Documentos de Académico

Documentos de Profesional

Documentos de Cultura

RMC 18-2011 - Clarify The Income Tax Exemption of Interest Earnings Under Long Term Deposits or Investments Certificates

Cargado por

locusstandi84Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

RMC 18-2011 - Clarify The Income Tax Exemption of Interest Earnings Under Long Term Deposits or Investments Certificates

Cargado por

locusstandi84Copyright:

Formatos disponibles

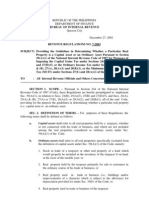

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

April 12, 2011

REVENUE MEMORANDUM CIRCULAR NO. 18-2011

SUBJECT: INCOME TAX EXEMPTION OF INTEREST INCOME EARNINGS FROM LONG

TERM DEPOSITS OR INVESTMENT CERTIFICATES UNDER SEC 24(B)(1) &

25(A)(2) OF THE NATIONAL INTERNAL REVENUE CODE OF 1997, AS

AMENDED

TO: All Revenue Officials, Employees and Others Concerned

--------------------------------------------------------------------------------------------------------------------------

This Circular is issued to clarify the income tax exemption of interest income

earnings from long-term deposits or investments certificates.

The term 'long-term deposit or investment certificates' shall refer to certificate of

time deposit or investment in the form of savings, common or individual trust funds, deposit

substitutes, investment management accounts and other investments with a maturity

period of not less than five (5) years, the form of which shall be prescribed by the Bangko

Sentral ng Pilipinas (BSP) and issued by banks only (not by nonbank financial intermediaries

and finance companies) to individuals in denominations of Ten thousand pesos (P10,000)

and other denominations as may be prescribed by the BSP [Section 22 (FF) of the National

Internal Revenue Code of 1997 as amended].

Sections 24(B)(1) and 25(A)(2) of the National Internal Revenue Code of 1997 as

amended provide that interest income from long-term deposit or investment in the form of

savings, common or individual trust funds, deposit substitutes, investment management

accounts and other investments evidenced by certificates in such form prescribed by the

Bangko Sentral ng Pilipinas (BSP) shall be exempt from income tax. However, should the

holder of the certificate pre-terminate the deposit or investment before the fifth (5

th

) year,

a final tax shall be imposed on the entire income and shall be deducted and withheld by the

depository bank from the proceeds of the long-term deposit or investment certificate based

on the remaining maturity thereof:

Four (4) years to less than five (5) years - 5%;

Three (3) years to less than (4) years - 12%; and

Less than three (3) years - 20%

From the foregoing, the following characteristics / conditions should be present to

enjoy income tax exemption, to wit:

1. the depositor or investor is an individual citizen (resident or non-resident)

or resident alien or nonresident alien engaged in trade or business in the

Philippines and not a corporation;

2. the long-term deposits or investments certificates should be under the

name of the individual and not under the name of the corporation or the

bank or the trust department/unit of the bank;

3. the long-term deposits or investments must be in the form of savings,

common or individual trust funds, deposit substitutes, investment

management accounts and other investments evidenced by certificates in

such form prescribed by the Bangko Sentral ng Pilipinas (BSP);

4. the long-term deposits or investments must be issued by banks only and

not by other financial institutions;

5. the long-term deposits or investments must have a maturity period of

not less than five years;

6. the long-term deposits or investments must be in denominations of Ten

thousand pesos (P10,000) and other denominations as may be prescribed

by the BSP;

7. only the interest income from long-term deposits or investments

certificates are covered by income tax exemption;

8. income tax exemption does not cover any other income such as gains

from trading, foreign exchange gain;

9. the long-term deposits or investments should not be terminated by the

investor before the fifth year, otherwise it shall be subjected to the

graduated rates of 5%, 12% or 20% on interest income earnings.

All rulings and issuances inconsistent with the foregoing are considered void and of

no legal effect for being contrary to law.

All internal revenue officers are hereby enjoined to give this Circular a wide publicity

as possible.

(Original Signed)

KIM S. JACINTO-HENARES

Commissioner of Internal Revenue

JMS

DCIR - EVS

COS - LIG

MOC

También podría gustarte

- Heiberg, FATCA - Toward A Multilateral Automatic Information Reporting RegimeDocumento29 páginasHeiberg, FATCA - Toward A Multilateral Automatic Information Reporting Regimelocusstandi84Aún no hay calificaciones

- ITU-T K.70, Series K, Protection Against Interference, Human Exposure To EMF, 2007Documento56 páginasITU-T K.70, Series K, Protection Against Interference, Human Exposure To EMF, 2007locusstandi84Aún no hay calificaciones

- IRR of PD 856 Sanitation Code - Disposal of Dead PersonsDocumento24 páginasIRR of PD 856 Sanitation Code - Disposal of Dead Personslocusstandi84100% (2)

- 2012 DOH AO 2012-0012 Rules On New Classification of Hospitals and Other Health Facilities, July 18, 2012Documento18 páginas2012 DOH AO 2012-0012 Rules On New Classification of Hospitals and Other Health Facilities, July 18, 2012locusstandi8450% (6)

- RMC 30-2013 - Mandatory Electronic Filing of Tax Returns and Electronic Payment of TaxesDocumento1 páginaRMC 30-2013 - Mandatory Electronic Filing of Tax Returns and Electronic Payment of Taxeslocusstandi84Aún no hay calificaciones

- IRR of RA 9711 (BFAD) PDFDocumento68 páginasIRR of RA 9711 (BFAD) PDFDesiree PompeyoAún no hay calificaciones

- An International Perspective On Language Policies, Practices and Proficiencies by Cunningham - HatossDocumento420 páginasAn International Perspective On Language Policies, Practices and Proficiencies by Cunningham - Hatosslocusstandi84Aún no hay calificaciones

- ICRC Map, State Party To The Geneva Conventions and Their Additional Protocols, As of Dec. 31, 2012Documento1 páginaICRC Map, State Party To The Geneva Conventions and Their Additional Protocols, As of Dec. 31, 2012locusstandi84Aún no hay calificaciones

- BIR RR 07-2003Documento8 páginasBIR RR 07-2003Brian BaldwinAún no hay calificaciones

- ICRC 2011, Strengthening Legal Protection For Victims of Armed ConflictsDocumento29 páginasICRC 2011, Strengthening Legal Protection For Victims of Armed Conflictslocusstandi84Aún no hay calificaciones

- ICRC 2011, International Humanitarian Law and Challenges of Contemporary Armed ConflictsDocumento53 páginasICRC 2011, International Humanitarian Law and Challenges of Contemporary Armed Conflictslocusstandi84Aún no hay calificaciones

- Seattle University School of Law - Penumbral Thinking Revisited, Metaphor in Legal ArgumentationDocumento30 páginasSeattle University School of Law - Penumbral Thinking Revisited, Metaphor in Legal Argumentationlocusstandi84Aún no hay calificaciones

- BIR RR 07-2003Documento8 páginasBIR RR 07-2003Brian BaldwinAún no hay calificaciones

- RA 10022 - Migrant Workers ActDocumento24 páginasRA 10022 - Migrant Workers Actldl_010101Aún no hay calificaciones

- Egbomuche-Okeke - Critical Appraisal of Obligation in Int'l. LawDocumento5 páginasEgbomuche-Okeke - Critical Appraisal of Obligation in Int'l. Lawlocusstandi84Aún no hay calificaciones

- Jurisdiction, Procedure and The Transformation of Int'l. Law From Nottebohm To Diallo in The ICJDocumento18 páginasJurisdiction, Procedure and The Transformation of Int'l. Law From Nottebohm To Diallo in The ICJlocusstandi84Aún no hay calificaciones

- PIL - Political Rhetoric of Emerging Legal NormDocumento23 páginasPIL - Political Rhetoric of Emerging Legal Normlocusstandi84Aún no hay calificaciones

- UNGA-ILC, Report On Unilateral Acts of StatesDocumento31 páginasUNGA-ILC, Report On Unilateral Acts of Stateslocusstandi84Aún no hay calificaciones

- UN PCNICC List of Documentary NotesDocumento10 páginasUN PCNICC List of Documentary Noteslocusstandi84Aún no hay calificaciones

- Lectures On The Legal System of The USDocumento556 páginasLectures On The Legal System of The USlocusstandi84Aún no hay calificaciones

- Lauterpacht's Concept of The In'l. Judicial FunctionDocumento35 páginasLauterpacht's Concept of The In'l. Judicial Functionlocusstandi84Aún no hay calificaciones

- Territorial Governments and Limits of FormalismDocumento60 páginasTerritorial Governments and Limits of Formalismlocusstandi84Aún no hay calificaciones

- Declaration of High Level Meeting of GA On Rule of Law at The National and Int'l. LevelsDocumento6 páginasDeclaration of High Level Meeting of GA On Rule of Law at The National and Int'l. Levelslocusstandi84Aún no hay calificaciones

- PLJ Volume 25 Number 2 - 01 - Jovito R. Salonga - Conflict of Laws - A Critical Survey of Doctrines and Practices and The Case For A Policy Oriented ApproachDocumento18 páginasPLJ Volume 25 Number 2 - 01 - Jovito R. Salonga - Conflict of Laws - A Critical Survey of Doctrines and Practices and The Case For A Policy Oriented ApproachMarivic SorianoAún no hay calificaciones

- WTO Legal Affairs Division - Evidence, Proof and Persuasion in WTO Dispute Settlement, Who Bears The Burden by Joost PauwelynDocumento32 páginasWTO Legal Affairs Division - Evidence, Proof and Persuasion in WTO Dispute Settlement, Who Bears The Burden by Joost Pauwelynlocusstandi84Aún no hay calificaciones

- Understanding Law and Economics, A Primer For Judges by Lourdes Sereno, Associate Professor, UP College of LawDocumento11 páginasUnderstanding Law and Economics, A Primer For Judges by Lourdes Sereno, Associate Professor, UP College of Lawlocusstandi84Aún no hay calificaciones

- An Essay On Law in Social Development by Dean Merlin M, MagallonaDocumento11 páginasAn Essay On Law in Social Development by Dean Merlin M, Magallonalocusstandi84Aún no hay calificaciones

- Revisiting The Underlying Philosophical Underpinnings of Philippine Commercial Laws by Cesar Villanueva, Ateneo de Manila Law SchoolDocumento58 páginasRevisiting The Underlying Philosophical Underpinnings of Philippine Commercial Laws by Cesar Villanueva, Ateneo de Manila Law Schoollocusstandi84Aún no hay calificaciones

- Legal PhilosophyDocumento22 páginasLegal Philosophygentlejosh_316100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (120)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2101)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Oil Refinery OpsDocumento3 páginasOil Refinery OpsPhiPhiAún no hay calificaciones

- As 3789.2-1991 Textiles For Health Care Facilities and Institutions Theatre Linen and Pre-PacksDocumento9 páginasAs 3789.2-1991 Textiles For Health Care Facilities and Institutions Theatre Linen and Pre-PacksSAI Global - APACAún no hay calificaciones

- Cost Volume Profit AnalysisDocumento7 páginasCost Volume Profit AnalysisMatinChris KisomboAún no hay calificaciones

- Phet Body Group 1 ScienceDocumento42 páginasPhet Body Group 1 ScienceMebel Alicante GenodepanonAún no hay calificaciones

- Rajkumar Kitchen Model Oil Expeller - INRDocumento1 páginaRajkumar Kitchen Model Oil Expeller - INRNishant0% (1)

- COMMUNICATIONS Formulas and ConceptsDocumento24 páginasCOMMUNICATIONS Formulas and ConceptsAllan Paul Lorenzo Abando76% (17)

- Risk-Based IA Planning - Important ConsiderationsDocumento14 páginasRisk-Based IA Planning - Important ConsiderationsRajitha LakmalAún no hay calificaciones

- Tankguard AR: Technical Data SheetDocumento5 páginasTankguard AR: Technical Data SheetAzar SKAún no hay calificaciones

- Online Illuminati Brotherhood Registration Call On +27632807647 How To Join IlluminatiDocumento5 páginasOnline Illuminati Brotherhood Registration Call On +27632807647 How To Join IlluminatinaseefAún no hay calificaciones

- Step Recovery DiodesDocumento3 páginasStep Recovery DiodesfahkingmoronAún no hay calificaciones

- 201183-B-00-20 Part ListDocumento19 páginas201183-B-00-20 Part ListMohamed IsmailAún no hay calificaciones

- DataBase Management Systems SlidesDocumento64 páginasDataBase Management Systems SlidesMukhesh InturiAún no hay calificaciones

- HR Q and ADocumento87 páginasHR Q and Asanjeeb88Aún no hay calificaciones

- Saarthi Education Jija Mata Colony, Near Paithan Gate A Bad. Cont: 8694947070 / 5050Documento8 páginasSaarthi Education Jija Mata Colony, Near Paithan Gate A Bad. Cont: 8694947070 / 5050Roshan KumarAún no hay calificaciones

- Sheep ETU: Apuuga's AmigurumiDocumento4 páginasSheep ETU: Apuuga's Amigurumifiliz8888Aún no hay calificaciones

- What Is EBSD ? Why Use EBSD ? Why Measure Microstructure ? What Does EBSD Do That Cannot Already Be Done ?Documento5 páginasWhat Is EBSD ? Why Use EBSD ? Why Measure Microstructure ? What Does EBSD Do That Cannot Already Be Done ?Zahir Rayhan JhonAún no hay calificaciones

- RA 9184 & RA 3019 NotesDocumento5 páginasRA 9184 & RA 3019 Notesleng_evenAún no hay calificaciones

- CH 2 How LAN and WAN Communications WorkDocumento60 páginasCH 2 How LAN and WAN Communications WorkBeans GaldsAún no hay calificaciones

- Zapanta v. COMELECDocumento3 páginasZapanta v. COMELECnrpostreAún no hay calificaciones

- BGD Country en Excel v2Documento2681 páginasBGD Country en Excel v2Taskin SadmanAún no hay calificaciones

- Carpio V ValmonteDocumento2 páginasCarpio V ValmonteErvin John Reyes100% (2)

- CV Najim Square Pharma 4 Years ExperienceDocumento2 páginasCV Najim Square Pharma 4 Years ExperienceDelwarAún no hay calificaciones

- Sparse ArrayDocumento2 páginasSparse ArrayzulkoAún no hay calificaciones

- Course Code: ACT 202 Section:07 Group Assignment: Submitted ToDocumento25 páginasCourse Code: ACT 202 Section:07 Group Assignment: Submitted ToMd.Mahmudul Hasan 1722269030100% (1)

- Mercantile Law Zaragoza Vs Tan GR. No. 225544Documento3 páginasMercantile Law Zaragoza Vs Tan GR. No. 225544Ceasar Antonio100% (1)

- Newton Gauss MethodDocumento37 páginasNewton Gauss MethodLucas WeaverAún no hay calificaciones

- South West Mining LTD - Combined CFO & HWA - VerDocumento8 páginasSouth West Mining LTD - Combined CFO & HWA - Verapi-3809359Aún no hay calificaciones

- How To Make Affidavit at Pune Collector OfficeDocumento1 páginaHow To Make Affidavit at Pune Collector Officejayram1961Aún no hay calificaciones

- Laser Security System For HomeDocumento19 páginasLaser Security System For HomeSelvakumar SubramaniAún no hay calificaciones

- TreeSize Professional - Folder Contents of - CDocumento1 páginaTreeSize Professional - Folder Contents of - CHenrique GilAún no hay calificaciones