Documentos de Académico

Documentos de Profesional

Documentos de Cultura

10120130406024

Cargado por

IAEME PublicationDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

10120130406024

Cargado por

IAEME PublicationCopyright:

Formatos disponibles

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), INTERNATIONAL JOURNAL OF MANAGEMENT (IJM) Volume

e 4, Issue 6, November - December (2013)

ISSN 0976-6502 (Print) ISSN 0976-6510 (Online) Volume 4, Issue 6, November - December (2013), pp. 192-197 IAEME: www.iaeme.com/ijm.asp Journal Impact Factor (2013): 6.9071 (Calculated by GISI) www.jifactor.com

IJM

IAEME

A STUDY OF CUSTOMERS PREFERENCE TOWARDS VARIOUS MUTUAL FUND SCHEMES IN THANE CITY

Prof. (Mrs.) SHRADDHA MAYURESH BHOME Asst. Professor, VPMs Joshi-Bedekar College, Thane, Maharashtra, Affiliated To University of Mumbai

ABSTRACT A Mutual fund is the dynamic investment vehicle for todays complex and modern financial scenario. We have seen the growing importance of mutual fund investment in India, when compared with other financial instruments. Investments in mutual funds are safer and also yields more returns due to proper portfolio management by the fund manager. Mutual fund are said to be the best channels for mobilizing the funds of the small investors an contribute significantly to the capital markets. The present study explains briefly about the mutual fund industry. The study also helps to understand the role of investment pattern and preferences of investors behind investing in mutual fund. In this paper, the impacts of various demographic factors on investors attitude towards mutual fund have been studied. For measuring various phenomena and analyzing the collected data effectively and efficiently for drawing sound conclusions, Chi-square test has been used and for analyzing the various factors responsible for investment in mutual funds Key Words: Mutual Fund, Investors Preferences, Chi-Square Test. INTRODUCTION A mutual is a set up in the form of trust, which has sponsor, trustee, assets management company (AMC) and custodian. Sponsor is the person who acts alone or in combination with another body corporate and establishes a mutual fund. Sponsor must contribute at least 40% of the net worth of the investment managed and meet the eligibility criteria prescribed under the Securities and Exchange Board of India (Mutual Funds) regulations, 1996. The sponsor is not responsible or liable for any loss or shortfall resulting from the operation of the schemes beyond the initial contribution made by it towards setting up of Mutual Fund. The Mutual Fund is constituted as a trust in accordance with the provisions of the Indian Trusts Act, 1882 by the Sponsor. Trustee is usually a company (corporate body) or a board of trustees (body of individuals). The main responsibility of the trustee is to safeguard the interest of the unit holders and

192

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), Volume 4, Issue 6, November - December (2013)

also ensure that AMC functions in the interest of investors and in accordance with the Securities and Exchange Board of India (Mutual Fund) Regulations 1996 the provisions of the Trust deed and the offer Document of the respective schemes. The AMC is appointed by the Trustees as the investment Manager of the Mutual Fund. The AMC is required to be approved by SEBI to act as an asset management company of the Mutual Fund. The AMC if so authorized by the Trust Deed appoints the Registrar and Transfer Agent to agent the mutual fund. The registrar processes the application form, redemption requests and dispatches account statements to the unit holders. The Registrar and Transfer agent also handles communications with investors and updates investor records. Among various financial instruments, i.e., shares, bonds and debentures. Mutual Fund is a special type of financial instrument that pools the funds of investors who seek to maximize ROI. Stocks provide high total returns with commensurate level of risk, while bonds may provide lower risks along with regular income. MFs presently offer a variety of options to investors such as income, balanced, liquid, gilt, index, exchange traded and sectoral funds. Today, there are 36 asset management companies covering Indian public sector, private sector and joint ventures with foreign players. These 36 mutual fund houses put together mobilized about Rs 6, 70,937 Cores worth assets. The total resources mobilized by the private sector institutions is 91.04%, Public sectors institutions other than UTI is 8.49%. The variation occurred in mobilization of funds during various periods is very high with Private sector participations followed by the public sector excluding UTI, and by UTI. There is considerable competition between foreign and domestic owned bodies and within domestic owned bodies. OBJECTIVES 1. To study the impact of various demographic factors on investors attitude towards mutual fund. 2. To analyze the investors awareness and perception regarding Mutual fund investment. 3. To find preference of investors about different investment avenue. REVIEW OF LITERATURE 1. Madhusudhan V Jambodekar (1996) conducted a study to assess the awareness of MFs among investors, to identify the information sources influencing the buying decision and the factors influencing the choice of a particular fund. The study reveals among other things that Income Schemes and Open Ended Schemes are more preferred than Growth Schemes and Close Ended Schemes during the then prevalent market conditions. Investors look for safety of Principal, Liquidity and Capital appreciation in the order of importance; Newspapers and Magazines are the first source of information through which investors get to know about MFs/Schemes and investor service is a major differentiating factor in the selection of Mutual Fund Schemes. 2. SEBI NCAER Survey (2000) was carried out to estimate the number of households and the population of individual investors, their economic and demographic profile, portfolio size, and investment preference for equity as well as other savings instruments. This is a unique and comprehensive study of Indian Investors, for; data was collected from 3,00,0000 geographically dispersed rural and urban households. Some of the relevant findings of the study are: Households preference for instruments match their risk perception; Bank Deposit has an appeal across all income class; 43% of the non-investor households equivalent to around 60 million households (estimated) apparently lack awareness about stock markets; and, compared with low income groups, the higher income groups have higher share of investments in Mutual Funds (MFs).

193

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), Volume 4, Issue 6, November - December (2013)

3. Desigan et al (2006) conducted a study on women investors perception towards investment and found that women investors basically are indecisive in investing in mutual funds due to various reasons like lack of knowledge about the investment protection and their various investment procedures, market fluctuations, various risks associated with investment, assessment of investment and redressal of grievances regarding their various investment related problems. Savings is a habit specially embodied into women. Even in the past, when women mainly depended on their spouses income, they used to save to meet emergencies as well as for future activities. In those days, women did not have any awareness about various investment outlets. But as time passed, the scenario has totally changed. 4. Ramamurthy and Reddy (2005) conducted a study to analyze recent trends in the mutual fund industry and draw a conclusion that the main benefits for small investors due to efficient management, diversification of investment, easy administration, nice return potential, liquidity, transparency, flexibility, affordability, wide range of choices and a proper regulation governed by SEBI. The study also analyzed about recent trends in mutual fund industry like various exit and entry policies of mutual fund companies, various schemes related to real estate, commodity, bullion and precious metals, entering of banking sector in mutual fund, buying and selling of mutual funds through online. LIMITATIONS 1. Sample size was limited to 100 because of limited time which is small to represent the whole population. 2. The research was limited to Thane city only and if the same research would have been carried in another city, the results may vary. 3. Sometimes the respondents because of their business didnt able to concentrate while filling up the questions. However the researcher tried her level best to overcome the limitation. RESEARCH METHODOLOGY The study is basically an analytical study based on primary research as well as also related to the analysis of the attitude of investors towards mutual funds. In order to conduct this study, 100 investors in Thane city of Maharashtra state have been selected by simple random sampling method. The structured questionnaire was prepared for collecting the data. All the data required for this analytical study has been obtained mainly from primary sources, but at times, secondary sources of data have also been considered. The data collection method used to obtain the desired information from primary sources has been through direct interview and questionnaire has been used as an instrument. For measuring various phenomena and analyzing the collected data effectively and efficiently to draw sound conclusions, Chi-square test for testing of hypothesis has been used and for analyzing the various factors responsible for investment in mutual funds. Chi- Square test of goodness of fit has been used. It is a powerful test for testing the significance of the discrepancy between theory and experiment as given by Karl Pearson. HYPOTHESIS 1. 2. 3. 4. There is no association between age and the attitude towards mutual funds. There is no association between gender and the attitude towards mutual funds. There is no association between income and the attitude towards mutual funds. There is no association between educational qualification and the attitude towards mutual funds.

194

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), Volume 4, Issue 6, November - December (2013)

ANALYSIS AND INTERPRETATION

TABLE 1: ASSOCIATION BETWEEN AGE OF RESPONDENTS AND ATTITUDE TOWARDS MUTUAL FUND AGE POSITIVE NEUTRAL NEGATIVE TOTAL 20-35 YEARS 18 21 03 42 35-50 YEARS 12 19 17 48 50- ABOVE 02 05 03 10 TOTAL 32 49 19 100 Expected frequencies: 13 15 21 24 8 9

3 5 2 0.055892 5.99

calculated chi square= tabulated chi-square df=2*1 5% level

Accept the null hypothesis as calculated chi square is less than tabulated. S0, there is association between age and investment preference of mutual fund. The people of younger age have more preference for investment in mutual funds schemes.

TABLE 2: ASSOCIATION BETWEEN GENDER OF RESPONDENTS AND ATTITUDE TOWARDS MUTUAL FUND GENDER POSITIVE NEUTRAL NEGATIVE TOTAL MALE 28 25 05 58 FEMALE 04 24 14 42 TOTAL 32 49 19 100 4.02308E-05 5.99

18.56 13.44

28.42 20.58

11.02 7.98

calculated chi square= tabulated chisquare df=2*1 5% level

Accept the null hypothesis as calculated chi square is less than tabulated. There are females who are not in favour of investment in mutual funds than males. So, gender have problem in investing in mutual funds schemes.

195

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), Volume 4, Issue 6, November - December (2013)

TABLE 3: ASSOCIATION BETWEEN LEVEL OF INCOME OF RESPONDENTS AND ATTITUDE TOWARDS MUTUAL FUND INCOME LEVEL (MONTHLY) POSITIVE NEUTRAL NEGATIVE TOTAL UPTO RS.20000/08 13 05 26 RS. 20000 TO 18 26 07 51 RS.30000 RS. 30000/- AND 06 10 07 23 ABOVE TOTAL 32 49 19 100 calculated chi square= 0.565199138

tabulated chi square df=2*1 5% level 5.99

The people in the mid income group which is Rs.20000- to Rs.30000/- p.m. are in favour of investment in mutual funds.

TABLE 4: ASSOCIATION BETWEEN LEVEL OF EDUCATION OF RESPONDENTS AND ATTITUDE TOWARDS MUTUAL FUND EDUCATION POSITIVE NEUTRAL NEGATIVE TOTAL LEVEL UNDERGRADUATE 04 05 03 12 GRADUATE 02 05 08 15 POST GRADUATE 21 14 05 40 DOCTORATE 05 25 03 33 TOTAL 32 49 19 100

3.84 4.8

5.88 3.75

2.28 2.85

calculated chi square = 6.30186E-05 tabulated chisquare df=2*1

12.8 10.56

19.6 16.17

7.6 6.27

5% level

5.99

The people who are post-graduates are in more favour of investment in mutual funds. So, accept the null hypothesis which is there is association between level of education as well as preference towards investment in mutual funds.

196

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), Volume 4, Issue 6, November - December (2013)

SUGGESTIONS 1. The investors should go for various schemes in mutual fund as Better Avenue of investment. 2. Mutual fund companies also should go for effective marketing of their product and must emphasis on portfolio management concept. 3. Mutual funds are dynamic investment avenue which should be treated for all age groups. REFERENCES 1. Vidya Shankar, S., "Mutual Funds - Emerging Trends in India", Chartered Secretary, Vol.20, No.8, 1990, 639-640. 2. Shankar, V., (1996), "Retailing Mutual Funds: A consumer product model, The Hindu, 24 July, 26. 3. Citing Website, Association of Mutual Funds in India 4. Ramamurthy, B. M. and Reddy, S. (2005), Recent Trends in Mutual Fund Industry, SCMS Journal of Indian Management, Vol. 2, No. 3, pp.69-76. | 6. 5. Badla, B S., and Garg, A. (2007), Performance of Mutual Funds in India - An Empirical Study of Growth Schemes, GITAM Journal of Management, Vo1. 5, No.4, pp.29-43 6. King, J.S. (2002), Mutual Funds: Investment of Choice for Individual Investors? Review of Business, Vol.23, No.3, pp.35-39. 7. Prof. Abdul Noor Basha and G.V.satya sekhar, A Critical View of Undisclosed Facts of Disclosed Fact Sheets: A Case Study of Benchmarking of Mutual Funds, International Journal of Management (IJM), Volume 1, Issue 2, 2010, pp. 44 - 52, ISSN Print: 0976-6502, ISSN Online: 0976-6510. 8. A.Vennila and Dr. R. Nandhagopal, Study on Performance Evaluation of Mutual Fund Schemes in India During Pre-Recession, Recession and Post-Recession Period, International Journal of Management (IJM), Volume 3, Issue 1, 2012, pp. 126 - 134, ISSN Print: 0976-6502, ISSN Online: 0976-6510. 9. Dr. K. Rakesh and V S M Srinivas, Understanding Individual Investors Investment Behavior in Mutual Funds (A Study on Investors of North Coastal Andhra Pradesh), International Journal of Management (IJM), Volume 4, Issue 3, 2013, pp. 185 - 198, ISSN Print: 0976-6502, ISSN Online: 0976-6510. 10. Sindhu.K.P and Dr. S.Rajitha Kumar, Influence of Characteristics of Mutual Funds on Investment Decisions A Study, International Journal of Management (IJM), Volume 4, Issue 5, 2013, pp. 103 - 108, ISSN Print: 0976-6502, ISSN Online: 0976-6510.

197

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2102)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- A Study On The Reasons For Transgender To Become EntrepreneursDocumento7 páginasA Study On The Reasons For Transgender To Become EntrepreneursIAEME PublicationAún no hay calificaciones

- Voice Based Atm For Visually Impaired Using ArduinoDocumento7 páginasVoice Based Atm For Visually Impaired Using ArduinoIAEME PublicationAún no hay calificaciones

- Determinants Affecting The User's Intention To Use Mobile Banking ApplicationsDocumento8 páginasDeterminants Affecting The User's Intention To Use Mobile Banking ApplicationsIAEME PublicationAún no hay calificaciones

- Analyse The User Predilection On Gpay and Phonepe For Digital TransactionsDocumento7 páginasAnalyse The User Predilection On Gpay and Phonepe For Digital TransactionsIAEME PublicationAún no hay calificaciones

- Impact of Emotional Intelligence On Human Resource Management Practices Among The Remote Working It EmployeesDocumento10 páginasImpact of Emotional Intelligence On Human Resource Management Practices Among The Remote Working It EmployeesIAEME PublicationAún no hay calificaciones

- Visualising Aging Parents & Their Close Carers Life Journey in Aging EconomyDocumento4 páginasVisualising Aging Parents & Their Close Carers Life Journey in Aging EconomyIAEME PublicationAún no hay calificaciones

- Broad Unexposed Skills of Transgender EntrepreneursDocumento8 páginasBroad Unexposed Skills of Transgender EntrepreneursIAEME PublicationAún no hay calificaciones

- Modeling and Analysis of Surface Roughness and White Later Thickness in Wire-Electric Discharge Turning Process Through Response Surface MethodologyDocumento14 páginasModeling and Analysis of Surface Roughness and White Later Thickness in Wire-Electric Discharge Turning Process Through Response Surface MethodologyIAEME PublicationAún no hay calificaciones

- A Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaDocumento9 páginasA Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaIAEME PublicationAún no hay calificaciones

- Influence of Talent Management Practices On Organizational Performance A Study With Reference To It Sector in ChennaiDocumento16 páginasInfluence of Talent Management Practices On Organizational Performance A Study With Reference To It Sector in ChennaiIAEME PublicationAún no hay calificaciones

- A Study On The Impact of Organizational Culture On The Effectiveness of Performance Management Systems in Healthcare Organizations at ThanjavurDocumento7 páginasA Study On The Impact of Organizational Culture On The Effectiveness of Performance Management Systems in Healthcare Organizations at ThanjavurIAEME PublicationAún no hay calificaciones

- Gandhi On Non-Violent PoliceDocumento8 páginasGandhi On Non-Violent PoliceIAEME PublicationAún no hay calificaciones

- A Study On Talent Management and Its Impact On Employee Retention in Selected It Organizations in ChennaiDocumento16 páginasA Study On Talent Management and Its Impact On Employee Retention in Selected It Organizations in ChennaiIAEME PublicationAún no hay calificaciones

- Attrition in The It Industry During Covid-19 Pandemic: Linking Emotional Intelligence and Talent Management ProcessesDocumento15 páginasAttrition in The It Industry During Covid-19 Pandemic: Linking Emotional Intelligence and Talent Management ProcessesIAEME PublicationAún no hay calificaciones

- Application of Frugal Approach For Productivity Improvement - A Case Study of Mahindra and Mahindra LTDDocumento19 páginasApplication of Frugal Approach For Productivity Improvement - A Case Study of Mahindra and Mahindra LTDIAEME PublicationAún no hay calificaciones

- Optimal Reconfiguration of Power Distribution Radial Network Using Hybrid Meta-Heuristic AlgorithmsDocumento13 páginasOptimal Reconfiguration of Power Distribution Radial Network Using Hybrid Meta-Heuristic AlgorithmsIAEME PublicationAún no hay calificaciones

- A Multiple - Channel Queuing Models On Fuzzy EnvironmentDocumento13 páginasA Multiple - Channel Queuing Models On Fuzzy EnvironmentIAEME PublicationAún no hay calificaciones

- Role of Social Entrepreneurship in Rural Development of India - Problems and ChallengesDocumento18 páginasRole of Social Entrepreneurship in Rural Development of India - Problems and ChallengesIAEME PublicationAún no hay calificaciones

- EXPERIMENTAL STUDY OF MECHANICAL AND TRIBOLOGICAL RELATION OF NYLON/BaSO4 POLYMER COMPOSITESDocumento9 páginasEXPERIMENTAL STUDY OF MECHANICAL AND TRIBOLOGICAL RELATION OF NYLON/BaSO4 POLYMER COMPOSITESIAEME PublicationAún no hay calificaciones

- Various Fuzzy Numbers and Their Various Ranking ApproachesDocumento10 páginasVarious Fuzzy Numbers and Their Various Ranking ApproachesIAEME PublicationAún no hay calificaciones

- Knowledge Self-Efficacy and Research Collaboration Towards Knowledge Sharing: The Moderating Effect of Employee CommitmentDocumento8 páginasKnowledge Self-Efficacy and Research Collaboration Towards Knowledge Sharing: The Moderating Effect of Employee CommitmentIAEME PublicationAún no hay calificaciones

- A Proficient Minimum-Routine Reliable Recovery Line Accumulation Scheme For Non-Deterministic Mobile Distributed FrameworksDocumento10 páginasA Proficient Minimum-Routine Reliable Recovery Line Accumulation Scheme For Non-Deterministic Mobile Distributed FrameworksIAEME PublicationAún no hay calificaciones

- Dealing With Recurrent Terminates in Orchestrated Reliable Recovery Line Accumulation Algorithms For Faulttolerant Mobile Distributed SystemsDocumento8 páginasDealing With Recurrent Terminates in Orchestrated Reliable Recovery Line Accumulation Algorithms For Faulttolerant Mobile Distributed SystemsIAEME PublicationAún no hay calificaciones

- Financial Literacy On Investment Performance: The Mediating Effect of Big-Five Personality Traits ModelDocumento9 páginasFinancial Literacy On Investment Performance: The Mediating Effect of Big-Five Personality Traits ModelIAEME PublicationAún no hay calificaciones

- Prediction of Average Total Project Duration Using Artificial Neural Networks, Fuzzy Logic, and Regression ModelsDocumento13 páginasPrediction of Average Total Project Duration Using Artificial Neural Networks, Fuzzy Logic, and Regression ModelsIAEME PublicationAún no hay calificaciones

- Analysis of Fuzzy Inference System Based Interline Power Flow Controller For Power System With Wind Energy Conversion System During Faulted ConditionsDocumento13 páginasAnalysis of Fuzzy Inference System Based Interline Power Flow Controller For Power System With Wind Energy Conversion System During Faulted ConditionsIAEME PublicationAún no hay calificaciones

- Quality of Work-Life On Employee Retention and Job Satisfaction: The Moderating Role of Job PerformanceDocumento7 páginasQuality of Work-Life On Employee Retention and Job Satisfaction: The Moderating Role of Job PerformanceIAEME PublicationAún no hay calificaciones

- Moderating Effect of Job Satisfaction On Turnover Intention and Stress Burnout Among Employees in The Information Technology SectorDocumento7 páginasModerating Effect of Job Satisfaction On Turnover Intention and Stress Burnout Among Employees in The Information Technology SectorIAEME PublicationAún no hay calificaciones

- A Review of Particle Swarm Optimization (Pso) AlgorithmDocumento26 páginasA Review of Particle Swarm Optimization (Pso) AlgorithmIAEME PublicationAún no hay calificaciones

- Analysis On Machine Cell Recognition and Detaching From Neural SystemsDocumento9 páginasAnalysis On Machine Cell Recognition and Detaching From Neural SystemsIAEME PublicationAún no hay calificaciones

- Full Download Social Psychology Myers 10th Edition Test Bank PDF Full ChapterDocumento36 páginasFull Download Social Psychology Myers 10th Edition Test Bank PDF Full Chapterallanpittmanqihu100% (13)

- 26th Kerala Science CongressDocumento1 página26th Kerala Science CongresskrishnaprasadpsAún no hay calificaciones

- Marketing ManagementDocumento84 páginasMarketing ManagementPY SorianoAún no hay calificaciones

- Media Multitasking: The Impacts of Media Multitasking On Children's Learning & DevelopmentDocumento36 páginasMedia Multitasking: The Impacts of Media Multitasking On Children's Learning & DevelopmentDerek E. Baird100% (1)

- Wa0001.Documento59 páginasWa0001.raguvaranm2001Aún no hay calificaciones

- Article Review Assignment IDocumento3 páginasArticle Review Assignment Iyemisrach fikiruAún no hay calificaciones

- Investigating The Level of Responsiveness of Vernacular Architecture To The Needs of Citizens in Sari, IranDocumento13 páginasInvestigating The Level of Responsiveness of Vernacular Architecture To The Needs of Citizens in Sari, IranHarshita BhanawatAún no hay calificaciones

- Philippine College of Science and Technology: Writing Research ProposalDocumento7 páginasPhilippine College of Science and Technology: Writing Research ProposalCharo GironellaAún no hay calificaciones

- Dr. Maria Asuncion Laxa BersabalDocumento11 páginasDr. Maria Asuncion Laxa BersabalFrancis ButalAún no hay calificaciones

- Ass #1 Ced 232Documento5 páginasAss #1 Ced 232Koolet GalAún no hay calificaciones

- Assignment 1.: Erm 101 Research MethodologyDocumento7 páginasAssignment 1.: Erm 101 Research MethodologyjohnAún no hay calificaciones

- Determination of Thermal Properties of Roxul Mineral Wool For Fire Modeling Purposes - Master's Thesis WaterlooDocumento99 páginasDetermination of Thermal Properties of Roxul Mineral Wool For Fire Modeling Purposes - Master's Thesis Waterloofire-1Aún no hay calificaciones

- Chaudhary Charan Singh University, MeerutDocumento1 páginaChaudhary Charan Singh University, MeerutSuhailTomarAún no hay calificaciones

- AIU Recognised Boards and UniversitiesDocumento179 páginasAIU Recognised Boards and Universitiesvicky611Aún no hay calificaciones

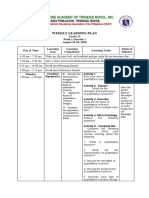

- St. Isidore Academy of Trinidad Bohol, Inc.: Weekly Learning PlanDocumento2 páginasSt. Isidore Academy of Trinidad Bohol, Inc.: Weekly Learning PlanSarah Mae AventuradoAún no hay calificaciones

- What Is Quantitative ResearchDocumento2 páginasWhat Is Quantitative ResearchmegumiAún no hay calificaciones

- AAA Ethics BlogDocumento12 páginasAAA Ethics Blogbluesapphire18Aún no hay calificaciones

- 2007 IJSE AppendixDocumento54 páginas2007 IJSE AppendixPaul NerAún no hay calificaciones

- Special Services For Construction ProjectsDocumento5 páginasSpecial Services For Construction ProjectsCha PaineAún no hay calificaciones

- Module 2 SH 004Documento11 páginasModule 2 SH 004vency amandoronAún no hay calificaciones

- Slide Seminar Online STK UDSDocumento60 páginasSlide Seminar Online STK UDSDicky KurniawanAún no hay calificaciones

- Critical Factors and Results of Quality Management - An Empirical StudyDocumento29 páginasCritical Factors and Results of Quality Management - An Empirical StudyKule89Aún no hay calificaciones

- Validated MatrixDocumento8 páginasValidated MatrixAndres MatawaranAún no hay calificaciones

- TFNDocumento83 páginasTFNDarlene TrinidadAún no hay calificaciones

- Metaphors of Memory A History of Ideas About The M PDFDocumento3 páginasMetaphors of Memory A History of Ideas About The M PDFStefany GuerraAún no hay calificaciones

- Value-Based Learning Healthcare Systems - Integrative Modeling and Simulation (2019, The Institution of Engineering and Technology) - LibDocumento377 páginasValue-Based Learning Healthcare Systems - Integrative Modeling and Simulation (2019, The Institution of Engineering and Technology) - LibkedwinAún no hay calificaciones

- Jumlah DAN Lama Paparan Debu Akrilik Pada Pembuatan Peranti Ortodonti LepasanDocumento9 páginasJumlah DAN Lama Paparan Debu Akrilik Pada Pembuatan Peranti Ortodonti LepasanNurlina NurdinAún no hay calificaciones

- Assignment NDP QuestionIndividual 1Documento6 páginasAssignment NDP QuestionIndividual 1Deeq HuseenAún no hay calificaciones

- NURS3003 Sem 1 Qualitative CA Marking GuideDocumento2 páginasNURS3003 Sem 1 Qualitative CA Marking Guidexue ZhangAún no hay calificaciones

- M&D OutlineDocumento6 páginasM&D Outlineyared100% (1)