Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Bse Vs Nasdaq

Cargado por

Bhavesh BajajDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Bse Vs Nasdaq

Cargado por

Bhavesh BajajCopyright:

Formatos disponibles

BSE V/S NASDAQ

Table Of Contents

Sr. No

Topic

Pg No.

1.

World Federation OF Exchanges

2.

Bombay Stock Exchange

3.

Nasdaq

25

4.

Correlation Between Bse & Nasdaq

41

5.

Factors Affecting Share Prices

43

6.

Subprime Crisis and its Impacts

48

7.

Conclusion

55

8.

Webliography

56

KC COLLEGE

BSE V/S NASDAQ

World Federation Of Exchanges

The World Federation of Exchanges (WFE) ranks the stock exchanges of the world. It is the trade association of 58 publicly regulated stock, futures and options exchanges. It sorts all the exchanges by size so as to identify the largest stock exchanges in terms of various factors like market capitalization, number of listed companies, total volume of shares, etc. To be a member, exchanges must adhere to the WFE Membership Criteria. Candidates are selected following a peer review. There are 2 Associates, 17 WFE Affiliates with separate professional relations and 31 exchanges which are WFE Correspondents. In 2012, the global market capitalization recovered with a 15.1% growth rate to USD 55 trillion. The best performance in 2012 was observed in the Americas (+17.2%) followed by Asia-Pacific (+15.4%) and EAME (+11.6%). In the Americas, the growth was mainly driven by the US exchanges that increased 19% while Canada increased slightly less (8%) and contrasted trends were observed in Latin American countries. Despite the good performance of market capitalization in 2012, the Electronic Order Book (EOB) turnover value declined by 22.5%. All the regions were affected by this trading volumes drop : EAME (-24.1%), Americas (- 23.2%) and Asia Pacific (-20%). The global number of trades also decreased significantly in 2012, but in Asia Pacific and EAME, the decrease was less pronounced than for the value of share trading. In 2012, the average transaction size (weighted by value of share trading) slightly increased from USD 8100 to 8300.

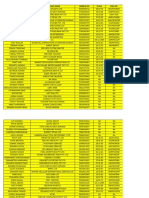

Regional and total WFE domestic equity market capitalization performances at year end 2012 compared to year end 2011. Time Zone Americas Asia Pacific Europe Africa Middle East Total WFE USD bn End 2012 23 193 16 929 14 447 54 570 USD bn End 2011 19 789 14 670 12 942 47 041 % change in USD 17.2% 15.4% 11.6% 15.1%

KC COLLEGE

BSE V/S NASDAQ

Bombay Stock Exchange

History Bombay Stock Exchange, commonly referred to as the BSE, is a stock exchange located on Dalal Street, Mumbai, Maharashtra, India. Established in 1875, BSE Ltd. (formerly known as Bombay Stock Exchange Ltd.), is Asias first Stock Exchange and one of Indias leading exchange groups. Over the past 137 years, BSE has facilitated the growth of the Indian corporate sector by providing it an efficient capital-raising platform. Popularly known as BSE, the bourse was established as "The Native Share & Stock Brokers' Association" in 1875. The Bombay Stock Exchange is the oldest exchange in India. It traces its history to the 1855, when four Gujarati and one Parsi stockbroker would gather under banyan trees in front of Mumbai's Town Hall. The location of these meetings changed many times, as the number of brokers constantly increased. The group eventually moved to Dalal Street in 1874 and in 1875 became an official organization known as 'The Native Share & Stock Brokers Association'. In 1958, the BSE became the first stock exchange to be recognized by the Indian Government under the Securities Contracts Regulation Act. In 1980 the exchange moved the Phiroze Jeejeebhoy Towers at Dalal Street, Fort area. In 1986 it developed the BSE SENSEX index, giving the BSE a means to measure overall performance of the exchange. In 2000 the BSE used this index to open its derivatives market, trading SENSEX futures contracts. The development of SENSEX options along with equity derivatives followed in 2001 and 2002, expanding the BSE's trading platform. Historically an open outcry floor trading exchange, the Bombay Stock Exchange switched to an electronic trading system in 1995. It took the exchange only fifty days to make this transition. This automated, screen-based trading platform called BSE On-line trading (BOLT) had a capacity of 8 million orders per day. The BSE has also introduced the world's first centralized exchange-based internet trading system, BSEWEBx.co.in to enable investors anywhere in the world to trade on the BSE platform.

KC COLLEGE

BSE V/S NASDAQ

Milestones In its 137-year glorious history, BSE has crossed several milestones and been a driver of several key initiatives and developments in the Indian capital market. 1830 to 1875

1830's Business on corporate stocks and shares in Bank and Cotton presses started in Bombay. 1860-1865 Cotton price bubble as a result of the American Civil War. 1870 - 90's Sharp increase in share prices of jute industries followed by a boom in tea stocks and coal

1875 To 1995

9th Jul 1875 The Native Share & Stock Broker's Association formed 2nd Feb 1921 Clearing House started by Bank of India 31st Aug 1957 BSE granted permanent recognition under Securities Contracts (Regulation) Act (SCRA) 2nd Jan 1986 SENSEX, country's first equity index launched (Base Year: 1978-79 =100) 10th Jul 1987 Investor's Protection Fund (IPF) introduced 3rd Jan 1989 BSE Training Institute (BTI) inaugurated 25th Jul 1990 SENSEX closes above 1000 15th Jan 1992 SENSEX closes above 2000 30th Mar 1992 SENSEX closes above 4000 1 May 1992 SEBI Act established (An Act to protect, develop and regulate the securities market) 29 May 1992 Capital Issues (Control) Act repealed 1992 Securities Appellate Tribunal (SAT) established 14th Mar 1995 BSE On-Line Trading (BOLT) system introduced

1996 To 2000

19th Aug 1996 First major SENSEX revamp 12 May 1997 Trade Guarantee Fund (TGF) introduced 21st Jul 1997 Brokers Contingency Fund (BCF) introduced 1997 BSE On-Line Trading (BOLT) system expanded nation-wide 22nd Mar 1999 Central Depository Services Limited (CDSL) set up with other financial institutions 1st Jun 1999 Interest Rate Swaps (IRS) / Forward Rate Agreements (FRA) allowed 15th Jul 1999 CDSL commences work 11th Oct 1999 SENSEX closed above 5000 9th Jun 2000 Equity Derivatives introduced

KC COLLEGE

BSE V/S NASDAQ

2001 To 2005

1st Mar 2001 Corporatisation of Exchanges proposed by the Union Govt. 1st Feb 2001 BSE Webx Launched 1st Jun 2001 Index Options launched 4th Jun 2001 BSE PSU index introduced 15th Jun 2001 WDM operations at commenced 2nd Jul 2001 VaR model introduced for margin requirement calculation 9th Jul 2001 Stock options launched 11th Jul 2001 BSE Teck launched, Indias First free float index 25th Jul 2001 Dollex 30 launched 1st Nov 2001 Stock futures launched 29th Nov 2001 100% book building allowed 31st Dec 2001 All securities clearing move to T+5 (trade date + 5 days) 1st Feb 2002 Two way fungibility for ADR/GDR 15th Feb 2002 Negotiated Dealing System (NDS) established 1st Apr 2002 T+3 settlement Introduced 1st Jan 2003 Indias first ETF on SENSEX - SPICE' introduced 16th Jan 2003 Retail trading in G Sec 1st Apr 2003 T+2 settlement Introduced 1st June 2003 Bankex launched 1st Sep 2003 SENSEX shifted to free-float methodology 1st Dec 2003 T group launched 2nd Jun 2004 SENSEX closes over 6000 for the first time (564.71 points, 11.14%) 17th May 2004 Second biggest fall of all time, Circuit filters used twice in a day (the Scheme) announced by SEBI 20th May 2005 The BSE (Corporatisation and Demutualisation) Scheme, 2005 8th Aug 2005 Incorporation of Bombay Stock Exchange Limited 12th Aug 2005 Certificate of Commencement of Business 19th Aug 2005 BSE becomes a Corporate Entity

KC COLLEGE

BSE V/S NASDAQ

2006 To 2010

7th Feb 2006 SENSEX closed above 10000 7th Jul 2006 BSE Gujarati website launched 21st Oct 2006 BSE Hindi website launched 2nd Nov 2006 iShares BSE SENSEX India Tracker listed at Hong Kong Stock Exchange 2nd Jan 2007 Launch of Unified Corporate Bond Reporting platform: Indian Corporate Debt Market (ICDM) 7th Mar 2007 Singapore Exchange Limited entered into an agreement to invest in a 5% stake in BSE 16th May 2007 Appointed Date under the Scheme i.e. Date on which Corporatisaton and Demutualisation was achieved. Notified by SEBI in the Official Gazette on 29.06.2007 10th Jan 2008 SENSEX All-time high 21206.77 1st Oct 2008 Currency Derivatives Introduced 18 May 2009 The SENSEX raised 2110.70 points (17.34%) and Index-wide upper circuit breaker applied 7th Aug 2009 BSE - USE Form Alliance to Develop Currency & Interest Rate 24th Aug 2009 BSE IPO Index launched 1st Oct 2009 Bombay Stock Exchange introduces trade details facility for the Investors 5th Oct 2009 BSE Introduces New Transaction Fee Structure for Cash Equity Segment 25th Nov 2009 BSE launches FASTRADE - a new market access platform 4th Dec 2009 BSE Launches BSE StAR MF Mutual Fund trading platform 7th Dec 2009 Launch of clearing and settlement of Corporate Bonds through Indian Clearing Corporation Ltd. 18th Dec 2009 BSE's new derivatives rates to lower transaction costs for all 4th Jan 2010 Market time changed to 9.0 a.m. - 3.30 p.m. 20th Jan 2010 BSE PSU website launched 22nd Apr 2010 New DBM framework @ Rs.10 lakhs - 90% reduction in Membership Deposit 12 May 2010 Dissemination of Corporate Action information via SWIFT platform 23 July 2010 Options on BOLT 29th Sep 2010 Introduction of Smart Order Routing (SOR) 4th Oct 2010 EUREX - SENSEX Futures launch 11th Oct 2010 Launch of Fastrade on Web (FoW) - Exchange hosted platform 5th Nov 2010 SENSEX closes above 21,000 for the first time 12th Nov 2010 Commencement of Volatility Index 22nd Nov 2010 Launch of SLB 10th Dec 2010 Launch of SIP 27th Dec 2010 Commencement of Shariah Index

KC COLLEGE

BSE V/S NASDAQ

2011 To 2013

17th Nov 2011 Maharashtra and United Kingdom Environment Ministers launched Concept Note for BSE Carbon Index 7th Jan 2011 BSE Training Institute Ltd. with IGNOU launched India's first 2 year full-time MBA programme specialising in Financial Market 15th Jan 2011 Co-location facility at BSE - tie up with Netmagic 22nd Feb 2012 Launch of BSE-GREENEX to promote investments in Green India 13th Mar 2012 Launch of BSE - SME Exchange Platform 30th Mar 2012 BSE launched trading in BRICSMART indices derivatives 19 February 2013 - SENSEX becomes S&P SENSEX as BSE ties up with Standard and Poor's to use the S&P brand for Sensex and other indices

KC COLLEGE

BSE V/S NASDAQ

Board Of Directors

Name

Designation

Mr. S. Ramadorai

Non-Executive Chairman

Vice Chairman, Tata Consultancy Services

Mr. Ashishkumar Chauhan

Managing CEO

Director

&

Mr. Sudhakar Rao

Public Interest Director

Dr. Sanjiv Misra

Public Interest Director IAS (Retd.)

Mr. S.H. Kapadia

Public Interest Director

(Former CJI)

Mr. Keki M. Mistry

Shareholder Directors

Vice-Chairman & CEO HDFC Ltd. Deputy CEO Deutsche Borse AG Alternate Director to Mr. Andreas Preuss

Mr. Andreas Preuss

Shareholder Directors

Mr.

Thomas

Bendixen Shareholder Directors

KC COLLEGE

BSE V/S NASDAQ

Need For BSE

BSE is one of the factors Indian Economy depends upon. BSE has played a major role in the development of the country. Through BSE, Foreign Investors have invested in India. Due to inward flow of foreign currency the, the Indian economies have started showing the upward trend towards the development of the country. BSE provides employment for many people. Trading in BSE is also a business for a few, their family income depends on it that is the reason why when scandals occur in the stock market it not only affects the companies listed but also affects many families. In the few extreme cases, it is observed that the bread winner of a family tends to suicide due to the losses occurred. In most of major industrial cities all over the world, where the businesses were evolving and required investment capital to grow and thrive, stock exchanges acted as the interface between Suppliers and Consumers of capital. One of the key advantages of the stock exchanges is that they are efficient medium for raising resources and channeling savings from the general public by the way of issue of Equity / Debt Capital by joint stock companies which are listed on stock exchanges. Not to forget that the taxes and other statutory charges paid by BSE are substantial and make a sizeable contribution to the Government exchequer (Financial resources; funds). For example, transactions on the stock exchanges are subject to stamp duties, which are paid to the State Government. The annual revenue from this source ranges from Rs 75 100 crores With the opening up of the financial markets to Foreign Investors a number of foreign institutional investors and brokers have established a sizeable presence in Mumbai.

KC COLLEGE

BSE V/S NASDAQ

10

S&P BSE SENSEX

The S&P BSE SENSEX (S&P Bombay Stock Exchange Sensitive Index), also-called the BSE 30 or simply the SENSEX, is a free-float market capitalization-weighted stock market index of 30 well-established and financially sound companies listed on BSE Ltd. The 30 component companies which are some of the largest and most actively traded stocks, are representative of various industrial sectors of the Indian economy. Published since 1 January 1986, the S&P BSE SENSEX is regarded as the pulse of the domestic stock markets in India. The base value of the S&P BSE SENSEX is taken as 100 on 1 April 1979, and its base year as 197879. The term Sensex was coined by Deepak Mohoni, a stock market analyst.

INDICES OF BSE

Index Watch As On 16 Sep 13 | 03:26 PM Category/Index 52 Week High Low Full Market Turnover Capitalisation ( Cr. ) % to ( Cr. ) % to Total Total Turnover Mkt Cap 475.84 374.34 140.37 26.85 21.12 7.92

Broad S&P BSE SENSEX S&P BSE MID CAP S&P BSE SMALL CAP S&P BSE 100 S&P BSE 200 S&P BSE 500 Thematic S&P BSE GREENEX S&P BSE CARBONEX Investment Strategies S&P BSE IPO S&P BSE SME IPO S&P BSE DOLLEX 30 S&P BSE DOLLEX 100 S&P DOLLEX 200

20443.62 17448.71 3279201.89 52.86 7391.34 5118.74 818193.21 13.19 7696.74 5085.56 271648.68 4.38 6246.37 2509.17 7792.70 1662.83 1014.36 5116.81 2041.82 6301.27 1383.18 0.00 4812209.76 77.57 5540128.95 89.30 6054239.42 97.59 1803629.60 29.07 4812209.76 77.57

1242.77 70.11 1555.14 87.74 1711.96 96.58 333.95 18.84 1242.77 70.11

-352.26 29773.40 11432.70 7397.09

-130.59 2173.28 802.04 514.37

48639.24 1985.92 126029.80 11568.08 126029.80

0.78 0.03 2.03 0.19 2.03

12.06 1.19 10.38 1.00 10.38

0.68 0.07 0.59 0.06 0.59

KC COLLEGE

BSE V/S NASDAQ

11

Sectorial S&P BSE BANKEX S&P BSE FMCG S&P BSE AUTO S&P BSE PSU S&P BSE CONSUMER DURABLES S&P BSE POWER S&P BSE OIL & GAS S&P BSE METAL S&P BSE CAPITAL GOODS S&P BSE TECK S&P BSE REALTY S&P BSE IT S&P BSE HEALTHCARE Volatility Index S&P BSE REALVOL1MTH S&P BSE REALVOL2MTH S&P BSE REALVOL3MTH Thematic S&P BSE 500 SHARIAH

15335.89 7600.05 11868.56 7945.26 8221.12

9535.75 439.19 9656.39 4774.97 5358.18

589605.41 614519.27 351162.54 1247785.76 40615.78

9.50 9.91 5.66 20.11 0.65

296.75 95.78 64.14 231.27 10.45

16.74 5.40 3.62 13.05 0.59

2113.73 9890.89 11510.14 11408.58 4571.07 2326.78 8154.14 9509.52

1315.62 7552.19 6353.75 6718.83 3268.17 1126.84 5496.03 7315.20

352512.87 762433.83 457361.09 191328.22 1112564.98 61317.76 796446.79 356446.92

5.68 12.29 7.37 3.08 17.93 0.99 12.84 5.75

79.30 72.53 110.81 58.58 180.13 50.44 125.92 285.85

4.47 4.09 6.25 3.30 10.16 2.85 7.10 16.13

----

----

----

----

----

----

--

--

6407205.68 --

--

--

KC COLLEGE

BSE V/S NASDAQ

12

Components

The BSE Sensex currently consists of the following 30 major Indian companies which are as follows : Company 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Housing Development Finance Corporation Cipla Bharat Heavy Electricals State Bank Of India HDFC Bank Hero Motocorp Infosys Oil and Natural Gas Corporation Reliance Industries Tata Power Hindalco Industries Tata Steel Larsen & Toubro Mahindra & Mahindra Tata Motors Hindustan Unilever ITC Sterlite Industries Wipro Sun Pharmaceutical Industry Consumer finance Pharmaceuticals Electrical equipment Banking Banking Automotive Information Technology Oil and gas Oil and gas Power Metals and Mining Steel Conglomerate Automotive Automotive Consumer goods Conglomerate Metals and Mining Information Technology Pharmaceuticals

KC COLLEGE

BSE V/S NASDAQ

13

21 22 23 24 25 26 27 28 29 30

GAIL ICICI Bank Jindal Steel & Power Bharti Airtel Maruti Suzuki Tata Consultancy Services NTPC DLF Bajaj Auto Coal India

Oil and gas Banking Steel and power Telecommunication Automotive Information Technology Power Real estate Automotive Metals and Mining

Calculation

The BSE constantly reviews and modifies its composition to be sure it reflects current market conditions. The index is calculated based on a free float capitalisation method, a variation of the market capitalisation method. Instead of using a company's outstanding shares it uses its float, or shares that are readily available for trading. As per free float capitalisation methodology, the level of index at any point of time reflects the free float market value of 30 component stocks relative to a base period. The market capitalisation of a company is determined by multiplying the price of its stock by the number of shares issued by of corporate actions, replacement of scrips, etc. The index has increased by over ten times from June 1990 to the present. Using information from April 1979 onwards, the long-run rate of return on the S&P BSE SENSEX works out to be 18.6% per annum, which translates to roughly 9% per annum.

KC COLLEGE

BSE V/S NASDAQ

14

Hours Of Operation

Session Pre-open Trading Session Trading Session Position Transfer Session Closing Session Option Exercise Session

Timing 09:00 - 09:15 09:15 - 15:30 15:30 - 15:55 15:50 - 16:05 16:07

The hours of operation for the BSE quoted above are stated in terms the local time (GMT + 5:30). BSE's normal trading sessions are on all days of the week except Saturday, Sundays and holidays declared by the Exchange in advance.

Particulars

For The Year Ended March 31, 2013 (Audited)

I. INCOME a) Operating Income b) Investments and Deposits Income c) Other Income Total Income II. EXPENDITURE a) Employee Costs b) Computer Technology Related Expenses c) Administration and Other Expenses d) Depreciation and Amortisation Total Expenditure 8,009 7,149 9,035 2,831 27,024 24,079 26,956 4,245 55,280

III. Profit from operations before Prior Period items, 28,256 Interest, Exceptional items & Tax

KC COLLEGE

BSE V/S NASDAQ

15

IV. Profit from operations before Interest, Exceptional 27,229 items & Tax a) Interest 245

V. Profit from operations before Exceptional items & 26,984 Tax a) Exceptional Items (Note 2) VI. Profit from operations before Tax a) Extraordinary Item VII. Profit before tax a) Tax Expenses 9,791 17,193 73 17,120 3,745

VIII. Net Profit For The Quarter/Year after tax but before 13,375 Minority Interest & Share of associates Share of Profit / (Loss ) of Associate (Net) Share of Minority (33) (2,485)

IX. Net Profit For The Quarter/Year Paid up Equity Capital (Face Value Per Share 1 Each) Reserves (Excluding Revaluation Reserve)

10,857 1,037 227,938

Basic and Diluted EPS before Extraordinary Item (Refer 10.34 Note Below) Basic and Diluted EPS after Extraordinary Item (Refer Note 10.25 Below) Note: Basic and Diluted EPS is not annualised for the quarter ended results.

KC COLLEGE

BSE V/S NASDAQ

16

Trading

Timing Trading on the BOLT System is conducted from Monday to Friday between 9:15 a.m. and 3:30 p.m. normally. Refer Notice No. 20101014-8 for call auction. Groups The scrips traded on BSE have been classified into various groups. BSE has, for the guidance and benefit of the investors, classified the scrips in the Equity Segment into 'A', 'B', 'T' and 'Z' groups on certain qualitative and quantitative parameters. The "F" Group represents the Fixed Income Securities. The "T" Group represents scrips which are settled on a trade-to-trade basis as a surveillance measure. Trading in Government Securities by the retail investors is done under the "G" group. The 'Z' group was introduced by BSE in July 1999 and includes companies which have failed to comply with its listing requirements and/or have failed to resolve investor complaints and/or have not made the required arrangements with both the depositories, viz., Central Depository Services (I) Ltd. (CDSL) and National Securities Depository Ltd. (NSDL) for dematerialization of their securities. BSE also provides a facility to the market participants for on-line trading of odd-lot securities in physical form in 'A', 'B', 'T' and 'Z' groups and in rights renunciations in all groups of scrips in the Equity Segment. With effect from December 31, 2001, trading in all securities listed in the Equity segment takes place in one market segment, viz., Compulsory Rolling Settlement Segment (CRS). The scrips of companies which are in demat can be traded in market lot of 1. However, the securities of companies which are still in the physical form are traded in the market lot of generally either 50 or 100. Investors having quantities of securities less than the market lot are required to sell them as "Odd Lots". This facility offers an exit route to investors to dispose of their odd lots of securities, and also provides them an opportunity to consolidate their securities into market lots. This facility of selling physical shares in compulsory demat scrips is called an Exit Route Scheme. This facility can also be used by small investors for selling up to 500 shares in physical form in respect of scrips of companies where trades are required to be compulsorily settled by all investors in demat mode.

KC COLLEGE

BSE V/S NASDAQ

17

Listed Securities The securities of companies, which have signed the Listing Agreement with BSE, are traded as "Listed Securities". Almost all scrips traded in the Equity segment fall in this category. Permitted Securities To facilitate the market participants to trade in securities of such companies, which are actively traded at other stock exchanges but are not listed on BSE, trading in such securities is facilitated as " Permitted Securities" provided they meet the relevant norms specified by BSE Tick Size: Tick size is the minimum difference in rates between two orders on the same side i.e., buy or sell, entered in the system for particular scrip. Trading in scrips listed on BSE is done with the tick size of 5 paise. However, in order to increase the liquidity and enable the market participants to put orders at finer rates, BSE has reduced the tick size from 5 paise to 1 paise in case of units of mutual funds, securities traded in "F" group and equity shares having closing price up to Rs. 15 on the last trading day of the calendar month. Accordingly, the tick size in various scrips quoting up to Rs.15 is revised to 1 paise on the first trading day of month. The tick size so revised on the first trading day of month remains unchanged during the month even if the price of scrips undergoes a change. Computation Of Closing Price Of Scrips The closing price of scrips is computed by BSE on the basis of weighted average price of all trades executed during the last 30 minutes of a continuous trading session. However, if there is no trade recorded during the last 30 minutes, then the last traded price of scrip in the continuous trading session is taken as the official closing price. Basket Trading System BSE has commenced trading in the Derivatives Segment with effect from June 9, 2000 to enable investors to hedge their risks. Initially, the facility of trading in the Derivatives Segment was confined to Index Futures. Subsequently, BSE has introduced the Index Options and Options & Futures in select individual stocks. Investors in the cash market had felt a need to limit their risk exposure in the market to the movement in S&P BSE SENSEX. With a view to provide investors the facility of creating S&P BSE SENSEX-linked portfolios and also to create a linkage of market prices of the underlying securities of S&P BSE SENSEX in the Cash Segment and Futures on S&P BSE SENSEX, BSE has provided to the investors as well as to its Members a facility of Basket Trading System on BOLT with effect from August 14, 2000. In the Basket Trading System, the investors through the Members are able to buy/ sell all 30 scrips of S&P BSE SENSEX in one go in the proportion of

KC COLLEGE

BSE V/S NASDAQ

18

their respective weights in the S&P BSE SENSEX. The investors need not calculate the quantity of S&P BSE SENSEX scrips to be bought or sold for creating S&P BSE SENSEX-linked portfolios and this function is performed by the system. The investors can also create their own baskets by deleting certain scrips from 30 scrips in the S&P BSE SENSEX. Further, the investors can alter the weights of securities in such profiled baskets and enter their own weights. The investors can also select less than 100% weightage to reduce the value of the basket as per their own requirements. To participate in this system, the Members need to indicate the number of S&P BSE SENSEX basket(s) to be bought or sold, where the value of one S&P BSE SENSEX basket is arrived at by the system by multiplying Rs.50 to the prevailing S&P BSE SENSEX. For example, if the S&P BSE SENSEX is 15,000, the value of one basket of S&P BSE SENSEX would be 15000 x 50= i.e., Rs. 7,50,000/-. The investors can also place orders by entering value of S&P BSE SENSEX portfolio to be brought or sold with a minimum value of Rs. 50,000 for each order. The Basket Trading System provides the arbitrageurs an opportunity to take advantage of price differences in the underlying S&P BSE SENSEX and Futures on the S&P BSE SENSEX by simultaneous buying and selling of baskets comprising the S&P BSE SENSEX scrips in the Cash Segment and S&P BSE SENSEX Futures. This would provide a balancing impact on the prices in both cash and futures markets. The Basket Trading System thus meets the need of investors and also improves the depth in cash and futures markets. The trades executed under the Basket Trading System are subject to intra-day trading and gross exposure limits available to the Members. The VaR, MTM margins etc, as are applicable to normal trades in the Cash Segment, are also recovered from the Members.

Clearing

Indian Clearing Corporation Limited (ICCL) was incorporated in 2007 as a wholly owned subsidiary of BSE Ltd. ICCL has been set up with an objective of promoting financial stability and integrity. ICCL is working towards becoming a globally recognized CCP that clears and settles trades for a multitude of diverse and sophisticated products. ICCL operates under the regulation of both the Securities and Exchange Board of India (SEBI) and RBI (for select products). Overseeing ICCL function is a professional management team ably guided by a Board of Directors, consisting of a majority of Independent Directors and seconded with nominee Directors from BSE offering their domain expertise.

KC COLLEGE

BSE V/S NASDAQ

19

ICCLs Clearing Members serve both professional traders and retail customers and comprise of the leading entities in the Indian financial sector. ICCLs goal is to service the clearing members and stock exchanges, with emphasis on timely, reliable and cost-efficient clearing operations. In its capacity as a Clearing Corporation, ICCL carries out the functions of clearing, settlement, collateral management and risk management for various segments of different stock exchanges. ICCL undertakes to act as the central counterparty to all the trades it provides settlement for. ICCL undertakes clearing and settlement activities for trades reported on the debt and mutual fund segments of BSE and for trades executed on all the other segments of BSE, including Equity Cash, Equity F&O, BSE SME, Offer for Sale, Securities Lending & Borrowing, etc. and the Currency Derivatives Segment (Currency F&O) of United Stock Exchange (USE). While over 20 banks are empanelled with ICCL as Clearing Banks for BSE activities, ten banks have been empanelled as Clearing Banks for providing clearing and settlement services for trades executed on USE platform.

Settlement

Compulsory Rolling Settlement All transactions in all groups of securities in the Equity segment and Fixed Income securities listed on BSE are required to be settled on T+2 basis (w.e.f. from April 1, 2003). The settlement calendar, which indicates the dates of the various settlement related activities, is drawn by BSE in advance and is circulated among the market participants. Under rolling settlements, the trades done on a particular day are settled after a given number of business days. A T+2 settlement cycle means that the final settlement of transactions done on T, i.e., trade day by exchange of monies and securities between the buyers and sellers respectively takes place on second business day (excluding Saturdays, Sundays, bank and Exchange trading holidays) after the trade day. The transactions in securities of companies which have made arrangements for dematerialization of their securities are settled only in demat mode on T+2 on net basis, i.e., buy and sell positions of a member-broker in the same scrip are netted and the net quantity and value is required to be settled. However, transactions in securities of companies, which are in "Z" group or have been placed under "trade-totrade" by BSE as a surveillance measure ("T" group) , are settled only on a gross basis and the facility of netting of buy and sell transactions in such scrips is not available. The transactions in 'F' group securities representing "Fixed Income Securities" and " G" group representing Government Securities for retail investors are also settled at BSE on T+2 basis.

KC COLLEGE

BSE V/S NASDAQ

20

In case of Rolling Settlements, pay-in and pay-out of both funds and securities is completed on the same day. Members are required to make payment for securities sold and/ or deliver securities purchased to their clients within one working day (excluding Saturday, Sunday, bank & BSE trading holidays) after the pay-out of the funds and securities for the concerned settlement is completed by BSE. This is the timeframe permitted to the Members to settle their funds/ securities obligations with their clients as per the Byelaws of BSE. The following table summarizes the steps in the trading and settlement cycle for scrips under CRS : DAY ACTIVITY T Trading on BOLT and daily downloading of statements showing details of transactions and margins at the end of each trading day. Downloading of provisional securities and funds obligation statements by member-brokers. 6A/7A* entry by the member-brokers/ confirmation by the custodians. T+1 Confirmation of 6A/7A data by the Custodians upto 1:00 p.m. Downloading of final securities and funds obligation statements by members T+2 Pay-in of funds and securities by 11:00 a.m. and pay-out of funds and securities by 1:30 p.m. The member-brokers are required to submit the payin instructions for funds and securities to banks and depositories respectively by 10:40 a.m. T+2 Auction on BOLT at 2.00 p.m. T+3 Auction pay-in and pay-out of funds and securities by 09:30 a.m. and 10:15 a.m. respectively.

The pay-in and payout of funds and securities takes places on the second business day (i.e., excluding Saturday, Sundays and bank and BSE trading holidays) of the day of the execution of the trade.

Surveillance

BSE is one of the few stock exchanges in the world, which has obtained the ISO certification for its surveillance function. The main objective of the surveillance function is to promote market integrity in two ways, By monitoring price and volume movements (volatility) as well as by detecting potential market abuses (fictitious/ artificial transactions, circular trading, false or misleading impressions, insider trading, etc) at a ascent stage, with a view to minimizing the ability of the market participants to influence the price of any scrip in the absence of any meaningful information By taking timely actions to manage default risk.

KC COLLEGE

BSE V/S NASDAQ

21

The surveillance activities at BSE are allocated to three Cells: Price Monitoring: is mainly related to the price movement/ abnormal fluctuation in prices or volumes of any scrip Investigations: conducting snap investigations/examinations/detailed investigations in scrips where manipulation /aberration is suspected. Position Monitoring: relates mainly to abnormal positions of Members in order to manage the default risk

Regulator

SEBI Securities and Exchange Board of India (SEBI) is an apex body for overall development and regulation of the securities market. It was set up on April 12, 1988. To start with, SEBI was set up as a non-statutory body. Later on it became a statutory body under the Securities Exchange Board of India Act, 1992. The Act entrusted SEBI with comprehensive powers over practically all the aspects of capital market operations. Role Functions of SEBI The role or functions of SEBI are discussed below. 1. To protect the interests of investors through proper education and guidance as regards their investment in securities. For this, SEBI has made rules and regulation to be followed by the financial intermediaries such as brokers, etc. SEBI looks after the complaints received from investors for fair settlement. It also issues booklets for the guidance and protection of small investors. 2. To regulate and control the business on stock exchanges and other security markets. For this, SEBI keeps supervision on brokers. Registration of brokers and sub-brokers is made compulsory and they are expected to follow certain rules and regulations. Effective control is also maintained by SEBI on the working of stock exchanges. 3. To make registration and to regulate the functioning of intermediaries such as stock brokers, sub-brokers, share transfer agents, merchant bankers and other intermediaries operating on the securities market. In addition, to provide suitable training to intermediaries. This function is useful for healthy atmosphere on the stock exchange and for the protection of small investors.

KC COLLEGE

BSE V/S NASDAQ

22

4. To register and regulate the working of mutual funds including UTI (Unit Trust of India). SEBI has made rules and regulations to be followed by mutual funds. The purpose is to maintain effective supervision on their operations & avoid their unfair and anti-investor activities. 5. To promote self-regulatory organization of intermediaries. SEBI is given wide statutory powers. However, self-regulation is better than external regulation. Here, the function of SEBI is to encourage intermediaries to form their professional associations and control undesirable activities of their members. SEBI can also use its powers when required for protection of small investors. 6. To regulate mergers, takeovers and acquisitions of companies in order to protect the interest of investors. For this, SEBI has issued suitable guidelines so that such mergers and takeovers will not be at the cost of small investors. 7. To prohibit fraudulent and unfair practices of intermediaries operating on securities markets. SEBI is not for interfering in the normal working of these intermediaries. Its function is to regulate and control their objectional practices which may harm the investors and healthy growth of capital market. 8. To issue guidelines to companies regarding capital issues. Separate guidelines are prepared for first public issue of new companies, for public issue by existing listed companies and for first public issue by existing private companies. SEBI is expected to conduct research and publish information useful to all market players (i.e. all buyers and sellers). 9. To conduct inspection, inquiries & audits of stock exchanges, intermediaries and self-regulating organizations and to take suitable remedial measures wherever necessary. This function is undertaken for orderly working of stock exchanges & intermediaries. 10. To restrict insider trading activity through suitable measures. This function is useful for avoiding undesirable activities of brokers and securities scams.

Mergers & Acquisitions

The recent decision of the Reserve Bank of India (RBI) to allow foreign investment up to 49 percent in stock exchanges, depositories and clearing corporations is hailed as a good development for the securities industry. Reflect on these recent developments: - Deutsche Boerse, Europe's top stock exchange and transaction service provider has signed an agreement to buy 5 percent equity in the Bombay Stock Exchange (BSE) for $43 million. BSE is the oldest bourse in Asia. The deal values the exchange at $910 million on an expanded equity base. - Singapore Stock Exchange (SGX) says its short listed for BSE stake. It claimed that it has been short listed to buy a 5 percent stake in the bourse. BSE is understood to have finalized its plans to have SGX as its second foreign partner.

KC COLLEGE

BSE V/S NASDAQ

23

NASDAQ Stock Market Inc., London Stock Exchange Group PLC and NYSE Group Inc. have also been touted as bidders for a stake in BSE. - NASDAQ has reportedly expressed its keenness to pick up stake in BSE. Indian exchange business is becoming increasingly global. The consolidation and alliance wave has reached Indian shores as well. India is currently growing at the rate of 8% per annum and has been doing so for a few years. Third, India is now the 4th largest country in the world in terms of purchasing power parity. If the current growth rate continues it will soon be the third largest, overtaking Japan and just behind the US and China. The fast growing stock markets in India are attracting major global investors. The international bourses feel that investments in India's Stock Exchanges (SEs) compliment their global growth strategy. Through a mutually beneficial partnership, the foreign groups will extend their global reach. Major global stock exchanges have been merging and forming alliances in recent years. As companies spread their global operations, such merged entities and alliances can offer listing possibilities in multiple markets. Regulatory controls in select markets like the US have also furthered this consolidation wave. After completing a round of domestic consolidation, US stock exchanges have stepped out and are acquiring exchanges in Europe besides forming alliances in Asia where outsight acquisitions may not be possible. Though RBI said it will allow up to 49 percent foreign investment in stock exchanges, the Securities and Exchange Board of India (Sebi) may say no to foreign players from becoming strategic investors in domestic stock exchanges. The Sebi may allow a foreign player to invest not more than 5 per cent in an exchange. According to the de-mutualisation plan laid out by the government, all corporatised stock exchanges are expected to divest 51per cent of their equity to public investors. The internal group suggested that of the 51per cent to be divested, 25 per cent could be offered to an Indian strategic partner. The rest could be offered to others, including foreign players and resident Indian investors, with no investor holding over 5 per cent each. In other words, the capital market regulator has capped the individual investment, direct or indirect, in such exchanges at five per cent. This means many investors need to join together to have a strategic control. Under the new rules, foreign direct investment would be limited at 26 percent, while foreign portfolio investments would be capped at 23 percent in all these entities, the central bank said. It, however, said portfolio investments would be allowed only through buying in the secondary market

KC COLLEGE

BSE V/S NASDAQ

24

The BSE is said to be looking for foreign investors. It plans to offload the stake held by some of the brokers to strategic investors (26%) and to the public (23%) through an IPO. The greater investment participation will incentivise foreign institutions to share technology and trading expertise with the Indian exchanges. For instance, Indian exchanges will have to explore the scope for creating alternative electronic trading platforms to ensure that institutional interest for 24X7 trading is serviced in the long run.

KC COLLEGE

BSE V/S NASDAQ

25

NASDAQ

NASDAQ began forty years ago at the National Association of Securities Dealers, or NASD. The NASD wanted to create a way for investors to buy and sell stocks on a computerized, transparent, and fast system. This would eliminate the burden and inefficiency of in-person stock transactions, which had been the prevalent model for nearly a century. The NASD believed that investors could make more money by closing the price gaps between buyers and sellers, and technology had evolved enough at that point to make it happen. On February 8, 1971, the National Association of Securities Dealers Automated Quotation (NASDAQ) went live with median quotes for 2,500 over-the-counter securities. As we celebrate the 40th anniversary of electronic trading, we are proud that the revolutionary, disruptive model that the NASD developed in 1971 is now the standard for markets worldwide. In our early years, we gave growth companies the opportunity to raise capital that wasnt previously available to them. Those companies (Intel, Microsoft, Apple, Cisco, Oracle, Dell, to name a few) used the capital raised on The NASDAQ Stock Market to make the cutting edge products that are now integral to our daily lives. These companies have also created millions of jobs around the world along the way. Today, the NASDAQ OMX Group owns and operates 24 markets, 3 clearing houses, and 5 central securities depositories, spanning six continents--making us the worlds largest exchange company. Eighteen of our 24 markets trade equities. The other six trade options, derivatives, fixed income, and commodities. We are the largest single liquidity pool for US equities and the power behind 1 in 10 of the worlds securities transactions. Seventy exchanges in 50 countries trust our trading technology to power their markets, driving growth in emerging and developed economies. NASDAQ OMX is also dedicated to designing powerful, relevant index and benchmark families that are in sync with the continually changing market environment. Utilizing the expanded coverage of our global footprint, NASDAQ OMX has nearly 2,000 diverse indexes that provide coverage across asset classes, countries and sectors. Not only do our indexes provide comprehensive insight into the global markets, but our unparalleled process, added value and competitive pricing set us apart from other indexers. Whether you are an institution, fund manager or private investor, NASDAQ OMX indexes are benchmarks that can help both influence and track investment strategies.

KC COLLEGE

BSE V/S NASDAQ

26

In 2006, NASDAQ completed its separation from the NASD and began to operate as a national securities exchange. The next year (2007), NASDAQ combined with the powerful Scandinavian exchange group OMX and officially became The NASDAQ OMX Group, further demonstrating its commitment to technology and innovation across global markets.

Origin

Because of the amount of planning involved, the development of the system did not begin until 1968. On February 8, 1971, NASDAQ officially opened, quoting more than 2,500 over-the-counter securities. While NASDAQ did not officially change its name to "The NASDAQ Stock Market" until 1990, it had developed many manifestations of itself. The NASDAQ National Market, a collection of company listings held to higher standards than other listed stocks, was created in 1982. In 1984, NASDAQ launched a system to execute small orders automatically, called the Small Order Execution System. NASDAQ created the OTC Bulletin Board in 1990 to provide information to investors on stocks not included in NASDAQ.

Timeline

KC COLLEGE

BSE V/S NASDAQ

27

Need For NASDAQ

NASDAQ was created in response to concerns from Congress in the 1960s that the Securities and Exchange Commission had been lax in supervising stock trades, and had not adequately enforced rules against large securities companies. A 1963 SEC report found that the American Stock Exchange "had failed in creating an adequate structure of surveillance, control and discipline," and it questioned the effectiveness of self-regulation and the ability of exchanges to protect investors. The SEC's solution was automation. It assigned this task of creating a computerized system to the National Association of Securities Dealers.

Board Of Directors

Names Executive Team Robert Greifeld Bruce E. Aust Post Department

Chief Executive Officer Corporate Client Group Executive Vice President,

Anna

Ewing Executive Vice President,

Global Solutions

Technology

Meyer "Sandy" Frucher John L. Jacobs

Vice Chairman,

Executive Vice President, Hans-Ole Jochumsen Edward S. Knight Executive Vice President, Executive Vice President,

The NASDAQ OMX Group Global Information Services Transactions Services Nordics General Counsel & Chief Regulatory Officer Transaction Services U.S

Eric W. Noll Executive Vice President,. Brad Peterson Executive Vice President and Chief Information Officer

KC COLLEGE

BSE V/S NASDAQ

28

Lee Shavel

Chief Financial Officer and Corporate Strategy Executive Vice President

Senior Vice Presidents Magnus Billing Senior Vice President, President of NASDAQ OMX Stockholm and Head of Nordic Fixed Income and Baltic Markets NASDAQ OMX Europe

Charlotte Crosswell Senior Vice President Joan Conley Senior Vice President and Corporate Secretary

P.C. Nelson Griggs

Senior Vice President,

Global Corporate Client Group

Ronald Hassen

Senior Vice President and Finance Controller Senior Vice President and Chief Economist Senior Vice President Global Data Products Louis Senior Vice President Corporate Strategy New Listings and the Capital Markets Group NASDAQ OMX Market Systems

Frank M. Hatheway Brian Hyndman Jean-Jacques Robert McCooey

Senior Vice President Ann Neidenbach Senior Vice President, Brian O'Malley Senior Vice President and General Auditor Lars Ottersgrd Senior Vice President and

Head of Technology

Market

KC COLLEGE

BSE V/S NASDAQ

29

Geir Reigstad Lauri Rosendahl

Senior Vice President of Commodities Senior Vice President Nordic Equities within NASDAQ OMX Transaction Services Nordic Transaction Services Nordic Commodities and Broker Service Global Corporate Solutions

Johan Rudn Bjrn Sibbern Demetrios N. Skalkotos

Senior Vice President Senior Vice President

Senior Vice President Jeremy Skule Senior Vice President and Chief Marketing Officer Bryan Smith Senior Vice President, Lex Speal Senior Vice President Peter Strandell Dean Tilsley

Head of Global Human Resources Corporate Finance

Senior Vice President and Group Treasurer Senior Vice President Corporate Operations

Bob Waghorne

Senior Vice President

Thomas A. Wittman Senior Vice President John A. Zecca Senior Vice President of

Global Technology Services, Derivatives Technology U.S. Options

MarketWatch

KC COLLEGE

BSE V/S NASDAQ

30

Indices

The Nasdaq Composite is a stock market index of the common stocks and similar securities (e.g. ADRs, tracking stocks, limited partnership interests) listed on the NASDAQ stock market, meaning that it has over 3,000 components. It is highly followed in the U.S. as an indicator of the performance of stocks of technology companies and growth companies. Since both U.S. and non-U.S. companies are listed on the NASDAQ stock market, the index is not exclusively a U.S. index.

Ticker Name

Name

Current Price

^IXBK ^NBI ^IXIC ^IXK ^IXF ^IXID ^IXIS ^IXFN ^IXUT ^IXTR ^NDX

NASDAQ Bank NASDAQ Biotechnology NASDAQ Composite NASDAQ Computer NASDAQ Financial 100 NASDAQ Industrial NASDAQ Insurance NASDAQ Other Finance NASDAQ Telecommunications NASDAQ Transportation NASDAQ-100

2,317.61 2,201.67 3,781.59 1,801.04 2,772.01 3,413.78 5,862.45 5,189.25 240.81 2,778.81 3,230.30

KC COLLEGE

BSE V/S NASDAQ

31

Twenty Most Active by Dollar Volume

As of 9/27/2013 4:00:00 PM

Symbol Company Facebook, Inc. FB AAPL QQQ CSCO MSFT TSLA GOOG YHOO MU QCOM INTC CELG AMZN CMCSA PCLN EBAY NFLX CERN GILD FOXA Apple Inc. PowerShares QQQ Trust, Series 1 Cisco Systems, Inc. Microsoft Corporation Tesla Motors, Inc. Google Inc. Yahoo! Inc. Micron Technology, Inc. QUALCOMM Incorporated Intel Corporation Celgene Corporation Amazon.com, Inc. Comcast Corporation priceline.com Incorporated eBay Inc. Netflix, Inc. Cerner Corporation Gilead Sciences, Inc. Twenty-First Fox, Inc. Century Last Sale $ 51.24 $ 482.75 $ 79.07 $ 23.33 $ 33.27 $ 190.90 $ 876.39 $ 33.55 $ 17.62 $ 67.38 $ 22.98 $ 154.61 $ 316.01 $ 44.74 Dollar Volume $ 4,165,236,165 $ 3,927,596,070 $ 1,968,441,166 $ 1,923,565,429 $ 1,841,237,689 $ 1,129,756,318 $ 1,103,219,013 $ 1,066,326,696 $ 793,199,769 $ 731,086,206 $ 664,709,599 $ 648,518,912 $ 523,867,790 $ 480,834,157

$ 1,014.97 $ 454,268,093 $ 55.78 $ 312.40 $ 52.61 $ 63.54 $ 33.26 $ 403,203,499 $ 370,688,842 $ 360,562,740 $ 357,899,089 $ 331,160,973

KC COLLEGE

BSE V/S NASDAQ

32

American Depositary Receipt (ADR)

An American depositary receipt (ADR) is a negotiable security that represents securities of a non-US company that trades in the US financial markets. Securities of a foreign company that are represented by an ADR are called American depositary shares (ADSs). Shares of many non-US companies trade on US stock exchanges through ADRs. ADRs are denominated and pay dividends in US dollars and may be traded like regular shares of stock. Over-the-counter ADRs may only trade in extended hours. Indian American Deposit Receipts (ADRS)

This list gives you a Current Market Price (US $), Total Number of Shares (in Millions), Change (US $) and % Change

COMPANY

ADR ISSUE LOCAL Price PRICE PRICE (US$) (US$) (Rs) 38.6 31.8 31.7 48.7 0.5 2.2 1.8 12.0 27.6 10.6 10.0 59.4 11.0 17.0 7.5 12.0 0.4 13.4 0.0 41.2 2,411.4 609.8 923.3 3,006.4 15.8 NM NM 182.9 339.9 475.2

NO OF ADR Volume ADRs MKT CAP (m) (US$ m) 169.8 259.8 288.2 571.4 157.5 55.2 714.0 210.1 638.0 6,555.4 8,258.6 9,127.9 27,838.6 70.9 123.1 1,306.7 2,514.6 17,602.4 232043 784481 1927813 1547990 3350 41221 20875 455,919 1256335 963889

DR. REDDYS LAB(REDY) HDFC BANK(HDBK) ICICI BANK(ICBK) INFOSYS LTD(INFY) MTNL(MTNL) REDIFF.COM(REDF) SATYAMINFOWAY(SIFY) SESA STERLITE(SESA) TATA MOTORS(TELCO) WIPRO(WPRO)

2,450.0 26,043.5

KC COLLEGE

BSE V/S NASDAQ

33

Market Tiers

NASDAQ Capital Market Small Cap Nasdaq Capital Market is a equity market for companies that have relatively small levels of market capitalization. Listing requirements for such "small cap" companies are less stringent than for other Nasdaq markets that list larger companies with significantly higher market capitalization NASDAQ Global Market Mid Cap NASDAQ Global Market is made up of stocks that represent the Nasdaq Global Market. The NASDAQ Global Market consists of 1,450 stocks that meet Nasdaq's strict financial and liquidity requirements, and corporate governance standards. The Global Market is less exclusive than the Global Select Market NASDAQ Global Select Market Large Cap NASDAQ Global Select Market is a market capitalization-weighted index made up of U.S.-based and international stocks that represent the NASDAQ Global Select Market Composite. The NASDAQ Global Select Market consists of 1,200 stocks that meet Nasdaq's strict financial and liquidity requirements and corporate governance standards. The Global Market Select is more exclusive than the Global Market. Every October, the Nasdaq Listing Qualifications Department reviews the Global Market Composite to determine if any of its stocks have become eligible for listing on the Global Select Market.

Quote availability NASDAQ quotes are available at three levels:

Level 1 shows the highest bid and lowest offer inside quote. Level 2 shows all public quotes of market makers together with information of market dealers wishing to sell or buy stock and recently executed orders . Level 3 is used by the market makers and allows them to enter their quotes and execute orders

KC COLLEGE

BSE V/S NASDAQ

34

Hours Of Operation

Regular Trading Session Schedule The NASDAQ Stock Market Trading Sessions (Eastern Time) Pre-Market Trading Hours from 4:00 a.m. to 9:30 a.m. Market Hours from 9:30 a.m. to 4:00 p.m. After-Market Hours from 4:00 p.m. to 8:00 p.m. Quote and order-entry from 4:00 a.m. to 8:00 p.m. Quotes are open and firm from 4:00 a.m. to 8:00 p.m.

Financials The NASDAQ OMX Group, Inc. Consolidated Balance Sheets

(in million Dollars) December 31, 2012 (unaudited) 497 85 223 333 33 209 --112 1,492 25 211 294 5,335 1,650 125 $ 9,132

Assets Current assets: Cash and cash equivalents Restricted cash Financial investments, at fair value Receivables, net Deferred tax assets Default funds and margin deposits Open clearing contracts: Derivative positions, at fair value Resale agreements, at contract value Other current assets Total current assets Non-current restricted cash Property and equipment, net Non-current deferred tax assets Goodwill Intangible assets, net Other non-current assets Total assets

KC COLLEGE

BSE V/S NASDAQ

35

Liabilities Current liabilities: Accounts payable and accrued expenses Section 31 fees payable to SEC Accrued personnel costs Deferred revenue Other current liabilities Deferred tax liabilities Default funds and margin deposits Open clearing contracts: Derivative positions, at fair value Repurchase agreements, at contract value Current portion of debt obligations Total current liabilities Debt obligations Non-current deferred tax liabilities Non-current deferred revenue Other non-current liabilities Total liabilities Commitments and contingencies Equity NASDAQ OMX stockholders' equity: Common stock Additional paid-in capital Common stock in treasury, at cost Accumulated other comprehensive loss Retained earnings Total NASDAQ OMX stockholders' equity Noncontrolling interests Total equity Total liabilities and equity

172 97 111 139 119 35 209 --45 927 1,931 713 156 196 $ 3,923

2 3,771 (1,058) (185) 2,678 5,208 1 5,209 $ 9,132

KC COLLEGE

BSE V/S NASDAQ

36

Clearing and Settlement

For more than 30 years, DTCCs family of companies has helped automate, centralise, standardise and streamline processes that are critical to the safety and soundness of the capital markets. As a result, weve helped our customers increase their operational efficiency, reduce risk and lower cost. DTCC is a holding company established in 1999 to combine The Depository Trust Company (DTC) and National Securities Clearing Corporation (NSCC). Those companies, in turn, grew out of Wall Streets paperwork crisis in the late 1960s and early 1970s. Neither company, however, started out serving a national market. They were formed initially to handle clearing and immobilise securities solely for the New York Stock Exchange and American Stock Exchanges, and later on, Nasdaq. Clearing and settlement in the US was highly fragmented at the time. Regional markets, such as those in Boston, Philadelphia and Chicago, each maintained separate clearing and depository businesses. As trading volumes grew, customers became concerned about the high costs, inefficiencies, redundant systems and disparate processes, as well as the need to post collateral at each of the clearing companies.

The Depository Trust & Clearing Corporation DTCC, through its subsidiaries, provides clearing, settlement and information services for equities, corporate and municipal bonds, government and mortgagebacked securities, money market instruments and over-the-counter derivatives. In addition, DTCC is a leading processor of mutual funds and insurance transactions, linking funds and carriers with their distribution networks. DTCCs depository provides custody and asset servicing for 2.8 million securities issues from the United States and 107 other countries and territories, valued at $36 trillion. In 2006, DTCC settled more than $1.5 quadrillion in securities transactions. DTCC operates through five subsidiarieseach of which serves a specific segment and risk profile within the securities industry : National Securities Clearing Corporation (NSCC) The Depository Trust Company (DTC) Fixed Income Clearing Corporation (FICC) DTCC Deriv/SERV LLC DTCC Solutions LLC

KC COLLEGE

BSE V/S NASDAQ

37

DTCCs joint venture company, Omgeo, has 6,000 customers in 42 countries and plays a critical role in institutional post-trade processing, acting as a central information management and processing hub for brokers, investment managers and custodian banks.

What Markets Does DTCC Serve Today? A. Clearing and Settlement 1. Equities, Corporate and Municipal Bonds DTCCs subsidiary, National Securities Clearing Corporation (NSCC), established in 1976, provides clearing, settlement, risk management, central counterparty services and a guarantee of completion for virtually all broker-to-broker trades involving equities, corporate and municipal debt, American depositary receipts, exchangetraded funds, and unit investment trusts. NSCC also nets trades and payments among its participants, reducing the value of securities and payments that need to be exchanged by an average of 98% each day. NSCC generally clears and settles trades on a T+3 basis. Services available: Automated Customer Account Transfer Service (ACATS) Continuous Net Settlement (CNS) Custom Index Share Processing Inventory Management System Processing Trade Reporting and Confirmation Real-Time Trade Matching Reconfirmation and Pricing Service Settlement Services Stock Borrow Program 2. Government Securities The Government Securities Division (GSD) of the Fixed Income Clearing Corporation (FICC), a subsidiary of DTCC, provides real-time trade matching, clearing, risk management and netting for trades in US Government debt issues, including repurchase agreements or repos. Securities transactions processed by FICCs Government Securities Division include Treasury bills, bonds, notes, zerocoupon securities, government agency securities and inflation-indexed securities.

KC COLLEGE

BSE V/S NASDAQ

38

Services available: Auction Takedown Real-Time Trade Matching/RTTM Web Government Securities Net Settlement Services Fail Netting Repurchase (Repo) Agreement Processing General Collateral Finance Repo Services 3. Mortgage-Backed Securities The Mortgage-Back ed Securities Division of the Fixed Income Clearing Corporation, a subsidiary of DTCC, provides real-time automated and trade matching, trade confirmation, risk management, netting and electronic pool notification to the mortgage-backed securities market. Key participants in this market are mortgage originators, government-sponsored enterprises, registered broker/dealers, institutional investors, investment managers, mutual funds, commercial banks, insurance companies and other financial institutions. Services available: Real-Time Trade Matching Electronic Pool Notification Services Netting Services Mortgage-Backed Securities Clearing Services

Regulator

The Securities and Exchange Commission (SEC) is the principal regulatory agency that regulates and makes compliance issues for the securities industry. The primary mission of the Securities and Exchange Commission is to protect investors and maintain the integrity of the securities markets including primary market and secondary market. The Commission are appointed by the government and have overall responsibility to formulate securities legislation and and administer as well. Securities and Exchange Commission also monitors various important regulatory and compliance functions. The Securities and Exchange Commission also oversees other key participants in the securities market, including stock exchanges, broker-dealers, investment advisors, mutual funds, and asset management companies.

KC COLLEGE

BSE V/S NASDAQ

39

Functions of Securities and Exchange Commission

The main purpose of the Securities and Exchange Commission activity deals with disclosure of important financial information, enforcing the securities rules and regulations, and protecting individual as well as institutional investors who interact with these organizations. The major functions of the Securities and Exchange Commission are as follows:

To control the stock exchange or any other security market business. To determine and register the activities of stock broker, sub-broker, share transfer agent, issue bank of manager, trustee or trustee deed, issue registrar, underwriter, portfolio manager, investment advisor, or any other middle body related with the share market. To register any type of joint-stock scheme including mutual fund and monitor and control them. To develop, monitor and control security markets all authorized and self controlled bodies/ organizations. To develop investment-related knowledge and to arrange for training facilities for persons involved with security market. To control speculative business especially for securities. To control speculative business especially for securities. To take shares and stock of companies and control of companies. To inspect security dealers, issuer and stock exchange and ask to provide information, investigation and conduct audit. To analyse, discuss and conduct research any activity related with security. To disclose and preserve any information and data related with security market. These are the functions of SEC to develop the share market and protect the interest of the shareholders.

KC COLLEGE

BSE V/S NASDAQ

40

Mergers

The NASDAQ OMX Group, Inc. is an American multinational financial services corporation that owns and operates the NASDAQ stock market and eight European stock exchanges in the Nordic and Baltic regions and Armenia under the NASDAQ OMX banner Boston and Philadelphia Exchanges purchase On October 2, 2007, NASDAQ purchased the Boston Stock Exchange. On November 7, NASDAQ announced an agreement to purchase the Philadelphia Stock Exchange. OMX purchase On May 25, 2007, NASDAQ agreed to buy the Swedish-Finnish financial company that controls 7 Nordic and Baltic stock exchanges OMX for USD 3.7 billion to form NASDAQ OMX Group. As of February 27, 2008, the deal was completed. Acquisition of Thomson Reuters businesses On December 12, 2012, NASDAQ OMX announced that it would acquire Thomson Reuters' investor relations, public relations and multimedia businesses for $390 million in cash. NASDAQ OMX completed the purchase on June 3, 2013.

Additional Services

In January 2013, NASDAQ OMX announced that it would combine its global data products and index businesses into a unit called Global Information Services, as part of an ongoing effort to broaden its portfolio. On June 29, 2007, NASDAQ entered into an agreement to acquire DirectorsDesk.com, a management suite for Boards of Directors. GlobeNewswire (previously PrimeNewswire) provides press release, editing and wire services. It was founded in 1998 and acquired by NASDAQ OMX in 2006. On July 27, 2010, NASDAQ OMX Group, Inc. has signed an agreement to acquire SMARTS Group, the world-leading technology provider of market surveillance solutions to exchanges, regulators and brokers.

KC COLLEGE

BSE V/S NASDAQ

41

CORRELATION OF BSE & NASDAQ

Correlation Coefficent

Bse Sensex

Nasdaq Composite

Diversification

Very weak diversification Overlapping area represents amount of risk that can be diversified away by holding Nasdaq Composite Inde and BSE in the same portfolio assuming nothing else is changed

KC COLLEGE

BSE V/S NASDAQ

42

Correlation Coefficient

0.45

Parameters Time Period Direction Strength Accuracy Values 1 Month Positive Weak 84.21% Daily Returns

Given investment horizon of 30 days, Nasdaq Composite Index Tracking is expected to generate 0.29 times more return on investment than BSE. However, Nasdaq Composite Index Tracking is 3.42 times less risky than BSE. It trades about 0.62 of its potential returns per unit of risk. BSE is currently generating about 0.13 per unit of risk. If you would invest 14,237 in Nasdaq Composite Index Tracking on August 30, 2013 and sell it today you would earn a total of 669 from holding Nasdaq Composite Index Tracking or generate 4.7% return on investment over 30 days.

KC COLLEGE

BSE V/S NASDAQ

43

Factors Affecting Share Prices

1. Demand & Supply 2. Bank Rate 3. Speculative Pressure 4. Actions Of Underwriters and other Financial Institutions 5. Change in Companys Board Of Directors 6. Financial Position Of The Company 7. Trade Cycle 8. Political Factors 9. Sympathetic Factors. 10. Other Factors : 1. Unexpected Climatic Changes 2. Personal Health Of The Head Of The Government OR The Head Of The Company 3. Oil Prices In The International Market 4. Exchange Rate Fluctuations 5. Border Tension 6. Scams 7. Strikes and Lock-out Of The Company. 8. New Budget Proposals 9. Liberalisation & Privatisation Of The Company 10. Upgradation or Degradation Of Credit Rating

FOREIGN INSTITUTIONAL INVESTORS (FII) Foreign investment refers to investments made by residents of a country in another countrys financial assets and production processes. After the opening up of the borders for capital movement, foreign investments in India have grown enormously. It affects the productivity factor of the beneficiary or the receiver country and has the potential to create a ripple effect on the balance of payments of that country. In developing countries like India, foreign capital helps in increasing the productivity of labor and to build up foreign exchange reserves to meet the current account deficit. It provides a channel through which these countries can have access to foreign capital. Foreign investment can be of two forms: Foreign direct investment (FDI) and Foreign portfolio investment (FPI).FDI involves direct production activity and has a medium to long term investment plans. In contrast the FPI has a short term investment horizon. They mostly investment in the financial markets which consist of Foreign Institutional Investors (FIIs). They invest in domestic financial markets like money market, stock market, foreign exchange market etc.

KC COLLEGE

BSE V/S NASDAQ

44

Foreign institutional investors investments are volatile in nature, and they mostly invest in the emerging markets. They usually keep in mind the potential of a particular market to grow.

FII has lead a significant improvement in India relating to the flow of foreign capital during the period of post economic reforms. The inflow of FII investments has helped the stock market to raise at a greater height according to financial analysts. Sensex touched a new height. It crossed 10000-mark in January 2006, which was 8073 on November 2, 2005, and 9323 in December 2005.FII participation in the Indian stock market triggers its upward movement, but, at the same time, increased liquidity through FII investment inflow increases volatility too. FIIs IMPACT ON THE INDIAN ECONOMY. The Ashok Lahiri Committee Report on encouraging FII Flows (Ministry of Finance, the Government of India) mentions some reasons for the need of FII flows. FII flows supplement and augment domestic savings and domestic investment without increasing the foreign debt of our country. Capital inflows to the equity market increase stock prices lower the cost of equity capital and encourage investment by Indian firms. The Indian stock markets are both shallow and narrow and the movement of stocks depends on limited number of stocks. As FIIs purchases and sells these stocks there is a high degree of volatility in the stock markets. If any set of development encourages outflow of capital that will increase the vulnerability of the situation. The high degree of volatility can be attributed to the following reasons: The increase in investment by FIIs increases stock indices in turn increases the stock prices and encourages further investments. In this event when any correction takes place the stock prices declines and there will be full out by the FIIs in large number as earning per share declines. The FIIs manipulate the situation of boom in such a manner that they wait till the index raises up to a certain height and exit at an appropriate time. This tendency increases the volatility further.

So even though the portfolio investment by FIIs increases the flow of money in the economic system, it may create problems of inflation.

KC COLLEGE

BSE V/S NASDAQ

45

CORE EDUCATION The share price of CORE Education and Technologies Ltd almost halved on Wednesday to a four-year low for reasons that remain unclear. The stock on Monday shed as much as 62.4% to Rs.110.95 on BSE. It gained 0.81% on Tuesday but fell 46.1% to Rs.60.30 on Wednesday. The scrip has declined 81% since the beginning of the year and is 87% off its 52-week high of Rs.345 seen on 26 September. Promoters held 46.5% stake in the company on 31 December30.45% by Wisdom Global Enterprises Ltd and the rest by CORE Infrapower Ltd. Of the total promoter stake, 46.5% has been pledged. Due to a sudden pledge of stakes in the company it lead to a steep fall of the share price from Rs. 345 to Rs. 60 in just 3 days.

KC COLLEGE

BSE V/S NASDAQ

46

SCAM THE KETAN PAREKH SCAM

Ketan Parekh was a graduate from HR College and CA by profession. Ketan Parekhs scam was often referred to as the one -man army or Pentafour Bull. The 176-point Sensex crash on March 1, 2001 came as a major shock for the Government of India, the stock markets and the investors alike This sudden crash in the stock markets prompted the Securities Exchange Board of India (SEBI) to launch immediate investigations into the volatility of stock markets. The scam shook the investor's confidence in the overall functioning of the stock markets. By the end of March 2001, at least eight people were reported to have committed suicide and hundreds of investors were driven to the brink of bankruptcy. The first arrest in the scam was of the noted bull, Ketan Parekh (KP), on March 30, 2001, by the Central Bureau of Investigation (CBI). Soon, reports abounded as to how KP had single handedly caused one of the biggest scams in the history of Indian financial markets. He was charged with defrauding Bank of India (BoI) of about $30 million among other charges. KP's arrest was followed by yet another panic run on the bourses and the Sensex fell by 147 points. By this time, the scam had become the 'talk of the nation,' with intensive media coverage and unprecedented public outcry. Bank of India along with Punjab National Bank and SBI were at the receiving end. Madhavapura Bank and Classic Cooperative Bank are the others affected. Ketan Parekh owes around Rs1.3bn to the Bank of India KPs scam was one of the major scam in India after Harshad Mehta which lost the confidence of investors in investing in share market. KPs scam is also regarded as one mans army scam.

KC COLLEGE

BSE V/S NASDAQ

47

As we see the graph above, we can surely notice the downfall from 01/03/2001 where the market was trading around 4250 points and in just a matter of days it came down to 3550 points approximately .

KC COLLEGE

BSE V/S NASDAQ

48

Case Study The Subprime mortgage crisis

The U.S. subprime mortgage crisis was a set of events and conditions that led to a financial crisis and subsequent recession that began in 2008. It was characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages. These mortgage-backed securities (MBS) and collateralized debt obligations (CDO) initially offered attractive rates of return due to the higher interest rates on the mortgages; however, the lower credit quality ultimately caused massive defaults. Several major financial institutions collapsed in September 2008, with significant disruption in the flow of credit to businesses and consumers and the onset of a severe global recession. There were many causes of the crisis, with commentators assigning different levels of blame to financial institutions, regulators, credit agencies, government housing policies, and consumers, among others. A proximate cause was the rise in subprime lending. The percentage of lower-quality subprime mortgages originated during a given year rose from the historical 8% or lower range to approximately 20% from 2004 to 2006, with much higher ratios in some parts of the U.S. high percentage of these subprime mortgages, over 90% in 2006 for example, were adjustable-rate mortgages These two changes were part of a broader trend of lowered lending standards and higher-risk mortgage products. Further, U.S. households had become increasingly indebted, with the ratio of debt to disposable personal income rising from 77% in 1990 to 127% at the end of 2007, much of this increase mortgagerelated When U.S. home prices declined steeply after peaking in mid-2006, it became more difficult for borrowers to refinance their loans. As adjustable-rate mortgages began to reset at higher interest rates (causing higher monthly payments), mortgage delinquencies soared. Securities backed with mortgages, including subprime mortgages, widely held by financial firms globally, lost most of their value. Global investors also drastically reduced purchases of mortgage-backed debt and other securities as part of a decline in the capacity and willingness of the private financial system to support lending. Concerns about the soundness of U.S. credit and financial markets led to tightening credit around the world and slowing economic growth in the U.S. and Europe. The crisis had severe, long-lasting consequences for the U.S. and European economies. The U.S. entered a deep recession, with nearly 9 million jobs lost during 2008 and 2009, roughly 6% of the workforce. U.S. housing prices fell nearly 30% on average and the U.S. stock market fell approximately 50% by early 2009. As of early 2013, the U.S. stock market had recovered to its pre-crisis peak but housing prices remained near their low point and unemployment remained elevated. Economic growth remained below pre-crisis levels.

KC COLLEGE

BSE V/S NASDAQ

49

Impact in the U.S.

Between June 2007 and November 2008, Americans lost more than a quarter of their net worth.. Housing prices had dropped 20% from their 2006 peak, with futures markets signaling a 3035% potential drop. Total home equity in the United States, which was valued at $13 trillion at its peak in 2006, had dropped to $8.8 trillion by mid-2008 and was still falling in late 2008. Total retirement assets, Americans' second-largest household asset, dropped by 22 percent, from $10.3 trillion in 2006 to $8 trillion in mid-2008. During the same period, savings and investment assets (apart from retirement savings) lost $1.2 trillion and pension assets lost $1.3 trillion. Taken together, these losses total $8.3 trillion.

KC COLLEGE

BSE V/S NASDAQ

50

1. Impact on Gross Domestic Product Real gross domestic product (GDP) began contracting in the third quarter of 2008 and did not return to growth until Q1 2010. CBO estimated in February 2013 that real U.S. GDP remained 5.5% below its potential level, or about $850 billion. CBO projected that GDP would not return to its potential level until 2017. 2. Impact on Unemployment Rate The unemployment rate rose from 5% in 2008 pre-crisis to 10% by late 2009, then steadily declined to 7.6% by March 2013. The number of unemployed rose from approximately 7 million in 2008 pre-crisis to 15 million by 2009, then declined to 12 million by early 2013. 3. Impact on Residential Investments Residential private investment (mainly housing) fell from its 2006 pre-crisis peak of $800 billion, to $400 billion by mid-2009 and has remained depressed at that level. Non-residential investment (mainly business purchases of capital equipment) peaked at $1,700 billion in 2008 pre-crisis and fell to $1,300 billion in 2010, but by early 2013 had nearly recovered to this peak. 4. Impact on Housing Prices Housing prices fell approximately 30% on average from their mid-2006 peak to mid-2009 and remained at approximately that level as of March 2013. 5. Impact on Stock Markets Stock market prices, as measured by the S&P 500 index, fell 57% from their October 2007 peak of 1,565 to a trough of 676 in March 2009. Stock prices began a steady climb thereafter and returned to record levels by April 2013. 6. Impact on Non Profit Organisations The net worth of U.S. households and non-profit organizations fell from from a peak of approximately $67 trillion in 2007 to a trough of $52 trillion in 2009, a decline of $15 trillion or 22%. It began to recover thereafter and was $66 trillion by Q3 2012.

KC COLLEGE

BSE V/S NASDAQ

51