Documentos de Académico

Documentos de Profesional

Documentos de Cultura

The Fuss About Fed Ending Stimulus

The Fuss About Fed Ending Stimulus

Cargado por

Rama V. RamachandranDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

The Fuss About Fed Ending Stimulus

The Fuss About Fed Ending Stimulus

Cargado por

Rama V. RamachandranCopyright:

Formatos disponibles

The fuss about Federal Reserve cutting back the stimulus.

The financial markets signal, by their gyrations whenever Federal Reserve suggests tapering of asset purchases, that the policy change will have a very adverse effect on the corporate sector. The Federal Reserve adopted quantitative easing to pull the economy from the eminent danger of sliding back into recession. The standard procedure to promote economic activity is for the Bank to increase money supply by purchasing of securities in the open market or by reducing the interest rate it charges on loans to banks. 1. Though the Federal Reserve loans are for short term, in general, long-term interest rates like mortgage rates move with it. Lower mortgage rates will increase demand for real estate and lower rates for commercial loans will induce firms to expand their operations. The additional construction and investment increase employment and the income they generate counter the threat of recession. In 2008 Fed realized that it had lost the ability to affect the economy through interest rate. Feds target rate was close to zero the real estate market in crisis. During 2006 and 2007, percentage of mortgage loans were given to buyers with low credit scores increased delinquency rates leading to what is known as subprime crisis.2. The delinquencies threatened solvency of interdependent financial institutions of the economy and the Federal Reserve decided to relieve the stress by purchasing on a large scale securities from government sponsored agencies Fannie Mae and Freddie Mac.3. The two institutions purchase mortgages from lending institutions and securitize them for resale in secondary markets. The purchase securities from the two allow them to buy more mortgages from lending institutions and mortgage banks in turn can in turn give out more mortgages. The availability of additional funds will also lower mortgage rates. . In spite of the unconventional stimulus offered by the Federal Reserve, the economy began to slow down in fall of 2010 and there was fear of it even sliding into double dip. After much discussion, the Federal Reserve announced on November 4, 2010 that it will purchase $600 billion of securities at a rate of $75 billion a month. The Fed had followed it with other measures to enhance liquidity in the economy.4. In 2013, the unemployment began inching down and the economy was showing steady growth even if at a lackluster rate. In July 2013, Chairman Bernanke announced that the bond-buying programme could be pared back at a "moderate" pace later this year if unemployment continues to fall and inflation stays low.5. It will be irresponsible for the Federal Reserve not to do so as it will lead to inflation. Yet the stock market is reacting as if it will be a disaster for the corporate economy. Share of a company is a right to its future profits and should ideally fluctuate with it. The reduction of the stimulus can affect a firm in many ways. The interest rate which was kept low through the actions of the Federal Reserve will now begin to increase. This will add to the cost of

Operating income Interest net Income before taxes Provision for taxes Net Income

Millions of dollars 12,200 600 11,600 4,000 7,600

Funds borrowed, the extent of which will depend on how much the firm has financed itself by debt as compared to equity. The table above is structured to roughly reflect the annual report of a major corporation in the technology field. 6. Its interest cost is only 5 percent of its operating income (roughly income from sales of its product less manufacturing costs). Even a 50 percent increase in interest rate will increase it only to $900 million. Assuming operating profits to be the same, it net income will decrease by 4 percent. But if the growth of economy, the reason for ending stimulus, increases the demand for product of the firm and a 2.5 percent increase in the net income will compensate for the interest cost increase. A corporation with a higher debt to equity ratio than the one in the table will find the increase in interest cost to be higher. The increase in interest rate has other effects. It will increase the flow of funds to the country as US citizens bring funds invested abroad home and as foreigners find that investment opportunity better in this country. The depreciation of Indian Rupee is attributed by many commentators to the policies of the Federal Reserve though, given other problems Indian economy have, it is hard to put much weight on that claim.7. The inward flow of funds into US will lead to appreciation of dollar. American goods will become more expensive abroad while foreign goods become less so in US. It will reduce the competitiveness of US industry. In turn that will reduce profits of the firms and employment in the country unless economic growth abroad Europe is showing positive growth - creates additional demand for US goods. The net effect on the economy and on the profitability of the firms depends on the balance of these opposing trends. The Federal Reserve has clearly stated that its policies will be based on the trends in economy. The gyrations in stock market are unwarranted.

Footnotes:

1.

For more details how discount rate affects market rate, see http://www.frbsf.org/education/publications/doctorecon/2002/june/discount-rate-mortgage-interest.

2.

See: http://www.investopedia.com/ask/answers/07/subprime-mortgage.asp ; http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1020396 .

3.

For an explanation of the historic origin of the program, see http://www.commercialappeal.com/news/2013/jul/17/why-the-fed-can-buy-mortgage-backed-securities/ . For a discussion of its effect, see http://www.federalreserve.gov/faqs/what-are-the-federal-reserves-large-scale-assetpurchases.htm .

4.

For a detailed discussion of how QE2 came into being is in Chapter 15 of The Alchemist by Neil Irwin (New York: The Penguin Press, 2013); http://money.cnn.com/2010/11/03/news/economy/fed_decision/index.htm

5.

http://www.theguardian.com/business/2013/jul/17/ben-bernanke-fed-stimulus-programme; also, http://research.stlouisfed.org/econ/bullard/pdf/BullardLouisville15August2013Final.pdf .

6.

Opportunities and choices: understanding our economic decisions http://www.scribd.com/doc/49513234/Opportunities-and-Choices

7.

http://www.ft.com/intl/cms/s/0/6bcd340a-0675-11e3-9bd9-00144feab7de.html#axzz2cM8kQAQH

Rama V. Ramachandran

http://www.visualeconomicanalysis.info/index.html Facebook: Ramanomics

Copyright 2013 Rama V. Ramachandran

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (844)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (540)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (822)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- Author Accounts Update Sheet (Hamid SEO)Documento50 páginasAuthor Accounts Update Sheet (Hamid SEO)Abdullah0% (1)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Astm A860 A860m-18Documento5 páginasAstm A860 A860m-18Zaida Isadora Torres Vera100% (2)

- Muscle Pharm WorkoutDocumento19 páginasMuscle Pharm WorkoutKevin AmitAún no hay calificaciones

- 3rd Annual Innovation Coast Conference Detailed ScheduleDocumento40 páginas3rd Annual Innovation Coast Conference Detailed ScheduleOrganic Nuts100% (1)

- Is India and US Destroying Their Fiscal CredibilityDocumento2 páginasIs India and US Destroying Their Fiscal CredibilityRama V. RamachandranAún no hay calificaciones

- Currency Depreciation Good or Bad?Documento2 páginasCurrency Depreciation Good or Bad?Rama V. RamachandranAún no hay calificaciones

- Immigration Reform:Subtleties.Documento2 páginasImmigration Reform:Subtleties.Rama V. RamachandranAún no hay calificaciones

- Who Is Afraid of Fiscal CliffDocumento2 páginasWho Is Afraid of Fiscal CliffRama V. RamachandranAún no hay calificaciones

- Opportunities and ChoicesDocumento236 páginasOpportunities and ChoicesRama V. RamachandranAún no hay calificaciones

- Broken RecordDocumento1 páginaBroken RecordRama V. RamachandranAún no hay calificaciones

- Wavering MarketsDocumento2 páginasWavering MarketsRama V. RamachandranAún no hay calificaciones

- MAE 4281 Homework #6: Xy X yDocumento3 páginasMAE 4281 Homework #6: Xy X ydadaAún no hay calificaciones

- Sajonas V CADocumento15 páginasSajonas V CAMary LeandaAún no hay calificaciones

- Decolonization in IndiaDocumento30 páginasDecolonization in IndiaBianca PrassosAún no hay calificaciones

- FINAL COACHING PROFESSIONAL EDUCATION Sir PaulDocumento5 páginasFINAL COACHING PROFESSIONAL EDUCATION Sir Paulvanessa doteAún no hay calificaciones

- Let's Begin Reading in English 2-Unit 2 PDFDocumento141 páginasLet's Begin Reading in English 2-Unit 2 PDFKate Leoriz NavidaAún no hay calificaciones

- Approaches To Study Economic GeographyDocumento5 páginasApproaches To Study Economic Geographyjainaastha28_1951858100% (3)

- Peptic Ulcer in Children 1995Documento11 páginasPeptic Ulcer in Children 1995kadekapiklestariAún no hay calificaciones

- Eh TW5825Documento2 páginasEh TW5825Lim Hendra Kurniawan Halim (Hendra)Aún no hay calificaciones

- 2014 - The Episteme Journal of Linguistics and Literature Vol 1 No 1 - 2-The Analysis of Language Style On The Campaign Speech ofDocumento9 páginas2014 - The Episteme Journal of Linguistics and Literature Vol 1 No 1 - 2-The Analysis of Language Style On The Campaign Speech ofwahyuningsi fahrahAún no hay calificaciones

- Practice Test 1,2Documento6 páginasPractice Test 1,2PhamnhunguyetAún no hay calificaciones

- David Brown 1200 Instruction Book TP638-8 1971Documento112 páginasDavid Brown 1200 Instruction Book TP638-8 1971Kris WettonAún no hay calificaciones

- October 13, 2009 - The Adoption of IFRS ForDocumento12 páginasOctober 13, 2009 - The Adoption of IFRS Formjay moredoAún no hay calificaciones

- Jan 13 2018Documento20 páginasJan 13 2018Jenna MWAún no hay calificaciones

- Consonant SoundsDocumento20 páginasConsonant SoundsRoselyn Lictawa Dela CruzAún no hay calificaciones

- Llanbadarn Show 2018 ScheduleDocumento40 páginasLlanbadarn Show 2018 ScheduleEmma HowellsAún no hay calificaciones

- Ebook Cornerstones of Financial Accounting 2Nd Edition Rich Test Bank Full Chapter PDFDocumento67 páginasEbook Cornerstones of Financial Accounting 2Nd Edition Rich Test Bank Full Chapter PDFfreyahypatias7j100% (8)

- (시험대비) 영어 - 2 - 천재 (정) - Lesson 04 - 1회Documento5 páginas(시험대비) 영어 - 2 - 천재 (정) - Lesson 04 - 1회래런YoutubeAún no hay calificaciones

- Darling of The CrowdDocumento1 páginaDarling of The CrowdRona Liee PelaezAún no hay calificaciones

- NASA-TM-2017-219475 Installation Torque Tables For Noncritical ApplicationsDocumento332 páginasNASA-TM-2017-219475 Installation Torque Tables For Noncritical ApplicationsRobert LauAún no hay calificaciones

- Typical Interview Questions (6-8 Questions) : Visa QuestionnaireDocumento2 páginasTypical Interview Questions (6-8 Questions) : Visa QuestionnaireSupriya CoolAún no hay calificaciones

- PDFDocumento595 páginasPDFKharisma PratamaAún no hay calificaciones

- Stahl PDFDocumento20 páginasStahl PDFLuis LopezAún no hay calificaciones

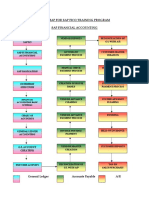

- Roadmap For SAP FICO Training ProgramDocumento4 páginasRoadmap For SAP FICO Training ProgramCorpsalesAún no hay calificaciones

- ConnectorDocumento81 páginasConnectorDe M OoAún no hay calificaciones

- Homework Slang WordDocumento8 páginasHomework Slang Wordafetuieog100% (1)

- Fiber Length: Bgmea University of Fashion & TechnologyDocumento11 páginasFiber Length: Bgmea University of Fashion & TechnologySayed Islam ShakilAún no hay calificaciones