Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Volume 9 Highlights: Inside

Cargado por

dpbasicTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Volume 9 Highlights: Inside

Cargado por

dpbasicCopyright:

Formatos disponibles

November 18, 2013

Report prepared by: Ryan Lewenza, CFA, CMT North America Equity Strategist

Volume 9 Highlights

Following the significant technical breakout of the S&P/TSX Composite Index (S&P/TSX), the S&P/TSX has been backing and filling as it works off its overbought technical condition. With the S&P/TSX currently at 13,334, we see the potential for a modest pullback to between 13,166 and 13,020, where 13,166 equates to a 38.2% retracement of its recent move and 13,020 being the 50-day MA. Overall, we expect a near-term consolidation/pullback, but given the technical breakout above key resistance of 12,900, we believe the outlook for the S&P/TSX has greatly improved. The Reuters/Jefferies CRB Index remains in a clear long-term downtrend and is trading below its declining 50- and 200-day MAs. The index recently sold-off and broke below short-term support of 275.54. We believe a central factor in the weakness was due to a recent surge in the U.S. Dollar Index, which rallied last week on the strong October U.S. nonfarm payrolls number. The CRB Index is now oversold and as such, could lead to a short-term oversold bounce in commodity prices. However, with the trend clearly down, we expect the CRB Index to retest the June 2012 lows of 267. Despite increased chatter from some pundits that the market looks toppy, the short-, intermediate- and long-term trends for the S&P 500 Index (S&P 500) are upward and very bullish, in our opinion. We are bullish on the U.S. financials sector, particularly on the U.S. life insurance industry. Given the strong price and relative trends we would recommend increasing exposure to U.S. lifecos on weakness. In this weeks report, we highlight Valeant Pharmaceuticals International Inc. (VRX-T), Kohls Corp (KSS-N) and Regions Financial Corp. (RF-N) as attractive technical buy candidates.

Inside

Technical Commentary (Pages 2 9) Technical Almanac Trading Ideas (Pages 10 12) Relative Strength Analysis (Pages 13 16) Sentiment Indicators (Page 17) Overbought/Oversold Stocks (Page 18) Market Statistics (Page 19)

Chart of the Week U.S. Lifecos Breakout to New Highs

This Document is for distribution to Canadian clients only. Please refer to Appendix A in this report for important information.

The Technical Take

November 18, 2013

Technical Commentary

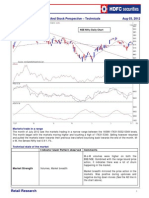

S&P/TSX Composite Index

Following the significant technical breakout of the S&P/TSX Composite Index (S&P/TSX) above the key 12,900 level, the S&P/TSX has been backing and filling as it works off its overbought technical condition. Momentum has begun to weaken, illustrated by the MACD beginning to rollover (red circle). With the S&P/TSX still technically overbought, currently 5.3% above its 200-day moving average (MA), the highest level since March 2013, and momentum rolling over, we see the potential for some near-term, downward pressure. With the S&P/TSX currently at 13,334, we see the potential for a modest pullback to between 13,166 and 13,020, where 13,166 equates to a 38.2% retracement of its recent move and 13,020 being the 50-day MA. One bullish, near-term observation is the developing flag pattern, which if the S&P/TSX were to breakout to the upside would have a measuring implication of 793 points, or 14,264 on the S&P/TSX, based on the length of flagpole. However, under this scenario, the S&P/TSX would have to break above next key resistance of 13,516 which marks the July 2011 highs. Overall, we expect a near-term consolidation/pullback, but given the technical breakout above key resistance of 12,900, we believe the outlook for the S&P/TSX has greatly improved, and see additional upside into the seasonally strong October to April period. Page 2

The Technical Take

November 18, 2013

Canadian Sector Highlights

Name S&P/TSX INFO TECH INDEX S&P/TSX MATERIALS INDEX S&P/TSX TELECOM SERV IDX S&P/TSX FINANCIALS INDEX S&P/TSX INDUSTRIALS IDX S&P/TSX COMPOSITE INDEX S&P/TSX CONS DISCRET IDX S&P/TSX CONS STAPLES IDX S&P/TSX ENERGY INDEX S&P/TSX UTILITIES INDEX S&P/TSX HEALTH CARE IDX Last Price 137.93 2107.36 1153.23 2046.30 1935.94 13326.04 1458.35 2600.03 2805.49 1775.69 1421.16 50 DMA 136.18 2150.25 1112.04 1954.64 1799.22 13008.94 1411.73 2533.82 2802.51 1760.26 1425.75 Trend of 50 DMA Uptrend Downtrend Uptrend Uptrend Uptrend Uptrend Uptrend Uptrend Uptrend Uptrend Downtrend 200 DMA 129.71 2320.68 1116.71 1857.39 1707.90 12653.17 1277.20 2376.26 2736.16 1849.69 1240.13 Trend of 200 DMA Uptrend Downtrend Uptrend Uptrend Uptrend Uptrend Uptrend Uptrend Uptrend Downtrend Uptrend RSI Market Ranking of Weekly Momentum 14 Day Condition Current 2 3 4 5 57.72 Neutral 1 10 11 11 2 45.33 Neutral 2 11 1 1 11 65.49 Neutral 3 5 5 7 1 82.23 Overbought 4 2 7 3 5 78.23 Overbought 5 3 2 9 4 59.67 Neutral 6 6 4 5 9 63.71 Neutral 7 1 6 10 8 57.81 Neutral 8 4 8 8 3 44.77 Neutral 9 7 10 6 7 43.25 Neutral 10 8 3 4 6 46.87 Neutral 11 9 9 2 10 6 8 11 10 6 2 7 3 4 9 5 1

Source: Bloomberg Finance L.P. As at November 13, 2013.

Weekly Momentum: The information technology, materials and telecommunication services sectors outperformed last week, while the energy, utilities and health care sectors underperformed the broader market. The materials sector has shown improvement lately but performance has been mixed, with the sector vacillating between the best and worst performing sector over the last six weeks. The industrials and financials sectors continue to trade well, with the sectors consistently near the top of the sector rankings over the last six weeks. Market Condition: Given the continued strength in the industrials and financials sectors, they are now overbought with Relative Strength Index (RSI) levels above 70. Other: With the recent strength in the telecommunications services sector, it is now trading back above its 200-day MA. The utilities and materials sectors remain below their respective 200-day MAs.

Page 3

The Technical Take

November 18, 2013

Reuters/Jefferies CRB Index

The S&P/TSX is heavily weighted in resources and as such, commodity prices are incredibly important to the performance of the Canadian equity market. On that front, we see little to get excited about and one reason why we continue to prefer U.S. equities. The Reuters/Jefferies CRB Index remains in a clear long-term downtrend, and is trading below its declining 50- and 200-day MAs. The index recently sold-off and broke below short-term support of 275.54. We believe a central factor in the weakness was due to a recent surge in the U.S. Dollar Index, which rallied on the strong October U.S. nonfarm payrolls number. As seen in the lower panel, the CRB index is generally negatively correlated with the U.S. Dollar Index, and with the recent strength in the U.S. Dollar Index, the current weakness in the CRB Index should not be a surprise. The CRB index is now oversold and as such, we could see a short-term oversold bounce in commodity prices; however, with the trend clearly down, we expect the CRB index to retest the June 2012 lows of 267. To become more constructive on commodity prices, we would need to see the CRB Index break above its downtrend and 200-day MA, which converge around the 290 level. Page 4

The Technical Take

November 18, 2013

S&P 500 Index

Despite increased chatter from some pundits that the market looks toppy, the short -, intermediate- and long-term trends for the S&P 500 Index (S&P 500) are upward and very bullish, in our opinion. Since the November lows, the S&P 500 has traded in a strong, upward channel and remains above its rising 50and 200-day MAs. In the short term, we note that: 1) the daily MACD indicator appears to be rolling over; 2) the relative uptrend of the small-cap Russell 2000 Index versus the S&P 500 was recently broken; and 3) investor sentiment remains overly bullish. Considering these factors, we see the potential for further near-term pressure, with the S&P 500 possibly retesting its rising 50-day MA, which currently intersects at 1,718. A decisive break below this level would likely cause us to take a more cautious view on U.S. equity markets. Outside of the potential for some short-term backing and filling, we remain bullish on U.S. equities, and with the markets entering its strong seasonal period of October to April, we see the potential for further gains.

Page 5

The Technical Take

November 18, 2013

U.S. Sector Highlights

Name S&P 500 MATERIALS INDEX S&P 500 FINANCIALS INDEX S&P 500 ENERGY INDEX S&P 500 INFO TECH INDEX S&P 500 INDUSTRIALS IDX S&P 500 INDEX S&P 500 CONS STAPLES IDX S&P 500 HEALTH CARE IDX S&P 500 CONS DISCRET IDX S&P 500 UTILITIES INDEX S&P 500 TELECOM SERV IDX Last Price 50 DMA 277.53 269.97 278.17 274.25 629.63 617.76 550.90 529.33 427.57 408.06 1767.69 1715.69 438.53 422.75 616.13 598.28 501.30 485.95 195.63 192.76 156.82 153.43 Trend of 50 DMA 200 DMA Uptrend 254.83 Uptrend 261.46 Uptrend 594.59 Uptrend 502.33 Uptrend 379.64 Uptrend 1633.18 Uptrend 415.38 Uptrend 561.30 Uptrend 450.22 Uptrend 194.42 Uptrend 156.83 Trend of 200 DMA Uptrend Uptrend Uptrend Uptrend Uptrend Uptrend Uptrend Uptrend Uptrend Uptrend Downtrend RSI 14 Day 57.78 52.33 53.46 66.15 68.22 59.77 61.59 60.40 57.79 49.16 51.38 Market Ranking of Weekly Momentum Condition Current 2 3 4 5 Neutral 1 11 4 7 10 Neutral 2 10 11 2 4 Neutral 3 8 10 4 7 Neutral 4 6 8 6 8 Neutral 5 4 1 10 3 Neutral 6 7 7 5 6 Neutral 7 2 6 9 2 Neutral 8 3 9 3 9 Neutral 9 5 3 8 11 Neutral 10 9 2 11 1 Neutral 11 1 5 1 5 6 2 5 4 6 10 7 11 1 3 9 8

Source: Bloomberg Finance L.P. As at November 13, 2013.

Weekly Momentum: The cyclical sectors outperformed last week with the materials, financials, energy and information technology sectors posting the strongest returns. Conversely, the utilities and telecommunication services sectors underperformed last week on the back of higher interest rates following the better-than-expected nonfarm payrolls release. Financials, which have been weak recently, showed improved performance last week on the back of the strong October U.S. nonfarm payrolls number. We view the financials sector as a key leading sector and we prefer to see it leading the market, rather than lagging, which has been the case in recent weeks. Market Condition: All sectors are neutrally ranked, with RSI readings between 30 and 70. Other: The telecommunication service sector is the only sector trading below its 200-day MA.

Page 6

The Technical Take

November 18, 2013

Dow Jones U.S. Life Insurance Index

We are bullish on the U.S. financials sector, particularly on the U.S. life insurance industry. The Dow Jones U.S. Life Insurance Index remains in a strong uptrend, currently above its rising 50- and 200-day MAs. The index recently broke above short-term resistance, making a new high. The sector has exhibited strong relative strength since May, outperforming the market and more importantly, continuing to outperform the financials sector. Stocks that we like technically include: Prudential Financial Inc. (PRU-N), Aflac Incorporated (AFL-N) and Metlife Inc. (MET-N). Given the strong price and relative trends we would recommend increasing exposure to U.S. lifecos on weakness.

Page 7

The Technical Take

November 18, 2013

Intermarket Picture

U.S. Dollar Index The U.S. Dollar Index reversed its recent weakness, with the U.S. dollar rallying on the better-thanexpected U.S. nonfarm payrolls release. A stronger jobs market increases the odds that the U.S. Federal Reserve (Fed) could begin to taper its asset purchases, hence the recent strength. We continue to believe the reduction of asset purchases will occur in Q1/14, which we believe would be bullish for the U.S. dollar. As such, we see the U.S. Dollar Index gaining in 2014, but see it more range-bound over the next few months. The U.S. Dollar Index is currently finding resistance at the 100-day MA at 81.44. A break above this level could result in he U.S. Dollar Index rallying back up to its resistance in the 82.50 to 83.50 range.

U.S. 10-Year Treasury Yield We correctly called for a bounce in the 10-year Treasury yield in our November 4 report when we stated that momentum (MACD) remains weak but could soon bottom. If this plays out, we expect to see the 10year mover higher in the short term, possibly back up to its 50-day MA, currently at 2.71%. The 10-year Treasury yield bounced off support at 2.46%, and is quickly approaching resistance. We continue to see the 10-year Treasury yield as range-bound over the next few months, but see it moving higher in 2014 on the back of the expected Fed taper. Page 8

th

The Technical Take

November 18, 2013

Gold The gold price found resistance at its short-term downtrend and 50-day MA, and is now retesting short-term support around US$1,250-1,260/oz. With the gold price at a technical support level and nearing an oversold condition, we expect a short-term bounce soon. However, if the downtrend persists, the gold price should be capped in the US$1,325/oz to US$1,345/oz range, which is the convergence of the 50-day MA and the short-term downtrend. We continue to believe gold prices will trade range-bound between US$1,180/oz and US$1,480/oz. on an intermediate basis.

West Texas Intermediate (WTI) Oil Oil prices remain under pressure, with WTI oil now trading at its uptrend support line at US$92.50/bl. With WTI oil technically oversold and at trend support, we see the potential for a short-term trading bounce. Resistance comes in at $US98/bl. which is the convergence of the 200-day MA and previous resistance. If WTI oil is unable to hold trend support, we could see it retest key support in the mid-$80s/bl. Page 9

The Technical Take

November 18, 2013

Technical Almanac Trading Ideas

Valeant Pharmaceuticals International lnc. Published November 6, 2013

VRX has been a stand-out performer in 2013, with the stock up 92% year-to-date. Despite the strong gains, we see the potential for further upside in the stock. VRX is trading in a solid uptrend, and above its 50- and 200-day moving averages (MA). On recent pullbacks, VRX has bounced off its 50-day MA, which is a sign of technical strength. This occurred last week after the company reported revenues that missed the consensus estimate and lowered earnings guidance. Investors quickly sold the stock on the news, but it recovered by the end of the day. When stocks rally in the face of negative news, it is a sign of technical strength. Finally, we note that VRXs relative strength remains strong, as it cont inues to outperform the market. While we see the potential for further upside, we would employ a stop loss just below $100, which was the August low.

Page 10

The Technical Take

November 18, 2013

Kohls Corp (KSS-N) Published November 8, 2013

We are highlighting the technical breakout of Kohls Corp. from our breakout/breakdown model*. KSS has consistently underperformed over the last few years and traded in a range between roughly $41 and $54. However, with the recent break above key technical resistance of $54, we believe KSS technical prof ile has improved and see the stock in a new higher trading range. Following the breakout, KSS became technically overbought with a Relative Strength Index (RSI) reading above 70. Additionally, its MACD indicator looks elevated and could roll over in the short term. As such, the stock could encounter some backing and filling in the near term. In light of KSS break above four-year resistance, we believe the stock is now in a new higher trading range, and would buy it on any weakness. We would employ a stop loss of $49, which is just below its rising 200-day moving average (MA).

NOTE: *Our technical breakout/breakdown model is based on a weekly screen of the S&P 500 and S&P/TSX Composite for stocks making a new high/low over the last 90 days on volume greater than +1 standard deviation from the 90-day average volume.

Page 11

The Technical Take

November 18, 2013

Regions Financial Corp. (RF-N) Published November 13, 2013

U.S. regional banks rallied on Friday, as the 10-year U.S. Treasury yield moved higher and yield curve steepened following the better-than-expected October U.S. nonfarm payrolls number. A steeper yield curve could provide a boost to banks profitability, which is what precipitated the breakout in regional banks. We have been bullish on U.S. regional banks for some time and highlighted Keycorp (KEY-N) on March 8, 2013 (up 30% since then) and Huntington Banchares Inc. (HABN-Q) on July 5, 2103 (up 6.5% since then). Today we are highlighting Regions Financial Corp. (RF-N) as an attractive technical buy candidate. RF is trading in a solid uptrend and above its rising 200-day moving average (MA). Since its July high, the share price has been trending lower, but we believe the stock is forming a symmetrical triangle and could breakout. Often when stocks breakout from triangles, it is in the direction of its previous trend, which in RFs case suggests the next move could be upward. We see the potential for further upside, but recommend investors employ a stop loss below the 200-day MA around $9.

Page 12

The Technical Take

November 18, 2013

Relative Strength Analysis

S&P 500

Cyclicals

13NOV10 - 13NOV13

0.295

S&P 500 CONS DISCRET IDX Relative to S&P 500

13MAY13 - 13NOV13

0.292

S&P 500 CONS DISCRET IDX Relative to S&P 500

0.261

0.282

The consumer discretionary sector remains in a longterm relative uptrend.

0.227 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.271 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

0.37 S&P 500 INFO TECH INDEX Relative to S&P 500

0.32

S&P 500 INFO TECH INDEX Relative to S&P 500

0.33

0.31

The information technology sector broke its intermediate downtrend and is trading range-bound in the short-term.

Oct 13 Nov 13

0.30 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.30 May 13

Jun 13

Jul 13

Aug 13

Sep 13

0.25 S&P 500 INDUSTRIALS IDX Relative to S&P 500

0.25 S&P 500 INDUSTRIALS IDX Relative to S&P 500

0.24

0.24

The industrial sectors long-term downtrend has recently been broken, due to its improving short-term trends.

Oct 13 Nov 13

0.22 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.23 May 13

Jun 13

Jul 13

Aug 13

Sep 13

0.20 S&P 500 MATERIALS INDEX Relative to S&P 500

0.16 S&P 500 MATERIALS INDEX Relative to S&P 500

0.17

0.16

The materials sector remains in a longterm relative downtrend. Improving on a shortterm basis.

0.15 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.15 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

0.46 S&P 500 ENERGY INDEX Relative to S&P 500

0.38 S&P 500 ENERGY INDEX Relative to S&P 500

0.41

0.37

The energy sector remains in a longterm relative downtrend. Short-term trend is range-bound.

0.35 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.36 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

Source: Bloomberg Finance L.P. As at November 13, 2013

Page 13

The Technical Take

November 18, 2013

Defensives

13NOV10 - 13NOV13

0.28 S&P 500 CONS STAPLES IDX Relative to S&P 500 0.27 S&P 500 CONS STAPLES IDX Relative to S&P 500

13MAY13 - 13NOV13

The consumer staples sector broke its long-term support. The sectors shortterm downtrend may be reversing.

0.26

0.25

0.23 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.24 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

0.18 S&P 500 FINANCIALS INDEX Relative to S&P 500

0.17 S&P 500 FINANCIALS INDEX Relative to S&P 500

The financial sectors long-term uptrend is under pressure. The sector is making new short-term relative lows. reversed.

0.16

0.16

0.14 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.16 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

0.37 S&P 500 HEALTH CARE IDX Relative to S&P 500

0.36 S&P 500 HEALTH CARE IDX Relative to S&P 500

The health care sector remains in a long-term uptrend. The health care sector is our preferred defensive sector.

0.32

0.35

0.28 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.34 May 13 0.10

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

0.12 S&P 500 TELECOM SERV IDX Relative to S&P 500

S&P 500 TELECOM SERV IDX Relative to S&P 500

0.10

0.10

The telecom sector recently made new long-term relative lows. Short-term trend remains weak.

0.09 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.09 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

0.16 S&P 500 UTILITIES INDEX Relative to S&P 500

0.13 S&P 500 UTILITIES INDEX Relative to S&P 500

The utilities sector is making new longterm relative lows. The sectors shortterm trend remains weak.

0.13

0.12

0.11 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.11 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

Source: Bloomberg Finance L.P. As at November 13, 2013

Page 14

The Technical Take

November 18, 2013

S&P/TSX Composite

Cyclicals

13NOV10 - 13NOV13

0.113

S&P/TSX CONS DISCRET IDX Relative to S&P/TSX Comp

13MAY13 - 13NOV13

0.112

S&P/TSX CONS DISCRET IDX Relative to S&P/TSX Comp

0.092

0.105

The consumer discretionary sector remains in a longand short-term relative uptrend.

0.071 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.099 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

0.02 S&P/TSX INFO TECH INDEX Relative to S&P/TSX Comp

0.01

S&P/TSX INFO TECH INDEX Relative to S&P/TSX Comp

0.01

0.01

The information technology sectors longer-term trend is improving. The sector is trading range-bound in the short-term. The industrial sectors long-term trend is bullish. The industrials sector is one of our preferred sectors.

0.01 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.01 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

0.15 S&P/TSX INDUSTRIALS IDX Relative to S&P/TSX Comp

0.15 S&P/TSX INDUSTRIALS IDX Relative to S&P/TSX Comp

0.12

0.14

0.10 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.13 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

0.34 S&P/TSX MATERIALS INDEX Relative to S&P/TSX Comp

0.19 S&P/TSX MATERIALS INDEX Relative to S&P/TSX Comp

0.25

0.18

The materials sectors trend is weak on a long- and shortterm basis.

0.16 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.16 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

0.25 S&P/TSX ENERGY INDEX Relative to S&P/TSX Comp

0.23 S&P/TSX ENERGY INDEX Relative to S&P/TSX Comp

The energy sector broke its long-term downtrend in June. The sector was improving on a shortterm basis, but recently has begun to weaken again.

0.23

0.22

0.21 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.21 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

Source: Bloomberg Finance L.P. As at November 13, 2013

Page 15

The Technical Take

November 18, 2013

Defensives

13NOV10 - 13NOV13

0.21 S&P/TSX CONS STAPLES IDX Relative to S&P/TSX Comp 0.21 S&P/TSX CONS STAPLES IDX Relative to S&P/TSX Comp

13MAY13 - 13NOV13

0.17

0.20

The consumer staples sectors longrelative trend is positive. Short-term trend is neutral.

0.12 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.18 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

0.16 S&P/TSX FINANCIALS INDEX Relative to S&P/TSX Comp

0.16 S&P/TSX FINANCIALS INDEX Relative to S&P/TSX Comp

The financial sector remains in a longterm relative uptrend. The sector is reaching new relative highs in the shortterm.

0.14

0.15

0.12 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.14 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

0.12 S&P/TSX HEALTH CARE IDX Relative to S&P/TSX Comp

0.12 S&P/TSX HEALTH CARE IDX Relative to S&P/TSX Comp

The health care sector remains in a long-term uptrend. Short-term uptrend is under pressure.

0.08

0.10

0.03 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.09 May 13 0.10

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

0.10 S&P/TSX TELECOM SERV IDX Relative to S&P/TSX Comp

S&P/TSX TELECOM SERV IDX Relative to S&P/TSX Comp

The telecom sectors long-term relative trend is neutral. Short-term trend is improving.

0.08

0.09

0.06 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.08 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

0.18 S&P/TSX UTILITIES INDEX Relative to S&P/TSX Comp

0.16 S&P/TSX UTILITIES INDEX Relative to S&P/TSX Comp

The utilities sector continues to make new relative lows.

0.15

0.15

0.13 Nov 10

May 11

Nov 11

May 12

Nov 12

May 13

0.13 May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov 13

Source: Bloomberg Finance L.P. As at November 13, 2013

Page 16

The Technical Take

November 18, 2013

Sentiment Indicators

Volatility (VIX) Index

30 1.5

CBOE Total Put/Call Ratio 5-Day MA

1.4 1.3 1.2

25

The VIX remains low capturing a complacent market.

Put/Call ratio is low in the 0.80 to 0.90 range.

20

1.1 1.0

15

0.9 10

0.8 0.7 5 Jan-12 Apr-12 0.6 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 CBOE Put/Call Level 0.87 1 M Ago 1.11 3 M Ago 1.00

Jul-12

Oct-12 Jan-13 Apr-13

Jul-13

Oct-13

VIX

Level 12.82

1 M Ago 15.72

3 M Ago 12.31

AAII Investor Sentiment: Bulls Minus Bears

60 50 40 30 20 10 0 -10 -20 -30 -40 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13

NYSE % of Stocks Above 200-day MA

100 90 80 70

Investor sentiment is overly bullish.

60

50

40

30

20

10

0 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13

Bulls Bears Bulls - Bears

Level 45.48 21.81 23.67

1 M Ago 37.84 30.07 7.77

3 M Ago 35.62 25.00 10.62

% of Stocks Above 200-day MA

Level 68

1 M Ago 70

3 M Ago 73

Source: Bloomberg Finance L.P. As at November 13, 2013

Page 17

The Technical Take

November 18, 2013

Overbought/Oversold Stocks

S&P 500

Most Overbought Name SOUTHWEST AIRLINES CO PERRIGO CO FOREST LABORATORIES INC CARDINAL HEALTH INC LORILLARD INC EXPEDIA INC AMERISOURCEBERGEN CORP NORDSTROM INC JOHNSON CONTROLS INC CR BARD INC HEWLETT-PACKARD CO INTUIT INC ROSS STORES INC TEXTRON INC UNITED PARCEL SERVICE-CL B

Source: Bloomberg Finance L.P. As at November 13, 2013

RSI (14D) 82.41 81.88 78.07 76.64 75.86 75.33 75.15 74.86 74.68 74.56 74.54 74.20 73.83 73.08 72.46

Most Oversold Name JDS UNIPHASE CORP FMC TECHNOLOGIES INC EDWARDS LIFESCIENCES CORP AVON PRODUCTS INC APARTMENT INVT & MGMT CO -A HEALTH CARE REIT INC WPX ENERGY INC VENTAS INC MEADWESTVACO CORP PLUM CREEK TIMBER CO PUBLIC STORAGE HCP INC CABLEVISION SYSTEMS-NY GRP-A AVALONBAY COMMUNITIES INC EQUITY RESIDENTIAL

RSI (14D) 25.99 28.08 28.46 28.88 28.89 30.42 31.53 32.16 33.07 33.24 33.51 33.87 33.97 34.59 35.44

S&P/TSX Composite

Most Overbought Name PETROMINERALES LTD GENIVAR INC THOMSON REUTERS CORP CAN IMPERIAL BK OF COMMERCE BANK OF NOVA SCOTIA TORONTO-DOMINION BANK WESTSHORE TERMINALS INVESTME HOME CAPITAL GROUP INC GENWORTH MI CANADA INC GREAT-WEST LIFECO INC POWER FINANCIAL CORP CANADIAN PACIFIC RAILWAY LTD SUN LIFE FINANCIAL INC NORTH WEST CO INC/THE NATIONAL BANK OF CANADA

Source: Bloomberg Finance L.P. As at November 13, 2013

RSI (14D) 82.78 76.33 76.45 78.94 76.97 75.58 58.18 56.88 77.61 69.95 77.68 73.52 73.97 56.70 82.97

Most Oversold Name CANEXUS CORP PENN WEST PETROLEUM LTD ATLANTIC POWER CORP WESTPORT INNOVATIONS INC DETOUR GOLD CORP BLACKBERRY LTD CENTERRA GOLD INC MANITOBA TELECOM SVCS INC PACIFIC RUBIALES ENERGY CORP COMINAR REAL ESTATE INV-TR U DUNDEE INTERNATIONAL REAL ES REITMANS (CANADA) LTD-A MEG ENERGY CORP PRETIUM RESOURCES INC DOREL INDUSTRIES-CL B

RSI (14D) 14.34 22.18 23.42 25.14 26.08 27.07 27.13 27.55 27.66 28.47 28.79 29.52 29.69 30.15 31.05

Page 18

The Technical Take

November 18, 2013

Market Statistics

Region U.S. Index S&P 500 Dow Jones Industrial Average Dow Jones Transportation Dow Jones Utilities Nasdaq Composite Russell 2000 Russell 1000 Value Russell 1000 Growth S&P/TSX Composite S&P/TSX 60 S&P/TSX Smallcap S&P/TSX Venture DAX FTSE 100 Nikkei 225 Hang Seng Shanghai MSCI World MSCI EAFE MSCI Emerging Markets Consumer Discretionary Comsumer Staples Energy Financials Health care Industrials Information Technology Materials Telecommunications Utilities Consumer Discretionary Comsumer Staples Energy Financials Health care Industrials Information Technology Materials Telecommunications Utilities Last 1771.89 15783.10 7049.62 502.04 3919.79 1101.50 894.17 821.85 13358.39 769.41 589.84 935.36 9076.48 6726.79 14588.68 22901.41 2126.77 1600.84 1855.51 283.01 502.41 438.09 635.12 280.78 616.51 427.46 549.14 278.35 156.34 197.46 1458.88 2593.82 2823.78 2047.07 1408.11 1933.39 136.47 2134.63 1146.88 1775.21 1 Week 0.27 0.85 0.10 -0.71 -0.51 -0.19 0.40 -0.15 -0.27 -0.05 -1.08 -2.75 -0.55 -1.79 1.60 -2.49 -2.41 -0.57 -0.97 -1.67 -0.82 0.00 -0.20 0.60 0.42 0.62 1.08 0.81 -0.90 -0.78 -0.21 -0.74 -1.33 0.78 -3.15 0.90 2.88 -1.73 1.21 -2.66 1 Month 3 Month 3.79 4.34 3.37 1.94 6.77 10.02 1.32 0.20 3.38 6.39 1.58 4.70 3.27 3.03 3.81 5.98 3.37 3.63 2.27 -0.33 3.05 2.06 1.13 -3.25 -6.29 2.65 1.50 -1.99 4.11 4.99 2.56 1.62 3.90 5.61 4.98 3.49 3.78 0.98 3.08 2.01 0.05 5.22 -1.39 7.56 0.41 4.49 4.05 0.94 5.41 6.15 2.89 0.13 6.84 0.13 5.05 -0.34 -0.86 4.67 5.11 4.65 5.46 2.75 4.53 1.17 4.71 8.14 5.67 6.39 1.53 -0.24 5.26 3.48 3.40 9.15 -1.78 13.58 -0.24 -3.58 12.31 0.06 YTD 23.94 20.20 33.76 9.95 29.82 29.68 24.30 24.81 7.18 7.64 0.11 -24.15 18.11 12.26 40.13 -0.85 -7.98 19.43 15.68 1.36 33.30 21.55 18.14 25.73 33.09 30.06 18.78 16.79 7.38 10.11 36.70 23.09 5.68 16.55 56.85 29.89 30.49 -29.40 7.95 -7.98 1 Year 28.60 23.47 40.43 11.74 35.92 39.60 30.04 28.94 9.82 10.56 0.63 -28.02 25.42 14.42 68.19 6.02 1.96 25.69 24.10 8.43 39.09 23.21 21.42 34.26 35.89 35.81 23.58 24.18 8.11 12.08 43.20 31.76 8.14 22.52 60.93 37.09 41.98 -31.93 8.51 -6.04 3 Year 13.81 12.06 13.88 7.50 15.89 15.26 13.68 14.44 1.49 1.65 -4.90 -22.72 10.11 4.53 14.42 -2.48 -11.24 8.94 4.39 n/a 20.88 13.92 10.27 11.44 19.84 15.24 12.02 8.08 8.76 7.30 11.44 17.09 -1.30 8.40 47.46 15.99 -15.89 -18.07 11.61 -0.61 5 Year 14.17 12.26 13.96 5.58 19.68 17.53 12.76 17.10 7.34 6.30 9.88 2.63 14.10 9.69 12.07 11.18 1.61 12.33 10.08 n/a 25.98 11.97 9.82 9.24 14.84 15.51 18.59 13.93 7.61 5.55 12.21 13.47 4.90 8.94 38.80 15.53 -6.58 3.35 6.13 2.78

Canada

International

S&P 500 Sectors

S&P/TSX Sectors

Source: Bloomberg Finance L.P. 3 and 5 year returns are annualized. As at November 13, 2013

Page 19

The Technical Take

November 18, 2013

Appendix A Important Disclosures

General Research Disclaimer The statements and statistics contained herein are based on material believed to be reliable, but are not guaranteed to be accurate or complete. This report is for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any investment fund, security or other product. Particular investment, trading, or tax strategies should be evaluated relative to each individuals objectives. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance. This document does not provide individual financial, legal, investment or tax advice. Please consult your own legal, investment and tax advisor. All opinions and other information in this document are subject to change without notice. The Toronto-Dominion Bank and its affiliates and related entities are not liable for any errors or omissions in the information or for any loss or damage suffered. TD Waterhouse Canada Inc. and/or its affiliated persons or companies may hold a position in the securities mentioned, including options, futures and other derivative instruments thereon, and may, as principal or agent, buy or sell such securities. Affiliated persons or companies may also make a market in and participate in an underwriting of such securities. Technical Research Disclaimer The opinions expressed herein reflect a technical perspective and may differ from fundamental research on these issuers. Fundamental research can be obtained through your TD Wealth advisor or on the Markets and Research site within WebBroker. The technical research opinions contained in this report are based on historical technical data and expectations of the most likely direction of a market or security. No guarantee of that outcome is ever implied. Research Report Dissemination Policy TD Waterhouse Canada Inc. makes its research products available in electronic format. These research products are posted to our proprietary websites for all eligible clients to access by password and we distribute the information to our sales personnel who then may distribute it to their retail clients under the appropriate circumstances either by email, fax or regular mail. No recipient may pass on to any other person, or reproduce by any means, the information contained in this report without our prior written consent. Analyst Certification The Portfolio Advice and Investment Research analyst(s) responsible for this report hereby certify that (i) the recommendations and technical opinions expressed in the research report accurately reflect the personal views of the analyst(s) about any and all of the securities or issuers discussed herein, and (ii) no part of the research analysts compensation was, is, or will be, directly or indirectly, related to the provision of specific recommendations or views expressed by the research analyst in the research report. Conflicts of Interest The Portfolio Advice & Investment Research analyst(s) responsible for this report may own securities of the issuer(s) discussed in this report. As with most other employees, the analyst(s) who prepared this report are compensated based upon (among other factors) the overall profitability of TD Waterhouse Canada Inc. and its affiliates, which includes the overall profitability of investment banking services, however TD Waterhouse Canada Inc. does not compensate its analysts based on specific investment banking transactions. Corporate Disclosure TD Wealth represents the products and services offered by TD Waterhouse Canada Inc. (Member Canadian Investor Protection Fund), TD Waterhouse Private Investment Counsel Inc., TD Wealth Private Banking (offered by The Toronto-Dominion Bank) and TD Wealth Private Trust (offered by The Canada Trust Company). The Portfolio Advice and Investment Research team is part of TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Bank. Trade-mark Disclosures Bloomberg and Bloomberg.com are trademarks and service marks of Bloomberg Finance L.P., a Delaware limited partnership, or its subsidiaries. All rights reserved. TD Securities is the trade name which TD Securities Inc. and TD Securities (USA) LLC. jointly use to market their institutional equity services. TD Securities is a trade-mark of The Toronto-Dominion Bank representing TD Securities Inc., TD Securities (USA) LLC, TD Securities Limited and certain corporate and investment banking activities of The Toronto-Dominion Bank. All trademarks are the property of their respective owners. /The TD logo and other trade-marks are the property of the Toronto-Dominion Bank or a wholly-owned subsidiary, in Canada and/or in other countries.

Page 20

También podría gustarte

- The Technical Take - September 16, 2013Documento20 páginasThe Technical Take - September 16, 2013dpbasicAún no hay calificaciones

- The Technical Take - April 21, 2014Documento18 páginasThe Technical Take - April 21, 2014dpbasicAún no hay calificaciones

- The Technical Take July 15 2013 2 PDFDocumento21 páginasThe Technical Take July 15 2013 2 PDFfu jiAún no hay calificaciones

- Technically Speaking - October 21, 2015Documento12 páginasTechnically Speaking - October 21, 2015dpbasicAún no hay calificaciones

- Technically Speaking - September 22, 2015Documento11 páginasTechnically Speaking - September 22, 2015dpbasicAún no hay calificaciones

- Weekly Trends March 10, 2016Documento5 páginasWeekly Trends March 10, 2016dpbasicAún no hay calificaciones

- US Market Review For Oct 8 2014Documento12 páginasUS Market Review For Oct 8 2014FusionIQAún no hay calificaciones

- U.S. Equity Strategy (Look To Increase Equity Exposure Following An Expected Near-Term Pullback) - Janaury 27, 2012Documento6 páginasU.S. Equity Strategy (Look To Increase Equity Exposure Following An Expected Near-Term Pullback) - Janaury 27, 2012dpbasicAún no hay calificaciones

- Blocks To Watch For Stocks USADocumento3 páginasBlocks To Watch For Stocks USAAnonymous TApDKFAún no hay calificaciones

- Technically Speaking - April 21, 2016Documento13 páginasTechnically Speaking - April 21, 2016dpbasicAún no hay calificaciones

- Technically Speaking - May 13, 2015Documento12 páginasTechnically Speaking - May 13, 2015dpbasicAún no hay calificaciones

- Technically Speaking - June 18, 2015Documento12 páginasTechnically Speaking - June 18, 2015dpbasicAún no hay calificaciones

- Technical Trend: (05 July 2011) Equity Market: India Daily UpdateDocumento4 páginasTechnical Trend: (05 July 2011) Equity Market: India Daily UpdateTirthankar DasAún no hay calificaciones

- May 2, 2010Documento10 páginasMay 2, 2010Stanky LeeAún no hay calificaciones

- The Sentiment Signal Suggesting Stocks Could Go FlatDocumento4 páginasThe Sentiment Signal Suggesting Stocks Could Go FlatAnonymous TApDKFAún no hay calificaciones

- 2014 Market ForecastDocumento13 páginas2014 Market ForecastJean Paul PAún no hay calificaciones

- Consulting Our Technical Playbook: MarketDocumento5 páginasConsulting Our Technical Playbook: MarketdpbasicAún no hay calificaciones

- Weekly Trends Aug 15Documento5 páginasWeekly Trends Aug 15dpbasicAún no hay calificaciones

- Welcome Morning Update & Oscillator Chat Room Charting Programs FAQ'sDocumento1 páginaWelcome Morning Update & Oscillator Chat Room Charting Programs FAQ'sHarvey DychiaoAún no hay calificaciones

- LAM Stock Market in Focus August 2022Documento14 páginasLAM Stock Market in Focus August 2022Edward C LaneAún no hay calificaciones

- Weekly Trends October 2, 2015Documento4 páginasWeekly Trends October 2, 2015dpbasicAún no hay calificaciones

- Weekly Trends: Earnings To The RescueDocumento4 páginasWeekly Trends: Earnings To The RescuedpbasicAún no hay calificaciones

- LINC Week 6Documento9 páginasLINC Week 6TomasAún no hay calificaciones

- Thackray Market Letter 2015 FebruaryDocumento10 páginasThackray Market Letter 2015 FebruarydpbasicAún no hay calificaciones

- Market Analysis Nov 2022Documento12 páginasMarket Analysis Nov 2022Muhammad SatrioAún no hay calificaciones

- Lane Asset Management Stock Market Commentary August 2011Documento9 páginasLane Asset Management Stock Market Commentary August 2011Edward C LaneAún no hay calificaciones

- Spring 2014 HCA Letter FinalDocumento4 páginasSpring 2014 HCA Letter FinalDivGrowthAún no hay calificaciones

- 1512 GMPDocumento57 páginas1512 GMPpuneet aroraAún no hay calificaciones

- Stocks and QE All Things Must PassDocumento27 páginasStocks and QE All Things Must Passambasyapare1Aún no hay calificaciones

- LAM Commentary July 2011Documento8 páginasLAM Commentary July 2011Edward C LaneAún no hay calificaciones

- DNH Sri Lanka Weekly 07-11 Jan 2013Documento9 páginasDNH Sri Lanka Weekly 07-11 Jan 2013ran2013Aún no hay calificaciones

- Accord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118Documento2 páginasAccord Capital Equities Corporation: Outlook For Week XXIV - June 13 To 17 - TD 114-118JC CalaycayAún no hay calificaciones

- There's Nothing Good Here: Views From The Blue RidgeDocumento8 páginasThere's Nothing Good Here: Views From The Blue RidgeZerohedgeAún no hay calificaciones

- Lane Asset Management Stock Market Commentary For October 2013Documento9 páginasLane Asset Management Stock Market Commentary For October 2013Edward C LaneAún no hay calificaciones

- STA MarketUpdate 5-17-10Documento9 páginasSTA MarketUpdate 5-17-10Ed CarlsonAún no hay calificaciones

- Thackray Market Letter 2013 DecemberDocumento11 páginasThackray Market Letter 2013 DecemberdpbasicAún no hay calificaciones

- S G & Cad & Aud: Tock Markets OLD CommoditiesDocumento8 páginasS G & Cad & Aud: Tock Markets OLD Commoditiesderailedcapitalism.comAún no hay calificaciones

- Finance 350 Stock Case Write-UpDocumento4 páginasFinance 350 Stock Case Write-Upapi-249016114Aún no hay calificaciones

- Weekly Trends Dec 5Documento4 páginasWeekly Trends Dec 5dpbasicAún no hay calificaciones

- Edition 10 - Chartered 7th July 2010Documento9 páginasEdition 10 - Chartered 7th July 2010Joel HewishAún no hay calificaciones

- Market Commentary 4/25/2012Documento1 páginaMarket Commentary 4/25/2012CJ MendesAún no hay calificaciones

- Thackray Market Letter 2015 AprilDocumento9 páginasThackray Market Letter 2015 AprildpbasicAún no hay calificaciones

- Global FX Insights - 8 August 2016Documento12 páginasGlobal FX Insights - 8 August 2016BBand TraderAún no hay calificaciones

- Thackray Newsletter 2016 09 SeptemberDocumento9 páginasThackray Newsletter 2016 09 SeptemberdpbasicAún no hay calificaciones

- 9/22/14 Global-Macro Trading SimulationDocumento10 páginas9/22/14 Global-Macro Trading SimulationPaul KimAún no hay calificaciones

- Technical Report 14th November 2011Documento5 páginasTechnical Report 14th November 2011Angel BrokingAún no hay calificaciones

- Stock Market Commentary November 2014Documento7 páginasStock Market Commentary November 2014Edward C LaneAún no hay calificaciones

- US Trading Note August 09 2016Documento3 páginasUS Trading Note August 09 2016robertoklAún no hay calificaciones

- EdisonInsight February2013Documento157 páginasEdisonInsight February2013KB7551Aún no hay calificaciones

- Master Trader Plan For Week 9-17-18Documento12 páginasMaster Trader Plan For Week 9-17-18tummalaajaybabuAún no hay calificaciones

- Lane Asset Management Stock Market and Economic February 2012Documento6 páginasLane Asset Management Stock Market and Economic February 2012Edward C LaneAún no hay calificaciones

- Monthly Market, Sectoral and Stock Perspective - Technicals Dec 08, 2012Documento5 páginasMonthly Market, Sectoral and Stock Perspective - Technicals Dec 08, 2012GauriGanAún no hay calificaciones

- Vital Signs: Happy Birthday Tenzin Gyatso!Documento4 páginasVital Signs: Happy Birthday Tenzin Gyatso!GauriGanAún no hay calificaciones

- Weekly Market Commentary 03302015Documento5 páginasWeekly Market Commentary 03302015dpbasicAún no hay calificaciones

- Monthly Market, Sectoral and Stock Perspective - Technicals Aug 03, 2012Documento5 páginasMonthly Market, Sectoral and Stock Perspective - Technicals Aug 03, 2012GauriGanAún no hay calificaciones

- Recap of Last Week's Watchlist:: Weekly Watchlist For Free MembersDocumento7 páginasRecap of Last Week's Watchlist:: Weekly Watchlist For Free MembersSebastian NilssonAún no hay calificaciones

- Global Macro Trading: Profiting in a New World EconomyDe EverandGlobal Macro Trading: Profiting in a New World EconomyCalificación: 4 de 5 estrellas4/5 (5)

- Anatomy of the Bear: Lessons from Wall Street's four great bottomsDe EverandAnatomy of the Bear: Lessons from Wall Street's four great bottomsCalificación: 4 de 5 estrellas4/5 (3)

- GMOMelt UpDocumento13 páginasGMOMelt UpHeisenberg100% (2)

- 2018 OutlookDocumento18 páginas2018 OutlookdpbasicAún no hay calificaciones

- Thackray Newsletter 2018 08 AugustDocumento9 páginasThackray Newsletter 2018 08 AugustdpbasicAún no hay calificaciones

- BMO ETF Portfolio Strategy Report: Playing Smart DefenseDocumento7 páginasBMO ETF Portfolio Strategy Report: Playing Smart DefensedpbasicAún no hay calificaciones

- The Race of Our Lives RevisitedDocumento35 páginasThe Race of Our Lives RevisiteddpbasicAún no hay calificaciones

- SSRN Id3132563Documento13 páginasSSRN Id3132563dpbasicAún no hay calificaciones

- Otlk-Bklt-Ret-A4 1711Documento48 páginasOtlk-Bklt-Ret-A4 1711dpbasicAún no hay calificaciones

- Etf PSR q4 2017 eDocumento7 páginasEtf PSR q4 2017 edpbasicAún no hay calificaciones

- TL Secular Outlook For Global GrowthDocumento12 páginasTL Secular Outlook For Global GrowthdpbasicAún no hay calificaciones

- Credit Suisse Investment Outlook 2018Documento64 páginasCredit Suisse Investment Outlook 2018dpbasic100% (1)

- Thackray Newsletter 2017 07 JulyDocumento8 páginasThackray Newsletter 2017 07 JulydpbasicAún no hay calificaciones

- Special Report 30jan2017Documento5 páginasSpecial Report 30jan2017dpbasicAún no hay calificaciones

- Retirement 20/20: The Right Advice Can Bring Your Future Into FocusDocumento12 páginasRetirement 20/20: The Right Advice Can Bring Your Future Into FocusdpbasicAún no hay calificaciones

- Retirement 20/20: The Right Advice Can Bring Your Future Into FocusDocumento12 páginasRetirement 20/20: The Right Advice Can Bring Your Future Into FocusdpbasicAún no hay calificaciones

- Thackray Seasonal Report Storm Warning 2017-May-05Documento12 páginasThackray Seasonal Report Storm Warning 2017-May-05dpbasic100% (1)

- Thackray Newsletter 2017 09 SeptemberDocumento4 páginasThackray Newsletter 2017 09 SeptemberdpbasicAún no hay calificaciones

- Thackray Newsletter 2017 09 SeptemberDocumento9 páginasThackray Newsletter 2017 09 SeptemberdpbasicAún no hay calificaciones

- TL What It Would Take For U.S. Economy To GrowDocumento8 páginasTL What It Would Take For U.S. Economy To GrowdpbasicAún no hay calificaciones

- Fidelity Multi-Sector Bond Fund - ENDocumento3 páginasFidelity Multi-Sector Bond Fund - ENdpbasicAún no hay calificaciones

- From Low Volatility To High GrowthDocumento4 páginasFrom Low Volatility To High GrowthdpbasicAún no hay calificaciones

- Thackray Newsletter 2017 01 JanuaryDocumento11 páginasThackray Newsletter 2017 01 JanuarydpbasicAún no hay calificaciones

- Hot Charts 9feb2017Documento2 páginasHot Charts 9feb2017dpbasicAún no hay calificaciones

- Boc Policy MonitorDocumento3 páginasBoc Policy MonitordpbasicAún no hay calificaciones

- Thackray Newsletter: - Know Your Buy & Sells A Month in AdvanceDocumento11 páginasThackray Newsletter: - Know Your Buy & Sells A Month in AdvancedpbasicAún no hay calificaciones

- GeopoliticalBriefing 22nov2016Documento6 páginasGeopoliticalBriefing 22nov2016dpbasicAún no hay calificaciones

- INM 21993e DWolf Q4 2016 NewEra Retail SecuredDocumento4 páginasINM 21993e DWolf Q4 2016 NewEra Retail SecureddpbasicAún no hay calificaciones

- The Trumpquake - Special Report 10nov2016Documento5 páginasThe Trumpquake - Special Report 10nov2016dpbasicAún no hay calificaciones

- Hot Charts 17nov2016Documento2 páginasHot Charts 17nov2016dpbasicAún no hay calificaciones

- Peloton Webinar September 26-2016Documento26 páginasPeloton Webinar September 26-2016dpbasicAún no hay calificaciones

- CMX Roadshow Final November 2016Documento25 páginasCMX Roadshow Final November 2016dpbasicAún no hay calificaciones

- In The High Court of Justice Business and Property Courts of England and Wales Business List (CH D)Documento190 páginasIn The High Court of Justice Business and Property Courts of England and Wales Business List (CH D)Legal CheekAún no hay calificaciones

- Financial Analysis For ToshibaDocumento13 páginasFinancial Analysis For ToshibaNoname Nonamesky100% (2)

- The Four Biggest Ways That Robinhood Changed InvestingDocumento3 páginasThe Four Biggest Ways That Robinhood Changed InvestingAna Carolina Goes MachadoAún no hay calificaciones

- Europe's Best Kept Secret: Individual TaxationDocumento8 páginasEurope's Best Kept Secret: Individual TaxationAbai AmanatAún no hay calificaciones

- Ch08 189-220Documento32 páginasCh08 189-220vancho_mkdAún no hay calificaciones

- The Rockefeller Foundation Ethical Investing Policy FrameworkDocumento9 páginasThe Rockefeller Foundation Ethical Investing Policy FrameworkЕвгений МихайловAún no hay calificaciones

- BULAT Practice Test 2Documento17 páginasBULAT Practice Test 2Lương Thị TâmAún no hay calificaciones

- Smallcap Growth StrategyDocumento4 páginasSmallcap Growth StrategyyashAún no hay calificaciones

- Entrepreneur Management Questions and AnswersDocumento24 páginasEntrepreneur Management Questions and AnswersArun DassiAún no hay calificaciones

- Sixth Departmental QuizDocumento8 páginasSixth Departmental QuizMica R.Aún no hay calificaciones

- Smart Growth Brochure Fina 0Documento24 páginasSmart Growth Brochure Fina 0Sooraj KuruvathAún no hay calificaciones

- Fundooprofessor - Teaching Notes On SymphonyDocumento23 páginasFundooprofessor - Teaching Notes On SymphonyIosiasAún no hay calificaciones

- 13633921Documento3 páginas13633921Ika Zuliani NofitaAún no hay calificaciones

- The Structure of Financial MarketsDocumento7 páginasThe Structure of Financial MarketsVũ Thị Thu HiếuAún no hay calificaciones

- Robo AdvisorsDocumento13 páginasRobo AdvisorsSRISHTI NARANGAún no hay calificaciones

- Joint VentureDocumento4 páginasJoint VentureSid ChAún no hay calificaciones

- AFS - Financial ModelDocumento6 páginasAFS - Financial ModelSyed Mohtashim AliAún no hay calificaciones

- WSO Private Equity Prep Package PDFDocumento242 páginasWSO Private Equity Prep Package PDFBill Lee100% (2)

- ACED 7 - Financial Management Module 5Documento15 páginasACED 7 - Financial Management Module 5maelyn calindongAún no hay calificaciones

- Act 1&2 and SAQ No - LawDocumento4 páginasAct 1&2 and SAQ No - LawBududut BurnikAún no hay calificaciones

- Acme Incorporated 20 Million InvestDocumento1 páginaAcme Incorporated 20 Million InvestDoreenAún no hay calificaciones

- Solutions Chapters 10 & 11 Transactions and Economic ExposureDocumento46 páginasSolutions Chapters 10 & 11 Transactions and Economic Exposurerakhiitsme83% (6)

- Basic AccountingDocumento48 páginasBasic Accounting3122Aún no hay calificaciones

- The Golden Rules of AccountingDocumento1 páginaThe Golden Rules of AccountingRamesh ManiAún no hay calificaciones

- RMC No. 2-2001 PDFDocumento8 páginasRMC No. 2-2001 PDFAnonymous cvFhSoAún no hay calificaciones

- A Definition For Infrastructure PDFDocumento328 páginasA Definition For Infrastructure PDFJohan Urrego GarzónAún no hay calificaciones

- What Is Financing?: The Account. Bank Overdraft Is Made For Convenience in Order To PurchaseDocumento3 páginasWhat Is Financing?: The Account. Bank Overdraft Is Made For Convenience in Order To PurchaseKim GuibaoAún no hay calificaciones

- Financial Analysis Getting A Grip With Accounts Part 1 FEUDocumento31 páginasFinancial Analysis Getting A Grip With Accounts Part 1 FEURommel Cabel CapalaranAún no hay calificaciones

- Invest Oct 2022Documento521 páginasInvest Oct 2022the kingfishAún no hay calificaciones

- Business Finance Module 5 StudentsDocumento18 páginasBusiness Finance Module 5 StudentsOnly MeAún no hay calificaciones