Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Key Performance Indices

Cargado por

Suryanarayana TataDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Key Performance Indices

Cargado por

Suryanarayana TataCopyright:

Formatos disponibles

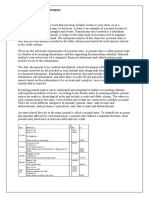

Gross Revenue - Earned

Gross Revenue - Earned

Name Gross Revenue - Earned

Description

Gross revenue - earned is income received for goods and services during a specific period, not considering the amounts of discounts and returned merchandise (in contrary to Net Revenue, which considers these factors). Earned means that the revenues are realized and hence relevant for the income statement.

Interpretation

Gross Revenue earned is the "top line" figure of the income statement from which costs are subtracted to determine net income. It is often simplified to "List Price x Quantity" (the price of a good times the number of goods sold) though it is rarely this simple in actuality. Gross revenue is used to measure company's growth performance. If a company displays solid gross revenue growth, analysts could view the period's performance as positive even if net revenue growth or net income growth is stagnant. Conversely, high income growth would be tainted if a company failed to produce significant gross revenue growth.

Calculation Formula

Absolute Total Value

Unit of Measure

Currency

Direction of Improvement

maximize

Industry Relevance

Generic

Country Relevance

Generic

Gross Revenue - Invoiced

Gross Revenue - Invoiced

Name Gross Revenue - Invoiced

Description

Gross Revenue - Invoiced is the monetary amount of invoiced revenues during a specific period, not considering the amounts of discounts and returned merchandise. Invoiced means that the amount is posted as receivable, whereas earned revenues may not have been realized yet. For companies that do not use revenue recognition method the invoiced and the earned revenues are the same.

Interpretation

Gross Revenue is often simplified to "List Price x Quantity" (the price of a good times the number of goods sold) though it is rarely this simple in actuality. Gross revenue is used to measure company's growth performance. If a company displays solid gross revenue growth, analysts could view the period's performance as positive even if net revenue growth or net income growth is stagnant. Conversely, high income growth would be tainted if a company failed to produce significant gross revenue growth.

Calculation Formula

Absolute Total Value

Unit of Measure

Currency

Direction of Improvement

maximize

Industry Relevance

Country Relevance

Net Income

Net Income

Name Net Income

Description

Net income is a company's total earnings (or profit). Net income is calculated by subtracting costs, expenses and taxes from the total revenue.

Interpretation

Net income is sometimes called the bottom line because it is typically found on the last line of a company's income statement. It is a useful snapshot of how profitable the company is over a period of time. If a company's total expenses exceed its total revenues for a certain period, it can be said to have a net loss. If revenues and expenses should turn out to be equal, the company will have broken even. The change in net income reflects the trend of company's performance. In

general, when a company's net income is negative or is fairly low, this could suggest a myriad of problems, ranging from inadequacies in customer or expenses management to unfavorable accounting methods. Net income varies greatly from company to company and from industry to industry. Generally, comparisons are most meaningful among companies within the same industry. In addition to providing information on its own, net income is also frequently used to calculate other figures in financial ratios in order to provide further information about a company's overall health, for example, earnings per share, return on stockholder's equity. Note: As net income can be changed considerably by various items such as changes in accounting principles, special items and sales of discontinues operations, Earnings before interest and tax is more accuracy indicator when analyzing business operating performance.

Calculation Formula

Absolute Total Value from Income Statement

Unit of Measure

Currency

Direction of improvement

maximize

Industry Relevance

Generic

Country Relevance

Generic

Net Incoming Orders

Net Incoming Orders

Name Net Incoming Orders

Description

Net Incoming Orders is the monetary amount of incoming sales and service orders during a specific period, considering discounts and returned merchandise. It can be used for revenue estimates and forecasting purposes.

Interpretation

Net Incoming Orders is one of key indicators to monitor the sales activities occurring within organization. As discounts and returned are included in net incoming orders, it is more precise than gross incoming order in monitoring sales amount and comparing with net revenue invoiced later. By analyzing the trend of net incoming orders, sales organization can optimize the sales management resource, sales strategy, promotion campaign to achieve superior performance. Stable growth of net incoming orders indicates that company has good sales perspective. It shows that the product is gaining market share. If the net incoming order is steady over a period of time,

this generally means that the product has reached its maturity stage and demand is level.

Calculation Formula

Net Incoming Orders = (Gross Incoming Orders) - (Sales Deductions) + (Merchandise Returned from Credit) + (Allowances for Damaged or Missing Goods) + (Freight Out) + (Cash Discounts)

Unit of Measure

Currency

Direction of Improvement

maximize

Industry Relevance

Generic

Country Relevance

Generic

Net Operating Profit after Tax (NOPAT)

Net Operating Profit after Tax (NOPAT)

Name Net Operating Profit after Tax (NOPAT)

Description

Net Operating Profit After Tax. An estimate of what a company would earn if it didn't have any debt, equal to operating income times (1 minus the tax rate). For companies which use leverage, NOPAT is an alternative measure for measuring operating efficiency. NOPAT is frequently used for calculating Economic Value Added (EVA). Net operating profit after tax (NOPAT) measures the operating profit made for all investors, both shareholders and debt holders. In contrast to EBIT, NOPAT does not take into account the tax savings which a company generates as a result of high debt.

Interpretation

NOPAT is a more accurate look at operating efficiency for leveraged companies. It does not include the tax savings many companies get because they have existing debt. It shows which profit the company would achieve in the event of pure equity financing. The justification for this is that a company creates wealth for shareholders by providing returns that are greater than the cost of capital. Therefore the management should focus on the actual returns to investors. This is the sum of the returns to shareholders and debt holders; the profit generated for shareholders plus the interest paid on debt. This is the same as the operating profit less tax. Hence the term NOPAT. A serious weakness of NOPAT is that it is distorted by the different tax treatment of debt and equity. The returns to debt and equity holders are calculated after tax, but the level of debt affects the level of tax and this is not corrected.

Calculation Formula

Net Operating Profit after Tax = (Operating Profit - Earned) * (1 - (Tax Rate))

Unit of Measure

Currency

Direction of Improvement

maximize

Industry Relevance

Country Relevance

Net Profit Margin

Net Profit Margin

Name Net Profit Margin

Description

This ratio compares Net Income with Net Revenue. It comes as close as possible to summing-up in a single figure how efficiently managers run the business. Also known as Contribution Margin 3.

Interpretation

Measured as Net profit divided by net revenues, often expressed as a percentage. This number is an indication of how effective a company is at cost control. The higher the net profit margin is, the more effective the company is at converting revenue into actual profit. A low-cost company in an industry would generally have a higher net profit margin. Since companies tend to sell the same product at roughly the same price (adjusted for quality differences), lower costs would be reflected in a higher net profit margin. Lower cost companies also have a strategic advantage in a competitive price war, because they have the ability to undercut their competitors by cutting prices in order to gain market share and potentially drive higher cost firms out of business. Companies clearly exist to expand their profits. But while increasing the absolute amount of dollar profit is desirable, it has minimal significance unless it is related to its source. This is why companies use measures such as net profit margin. The net profit margin is a good way of comparing companies in the same industry, since such companies are generally subject to similar business conditions. However, the net profit margins are also a good way to to compare companies in different industries in order to gauge which industries are relatively more profitable.

Calculation Formula

Net Profit Margin = ((Net Income) / (Net Revenue - Earned)) * 100%

Unit of Measure

Direction of Improvement

maximize

Industry Relevance

Country Relevance

Net Revenue - Earned

Net Revenue - Earned

Name Net Revenue - Earned

Description

Net Revenue - earned is a monetary amount of financial revenues during a specific period, considering the amounts of discounts and returned merchandise (in contrary to Gross Revenue, which does not consider these factors). Earned means that the revenues are realized and hence relevant for the income statement.

Interpretation

Net Revenue is a crucial part of any financial analysis. It represents the total finance revenue the company collected for any goods provided and/or services performed after deducting sales return and sales discount. Stable growth of net revenue indicates that company is in goods financial standing. It shows that the product is gaining market share. If the company reports steady net revenue over a period of time, this generally means that the product has reached its maturity stage and demand is level.

Calculation Formula

Net Revenue-Earned = (Gross Revenue - Earned) - ((Sales Deductions) + (Merchandise Returned from Credit) + (Allowances for Damaged or Missing Goods) + (Freight Out) + (Cash Discounts))

Unit of Measure

Currency

Direction of Improvement

maximize

Industry Relevance

Generic

Country Relevance

Generic

Net Revenue - Invoiced

Net Revenue - Invoiced

Name Net Revenue - Invoiced

Description

The monetary amount of invoiced revenues during a specific period, considering the amounts of discounts and returned merchandise. Invoiced means that the amount is posted as receivable, whereas earned revenues may not have been realized yet. For companies that do not use revenue recognition method the invoiced and the earned revenues are the same.

Interpretation

Net Revenue is a crucial part of any financial analysis. It represents the total finance revenue the company collected for any goods provided and/or services performed after deducting sales return and sales discount. Stable growth of net revenue indicates that company is in goods financial standing. It shows that the product is gaining market share. If the company reports steady net revenue over a period of time, this generally means that the product has reached its maturity stage and demand is level.

Calculation Formula

Net Revenue-Invoiced = (Gross Revenue - Invoiced) - ((Sales Deductions) + ( Merchandise Returned from Credit) + (Allowances for Damaged or Missing Goods) + (Freight Out) + (Cash Discounts))

Unit of Measure

Currency

Direction of Improvement

maximize

Industry Relevance

Country Relevance

Net Revenue per Full Time Equivalent (FTE)

Net Revenue per Full Time Equivalent (FTE)

Name Net Revenue per Full Time Equivalent (FTE)

Description

Net Revenue per Full Time Equivalent is calculated as a company's total net revenue --earned divided by the number of its full time equivalent. It shows how much revenue each regular employee generates. This ratio provides information on a company's efficiency within the peer group.

Interpretation

FTE or Full Time Equivalent is a unit of measure of an employee's or group's productivity. An FTE of 1.0 means that the person, or group of people, is equivalent to a full-time worker. A person who works half-time is counted as 0.5 FTE. FTE does not include contractual, temporary, or permanent seasonal positions. An example of group with a full-time billing manager and a clerk who assists him/her for about 10 hours/week has 1.25 FTE employees. (1 full-time + (40 hours/10 hours)) = 1.25 Net Revenue per Full Time Equivalent is basic measure of productivity. It is useful in determining whether a corporation is being run efficiently. This ratio is very industry dependent. Labor intensive businesses generally have low net revenue per FTE. When compared to the other companies within same industry, it instantly gives a relative comparison of operational efficiency. The higher the net revenue per FTE, the more efficient the operation, and therefore the more sustainable and profitable. Another way to look at this is to look at the trend of specific companies. If the revenue per FTE is stable over several years, it can be an indication that the business model is still working well. Annual increase in revenue per FTE reveals the extent of productivity growth. If the revenue per FTE is going down over time, it is an indication that the business is becoming less efficient.

Calculation Formula

Net Revenue per Full Time Equivalent = (Net Revenue - Earned) / (Full Time Equivalent)

Unit of Measure

Currency

Direction of Improvement

maximize

Industry Relevance

Generic

Country Relevance

Generic

Operating Profit - Earned

Operating Profit - Earned

Name Operating Profit - Earned

Description

Operating Profit - Earned resulting from substracting operating expenses from Gross ProfitEarned. It equals to the total operating result before interest, taxes and the financial result in the Income Statement. * * * * Operating Profit excludes income and expenditure from unusual, nonrecurring or discontinued activities. In the US the ratio is also known as EBIT. Note: Operating Profit is retrieved from the contribution margin analysis, while EBIT is from another data source, income statement! Therefore this KPI is listed individually. > See "EBIT"

Interpretation

Operating Profit is one of the most significant indicators of the company's profitability. It represents the profit of a company before interest expenses and income taxes. Operating Profit is more focus on the operating business itself, as it excludes income and expenditure from unusual activities, and also interest income and expense, as well as taxes related to profitability are mostly the result of factors. The figures are often used to gauge the financial performance of companies with high levels of debt and interest expenses. From absolute number perspective, it shows how much profit the company generates in order to be able to pay interest, taxes and dividends. The larger the Operating Profit value, the more profitable the company is likely to be. The growth rate of Operating Profit can be used to evaluate the company's growth. Sequential Operating Profit increase is mostly due to higher sales and better operational performance. Operating Profit decline could be mainly due to reduced revenue or increased manufacturing cost and operation costs. Based on Operating Profit, Operating Profit Margin which is the ratio of Operating Profit to sales can be calculated and used to compare Operating Profit profitability in different time periods for a same company, or compare in different companies. Also See EBIT.

Calculation Formula

Operating Profit-Earned = Total Value Resulting from Substracting Operating Expenses from Gross Profit - Earned

Unit of Measure

Currency

Direction of Improvement

maximize

Industry Relevance

Country Relevance

Operating Profit - Invoiced

Operating Profit - Invoiced

Name Operating Profit - Invoiced

Description

Operating Profit - Invoiced resulting from substracting operating expenses from Gross ProfitInvoiced. * * Operating Profit excludes income and expenditure from unusual, non-recurring or discontinued activities. In the US the ratio is also known as EBIT. Note: Operating Profit is retrieved from the contribution margin analysis, while EBIT is from another data source, income statement! Therefore this KPI is listed individually. > See "EBIT" Invoiced means that Operating Profit is only relevant to goods and services invoiced.

Interpretation

Operating Profit is one of the most significant indicators of the company's profitability. It represents the profit of a company before interest expenses and income taxes. Operating Profit is more focus on the operating business itself, as it excludes income and expenditure from unusual activities, and also interest income and expense, as well as taxes related to profitability are mostly the result of factors. The figures are often used to gauge the financial performance of companies with high levels of debt and interest expenses. From absolute number perspective, it shows how much profit the company generates in order to be able to pay interest, taxes and dividends. The larger the Operating Profit value, the more profitable the company is likely to be. The growth rate of Operating Profit can be used to evaluate the company's growth. Sequential Operating Profit increase is mostly due to higher sales and better operational performance. Operating Profit decline could be mainly due to reduced revenue or increased manufacturing cost and operation costs. Based on Operating Profit, Operating Profit Margin which is the ratio of Operating Profit to sales can be calculated and used to compare Operating Profit profitability in different time periods for a same company, or compare in different companies. Also See EBIT.

Calculation Formula

Operating Profit-Invoiced = Total Value Resulting from Substracting Operating Expenses from Gross Profit - Invoiced

Unit of Measure

Currency

Direction of Improvement

maximize

Industry Relevance

Country Relevance

Operating Profit - Ordered

Operating Profit - Ordered

Name Operating Profit - Ordered

Description

Operating Profit - Ordered resulting from substracting operating expenses from Gross ProfitOrdered. The Operating Profit ordered is used to determine the Operating Profit Margin ordered. The ordered values are useful to calculate Income Statement forecasts.

Interpretation

Operating Profit is one of the most significant indicators of the company's profitability. It represents the profit of a company before interest expenses and income taxes. Operating Profit is more focus on the operating business itself, as it excludes income and expenditure from unusual activities, and also interest income and expense, as well as taxes related to profitability are mostly the result of factors. The figures are often used to gauge the financial performance of companies with high levels of debt and interest expenses. From absolute number perspective, it shows how much profit the company generates in order to be able to pay interest, taxes and dividends. The larger the Operating Profit value, the more profitable the company is likely to be. The growth rate of Operating Profit can be used to evaluate the company's growth. Sequential Operating Profit increase is mostly due to higher sales and better operational performance. Operating Profit decline could be mainly due to reduced revenue or increased manufacturing cost and operation costs. Based on Operating Profit, Operating Profit Margin which is the ratio of Operating Profit to sales can be calculated and used to compare Operating Profit profitability in different time periods for a same company, or compare in different companies. Also See EBIT.

Calculation Formula

Operating Profit-Ordered = Total Value Resulting from Substracting Operating Expenses from Gross Profit - Ordered

Unit of Measure

Currency

Direction of Improvement

maximize minimize range

Industry Relevance

Country Relevance

Operating Profit Margin - Earned

Operating Profit Margin - Earned

Name Operating Profit Margin - Earned

Description

Relation of the Operating Profit Margin to Net Revenue: Shows how efficiently a company's management has been in generating income from the operation of the business. Considers earned values. Also known as Contribution Margin 2.

Interpretation

This indicator gives information on a company's profits ability based on earned values. Increase in Operating Profit Marin is mainly due to growth of net revenue, good cost control and strong productivity, Decrease in Operating Profit Margin largely results from reduction in revenue and higher operating costs. Operating Profit Margin is most useful when compared against other companies in the same industry. The higher Operating Profit Margin reflects the more efficient cost management or the more profitable business. If no positive Operating Profit Margin can be generated over a longer period, then the company should rethink the business model. Note: This margin can be used as relative indicator for international, cross-industry comparisons. Operating Profit Margin margin, however, varies greatly between industries, as factors both net revenue and Operating Profit directly impact on the Operating Profit Margin. E.g. retailers have quite a small Operating Profit Margin as they rely on small margins accompanied with high sales volume. Other industries would have small sales volume but expect to offset that with higher Operating Profit Margin.

Calculation Formula

Operating Profit Margin-Earned= ((Operating Profit-Earned) / ((Net Revenue-Earned)) * 100%

Unit of Measure

Direction of improvement

maximize

Industry Relevance

Country Relevance

Operating Profit Margin - Invoiced

Operating Profit Margin - Invoiced

Name Operating Profit Margin - Invoiced

Description

Relation of the Operating Profit Margin to Net Revenue: Shows how efficiently a company's management has been in generating income from the operation of the business. Only Considers invoiced values.

Interpretation

This indicator gives information on a company's profits ability based on invoiced values. Increase in Operating Profit Marin is mainly due to growth of net revenue, good cost control and strong productivity, Decrease in Operating Profit Margin largely results from reduction in revenue and higher operating costs. Operating Profit Margin is most useful when compared against other companies in the same industry. The higher Operating Profit Margin reflects the more efficient cost management or the more profitable business. If no positive Operating Profit Margin can be generated over a longer period, then the company should rethink the business model. Note: This margin can be used as relative indicator for international, cross-industry comparisons. Operating Profit Margin margin, however, varies greatly between industries, as factors both net revenue and Operating Profit directly impact on the Operating Profit Margin. E.g. retailers have quite a small Operating Profit Margin as they rely on small margins accompanied with high sales volume. Other industries would have small sales volume but expect to offset that with higher Operating Profit Margin.

Calculation Formula

Operating Profit Margin-Invoiced = ((Operating Profit-Invoiced) / (Net Revenue-Invoiced)) * 100%

Unit of Measure

Direction of Improvement

maximize

Industry Relevance

Country Relevance

Operating Profit Margin - Ordered

Operating Profit Margin - Ordered

Name Operating Profit Margin - Ordered

Description

Relation of the Operating Profit Margin to Net Revenue: Shows how efficiently a company's management has been in generating income from the operation of the business. Only Considers ordered values.

Interpretation

This indicator gives information on a company's profits ability based on ordered values. Increase in Operating Profit Marin is mainly due to growth of net revenue, good cost control and strong productivity, Decrease in Operating Profit Margin largely results from reduction in revenue and higher operating costs. Operating Profit Margin is most useful when compared against other companies in the same industry. The higher Operating Profit Margin reflects the more efficient cost management or the more profitable business. If no positive Operating Profit Margin can be generated over a longer period, then the company should rethink the business model. Note: This margin can be used as relative indicator for international, cross-industry comparisons. Operating Profit Margin margin, however, varies greatly between industries, as factors both net revenue and Operating Profit directly impact on the Operating Profit Margin. E.g. retailers have quite a small Operating Profit Margin as they rely on small margins accompanied with high sales volume. Other industries would have small sales volume but expect to offset that with higher Operating Profit Margin.

Calculation Formula

Operating Profit Margin - Ordered = (Operating Profit - Ordered / Net Revenue - Ordered) * 100%

Unit of Measure

Direction of Improvement

maximize

Industry Relevance

Country Relevance

Tools

1. Business KPIs 2. Business KPIs

3. Process

Perfect (Purchase) Order

Skip to end of metadata Page restrictions apply Added by Christine Meyer, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

Name

Perfect (Purchase) Order

Description Calculates the percentage of perfect purchase orders among all purchase orders. The following criteria apply to a perfect order:

right quantitiy damage free arrives on-time arrives at the right location is filled completly on the first call is entered correctly is communicated via a customer-specific medium (e.g. EDI, fax, phone, internet etc) has no invoicing or collection errors.

Interpretation This KPI measures the ability of a vendor to deliver to the customers' wishes. Perfect Order Characteristics: has the right amount of products; is damage free; arrives on-time; arrives at the right location; is filled completly on the first call; in entered correctly; is communicated via a customer-specific medium (e.g. EDI, fax, phone, internet etc); has no invoicing or collection errors.

Calculation Formula Perfect Order Calculation: Order Fill-Rate * Order Shipping Accuracy * Damage free order percentage *On-Time Order Percentage * claim free Order Percentage * Order Entry Accuracy * Order Comm Accuracy * Order Doc Accuracy Example Perfect Order Calculation: has the right amount of products; 97% is damage free; 98% arrives on-time; 93% arrives at the right location; 96% is filled completly on the first call; 72% in entered correctly; 94% is communicated via a custoemr-specific medium (e.g. EDI, fax, phone, internet etc); 89%

has no invoicing or collection errors; 93% =============================== 48%

Unit of Measure

Direction of Improvement

Maximize

Industry Relevance

ALL industries that want to measure their vendor compliance, e.g. Consumer Product (CP) Industry, Process Industry.

Country Relevance

Global

Tools

1. Business KPIs 2. Business KPIs 3. Process

Inventory Days of Supply - Work in Process

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Nov 02, 2011 (view change) show comment Go to start of metadata

Inventory Days of Supply - Work in Process

Name Inventory Days of Supply - Work in Process

Description

Total gross value of inventory at standard cost before reserves for excess and obsolescence. Only includes inventory on company books, future liabilities should not be included. Five point annual average of the sum of all gross inventories of direct and indirect materials, where direct material includes:

raw materials WIP plant FG, field FG, field samples and indirect material consists of: tangible fixed assets low value assets

consumable goods NOTE: For indirect materials IDS-TOTAL only applies as long as they are in stock only, once they are in use they are not "inventory" anymore. They turn into either "consumption" (? from a cost perspective this is likely to be assigned to SGA) or into "tangible fixed assets" (? from a cost perspective this is likely to cause the need for depreciation with the enterprise asset management function typically within financials dept.) This definition is in close alignment with SCOR 7.0. Total gross value of inventory at standard cost before reserves for excess and obsolescence. Only includes inventory on company books, future liabilities should not be included. Five point annual average of the sum of all gross inventories (raw materials & WIP, plant FG, field FG, field samples, other) (COGS 365).

Interpretation

The Inventory-Days-of-Supply allows to estimate for how long a stock level of a certain material will be sufficient to match upcoming requirements - basic assumption is a steady demand function.

Calculation Formula

IDS-wip [BPX:days] = SUMn (IDS_goodn-classified-as-WIP) [BPX:days] where the term of the SUM is derived from: IDS_ goodn-classified-as-WIP [BPX:days] = Stock-Value_ goodn [BPX:$]/Stock-Consumption_goodn [BPX:$/day] and with the sub-terms defined as: Stock-Value_ goodn [BPX:$] = Qty-per-Stock-Segment [BPX:UoM] x Price [BPX:$/UoM] Stock-Consumption_goodn [BPX:$/day] = Qty-per-Stock-Segment [BPX:UoM/day] x Price [BPX:$/UoM] NOTE1: The assignment of material classes to certain stock elements maybe customer specific and needs to be configurable. Details can be derived from Figure 2 and Figure 3. NOTE2: It is assumed that the product master contains:

a flag that indicates, what kind of material class a product belongs to (e.g. raw material, semifinished product, finished good etc.) a suitable price that contains actual data per period, since the stock consumption always requires a period to be specified, the lowest level of granularity will typically be a day (the calculation will always relate to the past, so the fixed data may be assumed, no more shifts will happen.)

Unit of Measure

days

Direction of Improvement

Meet target value

Industry Relevance

ALL industries that incorporate physical goods.

Country Relevance

GLOBAL

Tools

1. Business KPIs 2. Business KPIs 3. Process

Inventory Days of Supply - Raw Material

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Nov 02, 2011 (view change) show comment Go to start of metadata

Inventory Days of Supply - Raw Material

Name Raw Material

Description

Total gross value of inventory at standard cost before reserves for excess and obsolescence. Only includes inventory on company books, future liabilities should not be included. Five point annual average of the sum of all gross inventories of direct and indirect materials, where direct material includes:

raw materials WIP plant FG, field FG, field samples and indirect material consists of: tangible fixed assets low value assets consumable goods NOTE: For indirect materials IDS-TOTAL only applies as long as they are in stock only, once they are in use they are not "inventory" anymore. They turn into either "consumption" (? from a cost perspective this is likely to be assigned to SGA) or into "tangible fixed assets" (? from a cost

perspective this is likely to cause the need for depreciation with the enterprise asset management function typically within financials dept.) This definition is in close alignment with SCOR 7.0.[BPX: ]

Interpretation

The Inventory-Days-of-Supply allows to estimate for how long a stock level of a certain material will be sufficient to match upcoming requirements - basic assumption is a steady demand function.

Calculation Formula

IDS-raw [BPX:days] = SUMn (IDS_goodn-classified-as-RAW) [BPX:days] where the term of the SUM is derived from: IDS_ goodn-classified-as-RAW [BPX:days] = Stock-Value_ goodn [BPX:$] / Stock-Consumption_goodn [BPX:$/day] and with the sub-terms defined as: Stock-Value_ goodn [BPX:$] = Qty-per-Stock-Segment [BPX:UoM] x Price [BPX:$/UoM] Stock-Consumption_goodn [BPX:$/day] = Qty-per-Stock-Segment [BPX:UoM/day] x Price [BPX:$/UoM] NOTE1: The assignment of material classes to certain stock elements maybe customer s\pecific and needs to be configurable. Details can be derived from Figure 2 and Figure 3. NOTE2: It is assumed that the product master contains:

a flag that indicates, what kind of material class a product belongs to (e.g. raw material, semifinished product, finished good etc.) a suitable price that contains actual data per period, since the stock consumption always requires a period to be specified, the lowest level of granularity will typically be a day (the calculation will always relate to the past, so the fixed data may be assumed, no more shifts will happen.)

Unit of Measure

days

Direction of Improvement

meet target value

Industry Relevance

ALL industries that incorporate physical goods.

Country Relevance

GLOBAL

bpx_business_kpis

bpx_process_kpis

Tools

1. Business KPIs 2. Business KPIs 3. Process

Number of Contracts

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

Number of Contracts

Name Number of Contracts

Description

This KPI is defined as the number of maintained purchasing contracts in the system. Only valid and released contracts are counted.

Interpretation

Often the purchasing department wants to control the maximum of purchasing spend. Negotiating prices and conditions with the supplier and maintaining them in purchasing contracts is the best way to reach this objective, because then these prices and conditions are available as sources of supply and can be used for operational purchasing.

Calculation Formula

Number of Contracts = Number of Valid and Released Contracts Maintained in the System

Unit of Measure

number

Direction of Improvement

maximize

Industry Relevance

generic

Country Relevance

generic

1. Business KPIs

2. Business KPIs 3. Process

Ratio of Purchase Order Items with Product IDS

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

Ratio of Purchase Order Items with Product IDS

Name Ratio of Purchase Order Items with Product IDs

Description

This KPI is defined as the ratio between the number of purchase order items with reference to a product ID to the total number of purchase order items. Only sent purchase orders are taken into account.

Interpretation

With this number the buyers get to know if there are many purchase order items with no reference to a product ID. Very often these purchase orders will have then a free text entry. If the ratio is low, it is a hint to maintain product master in purchasing, if the purchasing activities shall be controllable and effective.

Calculation Formula

Ratio of Purchase Order Items with Product IDs = ((Number of sent purchase order items with a reference to a product ID) / (Total number of sent purchase order items)) * 100%

Unit of Measure

Direction of Improvement

maximize

Industry Relevance

generic

Country Relevance

generic

1. Business KPIs 2. Business KPIs 3. Process

Price Trend

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

Price Trend

Name Price Trend

Description

The Price Trend compares the price of two different time intervals. The time interval can be year or month. The Price Trend is calculated per product, but can be aggregated on product category, supplier, country of supplier or on any organizational level.

Interpretation

This KPI displays price changes on different levels and can be used to counter steer certain price development in the market.

Calculation Formula

Price Trend = (((Average Purchase Order Price of Current Period) - (Average Purchase Order Price of a Previous Period)) / (Average Purchase Order Price of Previous Period)) * 100%

Unit of Measure

Direction of Improvement

minimize

Industry Relevance

Generic

Country Relevance

Generic

1. Business KPIs 2. Business KPIs 3. Process

Supplier Evaluation Score

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

Supplier Evaluation Score

Name Supplier Evaluation Score

Description

The Supplier Evaluation Score is the aggregated result of the manual and automatic evaluation for a supplier. It is an outcome of the supplier evaluation.

Interpretation

This KPI gives an overview how the suppliers perform.

Calculation Formula

The calculation of the score is maintained by the user by defining relevant main criteria, criteria and weighting factors between them.

Unit of Measure

Direction of Improvement

maximize

Industry Relevance

Generic

Country Relevance

Generic

Tools

1. Business KPIs 2. Business KPIs 3. Process

Supplier-On Time Delivery Performance

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

Supplier-On Time Delivery Performance

Name Supplier-On Time Delivery Performance

Description

The KPI Supplier-On Time Delivery Performance is the comparison of the required delivery date in the purchase order to the actual goods receipt entry date per supplier. For the calculation of the Supplier-On Time Delivery Performance the delivery tolerances are respected.

Interpretation

This KPI gives an overview how many deliveries were in time and how many arrived not in time. This KPI is an important KPI to derive the supplier's performance. 1. Is the actual delivery date in the goods receipt equal to the required delivery date in the purchase order/purchase order acknowledgement or in the defined tolerance for the delivery, the document gets evaluated with a one. 2. Is the actual delivery date in the goods receipt not equal to the required delivery date in the purchase order/purchase order acknowledgement and not in the defined tolerance for the delivery, the document gets evaluated with a zero. Supplier-On Time Delivery Performance = ((Number of purchase order items evaluated with one) / (Total number of purchase order items per supplier)) * 100%

Calculation Formula

Unit of Measure

Direction of Improvement

maximize

Industry Relevance

generic

Country Relevance

generic

Tools

1. Business KPIs 2. Business KPIs 3. Process

First Call Resolution Rate

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

First Call Resolution Rate

Name First Call Resolution Rate

Description

Shows the percentage of Service Order Items with only one related Service Confirmation Item.

Interpretation

It is essential to track the effectiveness of the Field Organization. If it is taking more than one call to complete a customer issue, it means that a process is broken somewhere (either in the logistics process, or in the training/knowledge of the Field force).

Calculation Formula

First Call Resolution Rate = (Number of Service Order Items with only one Related Service Confirmation Item) / (Total Number of Service Order Items)

Unit of Measure

Direction of Improvement

Usually Maximize

Industry Relevance

Country Relevance

start of metadata

Sales Quantity - Earned

Name Sales Quantity - Earned

Description

Sales Quantity - Earned is quantity of goods sold in a specified period. Earned means that the sales quantity is matched with realized revenue in same period.

Interpretation

By showing overall changes in sales quantity, sales, product, marketing and finance managers can see at-a glance which region sales organization, product and customer group, etc. require attention. The analyses of sales quantity answer common business questions as below, - Which products have the greatest sales quantity and the least sales quantity? - What other products are selling at the same time to the top sales customer? - Which products have declining sales momentum? - How have sales quantities of product X changed period over period? - What is the annual sales trend of each product? - How do promotion activities effort in sales quantities? In general speaking, increase in sales quantity results in sales revenue if sales price and market requirement remain fairly constant over a period. In reality, however, actual results may be constrained by various factors, such as promotion campaign, competitors' sales strategy, change of economics environment etc.

Calculation Formula

Quantity

Unit of Measure

UoM defined in MDM

Direction of Improvement

maximize

Industry Relevance

Generic

Country Relevance

Generic

Tools

1. Business KPIs 2. Business KPIs 3. Process

Sales Quantity - Invoiced

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

Sales Quantity - Invoiced

Name Sales Quantity - Invoiced

Description

Sales Quantity - Invoiced is quantity of goods sold in a specified period. Invoiced means that the sales quantity is matched with invoiced revenue in same period.

Interpretation

By showing overall changes in sales quantity, sales, product, marketing and finance managers can see at-a glance which region sales organization, product and customer group, etc. require attention. The analyses of sales quantity answer common business questions as below, - Which products have the greatest sales quantity and the least sales quantity? - What other products are selling at the same time to the top sales customer? - Which products have declining sales momentum? - How have sales quantities of product X changed period over period? - What is the annual sales trend of each product? - How do promotion activities effort in sales quantities? In general speaking, increase in sales quantity results in sales revenue if sales price and market requirement remain fairly constant over a period. In reality, however, actual results may be constrained by various factors, such as promotion campaign, competitors' sales strategy, change of economics environment etc.

Calculation Formula

Quantity

Unit of Measure

UoM defined in MDM

Direction of Improvement

maximize

Industry Relevance

Country Relevance

Tools

1. Business KPIs 2. Business KPIs 3. Process

Sales Quantity - Ordered

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

Sales Quantity - Ordered

Name Sales Quantity - Ordered

Description

Sales Quantity - Ordered is the sales quantity reflected in the incoming orders.

Interpretation

By showing overall changes in sales quantity, sales, product, marketing and finance managers can see at-a glance which region sales organization, product and customer group, etc. require attention. The analyses of sales quantity answer common business questions as below, - Which products have the greatest sales quantity and the least sales quantity? - What other products are selling at the same time to the top sales customer? - Which products have declining sales momentum? - How have sales quantities of product X changed period over period? - What is the annual sales trend of each product? - How do promotion activities effort in sales quantities? In general speaking, increase in sales quantity results in sales revenue if sales price and market requirement remain fairly constant over a period. In reality, however, actual results may be constrained by various factors, such as promotion campaign, competitors' sales strategy, change of economics environment etc.

Calculation Formula

Quantity

Unit of Measure

UoM defined in MDM

Direction of Improvement

maximize

Industry Relevance

Generic

Country Relevance

Generic

Tools

1. Business KPIs 2. Business KPIs 3. Process

Discounts as % of Gross Revenue - Earned

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

Discounts as % of Gross Revenue - Earned

Name Discounts as % of Gross Revenue - Earned

Description

This indicator shows the ratio of total discounts to total Gross Revenue-Earned for a given period.

Interpretation

Generally, the offering of discounts to customers is a form of price competition. Higher discounts may result in increase in demand, especially for those customers who are price sensitive. Discounts, on the other hand, sometimes are very damaging to profits because discounts affect net income directly. It is possible to have good sales volume and productivity and still lose money. By analyzing discounts as % of gross revenue, sales, product, marketing managers can promote more effectively and discount more judiciously. Discounts as % of Gross Revenue reveals the extent of discounting based on gross revenue and displays trends and responses to special promotions. Increase in Discounts as % of Gross Revenue results in net revenue decreases, provided list prices remain and discounts can not be offset by additional sales.

Calculation Formula

Discounts as % of Gross Revenue-Earned = ((Discounts) / (Gross Revenue - Earned)) * 100%

Unit of Measure

Direction of Improvement

range

Industry Relevance

Generic

Country Relevance

Generic

Tools

1. Business KPIs 2. Business KPIs 3. Process

Inventory Days of Supply - Direct Materials (IDS-DIR)

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Nov 02, 2011 (view change) show comment Go to start of metadata

Inventory Days of Supply - Direct Materials (IDS-DIR)

Name Inventory Days of Supply - Direct Materials (IDS-DIR)

Description

Total gross value of inventory at standard cost before reserves for excess and obsolescence. Only includes inventory on company books, future liabilities should not be included. Five point annual average of the sum of all gross inventories of direct and indirect materials, where direct material includes: - raw materials - WIP - plant FG, field FG, field samples and indirect material consists of: * tangible fixed assets * low value assets * consumable goods NOTE: For indirect materials IDS-TOTAL only applies as long as they are in stock only, once they are in use they are not "inventory" anymore. They turn into either "consumption" (from a cost perspective this is likely to be assigned to SGA) or into "tangible fixed assets" (from a cost perspective this is likely to cause the need for depreciation with the enterprise asset management function typically within financials dept.) This definition is in close alignment with SCOR 7.0 (see URL of the SupplyChain Council www.supply-chain.org).

Interpretation

The Inventory-Days-of-Supply allows to estimate for how long a stock level of a certain material will be sufficient to match upcoming requirements - basic assumption is a steady demand function.

Calculation Formula

Inventory Days of Supply-Total = (Inventory Days of Supply - Raw Material) + (Inventory Days of Supply - Work in Process) + (Inventory Days of Supply - Finished Goods) where the individual terms represent: IDS-raw equals the valued sum of all goods assigned to "Raw Material". IDS-wip equals the valued sum of all goods assigned to "Work-in-Process". IDS-fgd equals the valued sum of all goods assigned to "Finished Goods".

Unit of Measure

days

Direction

Minimize

Industry relevance

ALL industries that incorporate physical goods.

*Country *

GLOBAL

[# ftnref1|BPX:1] Total gross value of inventory at standard cost before reserves for excess and obsolescence. Only includes inventory on company books, future liabilities should not be included. Five point annual average of the sum of all gross inventories (raw materials and WIP, plant FG, field FG, field samples, other) (COGS 365).

Tools

1. Business KPIs 2. Business KPIs 3. Process

Opportunity Success Rate

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

Opportunity Success Rate

Name

Opportunity Success Rate

Description

Number of Won Opportunities as % of the total closed Opportunities

Interpretation

Providing information about won and lost opportunities the KPI helps the user to assess the sales performance. This is much more valuable if you are able to compare it over a period whereby you can find the trends in your sales performance. If calculated with respect to sales people, you can set a benchmark for the entire team and any deviance needs to be studied.

Calculation Formula

Opportunity Success Rate = (((Number of Opportunities-Status Won) / ((Number of OpportunitiesStatus Won) + (Lost))) * 100%

Unit of Measure

Direction of Improvement

Usually: Maximize

Industry Relevance

Opportunity Management only in industries with long pre-sales cycles.

Country Relevance

Tools

1. Business KPIs 2. Business KPIs 3. Process

Value of Obsolete Stock

Skip to end of metadata Page restrictions apply Added by Davide Cavallari, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

Value of Obsolete Stock

Name Value of Obsolete Stock

Description

The value of obsolete stock is evaluated in a specific period of time, as the difference between the

value of valuated stock at the end of the chosen period, and the issue value of valuated stock during that period. If the issue value of valuated stock is greater than the value of valuated stock, the value of obsolete stock is zero.

Interpretation

The value of obsolete stock measures the excess of inventory. It can be evaluated for a specific material, for a warehouse or for a plant. On the one hand, obsolete materials take up valuable warehouse space, therefore should be scrapped or moved. On the other, cash sitting in inventory can be freed up. The evaluation period for the value of obsolete stock should be comparable with the frequency of supply. Example. A material is supplied weekly. The value of obsolete stock is calculated as the difference between the stock value and the issue value in a week. If we assume the issue value, supply frequency and supply amount are to remain constant, we can predict that a fraction of the available stock will never be used. The value of this fraction is the value of obsolete stock.

Calculation Formula

If Value of Valuated Stock(T2) > Issue Value of Valuated Stock(T1, T2), Value of Obsolete Stock(T1, T2) = Value of Valuated Stock(T2) - Issue Value of Valuated Stock(T1, T2); otherwise, Value of Obsolete Stock(T1, T2) = 0. T1 and T2 are two points in time, where T2 > T1.

Unit of Measure

company currency

Direction of Improvement

minimize

Industry Relevance

generic

Country Relevance

generic

Tools

1. Business KPIs 2. Business KPIs 3. Process

Vendors Fill Rate or Supplier performance

Skip to end of metadata Page restrictions apply Added by MURALIDHARA H.N, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

Name

Vendors Fill Rate or Supplier performance

Description

In Retail Industry, vendor evaluation will not play major role. Therefore, we have to create Fill rate based on ordered verses received Quantity.

Interpretation

This KPI gives a hint how often the merchandising / purchasing department can fulfill users requirements. The value of this KPI is dependent on the purchasing DC's performance and/or from the quantity of reliability of `company's suppliers.

Calculation Formula Vendor Fill Rate = (Supplied Quantity / Ordered Quantity) x 100% This development can be handled through ABAP / BW with following Logic:* Article Number is available at the Table EKPO as a field MATNR

Ordered = How much Purchase qty ordered for that Vendor, available at the EKPO table as field MENGE, Current Month (Current month is Purchasing Document Date as a field in the EKKO BEDAT)

Supplied = Against that Ordered qty how much Purchase qty been supplied by Vendor, available at the MSEG table as field MENGE Current Month Formula = Supplied/ Ordered*100

Unit of Measure

Direction of Improvement

maximize

Generic but more specific Retail Industry Relevance

Country Relevance

Generic but very common in India

Tools

1. Business KPIs 2. Business KPIs 3. Process

Average Lead Time of Service Requests

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

Average Lead Time of Service Requests

Name Average Lead Time of Service Requests

Description

Lead time is calculated as the time between creation of a Service Request and the setting of the request status to Closed. It is displayed in hours. Division by Number of Service Requests gives the Average Lead Time of Service Requests.

Interpretation

Shows the average time required to complete Service Requests within the user's service organization. It gives an indication of the efficiency of the internal processes, and is an important factor that can influence customer satisfaction.

Calculation Formula

Average Lead Time of Service Requests = (Lead Time of Service Requests) / (Number of Service Requests) Lead Time of Service Requests = Time between Creation of a Service Request and the Setting of the Request Status to Closed-in Hours

Unit of Measure

Hours

Direction of Improvement

Usually Minimize

Industry Relevance

Country Relevance

Tools

1. Business KPIs 2. Business KPIs 3. Process

Quote Success Rate

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

Quote Success Rate

Name Quote Success Rate

Description

Order value of the quote items that have actually been converted to sales order items compared to their original quote value.

Interpretation

The Quote Success Rate can be used to analyze the quote value that is actually sold to the customer. This in turn helps the user to monitor which products or services are popular and to spot areas where action is required.

Calculation Formula

Quote Success Rate = (Referred Value) / (Net Value of Accepted Quote Items)

Unit of Measure

Direction of Improvement

Usually: Maximize

Industry Relevance

Country Rekevance

Tools

1. Business KPIs 2. Business KPIs 3. Process

Average Call Closure Time

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Oct 31, 2011 (view change) show comment Go to start of metadata

Average Call Closure Time

Name

Average Call Closure Time

Description

Call Closure Time time is calculated as the time between creation of a Service Order and the setting of the order status to Completed. It is displayed in hours. Division by the Number of Service Orders gives the Average Call Closure Time.

Interpretation

The Average Call Closure Time gives an indication of the efficiency of the internal processes, and is an important factor that can influence customer satisfaction.

Calculation Formula

Average Call Closure Time = (Call Closure Time) / (Number of Service Orders) Call Closure Time = Time between Creation of a Service Order and the Setting of the Order Status to Completed-in Hours

Unit of Measure

Hours

Direction of Improvement

Usually Minimize

Industry Relevance

Country Relevance

1. Business KPIs 2. Business KPIs 3. Process

Inventory Days of Supply - Finished Goods

Skip to end of metadata Page restrictions apply Added by Florian Stapf, last edited by Alon Mizrahi on Nov 02, 2011 (view change) show comment Go to start of metadata

Inventory Days of Supply - Finished Goods

Name Inventory Days of Supply - Finished Goods

Description

Total gross value of inventory at standard cost before reserves for excess and obsolescence. Only includes inventory on company books, future liabilities should not be included. Five point annual average of the sum of all gross inventories of direct and indirect materials, where direct material includes:

raw materials WIP plant FG, field FG, field samples and indirect material consists of: tangible fixed assets low value assets consumable goods NOTE: For indirect materials IDS-TOTAL only applies as long as they are in stock only, once they are in use they are not "inventory" anymore. They turn into either "consumption" (? from a cost perspective this is likely to be assigned to SGA) or into "tangible fixed assets" (? from a cost perspective this is likely to cause the need for depreciation with the enterprise asset management function typically within financials dept.) This definition is in close alignment with SCOR 7.0. Total gross value of inventory at standard cost before reserves for excess and obsolescence. Only includes inventory on company books, future liabilities should not be included. Five point annual average of the sum of all gross inventories (raw materials & WIP, plant FG, field FG, field samples, other) (COGS 365).

Interpretation

The Inventory-Days-of-Supply allows to estimate for how long a stock level of a certain material will be sufficient to match upcoming requirements - basic assumption is a steady demand function.

Calculation Formula

IDS-fgd [BPX:days] = SUMn (IDS_goodn-classified-as-FGD) / n [BPX:days] where n is the no. of materials summed up and the term of the SUM is derived from: IDS_ goodn-classified-as-FGD [BPX:days] = Stock-Value_ goodn [BPX:$] / Stock-Consumption_goodn [BPX:$/day] and with the sub-terms defined as: Stock-Value_ goodn [BPX:$] = Qty-per-Stock-Segment [BPX:UoM] x Price [BPX:$/UoM] Stock-Consumption_goodn [BPX:$/day] = Qty-per-Stock-Segment [BPX:UoM/day] x Price [BPX:$/UoM] NOTE1: The assignment of material classes to certain stock elements maybe customer specific and needs to be configurable. Details can be derived from Figure 2 and Figure 3. NOTE2:

It is assumed that the product master contains:

a flag that indicates, what kind of material class a product belongs to (e.g. raw material, semifinished product, finished good etc.) a suitable price that contains actual data per period, since the stock consumption always requires a period to be specified, the lowest level of granularity will typically be a day (the calculation will always relate to the past, so the fixed data may be assumed, no more shifts will happen.)

Unit of Measure

days

Direction of Improvement

Meet target value

Industry Relevance

ALL industries that incorporate physical goods.

Country Relevance

GLOBAL

También podría gustarte

- Understanding Financial Statements (Review and Analysis of Straub's Book)De EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Calificación: 5 de 5 estrellas5/5 (5)

- Sample Operational Financial Analysis ReportDocumento13 páginasSample Operational Financial Analysis Reportshivkumara27Aún no hay calificaciones

- New GL Doc SplittingDocumento56 páginasNew GL Doc SplittingSam Kol100% (2)

- Income StatementDocumento3 páginasIncome StatementMamta LallAún no hay calificaciones

- Financial Ratio & LeverageDocumento25 páginasFinancial Ratio & Leverageankushrasam700Aún no hay calificaciones

- Track Product Design Changes with SAP Engineering Change ManagementDocumento14 páginasTrack Product Design Changes with SAP Engineering Change ManagementSuryanarayana TataAún no hay calificaciones

- COGM in SAPDocumento19 páginasCOGM in SAPSuryanarayana Tata85% (13)

- 8d Training 9-8-2008-Root Cause AnalysisDocumento78 páginas8d Training 9-8-2008-Root Cause AnalysisShashindra Dhopeshwar100% (1)

- Ratio Analysis - A2-Level-Level-Revision, Business-Studies, Accounting-Finance-Marketing, Ratio-Analysis - Revision WorldDocumento5 páginasRatio Analysis - A2-Level-Level-Revision, Business-Studies, Accounting-Finance-Marketing, Ratio-Analysis - Revision WorldFarzan SajwaniAún no hay calificaciones

- Financial Analysis FundamentalsDocumento12 páginasFinancial Analysis FundamentalsAni Dwi Rahmanti RAún no hay calificaciones

- Lecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetDocumento36 páginasLecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetRahul GautamAún no hay calificaciones

- Profit Margin PDFDocumento2 páginasProfit Margin PDFbungaAún no hay calificaciones

- Turtle Trader Practical SummaryDocumento7 páginasTurtle Trader Practical SummaryGrant Muddle67% (6)

- ERP For Printing and PackagingDocumento8 páginasERP For Printing and PackagingSuryanarayana TataAún no hay calificaciones

- About AFSDocumento119 páginasAbout AFSSuryanarayana TataAún no hay calificaciones

- Understanding The Income StatementDocumento4 páginasUnderstanding The Income Statementluvujaya100% (1)

- Pricing Decisions - MCQsDocumento26 páginasPricing Decisions - MCQsMaxwell;Aún no hay calificaciones

- T04 - Long-Term Construction-Type ContractsDocumento11 páginasT04 - Long-Term Construction-Type Contractsjunlab0807Aún no hay calificaciones

- SAP Security Audit Checks Technical & Process ControlsDocumento5 páginasSAP Security Audit Checks Technical & Process ControlsSuryanarayana TataAún no hay calificaciones

- SAP Planning & Scheduling Workshop AgendaDocumento196 páginasSAP Planning & Scheduling Workshop Agendachecho_mza100% (2)

- RatiosDocumento1 páginaRatiosSanthosh MathewAún no hay calificaciones

- Terms of Share MarketDocumento6 páginasTerms of Share Marketsearchanirban6474Aún no hay calificaciones

- Gross ProfitDocumento3 páginasGross ProfitRafeh2Aún no hay calificaciones

- Interpretation On RatiosDocumento3 páginasInterpretation On RatiosLorraine CalderonAún no hay calificaciones

- Clo-3 Assignment: Chemical Engineering Economics 2016-CH-454Documento9 páginasClo-3 Assignment: Chemical Engineering Economics 2016-CH-454ali ayanAún no hay calificaciones

- Financial Management Report (Group2 Delarosa, Peliyo)Documento6 páginasFinancial Management Report (Group2 Delarosa, Peliyo)ice chaserAún no hay calificaciones

- Net Block DefinitionsDocumento16 páginasNet Block DefinitionsSabyasachi MohapatraAún no hay calificaciones

- PAT and EBITDADocumento2 páginasPAT and EBITDATravel DiaryAún no hay calificaciones

- Cost of Goods Sold and Operating ExpensesDocumento4 páginasCost of Goods Sold and Operating ExpensesAna Mae CatubesAún no hay calificaciones

- ROEDocumento7 páginasROEfrancis willie m.ferangco100% (1)

- FSA Chapter 8 NotesDocumento9 páginasFSA Chapter 8 NotesNadia ZahraAún no hay calificaciones

- Income Statement Gross Profit Operating Profit: FormulasDocumento3 páginasIncome Statement Gross Profit Operating Profit: FormulasswapnillagadAún no hay calificaciones

- Zooming in On NOIDocumento8 páginasZooming in On NOIandrewpereiraAún no hay calificaciones

- Financial Ratio Analysis ToolDocumento6 páginasFinancial Ratio Analysis ToolJuan Pascual CosareAún no hay calificaciones

- Financial Accounting: Salal Durrani 2020Documento12 páginasFinancial Accounting: Salal Durrani 2020Rahat BatoolAún no hay calificaciones

- Far 4Documento9 páginasFar 4Sonu NayakAún no hay calificaciones

- Understanding the Key Elements of an Income StatementDocumento19 páginasUnderstanding the Key Elements of an Income StatementFrank HernandezAún no hay calificaciones

- Profitability Is The Ability of A Firm To Generate EarningsDocumento2 páginasProfitability Is The Ability of A Firm To Generate EarningsJaneAún no hay calificaciones

- Analyzing Your Financial RatiosDocumento38 páginasAnalyzing Your Financial Ratiossakthivels08Aún no hay calificaciones

- Accounting DocumentsDocumento6 páginasAccounting DocumentsMae AroganteAún no hay calificaciones

- A Study On Profitability Analysis atDocumento13 páginasA Study On Profitability Analysis atAsishAún no hay calificaciones

- All AccountingDocumento122 páginasAll AccountingHassen ReshidAún no hay calificaciones

- Current Ratio Liquidity Working CapitalDocumento3 páginasCurrent Ratio Liquidity Working CapitalAldren Delina RiveraAún no hay calificaciones

- 2-Income StatementDocumento22 páginas2-Income StatementSanz GuéAún no hay calificaciones

- What Are Profitability RatiosDocumento2 páginasWhat Are Profitability RatiosDarlene SarcinoAún no hay calificaciones

- Financial Accounting & AnalysisDocumento5 páginasFinancial Accounting & AnalysisSourav SaraswatAún no hay calificaciones

- Inc StatmentDocumento3 páginasInc StatmentDilawarAún no hay calificaciones

- Financial Analysis ComponentsDocumento6 páginasFinancial Analysis Componentskyrian chimaAún no hay calificaciones

- BCG Insidesherpa Technical TermsDocumento2 páginasBCG Insidesherpa Technical TermsAbinash AgrawalAún no hay calificaciones

- Module 8 and 9 EntrepDocumento16 páginasModule 8 and 9 EntrepmarieenriquezsalitaAún no hay calificaciones

- Financial Statements Across Periods: Learning ObjectivesDocumento53 páginasFinancial Statements Across Periods: Learning ObjectivesNoreenAún no hay calificaciones

- 3-Computing Gross ProfitDocumento5 páginas3-Computing Gross ProfitAquisha MicuboAún no hay calificaciones

- How To Prepare A Profit and Loss (Income) Statement: Zions Business Resource CenterDocumento16 páginasHow To Prepare A Profit and Loss (Income) Statement: Zions Business Resource CenterSiti Asma MohamadAún no hay calificaciones

- Profitability RatiosDocumento40 páginasProfitability Ratios401 KALAVALA SAI NAVEENAún no hay calificaciones

- Monetrix Combined - FinDocumento266 páginasMonetrix Combined - Fin21P028Naman Kumar GargAún no hay calificaciones

- Statement of Retained Earings and Its Components HandoutDocumento12 páginasStatement of Retained Earings and Its Components HandoutRitesh LashkeryAún no hay calificaciones

- 21.understanding Retail ViabilityDocumento23 páginas21.understanding Retail ViabilitySai Abhishek TataAún no hay calificaciones

- Task 2 Business TermsDocumento2 páginasTask 2 Business TermsAryan KumarAún no hay calificaciones

- How To Write A Traditional Business Plan: Step 1Documento5 páginasHow To Write A Traditional Business Plan: Step 1Leslie Ann Elazegui UntalanAún no hay calificaciones

- Analyzing Financial Statement New1Documento10 páginasAnalyzing Financial Statement New1Jung HoseokAún no hay calificaciones

- Key Takeaways: DirectDocumento13 páginasKey Takeaways: DirectSB CorporationAún no hay calificaciones

- 2.7 Lesson 7Documento13 páginas2.7 Lesson 7Dark PrincessAún no hay calificaciones

- Income statement overviewDocumento1 páginaIncome statement overviewHabib Ul HaqAún no hay calificaciones

- ABM2 - Fundamentals of ABM 2 FS AnalysisDocumento45 páginasABM2 - Fundamentals of ABM 2 FS AnalysisCharles Carlos100% (1)

- Analysis On Nestlé Financial Statements 2017Documento7 páginasAnalysis On Nestlé Financial Statements 2017Putu DenyAún no hay calificaciones

- Sample Operational Financial Analysis ReportDocumento8 páginasSample Operational Financial Analysis ReportValentinorossiAún no hay calificaciones

- Understanding Profit & LossDocumento3 páginasUnderstanding Profit & Lossnmvel100% (1)

- Analysis On Nestlé Financial Statements 2017Documento8 páginasAnalysis On Nestlé Financial Statements 2017Fred The FishAún no hay calificaciones

- Week 6 Learning Summary Financial RatiosDocumento10 páginasWeek 6 Learning Summary Financial RatiosRajeev ShahdadpuriAún no hay calificaciones

- 8D ReportDocumento20 páginas8D ReportSuryanarayana Tata100% (1)

- 8D Report CustomerDocumento2 páginas8D Report CustomerSuryanarayana TataAún no hay calificaciones

- Sales Return ProcessDocumento3 páginasSales Return ProcessSuryanarayana TataAún no hay calificaciones

- Deferred Taxes FIDocumento1 páginaDeferred Taxes FISuryanarayana TataAún no hay calificaciones

- Managing Linear AssetsDocumento9 páginasManaging Linear AssetsSuryanarayana TataAún no hay calificaciones

- Gage R&RDocumento10 páginasGage R&Rshobhit2310Aún no hay calificaciones

- APO PresentationDocumento31 páginasAPO PresentationSuryanarayana TataAún no hay calificaciones

- SAP For Logistics Service Provider ManagingDocumento16 páginasSAP For Logistics Service Provider ManagingSuryanarayana TataAún no hay calificaciones

- Solution Brief Textile Paper Printing and Packaging MachineryDocumento5 páginasSolution Brief Textile Paper Printing and Packaging MachinerySuryanarayana TataAún no hay calificaciones

- SAP R3 Reporting PracticesDocumento61 páginasSAP R3 Reporting PracticesJulio CoutoAún no hay calificaciones

- AFS Solution OverviewDocumento47 páginasAFS Solution OverviewSuryanarayana TataAún no hay calificaciones

- AFS Inventory ManagementDocumento29 páginasAFS Inventory ManagementSuryanarayana Tata100% (1)

- Cc8feec45e68c3a4a5823cb6619.html: Point of View - SMP Vs SAP FioriDocumento8 páginasCc8feec45e68c3a4a5823cb6619.html: Point of View - SMP Vs SAP FioriSuryanarayana TataAún no hay calificaciones

- Cross-System Depreciation AreaDocumento3 páginasCross-System Depreciation AreaSuryanarayana TataAún no hay calificaciones

- Order Change Management (OCM)Documento19 páginasOrder Change Management (OCM)Debasish BeheraAún no hay calificaciones

- Valuation With The Moving Average PriceDocumento4 páginasValuation With The Moving Average PriceSuryanarayana TataAún no hay calificaciones

- AFS Inventory ManagementDocumento29 páginasAFS Inventory ManagementSuryanarayana Tata100% (1)

- Capcity Levelling Profile in APODocumento9 páginasCapcity Levelling Profile in APOSuryanarayana TataAún no hay calificaciones

- Rework Order ConfirmationDocumento3 páginasRework Order ConfirmationSuryanarayana TataAún no hay calificaciones

- SAFS 6 Fu E - FramesetDocumento77 páginasSAFS 6 Fu E - FramesetSuryanarayana TataAún no hay calificaciones

- Early Warning SystemsDocumento24 páginasEarly Warning SystemsSuryanarayana TataAún no hay calificaciones

- Apo 1Documento3 páginasApo 1Suryanarayana TataAún no hay calificaciones

- Assessment - Set 1: Select The Correct AnswerDocumento15 páginasAssessment - Set 1: Select The Correct Answergatete samAún no hay calificaciones

- Practice 2Documento24 páginasPractice 2Софи БреславецAún no hay calificaciones

- Strategic Business ManagementDocumento5 páginasStrategic Business Managementchamila2345Aún no hay calificaciones

- Accounting and FinanceDocumento15 páginasAccounting and FinanceSujal BedekarAún no hay calificaciones

- Chapter 4 MNGT 8Documento26 páginasChapter 4 MNGT 8Angel MaghuyopAún no hay calificaciones

- An Introduction To The Nielsen CompanyDocumento17 páginasAn Introduction To The Nielsen CompanysinghbabitaAún no hay calificaciones

- Technical English 3 Homework 3 2023Documento3 páginasTechnical English 3 Homework 3 2023Efrain De GraciaAún no hay calificaciones

- PRINCIPLES OF MARKETING PPDocumento77 páginasPRINCIPLES OF MARKETING PPAvegail Ocampo TorresAún no hay calificaciones

- Sticker MonitorDocumento21 páginasSticker MonitorRestia SchleiferAún no hay calificaciones

- Market Segmentation and Target MarketDocumento2 páginasMarket Segmentation and Target MarketMikaela CatimbangAún no hay calificaciones

- Financial Reporting and Analysis 7th Edition Ebook PDFDocumento42 páginasFinancial Reporting and Analysis 7th Edition Ebook PDFdon.anderson433100% (35)

- Winata Syahputra CV AfterDocumento1 páginaWinata Syahputra CV AfterGina PuspitaAún no hay calificaciones

- Adragon Company Profile August 04, 2023Documento28 páginasAdragon Company Profile August 04, 2023Michael TalladaAún no hay calificaciones

- UBC Managerial Economics: Commerce/ FRE 295Documento11 páginasUBC Managerial Economics: Commerce/ FRE 295lucien_luAún no hay calificaciones

- Sales Forecasting: Sales Forecasting Is The Process of Estimating WhatDocumento13 páginasSales Forecasting: Sales Forecasting Is The Process of Estimating WhatarunangshusenguptaAún no hay calificaciones

- Marketing and Communication Officer For The Alliance Francaise Network in IndiaDocumento3 páginasMarketing and Communication Officer For The Alliance Francaise Network in Indiafrenchfaculty 1881Aún no hay calificaciones

- AT Quizzer (CPAR) - Audit SamplingDocumento2 páginasAT Quizzer (CPAR) - Audit SamplingPrincessAún no hay calificaciones

- Supply Chain Enhancement Through Product and Vendor Development ProgrammeDocumento14 páginasSupply Chain Enhancement Through Product and Vendor Development ProgrammechengadAún no hay calificaciones

- Selecting Indian Cities For Market EntryDocumento2 páginasSelecting Indian Cities For Market EntryJose Jacob KAún no hay calificaciones

- Comprehensive Guide to Miller and Richmond Company FinancialsDocumento12 páginasComprehensive Guide to Miller and Richmond Company FinancialsNucke Febriana Putri RZAún no hay calificaciones

- University of California PE and VC IRR ReturnsDocumento5 páginasUniversity of California PE and VC IRR Returnsdavidsun1988Aún no hay calificaciones

- 02 Break Even AnalysisDocumento9 páginas02 Break Even AnalysisMarenightAún no hay calificaciones

- Marketing RebelDocumento10 páginasMarketing RebelCarla NunesAún no hay calificaciones

- SM-Module-5-Generic Competitive StrategiesDocumento53 páginasSM-Module-5-Generic Competitive StrategiesAhmed RazaAún no hay calificaciones

- Grampians Tourism Visitor Servicing Review ReportDocumento12 páginasGrampians Tourism Visitor Servicing Review ReportEliza BerlageAún no hay calificaciones

- Chapter 6 Common Business Terminologies PDFDocumento30 páginasChapter 6 Common Business Terminologies PDFDiya SardaAún no hay calificaciones

- Adjusting Journal EntriesDocumento11 páginasAdjusting Journal EntriesKatrina RomasantaAún no hay calificaciones