Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Finance

Cargado por

muneerpp0 calificaciones0% encontró este documento útil (0 votos)

34 vistas4 páginasRisk arises in the investment evaluation because the forecasts of cash flows can go wrong. Statistical techniques are used to measure and incorporate risk in capital budgeting. O decision tree analysis provides a way to represent different possibilities.

Descripción original:

Título original

Finance (11)

Derechos de autor

© Attribution Non-Commercial (BY-NC)

Formatos disponibles

PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoRisk arises in the investment evaluation because the forecasts of cash flows can go wrong. Statistical techniques are used to measure and incorporate risk in capital budgeting. O decision tree analysis provides a way to represent different possibilities.

Copyright:

Attribution Non-Commercial (BY-NC)

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

34 vistas4 páginasFinance

Cargado por

muneerppRisk arises in the investment evaluation because the forecasts of cash flows can go wrong. Statistical techniques are used to measure and incorporate risk in capital budgeting. O decision tree analysis provides a way to represent different possibilities.

Copyright:

Attribution Non-Commercial (BY-NC)

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

Está en la página 1de 4

Ø Risk arises in the investment evaluation because the forecasts of cash flows can

go wrong. Risk can be defined as variability of returns (NPV or IRR) of an

investment project.

Ø Decision-makers in practice may handle risk in conventional ways. For

example, they may use a shorter payback period, or use conservative forecasts of

cash flows, or discount net cash flows at the risk-adjusted discount rates.

Statistical techniques are used to measure and incorporate risk in capital

budgeting. Two important statistics in this regard are the expected monetary

value and standard deviation.

Ø Expected Monetary Value is the weighted average of returns where

probabilities of possible outcomes are used as weights.

Ø Sensitivity Analysis It is a method of analysing change in the project’s NPV

for a given change in one variable at a time. It helps in asking “what if”

questions and calculates NPV under different assumptions.

Ø Scenario Analysis considers a few combinations of variables and calculates

NPV for each of them. It is a usual practice to calculate NPV under normal,

optimistic or pessimistic scenario.

Ø Sensitivity or scenario analysis forces the decision-maker to identify underlying

variables, indicates critical variables and helps in strengthening the project by

pointing out its weak links. Its limitations are that it cannot handle a large

number of interdependent variables and at times, fails to give unambiguous

results.

Ø Simulation Analysis The analyst specifies probability distributions for

variables and computer generates several hundred scenarios, probability

distribution for the project’s NPV along with the expected NPV and standard

deviation. It overcomes the limitations of sensitivity or scenario analysis.

Ø Decision Tree Analysis Another technique of resolving risk in capital

budgeting, particularly when the sequential decision-making is involved, is the

decision tree analysis. The decision tree provides a way to represent different

possibilities so that we can be sure that the decisions we make today, taking

proper account of what we can do in the future.

To draw a decision tree, branches from points marked with squares are used to

denote different possible decisions, and branches from points marked with

circles denote different possible outcomes. In a decision tree analysis, one has to

work out the best decisions at the second stage before one can choose the best

first stage decision.

Decision trees are valuable because they display links between today’s and

tomorrow’s decisions. Further, the decision-maker explicitly considers various

assumptions underlying the decision. The use of decision tree is, however,

limited because it can become complicated.

Ø Utility Theory One important theory, which provides insight into risk handling

in capital budgeting, is the utility theory. It aims at including a decision-maker’s

risk preferences explicitly into the capital expenditure decision. The underlying

principle is that an investor prefers a higher return to a lower return, and that

each successive identical increment of money is worth less to him than the

preceding one. The decision-maker’s utility function is derived to determine the

decision’s utility value.

The direct use of the utility theory in capital budgeting is not common. It is very

difficult to specify utility function in practice. Even if it is possible to derive

utility function, it does not remain constant over time. Problems are also

encountered when decision is taken by group of people. Individuals differ in their

risk preferences.

También podría gustarte

- The Emerging Global EconomyDocumento18 páginasThe Emerging Global EconomymuneerppAún no hay calificaciones

- Balance of PaymentDocumento12 páginasBalance of PaymentmuneerppAún no hay calificaciones

- The Indian Trademark Act 1999 ShamcDocumento1 páginaThe Indian Trademark Act 1999 ShamcmuneerppAún no hay calificaciones

- The World Is NOT EnoughDocumento43 páginasThe World Is NOT EnoughmuneerppAún no hay calificaciones

- 2 Module 4Documento23 páginas2 Module 4muneerppAún no hay calificaciones

- Mod 2 CultureiiDocumento14 páginasMod 2 CultureiimuneerppAún no hay calificaciones

- Module 1 GlobalizationDocumento24 páginasModule 1 Globalizationmuneerpp0% (1)

- Module 6 - Multinational CorporationsDocumento31 páginasModule 6 - Multinational CorporationsmuneerppAún no hay calificaciones

- Module 5 Regional IntegrationsDocumento40 páginasModule 5 Regional IntegrationsmuneerppAún no hay calificaciones

- Mod 2 CultureDocumento48 páginasMod 2 CulturemuneerppAún no hay calificaciones

- Module 1Documento33 páginasModule 1muneerppAún no hay calificaciones

- Vinoth Roll 60Documento3 páginasVinoth Roll 60muneerppAún no hay calificaciones

- Module 4Documento17 páginasModule 4muneerppAún no hay calificaciones

- Mod 2 - Political EconomyDocumento51 páginasMod 2 - Political Economymuneerpp100% (1)

- Macro Policies in Develop Ping CountriesDocumento62 páginasMacro Policies in Develop Ping CountriesmuneerppAún no hay calificaciones

- ICC PresentationDocumento48 páginasICC PresentationmuneerppAún no hay calificaciones

- Secondary Datya Chap 7Documento19 páginasSecondary Datya Chap 7muneerppAún no hay calificaciones

- Chapter 03.MrmDocumento21 páginasChapter 03.MrmmuneerppAún no hay calificaciones

- Research DesignDocumento7 páginasResearch DesignmuneerppAún no hay calificaciones

- RM - Multivariate AnalysisDocumento19 páginasRM - Multivariate AnalysismuneerppAún no hay calificaciones

- Unit 3Documento2 páginasUnit 3muneerppAún no hay calificaciones

- Multivariate Analysis (MVA) Is Based On The Statistical Principle ofDocumento5 páginasMultivariate Analysis (MVA) Is Based On The Statistical Principle ofmuneerppAún no hay calificaciones

- Strate MGTDocumento1 páginaStrate MGTmuneerppAún no hay calificaciones

- Report WritingDocumento27 páginasReport WritingmuneerppAún no hay calificaciones

- R.design Chap 5Documento24 páginasR.design Chap 5muneerppAún no hay calificaciones

- Reliability and Validity ExamplesDocumento3 páginasReliability and Validity ExamplesmuneerppAún no hay calificaciones

- Prob. Id-3Documento28 páginasProb. Id-3muneerppAún no hay calificaciones

- Primary - Qualitative Chap 8Documento29 páginasPrimary - Qualitative Chap 8muneerppAún no hay calificaciones

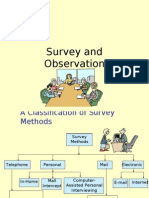

- Primary - Survey Chap-9Documento23 páginasPrimary - Survey Chap-9muneerppAún no hay calificaciones

- Newppt RMDocumento56 páginasNewppt RMmuneerppAún no hay calificaciones

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Causal Inference For The Brave and True - Causal Inference For The Brave and TrueDocumento2 páginasCausal Inference For The Brave and True - Causal Inference For The Brave and TrueVkook ForeverAún no hay calificaciones

- Decision Tree Classifier On Private DataDocumento8 páginasDecision Tree Classifier On Private DataBianca RodriguesAún no hay calificaciones

- Writing and Reporting For The Media Workbook 12Th Edition Full ChapterDocumento32 páginasWriting and Reporting For The Media Workbook 12Th Edition Full Chapterdorothy.todd224100% (23)

- Porter's Five Forces: Submitted by Subham Chakraborty PGDMDocumento5 páginasPorter's Five Forces: Submitted by Subham Chakraborty PGDMSubham ChakrabortyAún no hay calificaciones

- Service Manual 900 OG Factory 16V M85-M93Documento572 páginasService Manual 900 OG Factory 16V M85-M93Sting Eyes100% (1)

- Drilling RisersDocumento13 páginasDrilling Risersadvantage025Aún no hay calificaciones

- IQ, OQ, PQ: A Quick Guide To Process ValidationDocumento9 páginasIQ, OQ, PQ: A Quick Guide To Process ValidationGonzalo MazaAún no hay calificaciones

- General Chemistry 2 - LAS 2 LEARNING CAPSULEDocumento5 páginasGeneral Chemistry 2 - LAS 2 LEARNING CAPSULEMark RazAún no hay calificaciones

- Logisitim CircuitDocumento7 páginasLogisitim CircuitDragos ManoleaAún no hay calificaciones

- Functional Molecular Engineering Hierarchical Pore-Interface Based On TD-Kinetic Synergy Strategy For Efficient CO2 Capture and SeparationDocumento10 páginasFunctional Molecular Engineering Hierarchical Pore-Interface Based On TD-Kinetic Synergy Strategy For Efficient CO2 Capture and SeparationAnanthakishnanAún no hay calificaciones

- Design of A Neural Network Function Block For Insertion Into The Function Block Library of A Programmable Logic ControllerDocumento4 páginasDesign of A Neural Network Function Block For Insertion Into The Function Block Library of A Programmable Logic ControllerArmando Fermin PerezAún no hay calificaciones

- The Stress Relief PrescriptionDocumento8 páginasThe Stress Relief PrescriptionRajesh KumarAún no hay calificaciones

- Rosalind FranklinDocumento1 páginaRosalind FranklinMichael SmithAún no hay calificaciones

- MMA Electrode ClassificationDocumento3 páginasMMA Electrode ClassificationRathnakrajaAún no hay calificaciones

- Event Rulebook Authorsgate 3.0 IEEE SB KUETDocumento9 páginasEvent Rulebook Authorsgate 3.0 IEEE SB KUETKUET²⁰²¹Aún no hay calificaciones

- Template Project Overview StatementDocumento4 páginasTemplate Project Overview StatementArdan ArasAún no hay calificaciones

- Advantages and Disadvantages of Social MediaDocumento2 páginasAdvantages and Disadvantages of Social MediaCeleste GalvanAún no hay calificaciones

- 20752-Reservoir Management Training An Lntegrated ApproachDocumento6 páginas20752-Reservoir Management Training An Lntegrated ApproachdanonninoAún no hay calificaciones

- Beamware 2: Users ManualDocumento14 páginasBeamware 2: Users ManualAdi FaizinAún no hay calificaciones

- Adruino LCD, Test CodeDocumento20 páginasAdruino LCD, Test CodeDaniel Evans100% (1)

- Large Generator Protection enDocumento14 páginasLarge Generator Protection enNguyen Xuan TungAún no hay calificaciones

- FormatCARS KAAUH Alqahtani 106Documento8 páginasFormatCARS KAAUH Alqahtani 106ZEYNOAún no hay calificaciones

- AS-9100-Rev-D Internal-Audit-Checklist SampleDocumento4 páginasAS-9100-Rev-D Internal-Audit-Checklist Samplesaifulramli69Aún no hay calificaciones

- Map Book 4Documento58 páginasMap Book 4executive engineerAún no hay calificaciones

- t640 - Parts CatalogDocumento69 páginast640 - Parts CatalogSattittecInfomáticaAún no hay calificaciones

- Sample Quiz OM Chapter2Documento2 páginasSample Quiz OM Chapter2Patleen Monica MicuaAún no hay calificaciones

- Transmission Line Surge Impedance Loading ExplainedDocumento3 páginasTransmission Line Surge Impedance Loading ExplainedviksoniAún no hay calificaciones

- "Smart Attendance Using F Ttendance Management Using Face Recognition" Anagement SystemDocumento13 páginas"Smart Attendance Using F Ttendance Management Using Face Recognition" Anagement Systemamer HAún no hay calificaciones

- Introspective Hypnosis Class - 052017 - Antonio Sangio (2745)Documento62 páginasIntrospective Hypnosis Class - 052017 - Antonio Sangio (2745)sandra100% (4)

- Temp Gradient For Warping Stress in Rigid PavementDocumento9 páginasTemp Gradient For Warping Stress in Rigid PavementAmul KotharkarAún no hay calificaciones