Documentos de Académico

Documentos de Profesional

Documentos de Cultura

MPAA Theatrical Market Statistics 2011

Cargado por

ArthawkDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

MPAA Theatrical Market Statistics 2011

Cargado por

ArthawkCopyright:

Formatos disponibles

Global

Global box office for all films released in each country around the world reached $32.6 billion in 2011, up 3% over 2010s total, due entirely to the increase in international box office ($22.4 billion). Each international region experienced growth in 2011. Chinese box office grew by 35% in 2011 to become the 2nd largest International market behind Japan, experiencing by far the largest growth in major markets. International box office in U.S. dollars is up 35% over five years ago, driven by growth in various markets, including China and Russia.

U.S./Canada

2011 U.S./Canada box office was $10.2 billion, down 4% compared to $10.6 billion in 2010, but up 6% from five years ago. Despite strong second and third quarter box office performance, 2011 box office did not fully overcome the slow start in the first quarter. 3D film releases increased, yet 3D box office was down $400 million in 2011 compared to 2010, which contained Avatars record-breaking 3D box office performance. The decline in U.S./Canada box office was due to an equivalent decline in admissions (-4%) compared to 2010, as admissions reached 1.3 billion, while average cinema ticket price stayed relatively flat (+1%). More than two-thirds of the U.S./Canada population (67%) or 221.2 million people went to the movies at least once in 2011. Males and females went to the movies at similar levels. As in past years, Hispanics and 12-24 year olds are the most frequent moviegoers among their respective demographic categories. Ticket sales continue to be driven by frequent moviegoers, who represent only 10% of the population but purchase half of all movie tickets. In 2011, more 25-39 year olds were in the frequent moviegoer category, particularly males. Of all U.S/Canada moviegoers, half (51%) viewed at least one movie in 3D in 2011, with attendance continuing to skew significantly towards younger moviegoers, similar to 2010. The typical moviegoer over 25 years old attended one 3D movie in 2011, compared to two for moviegoers under 25 years old.

Theatrical Market Statistics 2011

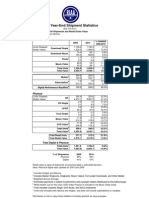

GLOBAL

Global box office for all films released in each country around the world1 reached $32.6 billion in 2011, up 3% over 2010s total. The increase was due to international box office ($22.4 billion), up 7% compared to 2010, due to growth in each geographic region. International box office in U.S. dollars is up 35% over five years ago.

Global Box Office All Films (US$ Billions)

International U.S./Canada $31.6 $27.7 $29.4 $32.6

$35

$30 $25 $20 16.6 $15 $10 $5 $0 2007 2008 2009 10.6 (63%) 18.8 (64%)

$26.2

21.0 (66%)

22.4 (69%)

18.1

(65%)

9.6

9.6

10.6

10.2

2010

2011

2007

2008

2009

2010

2011

% Change 11 vs. 10

% Change 11 vs. 07

U.S./Canada2

International3

$9.6

$16.6

$9.6

$18.1

$10.6

$18.8

$10.6

$21.0

$10.2

$22.4

-4%

7%

6%

35%

Total

$26.2

$27.7

$29.4

$31.6

$32.6

3%

24%

Values in the report include all films released, regardless of distributor or country of origin, except where specified as a subset. 2 Source: Rentrak Corporation Box Office Essentials, calendar year from January 1-December 31, 2011. 3 MPAA calculates international box office country-by-country based on a variety of primary and secondary data sources. 2010 international box office was revised due to a change by a source.

Each geographic region contributed to international box office growth for all films released in 2011. Europe Middle East & Africa (EMEA) increased 4%, due to growth across several major markets including France and Russia, which showed record performance. Latin American box office growth (24%) also centered around major markets, including Mexico and Brazil. Asia Pacific increased 6% based primarily on growth in China. In 2011, Chinese box office grew by 35% in U.S. dollars to $2.0 billion, moving it to the 2nd largest International market behind Japan.

International Box Office by Region All Films (US$ Billions)

Europe, Middle East & Africa $12 $10 $8 $6 $4 $2 $0 2007 2008 2009 2010 2011 % Change 11 vs. 10 4% 6% 24% 7% % Change 11 vs. 07 24% 38% 86% 35% 1.4 1.6 1.7 2.6 Asia Pacific $9.9 7.2 $10.4 8.5 6.5 6.8 Latin America $10.8 9.0

$9.7

$8.7

2.1

2007 Europe, Middle East & Africa Asia Pacific Latin America Total $8.7 $6.5 $1.4 $16.6

2008 $9.7 $6.8 $1.6 $18.1

2009 $9.9 $7.2 $1.7 $18.8

2010 $10.4 $8.5 $2.1 $21.0

2011 $10.8 $9.0 $2.6 $22.4

2011 Top 10 Intl Box Office Markets All Films (US$ Billions)

Source: IHS Screen Digest

Japan China France* U.K. India* Germany Russia Australia South Korea Italy

*Provisional value as

$2.3 $2.0 $2.0 $1.7 $1.4 $1.3 $1.2 $1.1 $1.1 $0.9 of March 2012.

Cinema screens increased by 3% worldwide in 2011, due to double digit increases in Asia Pacific, raising the total to just under 124,000. Digital cinema continues to grow rapidly (up 79%) and over half of the worlds screens are now digital.

2011 Cinema Screens by Format and Region4

Source: IHS Screen Digest

Analog 45,000 40,000 35,000 30,000 25,000 20,000 15,000 10,000 5,000 0 U.S./Canada 14,921 13,695

Digital Non 3-D

Digital 3-D

11,642 8,116

13,774

7,592 5,769

19,977

18,285

2,026 7,873

70

EMEA

Asia Pacific

Latin America

Digital Screens, U.S./Canada and International

Source: IHS Screen Digest

International 70,000

U.S./Canada

62,684

60,000

50,000 40,000 30,000 20,000

8,792 16,382

122% 79%

35,215

35,062

19,579

10,000 0

6,454

8,646

27,469 15,483

(44%) (44%)

4,650

(72%)

3,133 5,659

7,736

(64%) (47%)

2007

42011

2008

2009

2010

2011

total screens figures are forecasts as of February 2012. IHS Screen Digest revised the estimates for China and India significantly downward from 2010 levels, affecting the Asia Pacific and global totals.

Growth in 3D screens in 2011 slowed compared to the explosive growth experienced in 2009 and 2010 , as non-3D digital screens comprised a higher proportion of screens installed in U.S./Canada and Europe. Asia Pacific and Latin America sustained strong growth, raising the digital proportion of total screens to 29% in 2011, up from 19% in 2010.

Worldwide Digital 3D Screens

Source: IHS Screen Digest

2007

2008

2009

2010

2011

% of digital

U.S./Canada

EMEA Asia Pacific Latin America

994

211 80 12

1,514

594 344 84

3,548

3,510 1,584 362

8,505 13,695

8,143 11,642 4,659 1,104 8,116 2,026

50%

61% 58% 97%

Total

% change vs. previous year

1,297

403%

2,536

96%

9,004 22,411 35,479

255% 149% 58%

57%

--

Theatrical Market Statistics 2011

U.S./CANADA

2011 U.S./Canada box office was $10.2 billion, down 4% compared to $10.6 billion in 2010, but up 6% from five years ago. Despite strong second and third quarter box office performance, 2011 box office did not fully overcome the slow start in the first quarter. 3D box office was down $400 million in 2011 compared to 2010, which contained Avatars record-breaking 3D box office performance, while 2D box office was consistent with 2010.

U.S./Canada Box Office (US$ Billions)

Source: Rentrak Corporation Box Office Essentials (Total), MPAA (3D)

3D Box Office $12 $10 $8 $6 $4 $2 $0 2002 2003 2004 2002 $9.1 n/a 2005 2003 $9.2 n/a 2004 $9.3 n/a 2006 2005 $8.8 n/a

Non-3D Box Office $10.6 $9.6 $9.6 $10.6 $10.2

$9.1

$9.2

$9.3

$8.8

$9.2

1% 2007 2006 $9.2 $0.1

1% 2008 2007 $9.6 $0.1

2% 2009 2009 $10.6 $1.1

10%

2010 2010 $10.6 $2.2

21%

18%

U.S./Can. box office (US$B) -3D box office5

2008 $9.6 $0.2

2011 % Chg. 2011 11 vs. 10 $10.2 -4% $1.8 -18%

U.S./Canada movie admissions, or tickets sold, were 1.28 billion in 2011, down 4% against 2010. The national average of tickets sold per person (admissions per capita) decreased to 3.9 in 2011.

U.S./Canada Admissions6

1.80 1.60 1.40 Admissions (Blns) 1.57 5.2 1.52 4.9

Admissions (billions)

1.50 1.38 4.8 4.4 1.40 4.4

Domestic admissions per capita

1.40 4.4 1.42 4.3

6.0 1.34 4.1 1.28 3.9 5.0

1.20

1.00 0.80 0.60 0.40 0.20 0.00 2002

4.2

4.0

3.0 2.0 1.0 0.0

2003

2004 2002

2005 2003 1.52

2006 2004 1.50 2005 1.38

2007 2006 1.40

2008 2007 1.40

2009 2008 1.34 2009 1.42

2010 2010 1.34

2011 % Chg. 2011 11 vs. 10 1.28 -4%

U.S./Can. admissions (blns)

1.57

U.S./Can. admissions per

5 3D

capita7

5.2

4.9

4.8

4.4

4.4

4.4

4.2

4.3

4.1

3.9

-5%

box office figures include only box office earned from 3D showings, not total box office for films with a 3D release. Box Office Essentials calendar year box office data, and National Association of Theatre Owners (NATO) average annual ticket price (see page 5). 7Admissions per capita calculated using aggregated U.S. Census Bureau and Statistics Canada data for population aged 2+.

6Admissions calculated using Rentrak Corporation

Admissions per capita

1.34

Movie theaters continue to draw more people than all theme parks and major U.S. sports combined.

2011 Attendance (millions)8

1,400 1,200 1,000 800 600 400 200 0 Cinemas Theme Parks Sports 350 133 NFL, 17.1 NHL, 20.9 NBA, 21.3 MLB, 73.4

1,285

The average cinema ticket price increased by 4 cents in 2011 (+1%), less than the 3% increase in inflation as measured by the consumer price index (CPI). A movie still provides the most affordable entertainment option, costing under $40 dollars for a family of four.

Average Cinema Ticket Price (US$)

Sources: National Association of Theatre Owners (NATO) (Ticket price), Bureau of Labor Statistics (BLS) (Consumer Price Index)

2002

Average Ticket Price % Change vs. Previous Year CPI % Change vs. Previous Year % Change vs. 2011 $5.81 3% 2% 37%

2003

$6.03 4% 2% 32%

2004

$6.21 3% 3% 28%

2005

$6.41 3% 3% 24%

2006

$6.55 2% 3% 21%

2007

$6.88 5% 3% 15%

2008

$7.18 4% 4% 10%

2009

$7.50 4% 0% 6%

2010

$7.89 5% 2% 1%

2011

$7.93 1% 3% n/a

2011 Average Ticket Price for a Family of Four (US$)8

Sources: NATO, Sports Leagues, International Theme Park Services

$0 NFL NHL Theme Parks NBA MLB Cinemas

$50

$100

$150

$200

$250

$300

$350 $309.44

$228.40 $199.00 $193.92 $107.64 $31.72

NBA and NHL data is for the last complete season.

10

More than two-thirds of the U.S./Canada population aged 2+ (67%) or 221.2 million people went to a movie at the cinema at least once in 2011, comparable to the proportions in prior years. The typical moviegoer bought 5.8 tickets over the course of the year, below the totals in prior years, reflecting the decrease in ticket sales.

2011 Demographic Summary9 U.S./Canada population ages 2+ (328.3M) U.S./Canada admissions

Nonmoviegoers 33%

Moviegoers 67%

U.S./Canada Moviegoers 221.2 million

Annual Tickets per Moviegoer 5.8

Admissions: 2011 tickets sold 1.3 billion

Frequent moviegoers continue to drive the movie industry. They account for only 10% of the population but they bought half of all the movie tickets sold in 2011, comparable to the 2009 and 2010 results for this group.

2011 Moviegoer Share of Population and Tickets Sold U.S./Canada population U.S./Canada ages 2+ tickets sold

Infrequent 10% Occasional 47% Nonmoviegoers 33% Frequent 50% Frequent 10% Infrequent 2% Occasional 48%

Frequency definitions: Frequent=Once a month or more Occasional=Less than once a month Infrequent= Once in 12 months

The proportion of the population in each frequency category and the proportion of the tickets sold by frequency category remained comparable to 2010, indicating that the decrease in ticket sales in 2011 was among moviegoers and relatively consistent across the categories.

MPAAs analysis of attendance demographics is based on survey research and attendance projections by ORC International. See Appendix: Methodology (page 19) for details. Note that surveying is conducted in the U.S. only, so the results assume a similar demographic composition of U.S./Canada combined population as U.S. alone.

11

In 2011, the frequent moviegoers are older than in 2010. In the 25-39 age group, more people went to the movies frequently (9.7 million, compared to 7.7 million in 2010), particularly males. In contrast, younger frequent moviegoers in the 18-24 age group declined by nearly 1 million, particularly females.

Frequent Moviegoers (millions) by Age10

12.0

10.0 8.0 6.0 4.0 2.0 0.0 2-11 12-17 18-24 25-39 40-49 50-59 60+ 2.8 3.1 2.5 5.7 6.1 5.7 6.3 7.4 6.6 6.3 4.5 3.5 3.3 4.3 4.1 7.7 2009 2010 2011 3.4 9.7

2.9 3.0 3.1

2-11

12-17

18-24

25-39

40-49

50-59

60+

% of Population 2011

% of Frequent Moviegoers 2011

14%

7%

8%

16%

10%

19%

21%

28%

14%

9%

14%

9%

19%

12%

In 2011, the ethnic composition of frequent moviegoers looks much the same as in 2010, with Hispanics oversampling as frequent moviegoers relative to their proportion of the population. The spike in Hispanic frequent moviegoers in 2010 may be based on data variability due to sample size rather than reflecting a significant change in movie going.

Frequent Moviegoers (millions) by Ethnicity10

25.0 20.0 15.0 10.2 10.0 6.4 5.0 0.0 African Americans Caucasians Hispanics Other 2.9 3.2 3.5 3.2 2.8 3.5 8.4 19.4 19.0 19.5

2009 2010 2011

African Americans

Caucasians

Hispanics

Others

% of Population: 2011

% of Frequent Moviegoers: 2011

10

12%

10%

65%

56%

16%

24%

7%

10%

Prior years data may differ slightly from previously published data due to calculation methods and the effects of rounding.

12

The gender composition of moviegoers did not change from 2010 to 2011, and is consistent with that in the overall population (51% women to 49% men).

2011 Gender Share of Total Population, Moviegoers and Tickets Sold

Female Population Moviegoers Tickets sold 0% 10% 20% 51% 51% 50% 30% 40% 50% 60% 70% Male 49% 49% 50% 80% 90% 100%

Young people in the 12-24 age group continue to represent 22% of moviegoers and 30% of tickets sold. Overall, the age composition changed only slightly from 2010 to 2011. A slight increase in the oldest age group (60+) indicates that more of these people went to the movies (28.8 million) and bought more tickets (170.2 million) than in 2010, representing a 13% market share of both.

2011 Age Group Share of Total Population, Moviegoers and Tickets Sold

2-11 Population 12-17 14% 8% 18-24 10% 25-39 21% 40-49 14% 14% 50-59 19% 60+

Moviegoers

15%

10%

12%

24%

14%

12%

13%

Tickets sold 0%

11% 10%

13% 20%

17% 30% 40%

24% 50% 60%

12% 70%

10% 80%

13% 90% 100%

Although Caucasians make up the majority of the population and moviegoers (139 million), they represent a smaller share of 2011 ticket sales (58%). Hispanics are more likely than any other ethnic group to go to movies, but purchased fewer tickets in 2011.

2011 Ethnicity Share of Total Population, Moviegoers and Tickets Sold

Caucasian Population Moviegoers Tickets sold Hispanic 65% 63% 58% African American 16% 18% 22% Other 12% 12% 11% 7% 7% 9%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2011 Moviegoers: 221.2 million | 2011 Admissions 1.3 billion

13

In 2011 per capita annual movie attendance dropped to 3.9 overall. Both mens and womens per capita attendance decreased from 2010, and womens attendance remained below its high of 4.8 per capita in 2009.

Per Capita Attendance by Gender

10 8 6 4.0 4 2 0 Male Female 4.2 4.8 2009 4.0

4.0

3.9

2010 2011

In 2011 nearly all age groups went to the movies less frequently than in 2010, with the largest decline among 12-17 year olds. By contrast, attendance increased slightly in the 60+ age group and among the 40-49 year olds.

Per Capita Attendance by Age

10 8 6 4.1 4 2 4.3 3.4 3.0 7.9 7.6 6.2 8.4 7.0 6.8 5.0 4.7 3.9 3.0 3.2 2009 2010

3.0 2.9 2.7

2.4 2.4 2.7

2011

0

2-11 12-17 18-24 25-39 40-49 50-59 60+

Hispanics and ethnicities identified as Other (including Asian Americans) report the highest annual attendance per capita, attending on average 5 times per year, compared to less than 4 times per year for African Americans and Caucasians. All ethnicities report attending less frequently in 2011, with the exception of those identified as Other.

Per Capita Attendance by Ethnicity

10 8 6.0 6 6.8 5.3 5.5 4.2 5.0 2009 2010 2011 2 0 Caucasian African American Hispanic Other

4.0

3.5 3.5

4.0 3.7 3.7

14

Half of all moviegoers and nearly one third of the general population attended a 3D movie in 2011, similar to 2010. Agebased trends continued to reflect broader market trends. Young people in the 12-24 age group were the most likely to attend a 3D movie in 2011, more than 50%. Less than 15% of all people in the 60+ age group attended a 3D movie .

100% 90%

Moviegoers and Population Viewing 3D in 2011 By Age

% Who Attended a 3D movie in 2011 Adults (18+) 30%

80%

70% 60% 50% 40% 30% 20% 10% 0% 2-11 12-17 18-24 25-39 40-49 50-59

Children (2-17)

All

47%

34%

60+

Percent of population who viewed a movie at the cinema

Percent of population who viewed a 3D movie at the cinema

The typical moviegoer over 25 years old attended only one 3D movie in 2011, compared to two on average for moviegoers under 25 years old.

Average 3D Movies Viewed Per Moviegoer in 2011 By Age

2.5 2.1 2.0 1.5 1.0 0.5 0.0 2-11 12-17 18-24 25-39 40-49 50-59 60+ 1.4 2.0

1.3

1.2 0.7

0.6

15

In 2011, the number of films rated by the Classification and Ratings Administration (CARA) was up 7% compared to 2010. The number of films released in theaters in U.S./Canada was up 8% in 2011 (607), but down 8% from the historic high (633) in 2008.

Films Rated by CARA and Films Released in Domestic Theaters

Sources: CARA (Film ratings), Rentrak Corporation (Films released)

1,000 800 600 400 200 0 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Film ratings Films released

Films rated, including non-theatrical films, increased to 758 films in 2011, primarily due to an 11% increase in nonmember films. However, this non-member total is lower than the historic high in 2008 (696). MPAA members films rated have been in decline since 2004, mirroring the decline in MPAA member films released in domestic theaters over the same period (see below).

Film Ratings11

Source: CARA

Film ratings -MPAA members -Non-members

2002 786 296 490

2003 939 339 600

2004 867 325 542

2005 928 322 606

2006 853 296 557

2007 840 233 607

2008 897 201 696

2009 793 177 616

2010 706 174 532

2011 758 169 589

11 vs. 11 vs. 10 02 7% -4% -3% -43% 11% 20%

In 2011, non-MPAA affiliated independents continue to release the most films domestically, at more than three-quarters of all films. Films released by non-MPAA members (+41) accounted for a 7% overall increase over 2010, while the MPAA studios and subsidiaries remained constant (141). While the total number of films released reached 610 in 2011, film attendance by moviegoers remains more concentrated, as 110 films made up 90% of the box office in 2011.

Films Released

Sources: Rentrak Corporation Box Office Essentials (Total), MPAA (Subtotals)

Films released12 - 3D film releases MPAA member total - MPAA studios - MPAA studio subsidiaries Non-members

11

2002 475 0 205 123 82 270

2003 455 2 180 102 78 275

2004 489 2 179 100 79 310

2005 507 6 194 113 81 313

2006 594 8 204 124 80 390

2007 611 6 189 107 82 422

2008 638 8 168 108 60 470

2009 558 20 158 111 47 400

2010 569 26 141 104 37 428

2011 610 45 141 104 37 469

11 vs. 11 vs. 10 02 7% 28% 73% n/a 0% 0% 0% 10% -31% -15% -55% 74%

Note that films may be rated or re-rated months or even years after production. Includes non-theatrical films. Rentrak Corporation Box Office Essentials. Includes all titles that opened in 2011 that earned any domestic box office in the year. Historical data was updated by source.

12 Source:

16

PG-13 films comprised 15 of the top 25 films in release during 2011, more than in 2010 (12). Fewer PG rated films made the list in 2011 (5) than in 2010 (9). 3 of the top 5 and 6 of the top 10 films were released with 3D versions.

Top 25 Films by U.S./Canada Box Office Earned in 2011

Source: Rentrak Corporation Box Office Essentials, CARA (Rating)

Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

Title

Distributor

Box Office (USD MM)

Rating

PG-13 PG-13 PG-13 R PG-13 PG-13 G PG-13 PG-13 PG-13 PG-13 R PG PG-13 PG G PG PG-13 PG-13 PG PG-13 PG-13 R PG-13 PG

3D

Y Y

Harry Potter And The Deathly Hallows, Part 2 Warner Bros. $381.0 Transformers: Dark of The Moon Paramount 352.4 Twilight Saga: Breaking Dawn Part 1** Summit 274.8 The Hangover 2 Warner Bros. 254.5 Pirates of the Caribbean On Stranger Tides Disney 241.1 Fast Five Universal 209.8 Cars 2 Disney 191.5 Thor Paramount 181.0 Rise of the Planet of The Apes 20th Century Fox 176.8 Captain America: The First Avenger Paramount 176.7 The Help Disney 169.5 Bridesmaids Universal 169.1 Kung Fu Panda 2 Paramount 165.2 X-Men: First Class 20th Century Fox 146.4 Puss In Boots Paramount 145.3 Rio 20th Century Fox 143.6 Smurfs, The Sony 142.6 Super 8 Paramount 127.0 Sherlock Holmes: A Game of Shadows** Warner Bros. 124.1 Rango Paramount 123.5 Mission: Impossible Ghost Protocol** Paramount 121.7 The King's Speech* TWC 121.1 Horrible Bosses Warner Bros. 117.5 Green Lantern Warner Bros. 116.6 HOP Universal 108.1 *Film opened in 2010; total reflects box office earned from January 1 December 31, 2011 **Film still in theaters in 2012; total reflects box office earned from January 1 December 31, 2011

Y Y Y Y

Y Y Y Y

The number of MPAA member films beginning production over the past five years is down from 139 in 2007 to 97 in 2011, while among the non-MPAA members, films in production have increased from 650 in 2007 to 720 in 2011. Although large in number, only a small percentage (less than 10%) of the non-member films have reported medium budgets ($20m+) or higher.

Films Produced, for Future Theatrical Release13

2007 MPAA member total Non-members (est. $1m+ budget) 139 360 2008 111 368 2009 121 325 2010 118 372 % Change 201114 11 vs. 10 97 401 -18% 8%

- % with reported $20m+ budget

Non-members (est. <$1m budget) Total films produced

11%

290 789

10%

294 773

10%

305 751

9%

305 795

10%

319 817

-5% 3%

13

These figures reflect full-length feature films which began production in the year, with a U.S. production company (including co-productions), in English language, not including ultra-low budget films (<$200k estimated budget), student films, documentaries, or films created for video release. Budgets are estimated from public information. In the interest of accuracy, MPAA compiles data from a wide range of sources, and continues to update historical data as information becomes available. 17 14 Data for 2011 is provisional as of February 2012, and will be revised as more information becomes available .

In 2011, there were more than 39,600 screens in the U.S. The majority (80%) were located at venues with 8 or more screens.

U.S. Screens by Type of Venue

Source: IHS Screen Digest

2007 1-7 screen venues 8+ screen venues Total 9,804 29,170 38,974

2008 9,091 29,743 38,834

2009 8,673 30,560 39,233

2010 8,345 31,202 39,547

2011 7,878 31,763 39,641

In 2011, the number of digital screens in the U.S. nearly doubled, accounting for 65% of all U.S. screens. The largest growth was in non-3D digital screens. More than 6,100 non-3D digital screens were added in the U.S. in 2011. These screens now account for 33% of all screens, nearly equal to the 35% share for analog screens.

U.S. Screens by Type

Source: IHS Screen Digest

45,000 40,000 35,000 30,000 25,000 20,000 13,001 34,342 33,319 986 3,646 1,427 4,088 3,269 4,149 7,837 6,898 12,620 Digital 3D Digital non-3D Analog 14,020

15,000

10,000 5,000 -

31,815 24,812

2007

2008

2009

2010

2011

18

Theatrical Market Statistics 2011

APPENDIX

19

Attendance Demographics Study Methodology Survey research Motion Picture Association of America, Inc. (MPAA) commissioned ORC International to study motion picture cinema attendance in the United States. A survey was conducted among a national probability sample of 4,018 adults comprising 2,001 men and 2,017 women 18 years of age and older, living in private households in the continental United States. Interviewing was completed beginning January 5, 2012, and ending January 29, 2012 via four consecutive waves of CARAVAN, ORC Internationals weekly national telephone omnibus survey. A dual frame Random Digit Dial (RDD) sample consisting of landline and cell phone numbers was used in 2012. Completed interviews consisted of ~25% conducted via cell phone and 75% conducted via landline. Details about the CARAVAN dual frame sampling and weighting methodology are available upon request to ORC. The margin of error for surveys with samples of around 4,000 respondents, at the 95% confidence level, is plus or minus 2 percentage points. A table showing margin of sampling error for key subgroups is included on the next page. While any change in sampling methodology (such as a move to a dual frame landline and cell phone sample) can potentially raise concerns, this can be overcome by the use of consistent and standardized interviewing procedures and representative weighting. The survey collected data on the frequency of adult motion picture attendance in the prior calendar year (January December 2011) using the following questions: Think back to January 2011about a year ago. During the 12 month period from January through December 2011, about how many times did you go to the movies at theaters? (IF 1 OR MORE): And, of those [INSERT RESPONSE] movies that you saw in theaters, how many did you see in 3D?

Also, where the respondent indicated the presence of a child or children in the household ages 2-17, the respondent was asked to provide estimates of the frequency of each childs motion picture attendance, as well as the childs age and gender. Following were the questions used, which were repeated for each child in order of oldest to youngest: To better understand the make-up of the movie-going audience, we would also like to know about how frequently children 2 and older attended the movies in 2011, including all times they went with guardians or on their own. Now, thinking of your child at least 2 but under 18, how many times did he or she go to the movies at theaters in 2011? (IF 1 OR MORE): And, of those [INSERT RESPONSE] movies, how many did that child see in 3D?

Once the survey was fielded, two data sets were created the original set of adult respondent data and a second set representing the child data. Adult data was weighted by age, gender, region, race and education, using Current Population Survey (CPS) data. The childrens data was also separately weighted by age, gender, region and race. The data sets were combined and the childs data was then weighted to match the proportions to the number of total adult respondents in the US population 2 and older. This is necessary because there can be more than one child in many households. This weighted data set was used to produce the attendance projections.

20

Attendance Demographics Study Methodology continued

Attendance projections The survey process yields a self-reported frequency of motion picture cinema attendance for the total sample and for each demographic group. When this frequency number is used to calculate total attendance in a calendar year, it typically produces a number that exceeds the attendance figure reported by MPAA. This is due to over reporting on the part of the respondents. Therefore, an adjustment factor is calculated for the total sample and for each demographic group. This adjustment factor is derived by dividing the actual attendance number by the attendance number derived from the survey data for each demographic group. The resulting adjustment factor is typically a number slightly less than one. Attendance projections are calculated for each demographic group, using the weighted total number of admissions derived from the survey data, multiplied by the adjustment factor. Table of Sampling Error for Demographic Subgroups Subgroup All adults Children 2-17 Ages 2-11 Ages 12-17 Ages 18-24 Ages 25-39 Ages 40-49 Ages 50-59 Ages 60+ White, non Hispanic Black, non Hispanic Other Hispanic Male Female Margin of Error +/- 2 percentage points +/- 3 percentage points +/- 3 percentage points +/- 4 percentage points +/- 6 percentage points +/- 4 percentage points +/- 4 percentage points +/- 3 percentage points +/- 3 percentage points +/- 2 percentage points +/- 5 percentage points +/- 5 percentage points +/- 6 percentage points +/- 2 percentage points +/- 2 percentage points

21

También podría gustarte

- 2009 Theatrical Market StatisticsDocumento20 páginas2009 Theatrical Market Statisticsintheheat247Aún no hay calificaciones

- Cinema Operator Industry Report May 2014Documento27 páginasCinema Operator Industry Report May 2014Abhishek Kumar Singh100% (1)

- CRS MemoDocumento10 páginasCRS MemoStephen C. WebsterAún no hay calificaciones

- U.S. Theatrical Market: 2005 StatisticsDocumento26 páginasU.S. Theatrical Market: 2005 StatisticsIan Giaroli100% (1)

- Econ Club Extra Credit ProjectDocumento4 páginasEcon Club Extra Credit ProjectSpencer GladdenAún no hay calificaciones

- Estatísticas Music VideosDocumento2 páginasEstatísticas Music VideosRon RbAún no hay calificaciones

- H2Economics 2010 JC PrelimsDocumento230 páginasH2Economics 2010 JC Prelimsragul9650% (2)

- World Sales 2003Documento12 páginasWorld Sales 2003iop8888Aún no hay calificaciones

- Sample M&A Pitch BookDocumento19 páginasSample M&A Pitch BookAmit Rander79% (14)

- Netflix Case AnalysisDocumento13 páginasNetflix Case AnalysisTrishaIntrîgüeAarons100% (2)

- Web Scrapping Cia 3Documento5 páginasWeb Scrapping Cia 3YATEE TRIVEDI 21111660Aún no hay calificaciones

- How Far Can French Films Travel in China? An Empirical Analysis From The Cultural Discount PerspectiveDocumento11 páginasHow Far Can French Films Travel in China? An Empirical Analysis From The Cultural Discount PerspectiveIskandar ZulkarnaenAún no hay calificaciones

- MPA 2021 THEME Report FINALDocumento67 páginasMPA 2021 THEME Report FINALspectorAún no hay calificaciones

- Business in Brazil - An Introduction - : June 1, 2011Documento29 páginasBusiness in Brazil - An Introduction - : June 1, 2011LindgrenAún no hay calificaciones

- State of The Satellite Industry Report May12 - SIADocumento26 páginasState of The Satellite Industry Report May12 - SIAPho Duc NamAún no hay calificaciones

- Live Nation EntertainmentDocumento5 páginasLive Nation EntertainmentJohnAún no hay calificaciones

- 2011 PopCap Social Gaming Research ResultsDocumento76 páginas2011 PopCap Social Gaming Research ResultsLeow Siong MingAún no hay calificaciones

- EconomicsDocumento7 páginasEconomicsDoodz DingleAún no hay calificaciones

- Document 886483241Documento38 páginasDocument 886483241Cirillo Mendes RibeiroAún no hay calificaciones

- A Brief On The Global Market of 3D PC GamesDocumento11 páginasA Brief On The Global Market of 3D PC Gamesapi-3856333Aún no hay calificaciones

- GAMES CCNewzooSpringReport PagesDocumento12 páginasGAMES CCNewzooSpringReport PagesccvvkkAún no hay calificaciones

- Student Example Report NintendoDocumento42 páginasStudent Example Report NintendoErwinsyah Rusli100% (1)

- Phase 1 Report: Strategic Position Analysis: Organisation ProfileDocumento40 páginasPhase 1 Report: Strategic Position Analysis: Organisation ProfileBhupendra SharmaAún no hay calificaciones

- China - Film IndustryDocumento39 páginasChina - Film IndustrySimon Kai T. WongAún no hay calificaciones

- Oksana Troshchiev-Wissal Karoui - Cédric Jeanblanc December 2014Documento34 páginasOksana Troshchiev-Wissal Karoui - Cédric Jeanblanc December 2014ShakilAún no hay calificaciones

- ATKearney Winning in The Business of SportsDocumento12 páginasATKearney Winning in The Business of SportsServitalleAún no hay calificaciones

- Consumer To Business E-Commerce PresentationDocumento59 páginasConsumer To Business E-Commerce PresentationMERYEM LAHBOUBAún no hay calificaciones

- 3D TV Market and Future Forecast Worldwide, (2010 - 2014) : Publisher: Renub Research Published: January, 2011Documento14 páginas3D TV Market and Future Forecast Worldwide, (2010 - 2014) : Publisher: Renub Research Published: January, 2011api-114525849Aún no hay calificaciones

- Thesis Paper - Prof. Erwin GlobioDocumento43 páginasThesis Paper - Prof. Erwin GlobioPROF. ERWIN M. GLOBIO, MSITAún no hay calificaciones

- 01 NetflixDocumento13 páginas01 NetflixMaria ZakirAún no hay calificaciones

- The Skinny 2-18Documento2 páginasThe Skinny 2-18msikes6568Aún no hay calificaciones

- AMC Entertainment Inc.: J.P. Morgan Global High Yield Debt ConferenceDocumento20 páginasAMC Entertainment Inc.: J.P. Morgan Global High Yield Debt ConferenceAntonno HanksAún no hay calificaciones

- SuperData Global Games Market Report May2015Documento14 páginasSuperData Global Games Market Report May2015Anas DamounAún no hay calificaciones

- Jot Toy Company SynopsisDocumento2 páginasJot Toy Company Synopsismelodie03Aún no hay calificaciones

- Stock PickDocumento7 páginasStock PickjeffreyhartantoAún no hay calificaciones

- Residential Economic Issues & Trends ForumDocumento56 páginasResidential Economic Issues & Trends ForumNational Association of REALTORS®Aún no hay calificaciones

- Mobile Gaming: Casual Games Sector ReportDocumento8 páginasMobile Gaming: Casual Games Sector ReportGeoffroy de NanteuilAún no hay calificaciones

- Chinese Government's Role in Commercialisation of The Film IndustryDocumento37 páginasChinese Government's Role in Commercialisation of The Film IndustryDr.Sudhanshu MishraAún no hay calificaciones

- USA Tourism: Trends & StatisticsDocumento44 páginasUSA Tourism: Trends & StatisticsKatarina MišuracAún no hay calificaciones

- Screen Digest D Cinema ReportDocumento8 páginasScreen Digest D Cinema Reportpostamorbidosa100% (1)

- Skyfall AssignmentDocumento20 páginasSkyfall AssignmentJosh PictonAún no hay calificaciones

- Assesment of The Video Game IndustryDocumento15 páginasAssesment of The Video Game IndustryDaud Aron Ahmad100% (1)

- Netflix Strategy Analysis v1.0Documento24 páginasNetflix Strategy Analysis v1.0queradaAún no hay calificaciones

- UNESCO Survey On Feature Film StatisticsDocumento15 páginasUNESCO Survey On Feature Film Statisticsbluehorse99Aún no hay calificaciones

- Sony SWOTDocumento3 páginasSony SWOTziadiub007Aún no hay calificaciones

- DSA Fact Sheet 2010Documento1 páginaDSA Fact Sheet 2010Kevin ThompsonAún no hay calificaciones

- Deloitte Corporate Finance Retail and Consumer Update q4 2011Documento8 páginasDeloitte Corporate Finance Retail and Consumer Update q4 2011KofikoduahAún no hay calificaciones

- 164291xsports April 10Documento8 páginas164291xsports April 10Maria ProstoAún no hay calificaciones

- Economics SonyDocumento7 páginasEconomics Sony19281565Aún no hay calificaciones

- KPCB Internet Trends (2011)Documento66 páginasKPCB Internet Trends (2011)Kleiner Perkins Caufield & Byers80% (5)

- Fact SheetDocumento2 páginasFact SheetHeriberto NorzagarayAún no hay calificaciones

- Games EconomyDocumento3 páginasGames Economyapi-286044489Aún no hay calificaciones

- Scoggins Report - Sep 21 2011 - September ScorecardDocumento6 páginasScoggins Report - Sep 21 2011 - September ScorecardJason ScogginsAún no hay calificaciones

- Marketing Research in Music Retail MarketDocumento16 páginasMarketing Research in Music Retail MarketThao_Cing_1707Aún no hay calificaciones

- 2012 Tokyo Ebig Von RichthofenDocumento19 páginas2012 Tokyo Ebig Von RichthofenShivani NidhiAún no hay calificaciones

- Configuring the World: A Critical Political Economy ApproachDe EverandConfiguring the World: A Critical Political Economy ApproachAún no hay calificaciones

- Sheet (Window), Plate & Float Glass World Summary: Market Sector Values & Financials by CountryDe EverandSheet (Window), Plate & Float Glass World Summary: Market Sector Values & Financials by CountryAún no hay calificaciones

- Transnational Korean Cinema: Cultural Politics, Film Genres, and Digital TechnologiesDe EverandTransnational Korean Cinema: Cultural Politics, Film Genres, and Digital TechnologiesAún no hay calificaciones

- Household Furniture World Summary: Market Values & Financials by CountryDe EverandHousehold Furniture World Summary: Market Values & Financials by CountryAún no hay calificaciones

- Consumer Behaviors That Influence Purchases of Replicate Entertainment ProductsDe EverandConsumer Behaviors That Influence Purchases of Replicate Entertainment ProductsAún no hay calificaciones

- Mobile Phone HolographyDocumento5 páginasMobile Phone HolographyArthawkAún no hay calificaciones

- Mobile Phone HolographyDocumento5 páginasMobile Phone HolographyArthawkAún no hay calificaciones

- Sub Rosa Issue 6Documento47 páginasSub Rosa Issue 6Associazione NewTone100% (2)

- Sub Rosa Issue 6Documento47 páginasSub Rosa Issue 6Associazione NewTone100% (2)

- Blue Apron Final PresentationDocumento28 páginasBlue Apron Final Presentationapi-344187823Aún no hay calificaciones

- What Is Quantitative ResearchDocumento11 páginasWhat Is Quantitative ResearchSarah AndersonAún no hay calificaciones

- Employee Satisfaction: Himaliya Engineering Company Dediyasan, MahesanaDocumento49 páginasEmployee Satisfaction: Himaliya Engineering Company Dediyasan, MahesanamitAún no hay calificaciones

- Handbook On Data Quality Assessment Methods and Tools I PDFDocumento141 páginasHandbook On Data Quality Assessment Methods and Tools I PDFAnang Aris WidodoAún no hay calificaciones

- 1.1 Background of The StudyDocumento9 páginas1.1 Background of The StudyRabi ChaudharyAún no hay calificaciones

- 8604 Important QuestionsDocumento33 páginas8604 Important QuestionsShahzeb JamaliAún no hay calificaciones

- Measuring Service Quality in Higher Education: Hedperf Versus ServperfDocumento17 páginasMeasuring Service Quality in Higher Education: Hedperf Versus ServperfSultan PasolleAún no hay calificaciones

- Understanding Training NeedsDocumento15 páginasUnderstanding Training NeedsManoj Prasanna SinhapuraAún no hay calificaciones

- Role of Research in Business Decision MakingDocumento11 páginasRole of Research in Business Decision Makingsaqiblecturer5563Aún no hay calificaciones

- Erikson Institute Technology and Young Children SurveyDocumento5 páginasErikson Institute Technology and Young Children SurveyNancy Azanasía KarantziaAún no hay calificaciones

- Level of Receptiveness of Single Motorcycle On No Shoe No Drive Policy in OZamiz CityDocumento55 páginasLevel of Receptiveness of Single Motorcycle On No Shoe No Drive Policy in OZamiz CityApril AlagomAún no hay calificaciones

- Symbiosis International University (Siu) PHD Research Proposal For Faculty of ManagementDocumento13 páginasSymbiosis International University (Siu) PHD Research Proposal For Faculty of Managementmahima_sodadasiAún no hay calificaciones

- Ebp PaperDocumento35 páginasEbp Paperapi-654403621Aún no hay calificaciones

- Elements of A Research Proposal and ReportDocumento8 páginasElements of A Research Proposal and Reportapi-19661801Aún no hay calificaciones

- Greenhouse Project Interim ReportDocumento26 páginasGreenhouse Project Interim ReportMuneek ShahAún no hay calificaciones

- Duke Bioelectricity MOOC Fall2012Documento21 páginasDuke Bioelectricity MOOC Fall2012h20pologtAún no hay calificaciones

- RESEARCH TEMPLATE 2023 1 AutoRecoveredDocumento14 páginasRESEARCH TEMPLATE 2023 1 AutoRecoveredMark Lexter A. PinzonAún no hay calificaciones

- DLL4 Math 7 Week 2Documento5 páginasDLL4 Math 7 Week 2Angela Camille PaynanteAún no hay calificaciones

- FINAL CHAPTER 1 5 Real FinalDocumento60 páginasFINAL CHAPTER 1 5 Real Finalchristine dela cruzAún no hay calificaciones

- The Perception and Monitoring of Developmental Activities - A Case Study Among Kattunaika Tribes of Wayanad DistrictDocumento5 páginasThe Perception and Monitoring of Developmental Activities - A Case Study Among Kattunaika Tribes of Wayanad DistrictinventionjournalsAún no hay calificaciones

- Project Feasibility Study On ManufacturingDocumento25 páginasProject Feasibility Study On ManufacturingLEONNY NERVARAún no hay calificaciones

- Marketing Reserach ModuleDocumento86 páginasMarketing Reserach ModuleDan AbaracosoAún no hay calificaciones

- Research Paper in Practical Research 1Documento28 páginasResearch Paper in Practical Research 1Luigi Del MundoAún no hay calificaciones

- NSFAF ProposalDocumento12 páginasNSFAF ProposalMatias Bafana NghiludileAún no hay calificaciones

- Marketing Management: Dettol SoapDocumento5 páginasMarketing Management: Dettol SoapYogesh PandeAún no hay calificaciones

- Smoletz MA BMSDocumento44 páginasSmoletz MA BMSYsthanamhire TolentinoAún no hay calificaciones

- Conducting Marketing Research and Forecasting Demand: Learning ObjectivesDocumento16 páginasConducting Marketing Research and Forecasting Demand: Learning ObjectivesSripada PriyadarshiniAún no hay calificaciones

- TechnicalTermsUsedInResearch FinalDocumento5 páginasTechnicalTermsUsedInResearch FinalJake Angelo Trinidad100% (1)

- Employee Engagement - Project ReportDocumento55 páginasEmployee Engagement - Project Reportvinoth_1758871% (17)

- 2149 1 2128 1 10 20170301Documento15 páginas2149 1 2128 1 10 20170301Mark Lloyd ArgisAún no hay calificaciones