Documentos de Académico

Documentos de Profesional

Documentos de Cultura

2012 - 1115 Accounting and Auditing News (Impact of PAS 19 (R) ) PDF

Cargado por

Denzel Edward CariagaTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

2012 - 1115 Accounting and Auditing News (Impact of PAS 19 (R) ) PDF

Cargado por

Denzel Edward CariagaCopyright:

Formatos disponibles

Philippines Technical Research

Accounting & Auditing News Impact of PAS 19R Employee Benefits

Introduction

Upon adoption of the International Financial Reporting Standards (IFRS) in the Philippines in 2005, one of the standards that greatly affected most of the companies is PAS 19 Employee Benefits. After significant amendments made in 2006 to this standard, other significant amendments were issued on June 16, 2011 by the International Accounting Standards Board (IASB) and adopted by the Philippine Financial Reporting Standards Council (FRSC) to be effective for annual periods beginning on or after January 1, 2013. The objective of the amendments to PAS 19 was to enhance the financial reporting of employee benefits by: (a) reporting changes in defined benefit obligations in the fair value of plan assets in a more understandable way; (b) improving comparability by eliminating some presentation options currently allowed under PAS 19; (c) clarifying requirements that have resulted in diverse practices; and (d) improving disclosure requirements for defined benefit plans. This publication covers discussions of the key changes that the amendment to PAS 19 introduces and the impact of these changes. These includes: (a) changes in the accounting treatment of the actuarial gains and losses and past service cost; (b) changes in presentation approach; (c) new disclosure requirements; and (d) new definition of short-term employee benefits and additional guidance for termination benefits classification and recognition.

Changes in accounting treatment

The most significant amendment will require an entity to recognize changes in defined benefit obligations and plan assets when they occur; thus, eliminating the corridor approach permitted under the previous version of PAS 19. In addition, the option to defer the recognition of past service cost when unvested was eliminated as well. As a result of the amendment, entity currently using the corridor approach and / or deferred the recognition of past servic e cost may have to recognize a larger liability, or a smaller asset in the statement of financial position which could affect its compliance with debt covenants and impair its ability to pay a dividend. Also, Other Comprehensive Income and profit or loss will become more volatile due to immediate recognition of actuarial gains and losses and past service cost when compared to current provision of PAS 19. Actuarial gains or losses Under PAS 19R, all actuarial gains and losses are to be recognized immediately in Other Comprehensive Income (OCI). The option to recognize actuarial gains and losses in profit or loss has also been removed. Past service cost Past service cost arise in case of change of the employee benefit plan. Under the current provision of PAS 19, past service cost should be deferred when unvested. This results in an unrecognized amount which is amortized in profit or loss over the vesting period. Under PAS 19R, all past service cost are recognized in profit or loss as they occur.

Changes in presentation approach

The main issues in the current provision of PAS 19 were caused by a range of options. As a result, it was difficult to compare companies with similar obligations. By removing the options under PAS 19R and requiring entities to recognize changes immediately, the amendments will improve the comparability and understandability of changes arising from defined benefit plans. The amendments also introduced a new approach for presenting changes in defined benefit obligations and plan assets. The new presentation includes service cost, net interest, and remeasurement components. The concept of the expected return on plan assets has been eliminated.

New disclosure requirements

The following new disclosure requirements were introduced by the amendment to PAS 19: Characteristics of defined benefit plans and risk associated with them a. Disclosure of the characteristics of the plan, including: (i) the nature of the benefits, (ii) a description of the regulatory framework, and (iii) governance responsibilities. b. c. Description of the risk to which the plan exposes the entity. Description of plan amendments, curtailments and settlements.

Explanation of the amounts in the financial statements a. Minor modifications on the reconciliation from opening balance to the closing balance. PAS 19R requires that the reconciliation should show the plan assets, present value of the defined benefit obligation, the effect of the asset ceiling, and the reimbursement rights. b. Disaggregation of plan assets into different asset classes distinguished on the nature and risks of the plan assets. This includes subdividing those assets that do and do not have a quoted market price.

Amount, timing and uncertainty of future cash flows

a. b. c. Sensitivity analysis for each significant actuarial assumption; Description of any asset-liability matching strategies; and Effect of defined benefit plan on future cash flows.

New definition of short-term employee benefits and additional guidance for termination benefits classification and recognition

Under the current standard, short-term benefits is defined as employee benefits that are due to be settled within 12 months after the end of the period in which employees render the related service while under the revised standard, short-term benefits is defined as employee benefits that are expected to be settled wholly before 12 months after the end of the annual reporting period. The new definition will result in more plans being classified as long-term employee benefit plans that will then need to be measured using actuarial assumptions. PAS 19R provides clarifying guidance to help companies distinguish between benefits payable in exchange for service and benefits payable in exchange for termination of employment by providing indicators when an employee benefit is not a termination benefit. It also requires an entity to recognize a liability and expense at the earlier between (a) the date of offer if the benefits can no longer be withdrawn, and (b) the date when the entity recognizes costs for a restructuring that is within the scope of IAS 37; and involves the payment of termination benefits.

Action point

The above amendments will be effective for annual period beginning on or after January 1, 2013 with retrospective application. This means that the comparative information to be presented in the 2013 Financial Statements should be based on the provisions of PAS 19R. In preparation for this amendment, the impact of the amendments should already be known and such impact can already be determined by having an additional valuation to be performed in addition to the requirements of the current provisions of PAS 19. This will anticipate the potential impact of the amendments and to avoid the duplication of effort by the actuary when preparing the 2013 Financial Statements. For further details of the amendments, please click the link: http://www.deloitte.com/assets/Dcom-Netherlands/Local%20Assets/Documents/NL/Diensten/Accountancy/nl_nl_accountancy_brochure_IAS19_pensioen.pdf

Please contact the Technical Research Group at +63 2 581 9000 local 9088 / 9069 / 9078 or e-mail phtr@deloitte.com for questions regarding this publication.

19th Floor Net Lima Plaza 5th Avenue corner 26th Street Bonifacio Global City, Taguig 1634 Philippines Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee, and its network of member firms, each of which is a legally separate and independent entity. Please see www.deloitte.com/ph/about for a detailed description of the legal structure of Deloitte Touche Tohmatsu Limited and its member firms. Deloitte provides audit, tax, consulting, and financial advisory services to public and private clients spanning multiple industries. With a globally connected network of member firms in more than 150 countries, Deloitte brings world-class capabilities and high-quality service to clients, delivering the insights they need to address their most complex business challenges. Deloitte has in the region of 200,000 professionals, all committed to becoming the standard of excellence. This publication contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively, the Deloitte Network) is, by means of this publication, rendering p rofessional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this publication. 2012 Navarro Amper & Co.

También podría gustarte

- CREATE Features 26nov20Documento14 páginasCREATE Features 26nov20Denzel Edward CariagaAún no hay calificaciones

- Horngren Check FiguresDocumento10 páginasHorngren Check FigureslibraolrackAún no hay calificaciones

- A Business Plan For Laundry ShopDocumento31 páginasA Business Plan For Laundry ShopDenzel Edward Cariaga64% (11)

- Ligon Vs RTCDocumento10 páginasLigon Vs RTCDenzel Edward CariagaAún no hay calificaciones

- Chuidian Vs SandiganbayanDocumento16 páginasChuidian Vs SandiganbayanDenzel Edward CariagaAún no hay calificaciones

- Torres Vs SatsatinDocumento10 páginasTorres Vs SatsatinDenzel Edward CariagaAún no hay calificaciones

- Watercraft Venture Corp vs. WolfeDocumento17 páginasWatercraft Venture Corp vs. WolfeDenzel Edward CariagaAún no hay calificaciones

- Luzon Development Vs KrishnanDocumento6 páginasLuzon Development Vs KrishnanDenzel Edward CariagaAún no hay calificaciones

- Northern Islands Vs GarciaDocumento7 páginasNorthern Islands Vs GarciaDenzel Edward CariagaAún no hay calificaciones

- Phil Airconditioning Center vs. RCJ LinesDocumento25 páginasPhil Airconditioning Center vs. RCJ LinesDenzel Edward CariagaAún no hay calificaciones

- Mangila Vs Court of AppealsDocumento13 páginasMangila Vs Court of AppealsDenzel Edward CariagaAún no hay calificaciones

- Lim JR Vs LazaroDocumento6 páginasLim JR Vs LazaroDenzel Edward CariagaAún no hay calificaciones

- Spa Yumeno 012017Documento1 páginaSpa Yumeno 012017Denzel Edward CariagaAún no hay calificaciones

- Notes On Registration of Book of AccountsDocumento3 páginasNotes On Registration of Book of AccountsDenzel Edward CariagaAún no hay calificaciones

- Excellent Quality Apparel vs. Visayan SuretyDocumento17 páginasExcellent Quality Apparel vs. Visayan SuretyDenzel Edward CariagaAún no hay calificaciones

- Spa Yumeno 022017Documento1 páginaSpa Yumeno 022017Denzel Edward CariagaAún no hay calificaciones

- Notes On Application For Authority To Print ReceiptsDocumento3 páginasNotes On Application For Authority To Print ReceiptsDenzel Edward CariagaAún no hay calificaciones

- Writ of Continuing Mandamus v4 Super FinalDocumento30 páginasWrit of Continuing Mandamus v4 Super FinalDenzel Edward CariagaAún no hay calificaciones

- Spa Yumeno 012017Documento1 páginaSpa Yumeno 012017Denzel Edward CariagaAún no hay calificaciones

- Spa Yumeno 012017Documento1 páginaSpa Yumeno 012017Denzel Edward CariagaAún no hay calificaciones

- TS Circ01 2014Documento1 páginaTS Circ01 2014Denzel Edward CariagaAún no hay calificaciones

- Ship Mortgage and Maritime Liens ExplainedDocumento44 páginasShip Mortgage and Maritime Liens ExplainedDenzel Edward CariagaAún no hay calificaciones

- Spa Yumeno 012017Documento1 páginaSpa Yumeno 012017Denzel Edward CariagaAún no hay calificaciones

- Spa Yumeno 092016Documento1 páginaSpa Yumeno 092016Denzel Edward CariagaAún no hay calificaciones

- SpaDocumento1 páginaSpaJocknoAún no hay calificaciones

- Spa Yumeno 012017Documento1 páginaSpa Yumeno 012017Denzel Edward CariagaAún no hay calificaciones

- Spa Yumeno 012017Documento1 páginaSpa Yumeno 012017Denzel Edward CariagaAún no hay calificaciones

- Philhealth Premium StatementDocumento1 páginaPhilhealth Premium StatementDenzel Edward CariagaAún no hay calificaciones

- Spa Yumeno 012017Documento1 páginaSpa Yumeno 012017Denzel Edward CariagaAún no hay calificaciones

- Philhealth Premium StatementDocumento1 páginaPhilhealth Premium StatementDenzel Edward CariagaAún no hay calificaciones

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- FAR - Module 2 - The Accounting EquationDocumento5 páginasFAR - Module 2 - The Accounting EquationEva Katrina R. Lopez100% (1)

- He Integration of Information and Information Technology in Accounting Education Effects On Student PerformanceDocumento17 páginasHe Integration of Information and Information Technology in Accounting Education Effects On Student PerformanceconnieAún no hay calificaciones

- Intermediate Accounting III Course OverviewDocumento5 páginasIntermediate Accounting III Course Overviewdewi nabilaAún no hay calificaciones

- Audit and AssuranceDocumento368 páginasAudit and AssuranceOlabisi Shodimu100% (2)

- Reporting On The Status of Audit RecommendationsDocumento7 páginasReporting On The Status of Audit Recommendationsmindreadur3Aún no hay calificaciones

- Fa Chapt 1-3Documento63 páginasFa Chapt 1-3sushAún no hay calificaciones

- Chapter - 6 Comparative Study of Indian Gaap, Ifrs & Ind AsDocumento88 páginasChapter - 6 Comparative Study of Indian Gaap, Ifrs & Ind AsSaurabh GargAún no hay calificaciones

- Mgt101 - 1 - Basics of Financial AccountingDocumento64 páginasMgt101 - 1 - Basics of Financial AccountingMT MalikAún no hay calificaciones

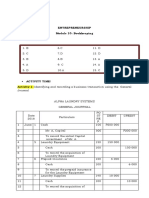

- Entrepreneurship Module 10: Bookkeeping What I KnowDocumento23 páginasEntrepreneurship Module 10: Bookkeeping What I KnowDos DosAún no hay calificaciones

- P1 - Corporate Reporting April 09Documento21 páginasP1 - Corporate Reporting April 09IrfanAún no hay calificaciones

- Adjusting Entries: Fundamentals of Accountancy, Business and Management-1Documento22 páginasAdjusting Entries: Fundamentals of Accountancy, Business and Management-1Arminda VillaminAún no hay calificaciones

- SMJ TUTORIAL, JAMMU PRE - BOARD 2 EXAMINATION ACCOUNTANCY (055Documento8 páginasSMJ TUTORIAL, JAMMU PRE - BOARD 2 EXAMINATION ACCOUNTANCY (055Balbir S BhatiAún no hay calificaciones

- Accounts from Incomplete Records AnalysisDocumento8 páginasAccounts from Incomplete Records AnalysisVisha JainAún no hay calificaciones

- Department of AuditingDocumento197 páginasDepartment of AuditingObert MarongedzaAún no hay calificaciones

- Adjusting Entries (Depreciation)Documento2 páginasAdjusting Entries (Depreciation)Mark Johnson LeeAún no hay calificaciones

- Comprehensive Example of Interperiod TAX ALLOCATIONDocumento9 páginasComprehensive Example of Interperiod TAX ALLOCATIONarsykeiwayAún no hay calificaciones

- Chapter Wise TallyDocumento24 páginasChapter Wise TallyNAVEEN BHARTI0% (1)

- FIAC6211 - Workbook 2023Documento88 páginasFIAC6211 - Workbook 2023Panashe SimbiAún no hay calificaciones

- BC - IsiDocumento15 páginasBC - IsiBen DoverAún no hay calificaciones

- Its My Cash Flow and I Need It Now Cash Flow in Oracle Cloud EPMDocumento39 páginasIts My Cash Flow and I Need It Now Cash Flow in Oracle Cloud EPMVinay NarulaAún no hay calificaciones

- Mapa MentalDocumento8 páginasMapa MentalJOHAN UBEIMAR PALMA ORTEGAAún no hay calificaciones

- SFP- key financial statementsDocumento14 páginasSFP- key financial statementsJuvie Rose BuenaventeAún no hay calificaciones

- Accounting Income Vs Economic Income DefinitionDocumento11 páginasAccounting Income Vs Economic Income DefinitionZahid UsmanAún no hay calificaciones

- IASB Framework Sets Financial Reporting StandardsDocumento3 páginasIASB Framework Sets Financial Reporting StandardsFaizSheikhAún no hay calificaciones

- Lebanese Association of Certified Public Accountants - IFRS KEY July Exam 2019Documento5 páginasLebanese Association of Certified Public Accountants - IFRS KEY July Exam 2019jad NasserAún no hay calificaciones

- Review Strategies of SLU CPA PassersDocumento6 páginasReview Strategies of SLU CPA PassersbrepoyoAún no hay calificaciones

- Auditing Multiple Choice Questions and AnswersDocumento6 páginasAuditing Multiple Choice Questions and AnswersKelvin Kenneth ValmonteAún no hay calificaciones

- JD-GM (CDD)Documento2 páginasJD-GM (CDD)DiyanaAún no hay calificaciones

- Cash Flow Disclosure-Checklist - KPMGDocumento7 páginasCash Flow Disclosure-Checklist - KPMGNafiul IslamAún no hay calificaciones

- Tuto 4Documento24 páginasTuto 4Qasih Izyan50% (2)