Documentos de Académico

Documentos de Profesional

Documentos de Cultura

9706 s13 QP 11

Cargado por

sharmat1963Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

9706 s13 QP 11

Cargado por

sharmat1963Copyright:

Formatos disponibles

UNIVERSITY OF CAMBRIDGE INTERNATIONAL EXAMINATIONS General Certificate of Education Advanced Subsidiary Level and Advanced Level

ACCOUNTING Paper 1 Multiple Choice

9706/11

May/June 2013 1 hour Multiple Choice Answer Sheet Soft clean eraser Soft pencil (type B or HB is recommended)

Additional Materials:

*7357873699*

READ THESE INSTRUCTIONS FIRST Write in soft pencil. Do not use staples, paper clips, highlighters, glue or correction fluid. Write your name, Centre number and candidate number on the Answer Sheet in the spaces provided unless this has been done for you. DO NOT WRITE ON ANY BARCODES. There are thirty questions on this paper. Answer all questions. For each question there are four possible answers A, B, C and D. Choose the one you consider correct and record your choice in soft pencil on the separate Answer Sheet. Read the instructions on the Answer Sheet very carefully. Each correct answer will score one mark. A mark will not be deducted for a wrong answer. Any rough working should be done in this booklet. Calculators may be used.

This document consists of 10 printed pages and 2 blank pages.

IB13 06_9706_11/FP UCLES 2013

[Turn over

2 1 A trader made four transactions. 1 2 3 4 paid for repairs to manufacturing equipment purchased an item to be used by the business for more than 12 months took goods for resale for his own use transferred his own vehicle to the business

Which items are capital expenditure? A 2 1 and 2 B 2 and 3 C 2 only D 3 and 4

A payment from a credit customer has been credited to cash sales. Which entries correct this error? account to be debited A B C D customer customer sales sales account to be credited bank sales bank customer

A statement of financial position includes a 10% provision for doubtful debts totalling $7800. The income statement shows bad debts written off of $750 and bad debts recovered of $150. What was the original value of trade receivables? A $78 000 B $78 600 C $78 750 D $78 900

A clubs income and expenditure account for 2012 showed rent and rates of $4000. On 31 December 2012 rent owing was $600 and rates paid in advance was $800. What was the amount shown in the receipts and payments account for rent and rates for the year ended 31 December 2012? A $3800 B $4000 C $4200 D $5400

UCLES 2013

9706/11/M/J/13

3 5 At the beginning of the year a business has a provision for doubtful debts of $2600. At the year end the provision is to be 5% of trade receivables. The balance on the sales ledger control account at the year end is $69 200, before writing off a bad debt of $480. The business operates a separate bad debts account. What is the entry in the income statement for the provision for doubtful debts? A 6 $836 credit B $836 debit C $860 credit D $860 debit

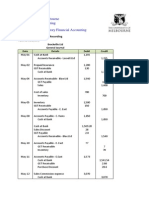

The table below shows how a non-current asset appears in the statement of financial position. $ non-current asset at cost accumulated depreciation net book value The asset is revalued to $136 000. What is the journal entry to record the revaluation? debit $ A B non-current asset at cost income statement non-current asset at cost accumulated depreciation revaluation reserve non-current asset at cost revaluation reserve non-current asset at cost revaluation reserve 16 000 16 000 16 000 18 000 34 000 34 000 34 000 16 000 16 000 credit $ 120 000 (18 000) 102 000

C D

A vehicle was part exchanged for a new vehicle. Which entries record the part exchange? account debited A B C D cash disposal motor vehicles motor vehicles account credited motor vehicles motor vehicles cash disposal

UCLES 2013

9706/11/M/J/13

[Turn over

4 8 Which transaction would increase the current assets of a business? A B C D 9 paying credit suppliers $750 cash purchasing a non-current asset on credit for $5000 purchasing inventory on credit for $1000 and selling immediately for $2000 cash selling inventory of $1000 at cost price on credit

A business has a bank balance of $4800. It pays for materials invoiced at $3000 less trade discount of 30% and cash discount of 10%. A cheque for $450 is received from a customer. What is the bank balance after these transactions? A $2250 B $2460 C $3360 D $3450

10 A sole trader pays private expenses from the business bank account and records them as drawings. Which accounting principle is applied? A B C D business entity going concern matching prudence

11 A draft statement of financial position shows a bank balance of $1400. The following information is now available. $ cheques issued but not yet cleared by the bank bank charges not in the cash book lodgements in the cash book but not on the bank statement Which figure is shown on the bank statement? A $1285 B $1355 C $1425 D $1515 150 45 220

UCLES 2013

9706/11/M/J/13

5 12 A suspense account showed the following. suspense account $ purchases 300 balance b/d Judy 300 The business did not maintain control accounts. Which errors had been made? purchases A B C D purchases journal had been overcast by $300 purchases journal had been overcast by $300 purchases journal had been undercast by $300 purchases journal had been undercast by $300 Judy credit sales of $460 had been entered as $640 in Judys account credit sales of $640 had been entered as $460 in Judys account credit sales of $460 had been entered as $640 in Judys account credit sales of $640 had been entered as $460 in Judys account $ 120 180 300

13 At the start of the year a business had the opening trade payables of $13 000. At the end of the year it owed $15 000 to trade payables. During the year it paid them $190 000, after taking a cash discount of $10 000. What was the amount of the credit purchases for the year? A $188 000 B $192 000 C $198 000 D $202 000

14 Which error must be corrected by a one-sided journal entry? A B C D a cheque entered in the cash book but not posted in a ledger account a contra entry in the sales ledger control account not entered in the purchases ledger control account an error in the total value of sales ledger balances included in the trial balance discount allowed entered in a customers account but not entered in the discount column in the cash book

UCLES 2013

9706/11/M/J/13

[Turn over

6 15 A trader uses his bank statements and paying in books to produce a summary of his receipts and payments for the year. Why does he do this? A B C D in order to calculate his closing inventory in order to prepare a bank reconciliation statement to be able to calculate total sales and total purchases to know the amount of bad debts written off

16 A trader has two departments in his clothes store mens and womens. The following information is available. mens sales staff (number) floor space value of non-current assets annual sales 7 81 m2 $90 000 $247 000 womens 13 99 m2 $135 000 $403 000

The cost of advertising and distribution is $68 100. What is the cost for advertising and distribution for the mens department? A $23 835 B $25 878 C $27 240 D $30 645

17 X and Y are in partnership sharing profits equally. They have capital account balances of $30 000 and $80 000 respectively. Z joins the partnership and pays $10 000 for his share of goodwill. The new profit-sharing ratio is 2 : 2 : 1. What is the balance on Ys capital account after Z joins? A $70 000 B $75 000 C $85 000 D $90 000

18 On which basis should inventory be valued? A B C D historical cost lower of cost and net realisable value lower of cost and replacement cost replacement cost

UCLES 2013

9706/11/M/J/13

7 19 A vehicle cost $12 000 and its estimated residual value was $2000. The vehicle was depreciated at 25% per annum using the straight line method. After three years the vehicle was sold for $3500. What was the profit or loss on disposal? A $500 profit B $1000 loss C $1000 profit D $4500 loss

20 What do the reserves of limited companies include? A B C D debentures ordinary shares preference shares share premium

21 Which stakeholder in a limited company has a voting right? A B C D company accountant debenture holder ordinary shareholder preference shareholder

22 Peter is a sole trader whose business is profitable. He is considering going into partnership with Axel, another sole trader, to improve his liquidity. Which figure from Axels financial statements is of particular interest to Peter? A B C D capital current assets net current assets non-current assets

UCLES 2013

9706/11/M/J/13

[Turn over

8 23 The profit margins of a company over two years showed the following. 31 March year 1 gross profit margin net profit margin 37.2% 12.2% 31 March year 2 39.1% 11.8%

Which combination of factors could have caused these changes? A B C D a change in the combination of goods sold leading to lower selling costs a loss of trade discounts on purchases but an increase in cash discounts taken from suppliers an advertising campaign to promote higher sales leading to higher selling prices an increase in both production and selling costs

24 The following information has been extracted from the statement of financial position of a limited company. $ 6% debenture (2016 2018) ordinary share capital issued 400 000 ordinary shares of $1 each 5% preference shares of $1 each share premium account retained earnings What is the value of the shareholders equity? A $525 000 B $545 000 C $695 000 D $725 000 400 000 200 000 50 000 75 000 20 000

25 A company has the following items on its statement of financial position. $000 ordinary shares 10% preference shares retained earnings 12 000 5 000 7 000

The company had made a profit of $5 000 000 of which $2 000 000 is paid in dividends, including $500 000 paid to preference shareholders. What is the return on capital employed? A 12.5% B 18.75% C 20.83% D 26.32%

UCLES 2013

9706/11/M/J/13

9 26 A business provides the following financial information. $ opening inventory closing inventory cost of sales sales What is the inventory turnover? A 47 days B 54 days C 73 days D 84 days 24 000 32 000 140 000 220 000

27 A business finds that its profit for 2012 is the same whether marginal costing or absorption costing is used. What does this mean? A B C D Inventories have been written down to zero value in the period. Inventories have decreased during the period. Inventories have increased during the period. Inventories have stayed the same during the period.

28 A baker receives one order for 350 loaves of bread. Which costing method will the baker use? A B C D absorption costing batch costing job costing unit costing

UCLES 2013

9706/11/M/J/13

[Turn over

10 29 A company manufactures and sells chairs. The following financial information is available. per unit selling price direct material and labour other variable production costs variable selling costs fixed costs $ 25 12 3 2 4

The company has the option of buying in the chairs for resale instead of making them. At which purchase price would the companys profit be unchanged? A $15 B $17 C $19 D $21

30 Purchases in January 2014 are expected to be $20 000 and to increase by $1000 each month. 20% of purchases are for cash. Credit purchases are paid for in the month following purchase. Which amount will be shown in the cash budget for payments to credit suppliers in March 2014? A $16 800 B $17 600 C $20 200 D $21 200

UCLES 2013

9706/11/M/J/13

11 BLANK PAGE

UCLES 2013

9706/11/M/J/13

12 BLANK PAGE

Permission to reproduce items where third-party owned material protected by copyright is included has been sought and cleared where possible. Every reasonable effort has been made by the publisher (UCLES) to trace copyright holders, but if any items requiring clearance have unwittingly been included, the publisher will be pleased to make amends at the earliest possible opportunity. University of Cambridge International Examinations is part of the Cambridge Assessment Group. Cambridge Assessment is the brand name of University of Cambridge Local Examinations Syndicate (UCLES), which is itself a department of the University of Cambridge.

UCLES 2013

9706/11/M/J/13

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Siridhanya-English - DR Khader ValiDocumento84 páginasSiridhanya-English - DR Khader ValiAnanth Kumar90% (42)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- Vertical Analysis of A Balance SheetDocumento4 páginasVertical Analysis of A Balance SheetMary80% (5)

- Protocols Book English DR Khadar LifestyleDocumento32 páginasProtocols Book English DR Khadar LifestylePraveen Uttekar93% (14)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- DR Khader Vali Lifestyle English Baswaraj Book 2019Documento24 páginasDR Khader Vali Lifestyle English Baswaraj Book 2019Ananth Kumar100% (6)

- 2024 Becker CPA Financial (FAR) NotesDocumento51 páginas2024 Becker CPA Financial (FAR) NotescraigsappletreeAún no hay calificaciones

- How I Handle Conflict WorksheetDocumento1 páginaHow I Handle Conflict Worksheetsharmat1963Aún no hay calificaciones

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Bookkeeping Kit Cheat SheetDocumento4 páginasBookkeeping Kit Cheat SheetAllan AmitAún no hay calificaciones

- Journal Balance Sheet Activity PDFDocumento1 páginaJournal Balance Sheet Activity PDFIrish CanutoAún no hay calificaciones

- Economics Unit ReflectionDocumento1 páginaEconomics Unit Reflectionsharmat1963Aún no hay calificaciones

- Aptitude Test For Staff: - Phone No: 90321 91111, 78423 00012 - Email IDDocumento4 páginasAptitude Test For Staff: - Phone No: 90321 91111, 78423 00012 - Email IDsharmat1963Aún no hay calificaciones

- Gem 2015 2016 Report Print Version Smaller 1481623410Documento154 páginasGem 2015 2016 Report Print Version Smaller 1481623410sharmat1963Aún no hay calificaciones

- Structural BudgetDocumento1 páginaStructural Budgetsharmat1963Aún no hay calificaciones

- Social ProtestDocumento1 páginaSocial Protestsharmat1963Aún no hay calificaciones

- 3.5 FirmsDocumento37 páginas3.5 Firmssharmat1963Aún no hay calificaciones

- 3.5 FirmsDocumento37 páginas3.5 Firmssharmat1963Aún no hay calificaciones

- What Is Industry, Innovation and Infrastructure?Documento1 páginaWhat Is Industry, Innovation and Infrastructure?sharmat1963Aún no hay calificaciones

- Economics Unit ReflectionDocumento1 páginaEconomics Unit Reflectionsharmat1963Aún no hay calificaciones

- Cambridge Economics 0465Documento30 páginasCambridge Economics 0465Oscar E. SánchezAún no hay calificaciones

- Economics Unit ReflectionDocumento1 páginaEconomics Unit Reflectionsharmat1963Aún no hay calificaciones

- Cambridge International AS & A Level: ECONOMICS 9708/22Documento4 páginasCambridge International AS & A Level: ECONOMICS 9708/22sharmat1963Aún no hay calificaciones

- Millet MiracleDocumento44 páginasMillet Miraclebharikrishnan17701100% (1)

- Demon Et IzationDocumento1 páginaDemon Et Izationsharmat1963Aún no hay calificaciones

- Plnats of Ayurvedic ValueDocumento127 páginasPlnats of Ayurvedic Valueadf_raghuAún no hay calificaciones

- ATL-Social Rubric UpdatedDocumento1 páginaATL-Social Rubric Updatedsharmat1963Aún no hay calificaciones

- Is Bjorn Lomborg Right To Say Fossil Fuels Are What Poor Countries Need - Environment - The GuardianDocumento7 páginasIs Bjorn Lomborg Right To Say Fossil Fuels Are What Poor Countries Need - Environment - The Guardiansharmat1963Aún no hay calificaciones

- Scheme of Work: Cambridge IGCSE / Cambridge IGCSE (9 1) Business Studies 0450 / 0986Documento39 páginasScheme of Work: Cambridge IGCSE / Cambridge IGCSE (9 1) Business Studies 0450 / 0986FarrukhsgAún no hay calificaciones

- Weavers Case StudyDocumento2 páginasWeavers Case Studysharmat1963Aún no hay calificaciones

- Question 1, DefineDocumento1 páginaQuestion 1, Definesharmat1963Aún no hay calificaciones

- Card Sort Population ActivityDocumento1 páginaCard Sort Population Activitysharmat1963Aún no hay calificaciones

- Exit TicketDocumento1 páginaExit Ticketsharmat1963Aún no hay calificaciones

- History Class X Chapter 2Documento24 páginasHistory Class X Chapter 2Ashish KumarAún no hay calificaciones

- Case StudiesDocumento1 páginaCase Studiessharmat1963Aún no hay calificaciones

- Relationship BuildingDocumento1 páginaRelationship Buildingsharmat1963Aún no hay calificaciones

- Femh 1 AnDocumento22 páginasFemh 1 AnRakesh Kumar SaranAún no hay calificaciones

- RATIO QuestionsDocumento5 páginasRATIO QuestionsikkaAún no hay calificaciones

- Audit K Sawaal CA Khushboo Sanghvi MamDocumento259 páginasAudit K Sawaal CA Khushboo Sanghvi MamAryan KapoorAún no hay calificaciones

- Revenue Accounting and RecognitionDocumento7 páginasRevenue Accounting and RecognitionjsphdvdAún no hay calificaciones

- CHAPTER 11 - PFRS For SMEsDocumento40 páginasCHAPTER 11 - PFRS For SMEsarlynajero.ckcAún no hay calificaciones

- Chap 006Documento28 páginasChap 006Rafael GarciaAún no hay calificaciones

- IAS 7 CASH FLOW STATEMENTDocumento14 páginasIAS 7 CASH FLOW STATEMENTChota H MpukuAún no hay calificaciones

- Cycle audit reveals sales and receivables risksDocumento42 páginasCycle audit reveals sales and receivables risksBonifasia SeptianaAún no hay calificaciones

- Maquiniana input and output controlsDocumento4 páginasMaquiniana input and output controlsMark Jason MaquinianaAún no hay calificaciones

- BUS 5110 Managerial Accounting-Portfolio Activity Unit 8Documento6 páginasBUS 5110 Managerial Accounting-Portfolio Activity Unit 8LaVida LocaAún no hay calificaciones

- Accounting In Business (Service company) Tổng Quan Về Nguyên Lý Kế Toán Trong Dn Dịch VụDocumento45 páginasAccounting In Business (Service company) Tổng Quan Về Nguyên Lý Kế Toán Trong Dn Dịch VụDung LêAún no hay calificaciones

- Tutorial 4 - Audit of Purchases System Tutorial 4 - Audit of Purchases SystemDocumento11 páginasTutorial 4 - Audit of Purchases System Tutorial 4 - Audit of Purchases SystemheyAún no hay calificaciones

- Ummary of Study Objectives: 312 Internal Control and CashDocumento5 páginasUmmary of Study Objectives: 312 Internal Control and CashchandoraAún no hay calificaciones

- Responsibility Accounting: A Review of Related LiteratureDocumento5 páginasResponsibility Accounting: A Review of Related LiteratureSapto PamungkasAún no hay calificaciones

- Basic Accounting SyllabusDocumento16 páginasBasic Accounting SyllabusMerdzAún no hay calificaciones

- Group Project Act202Documento22 páginasGroup Project Act202Khondoker All Muktaddir Shad 2112328630Aún no hay calificaciones

- 1Q - 2018 - HOKI - Buyung Poetra Sembada TBK PDFDocumento75 páginas1Q - 2018 - HOKI - Buyung Poetra Sembada TBK PDFNat FangAún no hay calificaciones

- Reporting of Fraud, Has Referred To Fraud As Encompassing "An Array of Irregularities and Illegal ActsDocumento6 páginasReporting of Fraud, Has Referred To Fraud As Encompassing "An Array of Irregularities and Illegal ActsNur Syifa NadiaAún no hay calificaciones

- AT20Documento10 páginasAT20audreyAún no hay calificaciones

- General Ledger Debits and Credits Normal Account Balances Journal Entries The Income StatementDocumento15 páginasGeneral Ledger Debits and Credits Normal Account Balances Journal Entries The Income StatementPriyashini RajasegaranAún no hay calificaciones

- Fiji National University course explores financial statement analysisDocumento15 páginasFiji National University course explores financial statement analysisManraj LidharAún no hay calificaciones

- ACTG 360 Midterm Exam ReviewDocumento3 páginasACTG 360 Midterm Exam ReviewSubha ManAún no hay calificaciones

- IFA Week 3 Tutorial Solutions Brockville SolutionsDocumento9 páginasIFA Week 3 Tutorial Solutions Brockville SolutionskajsdkjqwelAún no hay calificaciones

- Akuntansi Keuangan Lanjutan - Akuntansi Penggabungan UsahaDocumento67 páginasAkuntansi Keuangan Lanjutan - Akuntansi Penggabungan UsahachendyAún no hay calificaciones

- Management Syllabus For UPSC Main Examination: Paper-IDocumento4 páginasManagement Syllabus For UPSC Main Examination: Paper-IDeep DaveAún no hay calificaciones

- Fiji Police Force Other Ranks FS 2023Documento15 páginasFiji Police Force Other Ranks FS 2023Augustine SamiAún no hay calificaciones

- Accounting For Single Entry and Incomplete RecordsDocumento18 páginasAccounting For Single Entry and Incomplete RecordsCA Deepak Ehn77% (13)