones

- t-030f Spanish p35-48Documento4 páginast-030f Spanish p35-48Juan ContrerasAún no hay calificaciones

- Piper Lance II - Turbo Lance II-Maintenance - smv1986Documento568 páginasPiper Lance II - Turbo Lance II-Maintenance - smv1986willkobiAún no hay calificaciones

- DS 1Documento23 páginasDS 1aayush bhatiaAún no hay calificaciones

- Gpee6.0T01Tibbgde: Technical Data SheetDocumento2 páginasGpee6.0T01Tibbgde: Technical Data SheetHope SangoAún no hay calificaciones

- PronunciationDocumento5 páginasPronunciationHưng NguyễnAún no hay calificaciones

- Despiece Des40330 Fagor Sr-23Documento45 páginasDespiece Des40330 Fagor Sr-23Nữa Đi EmAún no hay calificaciones

- Mobil Dynagear Series Performance ProfileDocumento2 páginasMobil Dynagear Series Performance ProfileXavier DiazAún no hay calificaciones

- Hydraulic Accumulator - Test and Charge: Cerrar SIS Pantalla AnteriorDocumento9 páginasHydraulic Accumulator - Test and Charge: Cerrar SIS Pantalla AnteriorHomer Yoel Nieto Mendoza100% (1)

- ECO Report 03Documento96 páginasECO Report 03ahmedshah512Aún no hay calificaciones

- American Statistical AssociationDocumento7 páginasAmerican Statistical Associationmantu6kumar-17Aún no hay calificaciones

- Molding CavityDocumento7 páginasMolding CavitySudarno BaraAún no hay calificaciones

- DLL - Mathematics 5 - Q1 - W4Documento9 páginasDLL - Mathematics 5 - Q1 - W4Avelino Coballes IVAún no hay calificaciones

- Call For IPSF-EMRO Regional Working Group Subcommittees 2018-19Documento4 páginasCall For IPSF-EMRO Regional Working Group Subcommittees 2018-19IPSF EMROAún no hay calificaciones

- Sem2 NanoparticlesDocumento35 páginasSem2 NanoparticlesgujjugullygirlAún no hay calificaciones

- Closed Coke Slurry System: An Advanced Coke Handling ProcessDocumento33 páginasClosed Coke Slurry System: An Advanced Coke Handling ProcessFayaz MohammedAún no hay calificaciones

- Katalog - Bengkel Print Indonesia PDFDocumento32 páginasKatalog - Bengkel Print Indonesia PDFJoko WaringinAún no hay calificaciones

- Laptop Chip Level CourseDocumento2 páginasLaptop Chip Level CourselghmshariAún no hay calificaciones

- Insulation Resistance TestDocumento7 páginasInsulation Resistance Testcarlos vidalAún no hay calificaciones

- MD - Huzzatul Islam Contact Address: 01, International Airport Road, "Joar Sahara Bajar", APT # 13-F, Uttar Badda, Dhaka-1213, Bangladesh. Cell: +8801722223574Documento4 páginasMD - Huzzatul Islam Contact Address: 01, International Airport Road, "Joar Sahara Bajar", APT # 13-F, Uttar Badda, Dhaka-1213, Bangladesh. Cell: +8801722223574Huzzatul Islam NisarAún no hay calificaciones

- Final AnswersDocumento4 páginasFinal AnswersAnshul SinghAún no hay calificaciones

- Brent Academy of Northern Cebu, Inc: Talisay, Daanbantayan, Cebu First Periodical TestDocumento2 páginasBrent Academy of Northern Cebu, Inc: Talisay, Daanbantayan, Cebu First Periodical TestKristine RosarioAún no hay calificaciones

- Speech Language Impairment - Eduu 511Documento15 páginasSpeech Language Impairment - Eduu 511api-549169454Aún no hay calificaciones

- DLT - Ate 2022Documento28 páginasDLT - Ate 2022chellep.uniAún no hay calificaciones