Documentos de Académico

Documentos de Profesional

Documentos de Cultura

CH 8

Cargado por

sunanda88Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

CH 8

Cargado por

sunanda88Copyright:

Formatos disponibles

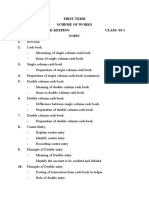

Chapter 8 The Cash Book

The cash book brings together the separate cash and bank transactions of a business into one book. This means that the cash account and the bank account are combined to form the cash book. The cash book is used to record the book-keeping transactions which involve the receipt and payment of money both in cash or by cheque. The main difference that this book has from the other books of original entry is that it forms an integral part of the double entry system. Control of cash and money in the bank is very important for all businesses. A shortage of money may mean that wages and other day-to-day expenses cannot be paid. This could lead to the failure of the business. Double Entry used: When money is received (either in cash or by cheque) the Cash Book is debited and the relevant account in the ledger is credited. When a payment is made (either in cash or by cheque) the Cash Book is credited and the relevant account in the ledger is debited. Example: (a) Paid Rent in Cash: Dr Rent Account (In the General Ledger) Cr Cash Book (Cash Column) (b) Received by cheque from A.Jones: Dr Cash Book (Bank Column) Cr A.Jones (Sales Ledger) Contra Entries: This is a transaction that affects both the cash account and the bank account. Example: (a) Took Lm50 out of the cash and paid it into the bank: Dr Bank Column Cr Cash Column (b) Withdrew Lm100 cash from the bank for business use. Dr Cash Column Cr Bank Column

Pg.31

A detailed example: From the following transactions you are required to write up a Two - Column Cash Book. Balance off at the end of the month. Jan 1 : Jan 2 : Jan 4 : Jan 6 : Jan 7 : Jan15 : Jan23 : Jan29 : Jan31 : Started business with Lm940 in the bank. Received cheque from M.Vella Lml15. Cash Sales Lm102. Paid Rent in cash Lm35. Took Lm50 out of the cash and paid it into the bank. Cash sales paid direct into the bank Lm40. Paid cheque to S.Wllliams Lm277. Withdrew cash from the bank for business use Lm120. Paid wages in cash Lml18.

N.B Jan7 and Jan29 are both Contra Entries but Jan15 is not a contra entry.

Dr Cash Jan-01 Jan-02 Jan-04 Jan-07 Jan-15 Jan-29 Capital M.Vella Sales Cash Sales Bank

Cash Book Bank 940 115 Jan-06 Jan-07 Jan-23 Jan-29 Jan-30 Jan-31 Rent Bank S.Williams Cash Wages Balance c/d

Cr Cash 35 50 277 120 118 19 222 748 1,145 Bank

102 50 40 120 222 19 1,145 748

Feb-01 Balance b/d

Note (i) Lm19 relates to Cash in hand. Lm748 relates to Cash at Bank. (ii) If the credit side of the bank column is greater than the Debit side of the bank column the bank balance will represent a bank overdraft. Sometimes a third column on each side is used to record cash discount, thus forming a three column cash book. A cash discount is an allowance offered for quick settlement (e.g. 5% discount for settlement within five days). Discount Allowed is the discount (reduction in price) given to customers and this is shown on the debit side of the Three Column Cash Book. Discount Received is the discount received from suppliers and is shown on the credit side of the Three Column Cash Book. Discount Allowed is an expense and discount received is a gain for the business.

Pg.32

Example From the following details prepare a Three Column Cash Book: May1: Balance brought down from April: Lm Cash Balance 29 Bank Balance 654 B.King pays us by cheque Lm117, after having deducted Lm3 cash discount. The business pays R.Long account of Lm100 by cheque less 5% cash discount. Withdrew Lm100 cash from the bank for business use. N.Campbell pays us Lm273 by cheque after deducting Lm7 cash discount. Paid wages in cash Lm92. D.Shand pays us in cash Lm38 after deducting Lm3 cash discount. The business pays U.Barrow his account of Lm60 by cheque less 5% cash discount. The business pays A.Allen by cheque Lm429 after deducting Lm11 cash discount. Cash Book Bank 654 May-08 117 May-11 May-25 273 May-29 May-30 May-31 1,044 363 General Ledger Dr May-31 Discount Allowed Account 12 Cr Cr Bank 95 100 57 429 363 1,044

May2: May8: May11: May16: May25: May28: May29: May30:

Dr Disc May-01 May-02 May-11 May-16 May-28 Balance b/d B.King Bank N.Campbell D.Shand 3 100 7 2 12 Jun-01 Balance b/d 38 167 75 Cash 29

R.Long Cash Wages U.Borrow A.Allen Balance c/d

Disc. 5

Cash

92 3 11 19 75 167

Total for month

Dr

Discount Received Account May-31 Total for month

Cr 19

Note that the discount columns are not balanced but they are simply totalled. The total of each is transferred to the general ledger.

Pg.33

Exercises: 1. Write up a Two-Column Cash Book from the following details, and balance off as at the end of the month: 1999 1 Jan : Started in business with Lm1,000 in cash. 4 Jan : Transferred Lm500 of the cash into the bank. 6 Jan : Paid rent Lm50 in cash. 8 Jan : Bought office equipment Lm250, paying by cheque. 11Jan : Cash sales Lm50. 15Jan : Bought goods Lm200, paying in cash. 17Jan : Cash sales Lm75 paid direct into the bank. 19Jan : Cash drawings Lm105 23Jan : Paid sundry expenses Lm35 in cash. 31Jan : Sold goods by cheque for Lm85. Write up a Two-Column Cash Book from the following transactions. 1999 Lm April 1: M. Borg commenced business with capital in cash 2,500 April 1: Paid cash into bank 2,200 April 12: Cash sales 520 April 13: Paid cash into bank 500 April 15: Paid rent by cheque 70 April 24: Paid cash for stationery 30 April 27: Paid B. Calleja by cheque 1,600 April 28: Received cheque from L. Saliba 100 April 30: Paid light and heat by cheque 80 April 30: Paid carriage in cash 100 Enter the transactions in a Two-Column Book. 1999 1 Oct: Balances brought down: Cash in hand Cash at bank 3 Oct: Bought goods for cash 4 Oct: Paid cash into bank 7 Oct: Cash sales 8 Oct: Paid cash into bank 17 Oct: Paid sundry expenses in cash 24 Oct: J. Farrugia paid his account by cheque 27 Oct: Paid R .Scicluna by cheque 28 Oct: Cash sales 29 Oct: Paid stationery by cheque 30 Oct: Withdrew cash from the bank for business use 31 Oct: Paid rent by cheque 31 Oct: Paid light and heat by cheque Lm 200 4,000 180 200 570 600 40 1,500 3,000 350 200 300 400 300

2.

3.

Pg.34

4.

From the following transactions you are required to open a Three-Column Cash Book. 1999 Lm 1 Feb: Balances brought forward Cash in Hand 110 Cash at Bank 385 3 Feb: P Galea settles his account Lm100 by cheque after deducting 5 per cent cash discount. 7 Feb: Paid amount owing to M Busuttil by cheque Lm120 less 2 per cent cash discount. 10Feb: Withdrew Lm150 in cash from the bank for business use. 17Feb: A Sammut paid amount owing by cheque Lm160 less 2 per cent cash discount. 20Feb: Paid wages by cheque Lm315. 22Feb: Paid amount owing to T Gerada Lm200 by cheque, after deducting 5 per cent cash discount. 25Feb: B Bugeja paid the amount owing by cheque Lm120 less 2 per cent cash discount. 28Feb: Paid rent in cash Lm60. 28Feb: Paid the amount owing to A Saliba Lm280 by cheque after deducting 2 per cent cash discount.

5.

The Three-Column Cash Book of the firm for which you work was not kept up todate for one week. The balances on the Cash Book at 25 October 1999 were: Cash in Hand Lm40 Cash at Bank Lm9236 Total of Discount Allowed column Lm36 Total of Discount Received column Lm20. The following items have not been dealt with: 28Oct: Paid N Dallis account of Lm150 by cheque, taking 2% cash discount; 28Oct: Lm100 cash from the bank for office use. 29Oct Received and paid into the bank a cheque from M Rizzo for Lm376. 30Oct: Cash Sales Lm285 paid directly into the bank. 31Oct: Received and paid into the bank a cheque for Lm185 from M Licari in full settlement of his account of Lm190. 31Oct: Paid travelling expenses Lm37 in cash. You are required to update the cash book.

Pg.35

6.

Enter the following transactions in a Three-Column Cash Book of M Abela for the month of April: Apr 1: Balances b/f : Lm Cash in Hand 200 Bank Overdraft 140 Received Lm195 in cash from A. Saliba. Paid Lm170 into the bank from cash Withdrew Lm50 by cheque for personal use. Received cheque form R.Debono in settlement of his account for Lm600 less 2% cash discount. Withdrew Lm350 from bank for office cash. Paid wages Lm336 in cash. Cash sales Lm218 Paid electricity in cash Lm63. Paid L .Bugeja by cheque his account for Lm300 less 2 per cent cash discount.

Apr 4: Apr 7: Apr12: Apr17: Apr24: Apr25: Apr27: Apr27: Apr28:

7. 1999 Mar 1 Mar 2 Mar 4 Mar 6 Mar 8 Mar 10 Mar 12 Mar 15 Mar 18 Mar 21 Mar 24 Mar 27 Mar 31

A three-column cash book is to be written up from the following details, balanced off, and the relevant discount accounts in the general ledger shown. Balances brought forward: Cash Lm230; Bank Lm4,756. R. Bartolo paid us by cheque Lm150, deducting 5%cash discount. Paid rent by cheque Lm120. J.Callus lent us Lm1,000 paying by cheque. We paid by cheque N. Saliba Lm300 deducting 2% cash discount. Paid motor expenses in cash Lm44. H. Mallia pays his account of Lm77 by cheque Lm74, deducting Lm3 cash discount. Paid wages in cash Lm160. C. Vella paid his account of Lm260 less 5% cash discount. Cash withdrawn from the bank Lm35 for business use. Cash drawings Lm12. Bought fixtures paying by cheque Lm650. Received commission by cheque Lm88.

Pg.36

Pg.37

También podría gustarte

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDe EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAún no hay calificaciones

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionDe EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionAún no hay calificaciones

- Ch8 Cabook PDFDocumento7 páginasCh8 Cabook PDFThiruvenkata ManiAún no hay calificaciones

- Cash BooksDocumento4 páginasCash Booksalbert.lumadede100% (1)

- Cash Book and Bank Reconciliation Lecture IDocumento10 páginasCash Book and Bank Reconciliation Lecture IDavidAún no hay calificaciones

- Types of Cash Books Single - Column Cash Book Two Column Cash Book Three Column Cash Book Past KCSE Questions On The TopicDocumento10 páginasTypes of Cash Books Single - Column Cash Book Two Column Cash Book Three Column Cash Book Past KCSE Questions On The TopicHENRY MURIGIAún no hay calificaciones

- Bank Reconciliation QuestionsDocumento2 páginasBank Reconciliation Questionsmercknjoro100% (1)

- Recording of Financial TransactionsDocumento8 páginasRecording of Financial TransactionsbarakaAún no hay calificaciones

- Cash BooksDocumento13 páginasCash BooksWanjala RajabAún no hay calificaciones

- ACCOUNTINGDocumento12 páginasACCOUNTINGharoonadnan196Aún no hay calificaciones

- Record Transactions in Journals & Cash BookDocumento20 páginasRecord Transactions in Journals & Cash BookSubodh Saxena100% (1)

- BY: Ms. Pakeezah ButtDocumento31 páginasBY: Ms. Pakeezah ButtHusnain MustafaAún no hay calificaciones

- Cash BookDocumento18 páginasCash BookDr. Mohammad Noor AlamAún no hay calificaciones

- Lecture-2 (Cash Book)Documento31 páginasLecture-2 (Cash Book)Ali AhmedAún no hay calificaciones

- Cash Book - Principles of AccountingDocumento13 páginasCash Book - Principles of AccountingAbdulla MaseehAún no hay calificaciones

- Accounting Procedures and Techniques: Cash BooksDocumento2 páginasAccounting Procedures and Techniques: Cash BookszkkoechAún no hay calificaciones

- Chapter - Ii: Accounting ProcessDocumento7 páginasChapter - Ii: Accounting ProcessPilau SinghAún no hay calificaciones

- Record Transactions and Apply Accounting ConceptsDocumento20 páginasRecord Transactions and Apply Accounting ConceptscalebAún no hay calificaciones

- Cash Book Notes ExamplesDocumento17 páginasCash Book Notes ExamplesLycan LycanAún no hay calificaciones

- Subdivision of JournalsDocumento23 páginasSubdivision of JournalsSarthak Gupta100% (3)

- The Cash BookDocumento22 páginasThe Cash Bookrdeepak99Aún no hay calificaciones

- Book KeepingDocumento10 páginasBook KeepingOnyiAún no hay calificaciones

- Accounting CycleDocumento12 páginasAccounting CycleAwais KhanAún no hay calificaciones

- Accounting For Current Assets - Cash and ReceivablesDocumento17 páginasAccounting For Current Assets - Cash and ReceivablesvladsteinarminAún no hay calificaciones

- DiscountsDocumento3 páginasDiscountsMemory BwalyaAún no hay calificaciones

- Petty Cash & 3 Column Cash BookDocumento22 páginasPetty Cash & 3 Column Cash BookAbisellyAún no hay calificaciones

- BANK RECONCILIATION STATEMENTDocumento40 páginasBANK RECONCILIATION STATEMENTLeteSsieAún no hay calificaciones

- Journal and ledger assignmentsDocumento39 páginasJournal and ledger assignmentsIndu GuptaAún no hay calificaciones

- Cash BookDocumento6 páginasCash BookTefo Lelentle Itachi MatlhoAún no hay calificaciones

- (A) (B) (C) (D) (E) (F) (G) : Cacwo Fundamentals of AccountingDocumento53 páginas(A) (B) (C) (D) (E) (F) (G) : Cacwo Fundamentals of AccountingacademianotesAún no hay calificaciones

- Cash BookDocumento29 páginasCash BookPrashantAún no hay calificaciones

- Cash Book Assignment QuestionsDocumento4 páginasCash Book Assignment Questionsρεrvy αlcнεмisτ (ραρi)Aún no hay calificaciones

- Cash BookDocumento2 páginasCash BookYin Liu100% (1)

- Format of The Petty Cash BookDocumento49 páginasFormat of The Petty Cash BookNa Ni63% (8)

- Form Three AssignmentDocumento5 páginasForm Three AssignmentKennedy Odhiambo OchiengAún no hay calificaciones

- TH TH TH TH TH RD TH ND TH TH TH THDocumento2 páginasTH TH TH TH TH RD TH ND TH TH TH THselina fraserAún no hay calificaciones

- 3 Column Cash BookDocumento4 páginas3 Column Cash BookMuketoi AlexAún no hay calificaciones

- Blue Print: Accounting: Class XI Weightage Difficulty Level of QuestionsDocumento12 páginasBlue Print: Accounting: Class XI Weightage Difficulty Level of Questionssirsa11Aún no hay calificaciones

- Subsidiary Books Track Business TransactionsDocumento53 páginasSubsidiary Books Track Business TransactionsAjay Kumar Sharma100% (2)

- Brief Exercises BE2 - 1: No. Account (A) Debit Effect (B) Credit Effect (C) Normal BalanceDocumento6 páginasBrief Exercises BE2 - 1: No. Account (A) Debit Effect (B) Credit Effect (C) Normal BalanceRakibul Islam Khan83% (6)

- Current JSS 2 BUSINESS STUDIES 3RD TERMDocumento34 páginasCurrent JSS 2 BUSINESS STUDIES 3RD TERMpalmer okiemuteAún no hay calificaciones

- Bad debts recovered and opening entries recordedDocumento4 páginasBad debts recovered and opening entries recordedBRAINSTORM Haroon RasheedAún no hay calificaciones

- Three Column Cash BookDocumento5 páginasThree Column Cash Bookvinodksrini007100% (2)

- Take It From NT:-Cash Book Plays Role of Both Journal As Well As LedgerDocumento17 páginasTake It From NT:-Cash Book Plays Role of Both Journal As Well As LedgerAnonymous b4qyneAún no hay calificaciones

- Two Column Cash BookDocumento24 páginasTwo Column Cash BookDarshans dadAún no hay calificaciones

- FA1 Source Documents and Books of Prime Entry Week 2Documento18 páginasFA1 Source Documents and Books of Prime Entry Week 2Sebastian FeuersteinAún no hay calificaciones

- Answer All The Accounting)Documento2 páginasAnswer All The Accounting)Sivabalan BionicAún no hay calificaciones

- Double Entry Cash BookDocumento3 páginasDouble Entry Cash BookGyanish JhaAún no hay calificaciones

- Bank ReconciliationDocumento21 páginasBank Reconciliationehab_ghazallaAún no hay calificaciones

- BankrecDocumento24 páginasBankrecehab_ghazallaAún no hay calificaciones

- Triple Column Cash Book TransactionsDocumento6 páginasTriple Column Cash Book Transactionsshahid sjAún no hay calificaciones

- The Journal: 1. The Opening of A Business On A Double Entry System ExampleDocumento16 páginasThe Journal: 1. The Opening of A Business On A Double Entry System ExampleNoman ParvezAún no hay calificaciones

- Accounting EquationDocumento24 páginasAccounting EquationRahul Badlani100% (1)

- Pac Ver Finalans KeyDocumento10 páginasPac Ver Finalans KeyArun LalAún no hay calificaciones

- What is a cash bookDocumento4 páginasWhat is a cash bookPayal MaskaraAún no hay calificaciones

- Lecture 3 Cash BookDocumento16 páginasLecture 3 Cash BookChaudhry F MasoodAún no hay calificaciones

- Problem 1: Use The Accounting Equation To Show Their Effect On His Assets, Liabilities and CapitalDocumento2 páginasProblem 1: Use The Accounting Equation To Show Their Effect On His Assets, Liabilities and CapitalMadeeha KhanAún no hay calificaciones

- CBSE Class 11 Accountancy Sample Paper 2013 PDFDocumento12 páginasCBSE Class 11 Accountancy Sample Paper 2013 PDFsivsyadav100% (1)

- Economic & Budget Forecast Workbook: Economic workbook with worksheetDe EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetAún no hay calificaciones

- PrintDocumento13 páginasPrintsunanda88Aún no hay calificaciones

- Questionnaire On Domestic Violence: Put Down Your Accomplishments or Goals?Documento2 páginasQuestionnaire On Domestic Violence: Put Down Your Accomplishments or Goals?sunanda88Aún no hay calificaciones

- PrintDocumento13 páginasPrintsunanda88Aún no hay calificaciones

- Petrol Price HikeDocumento30 páginasPetrol Price HikeHimanshu Jatana100% (1)

- JSKJHKJNSLKJKJNMSL HJHDSKJHNSJKHSKJ Jhahbsmnbsdjkhakjshki Im, DBHJHSGDJKQMWNDKL Dkqhwkjdghqkjdnkjqdhkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkijflkwe JksfhwskjfhniuwygfjwbDocumento1 páginaJSKJHKJNSLKJKJNMSL HJHDSKJHNSJKHSKJ Jhahbsmnbsdjkhakjshki Im, DBHJHSGDJKQMWNDKL Dkqhwkjdghqkjdnkjqdhkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkijflkwe Jksfhwskjfhniuwygfjwbsunanda88Aún no hay calificaciones

- Physical EduDocumento7 páginasPhysical Edusunanda88Aún no hay calificaciones

- Teaching of Economics ProjectDocumento30 páginasTeaching of Economics Projectsunanda88Aún no hay calificaciones

- Types of Teaching AidsDocumento13 páginasTypes of Teaching Aidsashrafmousa100% (1)

- DemandDocumento38 páginasDemandrohan_jangid8Aún no hay calificaciones

- Transfer PricingDocumento15 páginasTransfer Pricingsunanda88Aún no hay calificaciones

- Introduction To Economics: The Economic Problem Opportunity CostDocumento10 páginasIntroduction To Economics: The Economic Problem Opportunity Costsunanda88Aún no hay calificaciones

- Balanced ScorecardDocumento11 páginasBalanced Scorecardgagan310Aún no hay calificaciones

- Res AccountingDocumento33 páginasRes Accountingsunanda88Aún no hay calificaciones

- VALIX - IA 1 (2020 Ver.) Government GrantDocumento9 páginasVALIX - IA 1 (2020 Ver.) Government GrantAriean Joy DequiñaAún no hay calificaciones

- Uw eMBA Wikibook-Managerial-Accounting PDFDocumento103 páginasUw eMBA Wikibook-Managerial-Accounting PDFEswari Gk100% (1)

- GAAPDocumento4 páginasGAAPDPAún no hay calificaciones

- Management Advisory Services Review PRELIMDocumento5 páginasManagement Advisory Services Review PRELIMSintos Carlos MiguelAún no hay calificaciones

- The Effects of Audit Committee AttributesDocumento9 páginasThe Effects of Audit Committee AttributesYehezkiel OktavianusAún no hay calificaciones

- Chapter 1 Financial AccountingDocumento10 páginasChapter 1 Financial AccountingMarcelo Iuki HirookaAún no hay calificaciones

- Learn warranty liability in 40 charsDocumento9 páginasLearn warranty liability in 40 charsNovylyn AldaveAún no hay calificaciones

- Auditing Trs by IcapDocumento53 páginasAuditing Trs by IcapArif AliAún no hay calificaciones

- X Accounting 2Documento419 páginasX Accounting 2Amaury Guillermo Baez100% (2)

- Accounting Information SystemDocumento5 páginasAccounting Information Systemaccajay230% (1)

- 11 - Bank Reconciliation NotesDocumento3 páginas11 - Bank Reconciliation NotesJann GataAún no hay calificaciones

- CH 11Documento55 páginasCH 11Bhavin purohitAún no hay calificaciones

- Principle of Double Entry & Trial Balance: Prepared By: Nurul Hassanah HamzahDocumento35 páginasPrinciple of Double Entry & Trial Balance: Prepared By: Nurul Hassanah HamzahNur Amira NadiaAún no hay calificaciones

- Stratcosman CompilationDocumento22 páginasStratcosman CompilationAl Francis GuillermoAún no hay calificaciones

- Management AccountingDocumento68 páginasManagement AccountingNekibur DeepAún no hay calificaciones

- Cadbury AuditDocumento12 páginasCadbury AuditarpitchitranshAún no hay calificaciones

- AUT - 2016 Postgraduate Business ResearchDocumento23 páginasAUT - 2016 Postgraduate Business ResearchbhvilarAún no hay calificaciones

- LaporanKeuanganWIKA30September2018Documento164 páginasLaporanKeuanganWIKA30September2018arrizal firdausAún no hay calificaciones

- DSE invoice for button badges for schoolDocumento1 páginaDSE invoice for button badges for schoolafarz2604Aún no hay calificaciones

- Job Costing System for Pisano Company TITLE Accounting Press Job Costing HomeworkDocumento2 páginasJob Costing System for Pisano Company TITLE Accounting Press Job Costing HomeworkYogie YaditraAún no hay calificaciones

- EXAM ABM 11 Jan 29Documento1 páginaEXAM ABM 11 Jan 29Roz AdaAún no hay calificaciones

- Accounting DefinitionDocumento4 páginasAccounting DefinitionMarjealyn PortugalAún no hay calificaciones

- IAASB Strategy and Work Program 2012-2014-FinalDocumento28 páginasIAASB Strategy and Work Program 2012-2014-FinalSwapnil ChoudhariAún no hay calificaciones

- Accounting Problem CHART OF ACCOUNTSDocumento6 páginasAccounting Problem CHART OF ACCOUNTSkarenlasuncionAún no hay calificaciones

- 1 - Objectives, Role and Scope of Management AccountingDocumento11 páginas1 - Objectives, Role and Scope of Management Accountingmymy100% (2)

- CH 06Documento40 páginasCH 06lalala010899Aún no hay calificaciones

- Final Examination - Fabm - Ms. Alrose - 17 CopiesDocumento2 páginasFinal Examination - Fabm - Ms. Alrose - 17 CopiesAlrose Balani MacapunoAún no hay calificaciones

- SOP Arshdeep Singh, UelDocumento3 páginasSOP Arshdeep Singh, Uelcosmo worldAún no hay calificaciones

- Comp-Xm® Inquirer0Documento21 páginasComp-Xm® Inquirer0Jasleen Kaur (Ms)Aún no hay calificaciones

- INTERNAL AUDIT PROGRAMMEDocumento14 páginasINTERNAL AUDIT PROGRAMMERiya XavierAún no hay calificaciones