Documentos de Académico

Documentos de Profesional

Documentos de Cultura

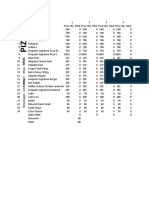

Return on Capital Employed Comparison for Two Divisions

Cargado por

Waqas Siddique SammaTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Return on Capital Employed Comparison for Two Divisions

Cargado por

Waqas Siddique SammaCopyright:

Formatos disponibles

1 Donny Co (Jun 09) The directors of Donny Co are reviewing the performance of two of its divisions.

The following information is available for the year ending 31 March 2009. South division North division $ 000 $ 000 Sales 50,000 3,200 Operating profit 700 840 Capital employed 3,500 4,000 South division is a food retailer that sells low priced food from a number of stores that are rented on short-term contracts. North division sells luxury motor vehicles, which it manufactures in a fully automated production plant. Required: (a) Calculate the following performance measures for the two divisions: (i) Return on capital employed; (2 marks) (ii) Return on sales; (2 marks) (iii) Asset turnover (based upon capital employed); (3 marks) (iv) Residual income (using an imputed interest charge of 12% per annum). (3 marks) (b) Suggest ONE reason for the differences between the two divisions in each of the following ratios: (i) Return on sales; (ii) Asset turnover. (4 marks) (c) Explain THREE benefits of using non-financial performance measures when measuring the performance of an organisation. (6 marks) (20 marks) 2 Vin Co (Dec 09) Vin Co operates a public bus service in a large city. Recently its bus service has been criticised for its poor level of efficiency. The managers of Vin Co have decided to undertake a benchmarking exercise to assess the efficiency of the bus service and have collected the following information. Bus Operators Industry average statistics for the year ended 31 December 2008 Return on capital employed 12% Return on sales 8% Asset turnover 15 times Average maximum capacity per bus 55 seats Average bus occupancy (% of maximum capacity) 70% of capacity Average bus km travelled per litre of fuel 525 km/litre Average fuel consumption per passenger kilometre* 0005 litres per passenger km Average number of fatalities per million passenger kilometres* 0035 fatalities per million passenger kilometres *A passenger kilometre equals one kilometre travelled by one passenger. The management accountant of Vin Co has collected the following information for the year ending 31 December 2008. Vin Co operating data for the year ended 31 December 2008

Capital employed $4,000,000 Operating profit $600,000 Sales revenue $3,600,000 Number of buses in operation 40 buses Total number of passenger seats available 1,920 seats Total number of passenger kilometres travelled 39,000,000 passenger kilometres Total bus kilometres travelled 3,250,000 kilometres Fatalities 1 Total fuel consumed 764,705 litres Required: (a) Calculate the following ratios and other statistics for Vin Co for the year ended 31 December 2008. (i) Return on capital employed; (ii) Return on sales; (iii) Asset turnover; (iv) Average maximum capacity per bus; (v) Average bus occupancy as a percentage of maximum capacity; (vi) Average bus km travelled per litre of fuel; (vii) Average fuel consumption in litres per passenger kilometre; (viii) Average number of fatalities per million passenger kilometres. (10 marks) (b) Give two reasons apparent from your analysis why Vin Cos fuel consumption per passenger kilometre is higher than that of the industry average. (2 marks) (c) Benchmarking involves the establishment, through data gathering, of targets and comparators from which an organisations relative level of performance can be measured. By the adoption of the best practices identified, performance may be improved. Explain the following types of benchmarking (i) Internal benchmarking; (ii) Functional benchmarking; (iii) Competitive benchmarking; (iv) Strategic benchmarking. (8 marks) (20 marks) 3 Brainerd (Jun 08) Brainerd is a passenger airline. In 2007 it was criticised in the press for the poor quality of the service that it offered to passengers, particularly with regard to flight punctuality and the courtesy of its staff. In 2008 it spent $220m on new aeroplanes and $10m on staff training in an attempt to improve its performance. Summarised financial statements are given below. Summarised income statement for the year ended 31 May 2007 2008 $m $m Revenue 1,800 1,850 Operating profit 180 175 Financing costs (32) (47) Tax expense (44) (35)

Profit for the period

104 Summarised statement of financial position as at 31 May $m Non-current assets (net) Current assets Inventory Receivables Cash 2007 $m 1,200 53 22 64 1,339 585 650 20

93 2008 $m 1,400 90 25 32 1,547 615 650 160

$m

Equity and reserves Long-term liabilities 8% Debenture 2009 Bank loan Current liabilities Total equity and liabilities

670 84 1,339

810 122 1,547

Required: (a) Calculate the following ratios for Brainerd for the years ending 31 May 2007 and 2008, clearly defining the ratio you are calculating and showing the figures used in your calculations: (i) Return on capital employed based upon closing capital employed; (ii) Operating margin (return on sales); (iii) Asset turnover; (iv) Current ratio; and (v) Capital gearing ratio. (10 marks) (b) Explain the meaning of ANY THREE of the above ratios and suggest one possible cause, apparent from the question, of changes in performances revealed by each of your chosen ratios. (6 marks) (c) Give TWO reasons why it would be important for Brainerd to use non-financial measures in assessing its performance. (4 marks) (20 marks) 4 Rothstein Co (Jun 11) Rothstein Co uses ratio analysis and industry average data to monitor its performance. The following data relates to its performance over the last two years. Company and industry average data for the year ended 31 March 2010. Ratio Rothstein Co Industry average Return on capital employed 35% 20% Return on sales 15% 15% Asset turnover 233 133 Current ratio 12 21 Capital gearing (debt to equity) 115% 50% Interest cover 14 8

Financial results for Rothstein Co for the year ended 31 March 2011. Income statement for the year ended 31 March 2011 Sales revenue Operating costs Operating profit Finance costs Tax expense Profit for the year Statement of financial position as at 31 March 2011 $ 000 Non-current assets Current assets Inventories Trade receivables Cash $ 000 4,000 $ 000 12,000 10,250 1,750 150 120 1,480

1,120 980 810 2,910 6,910

Total assets Equity and liabilities Equity Share capital Retained earnings

1,000 987 1,987 2,500 1,123 1,300 2,423 6,910

Non-current liabilities Current liabilities Trade payables Tax payable

Total equity and liabilities Required: (a) Explain briefly the meaning of the following accounting ratios: (i) Return on capital employed; (ii) Return on sales; (iii) Asset turnover; (iv) Current ratio; (v) Capital gearing; (vi) Interest cover.

(6 marks) (b) Comment upon the performance of Rothstein Co relative to the industry average for the year ended 31 March 2010 under the following headings:

(i) (ii) (iii)

Profitability; Liquidity; Gearing. (7 marks)

(c) Calculate the following ratios for Rothstein Co for the year ended 31 March 2011: (i) Return on capital employed; (ii) Return on sales; (iii) Asset turnover; (iv) Current ratio; (v) Acid test; (vi) Capital gearing; (vii) Interest cover. (7 marks) (20 marks) 5 The Carbone Co (Dec 10) The Carbone Co is a courier business. It delivers parcels in the Republic of Zedland. Parcels are collected by its fleet of vehicles and are sorted at one of its five depots before delivery to customers. Its delivery network covers all the major cities in Zedland, but it does not deliver to the 40% of the population who live in rural areas. The vast majority of its business involves the bulk collection and delivery of packages between large businesses located in Zedlands major cities. Carbone Co is a listed company and its objectives are to earn a competitive rate of return for its shareholders and to provide a first class service for its customers. Carbone Cos major competitor is the state owned Zedland postal service (ZPS). ZPS is a non profit -seeking organisation responsible for universal mail and parcel collection and delivery in Zedland. The Zedland government requires ZPS to provide a low cost collection and delivery service for all of Zedlands population and for its revenues to cover its costs which include an imputed interest charge on capital employed of 4% per annum. ZPS collects and delivers letters and parcels through its network of 14,000 offices located in every city, town and village in Zedland. Deliveries are made at least once every day to every part of Zedland at a government fixed price of $025 per letter and $400 per kg for a parcel. These prices have not increased in the last five years.The government refuses to allow ZPS to close any of its network of offices because they are also used to distribute government pension payments. Both organisations have recently published their results for the most recent year. Details are given below: Carbone Co ZPS Sales revenue $400 million $123,000 million Operating profit $80 million $38 million Capital employed $300 million $1,000 million Investors required rate of return 14% pa 4% pa Number of parcels delivered 10,000 million parcels 20,000 million parcels Total weight of parcels delivered in the year 80,000 million kg 27,000 million kg Number of letters delivered 0 60,000 million letters Total item kilometres (note 1) 376,000 million item km 9,000,000 million item km Average number of parcels undelivered at the end of each day 50 million parcels 110 million parcels Notes 1. An item kilometre is a single kilometre travelled by either a letter or a parcel. 2. Parcel deliveries for both businesses are spread evenly over a 365 day year. On seeing these results the leader of the Zedland government claimed that they showed the gross inefficiency of ZPSs management.

Required: (a) Calculate the following ratios and statistics for both Carbone Co and ZPS (i) Residual income; (3 marks) (ii) (iii) (iv) (v) Return on sales; (2 marks) Average distance travelled per item; (2 marks) Average weight per parcel; (2 marks) Average time (in days) taken to deliver a parcel. (3 marks) (b) Briefly explain three differences between Carbone Co and ZPS that make it difficult to compare their relative performances. (6 marks) (c) Explain, in general terms, the difference that may exist between assessing the performance of a manager and assessing the performance of the organisation the manager works for. (2 marks) (20 marks) 6 Kint Co (Dec 08) Kint Co manufactures shoes. The shoes are sold to large retailers who insist upon the highest standard of quality. The shoes have to be manufactured to precise dimensions and to be dyed to an exact colour shade. Below is a list of expenses incurred in the last month: $ Notes Customer complaints department 3,456 $2,000 fixed costs per month Finished goods inspection 3,588 Shade matching 1,479 required for all batches Quality control system development 5,110 Operative training 1,500 Rework 8,850 direct costs only Machine maintenance 850 routine servicing Goods inwards inspection 600 Compensation payments to customers for defective goods 4,600 Pre-despatch failure analysis 3,877 variable cost The production director attended a course on total quality management (TQM) recently and was told that quality initiatives could save money. Required: (a) Define the following costs of quality (i) Prevention costs; (ii) Appraisal costs; (iii) Internal failure costs; (iv) External failure costs. (8 marks) (b) Categorise the expenses from the month into the four categories of quality cost given in (a). (5 marks) (c) Failure analysis has revealed that 70% of defects can be traced to a machine in the moulding department. The production director has found a new type of machine that is 100% reliable and will save 70% of

external and internal failure costs. The machine would cost $60,000 more per year to hire than the existing machine. Running costs would remain unchanged. Additional staff costs would be $1,000 per month. Required: Calculate and recommend whether Kint Co should hire the new machine. (7 marks) (20 marks) 7 Jun 07 You are an accounting technician in the administration department of a small manufacturing company. Your manager, who is not an accountant, is about to attend a meeting and is unsure of the meaning of several items that appear on the agenda. Required: Produce notes on any TWO of the following three items to help your manager understand their meaning: (i) The balanced scorecard and its perspectives on performance; (ii) Total quality management (TQM) and the costs of quality; (iii) Benchmarking (including internal, competitive, functional and strategic benchmarking). Note: each of the areas you select will be worth 10 marks. (20 marks) 8 Nicholson (Dec 07) Nicholson sells mobile telephones. It supplies its customers with telephone handsets and wireless telephone connections. Customers pay an annual fee plus a monthly charge based on calls made. The company has recently employed a consultant to install a balanced scorecard system of performance measurement and to benchmark the results against those of Nicholsons competitors. Unfortunately the consultant was called away before the work was finished. You have been asked to complete the work. The following data is available: Nicholson Operating data for the year ended 30 November 2007 Sales attributable to new products $8 million Average capital employed $192 million Profit before interest and tax $48 million Average number of customers 1,960,000 Number of telephones returned for repair 10,000 Number of bill queries 12,000 Number of customer complaints 21,600 Number of customers lost 117,600 Average number of bill queries unresolved at the end of each day 118 Average number of telephones unrepaired at the end of each day 804 Required: (a) Calculate the following ratios and other statistics for Nicholson for the year ended 30 November 2007: (i) Return on capital employed; (ii) Return on sales (net profit percentage); (iii) Asset turnover; (iv) Annual number of complaints per thousand customers; (v) Percentage of customers lost per annum; (vi) Average time to resolve billing queries; (vii) Average wait for a telephone repair; (viii) Percentage of sales attributable to new products. (12 marks) (b) The following information is for the mobile phone industry for the year ended 30 November 2007.

Industry average statistics Mobile Telephones Annual number of complaints per 1,000 customers Percentage of customers lost per annum Average time to resolve billing queries Average wait for a telephone repair Percentage of sales attributable to new products Return on capital employed Return on sales (net profit percentage) Asset turnover

5 3% 14 days 2 days 20% 15% 5% 3 times

Required: Using the industry average information and your answer to part (a), discuss the performance of Nicholson in the year ending 30 November 2007 under the four balanced scorecard headings of: (i) financial success; (ii) customer satisfaction; (iii) process efficiency; and (iv) organisational learning and growth. Note: state any assumptions that you make. (8 marks) (20 marks) 9 Lewisville (Jun 06) Lewisville is a town with a population of 100,000 people. The town council of Lewisville operates a bus service which links all parts of the town with the town centre. The service is non profit seeking and its mission statement is to provide efficient, reliable and affordable public transport to all the citi zens of Lewisville. Attempting to achieve this mission often involves operating services that would be considered uneconomic by private sector bus companies, due either to the small number of passengers travelling on some routes or the low fares charged. The majority of the town council members are happy with this situation as they wish to reduce traffic congestion and air pollution on Lewisvilles roads by encouraging people to travel by bus rather than by car. However, one member of the council has recently criticised the performance of the Lewisville bus service as compared to those operated by private sector bus companies in other towns. She has produced the following information: Lewisville Bus Service Summarised Income and Expenditure Account Year ending 31 March 2006 000 000 Passenger fares 1,200 Staff wages 600 Fuel 300 Depreciation 280 1,180 Surplus 20 Summarised Balance Sheet as at 31 March 2005. 000 000 Fixed assets (net) 2,000 Current assets Stock 240

Cash

Less creditors due within one year Net current assets Total assets less liabilities Ordinary share capital (1 shares) Reserves

30 270 60 210 2,210 2,000 210 2,210

Operating Statistics for the year ended 31 March 2006 Total passengers carried 2,400,000 passengers Total passenger miles travelled 4,320,000 passenger miles Private sector bus companies Industry average ratios Year ended 31 March 2006. Return on capital employed 10% Return on sales (net margin) 30% Asset turnover 033 times Average cost per passenger mile 374p Required: (a) Calculate the following ratios for the Lewisville bus service (i) Return on capital employed (based upon opening investment); (ii) Return on sales (net margin); (iii) Asset turnover; (iv) Average cost per passenger mile. (4 marks) (b) Explain the meaning of each ratio you have calculated. Discuss the performance of the Lewisville bus service using the four ratios. (10 marks) (c) Another council member suggests that the performance of the bus service should be assessed on the basis of economy, effectiveness and efficiency. Required: Explain the meaning of the following terms in the context of performance measurement and suggest a measure of each one appropriate to a bus service. (i) Economy; (ii) Effectiveness; (iii) Efficiency. (6 marks) (20 marks) 10 Neeskens division (Dec 06) A large multinational company uses return on investment (ROI) to measure the performance of its divisions. Divisional managers have control over divisional revenues, and are given limited control over costs. Cash, land and buildings are managed by group head office. Divisional managers have control over all other divisional assets and

liabilities. Head office has a required rate of return of 15% for all divisions. Details of the performance of the Neeskens Division are given below. Neeskens division profit and loss account Year ended 30 September 2006 000 Sales 7,500 Cash operating costs (3,600) Depreciation: land and buildings (40) Depreciation: plant and machinery (300) Apportioned head office cost (1,500) Divisional profit 2,060 Neeskens division balance sheet as at 30 September 2005 (extract) 000 Fixed assets (net book value) Land and buildings Plant and machinery

000 2,000 13,200 15,200

Current assets Stock Debtors Cash

1,200 1,400 500 3,100 (1,400) 1,700 16,900

Less creditors due within one year Trade creditors Net current assets Net Assets

Required: (a) Calculate both the controllable and traceable return on investment (based upon opening investment) for the Neeskens division for the year ended 30 September 2006. (6 marks) (b) Calculate traceable residual income (based upon opening investment) for Neeskens division for the year ended 30 September 2006 and briefly explain what it means. (4 marks) (c) Explain the difference between controllable and traceable return on investment. Why is the difference important? (6 marks) (d) Give two advantages of residual income as a measure of divisional performance. (4 marks) (20 marks)

También podría gustarte

- Financial Management Tutorial QuestionsDocumento8 páginasFinancial Management Tutorial QuestionsStephen Olieka100% (2)

- Annuity Tables p6Documento17 páginasAnnuity Tables p6williammasvinuAún no hay calificaciones

- NPV Practice CompleteDocumento5 páginasNPV Practice CompleteShakeel AslamAún no hay calificaciones

- D15 Hybrid F5 QPDocumento7 páginasD15 Hybrid F5 QPadad9988Aún no hay calificaciones

- F9FM Mock1 Qs - d08Documento10 páginasF9FM Mock1 Qs - d08ErclanAún no hay calificaciones

- Executive MBA Power Accounting AssignmentDocumento5 páginasExecutive MBA Power Accounting AssignmentSai Phanindra Kumar MuddamAún no hay calificaciones

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Documento10 páginas3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliAún no hay calificaciones

- Benchmarking Bus Service EfficiencyDocumento5 páginasBenchmarking Bus Service EfficiencyMevika MerchantAún no hay calificaciones

- Financial Management and Control: Time Allowed 3 HoursDocumento9 páginasFinancial Management and Control: Time Allowed 3 HoursnsarahnAún no hay calificaciones

- Extra QDocumento8 páginasExtra QdubzayAún no hay calificaciones

- Financial Management: Thursday 9 June 2011Documento9 páginasFinancial Management: Thursday 9 June 2011catcat1122Aún no hay calificaciones

- RDocumento17 páginasRSarmad Sadiq E4 42Aún no hay calificaciones

- ACCA Paper F5 Mock Exam June 2011Documento6 páginasACCA Paper F5 Mock Exam June 2011Tasin Yeva LeoAún no hay calificaciones

- CH 4Documento20 páginasCH 4Waheed Zafar100% (1)

- Lcci 3012Documento21 páginasLcci 3012alee200Aún no hay calificaciones

- 2.4 Mock Exam Jun 06 Question-AJDocumento15 páginas2.4 Mock Exam Jun 06 Question-AJsaeed_r2000422Aún no hay calificaciones

- Students' Companion: The Chartered Institute of Taxation of NigeriaDocumento24 páginasStudents' Companion: The Chartered Institute of Taxation of Nigeriadejioyinloye2004Aún no hay calificaciones

- Du PontDocumento8 páginasDu PontTên Hay ThếAún no hay calificaciones

- NCFM Financial Modeling Exam Practice QuestionsDocumento10 páginasNCFM Financial Modeling Exam Practice Questionsmkg75080% (5)

- ABE Dip 1 - Financial Accounting JUNE 2005Documento19 páginasABE Dip 1 - Financial Accounting JUNE 2005spinster40% (1)

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDocumento6 páginasFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukAún no hay calificaciones

- Absorption and Marginal CostingDocumento3 páginasAbsorption and Marginal CostingZaira AneesAún no hay calificaciones

- Financial Management NPV AnalysisDocumento8 páginasFinancial Management NPV AnalysisAbid SiddiquiAún no hay calificaciones

- Accounting-2009 Resit ExamDocumento18 páginasAccounting-2009 Resit ExammasterURAún no hay calificaciones

- 2-4 2005 Jun QDocumento10 páginas2-4 2005 Jun QAjay TakiarAún no hay calificaciones

- Accounting concepts and principles in financial statementsDocumento6 páginasAccounting concepts and principles in financial statementskartikbhaiAún no hay calificaciones

- DeVry ACCT 212 Final Exam 100% Correct AnswerDocumento4 páginasDeVry ACCT 212 Final Exam 100% Correct AnswerJulia Richardson100% (1)

- Chap 4Documento7 páginasChap 4hcw49539Aún no hay calificaciones

- Lancaster University: January 2014 ExaminationsDocumento6 páginasLancaster University: January 2014 Examinationswhaza7890% (1)

- P1 - Financial Accounting April 07Documento23 páginasP1 - Financial Accounting April 07IrfanAún no hay calificaciones

- 2010 LCCI Bookkeeping and Accounts Series 3Documento8 páginas2010 LCCI Bookkeeping and Accounts Series 3Fung Hui Ying75% (4)

- Taxation (United Kingdom) : Tuesday 12 June 2012Documento12 páginasTaxation (United Kingdom) : Tuesday 12 June 2012Iftekhar IfteAún no hay calificaciones

- Q and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011Documento71 páginasQ and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011chisomo_phiri72290% (2)

- Trial Q - V & PMDocumento4 páginasTrial Q - V & PMANISAHMAún no hay calificaciones

- December 2002 ACCA Paper 2.5 QuestionsDocumento11 páginasDecember 2002 ACCA Paper 2.5 QuestionsUlanda2Aún no hay calificaciones

- Questions & Solutions ACCTDocumento246 páginasQuestions & Solutions ACCTMel Lissa33% (3)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Documento11 páginas3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- Management Control SystemDocumento11 páginasManagement Control SystemomkarsawantAún no hay calificaciones

- Pilot Paper F7Documento6 páginasPilot Paper F7Dorian CaruanaAún no hay calificaciones

- Exam2505 2012Documento8 páginasExam2505 2012Gemeda GirmaAún no hay calificaciones

- PSA - Financial Accounting (Question Bank)Documento276 páginasPSA - Financial Accounting (Question Bank)Anowar Al Farabi100% (3)

- AaaaDocumento5 páginasAaaaniranjanAún no hay calificaciones

- Copfin 1B August Block 2018Documento4 páginasCopfin 1B August Block 2018tawandaAún no hay calificaciones

- f9 Paper 2012Documento8 páginasf9 Paper 2012Shuja UmerAún no hay calificaciones

- 2-4 2003 Jun QDocumento9 páginas2-4 2003 Jun QAjay TakiarAún no hay calificaciones

- Sources of FundsDocumento6 páginasSources of FundsAl ShahriarAún no hay calificaciones

- AC1025 2008-Principles of Accounting Main EQP and Commentaries AC1025 2008-Principles of Accounting Main EQP and CommentariesDocumento59 páginasAC1025 2008-Principles of Accounting Main EQP and Commentaries AC1025 2008-Principles of Accounting Main EQP and Commentaries전민건Aún no hay calificaciones

- Exam Pattern Questions Marks Total SyllabusDocumento55 páginasExam Pattern Questions Marks Total Syllabusrahulnationalite83% (6)

- ACCA F3 Financial Accounting INT Solved Past Papers 0107Documento283 páginasACCA F3 Financial Accounting INT Solved Past Papers 0107Hasan Ali BokhariAún no hay calificaciones

- Company Accounts, Cost and Management CostsDocumento8 páginasCompany Accounts, Cost and Management CostsMohit BhatnagarAún no hay calificaciones

- ilovepdf_mergedDocumento21 páginasilovepdf_mergedsakschamcAún no hay calificaciones

- Model 1Documento13 páginasModel 1Binara KumarasingheAún no hay calificaciones

- Cost Accounting 2008wDocumento7 páginasCost Accounting 2008wMustaqim QureshiAún no hay calificaciones

- Van Conversion Service Revenues World Summary: Market Values & Financials by CountryDe EverandVan Conversion Service Revenues World Summary: Market Values & Financials by CountryAún no hay calificaciones

- Outboard Motorboats World Summary: Market Sector Values & Financials by CountryDe EverandOutboard Motorboats World Summary: Market Sector Values & Financials by CountryAún no hay calificaciones

- Marine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryDe EverandMarine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryAún no hay calificaciones

- General Automotive Repair Revenues World Summary: Market Values & Financials by CountryDe EverandGeneral Automotive Repair Revenues World Summary: Market Values & Financials by CountryAún no hay calificaciones

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryDe EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryAún no hay calificaciones

- Mercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryDe EverandMercantile Reporting Agency Revenues World Summary: Market Values & Financials by CountryAún no hay calificaciones

- Motor Vehicle Supplies & Parts Warehouse Distributor Revenues World Summary: Market Values & Financials by CountryDe EverandMotor Vehicle Supplies & Parts Warehouse Distributor Revenues World Summary: Market Values & Financials by CountryAún no hay calificaciones

- Day of July 2020 by and Between: - : Partnership DeedDocumento3 páginasDay of July 2020 by and Between: - : Partnership DeedWaqas Siddique SammaAún no hay calificaciones

- Time Value of Money and Capital Budgeting Techniques: By: Waqas Siddique SammaDocumento84 páginasTime Value of Money and Capital Budgeting Techniques: By: Waqas Siddique SammaWaqas Siddique SammaAún no hay calificaciones

- Investment Appraisal MethodsDocumento15 páginasInvestment Appraisal MethodsFaruk Hossain100% (1)

- GadgetDocumento4 páginasGadgetWaqas Siddique Samma100% (2)

- Process Map Maison de Bel Private LimitedDocumento3 páginasProcess Map Maison de Bel Private LimitedWaqas Siddique SammaAún no hay calificaciones

- IFSR Guide by PWC PDFDocumento67 páginasIFSR Guide by PWC PDFFazlihaq DurraniAún no hay calificaciones

- Fast Food Restaurant Daily Sales RecordDocumento7 páginasFast Food Restaurant Daily Sales RecordWaqas Siddique SammaAún no hay calificaciones

- Begin The Excel Tutorial (Final) DoneDocumento24 páginasBegin The Excel Tutorial (Final) DoneWaqas Siddique SammaAún no hay calificaciones

- Memorize WordsDocumento494 páginasMemorize WordsWaqas Siddique SammaAún no hay calificaciones

- Not-For-Profit: TechnicalDocumento3 páginasNot-For-Profit: TechnicalMuntazir HussainAún no hay calificaciones

- Allama Iqbal A Critic of Capitalism & Globalization (English)Documento5 páginasAllama Iqbal A Critic of Capitalism & Globalization (English)Saad JamalAún no hay calificaciones

- 19Documento4 páginas19Waqas Siddique SammaAún no hay calificaciones

- OBU Project Pass NotesDocumento2 páginasOBU Project Pass NotesWaqas Siddique SammaAún no hay calificaciones

- Allama Iqbal A Critic of Capitalism & Globalization (English)Documento5 páginasAllama Iqbal A Critic of Capitalism & Globalization (English)Saad JamalAún no hay calificaciones

- f5 2011conf PresDocumento21 páginasf5 2011conf PresWaqas Siddique SammaAún no hay calificaciones

- Analysis of Financial Statements of Fauji FertilizersDocumento17 páginasAnalysis of Financial Statements of Fauji FertilizersWaqas Siddique SammaAún no hay calificaciones

- Financial Ratio AnalysisDocumento17 páginasFinancial Ratio AnalysisG117Aún no hay calificaciones

- Network Marketing - Money and Reward BrochureDocumento24 páginasNetwork Marketing - Money and Reward BrochureMunkhbold ShagdarAún no hay calificaciones

- CounterclaimDocumento53 páginasCounterclaimTorrentFreak_Aún no hay calificaciones

- Pilot Registration Process OverviewDocumento48 páginasPilot Registration Process OverviewMohit DasAún no hay calificaciones

- Introduction To The Appian PlatformDocumento13 páginasIntroduction To The Appian PlatformbolillapalidaAún no hay calificaciones

- Aqua Golden Mississippi Tbk Company Report and Share Price AnalysisDocumento3 páginasAqua Golden Mississippi Tbk Company Report and Share Price AnalysisJandri Zhen TomasoaAún no hay calificaciones

- European Gunnery's Impact on Artillery in 16th Century IndiaDocumento9 páginasEuropean Gunnery's Impact on Artillery in 16th Century Indiaharry3196Aún no hay calificaciones

- The Art of War: Chapter Overview - Give A Brief Summary of The ChapterDocumento3 páginasThe Art of War: Chapter Overview - Give A Brief Summary of The ChapterBienne JaldoAún no hay calificaciones

- Intermediate Algebra For College Students 7th Edition Blitzer Test BankDocumento19 páginasIntermediate Algebra For College Students 7th Edition Blitzer Test Bankdireful.trunnionmnwf5100% (30)

- Mobile phone controlled car locking systemDocumento13 páginasMobile phone controlled car locking systemKevin Adrian ZorillaAún no hay calificaciones

- Pakistani Companies and Their CSR ActivitiesDocumento15 páginasPakistani Companies and Their CSR ActivitiesTayyaba Ehtisham100% (1)

- Ancient Hindu Mythology Deadliest WeaponsDocumento3 páginasAncient Hindu Mythology Deadliest WeaponsManoj KumarAún no hay calificaciones

- Quiz 2Documento2 páginasQuiz 2claire juarezAún no hay calificaciones

- Investment Decision RulesDocumento113 páginasInvestment Decision RulesHuy PanhaAún no hay calificaciones

- Statutory Audit Fee Estimate for CNC Firm FY20-21Documento1 páginaStatutory Audit Fee Estimate for CNC Firm FY20-21Saad AkhtarAún no hay calificaciones

- Neypes VS. Ca, GR 141524 (2005)Documento8 páginasNeypes VS. Ca, GR 141524 (2005)Maita Jullane DaanAún no hay calificaciones

- Dilg MC 2013-61Documento14 páginasDilg MC 2013-61florianjuniorAún no hay calificaciones

- 5 City Sheriff of Iligan City v. Fortunado (CANE)Documento2 páginas5 City Sheriff of Iligan City v. Fortunado (CANE)Jerry CaneAún no hay calificaciones

- MP Newsletter 6Documento24 páginasMP Newsletter 6acmcAún no hay calificaciones

- Pradeep Kumar SinghDocumento9 páginasPradeep Kumar SinghHarsh TiwariAún no hay calificaciones

- IJBMT Oct-2011Documento444 páginasIJBMT Oct-2011Dr. Engr. Md Mamunur RashidAún no hay calificaciones

- Galvanize Action donation instructionsDocumento1 páginaGalvanize Action donation instructionsRasaq LakajeAún no hay calificaciones

- The Indian Navy - Inet (Officers)Documento3 páginasThe Indian Navy - Inet (Officers)ANKIT KUMARAún no hay calificaciones

- Employee Separation Types and ReasonsDocumento39 páginasEmployee Separation Types and ReasonsHarsh GargAún no hay calificaciones

- Sunway Berhad (F) Part 2 (Page 97-189)Documento93 páginasSunway Berhad (F) Part 2 (Page 97-189)qeylazatiey93_598514100% (1)

- Plan Green Spaces Exam GuideDocumento8 páginasPlan Green Spaces Exam GuideJully ReyesAún no hay calificaciones

- USOnline PayslipDocumento2 páginasUSOnline PayslipTami SariAún no hay calificaciones

- ePass for Essential Travel Between Andhra Pradesh and OdishaDocumento1 páginaePass for Essential Travel Between Andhra Pradesh and OdishaganeshAún no hay calificaciones

- Chapter 3-Hedging Strategies Using Futures-29.01.2014Documento26 páginasChapter 3-Hedging Strategies Using Futures-29.01.2014abaig2011Aún no hay calificaciones

- BusLaw Chapter 1Documento4 páginasBusLaw Chapter 1ElleAún no hay calificaciones

- Flowserve Corp Case StudyDocumento3 páginasFlowserve Corp Case Studytexwan_Aún no hay calificaciones