Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Lit12ei New

Cargado por

Daniela CaraDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Lit12ei New

Cargado por

Daniela CaraCopyright:

Formatos disponibles

Legal and institutional framework for ensuring the functioning of the capital market from Romania The Romanian

capital market, while still young, has progressed over recent years from being an incipient market to a fairly regulated and complex one. The Romanian legal framework for securities trading was fi rst initiated in 1994 and led to the establishment of the Romanian capital markets regulator, the ational !ecurities "ommission #" $%& and to the establishment of the 'ucharest !tock (xchange. )resently, the infrastructure of the Romanian capital market is similar to other (uropean *nion #(*& markets. There are two regulated markets in Romania+ #i& the 'ucharest !tock (xchange which is the main regulated market and #ii& !ibex , the !ibiu !tock (xchange, which is mainly a derivatives market. "learing and settlement are performed by the Romanian "entral !ecurities -epositary for transactions concluded on the 'ucharest !tock (xchange and by the Romanian "learing .ouse for transactions performed on !ibex. The legislative framework of the Romanian "apital %arkets consists of the following /aws and Regulations+

"apital %arket /aw #/aw o. 09120334&4 "ompanies5 /aw #/aw o. 6121993&4 " $% instructions 7 regulations4 'ucharest !tock (xchange regulations4 )rivatisation laws. The ational !ecurities "ommission #8" $%9 in Romanian& is the main regulatory body, which supervises both securities markets and the derivatives market. The "ommission was established in :ctober 1994, as an independent administrative authority accountable to the Romanian )arliament. " $% is comprised of seven commissioners #appointed by the )arliament& who constitute its management board. The commissioners have five; year mandates, which can be extended only once. " $% has an e<uivalent role to the one of the =merican !(" in regulating the functioning of the Romanian e<uity markets. >t is responsible for the all operations on the Romanian securities markets, the protection of investors against unfair, abusive, and fraudulent practices, the circulation of information regarding securities, holders and issuers, and the establishment of a legal framework for financial services activities. >n order to protect the investors5 interest, the "ommission has the right to apply sanctions

for the breach of the provisions of the laws and the regulations issued for its implementation. !anctions may range from fines to withdrawal of authori?ation. /isted securities cannot be traded outside regulated markets, which are those established under the authority and the supervision of " $%. The implementation of the necessary institutional and regulatory framework and the liberalisation process made access by foreign investors to the Romanian market easier and led to a prolonged bull market between 0333 and 0331. The trading volume increased by almost 03 times between =pril 0333 and =pril 033@ and the trading value increased by almost 633 times.1 !ince 033@ Romania has experienced, like many other markets in the (uropean *nion, a prolonged financial crisis and, currently valuations of Romanian stocks continue to be low compared with peers in the region. .owever, a number of interesting new listings and government; planned initial and secondary public offerings, expected in a wide range of sectors and industries, paint a brighter picture for the future. These envisaged listings include, among others+ .idroelectrica #the largest Romanian energy producer&4

uclearelectrica #the nuclear power producer&4 Transelectrica #the operator of the national electricity transmission system&4 Romga? #the largest Romanian natural gas producer&4 Transga? #the operator of the national system of natural gas transmission&4 Romtelecom #the largest Romanian telecommunications company&4 "AR %arfa #the state;owned freight railway carrier&4 and Tarom #the Romanian airline company&. The EU accession process and the boosting effect on Romanian capital markets Thanks to the (* accession process, Romanian securities legislation experienced numerous changes which culminated in a new, consolidated "apital %arket /aw that was enacted in 0334. The "apital %arket /aw #/aw o. 09120334& is aimed at bringing the Romanian capital market in line with the (* acquis communautaire by implementing several (* directives.0 This law covers the following+ #i& regulated markets and their operation #ii& financial investment services

companies and other intermediaries and their activities on the market #iii& issuers and operations concerning securities including public offers #iv& undertakings for collective investments and investments management companies #v& the central depository and clearing house together with the registration, clearing and settlement operations performed through their systems. Bhile the "apital %arket /aw outlines only the general principles, additional secondary legislation was incorporated by the ational !ecurities "ommission. >n addition,when Romania became a member of the (uropean *nion on 1 Canuary 0331, the (* regulations and other enactments directly applicable to %ember !tates also became applicable to the Romanian market.

Romania adopted the following strong investor protection rules, and transparency and corporate governance principles that are generally in line with :("- and (* principles+ D The corporate governance framework ensures e<ual treatment of all shareholders of the same class, including minority and foreign shareholders. D 'oard members of listed companies are re<uired to disclose material interests in transactions or matters affecting the company. D /isted companies are re<uired to promptly and accurately disclose all new material matters that may affect their patrimony, financial condition or business and are also re<uired to prepare and release <uarterly, half;yearly and annual reports. D Transactions with securities tradeable on the capital markets on the basis of privileged information are prohibited and such transacting parties may be also penalised regarding insider dealings and market abuse. >ssuers must promptly disclose any privileged information of which they become aware. =lso, they must

prepare and regularly update records of persons who have access to inside information and submit such records to the ational !ecurities "ommission on re<uest.6 D =ll individuals and entities who directly or indirectly ac<uire shares in Romanian listed companies which entail their voting rights to reach, exceed or fall under certain thresholds must notify the relevant company, the ational !ecurities "ommission and the regulated capital market where the shares are traded. >ndividuals and entities who directly or indirectly ac<uire more than 66 per cent of the voting rights in a Romanian listed company, must launch a takeover public offer addressed to all the other shareholders for the balance of the remaining shares in that company. D The issuer, the offeror and other parties involved in a public offering of securities #including the investment banks that intermediate the offering& are liable for the truthfulness and accuracy of the information they

included in the offering document and the offering announcement. D >n addition, the "apital %arket /aw provides for an >nvestors "ompensation Aund which is established to compensate investors .

Conclusion Bhile Romania5s efforts to improve its local capital market framework has yielded notable success, areas in need of improvement remain and the development of these areas should be expedited in order to stimulate investments on the Romanian market. The reaction of the Romanian authorities in relation to these areas has been encouraging and amendment initiatives have been recently launched in relation to the legal frameworks dealing with E-Rs and mortgage bonds, respectively. These measures are expected to have a positive impact on the development of the securities market in Romania, leading to an increase in the number of domestic and foreign investors, issuers and professional market participants

También podría gustarte

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Stonehell Dungeon 1 Down Night Haunted Halls (LL)Documento138 páginasStonehell Dungeon 1 Down Night Haunted Halls (LL)some dude100% (9)

- Criminology Introduction and Crime ClassificationsDocumento108 páginasCriminology Introduction and Crime ClassificationsMjay Medina100% (2)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- Notes in Criminal Procedure Class of Atty. Plaridel Bohol II (UE & San Beda)Documento2 páginasNotes in Criminal Procedure Class of Atty. Plaridel Bohol II (UE & San Beda)Witch BRIONNEAún no hay calificaciones

- The Historical Development of TrademarksDocumento3 páginasThe Historical Development of Trademarksmarikit.marit100% (1)

- PERSONAL ID TECHNIQUESDocumento15 páginasPERSONAL ID TECHNIQUESGrant David Amahin100% (2)

- Lesson 5 FranchisingDocumento53 páginasLesson 5 FranchisingSuxian ToleroAún no hay calificaciones

- City of Rochester Press Log: From 04/15/2021 12:00:00 AM Through 04/15/2021 23:59:59 PMDocumento7 páginasCity of Rochester Press Log: From 04/15/2021 12:00:00 AM Through 04/15/2021 23:59:59 PMinforumdocsAún no hay calificaciones

- Marketbeats Indonesia Jakarta Landed Residential H2 2022Documento4 páginasMarketbeats Indonesia Jakarta Landed Residential H2 2022SteveAún no hay calificaciones

- Antolin Vs DomondonDocumento4 páginasAntolin Vs DomondonRon AceAún no hay calificaciones

- Rosebud SIoux Tribe Criminal Offense CodeDocumento5 páginasRosebud SIoux Tribe Criminal Offense CodeOjinjintka NewsAún no hay calificaciones

- Petitioner Vs Vs Respondents: First DivisionDocumento9 páginasPetitioner Vs Vs Respondents: First DivisionAdrian Jeremiah VargasAún no hay calificaciones

- Passenger Locator Form Status and Vaccine DataDocumento4 páginasPassenger Locator Form Status and Vaccine DataDamon TimmonsAún no hay calificaciones

- Wipro Consolidated Balance SheetDocumento2 páginasWipro Consolidated Balance SheetKarthik KarthikAún no hay calificaciones

- John Doe V U. Mass Amherst - ComplaintDocumento48 páginasJohn Doe V U. Mass Amherst - ComplaintLegal InsurrectionAún no hay calificaciones

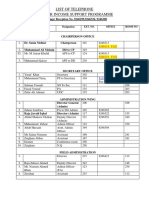

- DirectoryDocumento6 páginasDirectoryabbas dastiAún no hay calificaciones

- Historical Negationism W3P3Documento25 páginasHistorical Negationism W3P3Maria Reynagie Ogue100% (1)

- Law On Public OfficersDocumento23 páginasLaw On Public OfficersMary May NavarreteAún no hay calificaciones

- Sworn Statement Not BlacklistedDocumento2 páginasSworn Statement Not BlacklistedpatrickkayeAún no hay calificaciones

- Lest We Forget 1187-1948Documento34 páginasLest We Forget 1187-1948Aman ChaudharyAún no hay calificaciones

- EthicsJustice-And-Fairness Finals ReportingDocumento38 páginasEthicsJustice-And-Fairness Finals ReportingannahsenemAún no hay calificaciones

- ECB ManagersDocumento3 páginasECB Managersnikitas666Aún no hay calificaciones

- Written Notes of Arguments for bail CancellationDocumento11 páginasWritten Notes of Arguments for bail CancellationShashiprakash MishraAún no hay calificaciones

- विश्व के प्रमुख संगठनDocumento8 páginasविश्व के प्रमुख संगठनPradhuman Singh RathoreAún no hay calificaciones

- Letterof Acqof IBEULFinal SignedDocumento6 páginasLetterof Acqof IBEULFinal SignedVirendra PatilAún no hay calificaciones

- G.R. No. 105002Documento9 páginasG.R. No. 105002Samuel John CahimatAún no hay calificaciones

- Bpas DocDocumento2 páginasBpas DocSunil BeheraAún no hay calificaciones

- Lecture 6Documento5 páginasLecture 6euniceAún no hay calificaciones

- Bidding DocumentsDocumento57 páginasBidding DocumentsNatsAún no hay calificaciones

- MR Ersel Kizilay 23 Ohiti Road Crownthorpe Hastings 4179 New ZealandDocumento5 páginasMR Ersel Kizilay 23 Ohiti Road Crownthorpe Hastings 4179 New ZealandErselAún no hay calificaciones

- Unit 1 ICL E Notes BBALLBDocumento9 páginasUnit 1 ICL E Notes BBALLBSarthakAún no hay calificaciones