Documentos de Académico

Documentos de Profesional

Documentos de Cultura

MFWG: Mfi Performance Benchmarking December 2012 (Lao Mfis: Self-Reported Data)

Cargado por

leekosalTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

MFWG: Mfi Performance Benchmarking December 2012 (Lao Mfis: Self-Reported Data)

Cargado por

leekosalCopyright:

Formatos disponibles

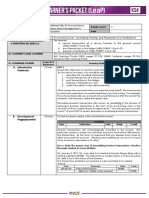

MFWG: MFI Performance Benchmarking December 2012

(Lao MFIs: Self-reported data)

MFIs other Asian countries (2012)

Lao MFI Peer Groups (December 2012)

Ref INDICATORS

A)

1

2

3

B)

4

5

6

7

C)

8

9

10

D)

11

12

E)

13

Institutional Characteristics

Gross Loan Portfolio (USD)

Total Assets (USD)

Number of staff

Outreach

Number of active borrowers (female and male)

% of female borrowers

Average outstanding loan size (USD)

Average outstanding loan size / GNI per capita

Financial Performance

Operational Self-Sufficiency (OSS)

Return on Assets (RoA)

Return on Equity (RoE)

Efficiency and Productivity

Number of loans outstanding per credit officer

Operating expense ratio

Portfolio Quality

Portfolio at risk 30+ days

Average

NDTMFIs

(6)

Average

SCUs

(5)

Average

DTMFIs

(5)

Average

Network

Support

Organisations

(4)

Overall

Average

Lao MFIs

(20)

Vietnam

(18 MFIs)

Cambodia

(13 MFIs)

East Asia &

Philippines Pacific Small

(8 MFIs)

Scale

(41 MFIs)

Industry

Standards

505,086

742,301

14

232,150

300,847

7

1,286,132

1,736,888

35

376,132

530,802

102

606,323

838,284

24

688,555

663,537

21

48,342,251

61,686,002

820

11,746,590

44,231,662

267

474,242

473,558

13

1,221

87%

449

36%

460

59%

459

36%

2,121

62%

776

62%

2,540

69%

180

14%

1,519

70%

480

38%

4,994

97%

161

12%

68,195

77%

875

104%

26,174

98%

161

7%

1,512

92%

220

12%

143%

10.5%

20.5%

120%

8.9%

25.6%

116%

3.2%

10.2%

180%

7.0%

59.5%

136%

7.5%

23.1%

135%

8.5%

13.2%

128%

4.1%

18.6%

115%

1.2%

17.9%

113%

2.3%

9.8%

126

21.8%

108

36.1%

151

32.2%

361

5.4%

175

25.7%

408

14.4%

162

13.9%

344

22.0%

282 >/= 150 / 300

13.9%

</= 20%

4.0%

13.3%

8.0%

15.4%

9.4%

0.3%

0.3%

4.5%

Notes:

The Lao MFI data used for establishing these benchmarks are based on self-reported data from Lao MFIs

Exchange rate applied: 1 USD = 7,985 Kip (BoL Reference Rate as of 28/12/12)

Source: Mix Market, Cross-Market Analysis database; values indicated are medians

Compound Peer Group "East Asia and Pacific Small Scale", i.e. FMIs from this region with a GLP < US$2 Million

GNI per capita for Laos in 2012 was US$1,260 (Source: WB, World Development Indicators Database)

2.1%

>/= 100%

>/= 2%

>/= 15%

</= 5%

MFWG: Lao MFI Performance Benchmarking December 2011 and December 2012

(Self-reported data)

Lao MFI Peer Groups - December 2011 and December 2012

Ref INDICATORS

A)

1

2

3

B)

4

5

6

7

C)

8

9

10

D)

11

12

E)

13

Institutional Characteristics

Gross Loan Portfolio (USD)

Total Assets (USD)

Number of staff

Outreach

Number of active borrowers (female and male)

% of female borrowers

Average outstanding loan size (USD)

Average outstanding loan size / GNI per capita

Financial Performance

Operational Self-Sufficiency (OSS)

Return on Assets (RoA)

Return on Equity (RoE)

Efficiency and Productivity

Number of loans outstanding per credit officer

Operating expense ratio

Portfolio Quality

Portfolio at risk 30+ days

Average

Average

NDTMFIs (6) NDTMFIs (6)

2011

2012

Average

SCUs (4)

2011

Average

SCUs (5)

2012

Average

DTMFIs (3)

2011

Average

Average

Overall

Average

Network

Network

Average Lao

DTMFIs (5)

Support

Support

MFIs (17)

Organisations (4) Organisations (4)

2012

2011

2011

2012

Overall

Average Lao

MFIs (20)

2012

249,218

424,956

11

505,086

742,301

14

92,518

168,345

6

232,150

300,847

7

1,320,299

1,568,140

38

1,286,132

1,736,888

35

359,365

439,573

49

376,132

530,802

102

427,279

569,755

24

606,323

838,284

24

577

73%

392

38%

1,221

87%

449

36%

316

68%

425

41%

460

59%

459

36%

2,557

54%

449

43%

2,121

62%

776

62%

1,747

83%

104

10%

2,540

69%

180

14%

1,140

69%

343

33%

1,519

70%

480

38%

104%

N/A

N/A

143%

10.5%

20.5%

124%

N/A

N/A

120%

8.9%

25.6%

171%

N/A

N/A

116%

3.2%

10.2%

119%

180%

7.0%

59.5%

124%

N/A

N/A

136%

7.5%

23.1%

99

126

21.8%

112

108

36.1%

192

N/A

361

5.4%

205

N/A

151

32.2%

556

N/A

21.0%

15.4%

9.0%

N/A

1.9%

4.0%

9.0%

Notes:

The data used for establishing these benchmarks are based on self-reported data from Lao MFIs

Exchange rate applied: 1 USD = 7,985 Kip (BoL Reference Rate as of 28/12/12)

GNI per capita for Laos in 2012 was US$1,260 (Source: WB, World Development Indicators Database)

13.3%

9.0%

8.0%

Industry

Standards

>/= 100%

>/= 2%

>/= 15%

175 >/= 150 / 300

25.7%

</= 20%

9.4%

</= 5%

También podría gustarte

- Local Youth Group: ? HEJ HI? /?IJ HIE #H 7J H I7F 7A 2008-2012Documento19 páginasLocal Youth Group: ? HEJ HI? /?IJ HIE #H 7J H I7F 7A 2008-2012Rushbh PatilAún no hay calificaciones

- Analysis of The SACCO Balance Sheet & PearlsDocumento43 páginasAnalysis of The SACCO Balance Sheet & PearlshackerbroAún no hay calificaciones

- Fitch RatingsDocumento7 páginasFitch RatingsTareqAún no hay calificaciones

- Variables 02Documento5 páginasVariables 02Mohammad KurshedAún no hay calificaciones

- Eco Factsheet 2012-09-0Documento2 páginasEco Factsheet 2012-09-0thailand2dayAún no hay calificaciones

- Turning The Corner, But No Material Pick-UpDocumento7 páginasTurning The Corner, But No Material Pick-UpTaek-Geun KwonAún no hay calificaciones

- Sapm Final DeckDocumento45 páginasSapm Final DeckShasank JalanAún no hay calificaciones

- Federal Bank: Performance HighlightsDocumento11 páginasFederal Bank: Performance HighlightsAngel BrokingAún no hay calificaciones

- Icici Bank: Performance HighlightsDocumento16 páginasIcici Bank: Performance HighlightsAngel BrokingAún no hay calificaciones

- 1 Introducing ADB by S. O'Sullivan Final For 20 March 2013Documento24 páginas1 Introducing ADB by S. O'Sullivan Final For 20 March 2013Butch D. de la CruzAún no hay calificaciones

- UBS Bonds ArticleDocumento46 páginasUBS Bonds Articlesouto123Aún no hay calificaciones

- CRISIL Event UpdateDocumento4 páginasCRISIL Event UpdateAdarsh Sreenivasan LathikaAún no hay calificaciones

- Wells Fargo Company and US BancorpDocumento9 páginasWells Fargo Company and US BancorpKassem MoukaddemAún no hay calificaciones

- TCS commentary stable, Seasonality to impact quarterDocumento3 páginasTCS commentary stable, Seasonality to impact quarterDarshan MaldeAún no hay calificaciones

- IJEF - 1001-0207 - DUONG - VONG - 278452 - Revisting BankDocumento15 páginasIJEF - 1001-0207 - DUONG - VONG - 278452 - Revisting BankPham Cong MinhAún no hay calificaciones

- HDFC May12 07 All LoanDocumento52 páginasHDFC May12 07 All Loanjohn_muellorAún no hay calificaciones

- Research Sample - IREDocumento7 páginasResearch Sample - IREIndepResearchAún no hay calificaciones

- Peer Reviewed - International Journal Vol-3, Issue-3, 2019 (IJEBAR)Documento8 páginasPeer Reviewed - International Journal Vol-3, Issue-3, 2019 (IJEBAR)Salsabil Shafa 350Aún no hay calificaciones

- ADIB Investor Presentation FY 2011Documento38 páginasADIB Investor Presentation FY 2011sunilkpareekAún no hay calificaciones

- Indian Bank: Performance HighlightsDocumento10 páginasIndian Bank: Performance HighlightsAngel BrokingAún no hay calificaciones

- 123 PDFDocumento13 páginas123 PDFMuhammadAún no hay calificaciones

- Bank of Baroda: Performance HighlightsDocumento12 páginasBank of Baroda: Performance HighlightsAngel BrokingAún no hay calificaciones

- 2012 11 13 Cyn Bofa-Ml Slides FinalDocumento37 páginas2012 11 13 Cyn Bofa-Ml Slides FinalrgosaliaAún no hay calificaciones

- Appendix Table IV.1: Indian Banking Sector at A Glance: Report On Trend and Progress of Banking in India 2011-12Documento2 páginasAppendix Table IV.1: Indian Banking Sector at A Glance: Report On Trend and Progress of Banking in India 2011-12Shivam KumarAún no hay calificaciones

- Jatin Johar Jitendra Kumar Tiwari Mahesh Singh Leena Bhatia Amit Kumar SinghDocumento18 páginasJatin Johar Jitendra Kumar Tiwari Mahesh Singh Leena Bhatia Amit Kumar SinghJatin JoharAún no hay calificaciones

- TFG 2012 Annual ReportDocumento48 páginasTFG 2012 Annual ReportTenGer Financial GroupAún no hay calificaciones

- Country Partnership Strategy: Georgia 2014 - 2018Documento19 páginasCountry Partnership Strategy: Georgia 2014 - 2018David BolesAún no hay calificaciones

- Bank of Kigali Investor Presentation Q1 & 3M 2012Documento43 páginasBank of Kigali Investor Presentation Q1 & 3M 2012Bank of Kigali100% (1)

- Q4 Aggregate NumbersDocumento4 páginasQ4 Aggregate NumbersAdam BelzAún no hay calificaciones

- Philippines Country DataDocumento7 páginasPhilippines Country DataArangkada PhilippinesAún no hay calificaciones

- Business Environment Snapshots MethodologyDocumento15 páginasBusiness Environment Snapshots MethodologyamrendrachandanAún no hay calificaciones

- Asian Development Fund VIII and IX OperationsDocumento151 páginasAsian Development Fund VIII and IX OperationsIndependent Evaluation at Asian Development BankAún no hay calificaciones

- Top Pages of ReportDocumento24 páginasTop Pages of ReportRakieb HusseinAún no hay calificaciones

- Week 3 BUS 650 Assignment Finance Goff ComputerDocumento12 páginasWeek 3 BUS 650 Assignment Finance Goff Computermenafraid100% (4)

- Eurekahedge July 2012 - Asset Flows Update For The Month of June 2012Documento1 páginaEurekahedge July 2012 - Asset Flows Update For The Month of June 2012EurekahedgeAún no hay calificaciones

- 2012-08-27 CORD - Si (S&P Capital I) CordlifeFY12ResultsDocumento8 páginas2012-08-27 CORD - Si (S&P Capital I) CordlifeFY12ResultsKelvin FuAún no hay calificaciones

- AXIS Bank AnalysisDocumento44 páginasAXIS Bank AnalysisArup SarkarAún no hay calificaciones

- Sassaf Citi PresDocumento29 páginasSassaf Citi PresakiskefalasAún no hay calificaciones

- Dell Presentation T2 Partners 9-13-11Documento11 páginasDell Presentation T2 Partners 9-13-11robirrAún no hay calificaciones

- Pengaruh DPK, Roa, Car, NPL, Dan Jumlah Sbi Terhadap Penyaluran Kredit Perbankan (Studi Pada Bank Umum Go Public Di Indonesia Periode 2008-2011)Documento9 páginasPengaruh DPK, Roa, Car, NPL, Dan Jumlah Sbi Terhadap Penyaluran Kredit Perbankan (Studi Pada Bank Umum Go Public Di Indonesia Periode 2008-2011)Regalia SuperAún no hay calificaciones

- SouthIndianBank 2QFY2013RU NWDocumento13 páginasSouthIndianBank 2QFY2013RU NWAngel BrokingAún no hay calificaciones

- ValueResearchFundcard IDFCGSFInvestmentRegular 2013apr14Documento6 páginasValueResearchFundcard IDFCGSFInvestmentRegular 2013apr14gauravpandey1Aún no hay calificaciones

- Radhe ShyamDocumento13 páginasRadhe Shyamchanchal shahiAún no hay calificaciones

- ICICI Bank, 4th February, 2013Documento16 páginasICICI Bank, 4th February, 2013Angel BrokingAún no hay calificaciones

- UOB Annual Report 2007Documento160 páginasUOB Annual Report 2007Patrick BernilAún no hay calificaciones

- Corporation Bank: Performance HighlightsDocumento10 páginasCorporation Bank: Performance HighlightsAngel BrokingAún no hay calificaciones

- Central Bank of India Result UpdatedDocumento10 páginasCentral Bank of India Result UpdatedAngel BrokingAún no hay calificaciones

- Determinants of Lending Behavior in Ethiopian BanksDocumento25 páginasDeterminants of Lending Behavior in Ethiopian BanksShemu Plc100% (1)

- Retail Banking and Wealth ManagementDocumento19 páginasRetail Banking and Wealth ManagementkaaashuAún no hay calificaciones

- PKSF evaluates intermediary portfolio performanceDocumento3 páginasPKSF evaluates intermediary portfolio performanceRashedur RahmanAún no hay calificaciones

- Analysis of Camel Ratios for HDFC, ICICI and Axis BankDocumento18 páginasAnalysis of Camel Ratios for HDFC, ICICI and Axis BankAnkush SainiAún no hay calificaciones

- Bank Failure Prediction Models For The Developing and Developed Countries Identifying The Economic Value Added For Predicting FailureDocumento12 páginasBank Failure Prediction Models For The Developing and Developed Countries Identifying The Economic Value Added For Predicting FailureLê Quốc VănAún no hay calificaciones

- 2 Plenary - Introducing ADB by RSubramaniam 15mar2016Documento20 páginas2 Plenary - Introducing ADB by RSubramaniam 15mar2016Butch D. de la CruzAún no hay calificaciones

- Market Watch Daily 05.12.2012Documento1 páginaMarket Watch Daily 05.12.2012Randora LkAún no hay calificaciones

- The Ge Challenge 2012 - Jaimay TeamDocumento13 páginasThe Ge Challenge 2012 - Jaimay TeamPhoebe NguyenAún no hay calificaciones

- World Bank Data CatalogDocumento29 páginasWorld Bank Data CatalogSiba PrasadAún no hay calificaciones

- Annual-Report-Duta Pertiwi Nusantara 2013 PDFDocumento160 páginasAnnual-Report-Duta Pertiwi Nusantara 2013 PDFwulan permatasariAún no hay calificaciones

- Financial Soundness Indicators for Financial Sector Stability in Viet NamDe EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamAún no hay calificaciones

- Financial Soundness Indicators for Financial Sector Stability in BangladeshDe EverandFinancial Soundness Indicators for Financial Sector Stability in BangladeshAún no hay calificaciones

- Centre For Training in Aviation SetDocumento1 páginaCentre For Training in Aviation SetleekosalAún no hay calificaciones

- Floods Damage Cassava CropDocumento1 páginaFloods Damage Cassava CropleekosalAún no hay calificaciones

- NDT MF Is 261012Documento2 páginasNDT MF Is 261012leekosalAún no hay calificaciones

- MFIs in Myanmar Go CommercialDocumento1 páginaMFIs in Myanmar Go CommercialleekosalAún no hay calificaciones

- Corporate Bridge Financial Modeling Ebook - Part 1Documento27 páginasCorporate Bridge Financial Modeling Ebook - Part 1leekosalAún no hay calificaciones

- 2013-09-27 Cambodia Post Bank Enters Crowded SectorDocumento1 página2013-09-27 Cambodia Post Bank Enters Crowded SectorleekosalAún no hay calificaciones

- Damage Control For DumexDocumento1 páginaDamage Control For DumexleekosalAún no hay calificaciones

- Mfi Performance Monitoring 2972013 EngDocumento5 páginasMfi Performance Monitoring 2972013 EngleekosalAún no hay calificaciones

- Lucky Opens Three More BranchesDocumento1 páginaLucky Opens Three More BranchesleekosalAún no hay calificaciones

- Yangon Power Plants in LimboDocumento1 páginaYangon Power Plants in LimboleekosalAún no hay calificaciones

- 6 Months 6 Months: WST Self-Study Pricing GridDocumento1 página6 Months 6 Months: WST Self-Study Pricing GridleekosalAún no hay calificaciones

- Assumptions Options Number of Average Treasury Options Strike Shares Balance Sheet, 3/31/09Documento1 páginaAssumptions Options Number of Average Treasury Options Strike Shares Balance Sheet, 3/31/09leekosalAún no hay calificaciones

- Yangon Power Plants in LimboDocumento1 páginaYangon Power Plants in LimboleekosalAún no hay calificaciones

- Calculating Enterprise Value 2Documento1 páginaCalculating Enterprise Value 2Ratnadeep BhattacharyaAún no hay calificaciones

- SotpDocumento1 páginaSotpleekosalAún no hay calificaciones

- DCF AnalysisDocumento2 páginasDCF Analysisanon_822236593Aún no hay calificaciones

- Tax Rate Impact on Projected Cash FlowDocumento2 páginasTax Rate Impact on Projected Cash FlowleekosalAún no hay calificaciones

- SotpDocumento1 páginaSotpleekosalAún no hay calificaciones

- Year 1 Year 2 Year 3 Year 4Documento1 páginaYear 1 Year 2 Year 3 Year 4leekosalAún no hay calificaciones

- Investing in Cambodia - FINALDocumento22 páginasInvesting in Cambodia - FINALleekosalAún no hay calificaciones

- Troubling Contrasts in ASEANDocumento1 páginaTroubling Contrasts in ASEANleekosalAún no hay calificaciones

- Myanmar Bourse Deadline LoomsDocumento1 páginaMyanmar Bourse Deadline LoomsleekosalAún no hay calificaciones

- 2013-4-22 VimpelCom Exits CambodiaDocumento1 página2013-4-22 VimpelCom Exits CambodialeekosalAún no hay calificaciones

- Investment Options For Local TelcosDocumento1 páginaInvestment Options For Local TelcosChou ChantraAún no hay calificaciones

- 2013-06-04 Micro Life Insurance On RiseDocumento1 página2013-06-04 Micro Life Insurance On RiseleekosalAún no hay calificaciones

- 2012-09-10 Insurance Becomes Next Emerging MarketDocumento1 página2012-09-10 Insurance Becomes Next Emerging MarketleekosalAún no hay calificaciones

- Insurance Regulation in Cambodia 74031Documento4 páginasInsurance Regulation in Cambodia 74031leekosalAún no hay calificaciones

- 2012-09-10 Insurance Becomes Next Emerging MarketDocumento1 página2012-09-10 Insurance Becomes Next Emerging MarketleekosalAún no hay calificaciones

- Infinity Reports Increased Revenue,: Pro FitsDocumento4 páginasInfinity Reports Increased Revenue,: Pro FitsleekosalAún no hay calificaciones

- CSI OverviewDocumento27 páginasCSI OverviewAmit Namdeo88% (8)

- Booking 1059985616Documento2 páginasBooking 1059985616Deni SetiawanAún no hay calificaciones

- Global Finance - Introduction ADocumento268 páginasGlobal Finance - Introduction AfirebirdshockwaveAún no hay calificaciones

- MT 309 Equity Shares: Benefits and RisksDocumento2 páginasMT 309 Equity Shares: Benefits and Riskspiyush chauhanAún no hay calificaciones

- Thesis SynopsisDocumento3 páginasThesis SynopsisShivani PandaAún no hay calificaciones

- F BirDocumento5 páginasF Birchari cruzmanAún no hay calificaciones

- The Concept and Development of Money in 40 CharactersDocumento1 páginaThe Concept and Development of Money in 40 CharactersLeo Alvarez OmamalinAún no hay calificaciones

- Investment BankingDocumento4 páginasInvestment BankingNirajGBhaduwalaAún no hay calificaciones

- A Manual ONDocumento20 páginasA Manual ONSpecs F Work75% (4)

- Fabm 1 LeapDocumento4 páginasFabm 1 Leapanna paulaAún no hay calificaciones

- 1Q13 Restructuring Advisory ReviewDocumento5 páginas1Q13 Restructuring Advisory ReviewAshish KrishnaAún no hay calificaciones

- FAR Test BankDocumento17 páginasFAR Test BankMa. Efrelyn A. BagayAún no hay calificaciones

- Case Study 1Documento3 páginasCase Study 1Narra JanardhanAún no hay calificaciones

- The Impact of Money Supply and Electronic MoneyDocumento60 páginasThe Impact of Money Supply and Electronic MoneyManuel LlajarunaAún no hay calificaciones

- The International Monetary System Chapter 11Documento23 páginasThe International Monetary System Chapter 11Ashi GargAún no hay calificaciones

- CW 13 LTF Key 1Documento6 páginasCW 13 LTF Key 1Jedidiah ManglicmotAún no hay calificaciones

- The Evolution of Money From Barter System To Cryptocurrency: When Money First IntroducedDocumento3 páginasThe Evolution of Money From Barter System To Cryptocurrency: When Money First IntroducedMohd AqdasAún no hay calificaciones

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento7 páginasDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMishra Bal GovindAún no hay calificaciones

- PFRS 9Documento1 páginaPFRS 9Ella MaeAún no hay calificaciones

- 014 - Acceptance For Value A4vDocumento2 páginas014 - Acceptance For Value A4vDavid E Robinson95% (43)

- Guideline On Classification of NPL and Provision For Substandard, Bad and Doubtful Debts (BNM-GP3)Documento20 páginasGuideline On Classification of NPL and Provision For Substandard, Bad and Doubtful Debts (BNM-GP3)Shaa DidiAún no hay calificaciones

- Continental Carriers IncDocumento3 páginasContinental Carriers IncEnrique Garcia25% (4)

- Tally AssignmentDocumento3 páginasTally AssignmentSoumya LatheyAún no hay calificaciones

- Financial Accounting Part 1Documento5 páginasFinancial Accounting Part 1Christopher Price100% (1)

- Terms and Conditions of The Loan AgreementsDocumento2 páginasTerms and Conditions of The Loan AgreementsCLATOUS CHAMAAún no hay calificaciones

- APAC SME Banking Conference 2013Documento5 páginasAPAC SME Banking Conference 2013snazruliAún no hay calificaciones

- Capital Budgeting at Kesoram CementDocumento12 páginasCapital Budgeting at Kesoram Cementammukhan khanAún no hay calificaciones

- Evaluating Non-Performing Loans of Bangladeshi BanksDocumento4 páginasEvaluating Non-Performing Loans of Bangladeshi Banksrafiddu89% (9)

- Global Tactical Cross-Asset Allocation - Applying Value and Momentum Across Asset ClassesDocumento18 páginasGlobal Tactical Cross-Asset Allocation - Applying Value and Momentum Across Asset ClassesMaver InvestAún no hay calificaciones

- Pas 21-The Effects of Changes in Foreign Exchange RatesDocumento3 páginasPas 21-The Effects of Changes in Foreign Exchange RatesAryan LeeAún no hay calificaciones