Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Untitled

Cargado por

api-227433089Descripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Untitled

Cargado por

api-227433089Copyright:

Formatos disponibles

Industry Report Card:

Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

Primary Credit Analysts: Tracy Dolin, New York (1) 212-438-1325; tracy.dolin@standardandpoors.com Volker Kudszus, Frankfurt (49) 69-33-999-192; volker.kudszus@standardandpoors.com Secondary Contact: Rob C Jones, London (44) 20-7176-7041; rob.jones@standardandpoors.com

Table Of Contents

Industry Credit Outlook Rating Evolution Shows A Slightly Negative Bias GMIs' Non-Life Operations Continue To Outperform The Sector The Performance Of Life Operations Remains Mixed The Implications Of G-SII Status For Insurers Are Still Unclear Issuer Review Recent Rating Activity Contact Information Related Criteria And Research

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 1

1191326 | 301967406

Industry Report Card:

Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

Industry Credit Outlook

Standard & Poor's Ratings Services considers that, overall, global multiline insurers (GMIs) still display better credit quality than other insurance groups or companies. We believe this stems from their wide geographic and product diversification and generally very strong market positions, which support earnings. In addition, over the past 18 months the GMIs' capital positions continued to improve. In fact, our ratings on GMIs remain stronger than the average for all insurers we rate. Of the 15 GMIs that we rate, only three currently carry negative outlooks compared with four at the end of last year. Overview In our view, global multiline insurers (GMIs) still display better credit quality than other insurance groups. GMIs' capital positions remain a rating strength. We see mixed trends in life insurance in the growth of assets under management and new-business margins, depending on the region and product line. In non-life insurance, we see rate increases in selected product lines in several regions.

Low interest rates continue to dampen GMIs' profitability, however, particularly from life insurance business. Life operations generally have longer-term liabilities than non-life operations, and in countries where a large portion of life insurance contracts traditionally have guaranteed yields, like Japan, and Germany, low interest rates mean lower investment income to cover these costs. That said, we see mixed trends in the growth of assets under management and new-business margins, depending on the region and product line. Our economists predict a slight increase in long-term interest rates between 2013 and 2015 in the U.S., U.K., Germany, and Japan. But the forecast rates are well below those seen before the financial crisis started in 2007. We therefore don't expect GMIs' profitability over the next few years to return to precrisis levels (see chart 1). Rather, our base case is that positive interest rate momentum might ease the pressure on earnings. Although rising interest rates may also reverse the unrealized capital gains insurers enjoyed in 2011 and 2012, GMIs' capital positions remain a rating strength (see chart 2). In addition, an only gradual rise in interest rates lowers the risk of a sudden increase in policy cancellations.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 2

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

Chart 1

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 3

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

Chart 2

Looking at non-life insurance, we see rate increases in selected product lines in several regions. In general, GMIs tend to be ahead in this segment, thanks to leading positions in several significant markets. Although some of them are already producing strong operating profits in certain countries, we cannot rule out setbacks. Overall, we believe non-life investment returns will continue to react faster than those of life operations because the invested assets have shorter terms (see chart 3). Also, GMIs with short-tail non-life business can adjust pricing faster to interest rate changes than those with large life insurance portfolios.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 4

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

Chart 3

As we expected, the Financial Stability Board (FSB), which coordinates international regulation and standards, published a list of global systemically important insurers (G-SIIs) in July. Eight of the nine G-SIIs are GMIs we rate, and the FSB's choice is somewhat in line with our expectations. Ultimately, we believe that from 2019 onward, potentially higher capitalization requirements and stricter supervision could influence our ratings on insurance groups classified as G-SIIs.

Rating Evolution Shows A Slightly Negative Bias

We classify the GMIs, which we consider to be the top 15 global primary insurers, into three categories (see table 1).

Table 1

Classification Of Global Multiline Insurers By Business Profile

Category I II III Business focus Life and non-life activities with broad geographic reach High bias toward property/casualty with broad geographic reach High bias toward life and savings with broad geographic reach Insurers AXA, Allianz, Zurich, Aviva, Generali, AIG ACE, QBE, XL, and Tokio Marine AEGON, ING, Prudential Financial, Met Life, and Prudential PLC

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 5

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

Table 1

Classification Of Global Multiline Insurers By Business Profile (cont.)

Source: Standard & Poor's.

Our ratings and outlooks on the 15 GMIs have changed little since our last article on the GMIs (see charts 4 and 5, and "What's Behind Our Ratings On The Top 15 Global Multiline Insurers Following The Application Of Our New Criteria," published June 4, 2013, on RatingsDirect).

Chart 4

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 6

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

Chart 5

The three negative outlooks do not directly reflect our view of those GMIs' insurance operations. Rather, for Italy-based Generali and Japan's Tokio Marine, they mirror the outlook on the respective sovereign ratings. In July, we lowered our long-term ratings on Generali by one notch to 'A-' after the downgrade of Italy. In our view, although Generali has a very strong business risk profile, potential volatility in capitalization exposes it to a deterioration of operating and financial conditions in Italy. Our negative outlooks on the Netherlands-based ING Verzekering and its core subsidiaries indicate our view of risks to the group, including uncertainties associated with ING's planned divestment of its insurance operations. Because of the GMIs' global footprint, sovereign creditworthiness has also influenced their strategies in some cases. We see, for instance, that U.K.-based Aviva is moving out of Italy. We affirmed the ratings on Allianz SE and assigned a stable outlook despite the downgrade of Italy, where Allianz has 30 billion of exposure. Although we view Italy's creditworthiness as a significant risk to the rating, we think the group's earnings capacity and capital adequacy provide a substantial cushion.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 7

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

GMIs' Non-Life Operations Continue To Outperform The Sector

The underwriting performance of the GMIs' non-life businesses has consistently exceeded the industry average, and we expect this to continue. We believe this is owing to superior cycle management, pricing prowess, economies of scale, and geographic diversity. Nevertheless, their investment earnings--like those of other insurers--are susceptible to a prolonged period of low interest rates. GMIs' asset allocation remains conservative, however, and we don't foresee many changes in 2013 or 2014 (see chart 6). Nonetheless, we note that several GMIs have added some alternative investments, private equity, infrastructure, and real estate assets to their portfolios. But the amounts are still marginal, and in our view do not indicate a comprehensive shift in insurers' asset-allocation policies.

Chart 6

We also observe that non-life insurance rates (premiums per risk) have continued to rise during 2013, although varying by product lines and regions. Nevertheless, with ample capacity in the market, competition remains fierce. In particular, we see rates increasing in the U.S., where they had dropped more steeply than in Europe during the financial crisis and only started recovering in 2011. We believe non-life insurers have been increasing prices mainly to counteract low interest rates, which continue to linger, as well as the higher frequency and severity of catastrophe losses and diminishing reserve cushions. Given the depth of GMIs' insurance offerings and their geographic reach, we

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 8

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

believe they can take advantage of pockets of favorable pricing conditions. But their ability to realize price increases often varies by region, account size, and business line. GMIs can also expand in attractive non-life markets more swiftly than smaller peers, given their established global presence, reputation, and sophisticated pricing capabilities. Emerging markets, accident and health, and specialty products remain attractive areas of growth for GMIs. On the flip side, alternative capital products have entered the market, and this is particularly evident in the number of new structured property-catastrophe transactions. These new products have not significantly affected GMIs' pricing power or competitive positions, in our view. We believe they pose greater challenges for reinsurers and actually give primary insurers more options to mitigate risk. Thanks to competitive advantages in many regions and product lines, GMIs are among the first to profit from non-life rate increases. Their combined (loss and expense) ratios remain less volatile than industry averages (see chart 7). In particular, we note the relatively low number of claims in recent years, which are unlikely to continue. We currently regard the competitive environment as fairly benign, so non-life insurers have been able to focus on underwriting profitability.

Chart 7

We also see enough capital in the market and no shortage of underwriting capacity. In our view, non-life operations

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 9

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

have been increasing insurance rates mainly to compensate for the effects of low interest rates, and may continue to do so at least through 2014. However, the pace may slow as interest rates have been inching upward and many GMIs' capital adequacy remains strong, as shown, for example, by the quality of their bond holdings over recent years (see chart 8).

Chart 8

The Performance Of Life Operations Remains Mixed

We don't see a uniform trend in the GMIs' life insurance performance. In many mature life insurance markets this is due to continually low investment yields. But new-business margins and asset flows also differ from country to country (see "The Low-Interest-Rate Fog Over Global Life Insurers May Be Lifting," published on July 25, 2013). In some markets, long-term interest rates strongly influence life insurance margins. Our economists anticipate a slight increase in interest rates in 2013-2015 in the U.S., U.K., Germany, and Japan (see table 2). In our view, this should enhance profitability at the GMIs' life insurance operations, but we don't envision a return to precrisis levels in that time frame. Some of the dependence on interest rates stems from higher hedging costs for variable annuity products, as well as lower investment yields to cover fixed policyholder guarantees, such as on whole-life insurance.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 10

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

Table 2

Selected Global Interest Rate Projections*

2012 Long-term nominal interest rates (%) World U.S. Canada U.K. Emerging Europe (CIS + CEB) Eurozone Australia Japan Asia-Pacific excluding Japan Latin America & Caribbean 3.8 1.8 1.9 1.9 8.0 3.7 3.4 0.8 5.9 6.8 3.8 2.3 2.1 2.2 7.8 2.9 3.0 0.8 5.7 6.9 4.2 2.7 2.5 2.4 7.1 3.0 3.5 1.3 6.0 7.4 4.4 3.1 3.0 3.6 6.3 3.5 4.8 1.6 6.2 7.3 2013 2014 2015

*2013-2015 numbers are projections and some 2012 numbers contain estimates. Interest rates are all annual averages. CIS--Commonwealth of Independent States. CEB--Central Europe and the Balkans. Sources: Standard & Poor's, "U.S. Economic Forecast: A Mighty Wind," published Aug. 23, 2013, and Global Economic Outlook: An Expansion With Complex Cross-Currents, published May 15, 2013.

We still believe that one of the key risks for life insurance operating performance is the ongoing low-yield environment, despite the forecast increase in interest rates. GMIs' repricing and restructuring of their life insurance product portfolios, in our view, indicate prudent assumptions on interest rate development. We have also observed some repricing of life insurance products and variable annuities in the U.S. in recent years. Also, GMIs in more traditional life insurance markets, like Germany, are designing and launching products that require less capital, possibly with fewer policyholder options and lower or no guaranteed yields. The mixed trends in inflows and outflows of life insurance assets under management in different regions mirror clients' acceptance of products that don't typically offer the same level of guaranteed yields. Europe-based GMIs' new-business margins remain stable, but lower than historically high levels (see chart 9). In our view, this is due to these groups' efforts to increase cost efficiency and ongoing product repricing. An overall increase in risk and expense margins has reduced some of the pressure on overall margins as investment yields remain low. However, because European GMIs report embedded-value figures, assumptions on underlying risk-free interest rates are still by far the biggest influence on their results. Embedded value is the net asset value plus the present value of future profits from a life insurance portfolio.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 11

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

Chart 9

The Implications Of G-SII Status For Insurers Are Still Unclear

Eight of the nine groups the FSB classified as G-SIIs in July are GMIs we rate: AIG, Allianz, Aviva, AXA, Generali, Metlife, U.S.-based Prudential Financial, and U.K.-based Prudential PLC. Ping An is the only non-GMI on the list. We are uncertain about what requirements G-SIIs will need to fulfill, be they higher capitalization, more detailed risk reporting, or stricter supervision (see "Possible Ratings Implications For Global Systemically Important Insurers," published July 19, 2013). Consequently, the GMIs' designation as G-SIIs has had no immediate consequences for the ratings. In any event, we believe any incremental capital requirements are unlikely to be imposed until 2019 at the earliest. This might put G-SIIs at a slight disadvantage relative to other insurers. On the other hand, G-SIIs may benefit from a more favorable perception of their status in the market, for example because of the potential for government support. That said, we do not reflect potential government support in our insurance ratings. We understand that the FSB will update the G-SII list in November, and we will continue to monitor the FSB's selection criteria. The initial list was based on companies' 2011 balance sheets and some restructuring has taken place

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 12

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

since then. Generali, for instance, has narrowed its business focus and disposed of non-core assets, which could prompt the FSB to review its inclusion as a G-SII. Before the FSB published its list of G-SIIs back in July, the U.S. Financial Stability Oversight Council had already announced that it regarded AIG and Prudential Financial as potentially nationally systemic entities, a decision Prudential Financial is appealing.

Issuer Review

Table 3

Global Multiline Insurance Groups

Company or group ACE Ltd. Counterparty credit rating; financial strength rating Holding company: A/Positive/--; operating companies: AA-/Positive

Analyst Tracy Dolin

Country U.S.

Comments The ratings on ACE Ltd. and related core operating subsidiaries (together ACE) reflect our view of the company's very strong business risk profile, supported by an extremely strong competitive position. In addition, the group has a very strong financial risk profile, reflecting extremely strong capital and earnings and strong financial flexibility, partly offset by a moderate risk profile. ERM and management are very strong and further support the ratings. We believe ACE will continue to post superior operating performance relative to its multiline insurance peers, supporting its extremely strong capital adequacy and competitive position. Furthermore, we expect ACE's diverse business mix and prudent catastrophe-management practices to continue reducing the group's exposure to any one line of business, and its earnings to be among the least volatile in its peer group. The ratings reflect our view of the group's very strong business risk and financial risk profiles, built on a very strong competitive position and very strong capital and earnings. AEGON has demonstrated its commitment and ability to maintain 'AA' levels of capital adequacy, even through the financial crisis. The group reported operating earnings of 1.8 billion in 2012, and we expect this to increase modestly over 2013-2015, translating into net income of 1.1 billion-1.4 billion. AEGON's risk position reflects intermediate risks, benefiting from its strong ERM and relatively low exposure to direct unhedged equities. We expect AEGON to maintain the strength of its balance sheet and the business and financial profiles of its key U.S. operations. The ratings on AIG Inc. reflect our view of the group's very strong business risk profile and strong financial risk profile, built on a very strong competitive position and very strong capital and earnings. We regard AIG's ERM and management and governance practices as consistent with the ratings. The stable outlook for AIG's property/casualty (P/C) and life operations reflects our belief that the group will sustain its competitive position, while P/C improves operating results to a level more consistent with AIG's peers' and life continues its strong operating performance. We expect consolidated capitalization to remain strong, supporting capital adequacy of the insurance companies commensurate with the ratings and the capital requirements of the remaining non-core and run-off operations.

AEGON N.V.

Holding company: A-/Stable/A-2; core operating companies: AA-/Stable

Sanjay Joshi

Netherlands

American International Group Inc.

Holding company: A-/Negative/A-2; operating companies A+/Stable

John Iten

U.S.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 13

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

Table 3

Global Multiline Insurance Groups (cont.)

Allianz SE Holding company: AA/Stable/A-1+; operating companies: AA/Stable Volker Kudszus Germany The ratings reflect our view of the group's excellent business risk profile and very strong financial risk profile, built on an extremely strong competitive position and very strong capital and earnings. Our assessment of ERM as very strong reflects our positive view of the risk-management culture, risk controls, and strategic and emerging risk management of this highly complex organization. We anticipate that Allianz group's capital adequacy will remain in the 'AA' range. In our view, the group's restored capital adequacy provides a substantial buffer against tough economic conditions in Italy and low interest rates, especially in Germany. We also anticipate that the group will maintain earnings consistent with our base case, mainly with at least a steady profit contribution from non-life and asset management, and an extremely strong competitive position. We lowered the ratings on Generali and its core subsidiaries to 'A-' from 'A' after the downgrade of Italy and limit them to two notches above the long-term rating on Italy. This is because we consider Generali's capitalization to be a relative weakness, although it has a very strong business risk profile with broad international diversification. Potential volatility in capitalization exposes Generali to deterioration in operating and financial conditions in Italy. Our assessment of Generali's moderately strong capital and earnings rests on our expectation that its profitability will recover and that it will complete several asset sales. These expectations are sensitive to changes in operating and financial conditions in Italy. The negative outlook primarily reflects that on Italy. In addition, the negative trend of operating and financial conditions in Generali's key Italian market could delay capital rebuilding and reduce Generali's ability to successfully execute its strategy. The ratings reflect our view of the group's very strong business risk profile and moderately strong financial risk profile, built on a very strong competitive position and strong capital and earnings. In our view, Aviva's risk position reflects moderate risks, driven by volatility of both capital adequacy and bottom-line profitability, as seen through 2011 and 2012. Aviva has strong financial flexibility, due to proven access to capital markets, and exceptional liquidity relative to its needs. In our view, the execution of the group's strategic plan will continue to bolster its financial risk profile without impairing its business risk profile. AXA's very strong business risk profile is built on an extremely strong competitive position and intermediate industry and country risks. We assess the financial risk profile as moderately strong because of the relative weakness of capital adequacy and inherent volatility from the group's somewhat higher investment leverage than peers' and reliance on weaker forms of capital. In our opinion, AXA's ERM, management, and governance are strong, reflecting the group's ability to manage its risks within tolerances. In our opinion, the group's ongoing execution of its strategy will likely strengthen earnings retention, while its strong ERM will likely maintain risk exposures within tolerances. The ratings reflect our view of ING Verzekeringen N.V.'s (INGV) strong business risk profile, based on the strength of its foothold within Europe and the Dutch market in particular, and its strong financial risk profile. Our expectation is that INGV will maintain its balance sheet strength through the IPO of ING's European insurance business and the divestment of the Asian and U.S operations. The negative outlook reflects our view of the risks relating to the group's financial risk profile, including uncertainties associated with the divestment by ING Groep (ING) of its insurance operations, as well as wider economic factors such as low interest rates. The negative outlook also reflects that on ING.

Assicurazioni Generali SpA

Holding company: A-/Negative/-- ; core operating companies: A-/Negative

Taos Fudji

Italy

Aviva PLC

Holding company: A-/Stable/A-2; core operating companies: A+/Stable

Simon Ashworth

U.K

AXA

Holding company: A-/Stable/A-2; core operating companies: A+/Stable

Lotfi Elbarhdadi

France

ING Verzekeringen N.V.

Holding company: A-/Negative/A-2; core operating companies: A+/Negative

Simon Ashworth

The Netherlands

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 14

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

Table 3

Global Multiline Insurance Groups (cont.)

MetLife Holding company:A-/Stable/A-2 ; core operating companies: AA-/Stable Shellie Stoddard U.S. The ratings on MetLife Inc. (MET) reflect our view of the group's very strong business risk profile and financial risk profile. MET has a very strong competitive position, in our view, predicated on its brand name recognition, global scale, and ability to positively differentiate itself from its competitors in key insurance markets. The group also has very strong global capital and earnings capabilities. We regard MET's ERM and management and governance practices as supportive of the ratings. In our view, MET's business and financial risk profiles are likely to remain very strong. We anticipate the group will maintain operating performance that at least matches that of key competitors in the same market, its very strong overall competitive position, and strong financial flexibility. In 2013, we expect fixed-charge coverage to remain above 6x and financial leverage to stay at about 30%-35%. The ratings on Prudential Financial Inc. (PRU) reflect our view of the group's very strong business and financial risk profiles. We base these assessments on PRU's very strong competitive position, reflecting well-established market positions in the U.S. and Japan, well-diversified distribution channels, innovative product designs, and a favorable brand and reputation. Regarding financial risk, PRU reports very strong capital and earnings and strong financial flexibility. We anticipate that PRU's U.S. operating subsidiaries will sustain their very strong competitive position and maintain capital adequacy consistent with the 'AA-' category. In 2013, we expect fixed-charge coverage of at least 8x on a pretax adjusted operating income basis, with further improvement in 2014. We expect the group's debt leverage to remain less than 20% and its total financial leverage, including hybrids, to remain less than 30%. Although PRU's recent large pension-risk transfers could increase operating earnings, it is unclear whether this improvement is sustainable, especially in view of potential longevity risk. The ratings on Prudential and its core subsidiaries predominantly reflect our view of the group's excellent business risk profile and very strong financial risk profile. Prudential has an extremely strong competitive position in our view, mainly stemming from its market leading positions across different geographies, product lines, and risk types. Overall, we assess capital and earnings as very strong. We expect the group to continue to manage variable annuity volumes and market risk exposures in line with its risk appetite and to keep improving the balance of risks and earnings from its U.S. business. In our view the group's growth strategy will not adversely affect its risk profile and that disciplined risk and capital management will protect its balance sheet. The ratings reflect our view of QBE's very strong business risk profile and moderately strong financial risk profile, owing to a very strong competitive position, stemming primarily from geographic and product diversity, and strong capital and earnings. QBE has shown strong financial flexibility through its ability to access debt and equity markets. We expect financial leverage and EBITDA interest cover ratios of 29% and 5.6x, respectively, at the end of fiscal 2012 to strengthen marginally over 2013-2015 as QBE looks to reduce leverage. We believe that QBE's capital adequacy will improve to the 'A' range over that period and that there won't be material reserve strengthening. We also anticipate that the group will maintain its very strong competitive position and its operating performance will stay consistent with our base case. In our view, QBEs interim 2013 results were modest and reserve increases and premium growth lower than we expected, due to the difficult environment for lender-placed business. Nevertheless, the group's combined (loss and expense) ratio was a sound 93% for the first half of 2013, with regulatory capital adequacy remaining solid and gearing improving slightly.

Prudential Financial Inc.

Holding company: A/Stable/A-1; core operating companies: AA-/Stable

Li Cheng

U.S.

Prudential PLC

Holding company:A+/Stable/A-1 ; core operating companies: AA/Stable

Simon Ashworth

U.K.

QBE Insurance Group Ltd.

Holding company: A-/Stable/--; core operating companies: A+/Stable

Mark Legge

Australia

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 15

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

Table 3

Global Multiline Insurance Groups (cont.)

Tokio Marine Holdings Inc. Holding company: not rated; core operating companies: AA-/Negative Reina Tanaka Japan In our view, the Tokio Marine Group has a very strong business risk profile, built on an extremely strong competitive position and intermediate industry and country risk. In particular, Tokio Marine Group's brand, market position, and product diversity are key strengths in our opinion. We consider Tokio Marine Group to have a strong financial risk profile, underpinned by strong capital and earnings, an intermediate risk position, and strong financial flexibility. In our base case, we assume the group will earn net income of at least 140 billion annually for fiscal 2013 and 2014, compared with about 71 billion on average during the past five years. We assess ERM as strong, owing to our positive view of the group's risk-management culture, risk controls, risk and economic capital models, and strategic risk management. The negative outlook reflects our view that the group's credit profile is constrained by the sovereign ratings on Japan, given that the core operating entities' business franchises and asset structures largely depend on the domestic market. The ratings on XLIT Ltd. reflect our view of the group's strong business and financial risk profiles, built on extremely strong capital and earnings and partly offset by high risk. We anticipate strong earnings to result from the continuation of strong underwriting performance, further optimization of the investment portfolio, and the materially reduced risk profile of the run-off businesses. More importantly, we expect the continued focus and recent enhancement of ERM to a strong level to reduce the frequency and severity of unanticipated losses. Additionally, we note that XLIT's financial flexibility metrics are improving, which also supports our positive outlook on the ratings. The ratings reflect our view of the group's very strong business and financial risk profiles, built on an extremely strong competitive position, mainly thanks to its geographic and product diversity, and very strong capital and earnings. Despite low investment yields, we anticipate in our base case that the group will continue to report very strong capital and earnings. We assume that Zurich Insurance Co. Ltd. (ZIC) will report an operating profit of US$4.0 billion-US$5.5 billion annually for 2013-2015. We anticipate that ZIC's competitive position will remain extremely strong, underpinned by our base-case assumption of the group maintaining favorable operating performance.

XLIT Ltd.

Holding company: BBB+/Positive/--; core operating companies A/Positive

Taoufik Gharib

Cayman Islands

Zurich Insurance Co. Ltd.

Holding company: not rated; core operating companies: AA-/Stable

Volker Kudszus

Switzerland

ERM--Enterprise risk management.

Recent Rating Activity

Table 4

Global Multiline Insurers--Rating/Outlook/CreditWatch Actions*

Issuer ACE Ltd. To A/Positive/-From A/Stable/-Date May 22, 2013 Reason The positive outlook reflects our view that ACE will continue to post superior operating performance relative to its multiline insurance peers, supporting its extremely strong capital adequacy and extremely strong competitive position in the next two-to-three years. Furthermore, we expect ACE's diverse business mix and prudent catastrophe-management practices to continue reducing the group's exposure to any one line of business, and its earnings to be among the least volatile in its peer group.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 16

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

Table 4

Global Multiline Insurers--Rating/Outlook/CreditWatch Actions* (cont.)

American International Group (PC Subsidiaries) A+/Stable/-A/Stable/-May 6, 2013 The stable outlooks on AIG's property/casualty operating subsidiaries (collectively, AIG PC) and life insurance subsidiaries (AIG L&R) reflect our belief that the group will sustain its competitive position, while AIG PC improves its operating results to a level more consistent with its peers', and AIG L&R continues to report strong operating performance. We expect consolidated capitalization to remain strong, supporting capital adequacy of the insurance companies at a level commensurate with the rating level and the capital requirements of the remaining noncore and runoff operations. We believe AIG's enterprise risk management should continue improving as the operating companies implement enhanced risk-management processes and fully integrate them throughout the AIG organization. In 2013, we believe AIG PC will report a combined ratio of around 103%, including our estimate for a catastrophe load of about 4% (average annual loss) and assuming minimal prior-year reserve development. This should translate into pretax operating income (before net realized capital gains/losses) of $3.5 billion-$4 billion. We expect AIG L&R to continue its strong operating performance and to generate pretax operating income of about $4 billion, slightly less than in 2012 due to pressure on net investment income from low interest rates. The stable outlook reflects our view that Allianz SE's capital adequacy will remain in the 'AA' range. In our view, the group's capital adequacy provides a substantial buffer against tough economic conditions in Italy and low interest rates, especially in Germany. We also anticipate that the group will maintain earnings consistent with our base case, with at least a steady profit contribution from non-life and asset management (PIMCO), and an extremely strong competitive position. We lowered our long-term ratings on Generali and its core subsidiaries after the downgrade of Italy. While our view of the 'a' anchor is unchanged, the rating is limited to two notches above that on Italy. The outlook is negative, both because of the negative outlook on the sovereign rating on Italy and the negative trend regarding operating and financial conditions in Generali's key Italian market. The stable outlook reflects our view that the group's growth strategy will not adversely affect its risk profile and that disciplined risk and capital management will protect its balance sheet. Our base-case assumption is that the group will continue to focus on accelerating growth in Asia, maintaining a strong position in the U.S. market and selective participation in the U.K., and expanding its asset management operations. In our view, this diversity somewhat insulates the group's business profile from the difficult global macroeconomic environment. We expect growth across the group and within each region to be balanced and do not expect it to constrain our assessment of the group's business or financial risk profiles. The stable outlook also reflects our view that Prudential's current competitive advantages will remain resilient to competitive pressures and that the group will maintain its current strong levels of operating performance. The stable outlook reflects our view that QBE's capital adequacy will improve to the 'A' range over 2013-2015 and that there will be no material reserve strengthening over this time frame. We also anticipate that the group will maintain its very strong competitive position and that its operating performance will stay consistent with our base case.

Allianz SE

AA/Stable/A-1+

AA/Stable/A-1+

July 12, 2013

Assicurazioni Generali Spa

A-/Negative/--

A/Watch Neg/--

July 12, 2013

Prudential PLC

A+/Stable/A-1

A+/Negative/A-1

May 22, 2013

QBE Insurance Group

A-/Stable/--

A/Negative/--

May 22, 2013

*From Jan. 1, 2013, through to Sept 6, 2013.

Contact Information

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 17

1191326 | 301967406

Industry Report Card: Global Multiline Insurers' Robust Market Positions And Improving Capital Translate Into Stable Ratings

Table 5

Contact Information

Credit analyst Simon Ashworth, Director Ralf Bender, Senior Director Mark Button, Senior Director Matthew Carroll, Senior Director Li Cheng, Director Tracy Dolin, Director Lotfi Elbarhdadi, Director Taos Fudji, Director Taoufik Gharib, Director John Iten, Director Rob Jones, Managing Director Sanjay Joshi, Associate Director Volker Kusdzus, Director Mark Legge, Director Miroslav Petkov, Director Location London Frankfurt London New York New York New York Paris Milan New York New York London London Frankfurt Telephone (44) 20-7176-7243 E-mail Simon.Ashworth@standardandpoors.com

(49) 69-33-999-194 ralf_bender@standardandpoors.com (44) 20-7176-7045 (1) 212-438-3112 (1) 212-438-1849 (01) 212 438 1325 (33) 1-4420-6730 (39) 02 72111276 (1) 212-438-7253 (1) 212-438-1757 (44) 20-7176-7041 (44) 20-7176-7087 (49) 69 33999 192 mark_button@standardandpoors.com matthew_carroll@standardandpoors.com li.cheng@standardandpoors.com tracy_dolin@standardandpoors.com lotfi.elbarhdadi@standardandpoors.com taos.fudji@standardandpoors.com taoufik.gharib@standardandpoors.com john.iten@standardandpoors.com rob.jones@standardandpoors.com sanjay.joshi@standardandpoors.com volker.kudszus@standardandpoors.com mark.legge@standardandpoors.com miroslav_petkov@standardandpoors.com shellie.stoddard@standardandpoors.com reina.tanaka@standardandpoors.com

Melbourne (61) 3-9631-2041 London (44) 02071767043 (01) 212 438 7244 (81) 3 4550 8587

Shellie A Stoddard, Senior Director New York Reina Tanaka, Associate Director Tokyo

Related Criteria And Research

Related criteria

Group Rating Methodology, May 7, 2013 Insurers: Rating Methodology, May 7, 2013 Principles Of Credit Ratings, Feb. 16, 2011 Refined Methodology And Assumptions For Analyzing Insurer Capital Adequacy Using The Risk-Based Insurance Capital Model, June 7, 2010

Related research

U.S. Economic Forecast: A Mighty Wind, Aug. 23, 2013 The Low-Interest-Rate Fog Over Global Life Insurers May Be Lifting, July 25, 2013 Possible Ratings Implications For Global Systemically Important Insurers, July 19, 2013 Global Insurance Key Risks And Credit Trends: At Mid-Year, Low Interest Rates And Regulation Prevail, July 18, 2013 What's Behind Our Ratings On The Top 15 Global Multiline Insurers Following The Application Of Our New Criteria, June 4, 2013 Global Economic Outlook: An Expansion With Complex Cross-Currents, May 15, 2013 Global Multiline Insurers' Credit Quality Remains Strong, But Many Hurdles Lie Ahead, Jan. 17, 2013

Additional Contact: Insurance Ratings Europe; InsuranceInteractive_Europe@standardandpoors.com

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 18

1191326 | 301967406

Copyright 2013 by Standard & Poor's Financial Services LLC. All rights reserved. No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process. S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription) and www.spcapitaliq.com (subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

SEPTEMBER 16, 2013 19

1191326 | 301967406

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Statement of Cash Flow by KiesoDocumento85 páginasStatement of Cash Flow by KiesoSiblu HasanAún no hay calificaciones

- Private Equity E BookDocumento141 páginasPrivate Equity E BookJM Koffi100% (2)

- Japanese Corporates Hitch Growth Plans To Southeast Asian Infrastructure, But Face A Bumpy RideDocumento14 páginasJapanese Corporates Hitch Growth Plans To Southeast Asian Infrastructure, But Face A Bumpy Rideapi-227433089Aún no hay calificaciones

- UntitledDocumento10 páginasUntitledapi-227433089Aún no hay calificaciones

- Hooked On Hydrocarbons: How Susceptible Are Gulf Sovereigns To Concentration Risk?Documento9 páginasHooked On Hydrocarbons: How Susceptible Are Gulf Sovereigns To Concentration Risk?api-227433089Aún no hay calificaciones

- Metropolitan Transportation Authority, New York Joint Criteria TransitDocumento7 páginasMetropolitan Transportation Authority, New York Joint Criteria Transitapi-227433089Aún no hay calificaciones

- Michigan Outlook Revised To Stable From Positive On Softening Revenues Series 2014A&B Bonds Rated 'AA-'Documento3 páginasMichigan Outlook Revised To Stable From Positive On Softening Revenues Series 2014A&B Bonds Rated 'AA-'api-227433089Aún no hay calificaciones

- The Challenges of Medicaid Expansion Will Limit U.S. Health Insurers' Profitability in The Short TermDocumento8 páginasThe Challenges of Medicaid Expansion Will Limit U.S. Health Insurers' Profitability in The Short Termapi-227433089Aún no hay calificaciones

- 2014 Review of U.S. Municipal Water and Sewer Ratings: How They Correlate With Key Economic and Financial RatiosDocumento12 páginas2014 Review of U.S. Municipal Water and Sewer Ratings: How They Correlate With Key Economic and Financial Ratiosapi-227433089Aún no hay calificaciones

- How Is The Transition To An Exchange-Based Environment Affecting Health Insurers, Providers, and Consumers?Documento5 páginasHow Is The Transition To An Exchange-Based Environment Affecting Health Insurers, Providers, and Consumers?api-227433089Aún no hay calificaciones

- UntitledDocumento16 páginasUntitledapi-227433089Aún no hay calificaciones

- Global Economic Outlook: Unfinished BusinessDocumento22 páginasGlobal Economic Outlook: Unfinished Businessapi-227433089Aún no hay calificaciones

- The Media and Entertainment Outlook Brightens, But Regulatory Clouds GatherDocumento17 páginasThe Media and Entertainment Outlook Brightens, But Regulatory Clouds Gatherapi-227433089Aún no hay calificaciones

- U.S. Corporate Flow of Funds in Fourth-Quarter 2013: Equity Valuations Surge As Capital Expenditures LagDocumento12 páginasU.S. Corporate Flow of Funds in Fourth-Quarter 2013: Equity Valuations Surge As Capital Expenditures Lagapi-227433089Aún no hay calificaciones

- Recent Investor Discussions: U.S. Consumer Products Ratings Should Remain Stable in 2014 Amid Improved Consumer SpendingDocumento6 páginasRecent Investor Discussions: U.S. Consumer Products Ratings Should Remain Stable in 2014 Amid Improved Consumer Spendingapi-227433089Aún no hay calificaciones

- UntitledDocumento14 páginasUntitledapi-227433089Aún no hay calificaciones

- New Jersey's GO Rating Lowered To A+' On Continuing Structural Imbalance Outlook StableDocumento6 páginasNew Jersey's GO Rating Lowered To A+' On Continuing Structural Imbalance Outlook Stableapi-227433089Aún no hay calificaciones

- Adding Skilled Labor To America's Melting Pot Would Heat Up U.S. Economic GrowthDocumento17 páginasAdding Skilled Labor To America's Melting Pot Would Heat Up U.S. Economic Growthapi-227433089Aún no hay calificaciones

- U.S. State and Local Government Credit Conditions Forecast: Waiting - . - and Waiting To ExhaleDocumento17 páginasU.S. State and Local Government Credit Conditions Forecast: Waiting - . - and Waiting To Exhaleapi-227433089Aún no hay calificaciones

- French Life Insurers' Credited Rates To Policyholders For 2013 Indicate A Renewed Focus On Volume GrowthDocumento5 páginasFrench Life Insurers' Credited Rates To Policyholders For 2013 Indicate A Renewed Focus On Volume Growthapi-227433089Aún no hay calificaciones

- Inside Credit: Private-Equity Owners Lead The European IPO Resurgence As Company Valuations ImproveDocumento11 páginasInside Credit: Private-Equity Owners Lead The European IPO Resurgence As Company Valuations Improveapi-227433089Aún no hay calificaciones

- The EdgeDocumento33 páginasThe EdgeSyahrull NizamAún no hay calificaciones

- ONGC Dividend Policy - PPTX PresentationDocumento22 páginasONGC Dividend Policy - PPTX PresentationvaishuladAún no hay calificaciones

- Uds Business Plan Presentation FinalDocumento21 páginasUds Business Plan Presentation FinalAdams Yussif KwajaAún no hay calificaciones

- Financial ModellingDocumento136 páginasFinancial ModellingSahil Shaha100% (1)

- Free Premium Course Final Course For Youtube PDFDocumento3 páginasFree Premium Course Final Course For Youtube PDFNitin GarjeAún no hay calificaciones

- Triple Top Chart Pattern: Rajesh Chauhan Ravindra JainDocumento10 páginasTriple Top Chart Pattern: Rajesh Chauhan Ravindra JainRohan SwamyAún no hay calificaciones

- Research Proposal: Changes in Oil Prices and Their Impact On Emerging Markets ReturnsDocumento11 páginasResearch Proposal: Changes in Oil Prices and Their Impact On Emerging Markets ReturnsMehran Arshad100% (1)

- Practice Quiz M5.4Documento4 páginasPractice Quiz M5.4Iraguha LonginAún no hay calificaciones

- Ecosystem Development FrameworkDocumento74 páginasEcosystem Development Frameworkana_ciAún no hay calificaciones

- AAG Constant Maturity SwapsDocumento3 páginasAAG Constant Maturity SwapsIshanGuptaAún no hay calificaciones

- Class 1 Investments BKM Chapter9Documento19 páginasClass 1 Investments BKM Chapter9Daniel PortellaAún no hay calificaciones

- Business Plan FOR: Division of Bataan Morong National High School Senior High School Sabang Morong BataanDocumento12 páginasBusiness Plan FOR: Division of Bataan Morong National High School Senior High School Sabang Morong BataanIvan RemegioAún no hay calificaciones

- Premier Pension Portfolio Funds: Potentially Higher Returns During Times of VolatilityDocumento3 páginasPremier Pension Portfolio Funds: Potentially Higher Returns During Times of VolatilityDavid BriggsAún no hay calificaciones

- Delgado - Forex: The Fundamental Analysis.Documento10 páginasDelgado - Forex: The Fundamental Analysis.Franklin Delgado VerasAún no hay calificaciones

- Understanding Faq Rule 144a Equity OfferingsDocumento12 páginasUnderstanding Faq Rule 144a Equity OfferingskcetconsultingAún no hay calificaciones

- BSMDocumento13 páginasBSMA. NavinAún no hay calificaciones

- Casey Executive MagDocumento6 páginasCasey Executive Magsmithcari13Aún no hay calificaciones

- Bu SyllabusDocumento5 páginasBu Syllabuswaleed20_20Aún no hay calificaciones

- Half Yearly - ST IgnatiusDocumento16 páginasHalf Yearly - ST IgnatiusuhhwotAún no hay calificaciones

- Ifrs 170120102142Documento10 páginasIfrs 170120102142ajayAún no hay calificaciones

- CSXDocumento130 páginasCSXmarcelluxAún no hay calificaciones

- Executive Summary - Retail Investor SurveyDocumento2 páginasExecutive Summary - Retail Investor SurveySandeep ApteAún no hay calificaciones

- Ratio Analysis Toyota Indus Motors Company Limited: Lquidity RatiosDocumento9 páginasRatio Analysis Toyota Indus Motors Company Limited: Lquidity RatiosArsl331Aún no hay calificaciones

- Finance Essay Shadow BankingDocumento3 páginasFinance Essay Shadow BankingSarah AzlinaAún no hay calificaciones

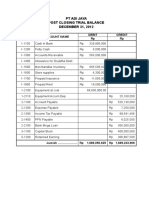

- Jawaban Silus Adijaya 2015Documento15 páginasJawaban Silus Adijaya 2015natsu dragnelAún no hay calificaciones

- Unit Linked Insurance PlansDocumento4 páginasUnit Linked Insurance Plansprudhvi rajAún no hay calificaciones

- Sip Project ReportDocumento45 páginasSip Project ReportArpita ArtaniAún no hay calificaciones

- 54543bos43717ipcc p3q PDFDocumento6 páginas54543bos43717ipcc p3q PDFPuneet VyasAún no hay calificaciones