Documentos de Académico

Documentos de Profesional

Documentos de Cultura

2 Registration & de Reg

Cargado por

Imran MemonDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

2 Registration & de Reg

Cargado por

Imran MemonCopyright:

Formatos disponibles

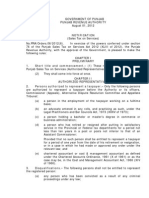

GOVERNMENT OF PUNJAB Punjab Revenue Authority Lahore, dated 2012

NOTIFICATION (Sales Tax on Services) No.PRA/Orders.06/2012 (1). In exercise of the powers conferred under section

76 of the Punjab Sales Tax on Services Act 2012 (XLIII of 2012), the Punjab Revenue Authority, with the approval of the Government, is pleased to make the following rules: CHAPTER I PRELIMINARY 1. Short title and commencement. (1) These rules may be cited as the

Punjab Sales Tax on Services (Registration and De-registration) Rules 2012. (2) They shall come into force at once. CHAPTER II REGISTRATION 2. Requirement of registration. (1) Every person engaged in providing

taxable service or services or pay tax under the Act is required to be registered in the manner specified in these rules. (2) Where a person provides one or more taxable services from one or

more premises and has a centralized billing or invoicing system or centralized accounting system in the Punjab, such person shall be entitled to apply for and take one registration. (3) Where a person is providing more than one taxable services, he may

make a single application mentioning therein all the taxable services provided by him and certificate of registration in such case shall indicate details of all taxable services provided by him. (4) Where a person carrying out business of providing taxable services

simultaneously in more than one province including the Punjab, such person is

required to take a separate registration for the Punjab and pay tax accordingly in respect of the services rendered by him in the Punjab. (5) Every registered person shall invariably and conspicuously mention his

registration number on his invoices, bills, vouchers or other similar documents and on his correspondence with the Authority or any of the officers of the Authority. 3. Application for registration. (1) A person required to be registered under

the Act shall apply electronically or manually to the Authority in the prescribed Form PST01 as appended to these rules and the applicant shall immediately be issued provisional certificate of registration. (2) The Authority may cause further verification or inquiry to ascertain the

accuracy of information or particulars declared in the application for registration for genuineness of the documents, if any, attached therewith and on completion of such verification or inquiry, it may register the applicant and issue a certificate of registration in PST-03 as annexed with these rules with specific number of the applicant in the prescribed form preferably within thirty days of application. (3) In case of rejection, the Authority shall inform the applicant specifying

the reasons for such rejection within thirty days from the date on which complete application is received in the office of the Authority. 4. Sanctity of registration. No person except the person to whom

registration has been issued can use the registration or its number for any lawful purpose and no person holding registration in his name can dispose of his registration in any manner. CHAPTER III DE-REGISTRATION 5. De-registration. Every registered person who ceases to provide taxable

service shall apply to the Authority through an application for the cancellation of the registration on a prescribed Form PST02 as annexed to these rules and the Authority after making such audit or enquiries as may be necessary shall deregister such person from such date as may be specified by the Authority or the date on which the tax, if outstanding, against such person are deposited by him, whichever is later.

6.

Suspension and cancellation of the registration. Where a registered

person commits any tax fraud, deliberate and intentional non-payment or short payment of tax or evasion of tax, his registration may, without prejudice to any other action under the law, be suspended by the Authority, the reasons or basis whereof shall be communicated to him and after necessary inquiry and after giving an opportunity of being heard, his registration may be cancelled. 7. Revival of cancelled registration. (1) Where it is proved that a

registration has been cancelled on account of any incorrect comprehension of facts or wrong understanding of the circumstances leading to cancellation, the Authority may revive the cancelled registration subject to such conditions and with effect from such date as it may deem appropriate to specify. (2) The person whose cancelled registration is revived, shall be entitled to

such benefits and privileges under the Act and rules made thereunder as may be specified by the Authority. 8. Treatment of invoices. During the period of suspension of a registration,

the invoices issued by a person whose registration has been cancelled shall not be eligible for the purpose of tax credit, adjustment or refund or any other similar benefit under the Act. 9. Undischarged tax liability. Suspension or cancellation of a registration

shall not absolve the person of any tax liability which he has not discharged during the period of his registration. CHAPTER IV MISCELLANEOUS 10. Automatic grant of registration. The existing taxpayers already

registered with the Federal Board of Revenue shall not be required to file any new application for registration , they shall be automatically registered for the purpose of the Act and shall receive an intimation from the Authority either through email or SMS or by courier or post, assigning them P as prefix to NTN(P+NTN). 11. Change in particulars of registration. In case there is a change in the

name, address or other particulars as stated in the registration certificate, including the cases covered under rule 10, the registered person shall intimate the proposed

change in the prescribed form (PST-01) to the Authority, which may either approve or reject the request for change preferably within thirty days of the receipt of such intimation. 12. Transfer of registration. (1) The Authority may either subject to

conditions or otherwise order the transfer of the registration of any person from the jurisdiction of one office or officer to the other office or officer of the Authority. (2) In case a registered person intends to shift his business activity from

the jurisdiction of one office or officer to another or he has any other valid reason for such transfer, he shall apply to the Authority for transfer of his registration along with necessary documents, if any, and the Authority shall after necessary verifications, decide such application under intimation to the registered person and concerned officer. (3) The Authority may on its own motion transfer any registration from

one office or officer of the Authority to another under intimation to the concerned registered person. 13. Treatment of a wrong compulsory registration. Where a person has

been compulsorily registered and it is subsequently proved that such person is not liable to registration for the purposes of the Act, the Authority may cancel such registration ab initio and a person whose such registration is cancelled shall not be subjected to any tax liability for the period of his such compulsory registration. 14. Sale of registered business or economic activity. (1) No business or

economic activity involving providing of taxable service or services for which registration has been obtained from the Authority shall be sold or disposed off without prior permission from the Commissioner. (2) The buyer of a registered business or economic activity shall obtain a

new registration certificate or if allowed by the Authority seek changes in the existing registration certificate. (3) While granting permission under sub rule (1), the Commissioner may

specify or impose such conditions or restrictions as he may deem appropriate with a view to safeguard the revenue interests of the Government.

(4)

Every permission granted by the Commissioner under this rule shall be

conveyed to the Authority within fifteen days thereof and shall be entered into the computerized system in such manner as may be specified by the Authority. Explanation: For the purpose of this rule, sale includes merger. 15. No fee for registration or deregistration.Registration and deregistration

under these rules shall be free of any fee or service charge.

Government of Punjab Punjab Revenue Authority Taxpayer Registration Form 1 2

Sheet No.

PST - 01

Rule 3 Token No. No NTN

Change in Particulars Duplicate Certificate

of Apply for

New Registration with PRA as Service Provider PRA Registration, who already have NTN

Authorization Category Basis Status CNIC/PP No. Reg./Inc. No. Name

Punjab Revenue Authority is authorized to obtain my registration / enrollment particulars from FBR and other provincial boards of revenue.

This option is applicable only to already registered taxpayer with FBR, and authorizing PRA Portal to transfer the registration & enrollment particulars from FBR Portal.

4 5 6 7

Comapany As per Law Resident

Individual Voluntary Registration Non-Resident

AOP Compulsory Registration Country of Non Resident

[for Individual only, Non-Residents to write Passport No.]

Expected Annual Turnover Rs.

Gender Birth / Inc. Date

Male

Female

Registry

8 9 10

[for Company & Registered AOP only]

Name of Registered Person (Company, Individual or AOP Name)

Address

Registered Office Address for Company and Mailing / Business Address for Individual & AOP, for all correspondence

Office/Shop/House/Flat/Plot No.

Street/Lane/Plaza/Floor/Village

Block/Mohallah/Sector/Road/Post Office/etc.

Province

District

City/Tehsil

Area/Town

11

Type of Service

Hotel / Club / Caterer Banking / Non-Banking

Advertisement ( Television / Radio / Cable Television ) Shipping Agent Insurance / Re-insurance

Customs Agent / Ship Chandler / Stevedore Courier Stock Broker

Telecommunication Others Service Code

12 13

Principal Service Agent CNIC / NTN Address

Office/Shop/House/Flat/Plot No. Street/Lane/Plaza/Floor/Village Block/Mohallah/Sector/Road/Post Office/etc.

Self

Agent u/s 71 in Capacity as Name

Agent Particulars u/s 71

Province

District

City/Tehsil

Area/Town

14

Phone

Area Code Number

Mobile

Area Code Number

Fax

Area Code Number

15 16 17

E-Mail

Total Director/Shareholder/Partners

(e-Mail address for all correspondence)

Web Address:

(if any)

Director/Shareholder/Partners

Please provide information about top-10 Directors/Shareholders/Partners

Name of Director/Shareholder/Partner

Total Capital

Share Capital Share % Action

(Add/Remove)

Type

NTN / CNIC / Passport No.

Other Activities

18 19

All Other Shareholders/Directors/Partners (in addition to 10) Activity Code

Other Business Activities in addition to the Principal Activity given at Sr-12 above

Action

(Add / Close)

20 21 22

Total business/branches

Provide details of all business/branches/outlets/etc., use additional copies of this form if needed

Bus/Br. Serial

Action Requested

Add

Change

Close

Business / Branch Name Bus/Br. Type

HQ/Factory/Showroom/Godown/Sub. Off./etc.

Business / Branches

Trade Name

Address

Office/Shop/House/Flat/Plot No. Street/Lane/Plaza/Floor/Village Block/Mohallah/Sector/Road/Post Office/etc.

Province

District

City/Tehsil

Area/Town

23

Nature of Premises Possession

Owned Rented Others

Owner's CNIC / NTN / FTN Yes No

Owner's Name Gas Consumer No. Business / Branch Close Date

if applicable

24 25 26

Electricity Ref. No. Phone No.

Area Code Number

Gas Connection Installed Business / Branch Start Date

Total Bank Accounts

Provide details of all bank accounts, use additional copies of this form if needed

Bank Accounts

27 28 29 30 31

Account Sr. A/C No. Bank Name

(NBP, MCB, UBL, Citi, etc.)

Action Requested A/C Title City Account Start Date

Add

Change

Close Type

Branch Account Close Date, if close action is requested

Declaration

I, the undersigned solemnly declare that to the best of my knowledge and belief the information given above is correct and complete in all respects. It is further declared that any notice sent on the e-mail address or the address given in the registry portion will be accepted as legal notice served under the law. I also hereby authorize, Punjab Revenue Authority to obtain my registration data from Federal Board of Revenue and other provincial tax administrations.

32 Date CNIC / Passport No. Name of Applicant SIGNATURE

Government of Punjab Punjab Revenue Authority De - Registration Form 1 2 3 4 5

NTN

PST - 02

Rule 5 Acknowledgement No. No

Comapany Resident Individual Non-Resident

(Sheet No AOP

of Firm

Category Status CNIC/PP No. Reg./Inc. No. Name

[for Individual only]

[for Company & Registered AOP only]

Date of Incorporation Trade Name

Registry

6 7

Name of Registered Person (Company, Individual or AOP Name)

Address

Registered Office Address for Company and Mailing / Business Address for Individual & AOP, for all correspondence

Office/Shop/House/Flat/Plot No.

Street/Lane/Plaza/Floor/Village

Block/Mohallah/Sector/Road/Post Office/etc.

Province

District

City/Tehsil

Area/Town

(e-Mail address for all correspondence)

Web Address:

Reasons of De-Registration

8 9 10

Ceased to carry on business Service has become exempt (Give details) Taxable turnover during the last 12 months has remained below the threshold (a) Please give the value of taxable services provided in last 12 months Rs. (b) Plese give reason(s) for reduction in your taxable turnover (attach sheet, if necessary) Transfer of sale of business (Attach proof) Other (Please Describe) Merger with another person (Attach proof)

Merger with another firm or business (Attach proof)

11 12

Declaration

13

I, the undersigned solemnly declare that to the best of my knowledge and belief the information given above is correct and complete in all respects. It is further declared that any notice sent on the e-mail address or the address given in the Serial 7 will be accepted as legal notice served under the law. I request for de-registration of my Business or Company (as the case may be).

14 Date CNIC / Passport No. Name of Applicant SIGNATURE

Punjab Revenue Authority

Government of Punjab

PST - 03

Rule 3 (2)

REGISTRATION CERTIFICATE

(Sales Tax on Services)

PNTN Name Business Name Business Address

: : : : :

Registration Date :

Category Status CNIC No.

: : :

Reg. / Inc. No.

Principal Activity Other Activities

: :

This certificate shall be prominently displayed at a conspicuous place of the premises in which business or work for gain is carried on. NTN certificate is also required to be indicated on the signboard.

NOTE:

The NTN must be written on all returns, payment challans, invoices, letter heads, advertisements, etc. and all correspondence made with the Punjab Revenue Authority.

CHAIRPERSON PUNJAB REVENUE AUTHORITY

También podría gustarte

- Bar Review Companion: Taxation: Anvil Law Books Series, #4De EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Aún no hay calificaciones

- 2 Registration & de RegDocumento8 páginas2 Registration & de RegHasnain KhanAún no hay calificaciones

- 1040 Exam Prep: Module II - Basic Tax ConceptsDe Everand1040 Exam Prep: Module II - Basic Tax ConceptsCalificación: 1.5 de 5 estrellas1.5/5 (2)

- Theoretical Aspects: Registration (Section 69 & Rule 4 of The Service Tax Rules, 1994)Documento54 páginasTheoretical Aspects: Registration (Section 69 & Rule 4 of The Service Tax Rules, 1994)Manish HarlalkaAún no hay calificaciones

- 1040 Exam Prep Module XI: Circular 230 and AMTDe Everand1040 Exam Prep Module XI: Circular 230 and AMTCalificación: 1 de 5 estrellas1/5 (1)

- The Sales Tax Rules, 2006 Chapter-12Documento6 páginasThe Sales Tax Rules, 2006 Chapter-12basit_efulifeAún no hay calificaciones

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsDe EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsAún no hay calificaciones

- LLB GST Notes Unit-4Documento15 páginasLLB GST Notes Unit-4It's time to studyAún no hay calificaciones

- Scope of TaxDocumento3 páginasScope of TaxSheikh WickyAún no hay calificaciones

- How To Get Service Tax Registration Number OnlineDocumento3 páginasHow To Get Service Tax Registration Number OnlinePriya GoyalAún no hay calificaciones

- Sales Tax - 03Documento6 páginasSales Tax - 03Bilal ShaikhAún no hay calificaciones

- TopicsDocumento40 páginasTopicsDa Yani ChristeeneAún no hay calificaciones

- Are You Under Scanner of Excise & Service Tax DepartmentDocumento2 páginasAre You Under Scanner of Excise & Service Tax DepartmentMahaveer DhelariyaAún no hay calificaciones

- Conditions For Purposes of Appearance. - (1) No Person Shall Be Eligible To AttendDocumento7 páginasConditions For Purposes of Appearance. - (1) No Person Shall Be Eligible To AttendLITTO GEORGEAún no hay calificaciones

- 1 Syllabus - NIRC Remedies (1st Sem 18-19)Documento13 páginas1 Syllabus - NIRC Remedies (1st Sem 18-19)Zyki Zamora Lacdao100% (3)

- RMO No.46-2018Documento13 páginasRMO No.46-2018Bobbit C ArninioAún no hay calificaciones

- RMO No.46-2018 PDFDocumento13 páginasRMO No.46-2018 PDFCzarina UmilinAún no hay calificaciones

- GST Reg, Loopholes, Corrective MeasuresDocumento5 páginasGST Reg, Loopholes, Corrective Measuresabhijeetpatel2007uAún no hay calificaciones

- Managing RiskDocumento3 páginasManaging RiskNaveedHussainAún no hay calificaciones

- Ovw1 1 - ST Ataglance 19may16Documento4 páginasOvw1 1 - ST Ataglance 19may16Sanjog DewanAún no hay calificaciones

- Sections 153 159 Companies Act, 2013 Rule 2 (D) Companies (Appointment and Qualification of Directors) Rules, 2014Documento3 páginasSections 153 159 Companies Act, 2013 Rule 2 (D) Companies (Appointment and Qualification of Directors) Rules, 2014zenith chhablaniAún no hay calificaciones

- Revenue Regulations No. 12-99: September 6, 1999Documento23 páginasRevenue Regulations No. 12-99: September 6, 1999Ricardo Jesus GutierrezAún no hay calificaciones

- Application For RegistrationDocumento9 páginasApplication For RegistrationSarinAún no hay calificaciones

- 0619-E Jan 2018 GuidelinesDocumento1 página0619-E Jan 2018 GuidelinesFarida Wahab Mama-BasagAún no hay calificaciones

- Tax RemediesDocumento8 páginasTax RemediesJade BelenAún no hay calificaciones

- Chapter - Registration 1. Application For Registration: Form GST Reg-01Documento10 páginasChapter - Registration 1. Application For Registration: Form GST Reg-01Abhishek MehtaAún no hay calificaciones

- Chapter12 PRADocumento6 páginasChapter12 PRAFakhar QureshiAún no hay calificaciones

- Guidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldDocumento1 páginaGuidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldMark Joseph BajaAún no hay calificaciones

- Boi Bir RulingDocumento172 páginasBoi Bir RulingChristine Fe BobisAún no hay calificaciones

- REVENUE REGULATIONS NO. 10-2010 Issued On October 6, 2010 Provides The GuidelinesDocumento1 páginaREVENUE REGULATIONS NO. 10-2010 Issued On October 6, 2010 Provides The GuidelinesChow Momville EstimoAún no hay calificaciones

- Tax Agents and PractitionersDocumento5 páginasTax Agents and PractitionerskawaiimiracleAún no hay calificaciones

- L13LLB183031Documento29 páginasL13LLB183031Debasis MisraAún no hay calificaciones

- Sale Tax PaperDocumento2 páginasSale Tax Paperazharhusnain808Aún no hay calificaciones

- Codal-The National Internal Revenue Code of The PhilippinesDocumento138 páginasCodal-The National Internal Revenue Code of The PhilippinespushlangyanAún no hay calificaciones

- 11-Withholding Rules 2012Documento5 páginas11-Withholding Rules 2012Imran MemonAún no hay calificaciones

- Merely Signing The Statement During Investigation Under Coercion and Admitting Tax Liability Not Amounts To Self-Assessment or SelfDocumento5 páginasMerely Signing The Statement During Investigation Under Coercion and Admitting Tax Liability Not Amounts To Self-Assessment or SelfShrey SharmaAún no hay calificaciones

- Taxation: 4. Other Percentage TaxDocumento6 páginasTaxation: 4. Other Percentage TaxMarkuAún no hay calificaciones

- Registration in Continuation With Class NotesDocumento5 páginasRegistration in Continuation With Class NotesRahul KumarAún no hay calificaciones

- Doc-20231022-Wa0005 231022 090138Documento9 páginasDoc-20231022-Wa0005 231022 090138kumarhealthcare2000Aún no hay calificaciones

- TYBAF 158 JaiminVasani SemV IndirectDocumento5 páginasTYBAF 158 JaiminVasani SemV Indirectjaimin vasaniAún no hay calificaciones

- Required Before The BIR May Audit The Records of The Taxpayer? Letter of Authority (LOA)Documento6 páginasRequired Before The BIR May Audit The Records of The Taxpayer? Letter of Authority (LOA)Jade CoritanaAún no hay calificaciones

- GST IiDocumento62 páginasGST Iisrisaidegree collegeAún no hay calificaciones

- 1601C GuidelinesDocumento1 página1601C GuidelinesfatmaaleahAún no hay calificaciones

- Tax Code of The PhilippinesDocumento166 páginasTax Code of The PhilippinesLab Lee100% (1)

- Below Authorities Will Be Involved in GSTDocumento6 páginasBelow Authorities Will Be Involved in GSTShailesh KurdukarAún no hay calificaciones

- Cancellation & Revocation of GST RegistrationDocumento5 páginasCancellation & Revocation of GST RegistrationshenbhaAún no hay calificaciones

- BIR Releases Rules On Appealing Disputed Tax AssessmentsDocumento13 páginasBIR Releases Rules On Appealing Disputed Tax AssessmentsDana100% (1)

- Commercial Tax Regulations EnglishDocumento25 páginasCommercial Tax Regulations EnglishYeyint099Aún no hay calificaciones

- Various Initial Registrations and LicensesDocumento34 páginasVarious Initial Registrations and LicensesshrividhulaaAún no hay calificaciones

- CGST Act, 2017Documento11 páginasCGST Act, 2017Laiba FatimaAún no hay calificaciones

- The Ultimate Guide To Online GST Registration - TaxGyataDocumento7 páginasThe Ultimate Guide To Online GST Registration - TaxGyataNikita RaiAún no hay calificaciones

- Profession Tax Registration ProcedureDocumento9 páginasProfession Tax Registration ProcedureParas ShahAún no hay calificaciones

- Powers & Authority of The Commissioner of Internal Revenue Under Sec. 4-7, Title 1 of The Tax CodeDocumento24 páginasPowers & Authority of The Commissioner of Internal Revenue Under Sec. 4-7, Title 1 of The Tax CodeRovi PatinoAún no hay calificaciones

- Defend RMC 12-2018Documento4 páginasDefend RMC 12-2018John Evan Raymund BesidAún no hay calificaciones

- Highlights of Model GST LAWDocumento4 páginasHighlights of Model GST LAWRajula Gurva ReddyAún no hay calificaciones

- Instructions On Belated AppealDocumento3 páginasInstructions On Belated AppealprakashramzAún no hay calificaciones

- RMO No. 14-2021 - DigestDocumento3 páginasRMO No. 14-2021 - DigestMike Ferdinand SantosAún no hay calificaciones

- Assessment DueprocessDocumento2 páginasAssessment DueprocessRester NonatoAún no hay calificaciones

- Powers of Audit, Search and Seizure Under GST: By: Pratha KhannaDocumento21 páginasPowers of Audit, Search and Seizure Under GST: By: Pratha KhannaLaiba FatimaAún no hay calificaciones

- Tax ReviewerDocumento68 páginasTax Reviewerviva_33Aún no hay calificaciones

- Annual Employer Statement Import TemplateDocumento6 páginasAnnual Employer Statement Import TemplateTanzeel Ur Rahman GazdarAún no hay calificaciones

- CGT Presentation Updated March 4 2015 WebsiteDocumento27 páginasCGT Presentation Updated March 4 2015 WebsiteImran MemonAún no hay calificaciones

- The Sindh Finance Bill 2013Documento32 páginasThe Sindh Finance Bill 2013Imran MemonAún no hay calificaciones

- Second ScheduleDocumento7 páginasSecond ScheduleImran MemonAún no hay calificaciones

- The Sindh Finance Bill 2013Documento32 páginasThe Sindh Finance Bill 2013Imran MemonAún no hay calificaciones

- 2011 PTD (Trib) 1306Documento22 páginas2011 PTD (Trib) 1306Imran Memon100% (1)

- Bypass Surgery Guide-Final For PrintingDocumento21 páginasBypass Surgery Guide-Final For PrintingImran MemonAún no hay calificaciones

- Owais Ali Khan: Career ObjectiveDocumento2 páginasOwais Ali Khan: Career ObjectiveImran MemonAún no hay calificaciones

- NTN Application1Documento1 páginaNTN Application1Imran MemonAún no hay calificaciones

- The Butterfly MosqueDocumento3 páginasThe Butterfly MosqueImran MemonAún no hay calificaciones

- Winter Clearance 2013Documento18 páginasWinter Clearance 2013Imran MemonAún no hay calificaciones

- 7 Authorized RepresentativeDocumento3 páginas7 Authorized RepresentativeImran MemonAún no hay calificaciones

- XyzDocumento10 páginasXyzImran MemonAún no hay calificaciones

- Richard FoltzDocumento2 páginasRichard FoltzImran MemonAún no hay calificaciones

- Restaurant Services Rules 09-10-2012Documento4 páginasRestaurant Services Rules 09-10-2012Imran MemonAún no hay calificaciones

- SRB 3 4 15 2011Documento2 páginasSRB 3 4 15 2011Imran MemonAún no hay calificaciones

- Fed CorporateDocumento1 páginaFed CorporateImran MemonAún no hay calificaciones

- Fasle Ase B Honge by Adem HashmiDocumento63 páginasFasle Ase B Honge by Adem HashmiImran MemonAún no hay calificaciones

- Sorath - Rai - Diyach: Page 1 of 3Documento3 páginasSorath - Rai - Diyach: Page 1 of 3Imran MemonAún no hay calificaciones

- PTCL City Wise Contact Detail For EVO USBDocumento1 páginaPTCL City Wise Contact Detail For EVO USBSandeep Kumar MugriaAún no hay calificaciones

- 10-Alternative Dispute ResolutionDocumento3 páginas10-Alternative Dispute ResolutionImran MemonAún no hay calificaciones

- 11-Withholding Rules 2012Documento5 páginas11-Withholding Rules 2012Imran MemonAún no hay calificaciones

- CV - Chartered Accountant (Word 2007)Documento2 páginasCV - Chartered Accountant (Word 2007)Imran MemonAún no hay calificaciones

- SRB 3 4 5 471 2011Documento2 páginasSRB 3 4 5 471 2011Imran MemonAún no hay calificaciones

- 6 Computerized SystemDocumento4 páginas6 Computerized SystemImran MemonAún no hay calificaciones

- 5 Specific ProvisionsDocumento11 páginas5 Specific ProvisionsImran MemonAún no hay calificaciones

- 3-Filing of ReturnsDocumento8 páginas3-Filing of ReturnsImran MemonAún no hay calificaciones

- 8 AuditDocumento4 páginas8 AuditImran MemonAún no hay calificaciones

- Government of Punjab Lahore, Dated 2012Documento8 páginasGovernment of Punjab Lahore, Dated 2012Imran MemonAún no hay calificaciones

- Vedic Town Planning ConceptsDocumento17 páginasVedic Town Planning ConceptsyaminiAún no hay calificaciones

- Takeover Strategies and DefencesDocumento20 páginasTakeover Strategies and DefencesJithu JoseAún no hay calificaciones

- CAKUTDocumento50 páginasCAKUTsantosh subediAún no hay calificaciones

- What Are The Challenges and Opportunities of ResearchingDocumento5 páginasWhat Are The Challenges and Opportunities of ResearchingmelkyAún no hay calificaciones

- 033 - Flight Planning Monitoring - QuestionsDocumento126 páginas033 - Flight Planning Monitoring - QuestionsEASA ATPL Question Bank100% (4)

- MSC 200Documento18 páginasMSC 200Amit KumarAún no hay calificaciones

- Gulf Case Study SolnDocumento9 páginasGulf Case Study SolnHarsh SAún no hay calificaciones

- Esp-2000 BSDocumento6 páginasEsp-2000 BSByron LopezAún no hay calificaciones

- Personal ComputerDocumento3 páginasPersonal ComputerDan Mark IsidroAún no hay calificaciones

- Applications of Remote Sensing and Gis For UrbanDocumento47 páginasApplications of Remote Sensing and Gis For UrbanKashan Ali KhanAún no hay calificaciones

- Samudra-Pasai at The Dawn of The European AgeDocumento39 páginasSamudra-Pasai at The Dawn of The European AgemalaystudiesAún no hay calificaciones

- Upend RA Kumar: Master List of Approved Vendors For Manufacture and Supply of Electrical ItemsDocumento42 páginasUpend RA Kumar: Master List of Approved Vendors For Manufacture and Supply of Electrical Itemssantosh iyerAún no hay calificaciones

- Jharkhand August 2014Documento61 páginasJharkhand August 2014Ron 61Aún no hay calificaciones

- BERKLYNInformation SheetDocumento6 páginasBERKLYNInformation SheetvillatoreubenAún no hay calificaciones

- Omegas Prezentacija 01Documento20 páginasOmegas Prezentacija 01Predrag Djordjevic100% (1)

- Sample Heat Sheets June 2007Documento63 páginasSample Heat Sheets June 2007Nesuui MontejoAún no hay calificaciones

- Ga-z68p-Ds3 v2.x eDocumento104 páginasGa-z68p-Ds3 v2.x ejohnsonlimAún no hay calificaciones

- Calculating Measures of Position Quartiles Deciles and Percentiles of Ungrouped DataDocumento43 páginasCalculating Measures of Position Quartiles Deciles and Percentiles of Ungrouped DataRea Ann ManaloAún no hay calificaciones

- Inclusions in Gross IncomeDocumento2 páginasInclusions in Gross Incomeloonie tunesAún no hay calificaciones

- 4th Conference ParticipantsDocumento14 páginas4th Conference ParticipantsmaxAún no hay calificaciones

- Where Business Happens Where Happens: SupportDocumento19 páginasWhere Business Happens Where Happens: SupportRahul RamtekkarAún no hay calificaciones

- Kharrat Et Al., 2007 (Energy - Fuels)Documento4 páginasKharrat Et Al., 2007 (Energy - Fuels)Leticia SakaiAún no hay calificaciones

- S L Dixon Fluid Mechanics and Thermodynamics of TurbomachineryDocumento4 páginasS L Dixon Fluid Mechanics and Thermodynamics of Turbomachinerykuma alemayehuAún no hay calificaciones

- Dr. Muhammad Mumtaz: Thesis TitleDocumento10 páginasDr. Muhammad Mumtaz: Thesis TitleDr. Muhammad MumtazAún no hay calificaciones

- Guide Rail Bracket AssemblyDocumento1 páginaGuide Rail Bracket AssemblyPrasanth VarrierAún no hay calificaciones

- Hormone Replacement Therapy Real Concerns and FalsDocumento13 páginasHormone Replacement Therapy Real Concerns and FalsDxng 1Aún no hay calificaciones

- English Literature Coursework Aqa GcseDocumento6 páginasEnglish Literature Coursework Aqa Gcsef5d17e05100% (2)

- Read The Text and Answer The QuestionsDocumento5 páginasRead The Text and Answer The QuestionsDanny RuedaAún no hay calificaciones

- Form IEPF 2 - 2012 2013FDocumento2350 páginasForm IEPF 2 - 2012 2013FYam ServínAún no hay calificaciones

- Lab 08: SR Flip Flop FundamentalsDocumento6 páginasLab 08: SR Flip Flop Fundamentalsjitu123456789Aún no hay calificaciones

- Learn Mandarin Chinese with Paul Noble for Beginners – Complete Course: Mandarin Chinese Made Easy with Your 1 million-best-selling Personal Language CoachDe EverandLearn Mandarin Chinese with Paul Noble for Beginners – Complete Course: Mandarin Chinese Made Easy with Your 1 million-best-selling Personal Language CoachCalificación: 5 de 5 estrellas5/5 (15)

- We Are Soldiers Still: A Journey Back to the Battlefields of VietnamDe EverandWe Are Soldiers Still: A Journey Back to the Battlefields of VietnamCalificación: 4 de 5 estrellas4/5 (28)

- Lands of Lost Borders: A Journey on the Silk RoadDe EverandLands of Lost Borders: A Journey on the Silk RoadCalificación: 3.5 de 5 estrellas3.5/5 (53)

- First Steps to Mastering Japanese: Japanese Hiragana & Katagana for Beginners Learn Japanese for Beginner Students + PhrasebookDe EverandFirst Steps to Mastering Japanese: Japanese Hiragana & Katagana for Beginners Learn Japanese for Beginner Students + PhrasebookAún no hay calificaciones

- Rice, Noodle, Fish: Deep Travels Through Japan's Food CultureDe EverandRice, Noodle, Fish: Deep Travels Through Japan's Food CultureCalificación: 4 de 5 estrellas4/5 (20)

- Learn Chinese: A Comprehensive Guide to Learning Chinese for Beginners, Including Grammar, Short Stories and Popular PhrasesDe EverandLearn Chinese: A Comprehensive Guide to Learning Chinese for Beginners, Including Grammar, Short Stories and Popular PhrasesAún no hay calificaciones

- The Travels of Marco Polo: The Complete Yule-Cordier Illustrated EditionDe EverandThe Travels of Marco Polo: The Complete Yule-Cordier Illustrated EditionCalificación: 5 de 5 estrellas5/5 (1)

- Oracle Bones: A Journey Through Time in ChinaDe EverandOracle Bones: A Journey Through Time in ChinaCalificación: 4 de 5 estrellas4/5 (239)

- The Longevity Plan: Seven Life-Transforming Lessons from Ancient ChinaDe EverandThe Longevity Plan: Seven Life-Transforming Lessons from Ancient ChinaAún no hay calificaciones

- Marco Polo: The Journey That Changed the WorldDe EverandMarco Polo: The Journey That Changed the WorldCalificación: 3.5 de 5 estrellas3.5/5 (28)

- Lonely Planet Malaysia, Singapore & BruneiDe EverandLonely Planet Malaysia, Singapore & BruneiCalificación: 3.5 de 5 estrellas3.5/5 (14)

- Empires of the Word: A Language History of the WorldDe EverandEmpires of the Word: A Language History of the WorldCalificación: 4 de 5 estrellas4/5 (236)

- Korean Picture Dictionary: Learn 1,500 Korean Words and Phrases (Ideal for TOPIK Exam Prep; Includes Online Audio)De EverandKorean Picture Dictionary: Learn 1,500 Korean Words and Phrases (Ideal for TOPIK Exam Prep; Includes Online Audio)Calificación: 4.5 de 5 estrellas4.5/5 (9)

- 14 Days in Japan: A First-Timer’s Ultimate Japan Travel Guide Including Tours, Food, Japanese Culture and HistoryDe Everand14 Days in Japan: A First-Timer’s Ultimate Japan Travel Guide Including Tours, Food, Japanese Culture and HistoryAún no hay calificaciones

- Next Steps in Mandarin Chinese with Paul Noble for Intermediate Learners – Complete Course: Mandarin Chinese Made Easy with Your 1 million-best-selling Personal Language CoachDe EverandNext Steps in Mandarin Chinese with Paul Noble for Intermediate Learners – Complete Course: Mandarin Chinese Made Easy with Your 1 million-best-selling Personal Language CoachCalificación: 4.5 de 5 estrellas4.5/5 (12)

- Chinese for Beginners: A Comprehensive Guide for Learning the Chinese Language QuicklyDe EverandChinese for Beginners: A Comprehensive Guide for Learning the Chinese Language QuicklyCalificación: 5 de 5 estrellas5/5 (32)

- Basic Mandarin Chinese - Speaking & Listening Textbook: An Introduction to Spoken Mandarin for Beginners (Audio and Video Downloads Included)De EverandBasic Mandarin Chinese - Speaking & Listening Textbook: An Introduction to Spoken Mandarin for Beginners (Audio and Video Downloads Included)Calificación: 4 de 5 estrellas4/5 (4)

- Survival Chinese: How to Communicate without Fuss or Fear Instantly! (A Mandarin Chinese Language Phrasebook)De EverandSurvival Chinese: How to Communicate without Fuss or Fear Instantly! (A Mandarin Chinese Language Phrasebook)Calificación: 3.5 de 5 estrellas3.5/5 (7)

- A Short Ride in the Jungle: The Ho Chi Minh Trail by MotorcycleDe EverandA Short Ride in the Jungle: The Ho Chi Minh Trail by MotorcycleCalificación: 4.5 de 5 estrellas4.5/5 (16)

- Insight Guides Pocket Vietnam (Travel Guide eBook)De EverandInsight Guides Pocket Vietnam (Travel Guide eBook)Calificación: 4 de 5 estrellas4/5 (1)

- Japanese Grammar 101: No Boring Linguistic Jargon No Overly Complex Explanations The Easy To Digest, Simple Approach to JapaneseDe EverandJapanese Grammar 101: No Boring Linguistic Jargon No Overly Complex Explanations The Easy To Digest, Simple Approach to JapaneseCalificación: 5 de 5 estrellas5/5 (1)

- Read Japanese Today: The Easy Way to Learn 400 Practical KanjiDe EverandRead Japanese Today: The Easy Way to Learn 400 Practical KanjiCalificación: 3.5 de 5 estrellas3.5/5 (24)

- Nihongi: Chronicles of Japan from the Earliest of Times to A.D. 697De EverandNihongi: Chronicles of Japan from the Earliest of Times to A.D. 697Calificación: 5 de 5 estrellas5/5 (2)

- Elementary Vietnamese, Fourth Edition: Moi ban noi tieng Viet. Let's Speak Vietnamese. (Downloadable Audio Included)De EverandElementary Vietnamese, Fourth Edition: Moi ban noi tieng Viet. Let's Speak Vietnamese. (Downloadable Audio Included)Calificación: 4.5 de 5 estrellas4.5/5 (2)