Documentos de Académico

Documentos de Profesional

Documentos de Cultura

SB SELF CERT (Fillable Form) - JR13023 VA BLDG 24 Seismic Corrections Fresno CA

Cargado por

jhongisdTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

SB SELF CERT (Fillable Form) - JR13023 VA BLDG 24 Seismic Corrections Fresno CA

Cargado por

jhongisdCopyright:

Formatos disponibles

The Walsh Group

Small Business Self-Certification Form

VA Bldg 24 Seismic Corrections, Fresno, CA

WG Project No - Name: ________________ - ________________________________________________________ WG Subcontract No.: ___________________________ Owner Contract No.: ___________________________

VA261-13-R-1360 VA261-13-R-2411

Subcontractor / Vendor Name: ______________________________________________________________________ Scope of Work: _________________________________________________________________________________ Primary NAICS Code: ___________________________

(Must be full 6 digit code)

SBAs NAICS Threshold ( one)

Millions $ Employees

_________________

(SBA Threshold Value)

Subs / Vendors: (a) Average Annual Receipts :(Mil): $

(Avg. from Last 3 Compl. Tax Years, Ref. 13 CFR 121.104 for calc. method)

(b) Average No. of Employees: __________________________

(Avg. from Last 12 Months, Ref. 13 CFR 121.106 for calc. method)

Indicate each Small Business Classification that applies by initialing next to the applicable category. Size designations indicated herewith shall be based on the Primary NAICS Code indicated above. If for a specific contract, the Primary NAICS Code indicated above shall be representative of the contract scope. If the contract scope covers more than one NAICS code, the Primary NAICS code shall be the one that makes up the greatest dollar value of the contract. If this form is not based on a specific contract, the Primary NAICS code above shall represent the scope of work most often provided by your company. The definitions provided herewith are not guaranteed and shall not waive the certifying company's responsibility to review and understand the definitions pursuant to the Federal Acquisition Regulation (FAR) part 19.7 or 52.219-8 (www.arnet.gov/far). Where the below definitions conflict with those provided in the FAR, the FAR definition shall govern. If you have difficulty ascertaining your size status, refer to SBA's website at www.sba.gov/size or contact your local SBA office. (*: Provide SBA or VA Certification In Addition To This Form): ______ SB: Small Business means a small business concern, including its affiliates, that is independently owned and operated, not dominant in the field of operations in which it is bidding, and qualified as a small business under the criteria and size standards in 13 CFR Part 121 (Size standards by standard Industrial Classification codes required by the Federal Acquisition Regulations (FAR), Section 19.102, may be found at www.sba.gov/size.). For non-manufacturers, annual average receipts, computed from the gross receipts for the last 3 fiscal years, do not exceed the amount listed in SBA Table of Small Business Size Standards, as matched to North American Industry Classification System Codes. The average annual receipt is computed by taking the sum of the gross receipts of the prior 3 fiscal years and dividing by 3. For manufacturers, do not exceed number of employees listed in SBA Table of Small Business Size Standards, as matched to North American Industry Classification System Codes. If a business does not qualify as an SB, then none of the other SBA classifications will apply.

(initial, if applicable)

______ VOSB: "Veteran-Owned Small Business" means a small business concern where not less (initial, if than 51 percent is owned by one or more veterans (as defined at 38 U.S.C. 101(2)) or, in the case of any applicable) publicly owned business, not less than 51 percent of the stock of which is owned by one or more veterans; and the management and daily business operations of which are controlled by one or more veterans. * If initialed, has VOSB status been verified by the Department of Veteran Affairs (Y/N): ______________ (If "Y", attach VA verification certificate). VA verification may be required on VA funded projects.

"X" is acceptable next to applicable classifications only if this form is completed and signed electronically. Otherwise, hand initials and hand signatures are required as indicated. Page1of4 Form:SBSELFCERT RevisionDate:August31,2012

VA Bldg 24 Seismic Corrections, Fresno, CA (VA261-13-R-2411) VA261-13-R-1360

The Walsh Group

Small Business Self-Certification Form

(initial, if applicable)

______ WOSB: "Woman-Owned Small Business" means a small business concern that is at least 51 percent owned (initial, if by one or more women; or in the case of any publicly owned business, at least 51 percent of the stock of which applicable) is owned by one or more women; and whose management and daily business operations are controlled by one or more women. ______ HUBZoneSB*: "HUB Zone Small Business" means a small business concern that is listed, on the date of its representation, as a qualified HUB Zone Small Business as maintained by the Small Business Administration (SBA), and no material change in ownership and control, principle office, or HUB Zone employee percentage has occurred since it was certified by the SBA in accordance with 13 CFR part 126. * SBA HUB Zone is a historically underutilized business zone, which is in an area located within one or more Certification qualified census tracts, qualified non-metropolitan counties, or lands within the external boundaries of an also Required Indian Reservation. To qualify for Certification as a HUB Zone Small Business, the business principal office must be located within a HUB Zone, must be owned and controlled by one or more U.S. citizens, and have at least 35% of its employees residing in a HUB Zone.

(initial, if applicable)

______ SDB: "Small Disadvantaged Business" means a small business concern that is at least 51 (initial, if percent unconditionally owned by one or more Socially and Economically disadvantaged individuals; or in the applicable) case of any publicly owned business, at least 51 percent of the voting stock is unconditionally owned by one or more Socially and Economically disadvantaged individuals; and whose management and daily business operations are controlled by one or more such individuals; and is a U.S. Citizen who also resides in the United States. Socially disadvantaged individuals are: Those who have been subjected to ethnic prejudice or cultural bias because of their identity as a member of a group without regard to their individual qualities. Minorities are presumed Socially disadvantaged but Social disadvantaged status can be self-certified by non-minorities when an individual believes, in good faith, they have been subjected to a Social disadvantage due to a distinguishing feature (such as gender, physical handicap, etc.) or cultural bias (religion, ethnicity, etc.). In such cases, non-minority Social disadvantaged status would be based on personal experiences through a preponderance of evidence. Economically disadvantaged individuals are: Socially disadvantaged individuals whose ability to compete in the free enterprise system has been impaired due to the diminished capital and credit opportunities as compared to others in the same or similar line of business that are not Socially disadvantaged. To qualify as Economically disadvantaged, an individual must satisfy the following three (3) criteria: (1) The Net Worth of each individual upon whom the certification is based must not exceed $750,000 after taking into account the applicable exclusions set forth (net worth exclusions are: (a) equity in business, (b) equity in prime residence, and (c) funds in retirement accounts provided there is a penalty associated with a withdrawal). (2) Annual income, averaged over the last three (3) years, of each individual upon whom the certification is based must not exceed $350,000. (3) Fair market value of Assets, excluding qualified retirement accounts, must not exceed $6 Million.

"X" is acceptable next to applicable classifications only if this form is completed and signed electronically. Otherwise, hand initials and hand signatures are required as indicated. Page2of4 Form:SBSELFCERT RevisionDate:August31,2012

VA Bldg 24 Seismic Corrections, Fresno, CA (VA261-13-R-2411) VA261-13-R-1360

______ SD-VOSB: "Service-Disabled Veteran-Owned Small Business" means a small business concern where not less than 51 percent is owned by one or more service-disabled veterans; or in the case of any publicly owned business, not less than 51 percent of the stock of which is owned by one or more servicedisabled veterans; and the management and daily business operations of which are controlled by one or more service-disabled veterans or, in the case of a veteran with permanent and severe disability, the spouse or permanent caregiver of such veteran. Service-Disabled Veteran means a veteran, as defined in 38 U.S.C. 101(2), with a disability that is service-connected, as defined in 38 U.S.C. 101(16) and declared by the United States Veterans Administration to be 10% or more disabled as a result of service in the armed forces. An SDVOSB automatically qualifies as a VOSB. * If initialed, has SD-VOSB status been verified by the Department of Veteran Affairs (Y/N): __________ (if "Y", attach VA verification certificate). VA verification may be required on VA funded projects.

The Walsh Group

Small Business Self-Certification Form

(initial, if applicable)

(initial, if applicable)

______ ANC/TO: "Alaskan Native Corporation" is any Regional Corporation, Village Corporation, Urban Corporation, or Group Corporation organized under the laws of the State of Alaska in accordance with the Alaska Native Claims Settlement Act, as amended (43 U.S.C. 1601, et seq.). An ANC also qualifies as a TO. "Tribally Owned" business concern is any business concern that is at least 51 percent owned by an Indian tribe. An Indian tribe means any Indian tribe, band, nation, or other organized group or community of Indians, including any ANC, which is recognized as eligible for the special programs and services provided by the United States to Indians because of their status as Indians, or is recognized as such by the State in which the tribe, band, nation, group, or community resides. Indian tribes also include Indian-owned economic enterprises that meet the requirements of 25 U.S.C. 1452(e). ANCs and TOs automatically qualify as an SB and SDB, regardless of size or SBA certification status. * If initialed, has ANC/TOs SDB status been certified by the Small Business Administration (Y/N): _____ (If "Y", attach SBA certification letter). * If initialed, does ANC/TOs size exceed threshold for the noted Primary NAICS Code (Y/N): _________

______ HBCU/MI: "Historically Black Colleges and Universities/Minority Institution". "Historically Black Colleges (initial, if and Universities", as defined by The Higher Education Act (HEA) of 1965, as amended, is: "...any historically applicable) black college or university that was established prior to 1964, whose principal mission was, and is, the education of black Americans, and that is accredited by a nationally recognized accrediting agency or association determined by the Secretary [of Education] to be a reliable authority as to the quality of training offered or is, according to such an agency or association, making reasonable progress toward accreditation." There are 105 Historically Black Colleges and Universities (HBCU) in the United States today, including public and private, two-year and four-year institutions, medical schools and community colleges. Most are in the former slave states and territories of the U.S. "Minority Institutions" are places of higher education whose enrollment of a single minority group, as the term "minority" is defined under 365(2) of the HEA (20 U.S.C. 1067k(2)), or combination of those minority groups, that exceeded 50% of its total enrollment. Since most HBCU/MI are not for profit, most would not qualify as a Small Business since organized "for profit" is a Small Business criteria. Some "for profit" HBCU/MI, however, will qualify as a Small Business. ______ AbilityOne: Qualified non-profit agencies (sometimes referred to community rehabilitation programs, work centers, industries, or rehabilitation facilities) for the blind or other severely disabled, that have been approved by the Committee for Purchase from People Who Are Blind or Severely Disabled under the Javits-WagnerODay Act (41 U.S.C. 46-48). ______ None of the provided categories (pages 1 through 3) apply.

(initial, if applicable)

(initial, if applicable)

"X" is acceptable next to applicable classifications only if this form is completed and signed electronically. Otherwise, hand initials and hand signatures are required as indicated. Page3of4 Form:SBSELFCERT RevisionDate:August31,2012

VA Bldg 24 Seismic Corrections, Fresno, CA (VA261-13-R-2411) VA261-13-R-1360

______ SDB8(a)*: "Small Disadvantaged Business, Class 8(a)" is a classification named for Section 8(a) of the Small Business Act. It signifies a small business that has been certified by the Small Business Administration (SBA) to participate in a business development program created to help small disadvantaged businesses compete in the market place. Generally, a concern meets the basic requirements for admission to * SBA the 8(a) BD program if it is a small business which is unconditionally owned and controlled by one or more Certification Socially and Economically disadvantaged individuals (qualifying under the initial eligibility Economic also Required disadvantaged thresholds) who are of good character, citizens of the United States, reside in the United States, and which demonstrates potential for success. A Participant receives a program term of nine (9) years from the date of SBA's approval letter certifying the concern's admission to the program. The Participant must maintain its program eligibility during its tenure in the program and must inform SBA of any changes that would adversely affect its program eligibility. A firm that completes its nine (9) year term of participation in the 8(a) BD program is deemed to graduate from the program. The nine (9) year program term may be shortened only by termination, early graduation, or voluntary graduation as dictated by the program. To qualify for the SDB8(a) program, a small business concern must also qualify as an SDB.

The Walsh Group

Small Business Self-Certification Form

Information furnished by:

______________________________________________________________________________________________ (Print or Type Name of Owner and/or Principal)

______________________________________________________________________________________________ (Name of Business or Firm)

_______________________________________________________________________________________ (Insert type of business: e.g. corporation, sole proprietorship, partnership, etc.)

______________________________________________________________________________________________ (Street Address)

______________________________________________________________________________________________ (City) (State) (Zip)

______________________________________________________________________________________________ (Phone) (Fax)

______________________________________________________________________________________________ (Email) Under 15 U.S.C. 645(d), any person who misrepresents its size status shall (1) be punished by a fine, imprisonment, or both; (2) be subject to administrative remedies; and (3) be ineligible for participation in programs conducted under the authority of the Small Business Act.

By:

__________________________________________ (Print Name)

_____________________________________ (Title)

__________________________________________ (Signature)

_____________________________________ (Date)

*************************** BELOW FOR INTERNAL USE ONLY *************************** HUBZoneSB and/or SDB8(a) status(es) have been verified in the Central Contractor Registration (CCR) Dynamic Small Business Search Database as of ___ / ___ / _______.

For SDB8(a), the expiration date is ____ / ____ / ________.

(Initial) _________.

Form:SBSELFCERT Page4of4 RevisionDate:August31,2012

VA Bldg 24 Seismic Corrections, Fresno, CA (VA261-13-R-2411) VA261-13-R-1360

También podría gustarte

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2103)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- Cry, The Beloved Country.Documento5 páginasCry, The Beloved Country.Avtar Dhaliwal100% (1)

- The Philippine Youth Development Plan (PYDP) 2017-2022Documento66 páginasThe Philippine Youth Development Plan (PYDP) 2017-2022Rohaina Sapal100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Hidden Figures (Final)Documento8 páginasHidden Figures (Final)Susan Beeley100% (2)

- JPL High-Tech Small Business Industry Day FlyerDocumento1 páginaJPL High-Tech Small Business Industry Day FlyerjhongisdAún no hay calificaciones

- Network Boost & Certification Simplified 12-5-13 Flyer PDFDocumento1 páginaNetwork Boost & Certification Simplified 12-5-13 Flyer PDFjhongisdAún no hay calificaciones

- Operation Boost FlyerDocumento1 páginaOperation Boost FlyerjhongisdAún no hay calificaciones

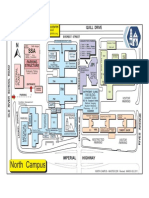

- North Campus Master 8-5x11Documento1 páginaNorth Campus Master 8-5x11jhongisdAún no hay calificaciones

- Subcontractor Questionnaire Satellite Earth Terminal Station Facility (DM13057)Documento14 páginasSubcontractor Questionnaire Satellite Earth Terminal Station Facility (DM13057)jhongisdAún no hay calificaciones

- SB Self-Certification Satellite Earth Terminal Station Facility (DM13057)Documento4 páginasSB Self-Certification Satellite Earth Terminal Station Facility (DM13057)jhongisdAún no hay calificaciones

- Invitation To Bid - SatEllite Earth Terminal Station Facility Camp Roberts CA (DM13057)Documento3 páginasInvitation To Bid - SatEllite Earth Terminal Station Facility Camp Roberts CA (DM13057)jhongisdAún no hay calificaciones

- QUAL QUEST (Fillable Form) - JR13023 VA BLDG 24 Seismic Corrections Fresno CADocumento6 páginasQUAL QUEST (Fillable Form) - JR13023 VA BLDG 24 Seismic Corrections Fresno CAjhongisdAún no hay calificaciones

- Walsh Construction II - Invitation To Bid For VA BLDG 24 Seismic Retrofit Fresno CA PDFDocumento3 páginasWalsh Construction II - Invitation To Bid For VA BLDG 24 Seismic Retrofit Fresno CA PDFjhongisdAún no hay calificaciones

- Atlanta Race RiotDocumento141 páginasAtlanta Race RiotWilliam N. GriggAún no hay calificaciones

- Women EmpowermentDocumento3 páginasWomen EmpowermentShubham JumdeAún no hay calificaciones

- National Inuit Strategy On ResearchDocumento48 páginasNational Inuit Strategy On ResearchNunatsiaqNewsAún no hay calificaciones

- PROFADDocumento10 páginasPROFADCristina L. JaysonAún no hay calificaciones

- Making A Cult Film Final Published VersionDocumento174 páginasMaking A Cult Film Final Published VersionstephencarthewAún no hay calificaciones

- Child RightsDocumento5 páginasChild RightsMeow SujiAún no hay calificaciones

- II-12BSA Roxas WEEK03 Assignment PDFDocumento2 páginasII-12BSA Roxas WEEK03 Assignment PDFJason RecanaAún no hay calificaciones

- Business Communication (Eng301)Documento3 páginasBusiness Communication (Eng301)Hifza MushtaqAún no hay calificaciones

- SWRB Social Work Practice Competencies - Self-Assessment 3 FinalDocumento3 páginasSWRB Social Work Practice Competencies - Self-Assessment 3 Finalapi-291442969Aún no hay calificaciones

- Disabliity Issues Duty To AccommodateDocumento83 páginasDisabliity Issues Duty To AccommodateKrazy Wild MannAún no hay calificaciones

- J.S.mill - of NationalityDocumento4 páginasJ.S.mill - of NationalityIleanaBrâncoveanuAún no hay calificaciones

- GBV Guidelines AS3 ProtectionDocumento8 páginasGBV Guidelines AS3 ProtectionnailaweAún no hay calificaciones

- Guide For Inclusive Support of All Students - Final3Documento11 páginasGuide For Inclusive Support of All Students - Final3Anthony TalcottAún no hay calificaciones

- Factors Influencing Business EthicsDocumento16 páginasFactors Influencing Business EthicsAparna Devi67% (3)

- The Dual Nature of ManDocumento4 páginasThe Dual Nature of ManJens DeriemaekerAún no hay calificaciones

- Chapter 1Documento4 páginasChapter 1Queen EroyAún no hay calificaciones

- InvictusDocumento6 páginasInvictusXyAún no hay calificaciones

- Black Rights Gay RightsDocumento51 páginasBlack Rights Gay RightsBlythe TomAún no hay calificaciones

- Hybels9 Ch3 PDFDocumento26 páginasHybels9 Ch3 PDFSteffiAún no hay calificaciones

- Leo Rosen, Utility Co-Workers Association and Morgan Sweeney v. Public Service Electric and Gas Company, 409 F.2d 775, 3rd Cir. (1969)Documento15 páginasLeo Rosen, Utility Co-Workers Association and Morgan Sweeney v. Public Service Electric and Gas Company, 409 F.2d 775, 3rd Cir. (1969)Scribd Government DocsAún no hay calificaciones

- Racism in Brazil Jessica EvansDocumento10 páginasRacism in Brazil Jessica EvansMarcela RodriguesAún no hay calificaciones

- Safeguarding PolicyDocumento14 páginasSafeguarding PolicyChrist's SchoolAún no hay calificaciones

- Elie Wiesel Nobel SpeechDocumento6 páginasElie Wiesel Nobel Speechapi-294659520Aún no hay calificaciones

- Davila v. Qwest Corporation, 10th Cir. (2004)Documento10 páginasDavila v. Qwest Corporation, 10th Cir. (2004)Scribd Government DocsAún no hay calificaciones

- Perception About General Awarness of Mental Illness: Group A2Documento23 páginasPerception About General Awarness of Mental Illness: Group A2Dilawar JanAún no hay calificaciones

- Loving v. Virginia, 388 U.S. 1 (1967)Documento9 páginasLoving v. Virginia, 388 U.S. 1 (1967)Scribd Government DocsAún no hay calificaciones

- Group 4:: Responsibility AS ProfessionalsDocumento20 páginasGroup 4:: Responsibility AS ProfessionalsMarchRodriguezAún no hay calificaciones