Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Banking System in India

Cargado por

hello707Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Banking System in India

Cargado por

hello707Copyright:

Formatos disponibles

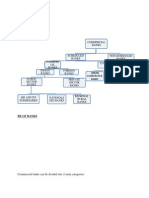

Home Banking Banking System in India The Banking System in India consists of the following types of banks

Reserve Bank or Central Bank Development Banks Public Sector Bank. Foreign Banks Private Sector Banks Cooperative Banks Regional Rural Banks Local Area Banks The Reserve Bank of India The Reserve Bank of India is the Central Bank of the Country and came into being by the Reserve Bank of India Act 1934. It was nationalized in 1948. Key functions of RBI It manages the public debt and has the obligation to transact the banking business of the Central Government. It undertakes to accept money on behalf of the Government and make payment on its behalf. Manages the foreign exchange rate and intervenes whenever required Devise all the monetary policy measures in order to control liquidity in the system The lender of Last Resort. It will lend to banks in trouble. It devises norms for External borrowing of the domestic companies. It stores the forex reserves and gold for the Government and supports the importers with the foreign currency during crisis time. Regulates all the NBFCs (Non-Banking Financial Corporations) and Co-operative banking institutions of a country. As per ne Micro Finance Bill passed in 2012, RBI also regulates all the Microfinance institutions in India

Development Banks These were set up to give long term finance for the development of the country. The main list of banks which were set up with the same purpose is provided below Industrial Credit and Investment Corporation of India Ltd (ICICI) The Industrial Finance Corporation of India (IFCI) The Industrial Development Bank of India (IDBI) The Industrial Reconstruction Bank of India (IRBI) and The National Bank for Agriculture and Rural Development (NABARD) ICICI, by a reverse merger in 2002, became a normal commercial bank. IDBI was converted to a commercial bank in October 2004 and merged with IDBI Bank on March 31, 2005. It is expected that the other development banks, having outlived their utility would also be either converted to commercial banks or merged with commercial banks. Public Sector Banks These are banks in which Indian government owns the majority stake and has control over the management and activities. The largest is the State Bank of India which was formed by the merger of the Presidency Banks the Bank of Bengal, the Bank of Bombay and the Bank of Madras in 1921. It was then known as the Imperial Bank. It was nationalized in 1955 by the passing of the State Bank of India Act, 1955. The other nationalized banks came into being on July 19, 1969 when Mrs. Gandhis Government nationalized fourteen banks that had deposits of Rs. 50 crores or more. On April 15, 1980, six more banks having demand and time liabilities of not less than Rs.200 crores were nationalized. This was done to take banking to the villages and serve the developmental needs of all sectors of the economy. Foreign Banks These are branches of banks incorporated outside India. The larger ones that have been operating in India for many years are Standard Chartered Bank, Citibank, American Express Bank, ABN Amro, BNP Paribas and Hong Kong and Shanghai Banking Corporation. In March 2004 the RBI issued guidelines permitting NRIs and Foreign Institutional Investors investing in the banking sector. This permitted aggregate foreign investment from all sources up to a maximum of 74 percent of the paid up capital of the bank while the resident Indian holding of the capital was to be atleast 26 percent. It also provided that foreign banks could only operate through one of the following branches. Wholly owned subsidiary or a subsidiary with an aggregate foreign investment of upto a maximum of 74 percent in a private bank.

In the first phase foreign banks will be permitted to set up wholly owned subsidiary by conversion of existing branches into a wholly owned subsidiary. These must have a minimum capital of Rs. 300 crores and must ensure sound corporate governance. They will have flexibility to open more than 12 branches a year and branch expansion in areas with lower banking presence. Permission for acquisition of shareholding in Indian banks will be limited to banks identified by the RBI for restructuring. Private Sector Banks These are banks which are not government owned or controlled. Their shares are freely traded in the Stock Markets. These may be divided into: Old Private Sector Banks such Federal Bank, Dhanalakshmi Bank, Catholic Syrian Bank New Private Sector Banks like ICICI Bank, HDFC Bank, , Axis Bank (Earlier known as UTI Bank), Kotak Mahindra Bank and Yes Bank. Cooperative Banks Cooperative Banks are those that are created by a group of individuals to support either a community or a religious group. They operate in metropolitan, urban and semi urban centers to cater to the need s of small borrowers.These are controlled by the RBI and by State Cooperative Acts. Regional Rural Banks These came into being on October 2, 1975 when 5 regional rural banks were established under what became the Regional Rural Banks Act 1975. These were to bridge the gap in rural credit granting loans and advances to small and marginal farmers, artisans, small entrepreneurs and persons of small means engaged in trade, commerce, industry or other productive activities within their area of operation. Local Area Banks

Local Area Banks came into existence in 1999 and licences were given for these banks as it was felt that regular commercial banks were not financial the rural/ agricultural sector adequately. Licences were given to open branches in three districts. Branches in urban/ semi urban areas were granted only after ten branches were established in rural areas/ villages. Four licences were in total granted two in Andhra, one in Punjab and one in Gujarat. They were opened with an initial capital of Rs. 5 crores.

También podría gustarte

- Pledge, Hypothecation, Mortgage and AssignmentDocumento2 páginasPledge, Hypothecation, Mortgage and Assignmenthello707Aún no hay calificaciones

- 28 Nakshatras - The Real Secrets of Vedic Astrology (An E-Book)Documento44 páginas28 Nakshatras - The Real Secrets of Vedic Astrology (An E-Book)Karthik Balasundaram88% (8)

- Clinical Skills Resource HandbookDocumento89 páginasClinical Skills Resource Handbookanggita budi wahyono100% (1)

- Reading Comprehension Animals Copyright English Created Resources PDFDocumento10 páginasReading Comprehension Animals Copyright English Created Resources PDFCasillas ElAún no hay calificaciones

- June 1997 North American Native Orchid JournalDocumento117 páginasJune 1997 North American Native Orchid JournalNorth American Native Orchid JournalAún no hay calificaciones

- Bill of QuantitiesDocumento25 páginasBill of QuantitiesOrnelAsperas100% (2)

- Tthe Sacrament of Reconciliation1Documento47 páginasTthe Sacrament of Reconciliation1Rev. Fr. Jessie Somosierra, Jr.Aún no hay calificaciones

- Regional Rural Banks of India: Evolution, Performance and ManagementDe EverandRegional Rural Banks of India: Evolution, Performance and ManagementAún no hay calificaciones

- Test Initial Engleza A 8a Cu Matrice Si BaremDocumento4 páginasTest Initial Engleza A 8a Cu Matrice Si BaremTatiana BeileșenAún no hay calificaciones

- Importers in BOC List As of June 2, 2015Documento254 páginasImporters in BOC List As of June 2, 2015PortCalls88% (8)

- Banking System in IndiaDocumento4 páginasBanking System in IndiaJitendra VirahyasAún no hay calificaciones

- Banking in IndiaDocumento6 páginasBanking in IndiaAmandeep KambojAún no hay calificaciones

- Types of Banks IndiaDocumento3 páginasTypes of Banks India17-075 Upgna PatelAún no hay calificaciones

- Classification of Banking System Final 52Documento7 páginasClassification of Banking System Final 52sonam1991Aún no hay calificaciones

- BankingDocumento74 páginasBankingAbhishek DubeyAún no hay calificaciones

- Structure of Banking CompaniesDocumento18 páginasStructure of Banking Companiesbeena antuAún no hay calificaciones

- Consumer Satisfaction IciciDocumento55 páginasConsumer Satisfaction IciciAkshay TullyAún no hay calificaciones

- Banking Structure in IndiaDocumento5 páginasBanking Structure in IndiaCharu Saxena16Aún no hay calificaciones

- Banking System in India or The Indian Banking System Can Be Segregated Into Three Distinct PhasesDocumento9 páginasBanking System in India or The Indian Banking System Can Be Segregated Into Three Distinct PhasesmayurAún no hay calificaciones

- RTL - BOB - LU1 - SLU1.4 - Indian Banking System-1 PDFDocumento9 páginasRTL - BOB - LU1 - SLU1.4 - Indian Banking System-1 PDFUtkarshMalikAún no hay calificaciones

- Banking & Financial Institutions in India: Historical BackgroundDocumento6 páginasBanking & Financial Institutions in India: Historical BackgroundRUPA GOELAún no hay calificaciones

- 0 Ashay% PDFDocumento55 páginas0 Ashay% PDFAshay AgrawalAún no hay calificaciones

- Indian Banking StructureDocumento5 páginasIndian Banking StructurevivekAún no hay calificaciones

- 4 Banking LawDocumento85 páginas4 Banking LawRamesh BuridiAún no hay calificaciones

- Comparing ICICI and IDBI BanksDocumento27 páginasComparing ICICI and IDBI BanksGUDDUAún no hay calificaciones

- ICICI Project ReportDocumento53 páginasICICI Project ReportPawan MeenaAún no hay calificaciones

- Structure of the Indian Banking System Sem IDocumento2 páginasStructure of the Indian Banking System Sem IAshitosh ChavanAún no hay calificaciones

- Assessments of BanksDocumento94 páginasAssessments of Bankskavita.m.yadavAún no hay calificaciones

- Structure of Indian BankingDocumento12 páginasStructure of Indian BankingYatin DhallAún no hay calificaciones

- A.2 AssignmentDocumento5 páginasA.2 AssignmentNijiraAún no hay calificaciones

- 01 Indian Banking SystemDocumento11 páginas01 Indian Banking SystemAmir AhmedAún no hay calificaciones

- Chapter 2. Lecture 2.1 Kinds of Banks and Its FunctionsDocumento7 páginasChapter 2. Lecture 2.1 Kinds of Banks and Its FunctionsvibhuAún no hay calificaciones

- Project On Customer AtitudeDocumento58 páginasProject On Customer AtitudeGurvi SinghAún no hay calificaciones

- Indian Banking System StructureDocumento13 páginasIndian Banking System StructureNandhini VirgoAún no hay calificaciones

- Lead Bank SchemeDocumento3 páginasLead Bank SchemeKarthik VinnakotaAún no hay calificaciones

- Concept of BankingDocumento36 páginasConcept of BankingDhaval B MasalawalaAún no hay calificaciones

- Banking Management Additional NotesDocumento118 páginasBanking Management Additional NotesLokesh ChAún no hay calificaciones

- Structure of Commercial BanksDocumento4 páginasStructure of Commercial BanksMunish PathaniaAún no hay calificaciones

- Structure of Indian Banking SystemDocumento53 páginasStructure of Indian Banking Systemsubba raoAún no hay calificaciones

- Performance of Indian Banking SystemDocumento40 páginasPerformance of Indian Banking Systemnikhil mudhirajAún no hay calificaciones

- Banking Sector in India: A Historical OverviewDocumento5 páginasBanking Sector in India: A Historical OverviewjaamssAún no hay calificaciones

- Abstract - Role of Commercial Banks in IndiaDocumento8 páginasAbstract - Role of Commercial Banks in Indiasalman.wajidAún no hay calificaciones

- History 2Documento5 páginasHistory 2bickyboom96Aún no hay calificaciones

- Types of Banks in India and Their ClassificationsDocumento2 páginasTypes of Banks in India and Their ClassificationsAnonymous HEhAAiAún no hay calificaciones

- Banking Industry Overview: History, Structure and Current ScenarioDocumento77 páginasBanking Industry Overview: History, Structure and Current Scenarioprashant mhatreAún no hay calificaciones

- Comparative Analysis of Commercial Bank (Icici and Idbi Bank)Documento31 páginasComparative Analysis of Commercial Bank (Icici and Idbi Bank)GUDDUAún no hay calificaciones

- Unit - 1Documento93 páginasUnit - 1Suji MbaAún no hay calificaciones

- Banking & Financial Awareness QuestionsDocumento162 páginasBanking & Financial Awareness QuestionsRagavi JoAún no hay calificaciones

- Indian Banking Structure ExplainedDocumento32 páginasIndian Banking Structure ExplainedSwaraj GolekarAún no hay calificaciones

- Rural DevelopmentsDocumento88 páginasRural DevelopmentsVyom K ShahAún no hay calificaciones

- Banking: History of Banking in IndiaDocumento4 páginasBanking: History of Banking in IndiatsfabmAún no hay calificaciones

- 1) History: Evolution of Indian Banking SectorDocumento8 páginas1) History: Evolution of Indian Banking SectorPuneet SharmaAún no hay calificaciones

- Banking StudyDocumento5 páginasBanking Studymav7788Aún no hay calificaciones

- Growth in Banking SectorDocumento30 páginasGrowth in Banking SectorHarish Rawal Harish RawalAún no hay calificaciones

- Banking in India: Bank of Bengal (HQ)Documento16 páginasBanking in India: Bank of Bengal (HQ)Kiran GireeshAún no hay calificaciones

- Financial Institutions & MarketsDocumento62 páginasFinancial Institutions & MarketsSaurav UchilAún no hay calificaciones

- The Oxford Dictionary Defines The Bank AsDocumento51 páginasThe Oxford Dictionary Defines The Bank AsMeenu RaniAún no hay calificaciones

- MBK Unit 3 (Ms. C. Yuvarani M.phil.,)Documento9 páginasMBK Unit 3 (Ms. C. Yuvarani M.phil.,)Edison paAún no hay calificaciones

- Discuss The Role of Banking System in Economic Growth and Development of IndiaDocumento5 páginasDiscuss The Role of Banking System in Economic Growth and Development of IndiaNaruChoudharyAún no hay calificaciones

- Banking SectorDocumento3 páginasBanking SectorVishal KhatriAún no hay calificaciones

- Banking Practical 1 InformationDocumento4 páginasBanking Practical 1 InformationMadhur AbhyankarAún no hay calificaciones

- Banking and Finance in India: An OverviewDocumento48 páginasBanking and Finance in India: An Overviewjags1156Aún no hay calificaciones

- Indian Banking System OverviewDocumento82 páginasIndian Banking System OverviewSvijayakanthan SelvarajAún no hay calificaciones

- Mission Vission and ValuesDocumento8 páginasMission Vission and ValuesJiby JohnAún no hay calificaciones

- Structure of BanksDocumento15 páginasStructure of BanksAmogh AroraAún no hay calificaciones

- Type of Banks: Different Types of Banks in India & Their FunctionsDocumento15 páginasType of Banks: Different Types of Banks in India & Their FunctionscecilAún no hay calificaciones

- Banking Structure in IndiaDocumento31 páginasBanking Structure in IndiaRishabhShuklaAún no hay calificaciones

- 1 Banking System PDFDocumento12 páginas1 Banking System PDFNilu91Aún no hay calificaciones

- Banking India: Accepting Deposits for the Purpose of LendingDe EverandBanking India: Accepting Deposits for the Purpose of LendingAún no hay calificaciones

- Finmin PromotionDocumento5 páginasFinmin Promotionanuadi77Aún no hay calificaciones

- Irctc Refund RulesDocumento11 páginasIrctc Refund RulesAditya AgrawalAún no hay calificaciones

- Irctc Refund RulesDocumento11 páginasIrctc Refund RulesAditya AgrawalAún no hay calificaciones

- Debt Restructuring PDFDocumento2 páginasDebt Restructuring PDFhello707Aún no hay calificaciones

- Nokia Asha 502 Dual SIM UG en GBDocumento43 páginasNokia Asha 502 Dual SIM UG en GBhello707Aún no hay calificaciones

- Monetary Policy India 2013 SepDocumento2 páginasMonetary Policy India 2013 Sephello707Aún no hay calificaciones

- Banking Ombudsman SchemeDocumento26 páginasBanking Ombudsman SchemeUjjwal SinghAún no hay calificaciones

- ActDocumento101 páginasActKarunakar RachapalliAún no hay calificaciones

- C M and Governers of StateDocumento1 páginaC M and Governers of Statehello707Aún no hay calificaciones

- Banking Ombudsman SchemeDocumento26 páginasBanking Ombudsman SchemeUjjwal SinghAún no hay calificaciones

- Intelligence: by Dr. Navin KumarDocumento42 páginasIntelligence: by Dr. Navin Kumarhello707Aún no hay calificaciones

- Urbanization As A Transformative Force: Quick FactsDocumento20 páginasUrbanization As A Transformative Force: Quick FactsJulio CovarrubiasAún no hay calificaciones

- Aerospace Propulsion Course Outcomes and Syllabus OverviewDocumento48 páginasAerospace Propulsion Course Outcomes and Syllabus OverviewRukmani Devi100% (2)

- Unit 20: Where Is Sapa: 2.look, Read and CompleteDocumento4 páginasUnit 20: Where Is Sapa: 2.look, Read and CompleteNguyenThuyDungAún no hay calificaciones

- Baldwin 1e Ch14 PPT FINAL AccessibleDocumento29 páginasBaldwin 1e Ch14 PPT FINAL AccessibleA BlessAún no hay calificaciones

- Brother LS2300 Sewing Machine Instruction ManualDocumento96 páginasBrother LS2300 Sewing Machine Instruction ManualiliiexpugnansAún no hay calificaciones

- One Stop Report - Tata MotorsDocumento119 páginasOne Stop Report - Tata MotorsJia HuiAún no hay calificaciones

- 100 Commonly Asked Interview QuestionsDocumento6 páginas100 Commonly Asked Interview QuestionsRaluca SanduAún no hay calificaciones

- Registration Form: Advancement in I.C.Engine and Vehicle System"Documento2 páginasRegistration Form: Advancement in I.C.Engine and Vehicle System"Weld TechAún no hay calificaciones

- Pengayaan Inisiasi 6-SynonymyDocumento35 páginasPengayaan Inisiasi 6-SynonymyAriAún no hay calificaciones

- Noise Pollution Control Policy IndiaDocumento10 páginasNoise Pollution Control Policy IndiaAllu GiriAún no hay calificaciones

- AR118 - MSDS 2023 (Chemlube) - 19.10.2023Documento8 páginasAR118 - MSDS 2023 (Chemlube) - 19.10.2023sanichi135Aún no hay calificaciones

- B1 Grammar and VocabularyDocumento224 páginasB1 Grammar and VocabularyTranhylapAún no hay calificaciones

- Assignment No1 of System Analysis and Design: Submitted To Submitted byDocumento7 páginasAssignment No1 of System Analysis and Design: Submitted To Submitted byAnkur SinghAún no hay calificaciones

- IDocumento8 páginasICarlaSampaioAún no hay calificaciones

- Labor DoctrinesDocumento22 páginasLabor DoctrinesAngemeir Chloe FranciscoAún no hay calificaciones

- Deep Work Book - English ResumoDocumento9 páginasDeep Work Book - English ResumoJoão Pedro OnozatoAún no hay calificaciones

- Is the Prime Minister Too Powerful in CanadaDocumento9 páginasIs the Prime Minister Too Powerful in CanadaBen YuAún no hay calificaciones

- 6 Economics of International TradeDocumento29 páginas6 Economics of International TradeSenthil Kumar KAún no hay calificaciones

- Who Is Marine Le PenDocumento6 páginasWho Is Marine Le PenYusuf Ali RubelAún no hay calificaciones

- Tahap Kesediaan Pensyarah Terhadap Penggunaan M-Pembelajaran Dalam Sistem Pendidikan Dan Latihan Teknik Dan Vokasional (TVET)Documento17 páginasTahap Kesediaan Pensyarah Terhadap Penggunaan M-Pembelajaran Dalam Sistem Pendidikan Dan Latihan Teknik Dan Vokasional (TVET)Khairul Yop AzreenAún no hay calificaciones

- Art 1207-1257 CCDocumento5 páginasArt 1207-1257 CCRubz JeanAún no hay calificaciones

- F77 - Service ManualDocumento120 páginasF77 - Service ManualStas MAún no hay calificaciones